Article

The Deloitte M&A Index 2017

Dealing with the future

Despite the big shifts in political tectonic plates in 2016, M&A markets managed to hold up well. The year ended with $3.2 trillion worth of announced deals, about 16 per cent down on the record-breaking figure in 2015, but still a high performing year out of the last ten.

Explore content

- Download the key themes

- Explore the innovation interactive dashboard

- About the M&A Index

- Previous editions

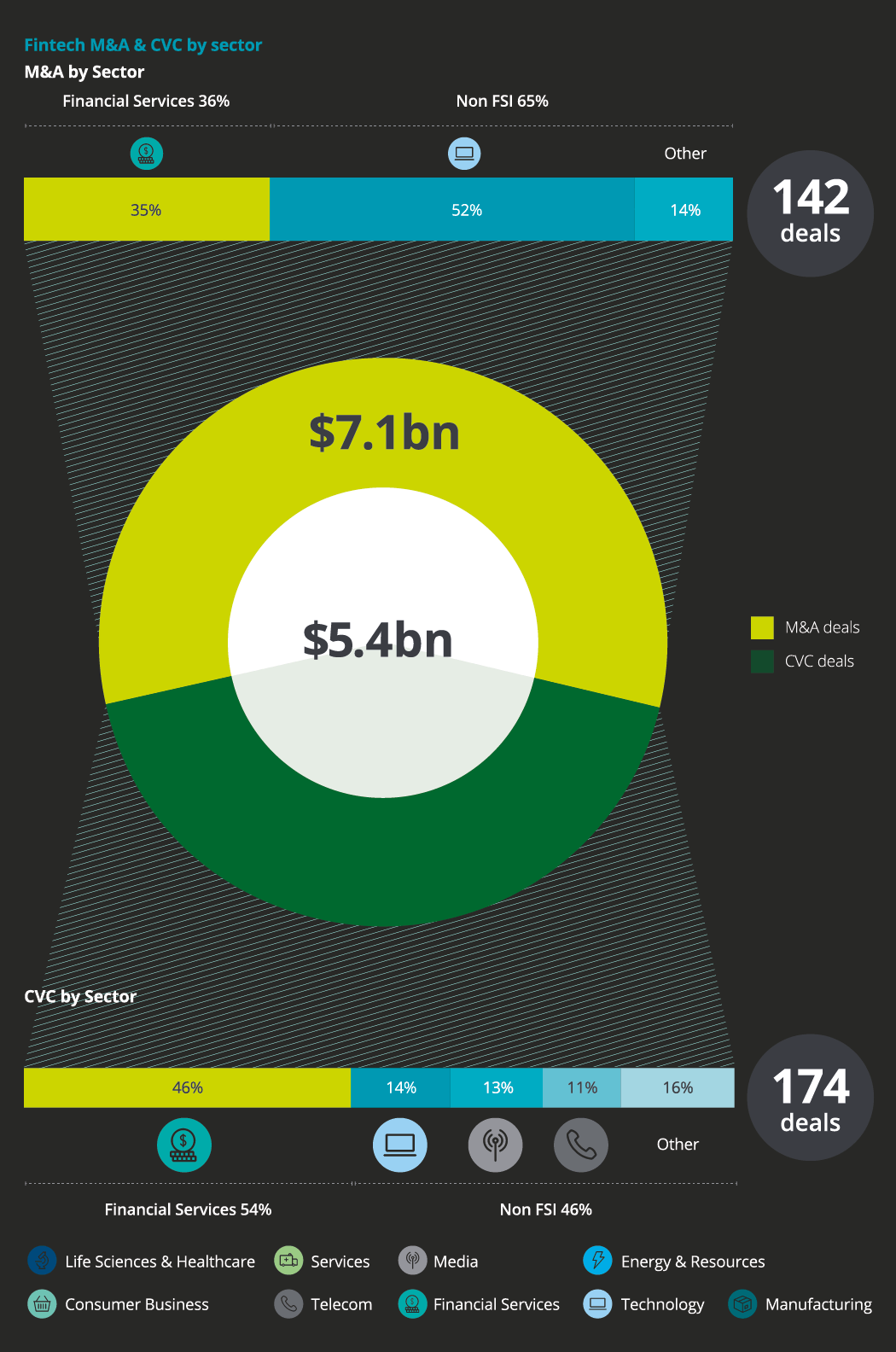

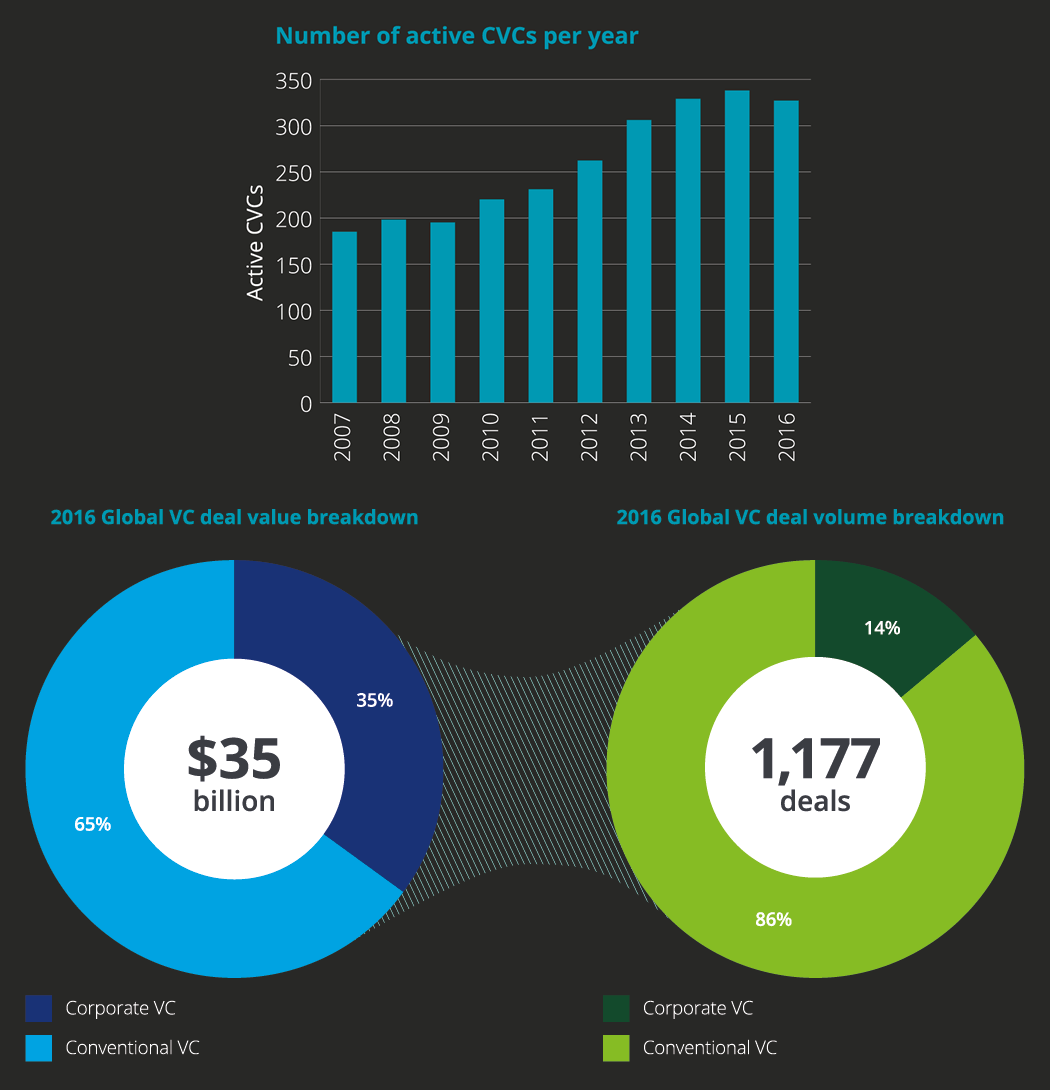

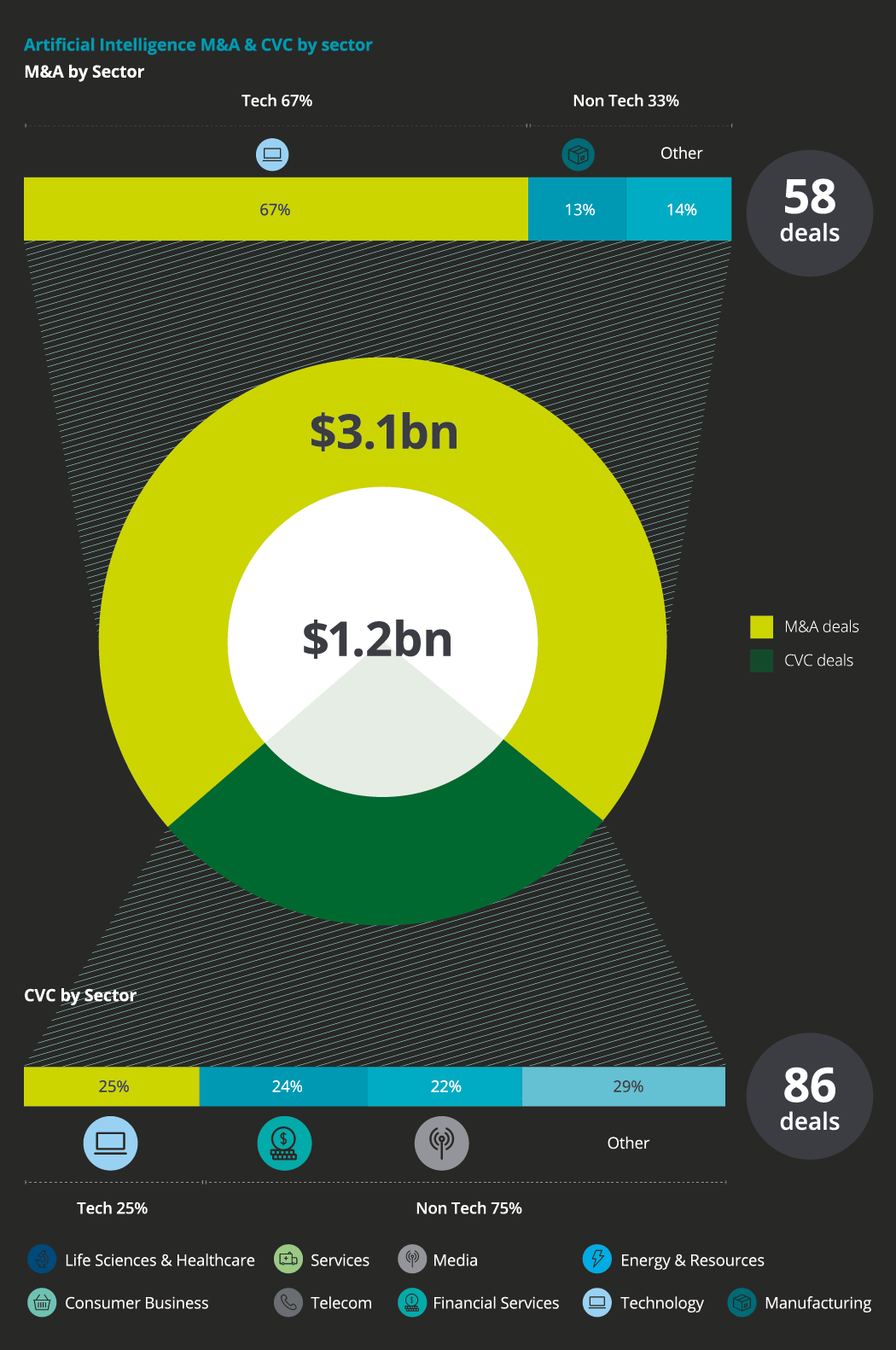

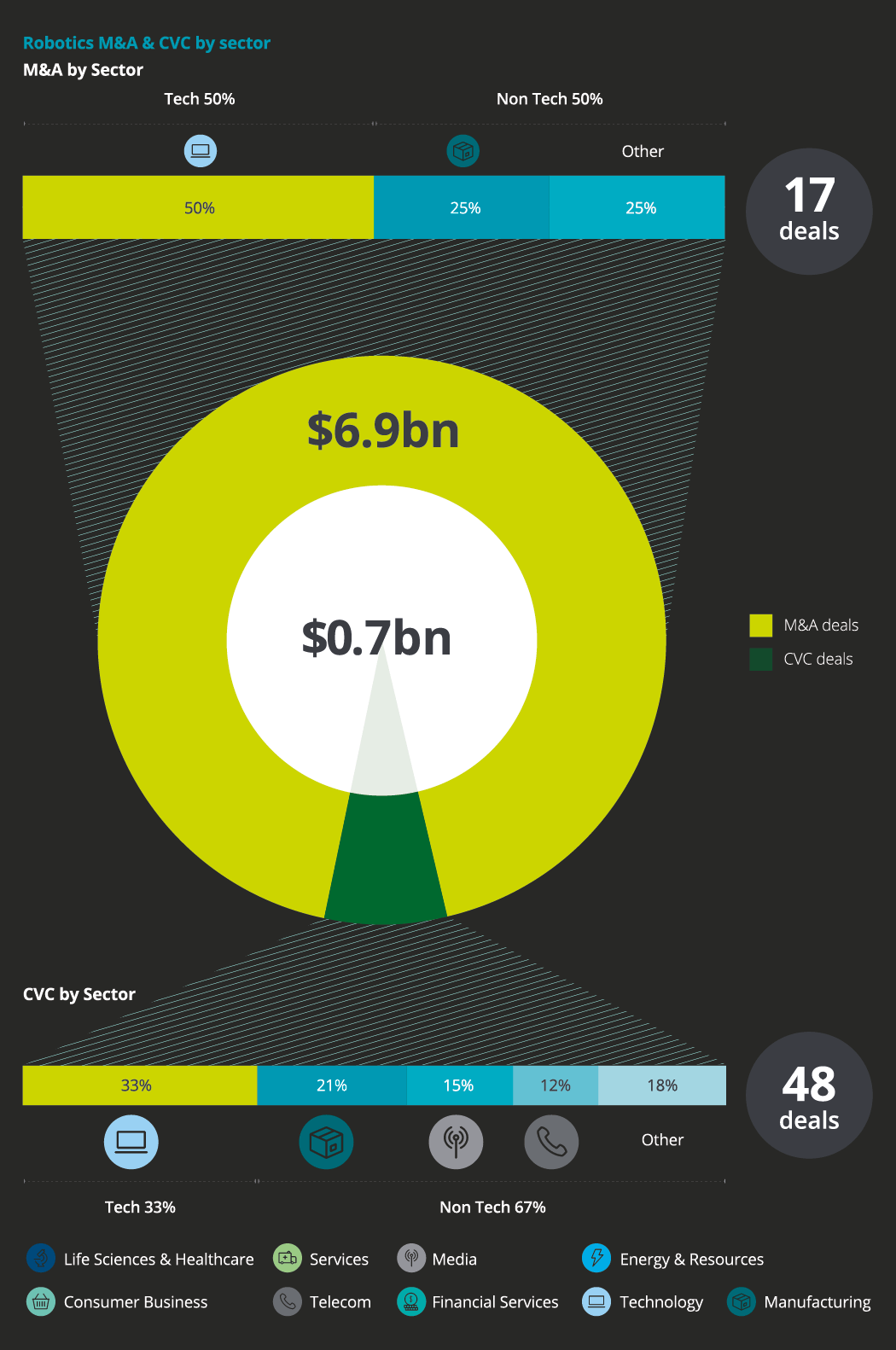

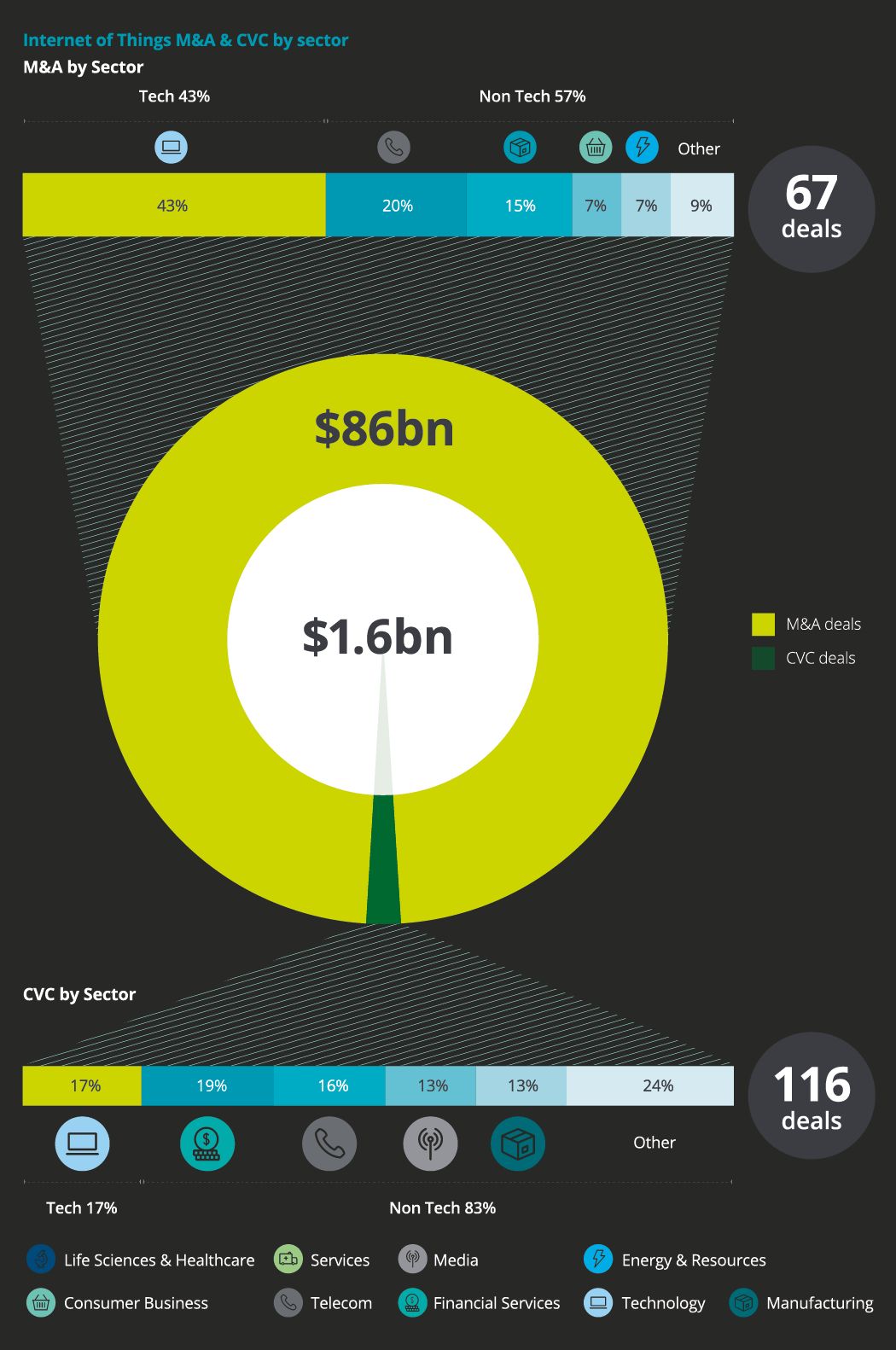

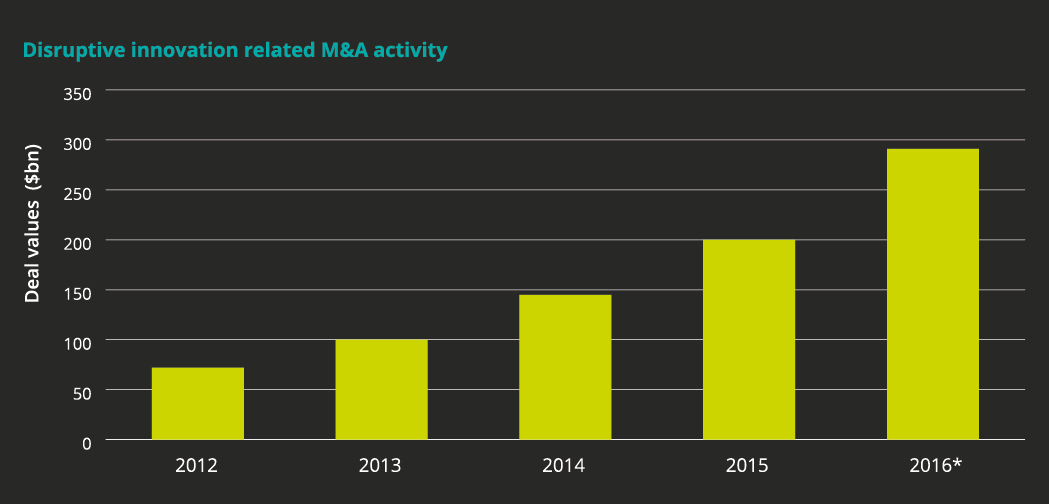

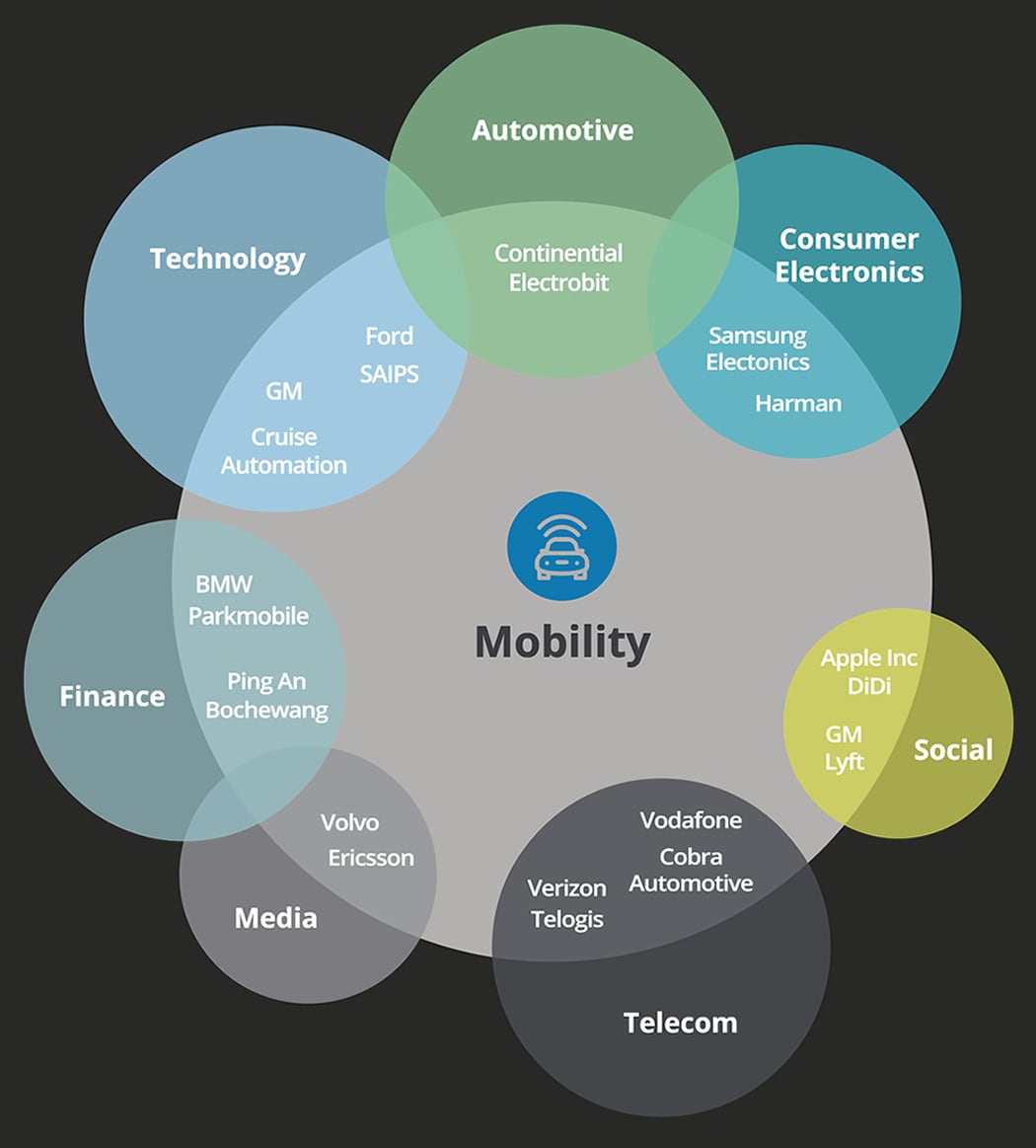

