Recharges - VAT or no VAT? has been saved

Perspectives

Recharges - VAT or no VAT?

Thought leadership article

By Chris Borg, Indirect Tax Principal and Michal Januszewski, Indirect Tax Manager

Explore Content

- Introduction

- Recharges outside the scope of VAT

- Stand-alone recharges

- Recharges in conjunction with other supplies

- Non-recharge

VAT is a system which is meant to be fully neutral to businesses engaged in VATable activities. As such, it should not influence their business decisions nor distort their operations in any way. In reality though, even businesses which recover VAT still face compliance obligations, including the task of interpreting and applying VAT rules. Given the complexity of the system, this is hardly an easy task. In our experience, one of the issues which continuously proves problematic in practice is the VAT treatment of recharges.

One of the reasons behind this could perhaps be the fact that the term “recharge” is not defined in VAT law. Consequently, this term is colloquially used to describe a number of similar albeit legally different situations which carry different VAT implications.

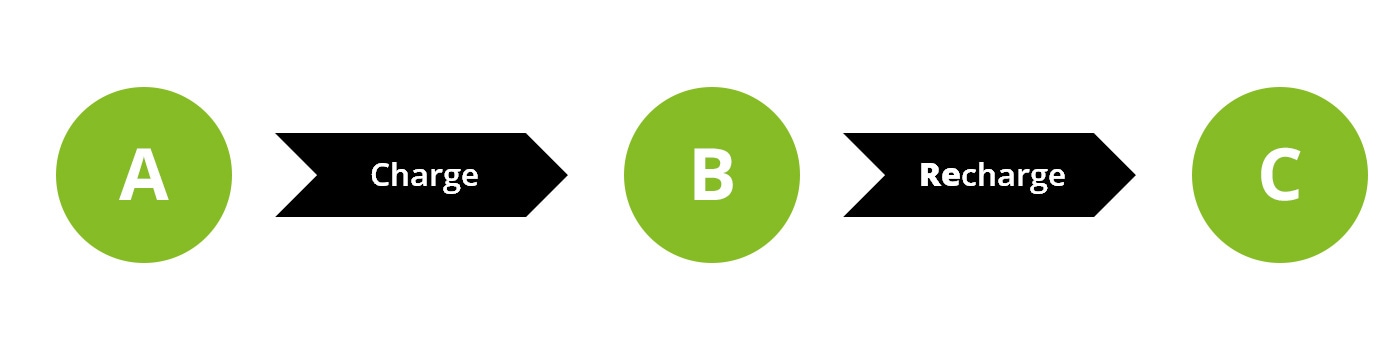

One factor that these situations do have in common, though, is that a recharge by one entity to another must, as the term itself implies, be preceded by a charge borne in the first place by the former. Thus, in a typical recharge situation there would be three entities:

- “A” which charges “B”

- “B” which is charged by “A” and, in turn, recharges the cost (or part thereof) to “C”

- “C” which incurs the recharge made by “B”

Therefore, it could be stated that a recharge invariably implies a transfer of cost. Of course, this does not mean that such a transfer always attracts the same VAT treatment.

Recharges outside the scope of VAT

Firstly, it is to be noted that certain recharges could be completely VAT neutral due to the legal status of the entities involved. For instance, where a recharge is made by a head office to its branch (or indeed vice-versa), the transaction would typically remain outside the scope of VAT. This is because the head office and the branch represent a single legal person and so, any operations between the two are of a purely internal character and do not attract VAT. Effectively, it is like taking money out of one pocket and putting it in another.

Secondly, recharges are also outside the scope of VAT in the case of disbursements paid by “B” in the name and for the account of “C”, i.e. where “B” purchases certain goods or services not its own name, but in the name and for the account of its customer (“C”) and later wishes to recover the cost by claiming a reimbursement from “C”.

