Trade to trump protectionists and boost global growth has been saved

Trade to trump protectionists and boost global growth Voice of Asia, January 2017

13 January 2017

Yes, the global rise of nationalism feels a little unnerving, and many fear the return of global currency wars and even full-scale trade wars. But economists hope that currency devaluations won't push campaign rhetoric to become policy and thereby undermine supply chains and international relations.

Trade has been part of the engine driving the emergence of Asia on the world stage. But it has been labouring for the better part of a decade. And although trade’s troubles are global, they’ve been biting deepest here in Asia, where trade flows stalled a few years back.

Learn More

Voice of Asia is also available via PDF in the following languages:

To date, most of those challenges have been economic. But the political challenges to trade are also mounting fast, with Trump’s anti-free trade agenda joining the Brexit revolution and question marks mounting in Europe, where the European Union faces a gauntlet of elections.

So will trade flows continue to lose steam, and drag down Asia’s 2017 prospects with it? The answer is no. In fact, Deloitte sees trade about to regain momentum for several reasons:

- Trade’s troubles were mostly temporary anyway, damaged by successive crises and shocks, the effects of which are finally wearing off.

- More importantly, a bunch of those troubles aren’t really trade-related anyway. The big fall in commodity prices in recent years—cheaper oil, gas, iron ore, and coal—undercut measures of the monetary value of trade. But commodity prices have since surged, and that artificial negative is disappearing fast.

- India’s services export story is still intact despite a marginal slowdown and political posturing from the United States.

- China’s economy is lifting—indeed, that’s why commodity prices have surged. And China’s recovery suggests that trade’s recovery will follow suit in 2017.

And there are some trends that will favour trade into the future:

- Policies have swung toward openness in the mega-economies of the future. Looking longer-term, Asia’s potential will increasingly swing toward economies such as Indonesia, Vietnam, and the Philippines. Although these economies have low trade multipliers, the sheer pace of growth in the years to come will see their rise as part of the global trade story.

- Just as the establishment of the European Union led to a large increase in trade within Europe, closer integration and connectivity within Asian economies will be a dominant influence on trade volumes over the coming decade.

- Finally, services are the new black. The global momentum in trade is swinging away from goods—where the populism of protectionists can do the most damage—toward services. Faster recovery in the United States and Europe can lead to greater services trade benefitting the Asian economy.

There are no guarantees, of course. However, President Trump’s influence on global trade volumes over the next few years may be smaller than many imagine, while the powerful forces within Asia and elsewhere point to trade strengthening over time.

Trade matters—a lot

Trade is the lifeblood of the global economy. It is a barometer of economic health, an enabler of economic development, a facilitator of technology transfer, and a mechanism for productivity improvements and income growth.

It is also a sprinter. 2017 marks exactly 200 years since David Ricardo proved that there are great gains to be had from trade, and that is exactly what has happened since. Global trade has grown half again as fast as the global economy over the past 50 years, doing better still—at twice the rate of economic growth—over the two decades from 1987 to 2007.1

The rapid pace of growth in global trade has arguably been more important for Asia than any other region. The transformation in Asia since the Second World War has been remarkable, starting with Japan and followed in quick succession by the “tiger” economies of Singapore, Hong Kong, South Korea, and Taiwan, then China, and now other Southeast Asian economies such as Malaysia, Thailand, Vietnam, and Indonesia.

The common thread through these phases of economic development in Asia has, in general, been a reorientation of each economy toward an outward, export-focused strategy. As chart 1 shows, Asia now accounts for around one-third of global trade.

The fact that global trade growth has outpaced global economic growth at a time when Asia has been going through a profound economic transformation has been hugely beneficial. It has allowed per capita income growth in Asia to accelerate faster than it otherwise would have, contributing to lifting millions of people into the middle class.

This is the first time in decades that global trade growth has been less than global economic growth for a sustained period, and that is having significant implications for the global economy.

Why global trade has slumped . . .

Since the global financial crisis, however, global trade growth has slumped. The financial crisis in 2008 was a massive shock for the world economy and severed many of the traditional economic relationships and linkages; global trade volumes plummeted in 2008 and 2009 (as seen in chart 2).

While trade flows have resumed a positive trajectory, their growth has been strangely subdued. The latest data suggests that global trade growth will slow in 2016, with the World Trade Organisation estimating growth on the order of 1.7 percent, the slowest pace since the global financial crisis.

That’s not necessarily surprising. Indeed, it makes sense that trade growth has moderated alongside soft global economic growth.

More concerning still is the deceleration in global trade growth relative to global growth. After all, it was the sustained outperformance of trade growth compared to global growth over the previous half-century that so meaningfully supported development in Asia.

