Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue XXV

14 April 2017

Economy

China – diverging views between economists and corporate executives

From China's perspective the outcome of the Xi-Trump meeting at Mar-a-Lago was better than expected. Major trade friction seems to have been avoided for now; presumably due to the implicit promises by China on increased purchases of American products and assurances on market access (though meaningful market access will remain a thorny issue in the medium term to long run). Surprisingly, the RMB exchange rate was not even mentioned, an unexpected about face considering President Trump's campaign rhetoric. The air strike by the US on the Assad regime has produced a sense of respite in China because since last November many policy wonks here have been worrying about the possibility of the US and Russia ganging up on China. While President Trump's action against Syria puts to rest this possibility, the air strikes are also an uncomfortable reminder that the US may consider similar action in the Korean Peninsula.

From the US perspective, the summit has allowed the two leaders to develop a "personal relationship" (or at least sizing each other up) though in concrete terms there has been little actual progress. Indeed, President Trump referred jokingly to the fact that "he has got nothing" from the Chinese President. To paraphrase President Xi, "there are more than a thousand reasons for creating a constructive Sino-US relationship". The immediate issue is North Korea whose long-range missiles are presenting a threat which the US is not likely to tolerate for much longer. Would China tighten sanctions against North Korea? Given that China has not done much so far on the sanction front, there is a lot of room for China to tighten the screws but to stop short of removing the regime's lifeline. The US is expected to reiterate its commitment on the "one-China" policy and to scale back arms sales to Taiwan. But by no means was the meeting a grand bargain between China and the US as some people hoped for. The only saving grace is that it is almost certain now that President Trump will visit China within a year, especially as demands from US companies' for greater access to China's vast domestic market are unlikely to subside.

Precisely because of persistent pressure on the trade front (against all "surplus countries such as Germany and Japan but China does stick out"), it is very likely that China will continue its efforts to maintain a stable exchange rate through tight controls on capital flows. Meanwhile, President Trump said that the dollar is "too strong" and that he would prefer the Fed to keep interest rates low and "won't label China a currency manipulator". Would such comments make the RMB stronger vis-a-vis the greenback in 2017? In a widely watched Yicai survey (March2017), a poll of over 30 China economists showed that most economists have upgraded their Q1 2017 GDP forecast to 6.8% and subsequently downgraded their USD outlook. The psychology of the forex market seems to be that the diminished likelihood of Trump's highly touted tax reform actually succeeding after the setback of trying to abolish Obamacare have hurt the prospects of the mighty dollar. Is this merely profit-taking on the back of a strong dollar or a fundamental change in trend in foreign exchange market? According to Ira Kalish, Deloitte Global Chief Economist, though the dollar is somewhat over-valued as a result of the US' persistent trade deficit, interest rate differentials and geopolitical factors favour a strong dollar in the short run.

In our view, if the Chinese economy indeed accelerates, trade surplus would be likely to fall on higher imports of commodities. Will the increase in confidence make the RMB rebound against the dollar? China's foreign reserves have registered moderate increases in March, suggesting reduced dollar hoarding in China. However, in view of the fact that the other currencies in the basket are still showing signs of weakness, an appreciation of the RMB against the dollar would affect China's exports adversely. In view of this it is unlikely that the PBOC will allow the RMB to appreciate. A plausible scenario is that the PBOC would choose to unwind some of its positions from interventions so far should the dollar lose its shine. Trump's comments on the dollar and RMB might be seen as a gesture of goodwill from the US Administration who is looking for bigger victory – meaningful market access which would lead to a more balanced trade between China and the US. Of course, economists in China tend to place greater emphasis on policy changes and less on corporate profit matrices and purely economic considerations are not the only ones that are likely to come into play. Therefore, it would be useful to also look at the views taken by executives who are perhaps ignorant of economic aggregates but deeply knowledgeable about the operating conditions of their sectors.

Surveys from executives at Boao, a leading indicator of the economy?

In recent years, Deloitte China has emerged as the most important intellectual partner for Boao, which is evolving into a Chinese version of Davos. As promotion of free trade and regional integration remain the focus of discussions, one of the key tasks for the Boao Forum is to come up with leading indicators of the Chinese economy based on candid discussions among executives and policymakers. Thus, with the aim of bringing executives closer to policy related discussions and debates, Deloitte Research designed and moderated two seminars for businessmen/owners of private enterprises and China CEOs.

