Will patients and caregivers embrace technology-enabled health care? has been saved

Will patients and caregivers embrace technology-enabled health care? Findings from the Deloitte 2016 Survey of US Health Care Consumers

30 August 2016

It’s one thing for health care providers to implement new IoT technology—and quite another for patients and caregivers to embrace it. Good news: According to Deloitte’s 2016 Survey of US Consumers, patients of all demographics—even seniors—are at least amenable to technology-enabled care.

Introduction

Most everyone who has set foot in a hospital or clinic in recent years has seen changes in everything from ICU equipment to billing practices, primarily based on technology advances. And now technology is actually making care outside of traditional settings both possible and desirable. Many providers are experimenting with delivering care outside the traditional setting, recognizing the potential efficiency and cost savings of keeping patients out of the hospital, lowering readmission rates, and promoting adherence to care plans. But it turns out that consumers—both patients and caregivers—can also be amenable to technology-enabled care.

Subscribe to receive IoT insights

Explore the Internet of Things collection

Watch the video

Learn more about Deloitte’s IoT practice

Many engaged consumers—along with value-based care payment models, an aging population (many who prefer to age in place), and increasing chronic disease prevalence—are largely driving growth in new technology development. These technologies, often based on Internet of Things (IoT) applications, will likely begin to transform how health care is delivered—and alter hospital, health system, nursing home, and medical device company operating models. In enabling providers to furnish more care outside of traditional health care settings, several new technologies aim to reduce costs and improve outcomes by keeping patients out of the hospital, lowering readmission rates, and promoting adherence to care plans. New payment policies can create the business case for achieving these outcomes.

As technology-enabled care evolves, which advances will likely be most successful among patients and caregivers? What preferences and what reservations might customers have? Which features of these new technologies will they likely value enough to pay for out of pocket?

Consumers are open to technology-aided care, but providers will likely need to earn their trust on both quality of care and protection of patient information.

Deloitte’s 2016 Survey of US Health Care Consumers explores consumer expectations, preferences, and concerns around technologies—including remote monitoring (the IoT), telemedicine, and robots and drones—that can deliver health care services outside of traditional settings. (See sidebar, “Inside the health survey.”)

This article explores the survey results—and the implications of those results. The survey found:

- Consumers have an appetite for using technology-enabled care. Seven in ten consumers are likely to use at least one of the technologies we presented.

- Telemedicine, in which half of respondents show interest, is the most popular technology. Respondents are most interested in using it for post-surgical care and chronic disease monitoring.

- Particular subgroups are especially keen on these technologies, especially those with chronic diseases, millennials for telemedicine, and seniors for remote monitoring.

- Caregivers are a key population. Consumers say they are most likely to use sensor technology (the IoT) when caring for others (caregivers) rather than for themselves. Experienced caregivers are more likely to use telemedicine and remote monitoring technology than non-caregivers.

- Consumers demand high quality, personalized care and want assurance that their personal information will be safe.

In short: Yes, consumers are open to technology-aided care, but providers will likely need to earn their trust on both quality of care and protection of patient information. Companies should consider targeting caregivers as well as patients for adoption, and work to coordinate care via integrated platforms. And potentially toughest of all: To win customer buy-in, the user experience—for caregivers, patients, insurers, and everyone else—will likely need to be as seamless as possible.

Inside the Deloitte 2016 Survey of US Health Care Consumers

The Deloitte Center for Health Solutions (DCHS) conducted an online survey of 3,751 American adults in February and March 2016. Since 2008, the DCHS has annually polled a nationally representative sample of US adults about their experiences and attitudes related to their health, health insurance, and health care. To understand consumer interest, preferences, and attitudes around technology-enabled health, we conducted a nationally representative survey of US adults (18 and older), exploring:

- current use of technology for monitoring health and fitness

- how much interest consumers have in using technology for health care services

- who consumers think should pay for care and how much they should pay for it out of their own pockets

- what features they would like these technologies to have and any specific concerns they raised

The national sample is representative of the US Census with respect to age, gender, race/ethnicity, income, geography, and insurance source.

How IoT applications are already shaping care

A range of technologies are creating opportunities across the health care industry, helping enable providers to furnish more care outside of traditional settings. But one of the key breakthroughs is in IoT technology, which makes objects “smart” via embedded sensors and links them through wired and wireless networks, generating oceans of fresh data and enabling everything from remote monitoring to self-regulating medication.1 Analysts project the global IoT-based health care market to grow by 38 percent from 2015 to 2020.2

It’s not only the new availability of IoT applications that is driving technology-enabled care solutions. Demographic, societal, and economic factors are increasing both demand and patients’ willingness to embrace elements of care they might have once rejected as impersonal:

A growing aging population. People 65+—the heaviest users of health care and long-term care—will grow from 15 percent to 22 percent of the population between 2014 and 2040.3

Higher prevalence of obesity and chronic diseases such as diabetes. About 35 percent of American adults (78.6 million) are obese,4 and 45 percent (133 million) suffer from at least one chronic disease.5

Increasing demand for caregivers. As of late 2014, approximately 40 million Americans were serving as caregivers6—a figure expected to reach 45 million by 2020, caring for 117 million people.

Preference to age in place. Most adults wish to remain in their homes as long as possible, with 82 percent preferring to do so, even if they need day-to-day assistance or ongoing care during retirement. Only 9 percent say they would prefer to move to a facility where care is provided; 4 percent anticipate moving into a relative’s home.7

Value-based care. As Medicare, Medicaid, and commercial insurers provide payment incentives to providers to improve health outcomes and lower costs, providers are looking to adopt technologies and other tools that help them succeed on those terms.

