Article

Global tax compliance and reporting - insights and trends : objectives and priorities

Welcome to Deloitte’s recent market research survey into the tax compliance and reporting landscape, a comprehensive, independently conducted research study that surveyed a representative sample of the largest multinational businesses across the globe, encompassing structured interviews with over 250 global tax decision makers. This was conducted in 2010 and again at the end of 2012.

This page covers commercial objectives and tax compliance and reporting priorities and looks at our research studies past and present – as well as key insights gleaned from our direct marketplace experience – highlighting the most important findings, reflecting on developments and extrapolating our thinking on future direction.

Executive summary – objectives and priorities

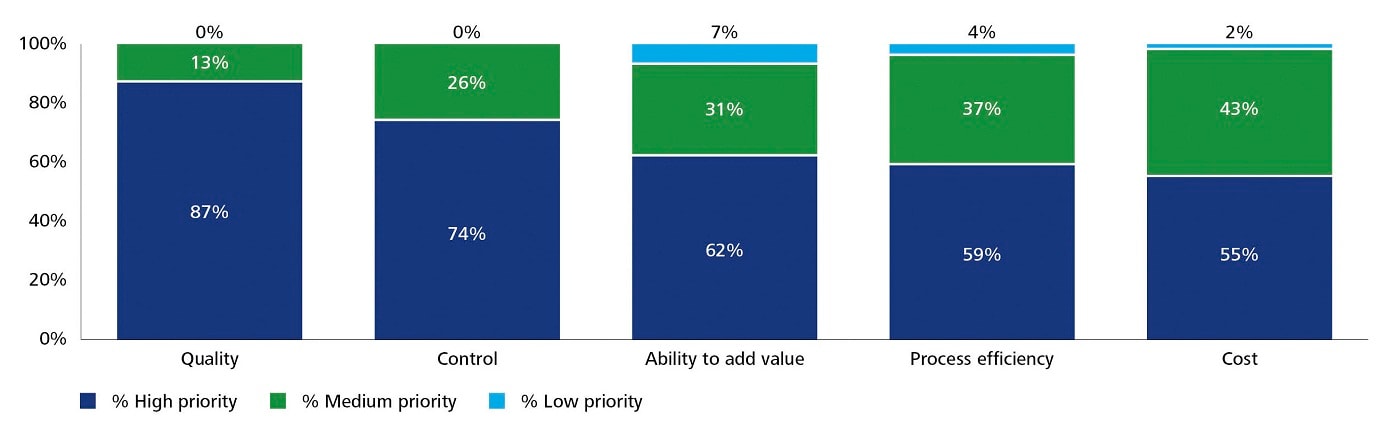

As with our 2010 study, our latest research continues to show clearly that the highest priorities for global tax directors are focused on quality (87% now rate this as a high priority) and control (74%). What is striking about our latest findings is that cost remains so far down the overall priority list. Indeed, it has moved further down the list since 2010. It seems that, in the minds of tax directors, the perceived risks and costs of getting compliance wrong often weigh heavier than the cost of getting it right. A clear development is the growing importance of process efficiency. Although still only ranked 4th in overall importance, the number of global tax directors who rated process efficiency of high importance has increased by 13% since 2010.

Commercial objectives

Understanding that commercial drivers would provide the biggest likely impetus for action, we asked global tax directors about their principal commercial objectives. The vast majority cited effective tax rate (ETR) and risk management as key drivers. Surprisingly, especially given the economic backdrop, operational efficiency and cost reduction were deemed less important.

Tax compliance and reporting priorities

When it came to specific compliance and reporting priorities in 2010, the greatest emphasis was placed on quality and control, both of which were rated of higher importance than cost or process efficiency. This qualitative emphasis was mirrored in tax directors’ future focus too, with 50% stating that managing changes in regulation and tax law would be their main compliance priority over the next three years.

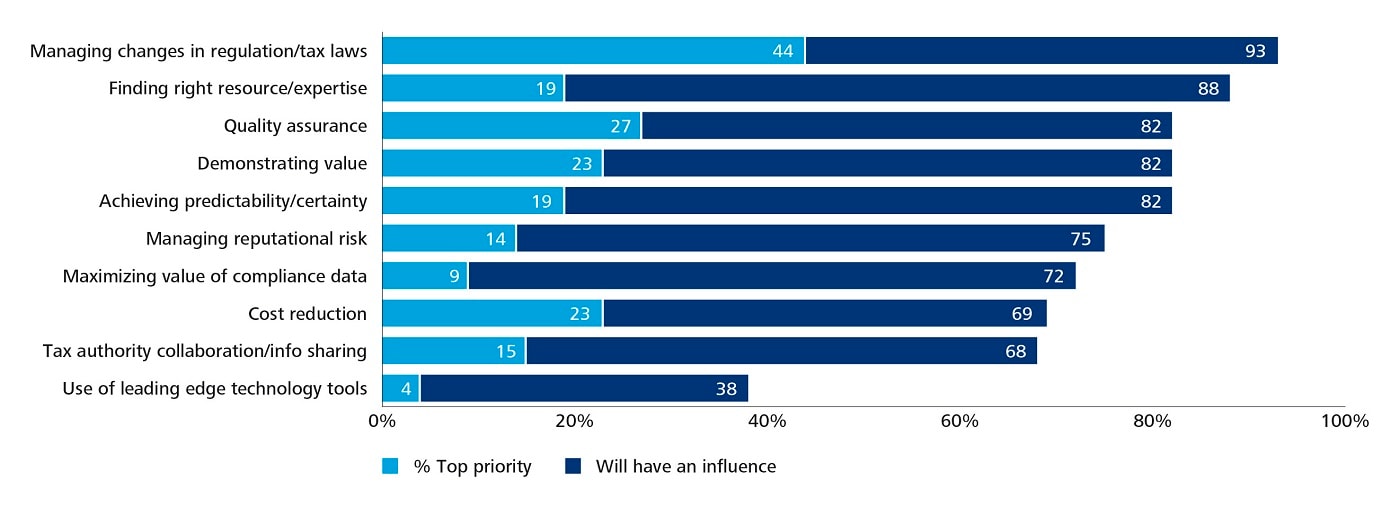

Future influences on management of tax compliance and reporting

Q. For each of these factors, could you tell me whether you think it will influence the way you organize and manage global compliance and reporting over the next three years. Which two are likely to be your top priorities?