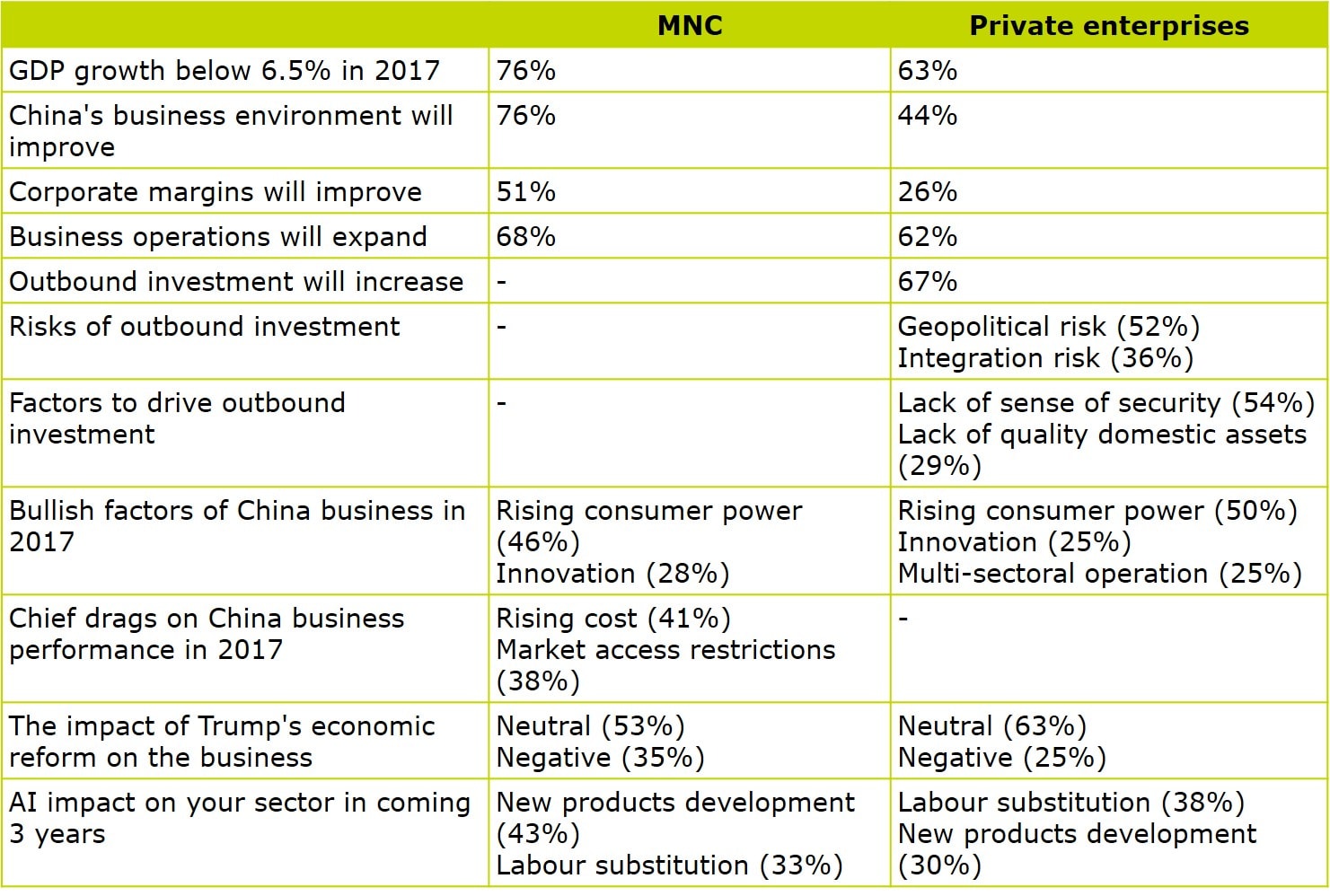

Table: Survey results

Key Takeaways of the seminars:

- Many of China's private companies as well as a large number of multinationals expect growth in China to slow this year to under 6.5% as China continues its shift away from infrastructure and investment-led growth, to growth driven by domestic consumption.

- Domestic Chinese consumers are driving much of the corporate growth and shaping business strategy. Thus, high-quality companies offering unique services in niche areas are best positioned to succeed in today's environment.

- China's domestic regulatory and legal environment is not only challenging for MNCs but for Chinese private companies as well; intellectual property protection, currency policies, funding costs, and the inconsistent application of commercial laws at the national and local levels are all areas of concern for both.

- The shifting geopolitical landscape following Brexit and the recent US election, especially in relation to the terms of trade is also a matter of concern.

- The double bind of rising costs and declining profits – stemming from increased competition from local players and, in some cases, restrictions on market access, are significant worries among multinationals in China.

- For China's private companies, outbound investment remains a key priority as they aspire to buy foreign technologies and brands to scale up their presence in the domestic market.

Roundtable Overview

At the 2017 Boao Forum, Deloitte China hosted a group of executives from China's leading private companies as well as major multinationals to exchange views on the challenges and opportunities in China's business environment. Major points of discussion included: the impact on business operations in 2017 due to the shifting geopolitical landscape – from the US election to Brexit, finding the most suitable outbound investment strategy, as well as finding ways for China's regulators to work with the business community to ensure policy support, rather than hinder business growth.

Slowing growth, higher labour costs, tight regulations and uncertainty abroad

2017 will undoubtedly be a trying year for many of China's private companies as well as multinationals in China. In addition to the usual challenges of building a successful business, China's private companies and MNCs now have to contend with a slowing economy, rising labour costs and a tighter regulatory environment, while also navigating an increasingly unpredictable global geopolitical landscape. The delegates who attended Deloitte's roundtables openly acknowledged this predicament.

