Your

customer needs

regulatory responsibilities

competitors

are changing, fast.

We’re living in a new digital era for banking. One that offers limitless opportunities – whether you’re looking to grow your customer base, reduce your operating costs, or transform your entire business model. But navigating the journey can feel overwhelming. And when it feels as though there are an infinite set of decisions to make, where do you start? We can help you break down that complexity and reduce thousands of decisions into the few that really count.

Modernise your business, launch new digital products and services, or build a digital bank from the ground up, with Converge by Deloitte. For retail and small business banking.

A different approach for digital banking

Welcome to the new model

We believe there’s a better way to achieve your digital vision. One where you’re not forced into either buying or building all the technology you need, but where you get the best of both. Flexibility, control and competitive edge, without compromising on cost transformation and pace.

In the new model, we’ve done the heavy lifting on foundations – developing the software you need to move towards your goals quickly and cost effectively, but with the freedom to refine, extend and make it your own. By combining this with our in-depth customer and digital banking insight, extensive delivery experience, and best-in-breed ecosystem, our approach means you can spend less time figuring out the fundamentals, and more on what really matters: setting your business apart.

Insight, experience and methodologies

In-depth customer insight, real experience delivering digital transformation for banks all over the world, and methodologies honed through lessons learned. Backed by the strength and technical experience of an organisation that's worked with the biggest names in financial services for decades.

Curated ecosystem

Our curated ecosystem of best-in-breed fintechs has been tried and tested, and we've done the heavy lifting for you. Pre-configured integrations, orchestrated to work for your specific use cases and all assembled in a way that lets you scale cost effectively.

BankingSuite

Our modern, composable banking platform integrates the ecosystem with our own cutting edge software and fills the gaps between what’s out there, and what you need to succeed – helping to save you thousands of hours of development effort. Everything we’ve built is flexible for you to extend, refine and make your own.

YOUR PATHS TO GROWTH

Choose your approach

Whether you’re looking to modernise your business or launch a new product or service, we’ve got a tailored approach to help you get there faster.

-

See more

1

Modernise my business

React faster to customer needs and behaviours, access the speed and scalability of cloud, and leverage real time data and insights to optimise your business by harnessing the composable architecture of a modern bank. Our retail and small business banking modernisation solutions have been designed to work together and independently, so that you can achieve your long-term modernisation goals whilst still realising value for your business quickly.

-

See more

2

Launch something new

Take the best of Deloitte across strategy, research, and design to innovate and shape new digital products, services, and ventures that your customers will love. And then make it real. We'll help you assemble and scale at pace, drawing on our BankingSuite platform if it's right for your opportunity. We bring a deep understanding of human behaviour, a drive to deliver better banking and a pioneering attitude to emerging technologies to uncover new possibilities that create growth for your business.

Solutions to unlock growth

Modernise your business

Achieve your long-term modernisation goals whilst still realising value for your business quickly. Our set of retail and small business banking solutions have been designed to work together and independently, giving you lots of options for where you choose to start. All underpinned by our BankingSuite platform.

