Deloitte Football Money League 2023

Get up, stand up

Welcome to the 26th edition of the Deloitte Football Money League, an annual profile of the highest revenue generating clubs in world football. In 2023, for the first time, the publication also analyses the revenue generated by the affiliated women’s teams of these clubs. Published less than eight months after the end of the 2021/22 season, the Money League remains the industry’s most contemporary and reliable independent analysis of the financial performance of clubs at the forefront of football.

The total revenue for the top 20 revenue generating clubs in 2021/22 stood at €9.2 billion, an increase of 13% compared to the €8.2 billion reported by the Money League clubs of 2020/21 (and was only marginally lower than pre-pandemic levels, also €9.2 billion in 2018/19).

The rise was driven by the return of fans after two COVID-hit seasons, with matchday revenue increasing from €111m in 2020/21 to €1.4 billion in 2021/22. Additionally, cumulative commercial revenue rose by 8% (from €3.5 billion to €3.8 billion), which was primarily facilitated by English clubs (who also benefitted from the movement in exchange rates over the financial year1). Five of the Premier League’s ‘big six’ reported increases of 15% or more in Euro terms (a total increase of €226m) as new partnerships were entered and non-matchday events such as concerts and stadium tours returned. However, the increase in commercial revenue was offset by an 11% (€485m) fall in broadcast revenue, as the bumper year experienced in 2020/21, as a result of the deferrals of revenue relating to the postponed 2019/20 seasons being recognised in the financial year, was not repeated.

1 The average exchange rate for the year ending 30 June 2022 was €1 = £0.85, compared to €1 = £0.89 in the year ending 30 June 2021.

The return of fans brought the overall revenue split of clubs in line with pre-pandemic levels, with the top 20 clubs in 2021/22 generating 15% of their revenue from matchday activities, 44% from broadcasting and 41% from commercial sources, which was almost identical to the split recorded in 2018/19. However, whilst the average revenue of a Money League club increased from €409m in 2020/21 to €462m in 2021/22, it is still marginally below the record levels experienced three years prior (€464m).

