Predictions

Touch Commerce: the mobile online checkout gets an express lane

TMT Predictions 2016

Executive summary

Deloitte Global predicts that in 2016, the number of individuals who use a third party touch-based payment service to make a purchase on their mobile devices (smartphones and tablets) should increase 150 percent, to reach 50 million regular users.

Touch commerce enables a customer to make a secure first-time or subsequent payment on any merchant’s website or app without having to provide registration or log-in details either to the merchant or to the payment service. Authorizing the transaction on a mobile device simply requires the application of a fingerprint or a few touches of a screen, significantly reducing the time taken from browsing to transaction from tens of seconds or even minutes to mere seconds.

Touch commerce enables retailers to exploit shoppers’ increasing use of mobile devices to browse retail sites and apps. Transactions on sites and apps remain scarce, with laborious payment processes often to blame. Indeed cart abandonment in mobile commerce can be as high as 80 percent. Easier checkout has been identified as a key factor/key requirement for increased mobile buying.

There are likely to be two principal types of third-party touch-based mobile payment services in 2016.

One is linked to the device’s operating system (OS). Shopping applications can use existing information associated with the OS, including payment card details and home address. Deloitte Global expects this category should represent the majority of touch-based payments made in 2016: there are billions of smartphones that have payment card and home address information associated with them. Additionally, the base of fingerprint reader-equipped devices is steadily rising, with more than 450 million forecast to ship this year, adding to the existing base of hundreds of millions’.

The second type of third-party touch-based mobile payment service is linked to existing payment service providers. Prior to being able to make purchases by one or two touches of the screen, the user would need to have opened an account with the payment provider and elected to stay logged in for future purchases. Once this feature is enabled, the user simply has to press buy and confirm buttons. Confirmation can be via a fingerprint with some devices.

These payment services enable retailers to outsource mobile transactions to third parties, and by so doing, convert payment from a frustrating to a friction-free experience. One merchant reported that the checkout process via their legacy app required 103 seconds for customers to type in their full credit card and shipping information; third-party touch payment reduced this to just 17 seconds.

Other payment services may emerge soon. For example, some large retailers could enable their customers to use pre-stored payment data to validate purchases made on other retailers’ apps.

Today’s consumers are constantly connected to their smartphones, from the early hours in the morning to late at night, when at work, while spending time with family and friends or while commuting. Touch commerce provides opportunities for converting browsing into purchases with a simplified payment process.

1 For a complete list of references and footnotes, please download the full PDF version of the TMT Predictions 2016 report.

Deloitte Global predicts that in 2016, the number of individuals who use a third party touch-based payment service to make a purchase on their mobile devices (smartphones and tablets) should increase 150 percent, to reach 50 million regular users.

Touch commerce enables a customer to make a secure first-time or subsequent payment on any merchant’s website or app without having to provide registration or log-in details either to the merchant or to the payment service. Authorizing the transaction on a mobile device simply requires the application of a fingerprint or a few (typically two) touches of a screen.

Critically, touch commerce reduces significantly the time taken from browsing to

Touch commerce enables retailers to exploit shoppers’ increasing use of mobile devices to browse retail sites and apps. Transactions on sites and apps remain scarce, with laborious payment processes often to blame.

