Who owns the road? The IoT-connected car of today—and tomorrow has been saved

Who owns the road? The IoT-connected car of today—and tomorrow The Internet of Things in automotive

19 August 2015

Simon Ninan United States

Simon Ninan United States Bharath Gangula United States

Bharath Gangula United States Matthias von Alten United States

Matthias von Alten United States Brenna Sniderman United States

Brenna Sniderman United States

The connected vehicle has been the most visible and familiar example of Internet of Things technology. But as cars become increasingly software-driven, the real IoT developments in the auto industry are behind the scenes, as automakers and software providers both lay claim to the driver’s seat.

Executive summary

Our cars have been connected for years, in ways that by now seem routine: They seamlessly link to our smartphones, register real-time traffic alerts, stream our Spotify playlists, and offer emergency roadside assistance at the touch of a button. Indeed, automakers began linking vehicles to information streams back in the early days of the Internet. When it comes to connecting drivers and technology, the auto industry has a longer and richer track record than any other sector.1

True, automakers have yet to turn the “connected car” into a significant revenue generator or a key driver of vehicle sales: Despite two decades of TV ads promoting advances in in-vehicle connected services, drivers have resisted paying extra for those features, either not understanding the new technologies or simply seeing little value in the services offered.2 But this—and a great deal more—is about to change.

Receive IoT insights

Subscribe

Explore the

Internet of Things collection

Indeed, the auto industry is on the brink of a revolution, and the driving force is the suite of technologies known as the Internet of Things (IoT). With IoT applications—grounded in advances in everything from sensors to artificial intelligence to big-data analysis—all manner of objects, from wristwatches to road signs, can be not only connected but also “smart.” And both industry insiders and everyday drivers will soon see a fundamentally different world of mobility.3

Analysts differ in their estimates, but all agree that the prospects are staggering. Gartner predicts that by 2020, more than 250 million vehicles will be connected globally, with the number of installed connectivity units in vehicles worldwide increasing by 67 percent and consumer spend on in-vehicle connectivity doubling. Deloitte’s consumer research suggests that drivers of the next generation want their cars to act as smartphones on wheels, like to remain connected and productive while on the go, consider fully connected vehicles among the most beneficial futuristic technologies, and are ready to pay a sizeable amount for a vehicle that meets all their technology needs and wants.4 We expect the impacts on the industry to be transformational, not incremental.

As ever, new opportunities bring fresh challenges. As IoT technologies and services transform the automobile, the ecosystem is witnessing a steady influx of new players and the continued evolution of the roles of key stakeholders and the balance of power among them. Of particular interest is the evolving relationship between automakers and software providers. Each has a viable claim on the driver’s seat in the rapidly changing auto-industry ecosystem, even as each new generation of services promises to throw into question just how long whoever might have their hands on the wheel can keep them there.

Revolutions per minute: A balancing act

The connected car has evolved in distinct stages, or phases, over the last few decades that show advances in both technology and the ecosystem in which that technology functions. At each stage, not only are new features and services added to the growing connected car product portfolio, but also new ecosystem players as well as, in many cases, new business models and supporting technologies. That’s why the best way to fully perceive the complexity of the playing field is to use the past as prologue, tracking the evolution of the connected car from its earliest stages to where it is today and where it’s going. Figure 1 outlines these phases of evolution.

Dare to DAIR: The R&D era

Since as far back as the mid-1960s, automakers have looked for ways to enhance the driving experience with information. General Motors’ Driver Aid, Information and Routing (DAIR) initiative sought to provide everything from directions to current road conditions and accident reports.5 Far ahead of its time, DAIR never got out of the R&D stage, mostly because the technology of the day simply wasn’t up to the task. Punch cards provided information for turn-by-turn directions; radio relay stations and magnetic sensors buried in roads communicated additional data. For such a system to be useful, it would have required ubiquitous availability—in other words, deployment on roads across the country or, at least, a substantial geographical scale—at the time, cost-prohibitive and commercially unworkable, which is why we classify DAIR as Phase 0, a connected car before connections truly existed.