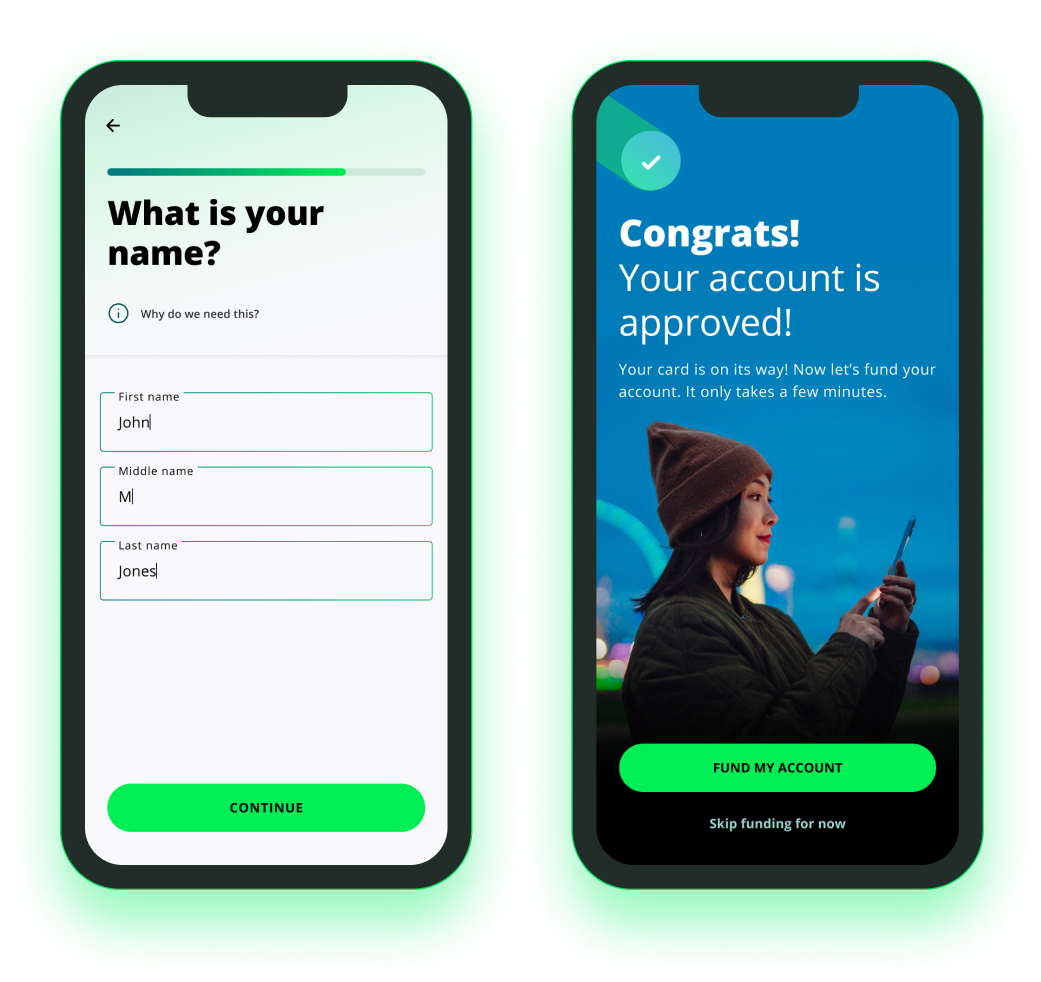

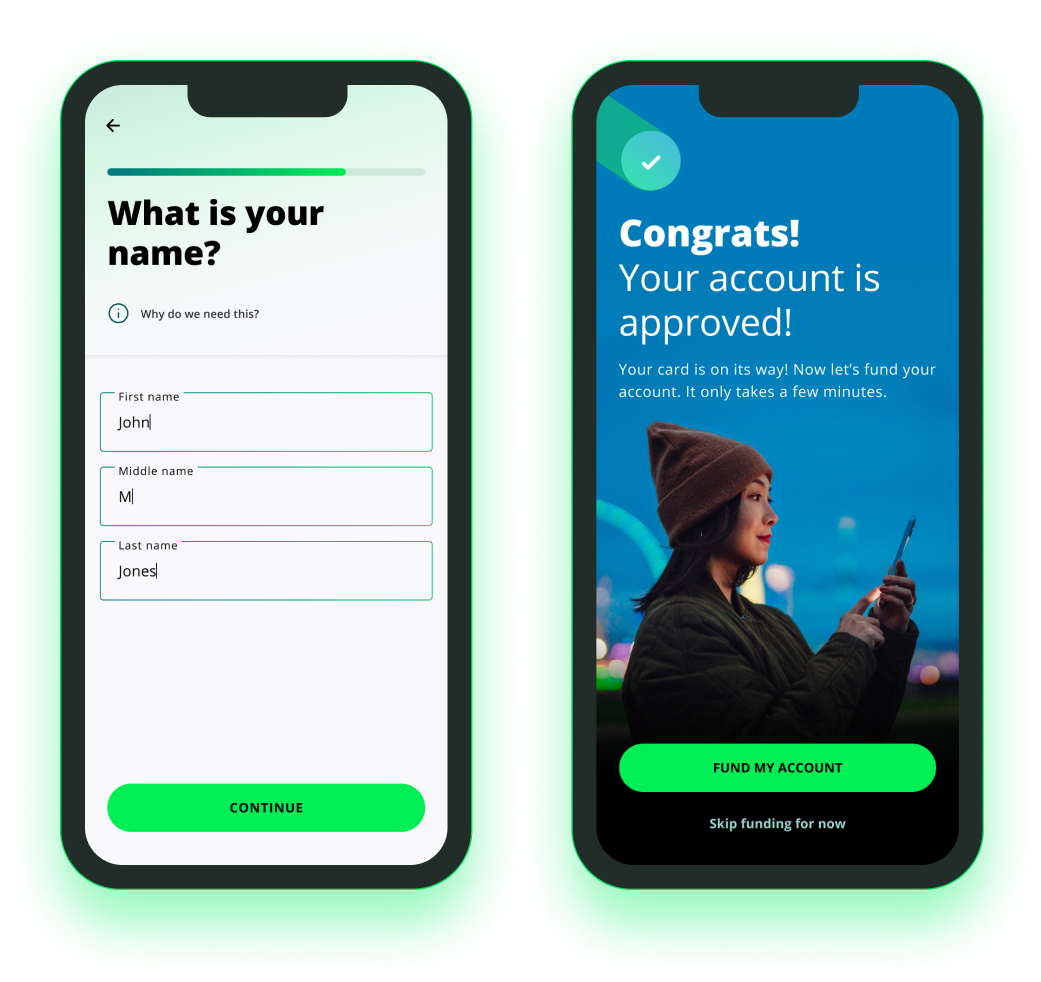

Experience

Meeting the demands of digital first customers is not easy. When it comes to UX, banks face a no-win choice: ‘renting’ customer experience from providers that limit customisation, or scaling large teams to build from the ground-up. We think it’s time to re-write the model, eliminating the trade-offs and giving banks the best of both worlds.

Introducing Experience by BankingSuite: a product framework underpinned by Flutter that builds on years of Deloitte studio research on design and experience and saves you thousands of hours of development effort. We’ve taken care of the new standards for experience that your customers have come to expect, with all the technical foundations needed for today’s modern digital apps ready to go, and a full inventory of pre-built journeys for you to customise. Best of all, you have the flexibility to build on top – focusing your effort on the differentiated features that are authentic to your brand and valuable to your customers.

Digital Onboarding

Deliver the best first impression to your customers with a seamless, user-friendly onboarding experience. Our Digital Onboarding platform for retail and small business banking connects pre-integrated ecosystem leaders, allowing you to orchestrate your chosen combination into industry standard and customisable journeys. Increase customer satisfaction, accelerate account opening time, and quickly see and respond to risks.