Health care technology is an area ripe for innovation. Exploring IoT applications, technology companies and care organizations are testing sensor-driven and big data initiatives that could transform the way patients and their providers manage their health (see sidebar, “Technology-enabled care innovation, today and tomorrow”). With the aid of IoT technology, it may soon be commonplace for providers to care for patients safely and effectively in more comfortable and convenient locations than a traditional office, hospital, or long-term care setting.

Exploring IoT applications, technology companies and care organizations are testing sensor-driven and big data initiatives that could transform the way patients and their providers manage their health.

With fresh innovations, IoT-based opportunities, and cost and quality pressures, it’s no surprise that use of technology for health care grew between 2015 and 2016—even though care technology use still lags use of technology for other purposes (see figure 1) and the annual increase was smaller than it will likely be in upcoming years. More consumers did report going online for health-related purposes in the 2016 Survey of US Health Care Consumers than in 2015, with the biggest jumps being for measuring fitness and health improvement, which grew from 28 percent to 32 percent, and for receiving alerts to take medication, which grew from 13 percent to 17 percent.

Consumers use technology more often for services such as shopping, banking, and tax filing than they do for most health applications. The health application with the greatest usage (exceeding tax filing and financial planning) was refilling prescriptions, which 58 percent of Rx users report doing.

Technology-enabled care innovation, today and tomorrow

Sensors, mobile devices, and related technologies are presenting new opportunities in health care to better diagnose, monitor, and manage patients and treatment. Many providers employ these technologies along a continuum of wellness and prevention, to therapeutic remedies and treatments for illness. Some examples of current innovations include:

For chronic disease monitoring

Diabetes: BlueStar®, a mobile prescription therapy developed for adults with type 2 diabetes and their care providers, integrated a blood glucose monitoring system component in 2016. The app creates a self-management plan using data from the patient and input from her health care provider. It compares current health data, such as glucose levels and medication, with past data and offers the patient real-time guidance while simultaneously sending her data to her provider.

Respiratory health management: The Propeller Health sensor, for respiratory health management (asthma and COPD), wirelessly links a GPS-enabled smartphone with an anti-inflammatory medication inhaler to passively sense the time and location of inhaler use. By tracking the inhaler’s use, the product encourages the patient to use his medication on time and thereby reduce the number of asthma attacks.8

Congestive heart failure: Endotronix is developing a wireless monitoring solution that measures cardiac function and securely transmits the data to the patient’s clinical care team. The sensor is implanted during a routine catheterization procedure. The goal is to improve the medical outcomes and quality of life, as well as lower costs for those with congestive heart failure and other cardiac conditions.9

For medication adherence

Smart pillboxes: Tiny Logics has developed Memo, intended to replace the traditional plastic seven-day pillbox. The device works in conjunction with a smartphone app to ensure patients take prescribed medication at the right time and in the right dosage.10

Edible “smart” pills: Proteus, PharmaTech, and TruTag Technologies are developing edible IoT technology, “smart” pills that can help monitor both medication regiments and health issues. These technologies can in turn help biopharma companies and care providers lessen risks and losses.11

Would you use technology-enabled care?

