New Deloitte report: Emerging green hydrogen market set to help reshape global energy map by end of decade, creating US$1.4 trillion market by 2050 has been saved

Press releases

New Deloitte report: Emerging green hydrogen market set to help reshape global energy map by end of decade, creating US$1.4 trillion market by 2050

- Decisive climate action can help make green hydrogen competitive in less than 10 years, could support around 2 million jobs globally per year between 2030 and 2050

- Decarbonising hard-to-abate sectors like steelmaking, chemicals, aviation and shipping will likely require global hydrogen use to grow six-fold, to nearly 600 million tons, by 2050

- The widespread availability and falling cost of renewable energy production helps to ensure that green hydrogen can be produced virtually anywhere, with developing economies gaining an edge

- In 2030, Deloitte predicts that Asia will capture 55% of the market, driven by skyrocketing demand in China, India, and Indonesia

- Deloitte announces two new initiatives: Global Hydrogen Center of Excellence and the Hydrogen Investment Corridor

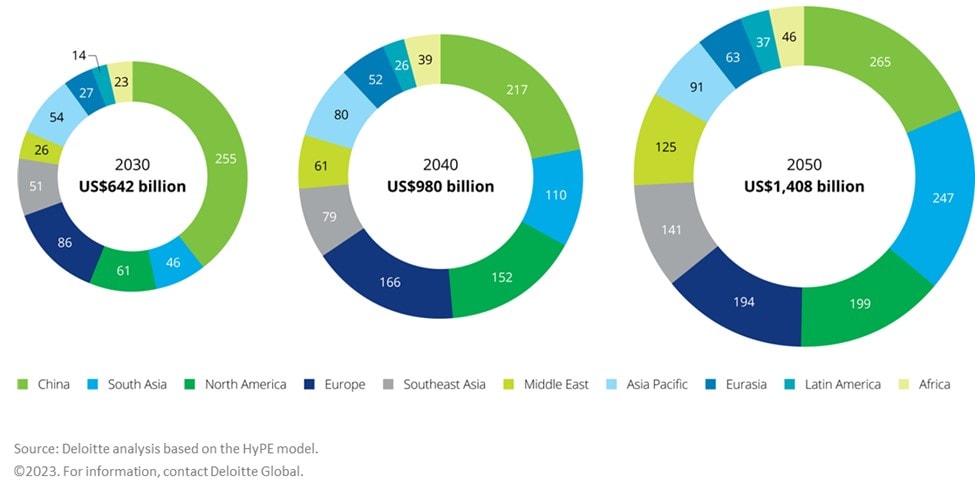

SINGAPORE, 8 June 2023 — As support for clean hydrogen as a reliable, sustainable energy source strengthens, the market is expected to top the value of the liquid natural gas trade by 2030 and grow further to US$1.4 trillion per year by 2050. Green hydrogen—produced by splitting hydrogen atoms from water molecules using electrical currents powered by renewable energy—is poised to help drive the bulk of the growth according to Deloitte’s new report “Green hydrogen: Energizing the path to net zero. Deloitte’s 2023 global green hydrogen outlook,” released today by the Deloitte Center for Sustainable Progress (DCSP). Global leaders can seize the opportunity presented by green hydrogen to rapidly decarbonise while investing in sustainable growth.

While market growth will likely be important for industrialised economies, clean hydrogen represents a major sustainable growth opportunity for developing countries, which, with targeted and significant investment, could account for nearly 70% of the US$1.4 trillion market in 2050.

The projections come from Deloitte’s Hydrogen Pathway Explorer (HyPE) model, which delivers one of the most comprehensive analyses of the supply of hydrogen globally. This research shows that clean hydrogen can deliver up to 85 gigatons in reductions to cumulative CO2 emissions by 2050, more than twice global CO2 emissions in 2021. Deloitte’s outlook provides extensive detail into the cost, production, and market of hydrogen, even analysing the business challenges facing the successful implementation of clean hydrogen, and providing insights into various market dynamics, such as optimal infrastructure sizing, investment needs, and technology choices. Furthermore, unlike blue hydrogen, green hydrogen prices have no direct correlation with natural gas prices, providing protection against the volatility recently observed in Europe and Asia.

Clean hydrogen has the potential to provide developing countries with a unique opportunity to advance to a low carbon future, while also fueling economic growth and sustainable development," said David Hill, Deloitte’s Asia Pacific CEO. " While other forms of renewable power are essential to a net-zero future, Deloitte’s research demonstrates that by embracing clean hydrogen and investing in its development, nations can significantly reduce their carbon emissions, create new industries and jobs, and improve energy security, all while contributing to the global effort to combat climate change."