Conceptually, however, we can think about this effort in terms of how the information creates value and therefore assess DAIR in those terms. The Information Value Loop describes the stages through which information must pass to create value, the technologies required to push information around the loop, and the characteristics of the data that drive value (see inset on page 5).

By connecting the vehicle with in-road sensors, DAIR created and communicated information, analyzing it to provide an augmented response—action—in the form of navigation and traffic information. In closed test environments, the value was visible as information completed the trip around the value loop. At commercial scale, however, the cost of putting the expensive sensor technology in place across large stretches of road created too tight a bottleneck for DAIR to be feasible. It did not help that, for a single-company initiative, there was no larger ecosystem in place to spread the costs around. Even for the GM of the 1960s, DAIR was too great a dare.

The Information Value Loop

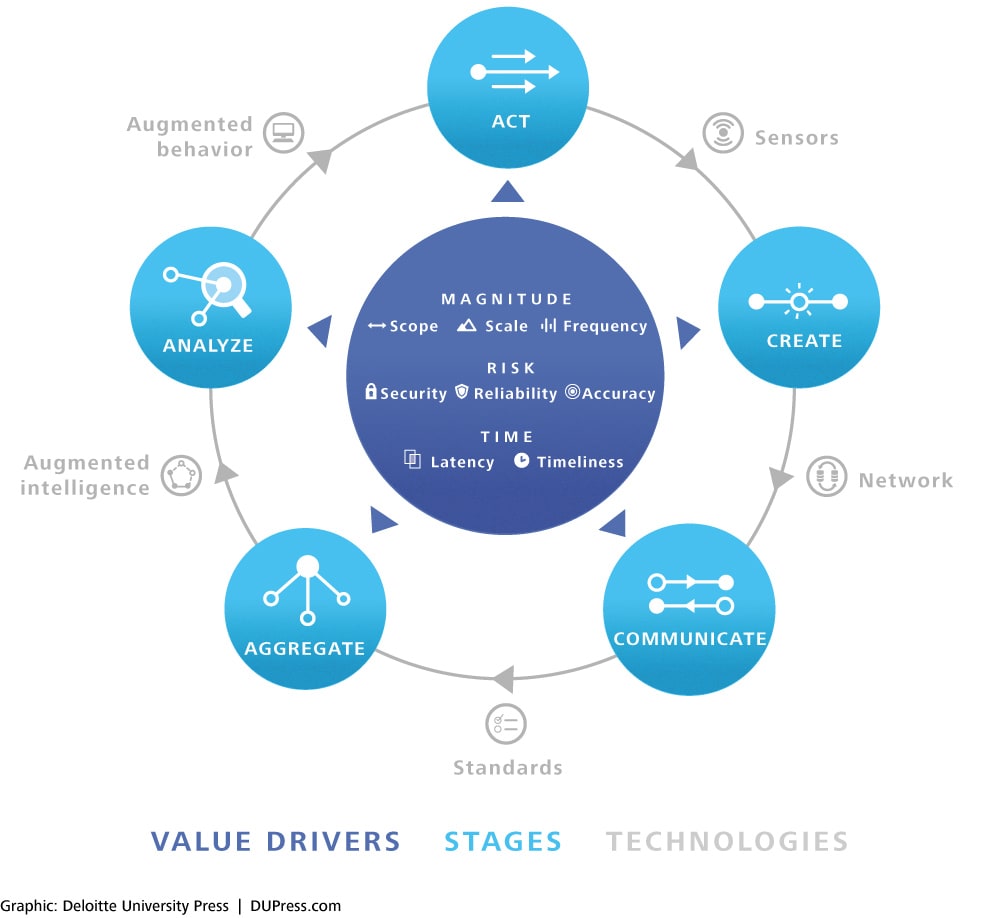

The suite of technologies that enables the Internet of Things promises to turn most any object into a source of information about that object. This creates both a new way to differentiate products and services and a new source of value that can be managed in its own right. Realizing the IoT’s full potential motivates a framework that captures the series and sequence of activities by which organizations create value from information: the Information Value Loop.