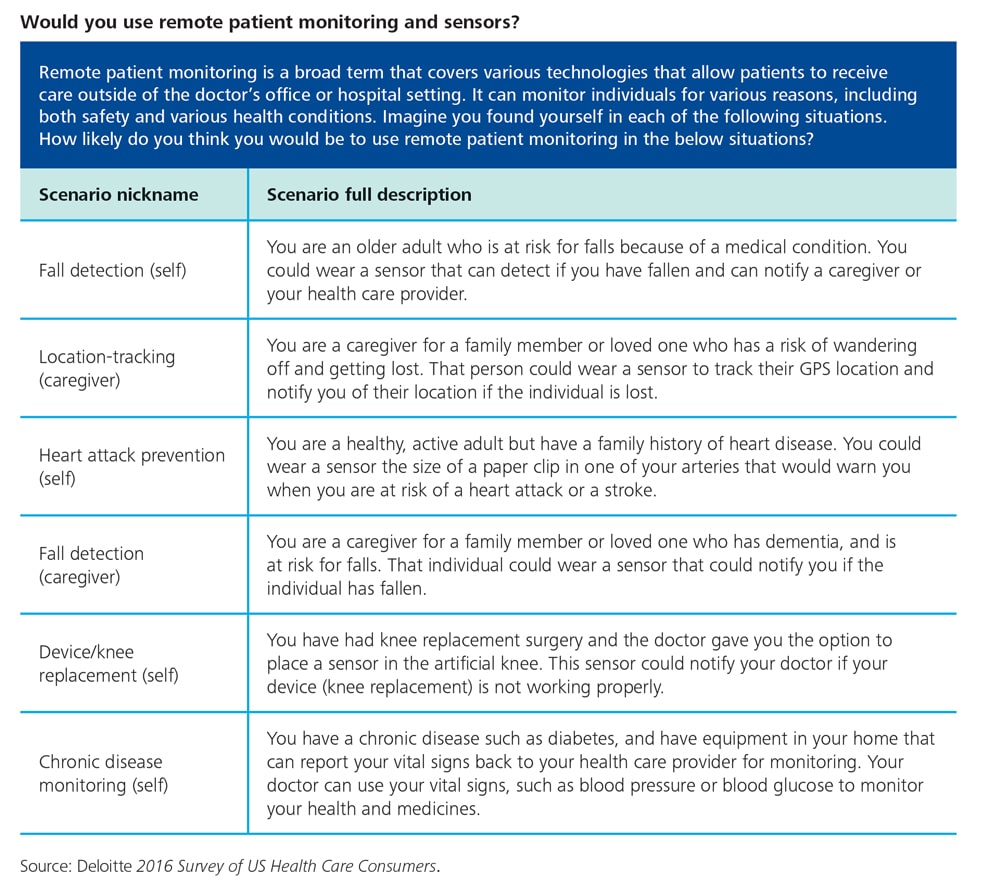

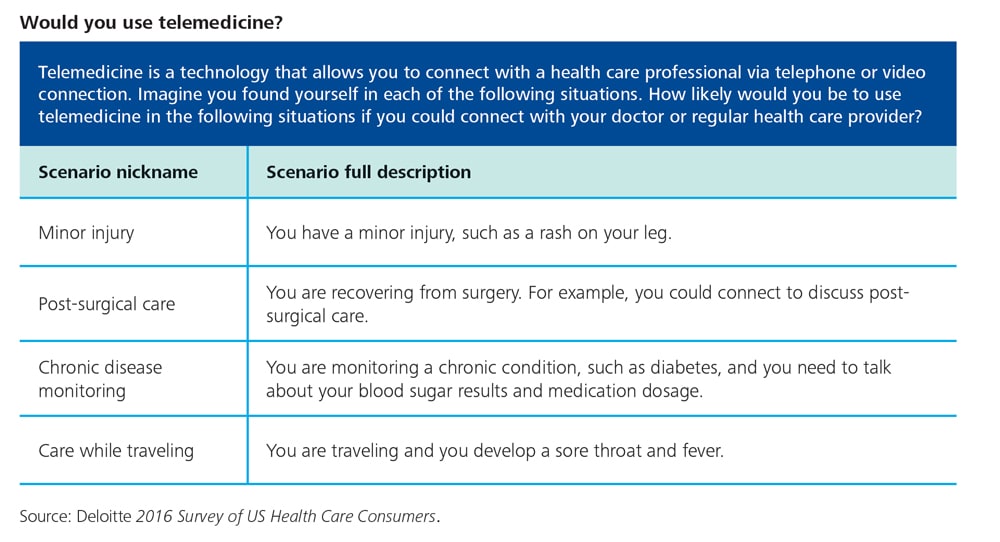

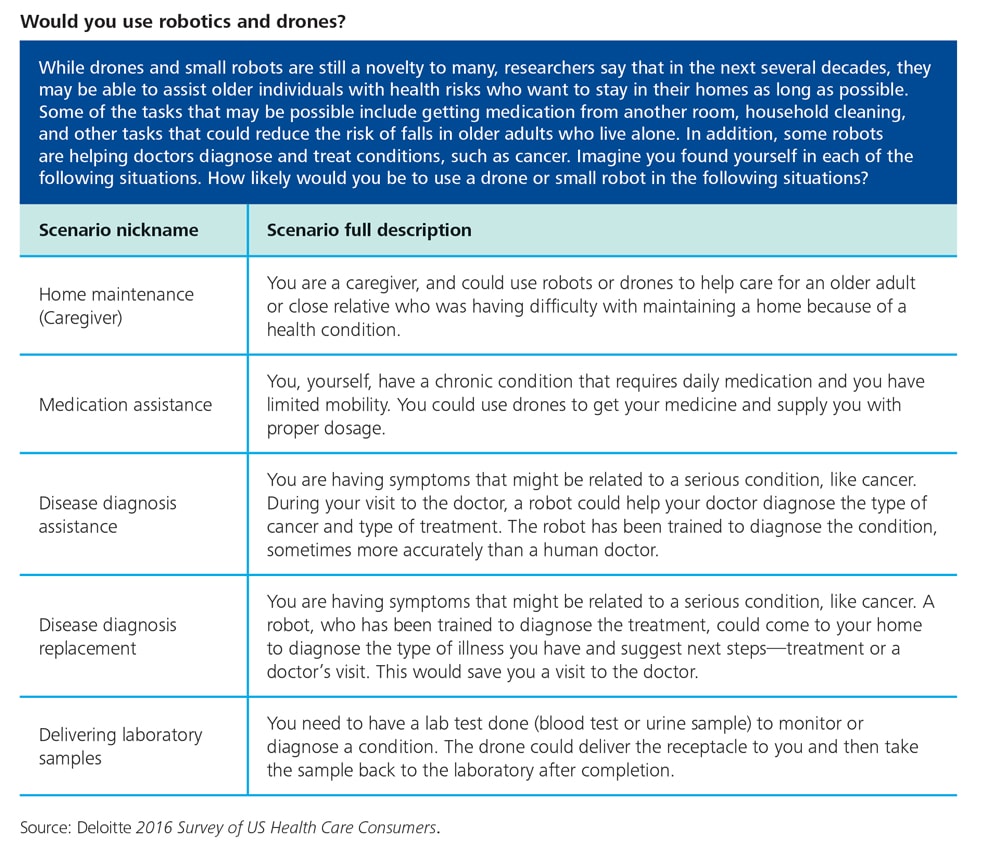

For the 2016 Survey of US Health Care Consumers, we tested consumer reactions to technology-enabled home care in 15 scenarios covering different types of technology and applications: telemedicine (four), remote patient monitoring/sensors (IoT) (six), and drones/robotics (five). We asked about reasonable cost and any concerns that technology developers, providers, or plans offering the technology should address.

The survey found:

Consumers have an appetite for using technology-enabled care. Seven in ten consumers are likely to use at least one of the technologies we presented.

Telemedicine, in which half of respondents show interest, is the most popular technology. Consumers are most interested in using it for post-surgical care and chronic disease monitoring.

Caregivers are a key population. More consumers say they are likely to use sensor technology when caring for others than on themselves. Caregivers are also more likely to use telemedicine and remote monitoring technology than are non-caregivers.

