Requirements for Maintaining Transfer Pricing Documentation has been saved

Insights

Requirements for Maintaining Transfer Pricing Documentation

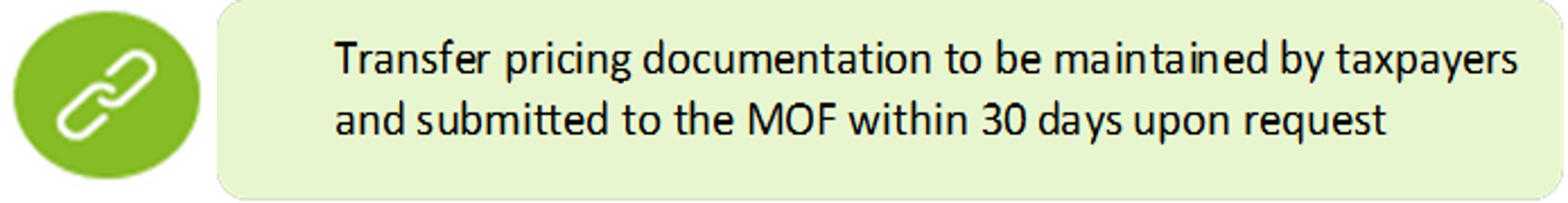

18 May 2023: On 11 May 2023, the Ministry of Finance (MOF) of the United Arab Emirates (UAE) issued the Ministerial Decision No. 97 of 2023 announcing the Requirements for Maintaining Transfer Pricing Documentation for the purposes of complying with the Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Business (CT Law).

In addition, on 12 May 2023, the MOF released the Explanatory Guide on the UAE CT Law with more detailed information on the meaning and intended effect of each Article of the UAE CT Law. More specifically, the Explanatory Guide provides additional clarifications on how particular provisions of the UAE Transfer Pricing (TP) regime may be interpreted.

The following sections provide an overview of the conditions, requirements, and thresholds stated by the Ministerial Decision No. 97 and the Explanatory Guide regarding the UAE TP Documentation.

Thresholds for maintaining TP Documentation:

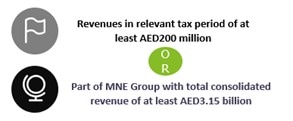

The Ministerial Decision No. 97 has provided the conditions under which a Taxable Person would be required to maintain both a Master File (MF) and Local File (LF) in the relevant tax period. These are as follows:

The announced revenue threshold of AED 200 million allows Resident Persons who do not meet this criteria to benefit from Small Business Relief and be exempt from maintaining TP Documentation. This is the intention of the MOF to further reduce the compliance burden.

However, if the Taxable Person is considered a Constituent Entity of a multinational enterprise (MNE) Group at any time during the Tax Period, it would be required to maintain TP Documentation, regardless of whether the revenue threshold is met.

Although the above thresholds have been announced, further clarity is expected on the thresholds applicable to the Disclosure Form, which will require the disclosure of information on transactions and arrangements with Related Parties and Connected Persons along with the Tax Return.

Persons required to maintain the MF and the LF:

As stated under the CT Law, the Explanatory Guide, and the Ministerial Decision, the following Persons will be required to maintain both the MF and LF:

- A Person subject to the CT Law (i.e., a Taxable Person)*; and

- A Parent Company responsible for filing a Tax Return within a Tax Group.

Furthermore, in order to be classified as a Qualifying Free Zone Person and enjoy the benefits of a 0% Corporate Tax rate on income from certain qualifying activities and transactions, compliance with the TP Documentation provisions, as stated in Article 55 of the CT Law, is required.

(*): Taxable Persons required to maintain the TP Documentation are subject to the thresholds stated in the previous section of this Tax Alert.