For information to complete the loop and create value, it passes through the loop’s stages, each enabled by specific technologies. An act is monitored by a sensor that creates information, that information passes through a network so that it can be communicated, and standards—be they technical, legal, regulatory, or social—allow that information to be aggregated across time and space. Augmented intelligence is a generic term meant to capture all manner of analytical support, collectively used to analyze information. The loop is completed via augmented behavior technologies that either enable automated autonomous action or shape human decisions in a manner leading to improved action.

Getting information around the Value Loop allows an organization to create value; how much value is created is a function of the value drivers, which capture the characteristics of the information that makes its way around the value loop. The drivers of information value can be captured and sorted into the three categories: magnitude, risk, and time.

OnStar and its constellation: The embedded era

When GPS technologies were opened up to civilian use in 1996, GM announced OnStar in collaboration with EDS and Hughes Electronics.6 As originally introduced, every connected car would have a digital communication module (DCM), essentially a phone embedded in the vehicle, responsible for communicating information wirelessly to a telematics service provider (TSP) or the automaker itself. In a breakthrough we categorize as Phase 1, this connected the car to information and services from the outside world to enable a safer and easier driving experience.

OnStar’s success is clear in terms of its ability to effectively push the right kinds of information around the Value Loop. For example, safety services leverage sensors embedded in the vehicle—aggregating information that the car creates and communicates associated with safety-related events and emergency situations. Navigation services use GPS technology to ascertain the auto’s location. Analysis of the information enables the provider to use augmented-behavior technologies to act on the customer’s behalf—from dispatching emergency services to the site of a crashed vehicle to providing live concierge services over the in-vehicle phone.7 The timeliness, reliability, and accuracy of information are the most critical value drivers, due to the importance of rapid response in emergency situations and the legal implications of safety failures.8

The automotive ecosystem was becoming more than just the car and its maker. Unlike the closed DAIR ecosystem, OnStar’s ecosystem brought in two new players: the hardware providers and Tier 2 chip providers that supplied the DCM devices and the TSPs that provided the core services. The new hardware providers, operating similarly to existing Tier 1 providers, fit within existing power structures. The TSPs, however, represented an important shift: Automakers’ introduction of embedded safety services expanded their business models beyond product manufacturing and retail into service provision, touch-points across the customer lifecycle, and the ability to collect recurring revenues. The communicate stage was an important bottleneck that TSPs were key to relieving. As a result, TSPs possessed two critical pieces of value in the partnership: the customer data related to the services provided and the actual interactions with customers themselves.9

After a century of carmakers’ unquestioned industry dominance, other players were staking a claim to ownership of the overall relationship with the customer. But the potential power struggle had to take a back seat to the fundamental problem of consumer adoption: Notwithstanding industry hype, consumers were slow to comprehend the new services being offered and the benefits of such connectivity; the high prices of these services proved a particularly big speed bump.10

Even just the two data points provided by DAIR and OnStar illustrate a trend: Communication-based technologies often require an expanded ecosystem to function effectively and affordably, appeal to customers, and offer opportunities to generate value. But while enlarging an ecosystem enables a given value loop to create more value, it poses additional challenges for the players involved when it comes to capturing that value.11 The continued evolution of the connected car has played out according to these same rules.