- At the private companies' roundtable, over 60% of attendees said China's growth in 2017 would not surpass 6.5% – which is even lower than the 26-year low of 6.7% logged in 2016. By the same token, more than 70% of delegates said private enterprise profits in China will probably decline this year.

Looking beyond their home market, many delegates expressed anxiety over the global macroeconomic environment, given political uncertainties across Europe, a newly elected and unproven US administration, rising real interest rates, and a more protective trade posture in the US and some parts of Europe.

Doubts still linger about the ripple effects of these seismic changes. On the one hand, many delegates are not overly worried: over 60% said US President Donald Trump's policies will have no material impact on their operations. On the other hand, the majority said geopolitical concerns are uppermost in their minds, especially when evaluating outbound investment and acquisition opportunities.

The results of the multinationals roundtable showed a similar pattern. Well over 70% of attendees said China's growth would not surpass 6.5% in 2017. While China's private companies' delegates considered geopolitical tensions a significant concern, a majority of multinational executives said rising costs, followed by restrictions on market access, are their primary concerns.

"In China, everything is difficult, but everything is possible," said a China CEO of a major US company. "In Europe, everything is easy, but nothing is possible. It's true -- China is full of opportunity, but the problem is there are many challenges." - For the past few decades many multinationals saw China as the "the world's factory", churning out everything from toys to sneakers for top global brands on a reliably low-cost basis – but no longer. Wages have inevitably risen in line with the country's growth trajectory, and its cost advantage in manufacturing has slipped. Nowadays some multinationals are shifting operations to countries such as Vietnam and Indonesia where labour costs are lower.

Meanwhile, China's regulatory environment is becoming increasingly difficult to navigate. On the financial front, the country's capital account – though opening gradually – remains closed, and accounting practices lag behind international standards. Tight currency controls also remain in place, making it difficult for multinationals to transfer funds in and out of the country.

Likewise, China is tightening its surveillance of foreign technology and media firms especially, all the while trying to become a leader in Internet development. Multinationals are nervous that they will be subject to unfair scrutiny and their intellectual property won't be protected – and they also perceive limitations on market access as unfair, especially if those limitations do not exist for Chinese companies with operations in markets such as the US and Europe.

Lastly, many home-grown Chinese firms, from smartphone makers to sportswear purveyors, have evolved rapidly in recent years, and are now competing head-to-head with their multinational counterparts. This is to be expected – the market should be fair and free, after all. However, increasing competition and oversaturation in some segments adds yet another pressure to an already challenging situation for many multinationals.

Opportunity still beckons: capturing consumer boom

If the predictions are right, purchasing power in China may be about to grow at an exponential pace. The world's most populous nation will add more than half a billion people to its middle class by 2030, the equivalent to a market nearly twice the size of the US. Despite the subdued outlook and concerns about rising costs and tighter regulation, many delegates from Chinese private companies as well as multinationals zero in on China's new drivers of growth.

Moreover, the middle-class Chinese consumer is no longer satisfied with a limited menu of generic options. Many are now travelling abroad and they are spending their disposable income in search of unique and tailor-made products and experiences. On that basis, China's private companies and MNCs need to become much more service and brand-focused in order to stay relevant, attract investment and safeguard their particular market niche. They need to create new aspirations for China's upwardly mobile consumer class via the development of brand identities that fit into the consumer's desired personal lifestyle.

- For China's private companies, one area in need of significant improvement is a commitment to quality. In recent years, many Chinese companies quickly went to market with low quality products and services, or were happy to copy established international brands and compete on price. But these tactics will no longer work if they want to climb the proverbial value chain, and earn the loyalty of demanding consumers.

"To maintain long-term competitiveness, China's private enterprises should look to practices in places such as Germany and Japan – places that evoke the spirit of craftsmanship," said a Deputy China CEO of a leading professional service company.

The good news is China's private companies already have an edge in the domestic market. Compared to their multinational counterparts, they are often in a far stronger position to grasp sudden swings in local consumer sentiment; and they often maintain better connections to financial institutions, distributors and other supporting business partners.

On the other side of the equation, private companies are not dependent on the government like China's huge and often inefficient state-owned enterprises. Though they may not enjoy the soft pillow of guaranteed financial backing from the government, their freedom allows them to address shifting consumer preferences in a more efficient and competitive manner.

"Compared to state-owned enterprises, private enterprises not only make their own decisions but also have the incentives to make the best decisions possible," said a senior banker in China. "They are more flexible, and can quickly address problems as they arise." - This has significant implications for multinationals. More precisely, a far more competitive Chinese market is probably here to stay. The genie is out of the bottle and is not going back in: Chinese companies are rapidly climbing the value chain by embracing the latest technologies, attracting the best international talent and tailoring their products to a consumer base they intuitively understand. Moving forward, success is likely to be all about the specifics – and the best product for a particular demographic group is likely to win.

To cope with this new reality, multinational firms need to adjust their expectations in China, and redouble their efforts to offer consumers unique products and experiences. Falling back on international brand power is no longer enough. That means multinationals that specialize in areas that China is still learning about, such as the physical fitness industry, are well positioned to win a sizable slice of the market.