International Monetary Fund data covering the last five years shows that the global trade elasticity—the ratio of trade growth to economic growth—has been approximately equal to 1. Looking at just the last three years, the elasticity has been less than 1.

This is the first time in decades that global trade growth has been less than global economic growth for a sustained period, and that is having significant implications for the global economy.

. . . with Asia taking a major hit

Just as the rapid expansion of trade over time was of huge benefit to Asia, the relatively slow growth in global trade since the financial crisis has hit the region hard. Chart 3 below shows how the trade intensity of different regions (measured by trade as a share of an economy, or the trade-to-GDP ratio) has changed since the onset of the global financial crisis. As a measure of this change, the chart simply shows the trade to GDP ratio in 2015 compared to the ratio in 2007.

Part of the trade slowdown is structural

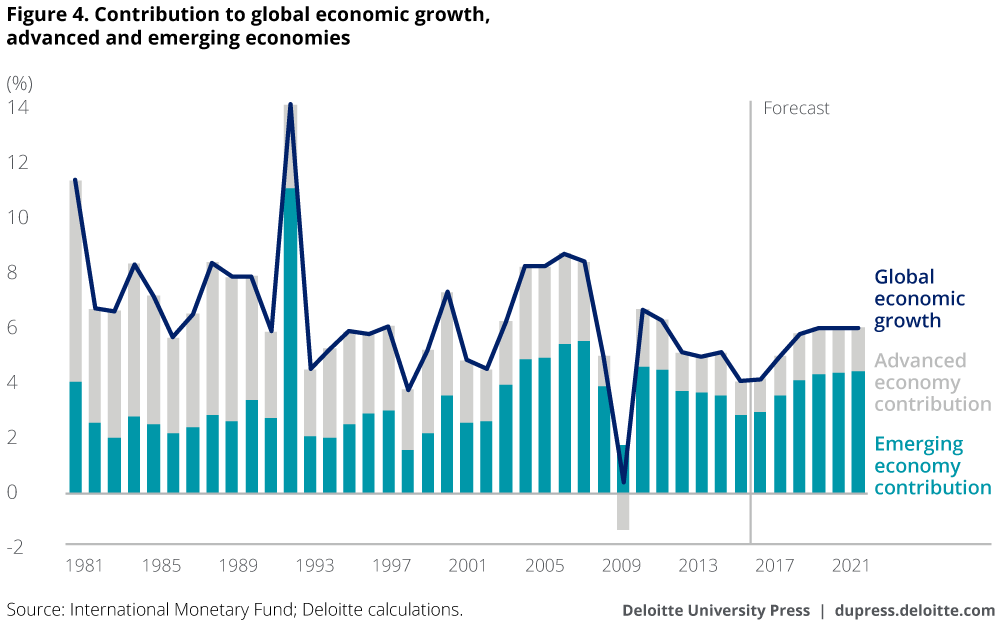

Over recent decades, emerging economies, particularly those in Asia, have contributed a rising share of global growth. Chart 4 shows that, in the early 1980s, emerging market economies contributed around one-third of global growth.

In the last five years, the contribution from emerging economies has increased to around three-quarters of global growth and is expected to remain at about that level over the medium term.

Emerging economies have much lower trade elasticity than do the advanced economies. Chart 5 shows the persistently lower trade elasticity in emerging economies since the early 1980s. As the emerging economies’ share of global activity and trade has risen, the global elasticity of trade has fallen.

Economies, firms, and policymakers in Asia should be preparing for a structurally lower trade elasticity into the future.

Moreover, the 1990s also stand out in chart 5 as being very unusual. The fall of the Berlin Wall and the corresponding raising of the Iron Curtain, along with the fragmentation of the former Soviet Union, combined to increase international trade both with and within Eastern Europe over the subsequent years.

Similarly, the opening up of China to global trade, while officially beginning in the previous decade, took hold during the 1990s in terms of a big leap in trade between China and other countries (both within Asia and beyond). In addition, with advancements in technology, networking, and connectivity, the outsourcing industry centered in India started to flourish. India’s trade with the United States and Europe in particular expanded rapidly during this period. The fragmentation of global supply chains, driven by widespread falls in information and transport costs, also helped to contribute to a structural shift in trade volumes.

At the same time, trade liberalisation lowered barriers to international trade. Within Asia, the ASEAN Free Trade Area agreement was signed in 1992. In Europe, the European Economic Area was established in 1994, providing the free movement of goods, services, and capital, as well as people, within the European Union. The North American Free Trade Agreement between Canada, Mexico, and the United States took effect from 1994, while the Uruguay Round of multilateral trade negotiations—which established the World Trade Organisation—were concluded in the same year.