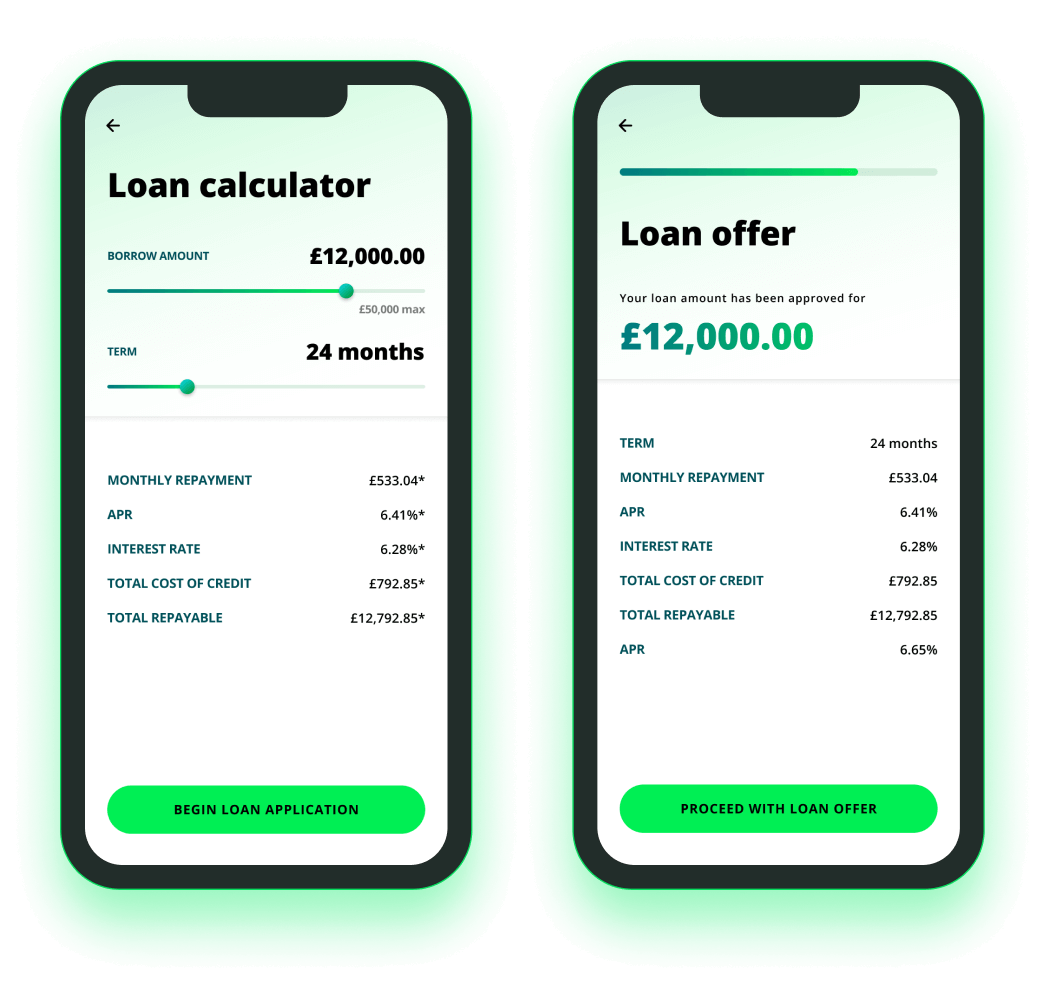

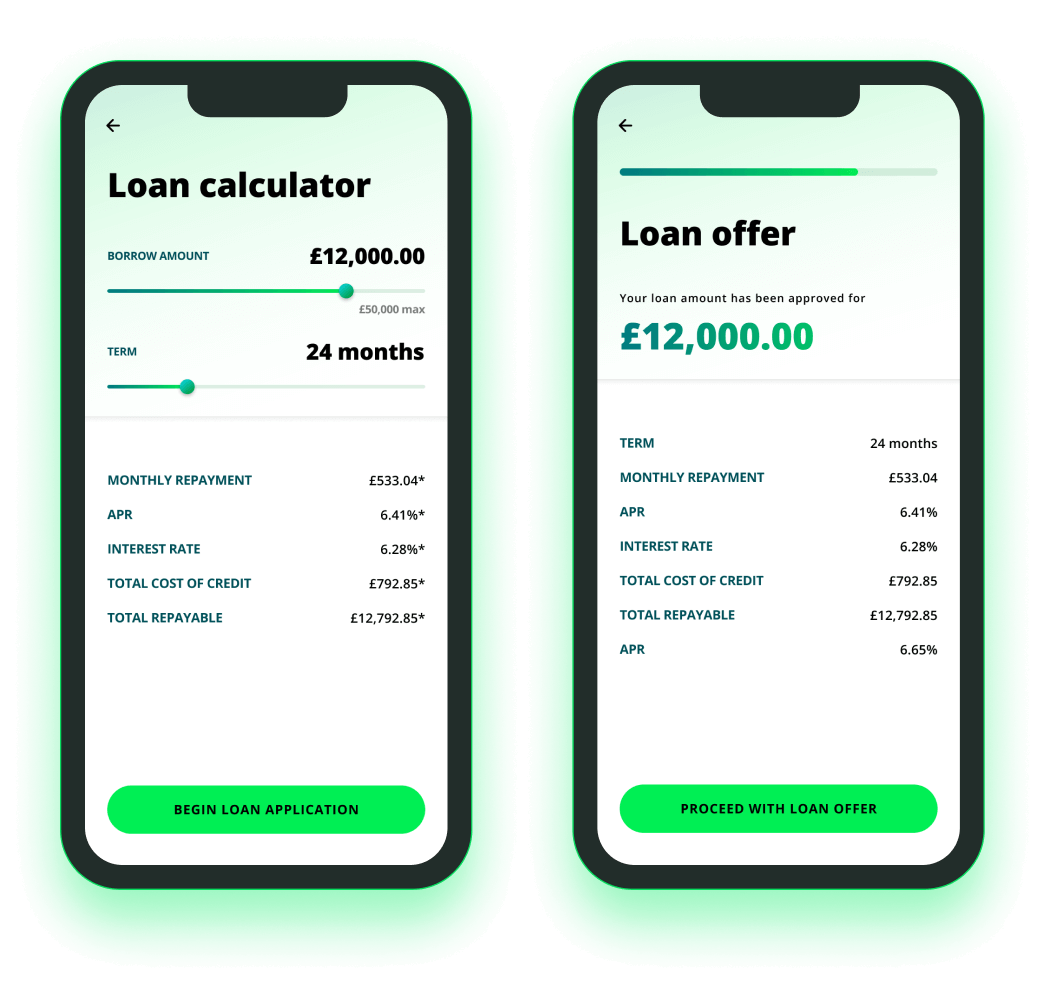

Digital Lending

Fast-track your lending transformation journey and unlock exceptional customer experiences, streamlined operations, and informed decisions with Digital Lending. Our Digital Lending platform allows you to gain insights into your customers, tailor compelling propositions, and enhance their end-to-end experience through an engaging, automated, and robust customer journey. Reporting and analytics are central to the platform, empowering you to generate actionable portfolio insights and optimise your risk and pricing models.

Digital Payments

Align your payment capabilities with the demands of the modern era. With our comprehensive experience in payments, design, and delivery, we can help you achieve your payment modernisation goals, create new opportunities, and deliver exceptional payment experiences to your customers quickly. Our Digital Payments platform provides you with a curated set of modules designed to address common payment challenges, complete with pre-built integrations to leading payment vendors. The result? A streamlined approach that enables secure and efficient payments for your customers.

Next Generation Core Systems

Next Gen Core Systems deliver scale and speed at the heart of your bank, but we know first-hand that implementation is complex. With extensive experience in implementing third-generation core banking engines such as 10x, Mambu, Temenos and Thought Machine, and with pre-configured cores ready to go, we help you understand the options, plan an approach, and navigate the journey. Whether you want to launch your first Edge play, want to better optimise co-existence or are ready for full migration, we have the right capabilities to get you there.

Platform Engineering

Running new digital capabilities and services on the cloud is complex. Security is paramount. As is scalability. You need to meet peak periods of user demand but not pay for more than you have to. You need to ensure your infrastructure services meet industry standards within an environment that allows developers to quickly deploy new releases with confidence. We’ve designed our Fabric platform to take care of this heavy lifting for you. Our series of pre-configured modules and tools provide a modern cloud platform that forms the bedrock for your new digital capabilities.