Heavier users of the health care system show the most interest in all technologies. Across the board, consumers with chronic conditions are the most interested in using technology-enabled care. Those reporting a major impact from their condition report even greater interest. Among generations, seniors show the highest interest in using sensors but lower interest in telemedicine.

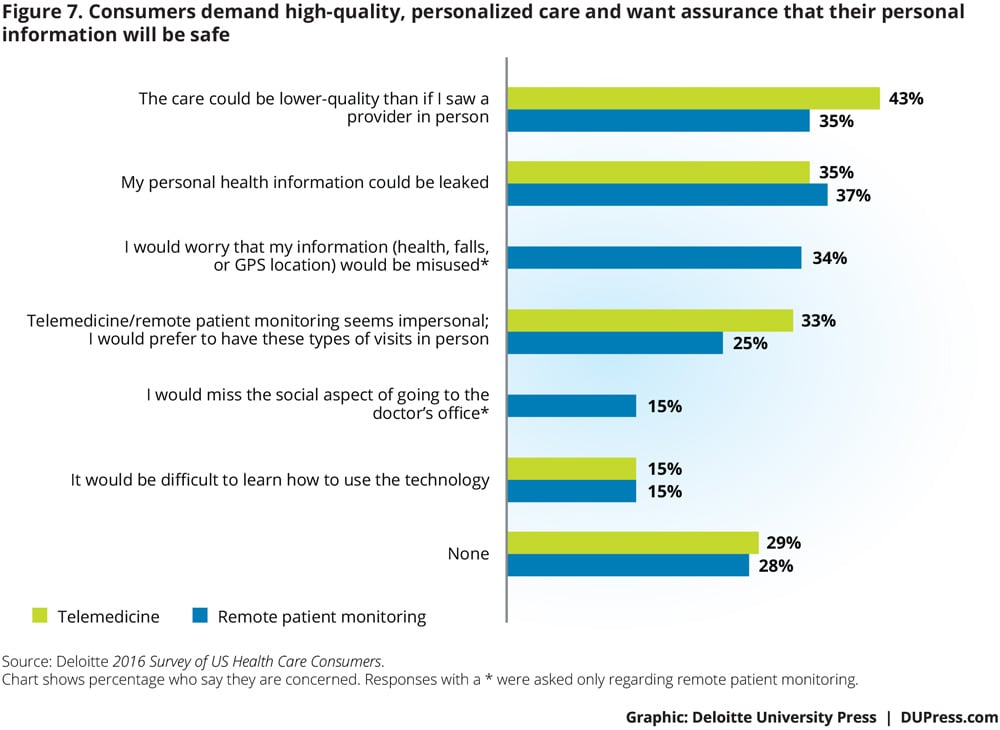

Consumers demand high-quality, personalized care and want assurance that their personal information will be safe. About a third express concern about the security of their information or that it might be misused. Four in ten think that care quality could be lower than if they saw a provider in person (43 percent for telemedicine, 35 percent for remote patient monitoring).

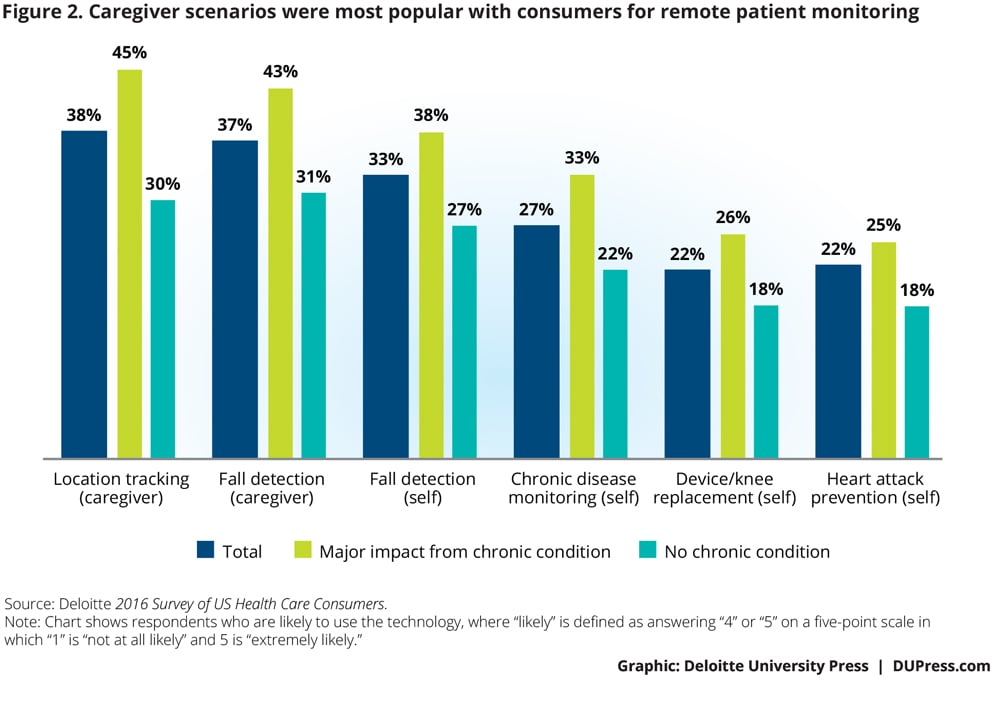

Consumers reported interest in using remote patient monitoring; interest was strongest in using it for caregiving (~38 percent) rather than for self-care (see figure 2). The gap between interest and use is substantial—other research has found that currently only 7 percent of caregivers are already using or have used the technology.12

Forty percent of respondents say they would likely approve of sensor use for the survey’s two caregiver scenarios (location tracking and fall detection). Closely following the caregiver scenarios in popularity were scenarios in which someone else is monitoring the person herself: 33 percent expressed interest in use for fall detection, with 27 percent interested in use for chronic disease monitoring. (See appendix for details of the survey scenarios.)