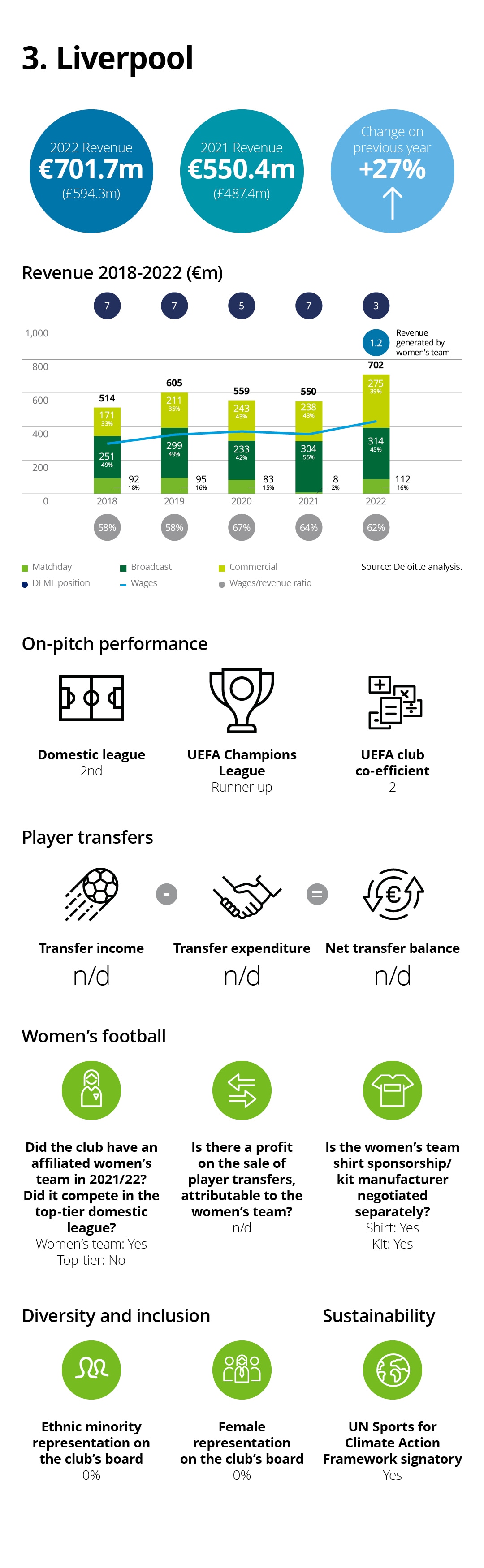

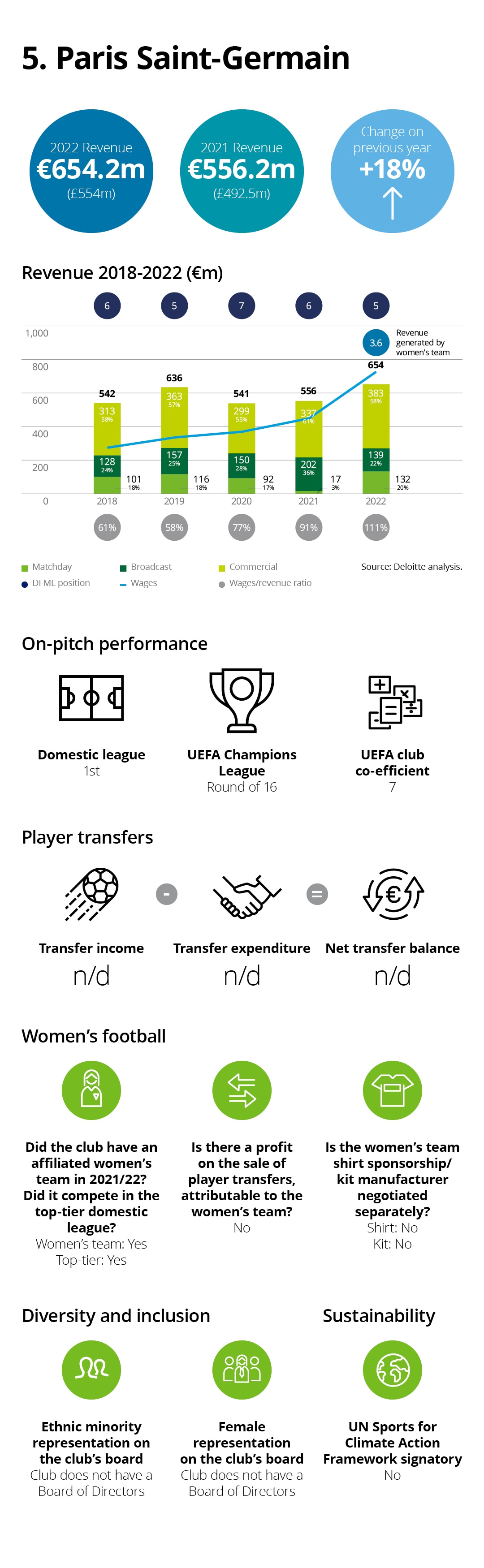

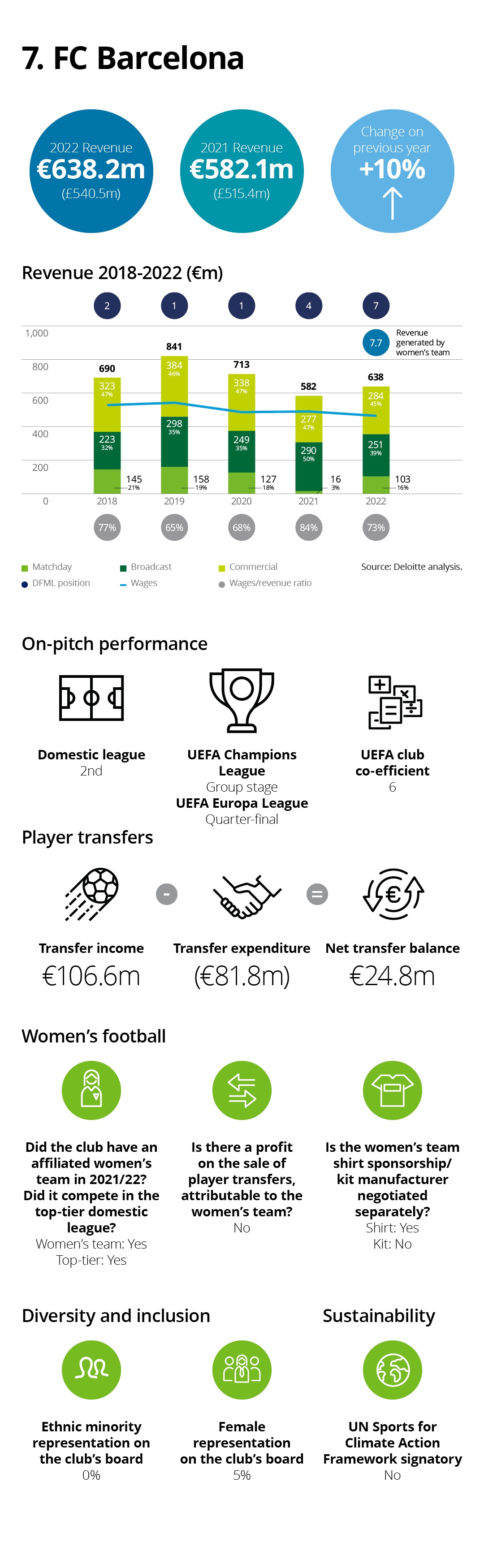

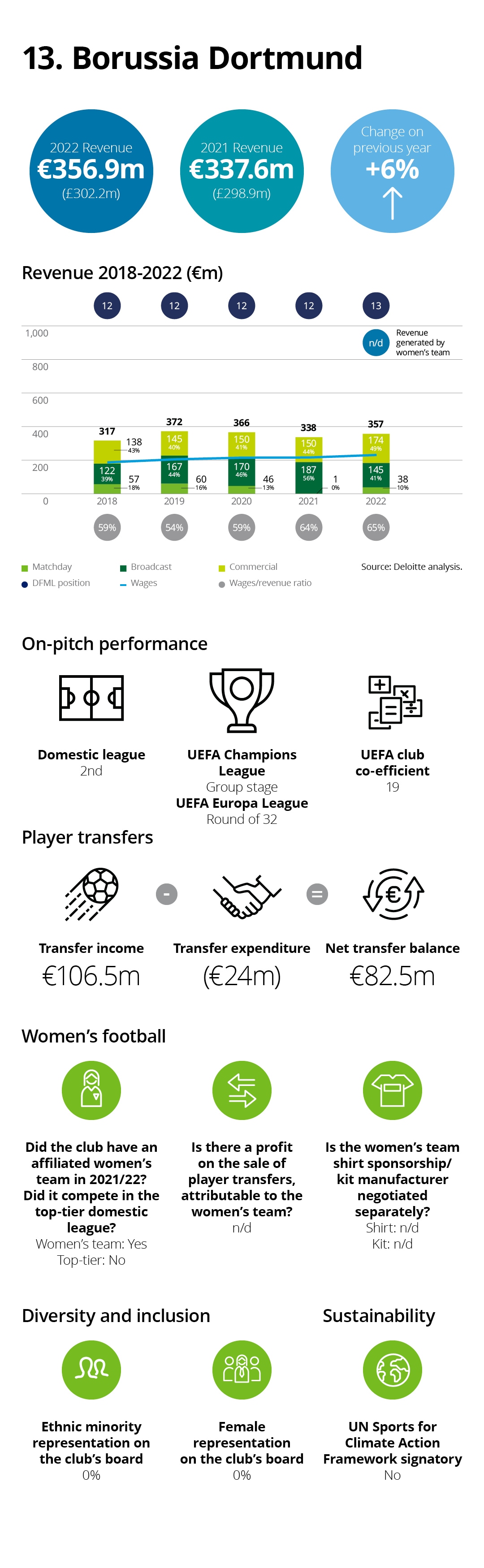

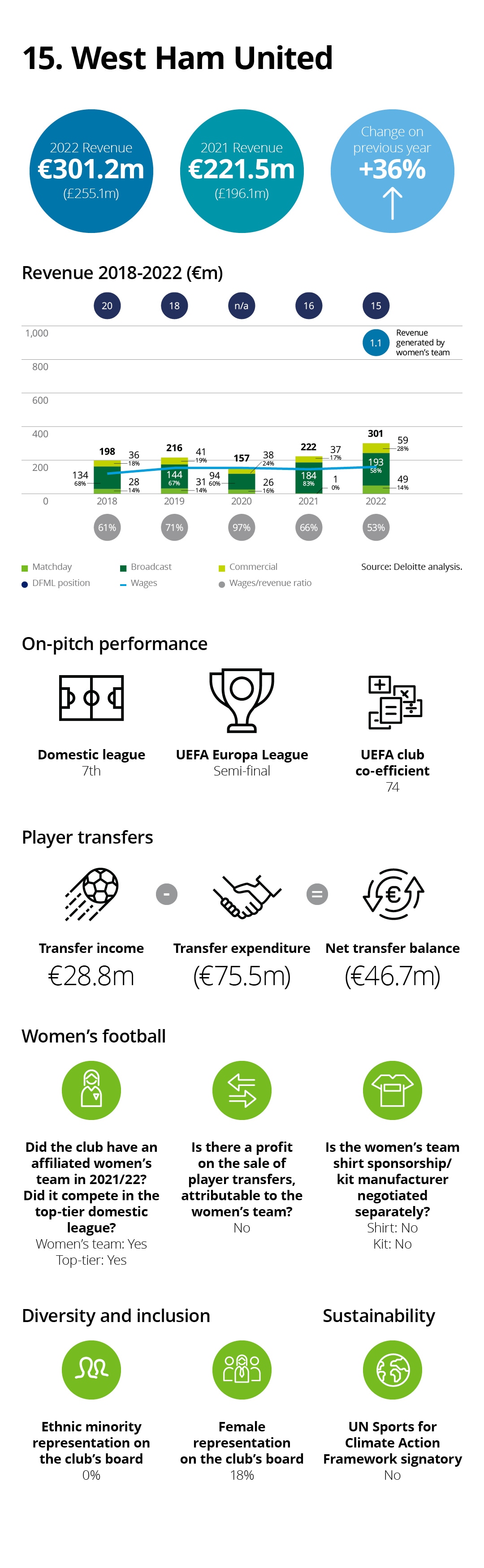

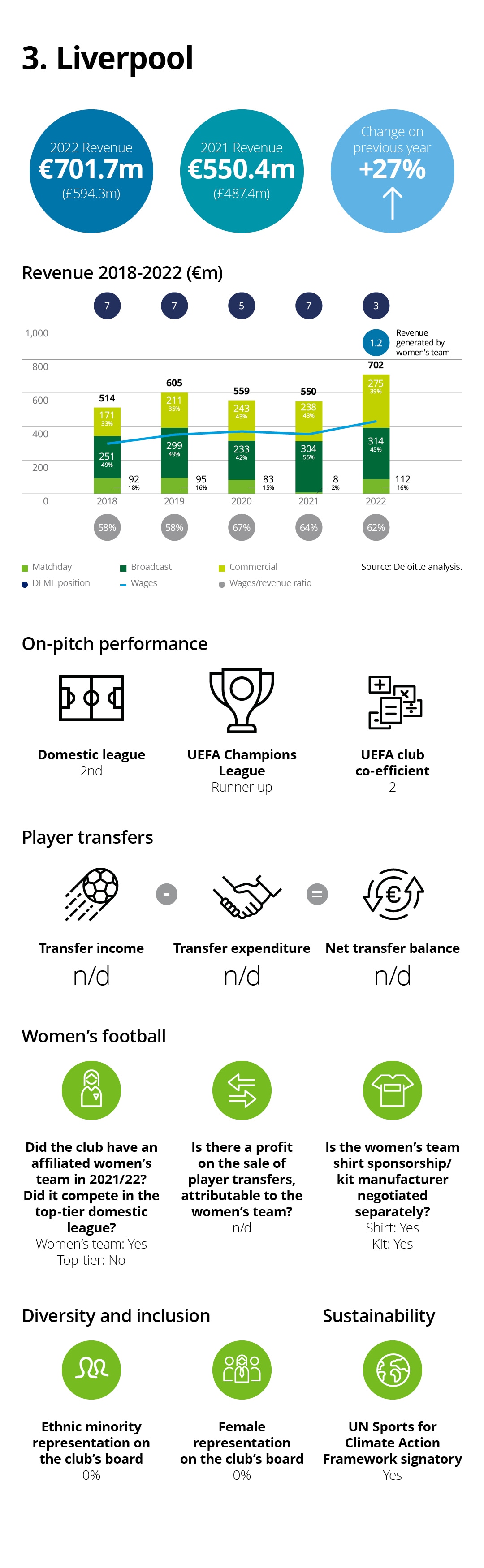

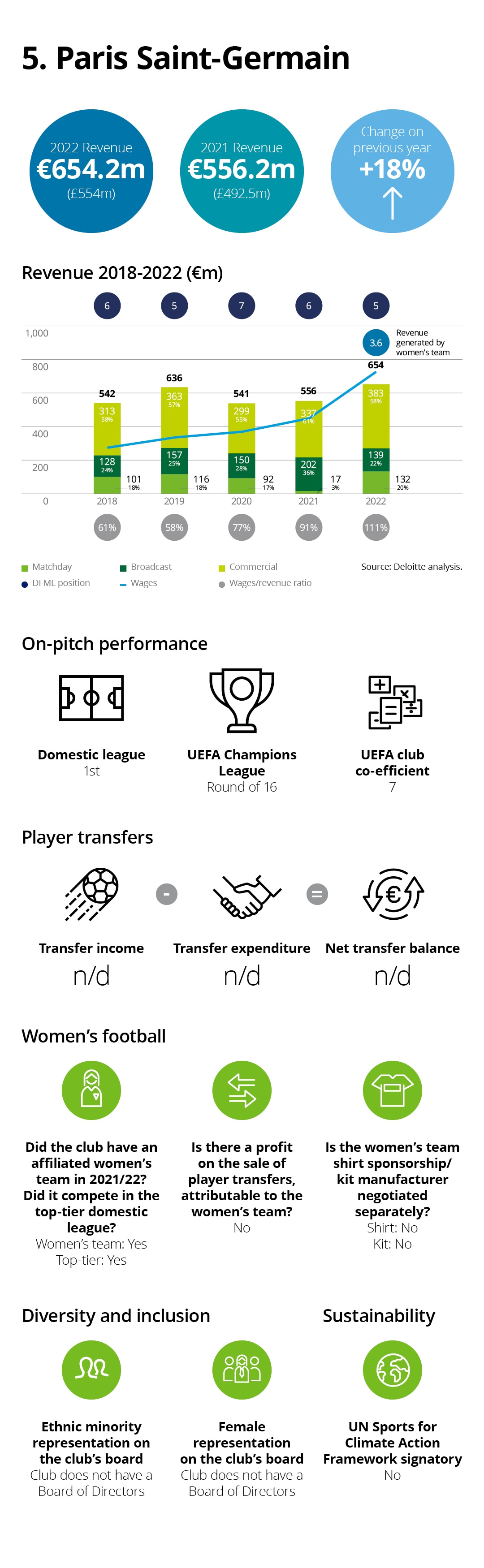

Club analysis

