Tax Analytics Insights has been saved

Services

Tax Analytics Insights

Big data and tax: Data with purpose

You might have the tax technology you need and tax data you want. But without the right people, processes, and strategies to bring them together, your tax department won’t be able to address the important challenges it faces. Deloitte can turn your data into predictive tax analytics tailor-made to help your team become the strategic partner your organization needs.

Explore content

- Taking tax technology and data analytics to new heights

- Start with the problem

- How tax technology and data analytics can help your team

- Why analytics? Why now?

- Experience with impact: The Deloitte difference

Taking tax technology and data analytics to new heights

Tax departments are being asked for more insights and answers than ever. In an era of exponential increases in available data and shortages in talent that can wrangle it, finding the needle in the haystack with consistency and precision requires transformative approaches to the way you access, analyze, and apply data.

Enter the Power of With: Humans working closely with machines to amplify insights, collaboration, accuracy, and speed.

You need tax technology and data analytics solutions that are purpose-built for your challenges. Our Tax Analytics Insights services help you address the specific big data and tax challenges your department faces, whether it’s one solution at a time or a department-wide strategy. We combine our deep tax knowledge with our hands-on experience across a range of data collection, wrangling, automation, and tax analytics tools to help you harness the Power of With for smarter insights and stronger outcomes.

Start with the problem

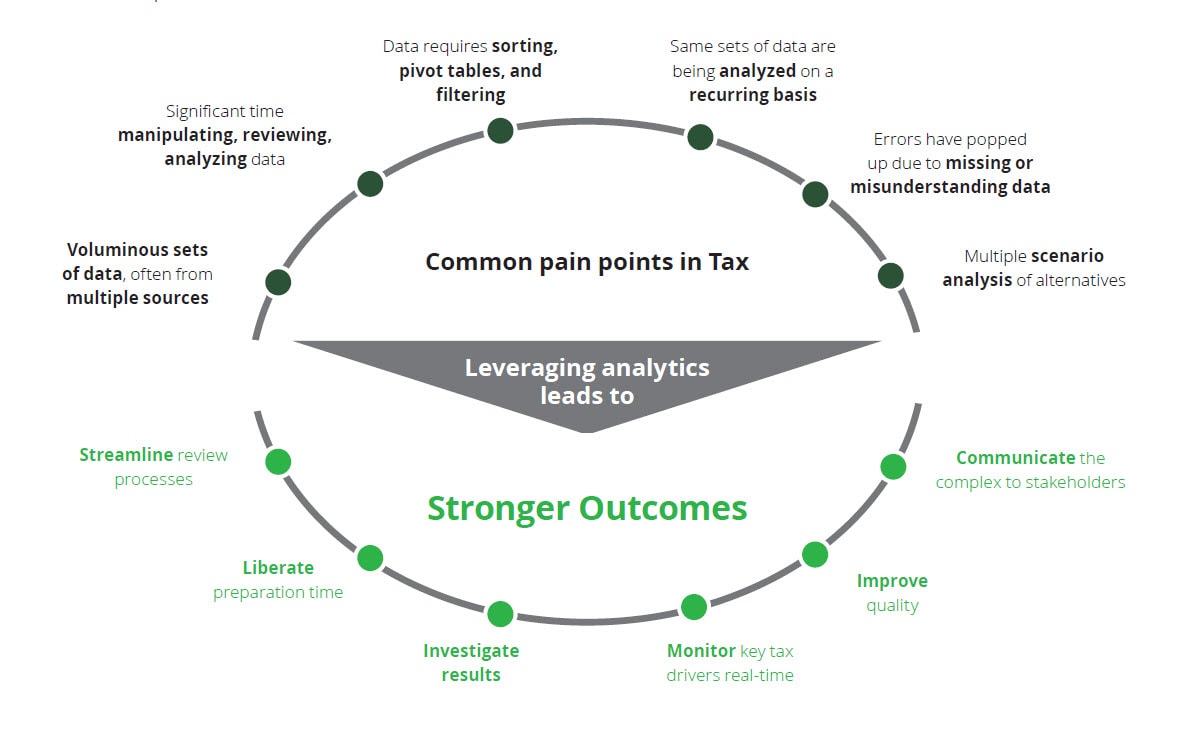

Our tax analytics specialists begin by understanding your challenges, so they can determine where and how tax technology and data analytics can be part of the solution. Predictive tax analytics can effectively address a range of issues you might face:

- Wading through tabs and tabs of spreadsheets and reports, trying to reach conclusions in your analysis to determine the right next steps?

- Tracking down the same sets of data and performing the same analysis over and over?

- Spending as much time collecting and preparing the data as you do performing your analysis?

- Discovering errors after the fact, or finding unwelcome surprises at the end of an analysis?

- Needing to make decisions on the path forward, but stuck in analysis paralysis?

How tax technology and data analytics can help your team

Do any of these scenarios sound familiar?

Data drag

Your team is spending too much time reviewing the data reported on tax returns, rather than quickly getting to the important issues and finding the potential insights. Analytics can speed things up by automating tax data to help find the right focus, allowing your team to spend their time on the right issues.

Quick turnaround

The close cycle on your quarterly tax provision is extremely tight. You spend your time putting together the computations, but have limited time to think about the results. Using analytics can help you reduce the analysis creation so you can spend more time on issue resolution.

Quality control

Your output assumes that the data in your systems is correct. You aren’t the creator of the data in the systems, but you think risk may be lurking in incorrect data. Analytics can be used for data validation to spot errors in the inputs.

Pay gaps

Through audits or reverse audits, you are experiencing significant indirect tax assessments or overpayments. Leverage analytics to pinpoint overpayments, discover transaction anomalies, and identify risk factors.

Feeling GILTI

You’re finding errors and getting unexpected results in your GILTI computations, but you don’t know why. Analytics can assist in identifying and investigating irregularities at a macro level and allowing you to dive deep into the details.

Unique problems typically can’t be solved with one-size-fits-all approaches. That’s why we specialize in creating custom solutions that build off your data sets and existing software tools—and our deep tax experience—to address your specific needs.

We can also help you address big data and tax challenges on a broader scale—working with you to identify and address immediate problems while creating an integrated tax technology and data analytics strategy that you can achieve one step at a time.

Why analytics? Why now?

Don’t put off bringing customized tax technology and data analytics capabilities to your organization. Imagine the amplified impact your tax department could have.

Deliver with efficiency

- Find potentially costly errors and prioritize quality

- Identify and explain outliers

- Quickly compare results period over period

- Reduce reliance on IT and other groups outside of tax for data and tools

- Reduce time spent on manual and redundant tasks

Lead with clarity

- Enable real-time scenario planning or modeling to help make better business decisions

- Identify and address risk

- Uncover hidden relationships and identify new trends

- Communicate complex tax scenarios to business leaders outside of tax

Experience with impact: The Deloitte difference

Our Tax Analytics Insights team leverages talent and skills from across Deloitte, combining advanced analytics and data science capabilities with extensive tax knowledge. Our tax technology and data analytics accomplishments have earned various accolades from independent research organizations and publications including:

- Gartner named Deloitte a leader for the 6th consecutive time in Data and Analytics Service Providers in their report Magic Quadrant for Data and Analytics Service Providers, Worldwide 2020.

- Forrester named Deloitte a global leader in their recent report entitled The Forrester Wave™: Robotic Process Automation (RPA) Services, Q4 2019.

- International Tax Review (ITR) named Deloitte the Americas Tax Technology Firm of the Year, 2018 and 2019.

Recommendations

Pairing tax with artificial intelligence

Your tax data with renewed analytics