Respondents found other applications less interesting: using sensors for warnings of health problems that either involve a medical device (e.g., a knee replacement surgery) or warn of risk of heart attack. This may reflect that these types of technologies are still in early stages.

Among generations, seniors have the highest interest in each scenario presented—as both caregivers and for self-care and prevention (figure 3). The biggest gap is in the caregiver scenarios: Baby Boomers and seniors report similar levels of interest (41 to 45 percent), with Millennials and Gen Xers tracking closely (33 to 34 percent).

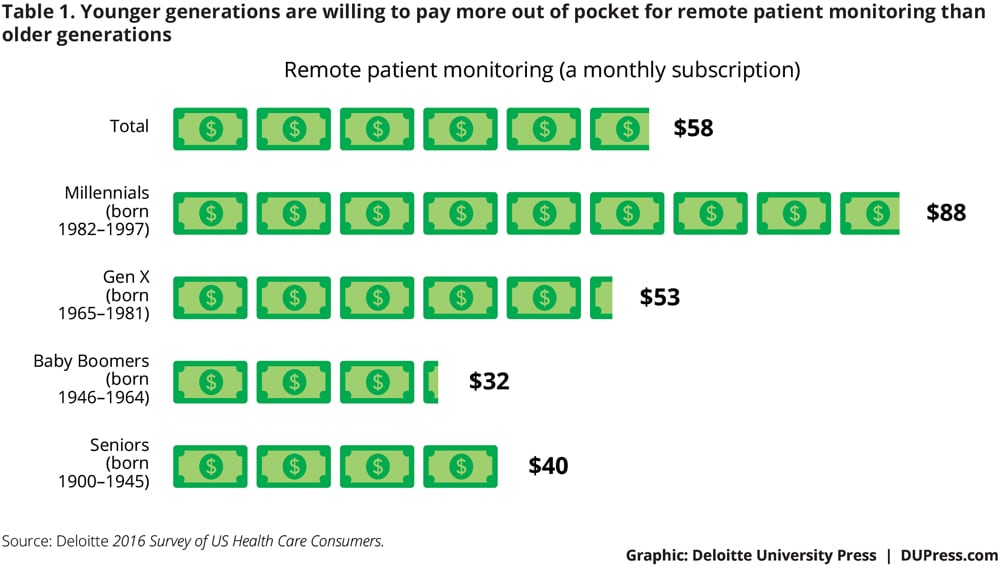

We asked consumers who expressed interest in using remote patient monitoring: Who should pay for it? Perhaps unsurprisingly, a majority said that insurers should pay. Only two out of ten said they’d be willing to pay out of pocket, while the rest said they would use monitoring only if the sessions were covered by their health insurance policy/plan with a small co-pay.

Of the 20 percent surveyed who were willing to pay out of pocket, when asked, “How much?”, consumers on average say that $58 is a reasonable cost for a monthly subscription for remote patient monitoring. This amount varies by generation (see table 1).

Sensors and IoT technology

Remote patient monitoring is one of the easiest IoT applications for consumers to understand—and one of the most promising uses for providers looking to cut costs. Basically, monitoring uses digital technologies to collect health data from an individual in one location and digitally transmit that information securely to a health system in a different location. By making measurement and analysis automatic, IoT applications promise to help improve and personalize care—and create new value for industry players.13

Monitoring is only one application for IoT-based sensors, which can be worn, embedded, or cloud-based, communicating wirelessly. Wireless communication has allowed sensors to develop from traditional forms—those requiring the patient’s active involvement in collecting data, transmitting it, or both—to passive forms that need no patient participation. The most fully passive sensors can provide constant monitoring of a person’s vital signs or other measures and, then, either store that data or send it wirelessly to a care team.

Technology companies have developed sensors that monitor across a continuum of wellness to illness, including:

- Blood sampling sensors (e.g., a non-invasive sensor that measures blood glucose levels)

- External sensors that connect to the body (e.g., a blood-pressure cuff)

- Epidermal sensors—e.g., an ultrathin, stretchable device for wireless evaluation of skin for applications ranging from dermatology and cosmetology to health/wellness monitoring (lymphedema, transdermal water loss, edema, and psychological stress)14

- Ingestible sensors (i.e., in the form of a pill and eventually dissolved)

- Tissue embedded sensors (e.g., a pacemaker or implantable cardio defibrillator)

- Wearables (embedded in clothing—e.g., smart fabrics—or worn as a bracelet or anklet)

Telemedicine: Improving care at home and on the road

Telemedicine makes health care services more accessible to patients so that they can minimize going to the hospital or physician’s office. It allows them to access care via different devices—a Web browser, a mobile phone or tablet, or a stand-alone kiosk in a retail clinic. It has the potential to improve remote monitoring and self-care strategies and, ultimately, reduce treatment costs by keeping people out of the hospital, out of the emergency room, and reducing physician office visits.15

