The Middle East goes electric! has been saved

Insights

The Middle East goes electric!

ME PoV Fall 2023 issue

The global automotive sector is on the brink of a seismic shift, with electric vehicles (EVs) leading the way as the most promising contender in the pursuit of sustainable transportation. As the world races towards a greener future, the Middle East, often associated with its oil-rich heritage, is making one stride after another in adopting EVs.

This article sheds light on the dynamic Middle Eastern EV market, with a particular focus on the role of customer experience in shaping its current trajectory and future potential.

Understanding Middle Eastern consumer preferences

Consumers

The Middle East is a diverse region with a rich tapestry of cultures and social dynamics. This diversity shapes consumer preferences, thus automakers must carefully navigate this intricate landscape to understand what people want in EVs. Market research shows that Middle Eastern consumers are drawn to EVs that are futuristic looking, mechanically advanced, and filled to the brim with digital innovations.

A large portion of consumers in the region have always shown an affinity towards sophistication in their vehicles. As a result, automakers are investing in blending cutting-edge technology with exquisite craftsmanship to create EVs that appeal to this discerning clientele. These vehicles feature luxurious interior comforts, high-quality materials, and state-of-the-art infotainment systems that are all seamlessly integrated to deliver an immersive driving experience.

Preferences

A recent survey conducted by Deloitte found that 220 local participants, who are all potential EV buyers and owners, consider price and product quality to be the most important factors when purchasing an EV. Participants also prefer to make their own decisions and educate themselves about EVs through various channels such as social media. They are more likely to buy from a brand they are familiar with and prefer to own the car outright rather than lease it.

Most of the participants value in-person showroom visits and test drives, and are motivated to buy an EV for reasons such as reduced maintenance, technological innovations, improved performance, and overall cost-saving improved technology. They prefer to pay with cash and want home charging stations as well. Increased range and faster charging are also important factors, as are rental models and priority customer service. Finally, participants are forward thinking and consider resale value when making an EV purchase decision.

Market

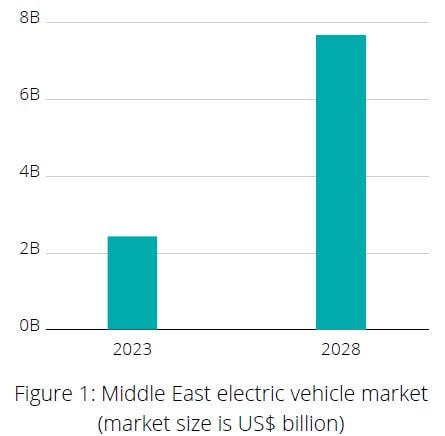

The EV market in the Middle East is expected to witness massive growth in the coming years. It is projected to reach US$7.65 billion by 2028, up from US$2.7 billion in 2023.1 This surge is being driven by a number of factors, including government initiatives to promote the use of electric vehicles, increased awareness of energy storage solutions, the expansion of 5G telecommunications networks, and the implementation of Vision documents in Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait.

|

Joint ventures for the win

Some of the world's most renowned EV manufacturers have already established their presence in the region and are now competing head-to-head for market domination. Brands such as Volkswagen, Nissan, Hyundai, BMW, and Tesla are some of the most popular among local consumers.2 But new players are progressively venturing into the region and expanding their horizons by forming partnerships with local organizations. Some recent examples include:

- Chinese EV maker NIO has secured a US$1.1 billion investment from Abu Dhabi investment firm CYVN Holdings to “strengthen its balance sheet and support business growth.”3

- Saudi Arabia's Ministry of Investment has entered into a US$5.6 billion partnership with Chinese EV startup Human Horizons to develop, manufacture, and sell electric vehicles.4

- Saudi Transport General Authority (TGA) recently announced that Lucid electric cars are now available for rent to residents and tourists in the country. This move is part of the country's efforts to adopt clean energy and preserve the environment.5

- Lucid Group, backed by the Public Investment Fund (PIF), announced in September 2023 it had opened its first international manufacturing plant in Saudi Arabia's Jeddah city under a deal designed to further the Middle Eastern country's electrification push, and an agreement with the Kingdom to buy up to 100,000 vehicles from the company over 10 years.6

Overcoming barriers

Range anxiety

Range anxiety stands as a major obstacle to the adoption of EVs around the world. This is especially true in the Middle East where the vast desert landscapes can make it difficult to find charging stations. However, there are a number of ways to mitigate range anxiety, including the ongoing development of advanced battery technologies that offer longer ranges and faster charging times, as well as the implementation of an EV infrastructure strategy.

Charging infrastructure

A robust charging infrastructure is essential for the widespread use of EVs. In the Middle East, governments are actively working to create a network of charging stations that will make EVs more accessible and convenient for drivers. For example, by 2025, both the Saudi Electric Vehicle Charging Infrastructure Development Initiative (SEVCIDI) and the Dubai Electricity and Water Authority (DEWA) are planning to have installed 50,0007 and 1,0008 charging stations in Saudi Arabia and Dubai respectively. Not only does this effort promote practicality, but it also demonstrates the region's commitment to sustainability.