"Multinationals can no longer just copy what they've developed in the head office," said a China CEO of Japanese company. "They need to think about research and development and adjust it to China's local needs."

Competition for capital is fierce – and the worst is yet to come

While the Chinese consumer has grown more discerning, China's regulatory regime has in many ways also become more demanding. Broadly speaking, multinationals approve of the intentions of China's policymakers. But distortions and contradictions will inevitably arise as authorities try to deliver on the country's massive financial reform ambitions which include slowly opening the capital account, cleaning up the banking system, and controlling capital outflows triggered by a declining currency.

The combination of these two distinct realities have made China a much more challenging investment case for multinationals seeking more funds for expansion from their boards and shareholders at home.

"China used to be the de facto number one or at least in the top three of desirable markets to invest in – but that is no longer the case," according to a China CEO of a major European firm. "It's getting more difficult to convince the head office (of the need to invest) at a time when we probably need to be much more active because the demands from China's consumers are changing much faster than in Europe."

A number of compelling investment alternatives to China have emerged in recent years, including high-growth markets like India and Southeast Asia. And in recent months, both the US and the EU – two regions grappling with unpredictable populist political movements – have announced corporate tax reform plans in order to attract and retain domestic and foreign capital. Even China's own companies acknowledge the difficulties inherent in local markets, and many are actively acquiring offshore assets and brands as a way to spur growth back home.

To sum up, the competition for capital is intensifying: some multinationals that were once bullish on China are having second thoughts, while many of China's home-grown brands are betting they will achieve better returns on their capital by investing overseas.

Outbound ambitions remain despite challenges

Given the slowdown in domestic growth, many Chinese companies are putting their money to work abroad by acquiring new technologies and established brands – from pizza restaurants to video game franchises. Such acquisitions usually serve two primary purposes: to add a new segment of revenue growth, and to give the Chinese company experience managing a global brand in their home market.

"China's market is huge and fundamental to any Chinese company," said a CEO of a large Chinese electronics company. "So we should go out to the overseas market and shop for brands and assets with the intent of coming back home."

In recent years, a number of Chinese companies and investor groups have done just that, winning both large and small auctions for established consumer brands. To cite just two examples, these deals include Hony Capital's purchase of the British chain "Pizza Express" for US$1.54 billion; and more recently, Tencent Holdings' deal to buy mobile games maker Supercell – the maker of "Clash of Clans" and other popular games – for US$8.6 billion.

Of course, outbound deals are not without their risks. In fact, China's government slightly dampened the outbound ambitions of many domestic companies in recent months with stricter policies around capital outflows – policies that aim to keep domestic capital from leaving the declining Renminbi. But the majority of delegates said overseas investment activity will likely accelerate regardless, while also acknowledging the difficulty of managing external geopolitical and cultural risks.

"We all recognize the risk of going out," said a senior government official who is in charge of FDI promotions. "Of course, the situation of each country is quite different and we need to do our research before investing. Sometimes Chinese companies lack the talent to operate abroad because they don't have enough experience in foreign operations."

Ensuring regulation does not impede growth

Against this backdrop, China's private companies can work hand-in-hand with domestic regulators to ensure that a pro-business environment is sustained in this era of uncertainty.

Many delegates agreed that China's regulators should partner with business leaders to adequately address reform in the area of intellectual property rights protection, which will not only ease the concerns of frustrated foreign multinationals in China, but will also protect the Chinese companies that are now aggressively building their own powerhouse brands.

Another area of concern is taxation and the associated fees of running a legally sound business in the domestic market. Although China's standard 25 percent corporate tax rate may seem low when compared to those in many developed economies in Europe or in the US, a range of labour and insurance-related fees on top of the standard corporate tax make for consistently high operating costs – which in turn, handicap companies from expanding and limit the amount of capital they can put to work.

On that note, Chinese companies will also need to collaborate with domestic policymakers to not only ensure that commercial policies and priorities support growth, but also to create a framework to review whether such policies are consistently applied across the national and local levels. Delegates agreed that it is not uncommon for local officials to have their own interpretations of national policies, hindering growth and creating confusion for both executives and regulators.

"The sense of arbitrariness is too strong," argued by the same senior banker who was quoted earlier. "There is a lack of standards, and sometimes the policy is not really implemented in a consistent manner. But private enterprises rely on the law. They need consistent enforcement to succeed."

In conclusion, there is clearly some divergence between economists and executives on both the economic outlook and policy responses. Most economists favour a higher GDP growth rate but executives focus more on profits. In our view, as the economy is undergoing a profound transformation, a slower GDP growth rate will result in greater policy leeway. The government will then also be able to concentrate on providing greater policy support to businesses, helping them to become the new engines of growth. A slightly lower GDP growth rate means a greater emphasis on quality of growth and reform.