Exclusions and inclusions to be considered for the preparation of the LF:

A key observation of the Ministerial Decision No. 97 is that Taxable Persons shall include in the LF transactions or arrangements with Related Parties and Connected Persons considering the following types of entities:

- Permanent Establishments in the UAE;

- Persons who derives State Source Income;

- Taxable Persons electing to be treated as not having derived any Taxable Income (i.e., Small Business Relief);

- Exempt Persons (e.g., Government Entities, Government Controlled Entities, Persons engaged in an Extractive Business, et al.); and

- Resident Persons subject to a different CT rate (i.e., Free Zone Persons).

Conversely, Taxable Persons shall exclude the following transactions and arrangements in the LF with Related Parties and Connected Persons if they meet the following criteria:

- Transactions with domestic entities are excluded from documentation requirements, with the following exceptions:

- Exempt persons;

- Free Zones; and

- Entities elecating for Small Business Relief.

- Transactions with natural person (to an individual) and juridical person:

- In order to exclude from the LF, a thorough analysis needs to be completed to ensure that the pricing is arm’s length (i.e., entities were acting independently)*; and

- A one-time analysis required to be documented as the law is not very clear as of now.

- Transactions with Permanent Establishment of a Non-Resident Person in the UAE with the same CT rate.

(*): Transactions undertaken in the normal course of business OR parties not exclusively transacting with each other. The MOF will consider all facts and circumstances to determine independence.

Outstanding clarifications:

- Thresholds and format of the TP Disclosure Form;

- Format of the MF and the LF; and

- Application of independence provision between transactions or arrangements with certain parties (e.g., Natural Persons and partners in an Unincorporated Partnership).

Key takeaways

The Ministerial Decision No. 97 of 2023, together with the Federal Decree Law No. (47) of 2023 (UAE CT Law), marks a significant shift in the UAE's transfer pricing landscape. These new regulations, which include the obligation for certain taxpayers to maintain MF(s) and LF(s), underline the UAE's commitment to align with international best practices and increase tax transparency.

The thresholds for maintaining MF(s) and LF(s) are set at on a relatively high level. As per the Ministerial Decision, only taxpayers with revenues of at least 200 million Emirati dirhams in a relevant tax period, or that are part of a MNE group with a total consolidated group revenue of at least 3.15 billion Emirati dirhams in the relevant tax period, are required to maintain these files. These thresholds seem to be targeting large corporations and MNEs, reflecting a global trend towards increased transparency and reporting obligations for these entities.

The Ministerial Decision also provides a clear delineation of related parties whose transactions need to be documented in the LF. This includes non-resident persons, exempt persons, resident persons making specific tax elections, and resident persons subject to different corporate tax rates. These specifications provide taxpayers with greater clarity about their reporting obligations, reducing uncertainty and potential disputes.

Interestingly, the Ministerial Decision outlines specific exclusions for documenting transactions in the LF. These exclusions, such as for individuals or juridical persons acting independently or permanent establishments in jurisdictions with the same corporate tax rate, can significantly reduce the compliance burden for some taxpayers.

Nevertheless, it's crucial to note that all taxpayers, regardless of whether they meet the thresholds for maintaining MF(s) and LF(s), are required to ensure that their controlled transactions comply with the arm's length principle. This requirement underscores the universal applicability of this principle in the UAE's tax regulations.

Furthermore, the Ministerial Decision indicates that the MOF will provide future guidelines for its application. These guidelines will likely offer additional clarity and guidance, particularly for complex situations or grey areas that may arise in practice.

Article 55 of the UAE CT Law complements the Ministerial Decision by outlining the MOF’s power to require taxpayers to maintain and disclose TP related information. It also highlights the taxpayers' obligation to provide supporting documentation to substantiate the arm's length nature of their transactions.

In conclusion, these new regulations signal a significant advancement in the UAE's TP framework, aligning it more closely with international standards. It is important for taxpayers to stay informed and make necessary adjustments to their compliance procedures, potentially seeking expert advice if required.

* Ministerial Decision No. (97) of 2023 and Federal Decree Law No. (47) of 2023