Weather conditions

The extreme temperatures in the Middle East pose a challenge for EVs which may struggle to maintain optimal performance in hot weather. According to a 2019 study by the American Automobile Association, EVs could lose up to 17% of their driving range in temperatures above 35ºC.9 EV manufacturers are tailoring vehicle components to not only withstand but thrive in these conditions. Battery cooling systems are being meticulously optimized to combat the searing heat and ensure consistent performance and prolonged lifespan.

Promoting a green community

In the Middle East, governments, businesses, and communities are working together to promote sustainable practices, such as the adoption of EVs. They are offering incentives such as tax breaks, toll waivers, and preferential parking to help make EVs more affordable and convenient, eventually leading to a wider adoption rate among the population. The United Arab Emirates Ministry of Energy and Infrastructure (MoEI) has announced that it plans to have 50% of all cars on UAE roads electric by 2050. This ambitious prospect is supported by Dubai’s own goal to have 42,000 EVs on its roads by 2030,10 which is roughly six times the number of EVs currently in use in the Emirates.11

|

To encourage people to choose EVs over conventional vehicles, manufacturers need to highlight the environmental benefits of EVs. EVs produce zero emissions, which can help to reduce air pollution and improve air quality. They also use less energy than gasoline-powered cars, which can help to reduce greenhouse gas emissions and combat climate change. This is in line with the global shift towards EVs, as people are increasingly aware of the need to “go green” and support the universal goal of net-zero emissions by 2050, as well as limit global warming to no more than 1.5°C, as mentioned in the United Nations’ Paris Agreement.12

The Middle East is looking to redefine transportation in the 21st century by harmonizing luxury, technology, and environmental consciousness. Automakers are adapting to changing consumer preferences by offering more luxurious, technologically advanced, and environmentally friendly vehicles. Governments, businesses, and consumers are all working in tandem to create a more sustainable tomorrow, powered by electric vehicles. As governments provide incentives, businesses develop new technologies, and consumers embrace change, the Middle East is moving towards a future where sustainable mobility is a reality.

By Dr. Ahmed Hezzah, Director, Consumer and Commerce, Consulting, Deloitte Middle East

Endnotes

- Mordor Intelligence, (2023) Middle East Electric Vehicle Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028). Available at: https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-automotive-electric-vehicle-market.

- Mordor Intelligence, (2023) Middle East and Africa Automotive Electric Vehicle Market Share. Available at: https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-automotive-electric-vehicle-market/market-share.

- CnEVPost, (2023) NIO secures $1.1 billion investment from Abu Dhabi fund. Available at: https:// cnevpost.com/2023/06/20/nio-secures-1-1-billion-investment-from-abu-dhabi-fund/.

- CNBC, (2023) Saudi Arabia signs $5.6 billion deal with Chinese parent of high-end EV brand HiPhi. Available at: https://www.cnbc.com/amp/2023/06/12/saudi-arabia-signs-5point6-billion-deal-with-chinese-parent-of-hiphi.html.

- Al Arabiya News, (2023) Saudi transport authority brings Lucid EVs to car rental offices. Available at: https://english.alarabiya.net/News/saudi-arabia/2023/07/19/-Saudi-transport-authority-brings-Lucid-EVs-to-car-rental-offices.

- Reuters, (2023) Lucid opens first international EV factory in Saudi Arabia. Available at: https://www.reuters.com/business/autos-transportation/lucid-opens-first-international-ev-factory-saudi-arabia-2023-09-27/.

- CNBC, (2023) How the Middle East is Preparing for the Post-Oil, EV Era of Transportation. Available at: https://www.cnbc.com/2023/07/20/how-the-mideast-is-preparing-for-post-oil-ev-era-of-transportation.html.

- Construction Week, (2023) Dubai to Build 1,000 New Electric Vehicle Charging Stations. Available at: https://www.constructionweekonline.com/projects-tenders/dubai-to-build-1000-new-electric-vehicle-charging-stations.

- AAA, (2022) AAA Study: What’s the Real Range of Electric Vehicles? Available at:https://info.oregon.aaa.com/aaa-study-whats-the-real-range-of-electric-vehicles.

- Zawya, (2023) Range Anxiety, Accessibility Pose Concerns for EV Adoption in the UAE. Available at: https://www.zawya.com/en/business/energy/range-anxiety-accessibility-pose-concerns-for-ev-adoption-in-the-uae-mxquy5em.

- International Trade Administration, (2023) United Arab Emirates Electric Vehicle Market. Available at: https://www.trade.gov/market-intelligence/united-arab-emirates-electric-vehicle-market.

- Middle East Institute, (2022) The Environmental Cost of Electric Vehicles. Available at:https://www.mei.edu/publications/environmental-cost-electric-vehicles.