Green hydrogen: Energizing the path to net zero

Deloitte’s 2023 global green hydrogen outlook

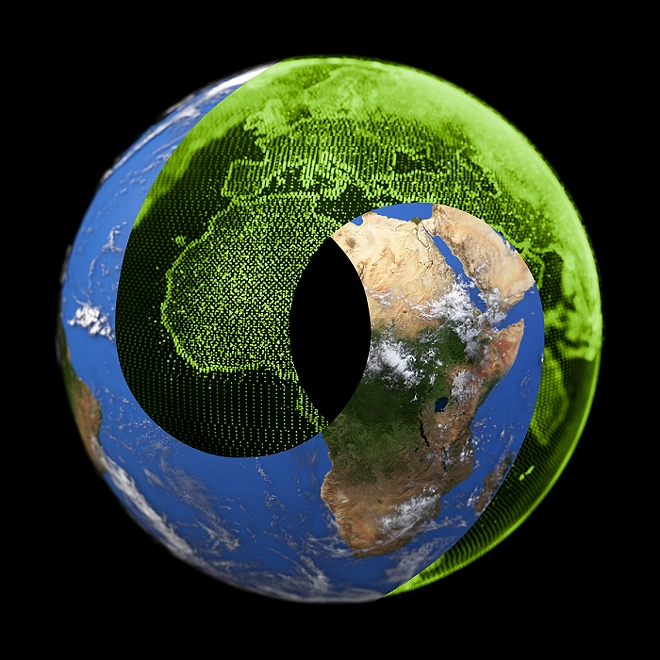

Deloitte’s new economic analysis shows how green hydrogen can play a paramount role to achieve net-zero targets by 2050. It can give us a second chance to decarbonize the planet, overcoming existing limitations and challenges posed by fossil fuels and technologies that add to greenhouse gas emissions.

Those who act now can reap the benefits, economic and environmental.

Governments, executives, researchers, and other parties around the world are looking to accelerate the ongoing energy transition to reach carbon neutrality. Aligning economies with the targets laid out in the Paris Agreement—limiting global warming to well below 2 °C, while pursuing efforts to limit the increase to 1.5 °Ci—means replacing legacy systems powered by fossil fuels with low-carbon energy sources such as renewables.

Green hydrogen could overcome these limits and become the key clean hydrogen supply option in the long run, being both economically viable and truly sustainable.

Either in its pure gaseous form or in the form of derivative molecules (ammonia, methanol and synthetic aviation fuels – SAF), it can lead to significant emission savings in hard-to-abate sectors: heavy industry (such as steelmaking and chemicals) and heavy transport (such as aviation and shipping). Moreover, if wind and solar power continue to expand, hydrogen can provide flexibility and network stability to the power systems.

Emerging green hydrogen market to redraw the global energy and resource map as early as 2030, creating a $1.4 trillion a year market by 2050.

Download the full report and visit our Global Hydrogen Center of Excellence.