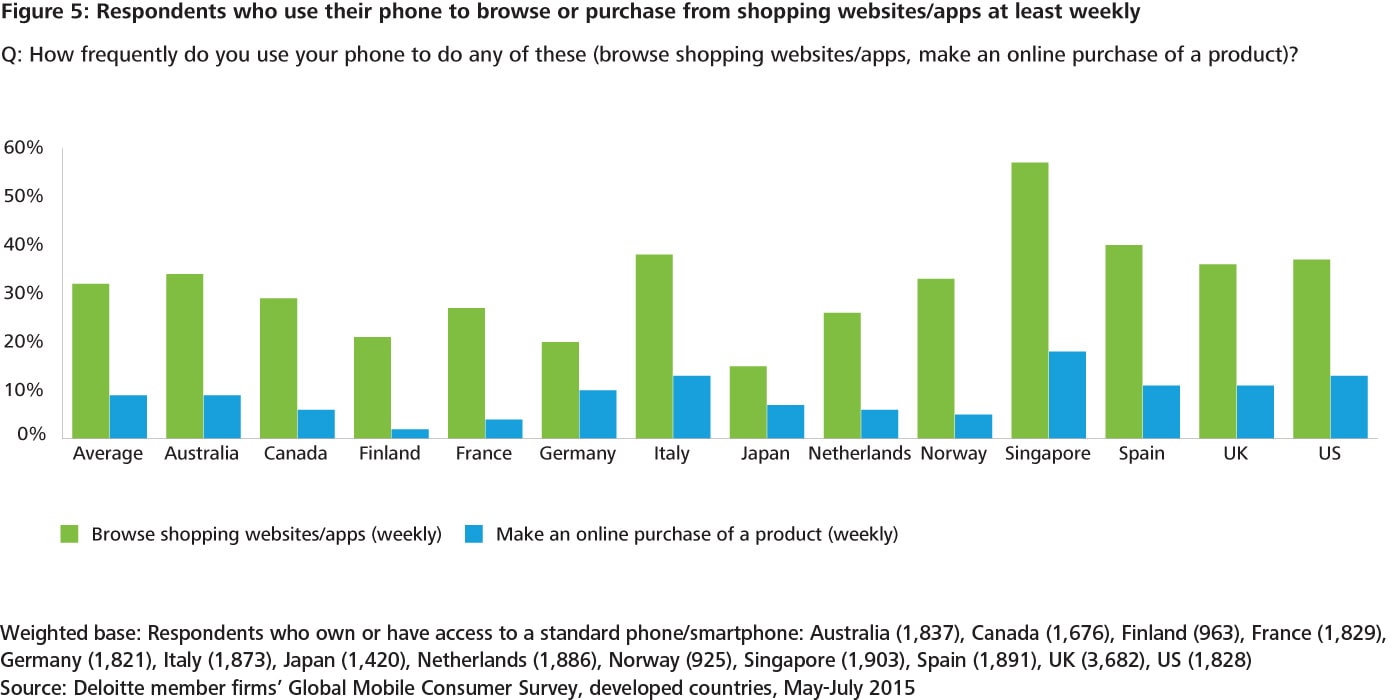

Deloitte member firm research has found that as of mid-2015 about a third of respondents in developed markets browse shopping websites/apps on a weekly basis, but only nine percent purchase (see Figure 1). A first-time visitor to a mobile website or app may need to type in

Question: How frequently do you use your phone to do any of these (browse shopping websites/apps, make an online purchase of a product)?

Weighted base: Respondents who own or have access to a standard phone/smartphone: Australia (1,837), Canada (1,676), Finland (963), France (1,829), Germany (1,821), Italy (1,873), Japan (1,420), Netherlands (1,886), Norway (925), Singapore (1,903), Spain (1,891), UK (3,682), US (1,828)

Source: Deloitte member firms’ Global Mobile Consumer Survey, developed countries, May-July 2015

Submitting all these data on a computer with a full-size keyboard is a chore. On a five-inch touch screen, with predictive text in a mischievous mood and on a juddering bus, it can be tortuous.

Touch commerce enabled by third-party services removes much of the ‘grit’ from mobile transactions, reducing the entire process to the application of a fingerprint or one or two touches of the screen.

There are likely to be two principal types of third-party touch-based mobile payment services in 2016.

One is linked to the device’s operating system (OS). Shopping applications can use existing information associated with the OS, including payment card details and home address. Payments for this service are typically authenticated by a fingerprint and can be used within apps. Goods can be shipped to the default address stored in the OS.

Deloitte Global expects this category should represent the majority of touch-based payments made in 2016: there are billions of smartphones that have payment card and home address information associated with them. Additionally, the base of fingerprint reader-equipped devices is steadily rising, with more than 450 million forecast to ship this year, adding to the existing base of hundreds of millions’.

The second type of third-party touch-based mobile payment service is linked to existing payment service providers. Prior to being able to make purchases by one or two touches of the screen, the user would need to have opened an account with the payment provider and elected to stay logged in for future purchases. Once this feature is enabled, the user simply has to press buy and confirm buttons. Confirmation can be via a fingerprint with some devices.

The combination of these data and technology enables retailers to outsource mobile transactions to third parties, and by so doing, convert payment from a frustrating to a friction-free experience. One merchant reported that the checkout process via their legacy app required 103 seconds for customers to type in their full credit card and shipping information; third-party touch payment reduced this to just 17 seconds.

Other payment services may emerge soon. For example, some large retailers could enable their customers to use pre-stored payment data to validate purchases made on other retailers’ apps.

Third-party touch-based mobile payment services are just a first step towards an overall improved shopping experience on mobile.

Consumers are increasingly likely to expect simplified authentication services, and may want this approach for online as well as in-store payments.

Bottom line

Consumers are constantly connected to their smartphones, from the early hours in the morning to late at night, when at work, while spending time with family and friends or while commuting. These provide opportunities for converting browsing into purchases with a simplified payment process.

Retailers should educate the market on the existence of touch commerce and encourage first-time usage, perhaps by offering small discounts for doing so. Marketing campaigns should show how fast touch payments are, but also explain how they are also as secure, and possibly more so, than conventional check out processes.

Retailers may need to offer a variety of payment options via a range of third parties.

Touch commerce is likely to tap into consumers’ appetite for impulse purchasing. But more mobile commerce and impulse purchases may mean that they will need to be even more responsive and able to cope with unpredicted spikes in demand that may happen at various times of the day and night. The potential impact on sales created by social media influencers should also be considered.

A simplified checkout process is not the only prerequisite for mobile commerce. A user-friendly and appealing mobile website or app is also essential.

Some approaches to touch commerce could cause retailers to lose some visibility of customer behavior. Retailers should carefully weigh the benefits of rapid transaction fulfilment with loss of control of customer data.

Retailers should also consider integrating touch payment services with loyalty schemes.

@DeloitteTMT