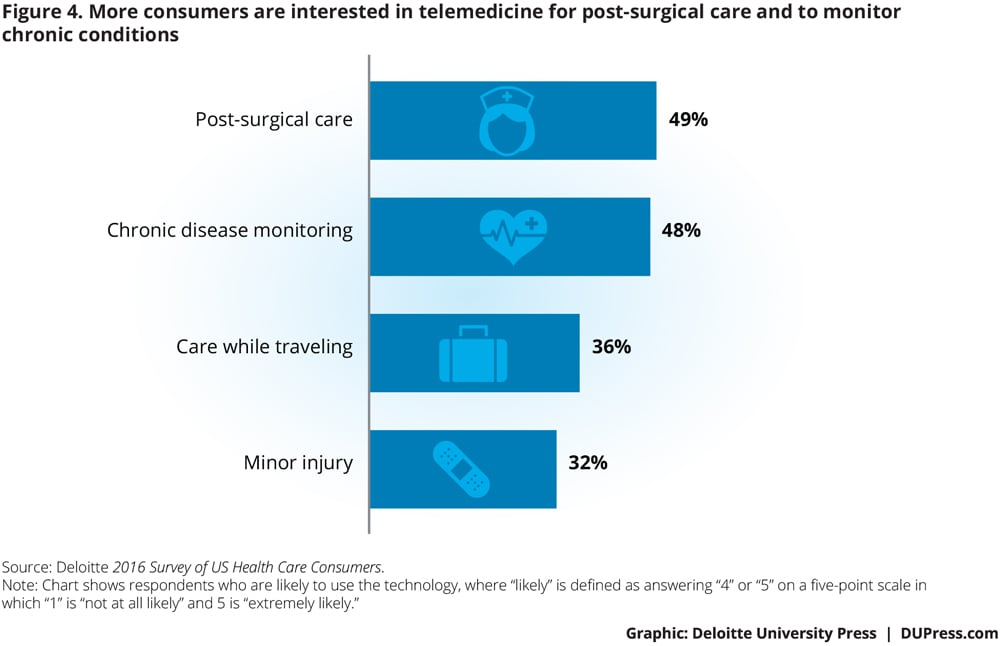

In the Deloitte 2016 Survey of US Health Care Consumers, consumers reported highest interest in using telemedicine for post-surgical care and for monitoring chronic conditions—49 and 48 percent, respectively. (See figure 4.) Fewer consumers showed interest in using telemedicine for more acute issues, such as for a sore throat (36 percent) or a minor injury (32 percent). (See appendix for further information about the survey scenarios.)

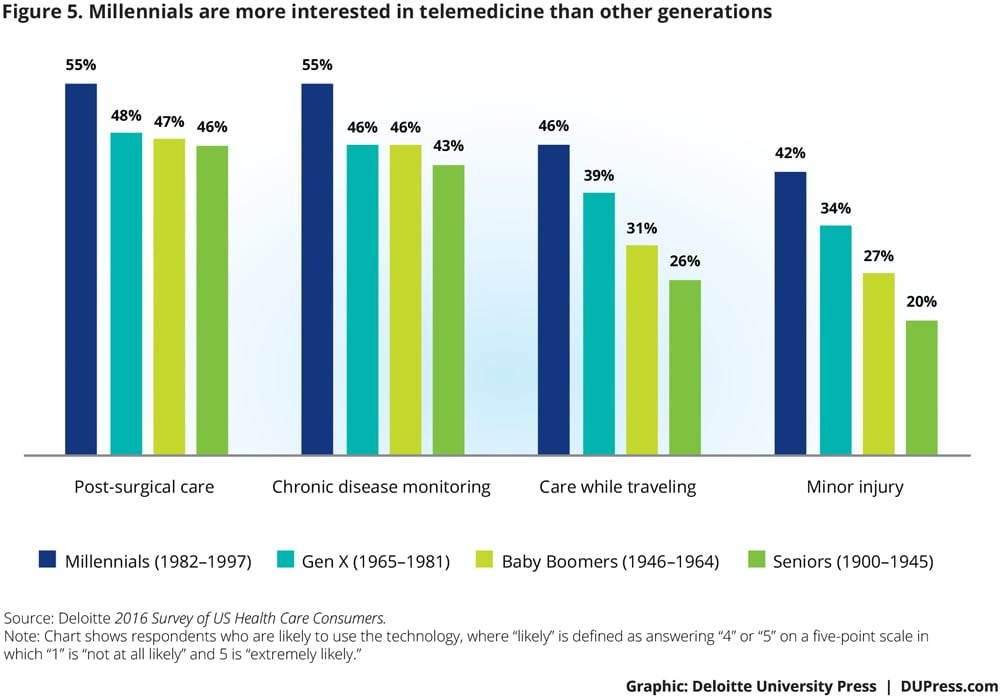

Unlike with remote monitoring, Millennials are more interested in telemedicine than any other generation (figure 5). We saw the largest difference among generations in the scenarios for minor injuries and care while traveling; for each of these, Millennials report a 20 percent higher level in interest than seniors. Seniors have the least interest in using telemedicine.

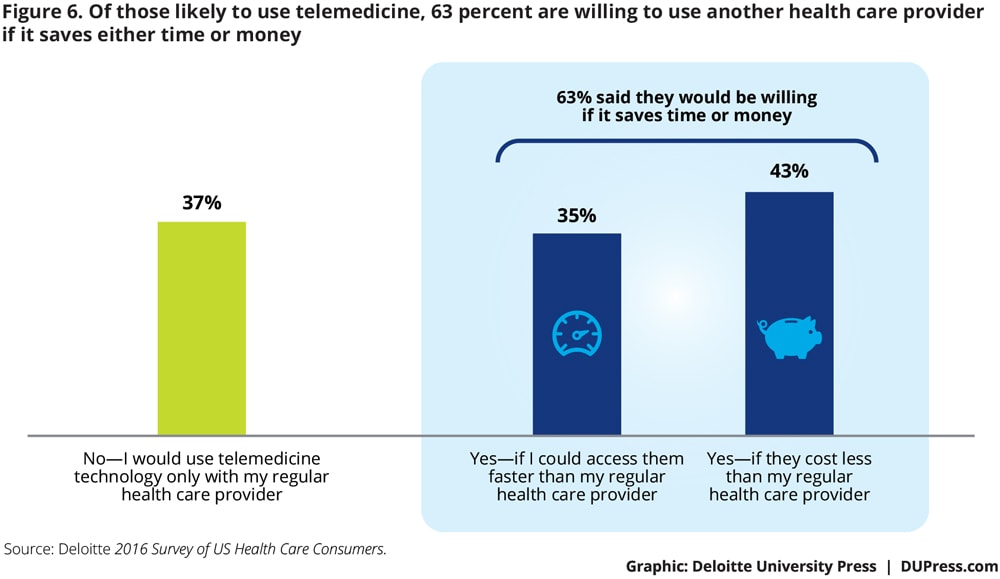

Some consumers (37 percent) would prefer to see their regular provider via telemedicine no matter what circumstance (figure 6). The rest said they are willing to see another provider if it saves them either time or money.

