Mergers and Acquisitions

At Deloitte, we know that every single choice matters. And when it comes to bringing organizations together through mergers and acquisitions or creating new entities through separations and divestitures, there’s no time to second-guess. With the combination of technology and experienced professionals around the world, we uncover, create, and drive maximum value across every stage of a deal.

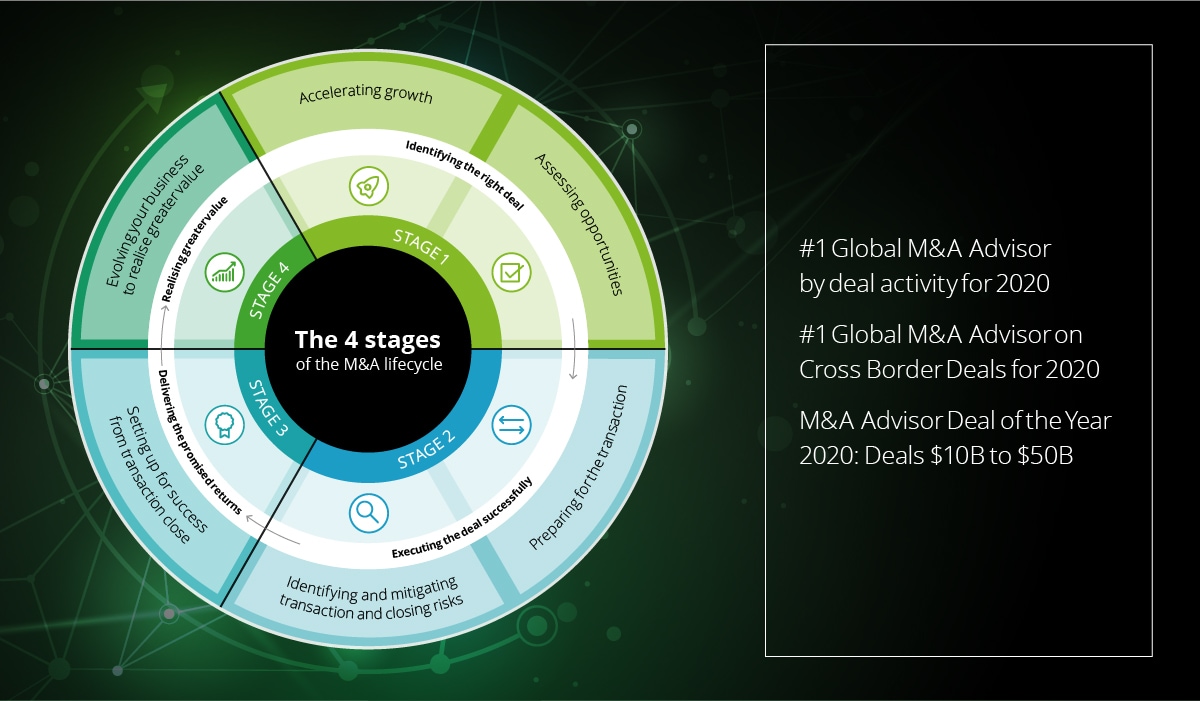

Our global network of M&A professionals can help you unlock value across the deal lifecycle

Accelerate growth & assess opportunities

Combining local and global expertise, we build the right team to explore potential growth strategies, assessing how emerging tech can accelerate inorganic and organic growth opportunities.

Our target screening approach and experience helps identify attractive and plausible acquisition targets, encompassing options to diversify or increase market differentiation.

Prepare for the transaction. Identify & mitigate transaction & closing risks

To facilitate our clients’ ability to make fully informed transaction decisions, we use our extensive deal and industry experience to highlight key issues and navigate blockers in valuations; deal structure; execution efforts and integration or separation planning.

Throughout the diligence process we impartially interrogate the deal, provide solutions to any risks, and identify and quantify potential upsides. An Executive briefing plan and board paper help ensure senior stakeholders understand the deal rationale and its implications, including closing risks.

Set-up for success from transaction close

Whether integrating or separating an entity, our team develops a plan to deliver on the anticipated business synergies. This can include running workshops to assess how sales teams, suppliers, employees, systems and processes will integrate; developing a customer retention plan and ensuring all regulatory and compliance obligations are met.

To unlock the full value of the transaction, we can also create and design talent retention programs, and help manage change and communication initiatives to drive a smooth and successful transaction.

Evolve your business to realize greater value

The complex nature of an M&A deal will often prompt our clients to seek a more in-depth and robust understanding of potential disruptors and transformational opportunities to evolve and advance their business.

