Article

CSRD: Booster for a sustainable Real Estate industry

The EU’s new sustainability directive as a game changer for Real Estate

#5 Real Estate Prediction

The Corporate Sustainability Reporting Directive (CSRD) will radically improve the scope and existing reporting requirements of the EU's Non-Financial Reporting Directive (NFRD). This ambitious package will make it mandatory for many Real Estate organizations to report on all relevant inward and outward Environmental, Social and Governance (ESG) issues and will have a significant impact in the short term. The proposed regulations will be in effect from 2023, and therefore, it is essential to be prepared. To comply with the requirements of the CSRD, it is crucial to do a materiality analysis and baseline assessment, set your ESG goals within a long-term ESG strategy and prepare your management systems and internal controls. The time to start is now.

Authors: Gijsbert Duijzer, Gerben Sinke, Mathijs Pott | Financial Advisory | The Netherlands

Purpose and background

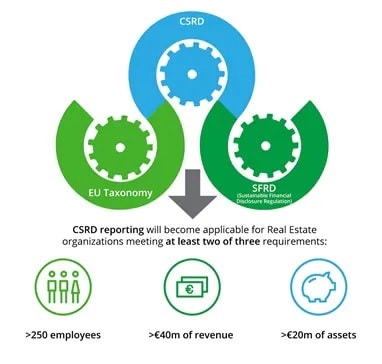

The EU Green Deal aims to turn an urgent challenge into a unique opportunity by cutting 55% of CO2 emissions by 2030 and achieving climate neutrality in 2050. As part of this effort, the EU introduced an action plan to finance the transition to carbon neutrality. Also, it introduced several regulations to support the achievement of this goal, including the Sustainable Financial Disclosure Regulation (SFDR), the EU Taxonomy, and the proposed Corporate Sustainability Reporting Directive (CSRD) as the success of the EU’s Non-Financial Reporting Directive (NFRD).

The purpose of the CSRD is to strengthen the foundations of sustainable investments in the EU’s transition to a fully sustainable and inclusive economic and financial system, in accordance with the European Green Deal and the UN Sustainable Development Goals. The proposed CSRD aims to radically improve the existing NFRD reporting requirements to increase transparency of corporate progress in terms of sustainability, and to align sustainability reporting with financial reporting. Companies will have to report on how ESG issues affect their business as well as on the impact of their activities on the environment and on society.

Why is the CSRD affecting the Real Estate industry?

The Real Estate industry is responsible for approximately 40% of CO2 emissions and greatly impacts our daily lives. To meet the EU's climate and energy targets for 2030 and reach the objectives of the European Green Deal, more and more Real Estate organizations commit themselves to sustainable climate targets such as zero emissions, and keeping global warming below 1.5 degrees. However, with the new CSRD reporting requirements, merely commitment and ambition aren't enough for Real Estate organizations to achieve their sustainability objectives.

The CSRD extends the EU’s sustainability reporting requirements. Also, it applies to all listed companies and large companies on EU-regulated markets that meet any two of the following three criteria:

- ≥ 250 employees

- ≥ €20mln of assets on balance sheet

- ≥ €40mln of net revenue.

The widening of the scope is expected to come into effect as of 2023. It will have a significant impact on more than 50,000 companies in the EU and over 1,700 within the Netherlands, many of which are Real Estate organizations. This is due to the nature of the sector with its fairly high net revenues and balance sheet totals.

What is going to change for the Real Estate industry?

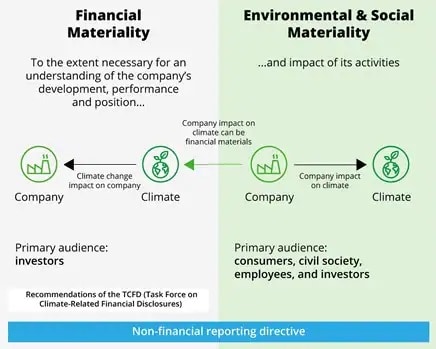

Because of the CSRD, Real Estate organizations can no longer report on their financial status without mentioning their environmental and social impact. In order to do so, it is essential to follow the materiality concept when determining which ESG topics you should report. Materiality is the concept that defines why and how specific issues are significant for a company. By introducing the concept of ”double materiality”, organizations need to consider both the impact of climate-related risk and opportunities on the company's value (”financial materiality” or ”inward impact”), and the external impacts of the company's activities on the environment (”environmental and social materiality” or ”outward impact”).

In addition to mandatory requirements, we do believe that the CSRD will be a major game changer for the industry in terms of transparency and insight into sustainability risks and opportunities. Also, it will help Real Estate organizations with a strong ESG performance attract capital. in order to comply with the CSRD, Real Estate organizations must have a long-term sustainability strategy and extend sustainability management to include both inward and outward sustainability risks and opportunities. Because the Real Estate market is stimulated by financing and investments from a wide range of investors, understanding sustainability performance, strategy and sustainability risks and opportunities will become increasingly important for attracting capital, gaining a competitive advantage and achieving your sustainability goals.

What can you do now?

The CSRD will be a major game changer in corporate ESG reporting with far-reaching implications for the Real Estate industry. Real Estate organizations, investors, regulators, auditors and other stakeholders will all need to devote significant time and resources to prepare for the implications of the CSRD. Given the significance of the CSRD and the time required to be prepared in 2023, these are the key topics you should start considering now:

- Perform a double materiality assessment to determine which ESG issues are material for your organization from both an inward and outward perspective. Perform an ESG baseline assessment for your material ESG issues to determine your starting point.

- Set measurable ESG goals in line with the EU Green Deal and UN Sustainable Development Goals.

- Develop a future-proof ESG strategy that includes, among other things, your purpose, vision, objectives, performance indicators, a strategic roadmap and policies required to comply with EU legislation and mandatory third party limited assurance as of 2023.

- Set up reporting and monitoring procedures in order to keep track of your ESG goals over time and reassess material ESG issues.

Recommendations

Real Estate Predictions 2022

Building a more sustainable and future-proof business with the Real Estate Predictions 2022

How AI can enhance urban planning, asset management and investments

Advanced analytics for the cities of the future