Seniors and consumers who suffer from chronic conditions are less likely to be flexible with the providers they see—41 percent with a chronic condition and 60 percent of seniors say they would use telemedicine options only with their regular health care provider. The younger the generation, the more flexibility they are willing to have with the providers they see: While only 27 percent of Millennials would limit telemedicine to a regular, trusted provider, 33 percent of Generation Xers and 44 percent of Baby Boomers would do the same.

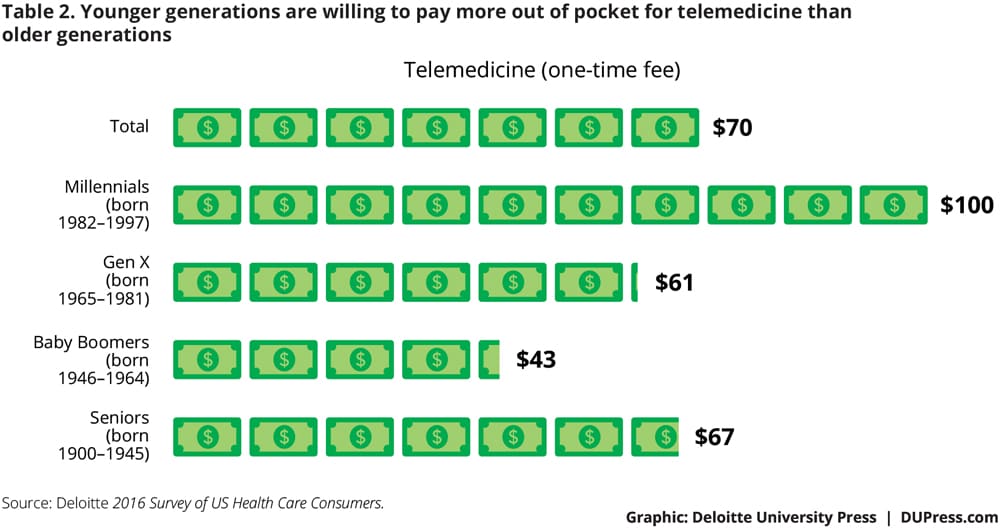

As with remote monitoring, a majority of consumers surveyed (80 percent) who are interested in using telemedicine think that insurance should pay for it. Of the 20 percent willing to pay out of pocket, they think—on average—that $70 is a reasonable cost for a telemedicine session. This varies by generation, with the youngest willing to pay the most (table 2).

In order to understand what would increase adoption of remote patient monitoring and telemedicine, we asked all consumers to identify any concerns they might have. One in three consumers expressed no specific concerns. Of the rest, similar themes emerged for the two technologies (figure 7), with worries about the quality of care and data security ranking highest for both telemedicine and remote monitoring. Fewer consumers (15 percent) have concerns about the difficulty of using the technology.

These results further quantify similar findings we learned in previous focus-group research on consumer-enabled technology.16 In the focus groups, we found that in general consumers are optimistic and the benefits of technology-enabled home health far outweigh the risks. However, many consumers value the personal nature of the patient-doctor relationship, and some expressed concern that increasing reliance on technology will weaken that relationship. Some mentioned the worry of sensory overload. And those worried about privacy and security fear that technology-enabled solutions (particularly those that measure sleep quality or motion patterns at home) might intrude on their privacy.

To effectively convey the benefits of using technology-enabled care, providers may need to educate both patients and caregivers. In our focus groups, once consumers heard personal stories of other group members who had used the technology or were experiencing the chronic condition, more participants were open to trying the technologies. As more care moves to self-care, many consumers want to have influence and control over their own health information and treatment options. They expect to learn about new technologies and to be actively involved—as patients or caregivers—in deciding which technologies are used for their care, how they are used, and what data providers will disclose and share.17

We explored some of the most common uses of disease treatment and prevention for sensors and telemedicine: cardiovascular and cardiopulmonary monitoring, blood glucose monitoring, and neurological monitoring, such as in post-operative management, outpatient care, and rehabilitation medicine.18 Analysis of our survey results suggests great potential for the prevention of adverse events and prevention of disease via monitoring. However, this is only the tip of the iceberg for the promise of these technologies for health care services.

A glimpse into the future: Robotics and drones

To many, drones and small robots are a novelty best suited to creating amusing online video clips. But researchers are aiming for far bigger things: Within the next several decades, they hope to introduce drones and robots capable of assisting older individuals with health risks who want to stay in their homes as long as possible. Some potential applications include household cleaning, retrieving medication from another room, and other tasks that could reduce the risk of falls in older adults who live alone. Although drones hold great promise for health care, monitoring, and medical product transport, care applications remain mostly hypothetical.