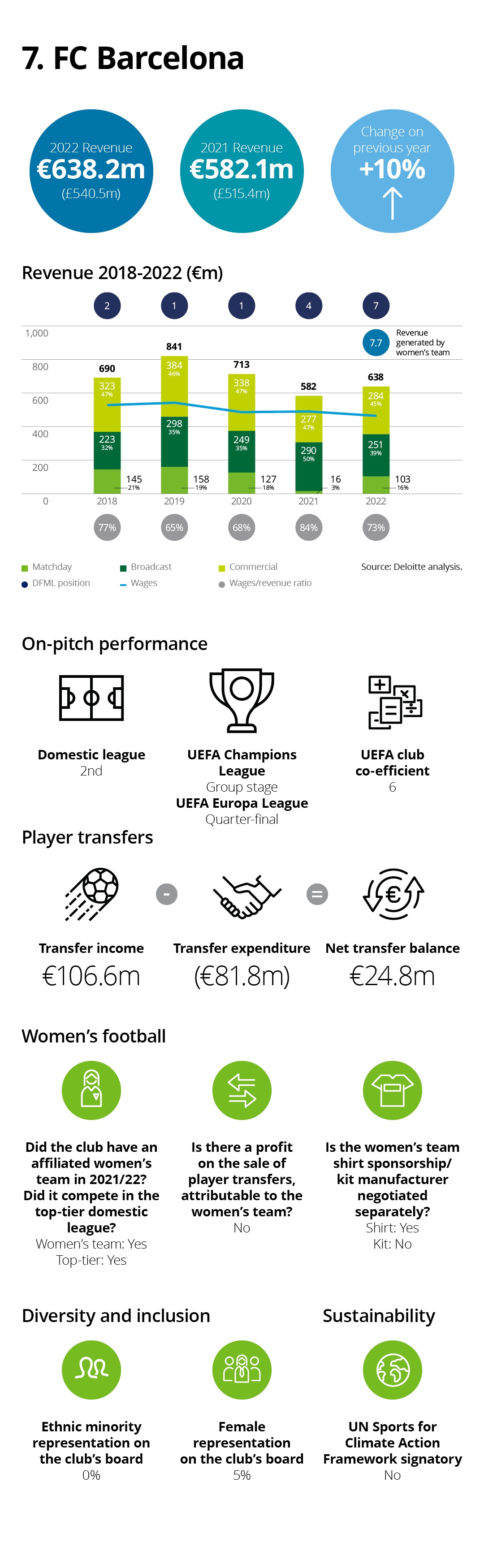

The historic Money League powerhouses of FC Barcelona and Real Madrid are yet to recover revenue to their pre-pandemic levels, with the clubs’ revenues down €203m and €43m respectively from 2018/19, a year which saw them both generate revenue that would have enabled them to top the Money League in 2021/22. Conversely, the chasing pack of Liverpool (up €97m compared to 2018/19), Paris Saint-Germain (up €18m) and Chelsea (up €55m) have outperformed their pre-pandemic levels, and in case of Manchester City (up €120m) has risen to the top of the ranking in that time.