Figure: Clean hydrogen market size (US$ billion per year),

2030 to 2050)

Interregional trade is key to helping unlock the full potential of the clean hydrogen market, supported by diversified transport infrastructure. Regions that are currently able to produce cost-competitive hydrogen in quantities that exceed domestic needs are already positioning themselves as future hydrogen exporters—supplying other less-competitive regions and helping to smoothly facilitate the energy transition. By 2050, more than 65% of the market will be in developing and emerging economies and 15% of revenues will accrue in the Asia Pacific region. The report also predicts that by 2050, the global hydrogen market will reach US$1.4 trillion, including US$280 billion of interregional trade. Of this, the size of the Asia-Pacific market will be US$645 billion in 2050, including about US$110 billion of interregional trade.

“Our research suggests that Asia Pacific will capture almost 55% of the market in 2030, driven by skyrocketing demand in China, India, Indonesia, Japan, and Korea.” Said Will Symons, Sustainability & Climate Leader, Deloitte Asia Pacific. “About 40% of the investment required to scale the clean hydrogen industry will be deployed in Asia Pacific. The clean hydrogen transformation could support up to 1.5 million jobs per year in developing and emerging economies between 2030 and 2050, with the majority of those jobs in Asia Pacific. Aside from the clear economic and climate benefits, an Asia Pacific clean hydrogen market will enhance energy security and independence.”

The report also details the major supply chain investments that will be needed to help optimise the global value of clean hydrogen. The report estimates more than US$9 trillion of cumulative investments are required in the global clean hydrogen supply chain to help meet net-zero compliance by 2050, including US$3.1 trillion in developing economies. An average yearly investment of US$150 billion is required in Asia-Pacific that helps to meet the global average requirement of US$375 billion. Export revenues from clean hydrogen helps today’s fossil fuel exporters offset declining revenue from oil, natural gas, and coal.

Green hydrogen is quickly becoming a viable solution to reduce carbon emissions in Singapore and Southeast Asia," stated Giam Ei Leen, Sustainability & Climate Leader, Deloitte Southeast Asia. “It has the potential to play a significant role in decarbonising economies and assisting countries in meeting their net zero targets. It also provides economic potential for businesses in Southeast Asia to make strides toward a cleaner, more sustainable future by embracing green hydrogen.”

Achieving net-zero greenhouse gas emissions in Asia-Pacific by 2050 will likely require the development of a 78 MtH2eq clean hydrogen market by 2030, growing to nearly 275 MtH2eq by 2050. However, based on current clean hydrogen project announcements, the global community could only provide a collective production capacity to meet one quarter of the projected demand in 2030.

To help scale up a robust and fair clean hydrogen economy to meet projected demand, the report recommends policymakers focus attention on three key components:

- Lay the market foundation. Lay out national and regional strategies to lend credibility to the market, develop a robust and shared certification process for clean hydrogen to help ensure transparency, and coordinate internationally to help mitigate political friction and promote a level playing field

- Spur action. Establish clear targets and/or markets for clean hydrogen-based products and offer pointed instruments, such as fiscal incentives and subsidies, to help reduce the cost difference between clean and fossil-based technologies and help businesses integrate clean hydrogen into their value chains

- Ensure long-term resilience. Diversify value chains—from trade partners to raw material suppliers—to help prevent costly bottlenecks during the transition to clean hydrogen, focusing specifically on improving infrastructure design to more effectively transport (pipelines and marine roads) and store (strategic reserves) clean hydrogen commodities

The Deloitte Global Hydrogen Center of Excellence:

To help policymakers and business leaders plan and execute a future built on clean hydrogen, Deloitte has unveiled its Global Hydrogen Center of Excellence. The center is dedicated to supporting clients in scaling up clean hydrogen and driving large-scale decarbonisation. Through practitioners at Deloitte firms, the center plans to work with clients across all stages of market development—from advising and sharing insights to help address some of the most complex questions, to implementing solutions and supporting the execution of projects on the ground, to helping enable operations, such as resilient supply chains and infrastructure.

“Scaling up Deloitte’s hydrogen-related offerings organisations around the world through the Center of Excellence is our latest effort to further support clients during this crucial energy transition and reflects Deloitte’s investment in and commitment to sustainability and climate,” said Tarek Helmi, Deloitte Global hydrogen leader. “Deloitte’s research demonstrates the growth potential of the global hydrogen market—and Deloitte is committed to helping organisations transform their operations through a currently underutilised but effective resource.”

The Deloitte Hydrogen Investment Corridor:

Deloitte has launched a Hydrogen Investment Corridor initiative to help establish multilateral collaboration across key hydrogen trade and investment pathways, with an initial focus on Germany, Australia, Africa, and Japan. As a global platform, the corridor will convene specialists from the public sector, industry, and finance to help accelerate investment in clean hydrogen value chains and help enable the ramp-up of this emerging industry. Through the corridor initiative, Deloitte will support the development of public policy, including hydrogen strategies for public authorities; bring economic and technical modeling skills to help inform decision-making; and convene different entities along the value chain to help support consortia formation and scaled investment.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which is a separate and independent legal entity, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Bengaluru, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Mumbai, New Delhi, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2023 Deloitte Southeast Asia Ltd