On-the-go: The infotainment era

By the mid-2000s, the near-ubiquity of mobile phones and the rapid rise of smartphones prompted the introduction of “infotainment” applications within the vehicle.12 These applications were built on a driver’s “brought-in” phone (using a phone’s cellular connection to stream data to the vehicle via Bluetooth) rather than embedded hardware (as with DAIR or OnStar). The connected capabilities within the car aimed to duplicate entertainment and features a driver could get elsewhere (at home or on their phone) rather than providing a wholly new stream of features—and new kinds of value. Even so, this signaled a new phase: a shift from creating value through technology to creating value through information, and expansion of connectivity to better integrate with the customer’s out-of-vehicle life.13

Infotainment services introduced two new categories of players to the ecosystem—software providers and third-party content and app providers—and consequently set off an important shift in the power equation in the industry, even as players within these categories proliferated and the Silicon Valley giants began to make their presence felt.14 Blackberry’s QNX, Google, and Apple all released proprietary software platforms in an effort to establish themselves in this market.

As access to content has increasingly shaped customers’ in-vehicle experience, who owns the customer’s experience—a key question in this phase—has grown more important.15 In other words, in the case of infotainment, value is captured by those who can aggregate—and thus control—the data that drivers create and communicate. With software providers taking on that role, automakers saw their own ability to capture value from data beginning to diminish.

The entry of the big Silicon Valley firms created something of a dilemma for the carmakers: The mass appeal and cross-industry possibilities of Google’s Android Auto and Apple’s CarPlay were offset by the fact that, in such a partnership, both players are competing to completely own the customer experience and customer data. No surprise that automakers—which consider the customers their own and want to retain control over the center stack—find this precedent troubling.16 Automakers fear that, should they lose control of the customer to software providers, cars could become commodity devices secondary to the software they run. Some carmakers have chosen to instead build or retain their own proprietary platforms,17 or to limit the data they share with their technology partners.18 Others are exploring innovative ways to bridge this gap and collaborate with software providers. Together with another major automaker, Toyota has opted for an open platform with BlackBerry’s QNX that can support not only a larger number of apps19 but also greater freedom for user-interface customization.20

On the whole, the infotainment era renewed interest and adoption in the connected car. However, monetization of services continued to be an issue—as customers grew accustomed to accessing music and other entertainment on demand, often for free, they resisted paying extra for those services in their cars.21

The onramp to tomorrow: The V2X era

For several years, players debated whether to create systems around embedded or brought-in technology and services, and that debate drove the scope of the connected-car ecosystem and the struggles over value capture. The last couple of years, however, have seen the development of a “hybrid model” that combines the two—and opens the door to the introduction of a host of applications and opportunities for value capture.22 High-tech innovation from outside the automotive world is bleeding into it, making the current period one of intense activity and excitement, with many new entrants, startups, VC investments, and M&A movements. It is no surprise, though, that this is further muddying the ecosystem’s waters. At the heart of these hybrid solutions are multiple sensors embedded not only in the vehicle itself but in all manner of smart devices across the IoT landscape—from wearables and Dedicated Short-Range Communications devices to smart-home gadgets to infrastructure—that can communicate with and share data with the vehicle through what is being called V2X integration.23

The breadth of devices and sensors available create a tremendous scale of data based on a wide scope of detected events, and that in itself is responsible for much of the value being seen in this phase. An IoT system can communicate the generated data to a common platform, where it may then be aggregated with data originating from other sources, including third-party content and social media, and analyzed, generating a response that is then delivered through the vehicle or other designated output device. This triangulation of data coming from these myriad devices is where the greatest value lies: firstly, in making sense of the data to paint a complete picture of both the customer’s behavior and the surrounding context to generate insights, and secondly, to even enable this aggregation in the first place in a way that is interoperable across devices and provides a comprehensive and cohesive customer experience.24

A platform that can aggregate and analyze all this data represents a complex undertaking, as it involves cooperation and collaboration between multiple stakeholders from multiple industry sectors. The aggregate and analyze stages are the real bottlenecks for this phase of connectivity, and this is what positions software providers at the center of value creation in this ecosystem, since they, and they alone, hold the wherewithal to deliver such a platform.