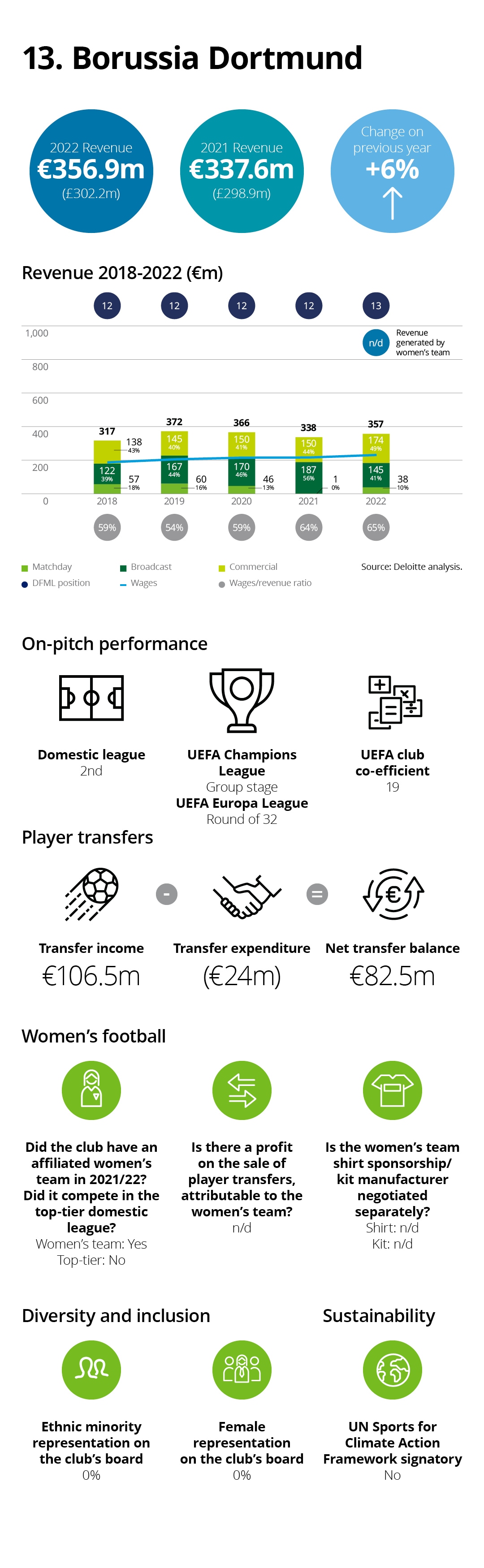

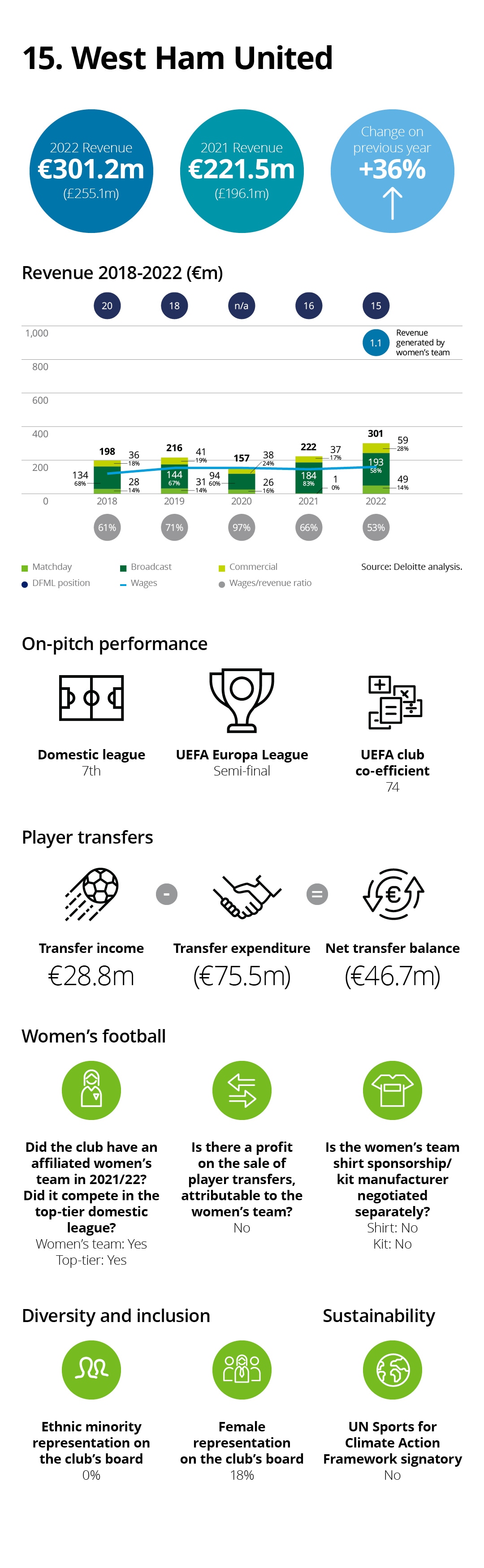

Further down the Money League, Juventus generated revenue of €401m in 2021/22, compared to €460m in 2018/19, primarily due to ongoing restrictions on Serie A attendances in 2021/22 and less successful performances in UEFA club competitions. Meanwhile domestic peer FC Internazionale Milano generated revenue of €308m in 2021/22, compared to €365m in 2018/19, which was the last year that many major regional partners were affiliated with the club. However, the lost revenue of these ‘top 20’ clubs was offset by a strong financial performance elsewhere, notably with West Ham generating €85m more than it did prior to the pandemic (with significant growth in all revenue streams).

Manchester City retain their position at the top of the Money League and for the second time were the club to generate the highest revenue in world football. This caps off a rapid rise up the rankings, with the club having only broken into the top five for the first time in 2015/16. This growth has been fuelled by an increase in commercial revenue (up €65m to €373m in 2021/22), which is a new Premier League record.

Liverpool were the biggest movers among the consistent clubs included in this and last year’s edition of the Money League. The club rose four places (from 7th to 3rd) to achieve its highest position in Money League history, and in doing so overtook Manchester United for the first time, on the back of a run to the UEFA Champions League Final 2022. It was also only one of five clubs to report over €100m in matchday revenue, which was the first time the club had done so, as fans returned to football stadia in their masses. This is expected to increase further in coming years, with the expansion of the Anfield Road Stand due to be completed prior to the 2023/24 season.

