Sustainable Finance has been saved

Sustainable Finance The risks and opportunities that (some) CFOs are overlooking

01 January 2012

- Nick Main, Sanford Cockrell

With the steady, significant expansion of the CFO's role and growing sustainability concerns in business, many CFOs have sustainability on their screens; some, however, have yet to fully engage with the new risks—and opportunities—that the sustainability imperative presents. This report provides a unique view into how CFOs think about sustainability—posing specific questions about their readiness to act as leaders in sustainable businesses, and offering corresponding actions.

Key findings

Two powerful and decades-long trends in business look set to intersect with increasing impact in coming years: the steady, significant expansion of the chief financial officer’s (CFO) role, and the still-evolving effects of sustainability considerations on corporate strategies and operations. But many CFOs, though they have these issues “on their screens,” have not yet fully engaged with the new risks—and opportunities—that the “sustainability imperative” presents.

This is a key finding from the global survey of more than 200 CFOs recently undertaken on behalf of Deloitte Touche Tohmatsu Limited and its member firms (Deloitte) by the independent analyst firm Verdantix. The survey responses, from companies with average annual revenues of $17 billion, suggest that any CFO would benefit from considering questions like the following:

- Have you fully worked through the basics of sustainability management for your finance function?

- Do your processes for capital investment and M&A/divestitures anticipate shifts to a sustainable economy?

- Do you understand your company’s position in markets linked to the environment?

- Do you know what sustainability questions your company’s stakeholders are asking—and do you have the answers?

- Do you have the right team with the right skills to address this set of crucial emerging issues?

The Deloitte survey raises other interesting and important questions, but we regard these as salient. At the conclusion of this brief paper, we offer some practical suggestions for CFOs wishing to come to grips with them. First, however, an overview of key findings from the survey.

The changing landscape.

Volatile commodity prices, new environmental regulations, calls for greater transparency about non-financial performance, and a range of other drivers are compelling management teams to deal with the sustainability imperative in a manner that supports their business goals (as distinct from, though not necessarily opposed to, a “save-the-planet” mindset). But the global economy is still feeling the aftershocks of the 2008–10 financial crisis, and the threat of a double-dip contraction has recently become more substantial.

No wonder then that conventional wisdom characterizes CFOs as somewhat slow to respond to sustainability issues. They have a spate of other concerns to address—concerns more closely aligned with the CFO’s “traditional” agenda.

Speak to a few CFOs, though, and you might be surprised by their awareness of—and engagement with—sustainability considerations. Deloitte’s recent global survey of CFOs suggests that a large majority of them are aware that sustainability will profoundly affect their “mainstream” duties. Many are already actively managing sustainability risks and gearing up for capital investments with sustainability in mind, as well as communicating sustainability performance to key observers.

Deloitte’s survey also suggests that CFOs will need to take a more energetic role in embedding sustainability into business strategy. Astute CFOs can help their companies gain a competitive advantage by developing strategic insights on costs, benefits, risks, and, ultimately, opportunities arising from the sustainability imperative.

Sustainability awareness takes hold.

At a tactical level, many CFOs are meaningfully engaged with sustainability right now. More than 70 percent of those surveyed expect sustainability to have an impact on compliance and risk management and more than 60 percent foresee changes to functions like financial auditing and reporting.1

Moreover, CFOs are prepared to commit capital. Nearly half of those surveyed are planning investments in equipment for increasing energy efficiency, generating on-site renewable energy, or reducing industrial emissions. These investments are critical to driving down operating and compliance costs, current and future. CFOs would do well to have specific goals or targets in areas such as specific energy efficiency rates, environmental regulatory compliance, the stability and security of energy supply, and adequate infrastructure. These goals should feature prominently when capital investment decisions are being taken, and project portfolios should be optimized to achieve these goals.

M&A: A sustainability blind spot?

