Article

Central Europe CFO Survey 2018

Balancing optimism with risk aversion

Although the majority of respondents anticipate favourable macro-economic conditions for 2018, not all are looking to the future in an altogether positive light. A positive economic outlook is insufficient to encourage risk-taking among Central Europe’s businesses.

Explore Content

Key findings

Economic outlook

- 85% of CFOs think inflation will increase in 2018

- CFOs are predicting average GDP growth of 2.4% in their countries (0.5 percentage points [pp] more than in 2017)

- 55% expect interest rates to rise during the year

Business environment outlook

- A significant majority – 69% of respondents – do not think 2018 will be a good time for companies to take on more risk.

- 44% believe the impact of interest rates on their business is too small to influence company strategy

Company growth outlook

- 91% of CFOs expect workforce costs to increase in 2018

- Only a small fraction of CFOs, 13%, expects CAPEX to fall in 2018.

- Nearly half (46%) of CFOs expect their workforce to expand in 2018, slightly more than in the 2017 survey.

Message from the CFO Program Leader:

What I think the survey shows is a population of CFOs looking to 2018 and beyond with optimism – but an optimism that is touched with the caution that comes from their awareness of possible obstacles, particularly relating to recruitment and cost increases. As a result, they will restrict the levels of risk that they are willing to take. The findings in this report are pretty positive overall, painting a region-wide picture of confident GDP expectations and the anticipation of company growth. However, these views are not translating into an increase in the region’s enterprising spirit. Firstly, respondents continue to see the level of uncertainty as ‘normal’ – what would it take for them to see it as ‘low’? Secondly there is still a general risk-aversion, which has now dominated the CFO survey results ever since the global financial crisis that is now close to a decade ago. Without some preparedness to take greater risk, companies are not going to achieve their full growth potential. If you cannot take risk in a time of anticipated economic growth, when can you?

Gavin Flook, CE CFO Program Leader, Deloitte Central Europe

The report is divided into four main chapters. The first three are on the macro-economic outlook, CFOs’ personal perspectives on the operating environment and their expectations for the performance of their own companies. The fourth chapter is a special focus on robotic process automation (RPA), covering their expectations of this key area of the digital economy.

Economic confidence remains on an upward trajectory

Positive expectations for factors like GDP, unemployment, inflation and interest rates abound across most markets. In particular, GDP growth is regarded positively, with predictions ranging from 1.8% in Ukraine to 2.9% in Slovakia.

Challenges fail to reduce widespread business optimism

The concerns that many CFOs have about external uncertainty at both a country and a company level are preventing many from taking more risk onto the balance sheet. Their chief worries relate to their ability to attract highly skilled employees and manage an overall increase in the costs of doing business.

Expectations of rising company revenues

Company perspectives are little different from those of 12 months before, as shown by a small rise in our Company Perspective Confidence Index. This suggests that CFOs believe their companies’ financial prospects over the next 12 months are good and that there is a high likelihood that their revenues will increase.

The inevitable rise of RPA

In this era of company digitalisation, CFOs are quick to recognise that ongoing process automation – across the business, but particularly in the finance department – is inevitable. However, few regard their own businesses as advanced adopters of RPA and many find it difficult to estimate the possible savings that it could deliver.

Specific findings in this area included:

- Only 7% think their companies are advanced in robotic process automation

- 62% of CFOs believe that the greatest beneficiaries of process automation will be their company operations

- 33% are unsure about the size of automation gains, whether already achieved or yet to come

About the survey

This annual questionnaire tracks the latest thinking and actions of CFOs representing largest and most influential companies in the Central European region. It explores top-tier CFO issues across four areas:

- Business environment

- Company priorities and expectations

- Finance priorities

- Digital transformation of finance function

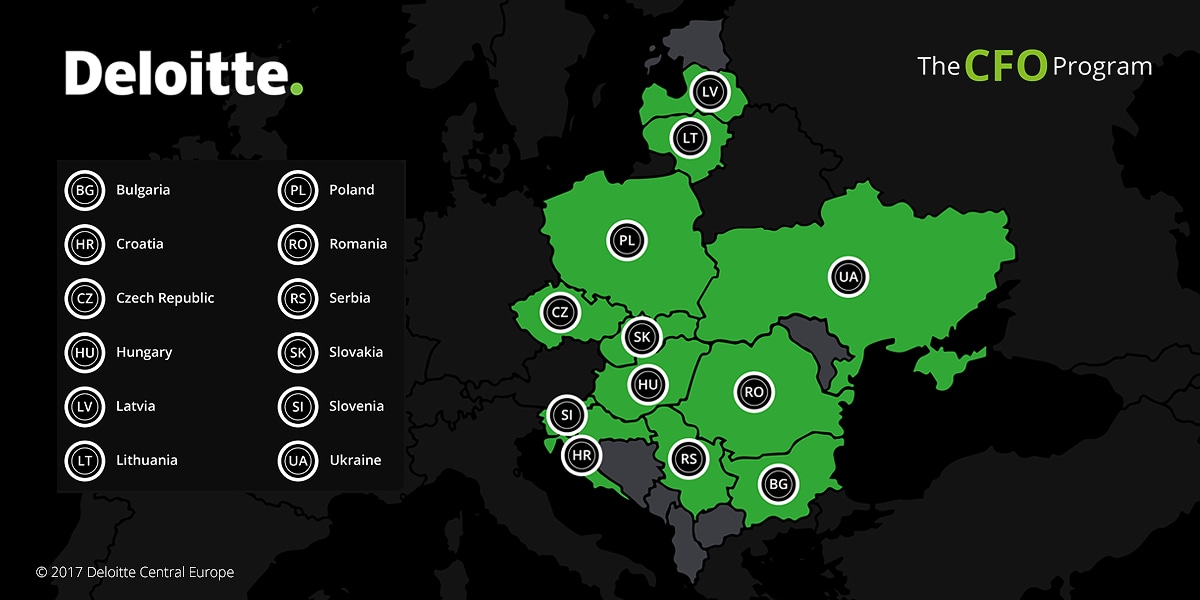

The findings discussed in Deloitte Central Europe CFO Survey 2018 represent the opinions of 584 CFOs based in 12 Central European countries: Bulgaria, Croatia, the Czech Republic, Hungary, Latvia, Lithuania, Poland, Romania, Serbia, Slovakia, Slovenia and Ukraine.

Previous editions

CE CFO Survey 2017 (PDF, 3MB)

CE CFO Survey 2016 (PDF, 6MB)

CE CFO Survey 2015 (PDF, 5MB)