For the first time since 2018/19 a new club entered the Money League top 10, with Arsenal replacing Juventus (who fell from 9th to 11th), primarily by virtue of the significant matchday revenue generated, which was almost three times that of the Serie A club in 2021/22. Whilst Juventus and other Italian clubs played a significant portion of their season under the crowd restrictions noted previously, it also reflects a significant return on the investment into the Emirates stadium and goes some way to justifying the infrastructure investment being explored by clubs such as Real Madrid, FC Barcelona, the Milan clubs and Everton, who are looking to future-proof their businesses.

In contrast to Liverpool and Arsenal, FC Barcelona reported one of the sharpest falls in the rankings, with the club dropping from 4th to 7th. This was primarily due to a 13% decline in broadcast revenues, which were partially attributed to underperformance in UEFA club competitions in comparison to previous years, as the club competed in the second tier of UEFA club competition in 2021/22 for the first time since the 2003/04 season (by virtue of the club dropping out of the UEFA Champions League Group stage). Furthermore, the growth in their commercial revenue was significantly outpaced by other clubs (€7m compared to €65m for Manchester City, €37m for Liverpool, €47m for Manchester United, €46m for Paris Saint-Germain and €33m for Bayern Munich). The club commenced a multi-year commercial agreement with Spotify, covering the men’s and women’s team shirt and training kit sponsorship as well as naming rights for the Camp Nou, in the 2022/23 season. It remains to be seen how this and the sale of the club’s ‘economic levers’ (which did not impact revenue in 2021/22), including the sale of both 49.9% of its ‘Barça Licensing and Merchandising’ company and 25% of its domestic La Liga rights over a 25-year period, impacts the club’s position in the Money League in upcoming editions.

For the first time, more than half of the top 20 clubs (11 of 20) heralded from one country – England – further highlighting the financial superiority of the Premier League and how clubs were able to better ride the wave of COVID. Indeed, there has been a steady increase in the number of English clubs in the Money League over the last decade, as clubs that have not competed in UEFA club competitions and that have moderately sized stadia have made their way into the rankings at the expense of clubs from other ‘big five’ leagues who regularly compete in UEFA club competitions. This is evidenced by Leeds United appearing in the rankings for the first time since the 2002/03 season, with the club competing in the second tier of the English football pyramid as recently as 2019/20.

When considering the top 30, there are 16 English clubs, representing 80% of all clubs in the Premier League. The remainder of the top 30 ranking includes five clubs from La Liga, three from both Serie A and the Bundesliga and one from Ligue 1, all of whom competed in UEFA club competitions in 2021/22 and, with the exception of Villarreal CF, played in a stadium with a capacity of over 40,000 or more (and over 60,000 for all other than Paris Saint-Germain, Juventus, Sevilla and Eintracht Frankfurt). Benfica (24th) and Ajax (27th) were the only clubs outside the ‘big five’ leagues to be ranked in the top 30, driven by consistent performance in Europe with a Quarter-final and Round of 16 appearance in the UEFA Champions League respectively.

Ranking 21-30

Future outlook

In the short term, the revenue superiority of English clubs is unlikely to be challenged and one now has to question whether it will be long before we see all 20 Premier League clubs in the top 30. Among the ‘big five’ European leagues from which Money League clubs tend to hail, only the Premier League and La Liga commenced new broadcast rights cycles in 2022/23. The Premier League saw the total value of its media rights increase, driven by demand from international broadcasters, which saw the value of international rights rise by €422m per season (an increase of 26% for the 2022/23 to 2024/25 cycle when compared to the 2019/20 to 2021/22 cycle). The value of domestic media rights remained flat as rights deals were ‘rolled over’ with existing rights holders for a further three seasons. Meanwhile, La Liga commenced a new domestic broadcast cycle. The league agreed deals with broadcasters for an extended five-year period, and also sold certain rights packages on a non-exclusive basis, and/or operated them directly.

