Analysis

2019 Global life sciences outlook

Focus and transform| Accelerating change in life sciences

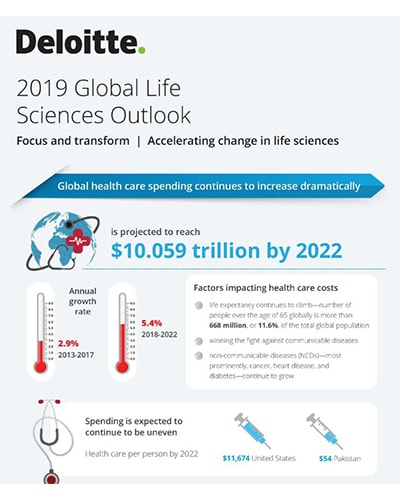

Strategic transformation is at the core of life science companies as they build new business models for the future. To accelerate change, focus will be on developing innovative and relationship-driven partnerships and creating real value for patients. Data is now the currency of life sciences, and mobilizing data throughout the enterprise, transforming work, and using technology symbiotically will be fundamental to advancing digital transformation.

Explore Content

- Download the report

- Infographic

- Strategic focus on deal-making and external innovation

- Focus on new entrants

- Focus on expanding a richly networked ecosystem

- Focus on outsourcing

- Collaborating with new partners for transformation

- Transformative technologies in life sciences

- Mobilizing data, the currency of life sciences innovation

- Creating value with new business and operating models

- Advancing digital transformation in life sciences

- Transforming work

- Explore previous outlooks

- Follow us on social media

- Key contact

Overview

What are the trends affecting life sciences? In 2019, the life sciences sector will see a strategic rise of the digital mindset and further adoption of transformative technologies. While traditional investment vehicles, like mergers & acquisitions, can expect a sharper focus, external innovation can become a meaningful culture change-agent through innovative and creative partnerships with new entrants and non-traditional players.

The digital age requires more transparency and disclosure and a need for real relationship-driven partnerships will extend to all sector stakeholders—patients, advocacy groups, and regulators —and also to outsourcing vendors critical to the supply chain. Data will be the force behind new revenue models and crucial to understanding and delivering an exceptional patient experience.

Continued pricing pressures, increasing access to drugs, growth of gene and cell therapies, and uncertain trade policies will further change the dynamics of the market. The 2019 Global Life Sciences Outlook gives insights into the global life sciences economy and reviews the trends impacting businesses as they look to accelerate change and elevate the patient experience. The outlook provides suggestions for stakeholders to deal with the changing global economy and discusses examples from the market. The report also provides leaders with key questions and actions to consider in the year ahead.

Global life sciences sector issues in 2019

Strategic focus on deal-making and external innovation

In 2019, biopharma faces a compelling strategic imperative for external innovation. The simultaneous hunt for next gen medicines against declining R&D returns make external deals a key innovation source for companies. It is likely to be the dawn of a new age of deal-making, especially, for companies looking to take the lead in next-generation therapies. Large, transformative acquisitions in the US$60-70 billion range defined 2018 and the beginning of 2019. This year, we will see an increase in appetite for mid-sized strategic transactions that complement a company’s core and shedding of non-core assets.

Key takeaway:

Companies need to aim to strengthen their R&D pipeline through mergers and acquisitions, licensing, and strategic partnerships. However, this year, the transactions are likely to be more complex with innovative structuring, as opposed to the conventional framework. While companies may be rearranging portfolios based on pricing controls, acquisitions are expected to be very strategic with a focus on core therapies or specialties. As a result, a lot of activity is also expected in divestitures.

Focus on new entrants

As digitization continues to shape the corners of pharma, a new generation of startups and tech giants have emerged, disrupting the status quo and threatening pharma’s legacy culture. While pharma giants are investing in gene-based therapeutic solutions, more than 250 startups are already developing these therapies and building them around the patient. These startups could merge and form a whole new breed of company with a very different culture around innovation and life sciences. In 2019, a lack of manufacturing capacity for next generation therapies still poses a challenge.

Tech giants diversifying into health care and investing in startups are masters of data. They know how to simplify the patient experience and are developing medical grade technology for both diagnostics and therapeutics. In 2018, the first tech giant received an FDA clearance demonstrating that regulatory is also poised for disruption from these new entrants. According to a recent survey, more than 80 percent of medtech R&D leaders plan to partner with organizations outside of medtech─like technology and health care companies.

Key takeaway:

While new entrants provide an opportunity for companies to drive innovation, they also pose an undeniable threat. Unable to cope with the new age capacities and diversities, the old school pharma may find itself outside the value chain. In the digital economy, smaller companies, often with one asset, are increasingly trying to control that asset throughout its life cycle. Even with limited infrastructure, they could compete with pharma giants in their domains.