Only 29 percent of the CFOs in Deloitte’s survey indicated a belief that M&A activities would be affected by sustainability. This finding points to a blind spot among CFOs. Transactions often present immediate sustainability risks—asset impairment, remediation and indemnification expenses, environmental liabilities, and regulatory sanctions, to name a few—as well as longer-term issues such as the future costs and availability of resources and capabilities (e.g., water, waste disposal). Particularly in some emerging markets, there will likely be some real constraints on water and other commodities vital to manufacturing. Sustainability analysis needs to be built into deal structures, post-transaction integration, and long-term planning for disposition. (For more insights on sustainability and M&A, visit the Deloitte US firm’s webpage on the topic: http://ow.ly/6I2AC).

Capital investments to improve sustainability performance also have meaningful financial impacts: Verdantix has forecast that growth rates of investment in sustainable business programs will be 50 percent to 100 percent higher in 2013 than in 2011, and the total spent on sustainable business programs by large companies (revenues of more than $1 billion) in Australia, Canada, the UK, and the US will reach $60 billion in 2013.2 CFOs are also conscious of stakeholders’ burgeoning interest in sustainability as a business matter. More than three-quarters of the survey respondents indicated that it is important or very important to communicate about sustainability to shareholders and institutional investors. More than half said that sustainability is an important or very important topic of communication with all the stakeholder groups named in the survey, including suppliers, policymakers, and customers.

Finally, CFOs—who often serve as de facto chief risk officers3—are active in assessing sustainability risks. Nearly three-quarters of the CFOs surveyed reported plans to assess compliance and enterprise risks related to sustainability issues; almost two-thirds plan to assess sustainability risks to physical assets. Only six percent of the CFOs surveyed said they believe no risk assessments are needed with respect to sustainability issues. These findings are encouraging: if CFOs can frame sustainability risks in strategic terms, they can better help management teams mitigate risks and take advantage of the openings that risks can create.

In 2011 what actions will you take to manage the sustainability and climate change risks your business faces? (multiple responses)

Sustainability strategy and governance represent a growth area for CFOs

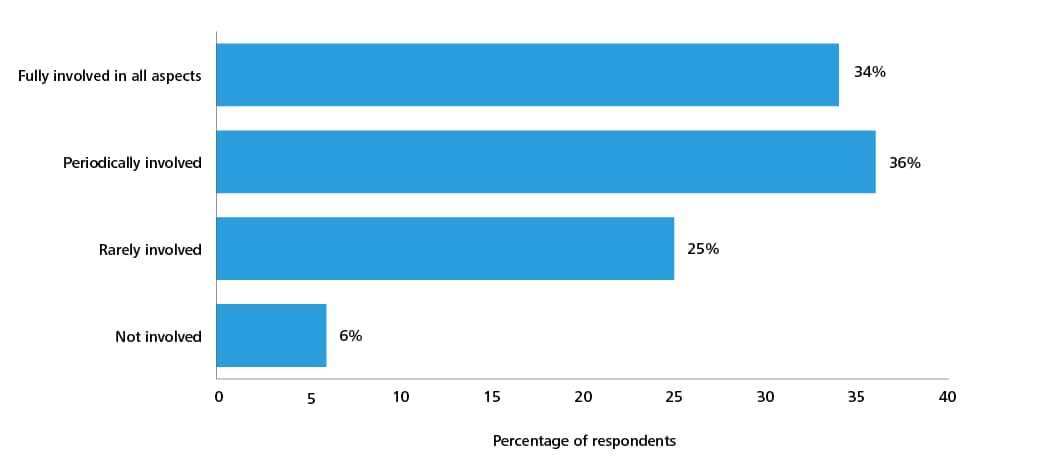

A third describe themselves as fully involved now in sustainability strategy and governance; a fifth plan to become more involved in the next two years. Compared to CFOs’ broad acceptance of sustainability risk, this remains an area for growth.

What best describes your current involvement in sustainability strategy and governance at your firm?

How do you expect your role in sustainability strategy and governance to change in the next 2 years?

