Global tax compliance and reporting - insights and trends : technology has been saved

Article

Global tax compliance and reporting - insights and trends : technology

Welcome to Deloitte’s recent market research survey into the tax compliance and reporting landscape, a comprehensive, independently conducted research study that surveyed a representative sample of the largest multinational businesses across the globe, encompassing structured interviews with over 250 global tax decision makers. This was conducted in 2010 and again at the end of 2012.

This page covers technology and looks at our research studies past and present – as well as key insights gleaned from our direct marketplace experience – highlighting the most important findings, reflecting on developments and extrapolating our thinking on future direction.

Executive summary – technology

As companies move towards more centralized operating models, we usually see a corresponding growth in their demand for external assistance, often in the form of technology consulting services. Interestingly though, our latest findings suggest that companies are less concerned about the specific choice of technology deployed. It is what technology is perceived to deliver, in terms of results and benefits, that remains more important.

New ways of working

When it came to technology, there was evidence in 2010 that 87% of global tax directors believed they could do more with IT, but deeper questioning suggested many were daunted by new technology and wary of big implementations.

This reluctance was also more widely evident when it came to making major organizational changes. Typically, concerns related to the risks of disruption to the business. An ‘if it ain’t broke, don’t fix it’ mentality prevailed.

Current thinking

External support

As companies move towards more centralized operating models, we usually see a corresponding growth in their demand for external assistance, often in the form of technology consulting services.

The use of workflow technology, either in‑house or by external providers, is often the starting point, with this seen as the first step to tracking progress and deadlines, thereby establishing more control and visibility over the process.

Interestingly though, our latest findings suggest that companies are less concerned about the specific choice of technology deployed. It is what technology is perceived to deliver, in terms of results and benefits, that remains more important.

Click here to download the whole report.

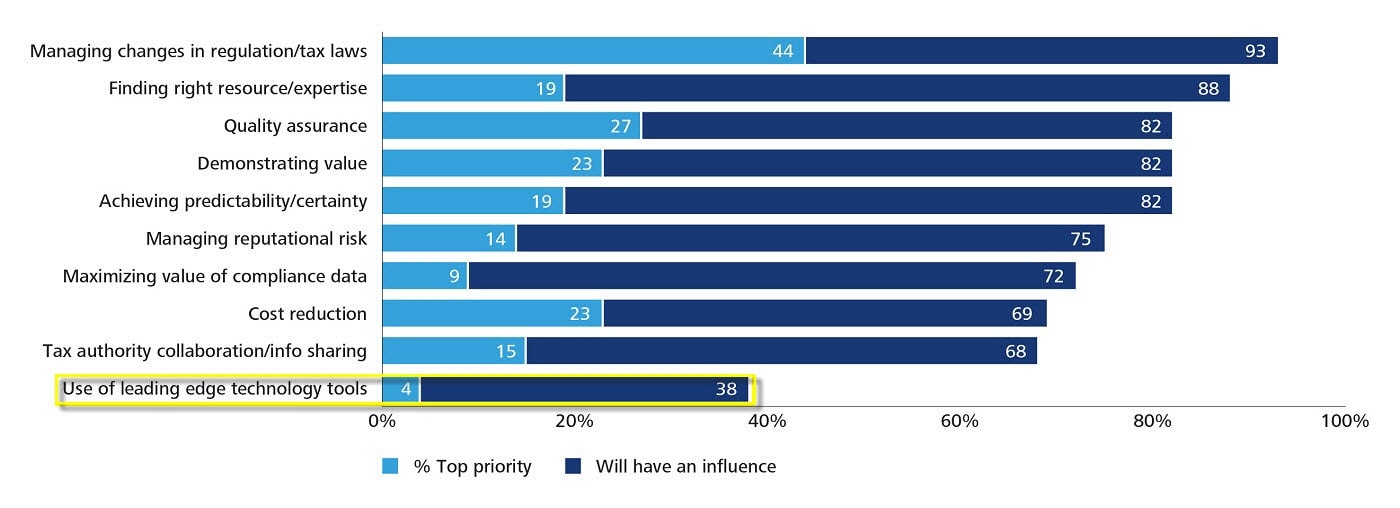

Future influences on management of tax compliance and reporting

Q. For each of these factors, could you tell me whether you think it will influence the way you organize and manage global compliance and reporting over the next three years. Which two are likely to be your top priorities?

New ways of working

A focus on value

As their approach to managing compliance and reporting is transformed, some tax directors are becoming increasingly alert to the potential that exists to leverage consolidated compliance data and extract greater value.

This complements the likely longer term shift away from the substantive production of traditional tax returns to a more systems-based approach, encouraged by those revenue authorities moving to more sophisticated forms of e‑filing. In countries such as Brazil, the e‑filing requirements offer a comprehensive source of tax data which exponentially increases the potential for smart use of data analytics – by revenue authorities and taxpayers alike.

Extreme automation

We also expect to see an era of ‘extreme automation’ follow the current trend towards e‑filing. We have already seen signs of this in some jurisdictions where data in company systems is required to be held in visible and accessible formats for revenue authorities to extract or review.

Further forward, revenue authorities are likely to move away from requesting and holding vast quantities of data themselves. The tax return may disappear. Revenue authorities might become much leaner organizations. The responsibility could move to companies to self assess their tax liabilities and maintain data in formats allowing easy access and review. Alternatively, in the future, revenue authorities might simply publish protected software routines for taxpayers to run across data sets and file the results.

This will require a quantum leap in the transformation of companies’ global financial systems and place greater emphasis on the tax sensitization of data at source. In this view of the future, rather than apply tax knowledge to financial data retrospectively to prepare a return, the onus will shift to the point of data entry, so that tax sensitized data is inherent within the normal transactional data residing in financial management systems.

"As we harness technology we will reallocate resources, so that more people are supporting our business units, and less people are doing compliance work."

Anonymous, Tax Director

The value of insight

We expect the application of expert knowledge and the ability to deliver valuable insight to be increasingly key features of the tax department and its advisers in the future. As we have discussed, we have already begun to see companies anticipate additional benefits as they standardize processes and tax data globally. As organizations accumulate several years’ worth of consistently formatted tax data, readily accessible and presented in easy intuitive formats, the options and opportunities for analysis become significant.

With the right systems and data in place, the use of sophisticated data analytics to perform searches for transaction coding errors, assess supply chain efficiency, identify high cash tax business units and run tax scenarios across global groups, will provide global tax directors and their teams with the power to uncover and deliver new sources of business value.

This availability of data comes at an opportune time for global tax directors. Growing concerns around corporate responsibility and the impact perceived tax behaviors can have on consumer attitudes means global transparency and access to information will become increasingly important.

As compliance becomes the starting point for generating value, rather than an end in itself, it is at this point that it becomes truly transformed.