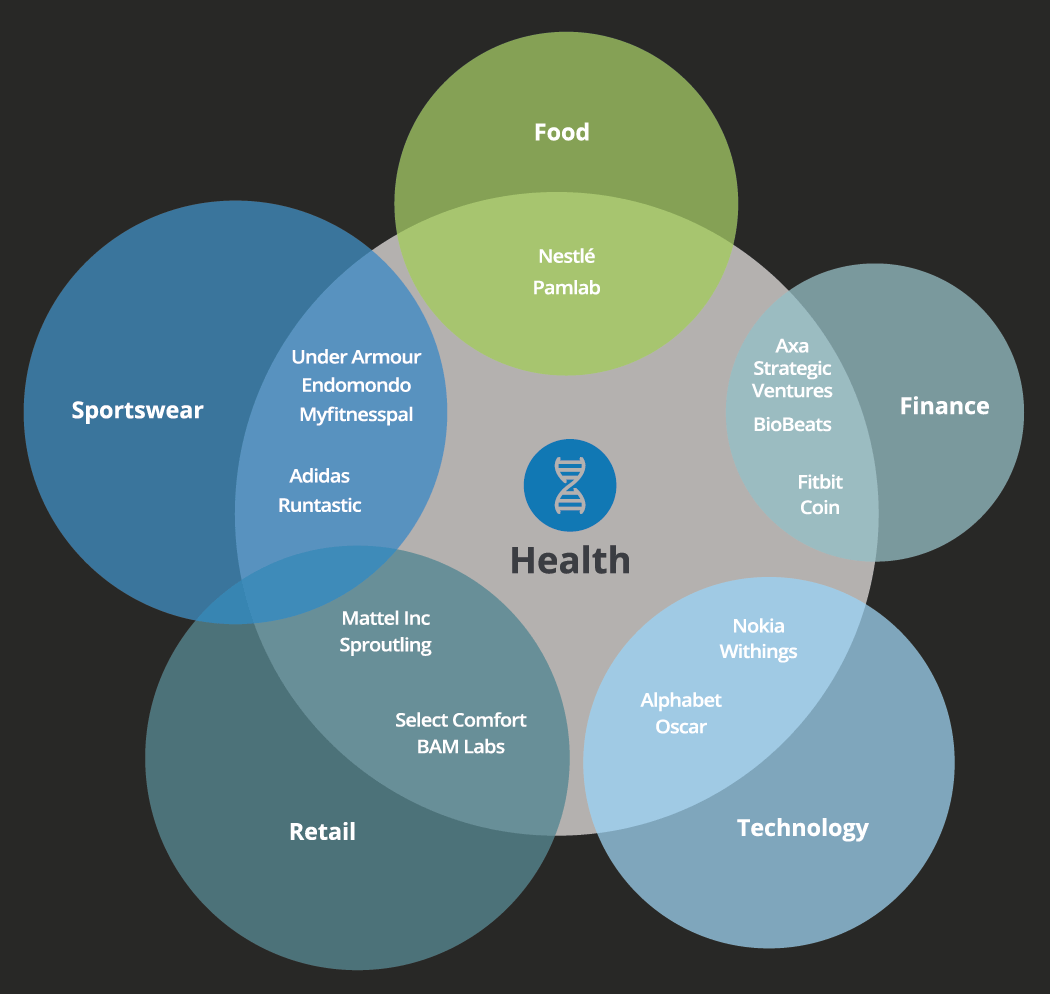

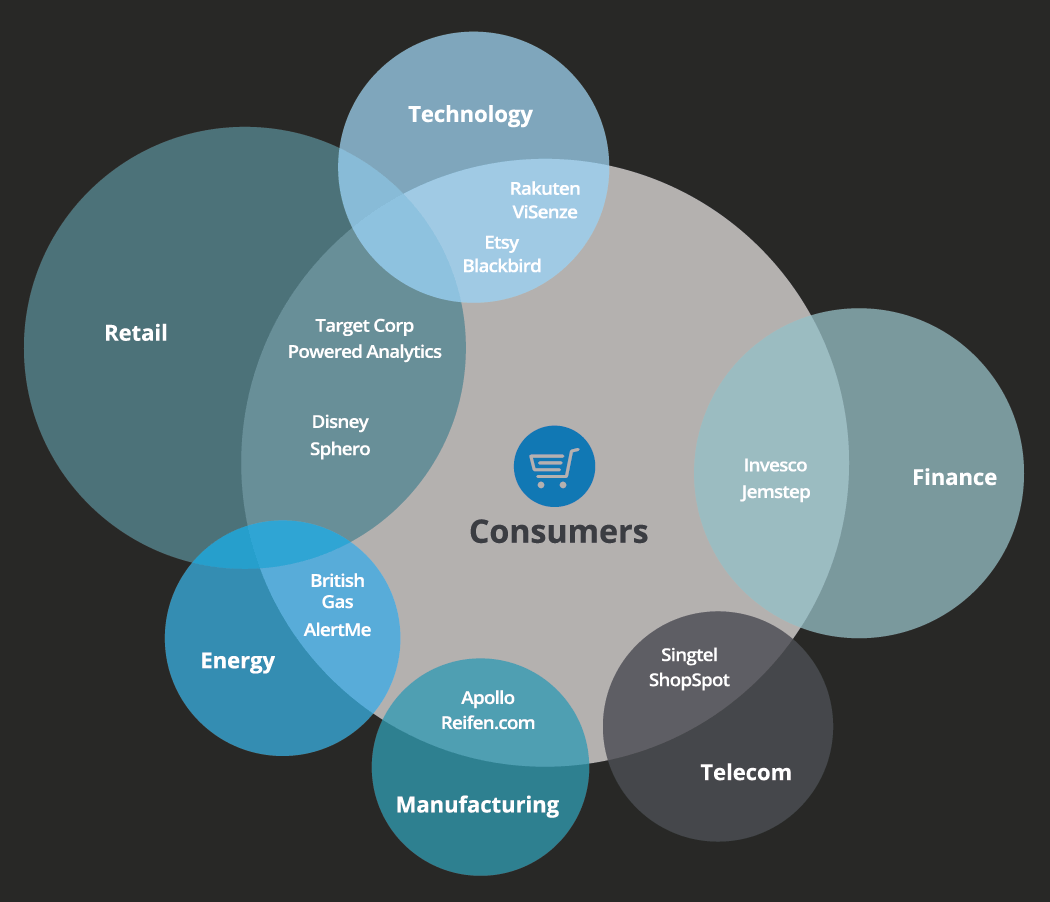

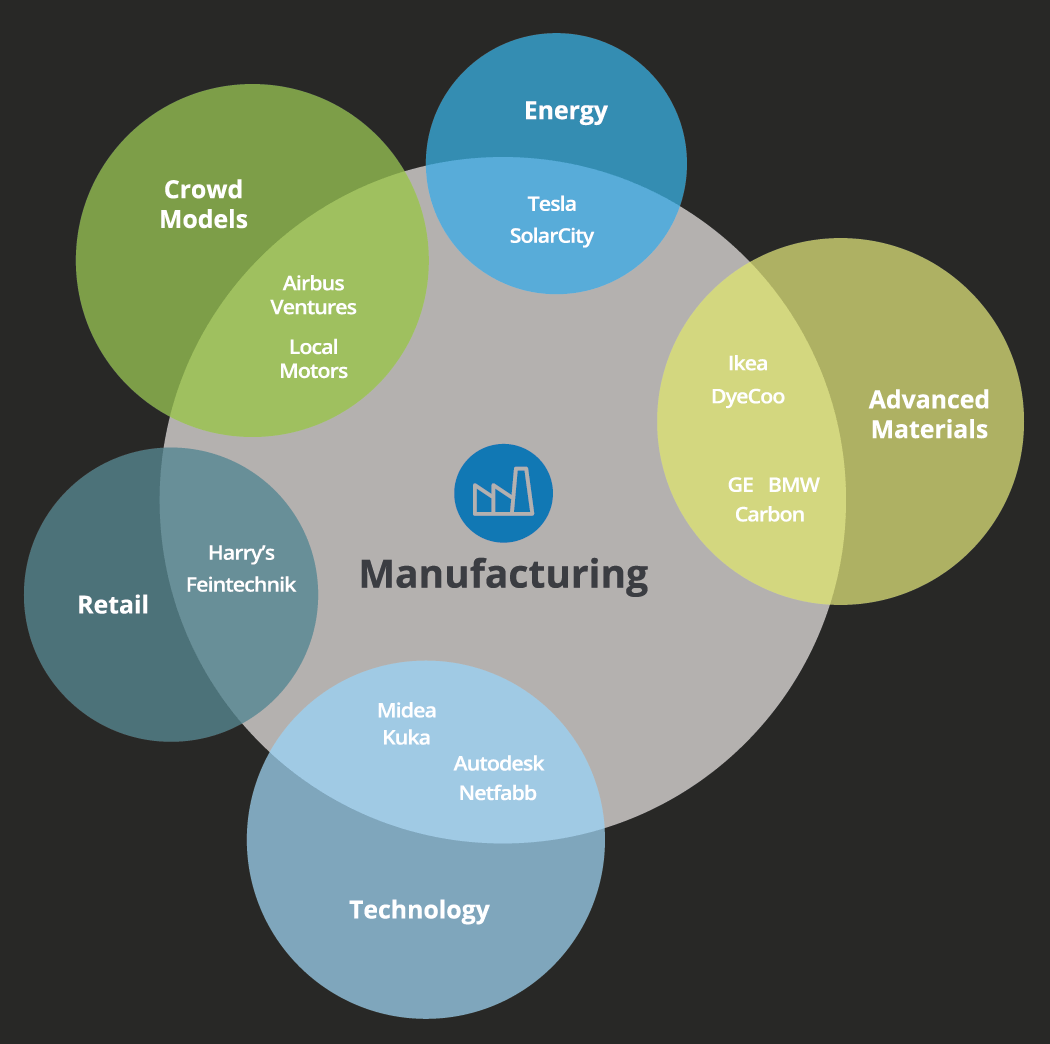

A characteristic trend of 2016 was companies increasingly turning to M&A and corporate venturing to harness the growth potential of new, disruptive technologies. A host of new consumer offerings that blur the boundaries of traditional sector