Financial Services

Debt-equity swaps aim at attracting private capital

By the second quarter in 2016, China's non-financial enterprises leverage ratio (debt/GDP) was 167.6%, 77.6 points above the warning line and far more than the world average of 95.6% stated by BIS. SOE debt has ballooned since 2008 reaching the ratio of 177% by the end of 2016, according to the Ministry of Finance. With such highly concentrated repayment risk, both enterprises and banks are under great stress. This could easily trigger a debt crisis. The policy guidelines promulgated by the State Council last October on enterprise financial de-leveraging and market-based debt-to-equity (D/E) swaps ushered in a new round of D/E operations in China after a 17-year hiatus.

So far, ICBC, ABC, BOC, CCB and BoCom have announced to establish wholly owned asset management companies (AMCs) which specifically engage in D/E operations, each pledging to invest RMB10 to 12 billion. From the reopening in October 2016 to the end of March this year, the D/E contract volume reached RMB522.8 billion with nearly 40 enterprises involved by big five banks. On 5 April, Ansteel and CIB just signed the RMB10 billion debt/equity swap agreement, which is the first case by a joint-stock bank.

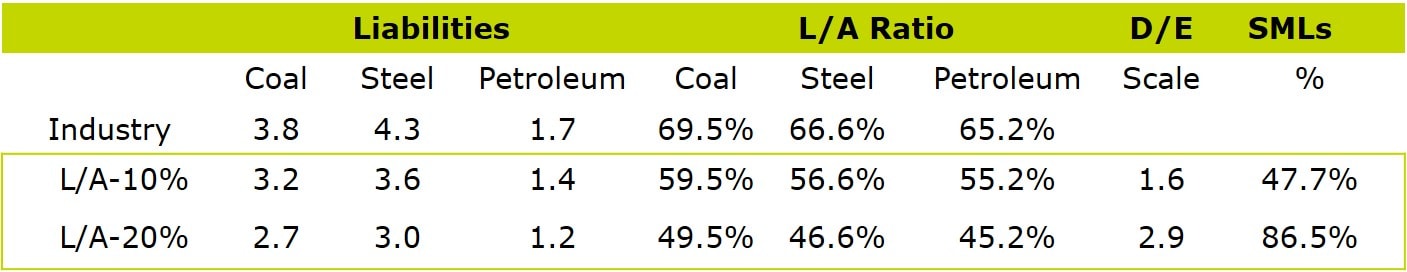

Focus on large and listed SOEs in strongly cyclical sectors. This time around the situation is radically different from the late 1990s when the central government established four AMCs to save the banking system from chaos as NPL ratio hit a high level of 20%. The new round of D/E swaps focus on reduction of enterprises' leverage targeted for industries with excess production capacity and strong cyclicality such as coal, steel and petroleum. Based on the NDRC target to reduce the liability-to-asset (L/A) ratio by 10-20%, the estimated initial D/E scale will be at between RMB1.6 to 2.9 trillion which may take almost 3 years to process.

Chart: debt-equity swap estimation (RMB trillion)

No free lunch and no lifeline to zombie enterprises. Aimed at debt relief to enterprises, banks prefer the conversion of normal and special mention loans (SMLs) into equity instead of NPLs. Meanwhile, D/E operations for zombie enterprises and discredited enterprises or those likely to increase excess capacity or inventory are strictly forbidden. Without any administrative orders, D/E operations are totally market-based and private capital participation is encouraged.

As regulatory guidelines are expected to be issued later, the operation process, sources of funds, pricing mechanism and exit mechanism of D/E will be further defined. Opportunities abound for enterprises, banks and implementation institutions:

Reform of SOE mixed ownership. In the long run, diversified equity structures after D/E swaps will improve corporate governance of SOEs, and market-based operations will provide avenues for private capital participation. Under the D/E agreement between CCB and Shandong Energy, for example, CCB set up a special fund to attract private capital to replace liabilities.

New opportunities for banks and AMCs. D/E swaps are a good opportunity for banks to strip away bad assets, enhance profits and invest in companies. However, it may impact banks in their prudent operation and additional capital infusion may be needed. Market competition is heating up as traditional and province-level AMCs are joining in the operation worth trillion. Therefore, specialized talents are in urgent need as institutions must improve risk control capability, preventing "shady agreements" or debt kept in the guise of equity from happening during the operation.

Alert for moral hazard. As the D/E swap is so attractive to enterprises mired in debt, such enterprises may exaggerate their indebtedness to take advantage of D/E operations, or related parties may collude so as to make the government bail them out. Hence, internal control and compliance review must be very tight and eligibility for D/E swaps must be strictly monitored so that enterprise executives are put under so much pressure that they will enhance corporate governance and guarantee improvement in performance.

As a way to de-leverage, swapping debt into equity is but a short-term solution. The long-term and ultimate solution to the debt problem depends upon the establishment of a mechanism that restricts debt from ballooning to an unsustainable level.

Energy

Independent refineries: a game changer or a flash in the pan?

The recent visit to China by the Saudi King Salman was much more than just a lavish tour, it was a visit with a mission - to secure the kingdom's place as leading oil supplier to the world's 2nd largest oil consumer. And part of the Saudi plan is to sell more crude oil to China's independent refineries.