It should be noted that with great power comes great responsibility. The increasing scale and scope of data from the vehicle and connected devices represents a tremendous revenue opportunity for the players that own and control this information, but it raises the stakes for these same players in ensuring that the data remains secure. Car hacking has grown as a concern over the last few years, with several digital-security studies revealing the dangers of vehicle security breaches: Protected personal information could be stolen; hackers could potentially even seize remote control of a vehicle, with dangerous consequences.25 In light of such possibilities, the players that own and operate on the data expose themselves to significant legal liability, an additional consideration that they will have to take into account as they look to establish their positions in this space.

The notion of adding vehicles to the ever-widening ecosystem of interconnected devices heralds a significant shift: the treatment of the vehicle as just another connected device—albeit a powerful and multi-functional one—in a significantly expanded ecosystem. The implications for the balance of power between automakers and software-platform providers are still unfolding: Indeed, software providers may gradually supplant carmakers as the center of the ecosystem and the owner of customer data and experience.26

Naturally, automakers hope to retain control over the automotive ecosystem; they continue to make big IoT investments and work to stake a claim beyond the car. One automaker has launched a series of 25 “experiments” worldwide that showcase V2X connectivity, from testing out electric bikes and urban-mobility options to data-driven health care and insurance, as well as car-sharing, 3D printing, and biomimicry.27 Mercedes-Benz also co-hosted Hack with the Best, a hackathon to develop new IoT and wearable concepts for the company’s vehicles.28

Who will ultimately sit in the driver’s seat remains unclear; for now, at least, there are several pairs of hands on the wheel.

AUTOMAKERS NAVIGATE AN EVOLVING MARKET WITH CHANGING EXPECTATIONS

The same cultural, ecosystem, and technological changes that affect automakers’ competitive position affect manufacturing considerations and processes as well. Indeed, when it comes to manufacturing, many foresee the auto industry’s recent challenges persisting for the foreseeable future:

Customers opting out of owning. For many customer segments, behavior has changed dramatically with the rise of car-sharing and alternative travel methods, making car ownership less appealing. “Total cost of ownership” has also increased, pushing customers to choose less expensive new cars or opt for used vehicles instead. This has directly impacted carmakers’ profitability, and this trend is expected to continue; for the companies, customer satisfaction and loyalty, along with the ability to convert prospects, are increasingly important.

Faster design cycles. Interaction between people and devices has increased massively over the last 10 to 15 years, and the connected car comes with tremendous business potential. But beyond market share, the implications of connectivity extend to development. Rapid advances in technology have forced a continuous reduction in the time it takes to bring a new product to market: While mobile-device makers typically issue annual updates, the automotive development cycle is far longer—about six to seven years, with a market lifecycle of seven to fifteen years. In other words, cars take longer to develop and last far longer than the software, smartphones, and other connected technology with which they need to work, meaning that automakers face the additional challenge of ensuring upgrades can be accommodated, so connected cars don’t become obsolete long before consumers are ready to replace them.

Building in upgradability. With the shorter lifecycles of electronic software and hardware, consumers increasingly expect that their cars will seamlessly accommodate the latest gadgets and automatically update them whenever needed. Today, the technology exists to update a vehicle’s features by delivering a software upgrade over the air, but this system requires the vehicle to have processing and memory capabilities that can accommodate for scaling, to prevent the vehicle from becoming obsolete. Given the rate of technology development, this can pose a real challenge. With these challenges in mind, carmakers are exploring new ways to reduce overall product costs, shorten time to market, build in greater flexibility, and distinguish their vehicles in an era in which software is fast becoming as key a differentiator as body design and fuel economy. Indeed, several automakers have begun redesigning the product-development process by focusing on standard components and technology. The ratio of standard components will increase, reducing the product-development process per car (for example, time to market) and decreasing production costs. Automakers are also working to increase production flexibility and more efficiently leverage production capacities. Virtual car development, integrated production planning, data integration, and extensive data analysis will also further streamline the process.

Carmakers can also leverage the data generated by the connected car and apply increasingly sophisticated analytics capabilities to guide their internal decision processes, from better understanding and predicting customer preferences to driving design, testing, flexible production planning, and quality assurance. The automotive industry already has a long history of leveraging cutting-edge, cross-industry technologies in design and production, from digital technology to augmented reality to 3D printing. Smart infrastructure and wearables integration are the next step.