Getting the basics right

As with our 2010 study, our latest research continues to show clearly that the highest priorities for global tax directors are focused on quality (87% now rate this as a high priority) and control (74%).

As we explore this in more qualitative terms, we find that their baseline need is confidence in the process of delivering and filing tax returns and statutory reports on a global basis. To achieve this, they want real time visibility over their global operations and assurance that everything is being done correctly and delivered or filed on time.

Managing uncertainty

What is striking about our latest findings is that cost remains so far down the overall priority list. Indeed, it has moved further down the list since 2010. It seems that, in the minds of tax directors, the perceived risks and costs of getting compliance wrong often weigh heavier than the cost of getting it right.

Certainly, the fact that managing changes in regulation or tax laws is still cited as having the greatest influence on the future organization and management of compliance and reporting suggests that tax directors remain concerned about growing complexity in this area.

Demands for greater data transparency from revenue authorities through initiatives such as e‑filing, coupled with moves towards greater cross‑border collaboration, are clearly exercising the minds of those responsible for tax within large global corporations.

Our qualitative assessment also suggests that the emphasis on quality and control is further exacerbated by more recent pressures on global corporations to be seen as ‘good’ taxpayers around the world, as part of their publicly perceived social responsibility.

Relative importance of tax compliance and reporting drivers

Q. For each of the following factors, please indicate whether it is of high, medium or relatively low importance as a driver for your business.

Making compliance easy

A clear development is the growing importance of process efficiency. Although still only ranked 4th in overall importance, the number of global tax directors who rated process efficiency of high importance has increased by 13% since 2010.

By contrast, when asked about satisfaction with their current model, process efficiency is the area that decision makers now seem least happy with: only 45% of our latest survey sample stated they were happy with this aspect of their current model.

Process efficiency is also mentioned frequently in qualitative terms. Language such as ‘standardized methodologies’, ‘consistent processes’, ‘error reduction’, ‘faster delivery’ and ‘greater simplicity’ has become more common currency in our latest interviews with global tax directors.

Indeed, the last phase seems to summarize a growing sentiment within global tax departments, of the need to reduce complexity and ultimately, make global compliance simpler.

Internal drivers

Process efficiency and greater simplicity also correspond with a stated desire to make better use of in‑house resources by taking them away from manual compliance tasks and refocusing them on higher value work and greater engagement with the rest of the business.

Another influence on tax directors’ thinking emanates from the wider theme of finance transformation. More and more we either see pressure being exerted by CFOs on tax departments to embrace this or tax directors anticipating this pressure and proactively looking at process efficiency within their function.

Relative importance of tax compliance and reporting drivers

Q. For each of the following factors, please indicate whether it is of high, medium or relatively low importance as a driver for your business.

An appetite for change

As discussed in earlier sections, businesses have historically displayed a high degree of disinclination to change their compliance and reporting arrangements. While a theoretical desire to improve was often evident, so too was a reluctance to implement major change. Our most recent survey suggests, however, that this dynamic is changing.

Not only are global tax directors less happy with their existing compliance and reporting models, they are now showing a greater appetite for change. In our survey, 45% of those who only expressed happiness in one or two measures also said they planned to change their compliance and reporting operating model in the next three years.

Satisfaction appears to increase as companies move to methods 2 and 3. Moreover, our research suggests there will be significant future movement away from method 1. With this movement, we are also likely to see increased outsourcing in regions such as Asia Pacific, with 44% of companies surveyed there expecting to outsource more over the next three years.

A focus on value

It is intriguing to observe that happiness with ‘ability to add value’ is at its lowest within method 3 models. Further interrogation suggests a degree of frustration from more progressive companies that additional value is yet to be seen. Future success for these global tax directors is likely to be determined by whether or not a truly value‑based compliance approach can be achieved with tangible delivery of the anticipated benefits. Indeed it appears that happiness with ‘ability to add value’ is at its lowest within method 3 models because this model should provide the most potential for leverage of centralized, multi‑country data.

Relative importance of tax compliance and reporting drivers

Q. For each of the following factors, please indicate whether it is of high, medium or relatively low importance as a driver for your business.

The value of insight

We expect the application of expert knowledge and the ability to deliver valuable insight to be increasingly key features of the tax department and its advisers in the future. As we have discussed, we have already begun to see companies anticipate additional benefits as they standardize processes and tax data globally. As organizations accumulate several years’ worth of consistently formatted tax data, readily accessible and presented in easy intuitive formats, the options and opportunities for analysis become significant.

With the right systems and data in place, the use of sophisticated data analytics to perform searches for transaction coding errors, assess supply chain efficiency, identify high cash tax business units and run tax scenarios across global groups, will provide global tax directors and their teams with the power to uncover and deliver new sources of business value.

This availability of data comes at an opportune time for global tax directors. Growing concerns around corporate responsibility and the impact perceived tax behaviors can have on consumer attitudes means global transparency and access to information will become increasingly important.

As compliance becomes the starting point for generating value, rather than an end in itself, it is at this point that it becomes truly transformed.