lines–FinTech and HealthTech are two such examples–provide new avenues for companies to explore in their quest for growth. The M&A spend on disruptive innovation-related sectors reached $291 billion in 2016, four times the $72 billion in 2012.

Sector outlook

|

Outlook for sectors and regions |

2017 M&A themes

|

Uncertainty is the 'new normal' |

|

Creating shareholder value through divestments |

|

Fuelling growth through innovation |

Explore the role of M&A and CVC to capture innovation opportunities

Fuelling growth through innovation

CHANGE SELECTION

Explore further

About the M&A Index

The Deloitte M&A Index is a forward-looking indicator that forecasts future global M&A deal volumes and identifies the factors influencing conditions for dealmaking.

The Deloitte M&A Index is created from a composite of weighted market indicators from four major data sets: macroeconomic and key market indicators, funding and liquidity conditions, company fundamentals, valuations.

Each quarter, these variables are tested for their statistical significance and relative relationships to M&A volumes. As a result, we have a dynamic and evolving model which allows Deloitte to identify the factors impacting dealmaking and enable us to project future M&A deal volumes. The Deloitte M&A Index has an accuracy rate of over 90% dating back to Q1 2008.

Previous editions of our M&A Index

2016 M&A Index - Opportunites amidst divergence

Q3 2015 M&A Index - US companies leading surge in M&A

H1 2015 M&A Index - Deal momentum continues into 2015

Q4 2014 M&A Index - Mega-deals lead the resurgence in M&A markets

Q3 2014 M&A Index - Rising 'animal spirits' continue to stoke M&A activity

Q2 2014 M&A Index - Growth is back on the corporate agenda

H2 2013 M&A Index – Recovery of deal volumes expected in H2 as sentiment improves

Q2 2013 M&A Index - Strong US recovery to push M&A volumes higher