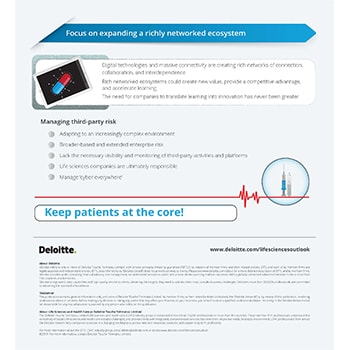

Focus on expanding a richly networked ecosystem

Digitization, no doubt, is helping establish a richly networked and collaborative ecosystem. While such a system provides an excellent scope for value creation, it also poses risks from unmonitored third-party activities. Data partners, the Internet of Things (IoT), and the growing Internet of Medical Things (IoMT) have constantly been warning about the surfacing cyber risks in pharma. Therefore, leaders are expected to develop management frameworks and partner with those having compatible risk profiles. Digitization of health care processes has also given way to mounting patient expectations. This essentially means that life sciences leaders should try to gain a deeper understanding of patient experiences and expectations when designing value chains.

Key takeaway:

While digitization brings in ample opportunities, it also exposes pharma companies to vulnerabilities like cyber threats, especially in a scenario where interdependency and collaboration are scaling. With digitization of tools and processes, patient expectations too have risen. Stakeholders should create coherent and meaningful experiences through the entire chain of patient interactions across all phases—from R&D and product launch to commercialization.

Focus on outsourcing

Pharmaceutical giants are moving to adopt strategic and relationship-based outsourcing models as opposed to the traditional transactional engagements. This will likely stimulate biologics and data-driven clinical innovation, and bolster manufacturing capacity. The upcoming year could see more outsourcing of expertise, especially, cognitive automation, AI, and cloud computing. Sector growth driven by biopharmaceutical outsourcing is also a possibility. Strategic partnerships with academia and contract research organizations (CROs) indicate that companies are focusing on strengthening R&D capabilities.

Key takeaway:

Strategic, long-term partnerships is a requisite for pharma companies to streamline supply chain, better manage the capacity gap arising from the shift to biologics and personalized medicine, and thereby, improve time-to-market. Sustaining close relationships with vendors is critical for maintaining compliant operations because an oversight may cost pharma companies their reputation. Knowledge management is moving to the next level in the pharma space with advanced technologies like AI, machine learning, and IoT.

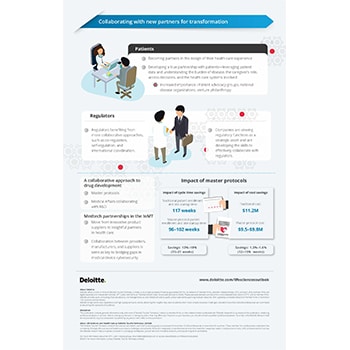

Collaborating with new partners for transformation

Digitization of health care has transformed the way patients, providers, and innovators interact. A highly patient-centric future is already surfacing and organized patient advocacy groups are playing an increasingly important role. In 2019, collaborative approaches will be key for working with patients and regulators, advancing drug development and the Internet of Medical Things. Large and small companies will also need to work together to minimize cyber risks in the ecosystem.

Key takeaway:

In this highly digitized and connected world where patients have complete visibility into the experience they will be provided, it is imperative for companies to double the focus on customer experience. Companies should prioritize interpreting the burden of a disease on specific groups by building a culture where patients are partners, and not just consumers. Advanced technologies like AI can play a critical role here by helping pharma companies produce highly personalized solutions at competitive prices within shorter durations. Integrating connected medical devices into existing care pathways require collaboration across the IoMT ecosystem that can be facilitated by partnerships and joint ventures.

Transformative technologies in life sciences

The physical, digital, and biological worlds converge in Industry 4.0. Forward-thinking pharma companies are moving beyond pilots and focusing on how new technologies can add value. These are some of the technologies driving digital transformation in life sciences.

Artificial Intelligence (AI): AI is just beginning to be applied in life sciences to help with intelligent use of data. It has the potential to revolutionize diagnoses, treatment planning, patient monitoring, and drug discovery.

Internet-of-Medical-Things (IoMT): The rising number of connected medical devices—together with advances in the systems and software that support medical grade data and connectivity—have created the IoMT. Connecting devices is currently a priority as sensors are transforming diagnosis and the way patients are treated and monitored.

Software-as-a-Medical-Device (SaMD): Software is changing how clinicians practice medicine, how consumers manage their own health, and how patients and providers interact. SaMD is a software that provides one or more medical functions and is usually embedded in hardware. The algorithms powering SaMD are already proving better than some clinicians’ diagnoses.

Blockchain: Blockchain has emerged as a potent solution to aggregate data with ease and share it securely in an automated and error-free way.

DIY diagnostics and virtual care: Tools that provide at-home convenience can also help with faster diagnoses and provide 24/7 access to health coaching and monitoring. DIY diagnostic tests can help low-income or rural consumers determine if a condition warrants a visit to a doctor or hospital.