One title, many attitudes

CFOs’ approaches to sustainability, driven in part by variations in national regulation as well as industry profile, turned out to be far from uniform across our survey group. South Africa and China represent two examples of the diversity among countries. Perhaps because of South Africa’s King III Code on corporate governance, CFOs surveyed there were most likely to identify themselves as being responsible for sustainability strategy and to anticipate seeking external support for integrated reporting (70 percent) and assurance (60 percent). Of the country groups, they were the most likely to be fully involved in sustainability strategy (50 percent), to expect to become significantly more involved (35 percent), and to perceive a strong link between sustainability strategy and firm performance (70 percent).

China presents an intriguing contrast in many respects. Chinese respondents were least likely to name the CFO as responsible for sustainability strategy (overwhelmingly naming PR/investor relations).

None saw themselves as “fully involved” in sustainability strategy and governance, and almost half expected this not to change in the next two years. Two-thirds saw a weak link between sustainability strategy and business performance. Yet recent years have witnessed a striking turnaround in official Chinese attitudes towards—and investment in—sustainability, which cannot but affect the eventual attitudes of Chinese companies' CFOs.

CFO attitudes also differed among industry sectors, even sectors that appear to face comparable sustainability issues. Respondents in the construction and automotive sectors saw a weak link between sustainability strategy and performance, while their counterparts in the basic materials sector saw a strong link. Considering that all three industries are subject to similar sustainability cost drivers and risks, construction and automotive CFOs, who may be more concerned about immediate economic conditions, might do well to examine the long-range sustainability issues that their basic materials peers are looking at.

So what about those questions?

We close with a few thoughts about the five questions concerning the CFO’s readiness to act as a leader in a sustainable business.

- Covering the basics. For CFOs, this means incorporating a sustainability dimension in day-to-day functions such as energy and resource management, internal controls (over sustainability information), compliance with tax regulations and pursuit of tax incentives (such as those for green initiatives), and performance measurement and reporting (of financial and non-financial indicators).

- Capital investment and M&A/divestitures. Deal analysis should incorporate scenarios where energy and commodity availability and pricing vary greatly. Post-deal integration and exit strategy planning may need to be adjusted to account for these factors. For instance, facilities located in geographic areas where commodity prices are forecast to be higher or more volatile should be targets for consolidation or closing, and energy-intensive operations should be targeted for re-design in the integration process. On capital projects, CFOs can expect tougher questions from lenders, many of whom are signing pledges, such as the Equator Principles, which oppose the financing of projects that are seen as likely to cause environmental harm.

- Markets linked to the environment. The prices of energy and materials are experiencing unprecedented volatility and inexorable increases. Many companies also have exposure in new classes of environmental commodities: carbon emissions, water, forests, and ecosystems. As the markets for these commodities take shape and set prices, the hit (or boost) to a company’s income statement and balance sheet could be enormous.

- Stakeholder questions. More and more stakeholders are making decisions based on companies’ sustainability performance, as reflected in the growing market share of sustainability-sensitive investors (commonly labeled SRI for socially responsible investment or ESG for environmental, social, and governance), the proliferation of codes of sustainable business conduct, and the widening acceptance of voluntary standards for reporting sustainability performance.

- The right team. Many sustainability-related duties require specialized knowledge and training. As the heads of sizable teams, CFOs must prepare to recruit, develop, and deploy staff who can carry out both traditional finance tasks and new tasks that support corporate sustainability programs.

The vantage point that CFOs enjoy within organizations, with visibility into balance sheets, corporate transactions, and the entire business means that they are positioned to shape strategy while carrying out core finance functions. In our view, CFOs will increasingly come to recognize the relevance of sustainability initiatives to their portfolio of responsibilities, and they will seek a greater role in driving those initiatives.

Checking up

Many civil society groups track corporate sustainability performance and promote codes of sustainable conduct.

- Sustainability-screened stock indexes: Dow Jones Sustainability Indexes, FTSE4Good

- Investor-driven performance surveys: Carbon Disclosure Project, CDP Water Disclosure

- Disclosure guideline-setters: Global Reporting Initiative, AccountAbility

- Sustainability codes of conduct: UN Global Compact, Transparency International

© 2021. See Terms of Use for more information.