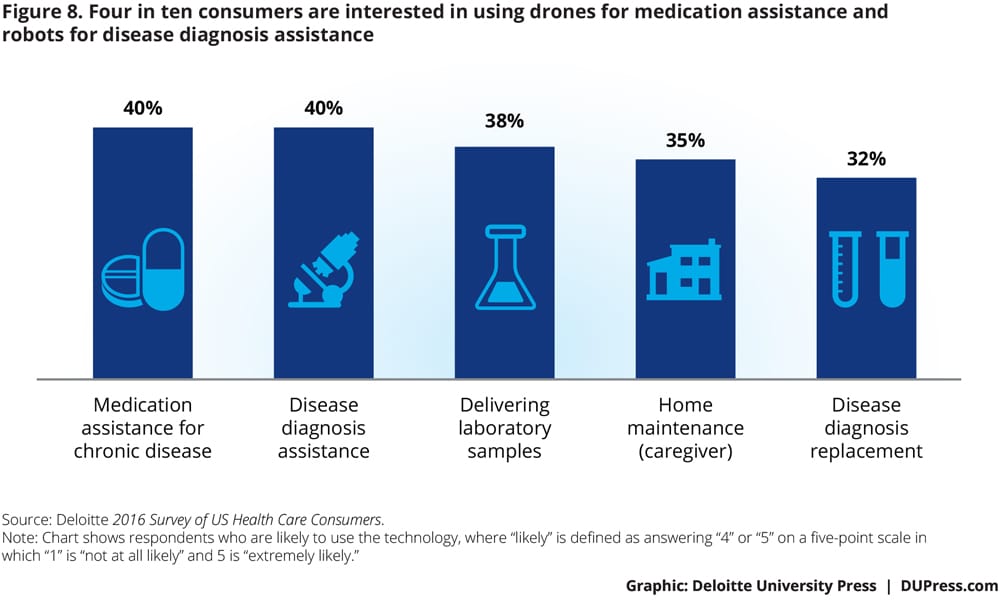

For the Deloitte 2016 Survey of US Health Care Consumers, we assessed consumer interest in using robotics and drones in various future scenarios. (See appendix for more information about the survey scenarios.) Forty percent of consumers surveyed are interested in using drones to help with self-care, including medication assistance, for a chronic disease (see figure 8). Interest is equally as high in having robots assist doctors in diagnosing a condition. Fewer are interested in using robots to diagnose in the absence of a doctor (32 percent) or, for caregivers, to monitor others (35 percent).

Implications for health care stakeholders

For those developing and implementing technologies for care, opportunities abound for new products and offerings over the coming years and decades. Our survey research suggests some considerations and cautions:

- Earning consumers’ trust on quality of care and personal information can be essential for adoption.

- Prioritize keeping patient information safe; consider developing risk mitigation strategies that take into account possible uses and misuses of personal information.

- Care coordination may be a critical need, especially for patients with complex conditions. Making care delivery more patient-centric will likely require increased collaboration and shared decision-making between providers and patients.

- Include the caregivers. Many caregivers are interested in using technology—but adoption thus far is low. Some focus groups have shown that caregivers seek integrated, multifaceted platforms that help them coordinate tasks and selectively disseminate information. Most caregivers also want tools to ensure that medications are managed accurately and with ease.

- A consistent, trusted connection. Consumers express preference in seeing their regular doctor for telemedicine visits. However, this may not be feasible in many instances. Other Deloitte focus group research suggests that consumers are open to seeing other doctors/nurses than their regular doctor—if they can consistently see that same person over time for their telemedicine or retail care visits.19

- Patient and caregiver engagement. To effectively engage patients, providers should consider getting to know who is in their patients’ support networks and understand patients’ and caregivers’ learning styles, communication preferences, and willingness to make decisions.

- Seamless user experience. Tools likely need to provide an end-to-end experience. For example, if a tool helps patients obtain and track prescriptions but doesn’t allow them to refill medication, many would rather not use that tool at all.

- Give consumers what they want. Consumers have clear preferences for which health care services they are interested in using telemedicine and remote patient monitoring. For example, there is more interest in chronic disease monitoring than for acute care in telemedicine. Retailers, providers, and plans should consider aligning their offerings where the interest is highest.

Remote monitoring and telemedicine hold profound potential for health care. They can play an important role in the future of care—monitoring a person’s health, helping individuals get access to more convenient care, offering piece of mind to caregivers, and helping older adults stay in more comfortable settings. These technologies have the potential to increase consumer satisfaction, improve medication adherence, and help consumers track and monitor their health (including signs and symptoms that may identify the need for care).

The Deloitte 2016 Survey of US Health Care Consumers shows that consumers are open to adopting these technologies—and suggests that manufacturers and providers can address their concerns and reservations. Particular subgroups are especially keen on these technologies, especially those with chronic diseases, caregivers, and seniors for remote monitoring.

As more health care moves to self-care, consumers will likely demand easy-to-use platforms, high-quality care, and secure health and personal information. Many will want to keep a human connection with their physicians, even if connected over a phone, video, or the Internet. So it will be incumbent upon manufacturers and care providers to develop products and services that meet consumer expectations while taking advantage of IoT technology’s benefits—and to educate consumers, both as patients and caregivers, to recognize and understand the value for them as well.

Appendix: Scenarios

For the Deloitte 2016 Survey of US Health Care Consumers, we asked consumers to consider several scenarios in each of several areas, rating how likely they would be to use different technologies as patients and potential caregivers.

About the Deloitte Center for Health Solutions

The Deloitte Center for Health Solutions (DCHS) is the research division of Deloitte LLP’s Life Sciences and Health Care practice. The goal of DCHS is to inform stakeholders across the health care system about emerging trends, challenges, and opportunities. Using primary research and rigorous analysis, and providing unique perspectives, DCHS seeks to be a trusted source for relevant, timely, and reliable insights.

© 2021. See Terms of Use for more information.