Future of mobility: The emergence of connected, electric, and autonomous vehicles will bring another transformation in the pharma world by expanding mobility and thereby, access to care and democratization of clinical trials.

Key takeaway:

Disruptive technologies have certainly transformed health care and life sciences. But organizations would need to look at how the disruptive technologies can work in tandem to drive meaningful transformation and provide value. Many companies are still in the experimental stage when it comes to digital. To realize their full potential and keep pace with technology’s rapid evolution, regulation of these technologies needs to become more agile.

Mobilizing data, the currency of life sciences innovation

Forward-looking life sciences leaders who have adopted digital platforms and emerging technologies are measuring value and outcomes with greater efficacy. Big Data driven insights can dramatically transform patient care and enhance productivity of trials.

R&D seems to have embarked on a new journey with the digital wave where trials are less burdensome and more engaging. Patients are collaborators during clinical trials and not just passive participants. The emergence of virtual clinical trials has eliminated the need for travel, thereby, expanding the geographical reach and accessibility from a patient-care point of view. R&D executives are placing greater emphasis on the role of Real-World Evidence (RWE) and focusing on end-to-end, AI-driven, internally-developed solutions.

Key takeaway:

Key takeaway: In 2019, the early adopters of digital technologies and platforms could benefit from better engagement with patients, deeper insights from clinical trials, and faster cycle times for products in development.

Creating value with new business and operating models

Digitally maturing biopharma companies are exploring ways of applying an enterprise-wide approach to digital transformation. All of these approaches require patient centricity.

B2C thinking: Organizations aligning with how consumers respond to or use products or services—like digital health apps, telemedicine, wearable monitoring devices, etc. can design top-notch engagement strategies.

Engagement tools: Patients who are informed about their condition and involved in their treatment decisions tend to have better health outcomes and typically incur lower costs.

Focus on prevention and digital therapeutics: Digital therapeutics can be a new source of revenue for life sciences, potentially providing reimbursement through insurance plans in the same way as drugs or medical technologies.

Opportunities to monetize data: The challenge for life sciences companies is building trust. 40 percent are willing to share their data for health care research or to improve a device. Fewer are willing to share information with device manufacturers.

Key takeaway:

Life sciences leaders are also looking to leverage advanced digital technologies to identify new revenue sources. The sector will likely need to harness the shift from product to service. Companies should have a vision for their role in the patient journey and the overall health care system.

Advancing digital transformation in life sciences

More than three-quarters of biopharma companies agree that their organizations need new leaders to succeed in the digital age. Many companies are recruiting outside of the life sciences sector for digital expertise. Currently, only 20 percent of companies feel they have matured in their journey to becoming a digital enterprise.

Key takeaway:

To advance digital transformation in 2019, life sciences companies should start with determining and articulating their ambition. This means prioritizing initiatives, anchoring decisions, and focusing on the future. Leaders can then be poised for adapting new operating models, transforming work culture, implementing technology, and scaling solutions.

Transforming work

A greater percentage of digitally-maturing biopharma companies are exploiting new ways of doing business as opposed to exploiting organizational competencies. Collaboration is seen as a key differentiator. Leaders should not only encourage collaboration internally across functions, but also externally. They also need to provide a clear vision and purpose for their organization’s digital investments and empower people to think differently.

The future of work requires a fresh perspective and the sector is beginning to embrace new recruits, like chief digital officers (CDOs), coming from outside the life sciences sector. In addition to having a digital-first attitude, outsiders will increasingly be sources of expertise for advanced data analytics and machine learning. The increased use of advanced technologies does not mean human effort will be replaced, rather, it will be leveraged for high level tasks so that efficiencies can be optimized and adversaries are eliminated.

Key takeaway:

To maximize the potential value of advanced technologies today and minimize the potential adverse impacts on the workforce tomorrow, organizations should put humans in the loop—reconstructing work, retraining people, and rearranging the organization. Companies can create incubator spaces in innovation clusters around the globe, specifically designed to support early-stage companies that need facilities, mentoring, and networking to progress.

Visit our 2019 Global health care outlook to learn more about the trends and issues impacting the health care sector.

Explore our previous outlooks

Review or download previous life sciences sector outlooks.

2018 - Global life sciences outlook

2017 - Global life sciences outlook

2016 - Global life sciences outlook

Explore Content

- Download the report

- Infographic

- Strategic focus on deal-making and external innovation

- Focus on new entrants

- Focus on expanding a richly networked ecosystem

- Focus on outsourcing

- Collaborating with new partners for transformation

- Transformative technologies in life sciences

- Mobilizing data, the currency of life sciences innovation

- Creating value with new business and operating models

- Advancing digital transformation in life sciences

- Transforming work

- Explore previous outlooks

- Follow us on social media

- Key contact