Meeting the demands of digital first customers is not easy. When it comes to UX, banks face a no-win choice: ‘renting’ customer experience from providers that limit customisation, or scaling large teams to build from the ground-up. We think it’s time to re-write the model, eliminating the trade-offs and giving banks the best of both worlds.

Introducing Experience by BankingSuite: a product framework underpinned by Flutter that builds on years of Deloitte studio research on design and experience and saves you thousands of hours of development effort. We’ve taken care of the new standards for experience that your customers have come to expect, with all the technical foundations needed for today’s modern digital apps ready to go, and a full inventory of pre-built journeys for you to customise. Best of all, you have the flexibility to build on top – focusing your effort on the differentiated features that are authentic to your brand and valuable to your customers.

Deliver the best first impression to your customers with a seamless, user-friendly onboarding experience. Our Digital Onboarding platform for retail and small business banking connects pre-integrated ecosystem leaders, allowing you to orchestrate your chosen combination into industry standard and customisable journeys. Increase customer satisfaction, accelerate account opening time, and quickly see and respond to risks.

Fast-track your lending transformation journey and unlock exceptional customer experiences, streamlined operations, and informed decisions with Digital Lending. Our Digital Lending platform allows you to gain insights into your customers, tailor compelling propositions, and enhance their end-to-end experience through an engaging, automated, and robust customer journey. Reporting and analytics are central to the platform, empowering you to generate actionable portfolio insights and optimise your risk and pricing models.

Align your payment capabilities with the demands of the modern era. With our comprehensive experience in payments, design, and delivery, we can help you achieve your payment modernisation goals, create new opportunities, and deliver exceptional payment experiences to your customers quickly. Our Digital Payments platform provides you with a curated set of modules designed to address common payment challenges, complete with pre-built integrations to leading payment vendors. The result? A streamlined approach that enables secure and efficient payments for your customers.