Automakers will continue to face many of the same challenges they always have: managing complexity and quality, improving flexibility and process optimization, conserving resources, and ensuring profitable growth. And while connectivity and mobility will change automotive business models—perhaps dramatically—they can also support many traditional functions and help improve companies’ overall competitiveness.

The key is settling on the right strategy. In this case, as always, it is better to be the leader than the follower.

A crowded or empty driver’s seat? The new mobility era

Even as V2X ramps up and an increasing number of well-resourced and well-positioned players vie for dominance, the automotive industry is already looking ahead to the next phase and beyond: the autonomous or self-driving car. Automakers and software providers alike are pouring in R&D investments into self-driving technologies,29 and prototype self-driving vehicles are already on the road. As technology obviates human drivers, new interior designs for automobiles will create space and opportunity for passengers to enjoy greater productivity and personalization of experiences, while passenger data create ever-expanding sources of potential value. In addition, self-driving vehicles may encourage a further shift away from vehicles as owned assets—a self-driving Uber model, so to speak. Many observers look ahead to a not-too-distant future where shared vehicles operate autonomously, rarely crash, and provide true multi-modal transport options.30

Some foresee enormous benefits from this transformation: Morgan Stanley expects “full automation” by 2022, creating $1.3 trillion in value in the United States alone.31 The benefits will be accrued by businesses across a gamut of sectors even outside of automotive: cities, governments, and municipalities; customers themselves; and society at large.32

Self-driving cars require multiple connected technologies to work: GPS technologies to support navigation and routing; sensors including radar, lidar, high-powered cameras, sonar, and lasers that create and communicate a continuous, three-dimensional, omnidirectional view of a vehicle’s surroundings; sophisticated software that analyzes this information, including artificial intelligence that allows for self-learning capabilities; and technologies that translate the information collected and processed into action, including accelerating, braking, and steering.33

Google’s Self-Driving Car project, which the company expects to be commercial by 2020,34 exemplifies all of these capabilities. Google began by retrofitting a Toyota Prius with driverless technology and has moved on to its own designed prototype vehicles, with neither steering wheel nor pedals. The car is driven by sensors that can detect objects and steer around them: Google Chauffeur artificial-intelligence software processes the sensed information, predicts how these objects might behave, and makes decisions on how the car should respond.35 The car’s self-learning capabilities allow it to identify, respond to, and learn from new situations.

The vehicle’s functioning is based on its ability to respond instantly to stimuli and make decisions that drive the right response: that is, the timeliness, accuracy, and frequency of communication and processing of the information. At the same time, with little direct human control over the vehicle, security of the data communicated will be a critical value driver. And as connectivity expands and the vehicle is increasingly integrated into a broader ecosystem of other devices and infrastructure, still other capabilities will likely arise, such as smart traffic routing of self-driving vehicles, aimed at improving roadway efficiency.

The scope of the technologies involved appears to imply, as it has in the past, an expansion of the ecosystem needed to enable this Value Loop and a consequent further shift in the balance of power among the relevant players. However, the potential impacts on the automotive business model in this case indicate a more fundamental and widespread transformation of the industry itself. In one scenario, the power lies firmly with the software-platform providers, and the vehicle is just a conduit that acts on the information it is given—and is only as powerful as its operating system. In this way, it becomes little different than a smartphone or smart thermostat, chosen less for its own merits than for its operating system and its compatibility and interoperability with other connected devices that run on the same platform. Here, the majority of value is captured by players in the ecosystem that have the ability to use information generated by the vehicle and its surroundings—but none more so than the software providers that aggregate all of that data.