Diversity and inclusion

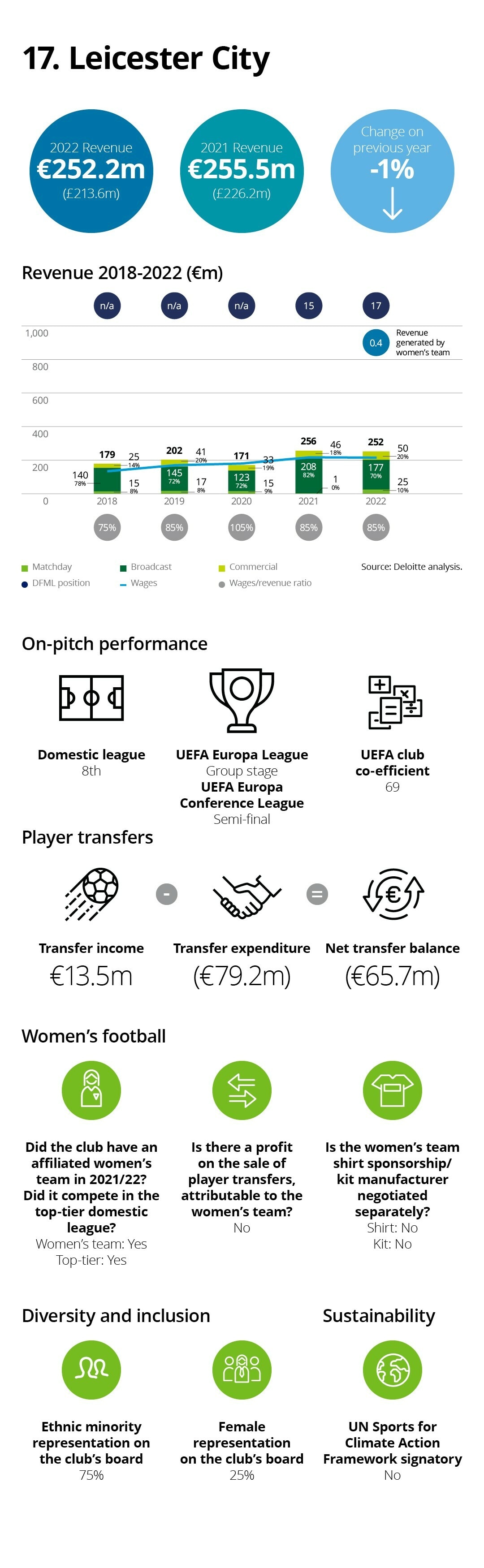

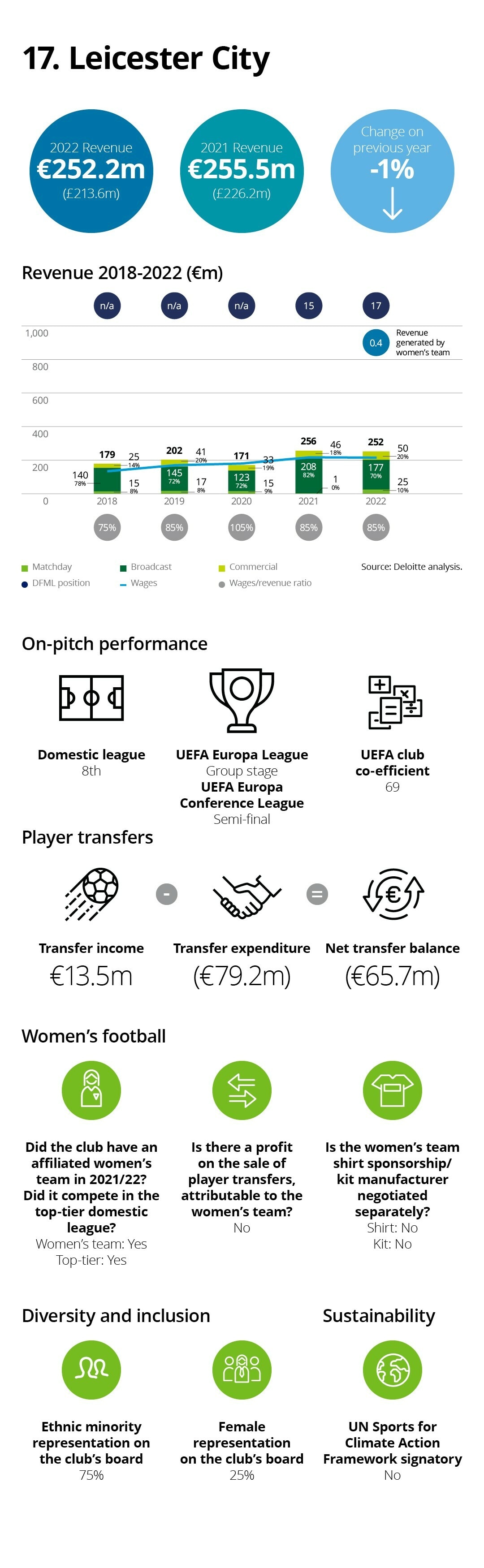

On average 16% of members on Club boards were considered ethnically diverse2, and there was significant disparity across clubs. Leicester City led the way (75%), followed by FC Internazionale Milano (60%), Newcastle and Manchester City (both 50%). Eight clubs recorded no ethnically diverse Board members, with a further three not disclosing information with respect to this metric.

Of the 17 Money League clubs which disclosed their board members’ ethnicities in the previous edition of the Money League, 11 (65%) had no ethnically diverse representation and, on average, just 15% of board members were identified as being ethnically diverse.

There are a myriad of benefits to having increased diversity at all levels of an organisation, including ensuring the right mix of skills and experience and constructive challenge, helping to define the connection between an organisation’s stated purpose and its business model, and helping to strengthen corporate culture3. It also brings diversity of thought and visible leadership to the entire industry.

We expect this to see this proportion increase in the years to come – not only as the influx of global investors from diverse backgrounds – and the Boards they appoint - continues to grow, but also as the benefit to business, and society more widely, moves the topic further up clubs’ agendas.

2 Using data from 16 Money League clubs that provided information with respect to the number of ethnically diverse Board Members as a proportion of the total number of members of a club's Board of Directors.

3 Greater focus is needed on stakeholder engagement, diversity and the importance of corporate culture, Deloitte 2020

Sustainability

Sustainability is another topic that has quickly risen to the top of the agenda for many sports organisations (and those across all sectors). Due to the wide range of associated issues and the significant impact on organisations and wider society, it has become paramount for organisations to understand and address sustainability related risks and opportunities. In particular, there is a growing recognition of the vital role sport can play in this – whether that’s due to sport’s inherent reliance on nature or its historically important role in local communities – sustainability issues are fundamental for sports organisations in achieving success.

The United Nation’s Sport for Climate Action Framework is a voluntary pledge, with those that sign up committing to pledge, plan, proceed with action and report on publicly disclosed commitments4, and at present four Money League clubs are signatories. We hope that great swathes of signatories from within football – and across the Money League - join Liverpool, Tottenham, Arsenal and Juventus (as well as those clubs that have pledged but that are not included in the Money League) in the coming editions of the report, as organisations increasingly embark on a journey of net zero transformation and beyond : both because they understand its importance, but also as pressure from stakeholders such as fans, partners, investors and regulators intensifies.

4 UN Sports for Climate Action Framework

Closing notes

The Deloitte Football Money League was compiled by Tim Bridge, Tom Hammond, Alex Carr, Dhruv Garg, Alasdair Malcolm and Jenny Pang from the Deloitte Sports Business Group. As always, our thanks go to Henry Wong and others who have helped us, inside and outside of the Deloitte international network. We particularly thank greatly those clubs who have taken the time to help us with the information and explanations, and we hope that you have enjoyed this edition of the publication.

There are a number of metrics, both financial and non-financial, that can be used to compare clubs, including attendances, worldwide fan base, social media following and on-pitch performance. In the Money League we record clubs’ ability to generate revenue from matchday, broadcast rights and commercial sources.