Next Gen Core Systems deliver scale and speed at the heart of your bank, but we know first-hand that implementation is complex. With extensive experience in implementing third-generation core banking engines such as 10x, Mambu, Temenos and Thought Machine, and with pre-configured cores ready to go, we help you understand the options, plan an approach, and navigate the journey. Whether you want to launch your first Edge play, want to better optimise co-existence or are ready for full migration, we have the right capabilities to get you there.

Running new digital capabilities and services on the cloud is complex. Security is paramount. As is scalability. You need to meet peak periods of user demand but not pay for more than you have to. You need to ensure your infrastructure services meet industry standards within an environment that allows developers to quickly deploy new releases with confidence. We’ve designed our Fabric platform to take care of this heavy lifting for you. Our series of pre-configured modules and tools provide a modern cloud platform that forms the bedrock for your new digital capabilities.

For Retail and Small Business Banking

Launch new digital products, services and ventures

Get the right idea to market, fast. Our FS innovation capability, Fusion, is dedicated to helping you anticipate and explore what’s next. The home of our mixed methods customer research, digital banking intelligence and design accelerators, Fusion connects you to a host of brilliant minds across strategy, design, and data science to shape new ideas and spark change. Collaborating with you to explore what’s possible, we’ll inspire new thinking and enable the creative connections that ignite innovation. Then, backed by the breadth of capability across Deloitte, and powered by our BankingSuite platform, we’ll help you make your new ideas a reality at pace.

Our job is to help you to get to value faster – but building quickly is only a fraction of the equation, so we’ve taken lessons learned helping organisations innovate and launch new propositions to create a methodology that rapidly uncovers the right ideas for your business. Whether you’re looking to reimagine the homebuying process or unlock growth in different segments, our range of new proposition concepts and design accelerators mean you won’t have to start from scratch. Our Fusion team combines market and customer insights and innovation to bring you perspective on what’s next for your business, supported by tech teams that can help you evaluate feasibility fast. Together, we’ll work with you to shape the right opportunities for your business – opportunities that match your ambition, align with your brand and grow your bottom line.

Once we’ve identified the right idea for you, our BankingSuite platform provides the foundational building blocks to help you build at pace. We bring a curated ecosystem of cutting-edge technology partners, complete with pre-built integrations, our own software to fill in identified gaps, and a composable architecture that allows you to pick and assemble quickly.

Backed by the capabilities of our full-service creative agency, we help you build a comprehensive go-to-market approach across brand, marketing, product, and operations so you’re ready to execute your product launch with impact. But we don’t just stop at your product release. We’re committed to your long-term success, supporting you in running and maturing your new product or service as you scale and iterate with new launches. We can be your team behind the scenes for as long as you need us—running the new venture on your behalf until you’re ready to take over.

Digital transformation that delivers tangible value

Transformation is hard. We see Financial Services organisations who have repeatedly and consistently struggled to effect meaningful change across their business and technology estate, while the world is moving around them, and their competitors are overtaking. We've designed our value-based transformation approach to tackle this head-on: identifying the highest value opportunities for your organisation and using these as drivers for long term transformation.

We’ll help you map out the various routes to achieving your goals, and once we know the right direction for you, we’ll pick one step to take at a time, providing a simpler investment commitment. Using the modernisation solutions we’ve already built, we can help you establish foundational capabilities quickly, and in the right order for your business – scaling up as your confidence builds.

Our experience

Millions of hours

learning and crafting.

All yours in an instant.

We help banks all over the world on their digital transformation journeys. We know the best fintechs in the business—and we know their limits. After spearheading thousands of implementations, enabling countless customer experiences, and building hundreds of capabilities, we know what it takes—and we’ve built that experience into our modern, composable banking platform: BankingSuite.

We are financial services specialists, engineers, product developers and creatives. Backed by an organisation that’s been working with the biggest names in financial services for decades. Whatever the challenge, we’ve been through it before. We have the battle scars. We know how to help.