Many analysts predict significant impacts, not all positive for automakers: Barclays forecasts that shared driverless cars entering the market could cut total U.S. auto sales by 40 percent, meaning that automakers “would need to shrink dramatically to survive.”36 Automakers must make very deliberate choices today about the role they would play and how they would work within this ecosystem, if they are to survive in such a future. GM believes that it has designers, engineers, and scientists who “are working at the cutting edge, and we’re confident GM will be very successful.”37 Essentially, this creates a vision of OEMs not as carmakers but as tech companies that solve mobility problems.38 In other words, rather than lose their longstanding positions to software providers, automakers are themselves making a brave push into the software space, to ensure they can maintain more control over their vehicles—and customers—and capture IoT value as well. If you can’t beat them, join them? Only time will tell who will win this particular power struggle—the tech giants trying to be carmakers or the automotive giants trying to be tech companies.

THE SOFTWARE-DRIVEN CAR SPEEDS TOWARD NEW CHALLENGES

Remember when a customer simply wrote a check and drove her new SUV off the lot? Those days are numbered, as connected cars suggest ongoing customer relationships. Considering that increased connectivity is, in turn, powered by increasingly sophisticated software technologies, automakers may look to software revenue models for ways to monetize. For example, software-as-a-service can enable pay-per-use models for in-vehicle services; licensing can allow for tiered services based on a customer’s selected level of service; ad-supported content can subsidize delivery of in-vehicle services; and other software-industry concepts can be leveraged to drive in-vehicle service adoption.

Similarly, several of the other challenges the automotive sector faces now bear closer resemblance to those faced by software providers: Vehicle security and customer privacy may go hand-in-hand with developments in software and mobile-device security; the regulatory environment may more closely resemble the software industry; data and intellectual-property ownership may reside primarily in the hands of the software providers; technical governance and integration may reside with the software players as well; and so on. It may not be a stretch, in fact, to reclassify the automotive industry of the future as a software-driven mobility industry.

Who’s gonna drive you home?

The Internet of Things enables transformational change, and there is no question that the automotive sector is changing extremely rapidly. IoT-related technologies will draw the map for the industry to follow, and the connected car will play a major role on the roads and in the economy of the future.

The power struggle between automakers and software developers is a symptom of the ongoing transformation, like birth pangs as the industry reinvents itself. We are moving from an age of products to an age of services and experiences, from hardware to software, from functionality to information as the key object of value creation, and from industry silos to intricately connected ecosystems and value loops. It is no surprise that carmakers find themselves navigating new terrain within an ever-expanding ecosystem of players, all of which are trying to capture value, and where players that control the aggregation and analysis of this information—the software providers—steadily gain ground.

As automakers consider their place in this changing industry, they can consider several approaches to strengthening their position:

- Align on a vision of the role that the business will play in the ecosystem, understanding and accepting the transformational impacts this may have on the business and on the “old ways of thinking.”

- Develop a clear mapping of where data originates—and, consequently, who owns it—for each of the services delivered, to better understand where value can be captured.

- Develop a roadmap for shifting to a more service-oriented approach as an entire organization, not just in the connected-vehicle divisions, to enable ongoing interaction with customers throughout the entire lifecycle.

- Accept new capabilities that need to either be built internally or acquired externally. Seek greater involvement in—and ownership of—in-vehicle software-platform development.

- Consider ways to address manufacturing/lifecycle challenges by working closely with technology providers to more closely integrate development processes and software-driven feature rollouts and updates.

- Identify and build strategic partnerships with key players across the ecosystem, including with emerging smart-device manufacturers, and work across the value chain to build a broader, more holistic brand experience enabled through connected technologies.

The road ahead for the industry is open and lined with opportunity. It’s time to shift into high gear.

Deloitte’s Internet of Things practice enables organizations to identify where the IoT can potentially create value in their industry and develop strategies to capture that value, utilizing IoT for operational benefit.

To learn more about Deloitte’s IoT practice, visit http://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/topics/the-internet-of-things.html.

Read more of our research and thought leadership on the IoT at http://dupress.com/collection/internet-of-things/.

© 2021. See Terms of Use for more information.