The Rise of independent refineries

China's independent refineries (also known as "locals" or "teapots") are private refineries with relatively small capacities in comparison to State-owned oil companies.

These refineries have become a key growth driver of crude oil imports since the government began to grant them licences to import crude oil in 2015. As a result, China's 2016 imports of crude oil increased 13.6% year-on-year to 381 million metric tonnes (7.6 million b/d), of which independent refineries imported 60 million metric tonnes (1.2 million b/d), representing 16% of the total.

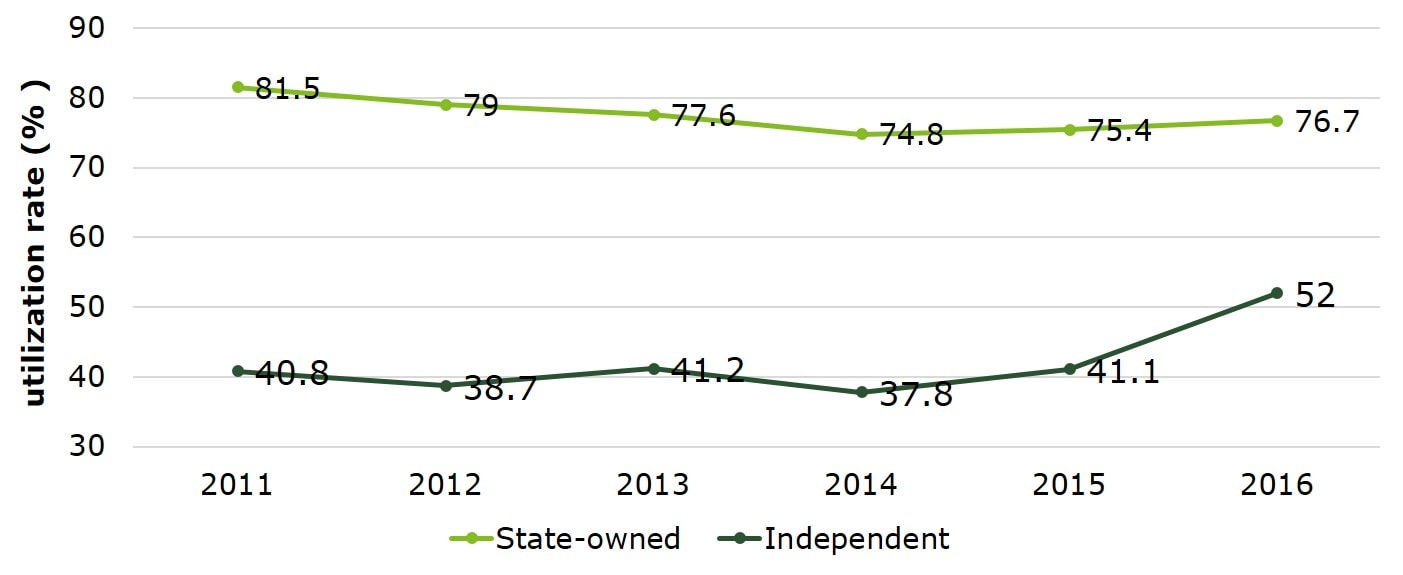

The utilization rate of independent refineries has been on a steady rise. In January and February, the Shandong-based independent refineries operated their plants at between 58% and 61%, up from 53-54% a year ago. In contrast, Sinopec and PetroChina, the two largest State-owned refinery companies, have cut output in the face of increased flow from independent rivals.

Chart: Utilization rate of independent refineries on steady rise

Unfortunately, the government has of late tightened their scrutiny of independent refineries because of compliance and tax evasion problems. Other regulations have also been changed. Instead of granting independent refineries a one-time full-year quota as it did in the past, the government now hands out the full-year import quota in several batches. In addition, the government is yet to resume the issuing of export permits to independent refineries, without which refineries won't get tax exemption for fuels exported. Given this surprising policy move, some argue that independent refineries will lose their growth momentum or may even be regulated out of the market.

Just a flash in the pan?

We do not disagree that the policy change will lead to a slowdown of crude imports by China's independents in the coming months as several refiners have used up most of their allocation from the first round of import quotas and will need to wait until June for the second round before purchases are resumed. But we think the rise of independent refineries is much more than just a flash in the pan. However much the current policy is in favour of State-owned oil companies, the government will have to break the monopoly in the oil and gas sector, especially in the downstream businesses, to achieve the desired improvement in efficiency. China's Energy 13th Five Year Plan has made it clear that SOEs' large presence along the oil and gas sector value chain will have to be whittled down through the incorporation of competitive market mechanisms, thus putting private firms and large SOEs on a level playing field.

The prospect of downstream industry liberalization has attracted new investors. Privately-run conglomerate CEFC China Energy has approached several independent refineries in its quest to acquire its first domestic refinery operation. Saudi Arabia's state oil company is looking for domestic partners to establish joint ventures in China for downstream businesses – integrated refining, chemicals, retailing and distribution.

There is, however, one immediate and outsized risk – the growing overcapacity in the refining market. It is estimated that China currently has 15 million b/d of refining capacity, with “teapots” making up for roughly 4.5 million b/d. China processed 10.8 million b/d of crude oil in 2016, suggesting nearly one third of the capacity could be surplus capacity.