-

10

countries live

-

42

fintechs integrated

-

775

BIAN Informed API endpoints

-

35

3rd gen core implementations

The Bankingsuite Platform

A modern platform for modern banks

BankingSuite is the modern, composable platform that underpins how we deliver for you. Software that helps you get to your goals quickly but with the flexibility to extend, refine and make your own. You can choose from individual capabilities to modernise specific parts of your business, or take the full stack to build new propositions quickly.

Benefits for your business

-

1

Grow

Accelerate market offerings and grow revenue.

With BankingSuite, we save you thousands of development hours enabling you to bring new innovative products and services to market in months, not years. We’ll get you to an MVP quickly so you’re earning revenue as you build out your proposition.

Enhance reach & retention.

Build experiences your customers love with distinctive user-centric features and intuitive UI design out-of-the-box, and the ability to build differentiating features on top that are authentic to your brand and valuable to your customers. Increase customer acquisition and retention by making self-service easy, giving nudges to improve financial well-being and rewarding your customers’ loyalty with meaningful personalisation.

Access the best fintech players.

BankingSuite is designed to be your gateway to a curated ecosystem of cutting-edge technology companies that have been tried and tested. Integrations are pre-configured, orchestrated to work for your specific use cases, and set up in a way that allows you to scale cost effectively. Our composable architecture means you can also plug and play with your own providers.

-

2

Save

De-risk your investment.

Skip the painful learning curve and leverage the experience we’ve gained delivering digital transformation for banks all over the world, as well as the investment we’ve made in the building blocks to accelerate your journey.

Reduce cost to serve.

Make the most of your resources and drive new efficiencies with access to composable architecture, reducing operational expenses, capital expenditure, and contractual obligations.

Unlock value at every turn.

Our approach is designed to identify the highest value opportunities for your organisation, using these as drivers for long term transformation. We’ll help you map out the various routes to achieving your goals, and once we know the right direction for you, we’ll pick one step to take at a time, focusing on delivering value for your business incrementally throughout your journey.

-

3

Flex

Composable architecture.

We designed BankingSuite to be composable so you have the flexibility to pick and choose what fits your unique needs. Change the flow, swap providers, configure in multiple different ways to make it yours. There’s no rigidity, no trapping you into buying an extra 20 features when you only need one. Take as much or as little as you need.

Own your future.

Our approach is to build with you and everything we build together, you can control. You’re not locked into individual vendors, giving you the freedom to evolve your capabilities over time. If it’s more efficient for your business, we offer services to operate and run your new capabilities until you’re ready to take over.

Custom build when you need it.

With BankingSuite, you don’t have to spend time building table stakes. You can focus your build efforts on the differentiating features that make the difference. Where you need support, you’ll have access to the best of our strategy, design and engineering talent to help you do this.

-

4

Secure

Protect against cyberthreats.

With security built in, BankingSuite can help you ensure that you have the right controls in place to provide the highest level of privacy and to protect your company’s and your customers’ data against cyberthreats.

Meet compliance obligations.

Our experience in navigating risk and regulation means we’re committed to facilitating complete adherence to CISO and regulatory requirements.

Stay up to speed.

Industry standards and new cyberthreats are constantly evolving, so our specialist cloud engineering teams are on call to support and upskill your team where required. We can help you evolve your controls, giving you ongoing resilience against threats.

Insights

-

Perspectives

The FinTech Strategic Review (Kalifa Review)

Time to read: 3 minutes

Deloitte takes a pivotal role in the first comprehensive grassroots analysis of UK FinTech activity.

-

Video

Achieve new heights in digital banking with Converge by Deloitte

Time to watch: 2 minutes

Banking is at an inflection point and banks must evolve in order to thrive. But with a myriad of solutions and fintech providers available, what is the right choice?

-

Video

Converge by Deloitte for Banking: Secure and compliant solutions with AWS

Time to watch: 5 minutes

Andy McKee, BankingSuite Chief Technology Officer, Deloitte, joins AWS to discuss how Converge by Deloitte for Banking is helping global, regional and local banks put security and scalability at the heart of their infrastructure.

-

Perspectives

What does the future of money look like?

Time to read: 5 minutes

Money is in a state of flux. In light of mass digitalisation, the ubiquity of the internet and social media platforms, and the rapid disruptions of big tech, fintech and opensource innovators, organisations face new challenges and opportunities. Our research is designed to support the informed discussion the industry needs to navigate a path towards the future of money.

Get started