This might include assessing avenues for value creation, exploring performance improvements or reviewing readiness for disruptive technologies or events that may impact the future stability and success of the business.

Corporate Finance Advisory

Providing independent financial, M&A and debt / equity advice – whether you are seeking to expand organically or via a strategic acquisition, realize value through the sale of a business, a subsidiary or a shareholding, raise new finance, review debt facilities or improve balance sheet funding efficiencies.

Disruptive Events Advisory

Deloitte’s deep accounting, financial reporting, finance operations, controls, and regulatory experience can help CFOs and their finance teams successfully navigate disruptive events, such as IPOs, mergers and acquisitions, divestments, new joint ventures, and business model changes, and exceed stakeholder expectations.

M&A Strategy & Diligence

From conceiving strategy to selecting the right partner…From conducting thorough due diligence to closing the deal…From beginning to end, Deloitte addresses your transactions, integration, and separation needs, all with the goal of generating value for your organization.

M&A Tax & Legal

Deloitte offers differentiated solutions to help companies identify M&A opportunities, assess risks and exposures, understand the tax synergies that can be captured in transactions, and deploy offensive and defensive M&A strategies to navigate uncertainty and rebuild profitability.

Turnaround & Restructuring

Deloitte’s Turnaround & Restructuring teams assist companies and stakeholders to address pressures and effect turnarounds, to regain control, manage crisis, improve return to creditors and limit exposure to risk and bad debt through a full suite of services.

Value Creation Services

Deloitte Value Creation Services is predicated on the rapid identification, planning, and implementation of prioritized performance improvement initiatives that will improve cash and enhance profits.

Valuation & Modelling

For years, leading companies have turned to Deloitte for our deep experience in valuing, modeling, and analyzing business interests and their underlying assets. We provide transformative insights to turn critical and complex issues into opportunities for growth, resilience, and long-term advantage.

${title}

M&A. Make history.

The pace of today’s M&A activity demands that decision-makers be able to make the right moves confidently and swiftly to capitalize on new opportunities.

Deloitte’s member firms understand the challenges on both sides of the transaction and the need for all parties to drive maximum value. Our global network of M&A professionals are forward-looking specialists with unparalleled experience, skills, and deep industry expertise. By combining these capabilities with proprietary tools and analytics, we identify key risks and rewards, so you can confidently navigate M&A complexities.

For sellers, we help you understand the potential risks and rewards of a divestiture. We assess your situation and support your negotiating position to maximize the sale price and execute the deal with minimal disruption to remaining operations.

For buyers, we recognize the need to unlock value at every stage. We work with you to identify potential targets and support an efficient transaction process for the most complex deals. We also help align deals with your strategic business objectives, maintain compliance, and enhance value through integration and potential upside opportunities.

With building value at the core of our focus, we work seamlessly with you across all stages of planning and executing acquisitions and divestitures.

Client success stories & experiences

Deloitte supported our client's in-house M&A team on the disposal of seven separate assets.

The Issue—making the most of this moment

In 2015, disruption rippled through the technology industry. When many software companies were shrinking, personal computer maker Dell and software pioneer EMC decided to join forces. The road to a seamless launch and value-focused transformation was truly uncharted territory.

The president and CEO of EMC at the time, along with the president of Dell Services, Digital and IT, formed the Value Creation Integration Office—bringing together leadership and selecting a trusted advisor.

Deloitte has extensive experience on M&A engagements but it was the organization’s ability to look deeper that differentiated Deloitte from other professional service advisers.

The Solution—making the client experience even better

Deloitte’s first recommendation was identifying critical milestones. Through a customer-first lens, the team prioritized and executed 20 percent of the opportunities that presented 80 percent of the accretive value.

The next challenge was workstreams. Thousands of global people needed to understand how their actions affected others and Deloitte helped over 20 workstreams identify and address possible threats.

Due to the size of this tech M&A, Deloitte quickly recognized the need to deploy efficient solutions. Deloitte assisted in the development of digital tools, including a welcome eGuide for over 140,000 employees and an e-runbook targeting 40,000-plus sales professionals on efficiently cross-selling on Day 1.

From specialists in go-to-market, IT, human capital, supply chain, real estate, finance, and tax, Deloitte’s cross-functional expertise certainly contributed to the merger’s ultimate notoriety as the new M&A case study blueprint.

The Impact—making history

September 7, 2016, marked the official close of the deal, with Dell and EMC becoming Dell Technologies.

It was a technology M&A case study like no other. Between Dell, EMC, and Deloitte, the entire project was an exercise in collaboration, innovation, and thoughtful strategic planning.