What's next?

In the face of weak domestic demand and overcapacity, Chinese independent refineries will experience massive consolidation in the coming years.

Most of the 200 plus independent refineries will have to be phased out due to lack of competitive advantages. Large firms will pounce on the opportunity to increase their market share by acquiring domestic rivals. China's biggest independent refiner Dongming Petrochemicals is looking at acquisitions of other independents. The company believes that China's refining sector will eventually be dominated by 10 refining companies, State-owned and private included.

Independent refineries are also expanding in the overseas market. Dongming Petrochemicals has set up a trading office in Singapore to facilitate its cross-border business while Hengyuan Petrochemicals purchased Royal Dutch Shell's 51% stake in the Port Dickson refinery in Malaysia. Recent reports also show that the Chinese independent refineries are pooling their financial resources to fund acquisitions of overseas upstream assets.

We believe that in the future a few private companies are likely to emerge as survivors and champions from the numerous independent refineries that exist today. These companies will become the game changers in a sector long dominated by SOEs.

Automotive

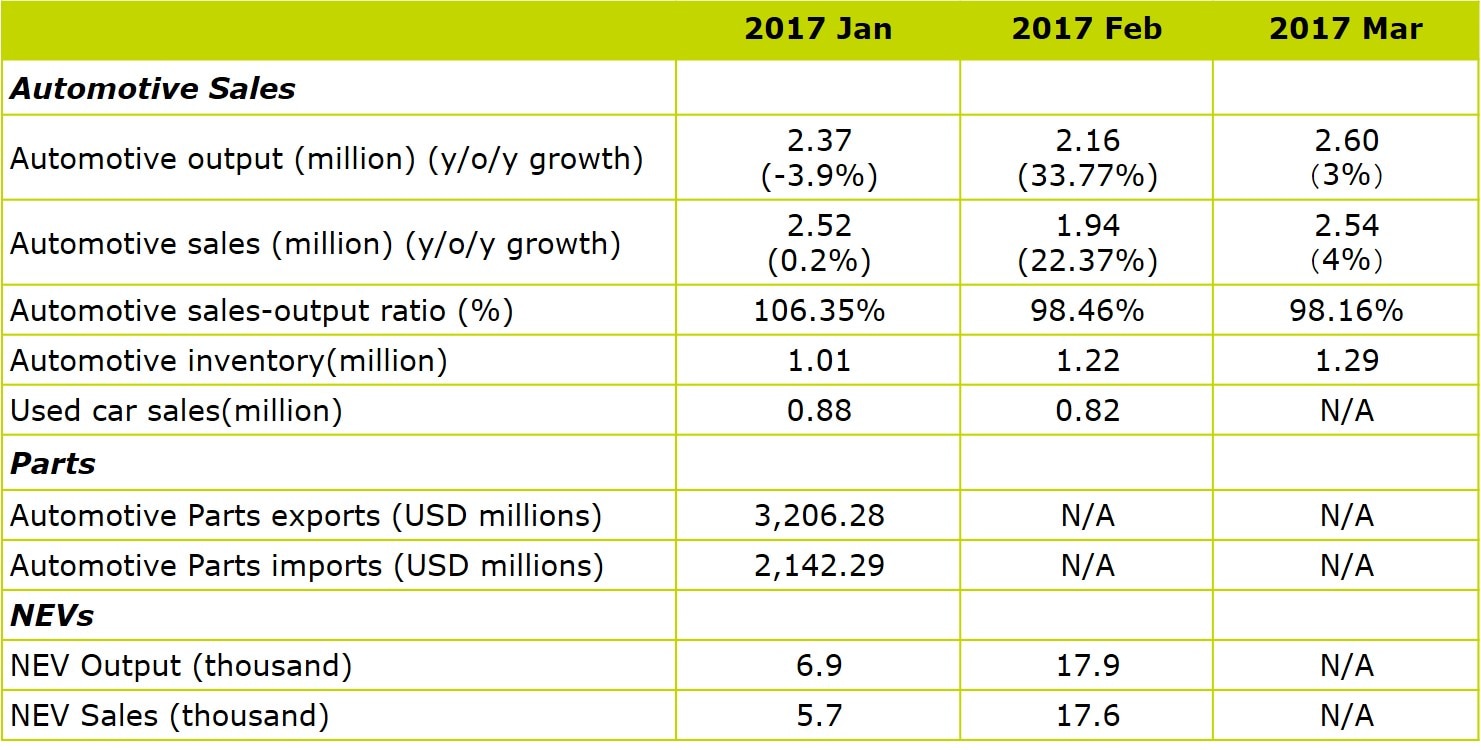

China to curb monopolistic practices in the automotive market

Auto Brand Sales Measures, a document that offers de facto regulatory guidance on auto sales, distribution and aftermarket services which has been in place since 2005, is about to see its first update in 12 years this April. It is a welcome and long-overdue move as the Chinese government is more determined than ever to curb monopolistic practices by automakers, especially foreign brands whose leading market positions have been helped by the existing rule. The Auto Brand Sales Measures document has long enabled auto manufacturers to keep a tight grip on dealerships. But with the drastic changes that have taken place in auto market, the existing rule can barely serve its purpose. We believe the proposed new rule which has been under consideration for the last two years will have significant impact on dealers' business model, parts distribution and the aftermarket landscape.