Finally, a recharge might also be outside the scope of VAT if it relates purely to employee salary costs. The collection by a company from one or more other companies of an amount that is intended to compensate the former company for a percentage of the employee’s salary costs at no mark-up is generally accepted not to constitute a supply of services for consideration for VAT purposes, and thus is not subject to VAT. This is a corollary to the general principle that employment falls outside the scope of VAT. This VAT-free outcome is subject to the satisfaction of certain conditions, and is a common market practice particularly in the case of groups of companies where it is typically expedient for an employee to be formally engaged by one designated group company, while the employee owes his employment duties also to one or more other companies within the group.

If the chargeability to VAT of a recharge cannot be ruled out for any of the above reasons, the next step is to assess whether the recharge constitutes a separate and independent supply for VAT purposes, or alternatively if it is of ancillary character to another supply which is made by “B” to “C”.

Stand-alone recharges

In a situation where the recharge constitutes the only supply by entity “B” to entity “C”, this recharge from “B” to “C” must typically be regarded as an independent supply which is subject to VAT.

For example, where “B” buys a software licence from “A” but grants a sub-licence to “C”, the supply by “B” to “C” is subject to VAT. The fact that the licence is acquired by “B” from “A”, which is another taxable supply in itself, does not influence the VAT treatment of the supply by “B” to “C”. The latter is an entirely separate and independent transaction.

Recharges in conjunction with other supplies

The situation gets somewhat more complicated where “B” also provides “C” with supplies other than the one which is the subject of the recharge. A common example is service charges charged under a real estate rental contract by a landlord to a tenant in connection with rent-related costs, such as the supply of water, heating, building maintenance, cleaning of the common parts and/or the security of the building. In this case, the landlord (“B”) incurs the cost of the respective supplies from its various suppliers (“A”) and recharges this to the tenant (“C”).

Based on the judgments delivered by the Court of Justice of the European Union (CJEU) in landmark VAT cases such as Field Fisher Waterhouse LLP (C-392/11) and Wojskowa Agencja Mieszkaniowa w Warszawie (C-42/14), such recharges may be seen as merely ancillary to the principal supply (namely, the rental of property) when certain conditions are met. In this respect, according to the CJEU it is important to consider, amongst others, whether the landlord can terminate the rental arrangement if the tenant fails to pay the service charges. If this is the case, it could be argued that the service charges are not independent from the property rental – rather, these should be seen as forming a single supply. Conversely, the court also stated that if the tenant is at liberty to choose its own preferred supplier for the other supplies or is entitled to conclude a contract directly with the supplier, this would suggest that the recharges are to be considered as a supply which is separate from the rental of property.

Assessing whether a recharge is ancillary to another supply or an independent one is crucial for the purposes of applying the correct VAT treatment. This is so because where the recharge proves to be an independent supply, the fact that “B” may make other supplies to “C” becomes irrelevant to the VAT treatment of this recharge.

However, where the recharge is to be viewed as merely ancillary to another supply by “B” to “C”, it would not constitute a separate supply for VAT purposes, but would instead form a single supply with the principal supply, and sharing the latter’s VAT treatment. Referring back to the above example concerning property rental, this means that if the property rental is VAT exempt (which in Malta is generally the case, subject to certain exceptions), the recharge of service charges by the landlord to the tenant would also be VAT exempt – even if the landlord had been charged VAT on the same supplies.

Non-recharge

In certain situations, what would at first appear to be a recharge may in actual fact be treated as a transaction of a different nature for VAT purposes. This was so in the case decided by the CJEU called Auto Lease Holland (C-185/01) which concerned fuel cards. In this case, “A” charged to “B”, which in turn recharged to “C”, costs for fuel purchased by “C” at filling stations run by “A”. “B” argued that it had, for VAT purposes, first acquired the fuel from “A” and then resold it to “C”. However, due to the limited impact of “B” on the transactions and the direct interaction between “A” and “C”, “B” was eventually deemed to be merely financing the purchase (i.e. supplying a financial service to “C”), and not actually purchasing the fuel and reselling it.

In light of its complexity, it is expected that the VAT treatment of recharges will continue to prove problematic to taxpayers. The VAT treatment of any particular recharge situation must of course be determined on a case by case basis, based on the specific facts of the transaction and in light of the aforementioned VAT principles and CJEU case law concepts.