Perspectives

Contingent & Business Interruption insurance claims

Does COVID-19 trigger cover?

The impact on business supply chain operations due to the COVID-19 pandemic will be unprecedented in terms of scale and complexity, and at the same time its impact will be inherently difficult to estimate.

Business Interruption insurance

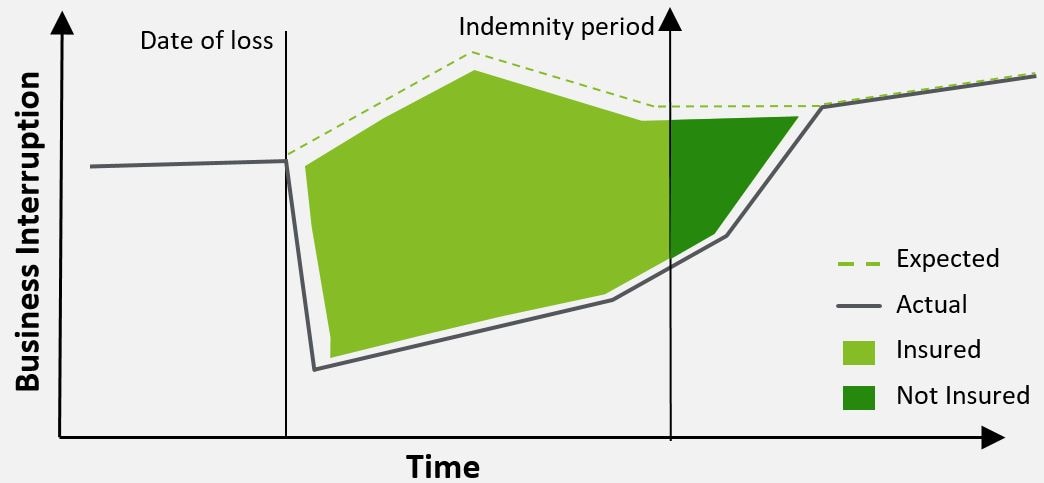

Businesses procure Business Interruption (“BI”) insurance to protect them from critical events and put them into a position “as if” the loss had not occurred, subject to the company’s risk appetite and agreed limitations such as deductible, exclusions or indemnity period.

Simply put, the loss under a BI policy is typically the 'loss of profit, less savings, plus extra costs and additional increased costs of working'.

Is COVID-19 an insured event?

The determination of an “insured event” is complex in the case of COVID-19. Whether a BI policy covers losses from COVID-19 needs to be assessed on a case-by-case basis. Typically, extended BI will cover such an epidemic, whilst basic cover that requires a physical impact on insured property would likely not. However, even with extended cover, some policies contain “pandemic” exclusions in their terms and conditions, which require close monitoring of whether COVID-19 becomes defined as “pandemic” in certain jurisdictions (on 11 March 2020, the WHO characterized COVID-19 as a pandemic).

Contingent Business Interruption cover

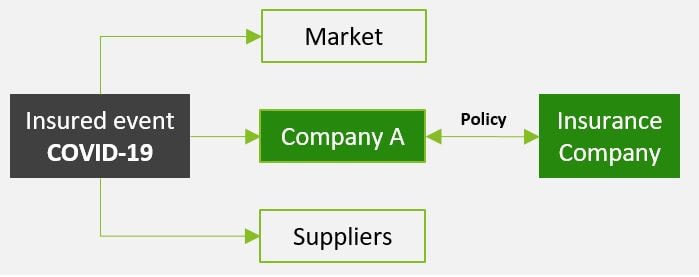

BI insurance cover can apply to instances where the insured business itself is directly impacted by effects from COVID-19, for example when the authorities quarantine an area where the business operates and the workforce is unable to work. This contrasts to Contingent BI insurance, which covers the losses arising from a company’s supply chain disruptions. This might involve a supplier, key logistics provider or customer who is subject to quarantine and as a result is unable to deliver or procure products or services to or from the company, and the company suffers consequential loss. Often “All Risk” policies include Contingent cover throughout the direct supply chain, whilst basic BI cover might not.

Will you have a loss in 6 months’ time?

When cover is established, some businesses may initially assess that they are impacted though not significantly; or that the policy deductible is significant meaning that a claim will not be viable. Our experience suggests that businesses should nevertheless make a comprehensive effort to capture and record losses throughout their operations to make sure that they:

- Raise awareness throughout their operational and finance functions that the business is insured, how the cover works, and what crucial information and evidence is required to prepare a valid claim; and

- Engage in internal dialogue to understand how operational functions are impacted and in which areas they may be exposed to risk (e.g. remote markets, niche products) so that a mitigation plan can be put in place. Often BI claims contain a significant amount of “inefficiencies” that can be difficult to capture.

Gathering information from your supply chain

A lesson learned from past handling of events that trigger widespread contingent cover (like earthquakes or flooding) is that some companies are unable to submit an effective insurance claim because they struggle to collect the necessary information from their supply chain. Companies in your supply chain may choose not cooperate for a number of reasons, such as:

- they do not consider the business to be a strategic partner;

- the information requested may be in conflict with ongoing commercial discussions;

- companies may not want to commit to what the facts are (e.g. planned volumes) as they are assessing their own claim;

- a cultural tendency to avoid open discussion of issues; or

- a lack of training and professional staff to deal with requests.

Managing your insurance cover

Time will tell how many businesses have effective insurance against business interruption from COVID-19, and whether the impact can be managed or mitigated through make-up sales or future production, and whether they are able to document and substantiate their claims effectively. However, one thing is for sure: recent events have triggered a critical need for most businesses to assess potential impacts and ensure that adequate insurance cover is in place.

Do you have an effective insurance claims protocol in place?

Here are some best practices, we have experienced when supporting insurers and insured businesses:

1. Set priorities

Understand and define your priorities to maximize value from your insurance policies. Some companies may require short term cash advances to finance operations in times of crisis, whilst others may seek to maximize the settlement. A claim can be an opportunity to change and mitigate future risk – and a strategic insurance partner may invest in the change if there are mutual benefits.

2. Invest in your recovery

With complex claims, insurers typically instruct BI Claim Experts to help them audit and review the insurance claim. Contingent and Business Interruptions are complex claims, and the insured gross profit basically differs substantially from accounting gross profit. Ensure that you have expertise that is appropriate for the amount under negotiation for settlement.

3. Task force

As with any crisis, we advise making sure that you have an adequate task force in place. Nominate the right stakeholders at a sufficiently seniority level, and ensure they have the competence/authority to make decisions and that information is shared. Typically, Risk, Legal, Operations, Sales and Finance/Controlling will need to be involved in the claims process. Your claim will likely involve a significant amount of recovery, therefore we advise treating the claims process with the same level of diligence that you will apply to a commercial negotiation of comparable size.

4. Claims capture

Contact your insurer to alert them to the fact that you may have a claim so that they put a loss reserve in place. The chances are that your Insurer will be inundated with (potential) claims so it’s important that you are not last on the list. In our experience, pro-active provision of adequate information often expedites claims settlement. From the early stages, put adequate mechanisms in place to capture the claim – this requires that key stakeholders across your business should understand what is required to compile an effective claim and how they may “benefit” from settlement, and that the information is in fact delivered to the task force.

Recommendations

Addressing the financial impact of COVID-19

Working capital solutions for companies with urgent cash needs