4S store is no longer the only game in town

Most automakers sell their cars and parts through their network of authorized 4S stores in China. Under the current rule, a single dealership cannot sell rival brands. In 2014, the State Administration of Industry and Commerce (SAIC) announced that they would terminate the record filing of authorized dealers, a move which is widely seen as a relaxation on authorization requirements as SAIC decides on the business scope of any legal entities in China. Dealers who sell single brand will be required to establish other legal entities in order to sell vehicles from multiple carmakers. It is expected that the proposed new rule will recognize both authorized and unauthorized sales channels, meaning that 4S stores will no longer be the only legitimate channel for selling cars or parts. As a result, new business models such as car supermarkets and online auto stores will also be able to function.

Automakers lose their control over dealerships

Auto manufacturers have long placed a tight noose on dealer's daily operations –ranging from floor space, investment amount and sales quotas to marketing strategies. Under the draft rule, auto manufacturers are no longer able to keep a tight grip on dealerships as practices like inventory pile-up at dealers' lots and bundled sales with unpopular models will be prohibited. Large dealership groups have experienced declining profit margins on new car sales for the past few years. Once the new rule takes effect, we believe dealers' profits will see a substantial increase. Although dealers will benefit from diminished control from auto makers, their influences over consumers purchase decisions will also be weakened. For instance, moves such as force-placed insurance, limiting choices in auto lenders will be strictly forbidden.

Level the playing field for independent repair shops

Auto companies managed to control distribution of spare parts mainly by forbidding parts suppliers from selling original products to third parties, such as unauthorized dealerships and independent repair shops. Thus, consumers would get their cars serviced at authorized dealerships during the warranty period as otherwise, they would have to assume the risk of paying for counterfeit parts at independent workshops. This will no longer be the case. Under the rule, auto manufacturers will have a great deal less influence over distribution and pricing of spare parts. A free flow of better and original spare parts will help level the playing field for independent workshops which have long been suppressed.

Logistics

E-commerce and logistics enterprises go overseas in lockstep

E-commerce business expands the space and the place of international trade, shortens the distance and the time of international trade, and pushes forward the rapid developments of global economy. China's e-commerce enterprises have also taken a solid step in the direction of globalization. On March 22, 2017, China's first overseas Electronic World Trade Platform (eWTP) initiated by Alibaba Group went online in Malaysia. In a typical lockstep move, Cainiao Logistics announced plans to establish a super logistics hub located at Kuala Lumpur airport. The super hub will be as much an air cargo warehouse and distribution center as a comprehensive eWTP Park, including logistics, customs clearance, trade and finance services along with a series of supply chain and commercial service facilities. The hyper hub is expected to go into operation in 2019.

Along with the rapid development of cross-border e-commerce, China's express delivery industry has also been growing, with capacity accounting for nearly half of the world's capacity. China's express enterprises (Yuantong、Shentong、Baishi and Yunda), and China's warehousing and distribution enterprises (Xinyi, Beiling, Wanxiang and Shengbang) are all involved in these super logistics hub projects. The logistics hubs will make good pilot programs for the subsequent development of eWTP on a global scale.

When consumers make cross-border purchases, they are mostly concerned with authenticity of the purchased products and certainty in shipping. To address these concerns, Cainiao Logistics last year opened global order fulfillment centers (GFC) in Hong Kong and Australia. If a seller uses GFC, his consumers can view logistics details in real time, including orders, purchases in and out of the warehouse, flights en route, customs clearance and other information. As a result of the integration of consumer transactions, payment and logistics information, the consumers do not need to provide additional personal information when GFC goods clear customs, which simplifies the cross-border shopping process and improves the efficiency of logistics mechanisms.

In terms of import and export of cross-border logistics, Cainiao Logistics and other logistics enterprises partners have reserved 19 import bonded warehouses in such cities as Shanghai, Hangzhou, Ningbo, Guangzhou, Chongqing, Zhengzhou as the company also provides global cargo lines in the United States, Britain, France, Australia, New Zealand, Japan, South Korea, Taiwan, Hong Kong as well as in nine other countries and regions. In addition, Cainiao Logistics has access to more than 110 overseas warehouses, spanning the globe with 224 import and export logistics networks. It has been found that overseas warehouses efficiently address distribution issues, making domestic and foreign goods transactions much easier.

Many challenges exist for eWTP, such as difficulty to build up global networks (including trade network, logistics network and payment network), fierce completion coming from the likes of Amazon and other international rivals, and the disruptive impact of emerging technologies. However, the eWTP model is positively recognized.

In view of the development of China's global logistics business, Deloitte is well placed to provide strategic consulting, tax planning and overseas investment risk management for domestic logistics enterprises.