The end result solidified the new company and its participants in the annals of the tech industry; the merger was valued at $58B at close and impacted 140,000 team members across 180 countries.

When you want to make history, talk to Deloitte.

When this airline ran into trouble, it was a matter of national importance. A competitive aviation sector is vital for a strong economy and significant parts of Australia’s tourism and hospitality sectors relied upon it. The business was burdened by a legacy of high debt, a high cost base and an ill-conceived strategy to move from a low-cost carrier to a full-service airline.

In April 2020, Deloitte was appointed the administrator of the airline as the growing economic toll of COVID-19 on the travel sector was accelerating, and the airline had a sudden 95% drop in revenue. There were 1.6 million creditors with a debt burden of AUD7 Billion – many of whom were customers with pre-paid tickets, together with over 10,000 employees who needed to be protected. In order to avoid liquidation of the airline, the Deloitte administrators decided to trade the business and commence a (very) accelerated sale process. The Deloitte team was focused on saving the airline and avoiding a liquidation to provide the best outcome to key stakeholders including financiers, trade creditors, investors and employees alike.

Deloitte and the airline’s management worked around the clock on a restructure to rescue the business. The restructure simplified and reduced the cost base to attract a new owner. The Deloitte team actioned a number of initiatives to significantly reduce costs including streamlining the fleet from nine aircraft types to two, reducing the property leasing footprint (including moving the head office), and renegotiating supplier contracts.

In a record 67 days from date of appointment, the business was successfully sold to a private equity firm. This is a great example of how the voluntary administration process can be used to successfully save a business and more importantly preserve jobs for the thousands of employees. This was incredibly rewarding for our team given the national significance of the airline and the number of jobs saved by the restructure.

The Deloitte M&A Institute can help M&A professionals enhance their capabilities and readiness by providing a collaborative environment where they can build connections, tap into world class thought leadership, access relevant trainings, and register for in-person events.

The Digital Deal Room is now virtually enabled to support businesses preparing for their next M&A opportunity.

With increasing economic uncertainty, it has never been more crucial to have the right M&A strategy in place.

Accelerated and Differentiated Outcomes

iDeal

Our advanced analytics capability identifies deep insights in hours Vs weeks, delivering accelerated, game-changing outcomes when it matters most. iDeal combines tools, processes and techniques to produce big-picture insights with a microscopic level of detail

Mergers & Acquisitions (M&A) decisions are driven at least in part by data. In the past you might not have known the story behind the numbers until your business was in the trenches of post-deal transition. Today, you have M&A data analytics. Within the typical tight timeframe of most deals, iDeal enables you to go deeper into the data to find the story behind the data – while there’s still time to take action.

ValueD

Cut through complexity leveraging our AI and cognitive analytics. With market-based benchmarks and our vast industry knowledge for valuation insights power and inform your decisions. ValueD can bring clarity to complexities and offers new insights for better more strategic decisions using real-time visualization

With ValueD, we can help you access the right information to make informed business decisions and mitigate risks to maximize internal, external, and shared values. Real-time scenario analysis, advanced analytics, and sensitivity capabilities allow us to efficiently identify impactful assumptions and inputs, as well as potential impact on stakeholders and society at large.

Enhanced quality: Utilizes AI and cognitive technologies coupled with our experience to enhance quality and reliability.

Business insights: Provides benchmarking and insights based on a variety of research and proprietary databases to deliver value creation insights that enable informed business decisions.

Dynamic modeling: Offers the ability to dynamically perform multi-variable sensitivity analysis and evaluate alternative scenarios on demand.

Data analysis: Provides an improved understanding of sources and calculations enabling you to uncover and convey true value.

Valuation management: Provides enhanced visibility of project status, enables real-time tracking of data requests, and facilitates response to data requests.

M&A Central

Accelerate planning and realization of project value with holistic, cloud-based M&A project management technology that standardizes program delivery and enables real-time collaboration. M&A Central is our proprietary, market-leading tool to drive execution. Leverage dynamic dashboards, interdependency management, synergy tracking and secured clean rooms

M&A Central standardizes program delivery and enables real-time collaboration to drive program executions. This market-leading cloud-based program management tool creates opportunities to identify and engage with ‘off track’ initiatives that require support, reduces the need for management office support and reduces physical labor hours.

${title4}

${description4}

${title5}

${description5}

${title6}

${description6}

${title7}

${description7}

${title8}

${description8}

${title9}

${description9}

${title10}

${description10}

${title11}

${description11}

${title12}

${description12}

Get in touch with our cross border experts

Indonesia Strategy, Risk & Transaction Leader

sahalasitumorang@deloitte.com