We have used the figure for total revenue extracted from the annual financial statements of the company or group in respect of each club, or other direct sources, for the financial year ending in 2022 covering the 2021/22 season (unless otherwise stated). We also present figures for the financial year ending in 2021 covering the 2020/21 season, as covered in the previous edition of the Deloitte Football Money League, as well as information covering the preceding three seasons (taken from the Deloitte Football Money League or Deloitte’s Football Intelligence Tool). For some clubs, the annual financial statements for the financial year ending in 2021 also included a proportion of revenue related to the completion of the 2019/20 season due to the impact of the COVID pandemic. For the avoidance of doubt, we have not made any adjustments to remove revenue in respect of the 2019/20 season from the financial year ending in 2021.

Revenue excludes player transfer fees, VAT and other sales related taxes. In a few cases, we have made adjustments to total revenue figures to enable, in our view, a more meaningful comparison of the football business on a club by club basis.

Information is derived from annual financial statements or information provided directly from individual clubs. Based on the information made available to us in respect of each club, to the extent possible, we have split revenue into three categories – being revenue derived from matchday, broadcast and commercial sources. Clubs are not wholly consistent with each other in the way they classify revenue. In some cases, we have made reclassification adjustments to the disclosed figures to enable, in our view, a more meaningful comparison of the financial results.

Matchday revenue is largely derived from gate receipts (including ticket and corporate hospitality sales). Broadcast revenue includes revenue from distributions from participation in domestic leagues, cups and UEFA club competitions. Commercial revenue includes sponsorship, merchandising and revenue from other commercial operations. For a more detailed analysis of the comparability of revenue generation between clubs, it would be necessary to obtain information not otherwise publicly available.

Some differences between clubs, or over time, may arise due to different commercial arrangements and how the transactions are recorded in the financial statements, due to different financial reporting perimeters in respect of a club, and/or due to different ways in which accounting practice is applied such that the same type of transaction might be recorded in different ways. For example, the unique circumstances of the 2019/20 and 2020/21 seasons arising from the COVID pandemic, has led to some different accounting practices derived from interpretations of respective accounting standards across the world of football.

The publication also discloses revenue generated by the women’s team and associated activities of each club, in relation to the financial year ending in 2022 covering the 2021/22 season. This includes revenue from matchday, broadcast and commercial sources (as defined above) attributed to the women's team and associated activities. Women’s football revenue excludes revenue contributions from men’s football. The women’s team may be part of a separate corporate entity and therefore the revenue generated by the women’s team may not be included in the revenue shown in club rankings. Club pages also note whether there was profit on the sale of player transfers, attributable to the women’s team, and if the women’s team shirt sponsorship and kit manufacturer were negotiated separately to the men’s team’s equivalent agreements. These data points were received directly from clubs, with information not necessarily in the public domain.

The publication contains a variety of information derived from publicly available, or other direct, sources other than financial statements. We have not performed any verification work or audited any of the information contained in the financial statements or other sources in respect of each club for the purpose of this publication. Some charts may not sum due to rounding.

Key performance indicators shown for each Money League club relate to the football season ending in 2022, unless otherwise stated. UEFA Champions League, UEFA Europa League and UEFA Europa Conference League performances shown include participation from the final play-off round only. The UEFA club co-efficient displayed on club pages was correct as of the end of the 2021/22 season.

Player transfer income is the aggregate proceeds generated from the transfer-out and/or loan-out of players to other clubs contracted during the financial year ending in 2022. Player transfer income can be recalculated from clubs’ annual financial statements as the net book value of disposals of player registrations plus profit/(loss) on disposal of player registrations and any player loan income. Player transfer expenditure is the spend on the transfer-in and/or loan-in of players from other clubs contracted during the financial year ending 2022. Player transfer expenditure can be recalculated from clubs’ annual financial statements as the additions to player registrations plus any player loan expenditure. Note that these amounts do not reflect the total cash flows in respect of player transfers for the year under analysis (which may differ due to contracted payment schedules). Net transfer balance is equal to player transfer income less player transfer expenditure.

Wage costs includes wages, salaries, signing-on fees, bonuses, termination payments, social security contributions and other employee benefit expenses for all employees (including players, technical and administrative employees).

The proportion of females and ethnic minority individuals of the total number of members of a club’s Board(s) of Directors were disclosed to us by clubs between October 2022 and January 2023 and reflected the club’s Board(s) of Directors at that point in time. Signatories of the UN Sports for Climate Action Framework are those clubs listed as such on the United Nations Framework Convention on Climate Change website (www.unfccc.int) as of 12 January 2023.

For the purpose of the international comparisons, unless otherwise stated, all figures for the financial year ending in 2022 have been translated at the average exchange rate for the year ending 30 June 2022 (€1 = £0.85; €1 = BRL 5.92; €1 = CHF 1.05; €1 = DKK 7.44; €1 = TRY 13.82).

Comparative figures have been extracted from previous years of the Deloitte Football Money League, or from relevant annual financial statements or other direct sources.

In relation to estimates and projections actual results are likely to be different from those projected because events and circumstances frequently do not occur as expected, and those differences may be material. Deloitte can give no assurance as to whether, or how closely, the actual results ultimately achieved will correspond to those projected and no reliance should be placed on such projections.

For previous editions back to 2006, download here or contact us directly:

2022, Restart Download

2021, Testing times Download

2020, Eye on the prize Download

2019, Bullseye Download

2018, Rising stars Download

2017, Planet Football Download

2016, Top of the table Download

2015, Commercial breaks Download

2014, All to play for Download

2013, Captains of industry Download

2012, Fan power Download

2011, The untouchables Download

2010, Spanish masters Download

2009, Lost in translation Download

2008, Gate receipts Download

2007, The reign in Spain Download

2006, Changing of the guard Download

Key contacts

Timothy Bridge

Partner, Sports Business Group

Tom Hammond

Manager, Sports Business Group

Lizzie Tantam

Public Relations Manager