The 1990s was also a period when a number of countries within Asia, and some outside Asia, sought to open up their economies, including putting in place incentives for exports. This widening of the “Asian model” of economic growth—which had previously become synonymous with the economic performance of the Asian tiger economies during the 1960s and ’70s—deeper into Southeast Asia helped to underpin rapid export growth in that region in particular.

All of that suggests that global trade elasticity in the 1990s was unsustainably high.

And now there are strengthening political currents running against trade liberalisation. American voters elected Donald Trump on promises to protect US manufacturers and their workers against import competition from emerging economies. And Trump is only the most prominent example of a new global wave of nationalistic sentiment that includes the Brexit vote in the United Kingdom and the election of politicians on populist, anti-globalisation platforms in Europe, Australia, and elsewhere.

This sentiment is undercutting efforts to pursue more liberal trade policies around the world. Indeed, it threatens to reverse past gains. An example is Trump’s commitment (on day one) to withdraw US support for the Trans-Pacific Partnership (TPP)—a regional trade agreement covering 12 countries that account for around 40 percent of the global economy—despite it having already been signed by each of the proposed members (though it had been awaiting ratification in the United States).

Fortunately, it is possible that the remaining TPP signatories will proceed with a similar type of agreement that leaves out the United States, taking a broader scope and possibly including China. Indeed, many are encouraged by the potential to leverage the existing Regional Comprehensive Economic Partnership negotiations—which includes ASEAN, Australia, China, Japan, India, Republic of Korea, and New Zealand—into a broader TPP-style agreement.

Moreover, trade liberalisation is only one aspect of what drives trade volumes. Other forces—including greater integration of economies, technological change, and improvements in logistics—are set to continue.

Trade has been an important contributor to Asia’s rising prosperity, but the gains of the past were artificially good, and the politics of the future are problematic. Yet the outlook is better than you think.

Trump is only the most prominent example of a new global wave of nationalistic sentiment that includes the Brexit vote in the United Kingdom and the election of politicians on populist, anti-globalisation platforms in Europe, Australia, and elsewhere.

Here’s the good news: The rest of the slump is cyclical

Cyclical? That means it’s temporary, and indeed, the signs indicate an impending upswing. The clearest cyclical influence on trade in recent years has been the global financial crisis, which clearly had an effect on the volume of global trade activity. The impact on financial markets—including the availability of credit, borrowing costs, exchange rates, and commodity prices—added to weakness in trade.

However, most of those effects have been worked through. So why is there any lingering impact on global trade, more than eight years since the collapse of Lehman Brothers? Part of the answer to that question lies in chart 7.

That chart shows the breakdown of spending across the seven major advanced economies known as the Group of 7 (or “G7”). Growth since the global financial crisis has been driven by private and public consumption—the spending by households and governments. In contrast, investment—the spending on physical capital such as roads, factories, computers, office buildings, and shopping centers, all of which improves the economy’s productive capacity—remains weak. Indeed, data from the Organisation for Economic Co-operation and Development (OECD) shows that the level of investment spending across the G7 economies in 2016 was exactly the same as it was a decade ago.

That has important implications for future growth. Spending on investment—capital expenditure—is a bet on the future, and firms will invest only if they can expect an adequate return on that investment. In part, that expected rate of return is driven by an anticipation of future economic growth. Paradoxically, investment also helps to underpin stronger economic growth into the future, including by boosting productivity.

In turn, that means low investment today will weigh on economic growth tomorrow.

So the failure of investment to recover more quickly in G7 economies also has important implications for trade. As chart 8 shows, changes in the composition of economic growth can generate changes in the trade intensity of an economy. The post-2007 change in the composition of the G7 economies toward consumer spending and away from investment has contributed to a shift in trade intensity. As a result, the elasticity of trade across G7 economies—and, importantly, their trading partners in Asia—has dropped.

Still, there is an upside to the cyclical story about trade. We think the pace of Asian trade growth will surprise in 2017.

Three reasons Asian trade will surprise on the upside in 2017

First: World trade volumes were temporarily damaged by successive crises and shocks, the effects of which are finally wearing off.

The global economy suffered an unusual sequence of shocks over the past decade. But the world economy and global businesses have adjusted to those shocks and are coming to terms with them.

With no new shocks in evidence and the damage of previous shocks wearing off, business confidence is recovering and demand is likely to normalise.

This recovery is already evident in the US economy, which is likely to grow by around 2.2 percent in 2017 despite some weakness in recent quarters, and, increasingly, in Europe.

Our take is that the world economy is finally emerging from a dark period of successive major shocks, and what we are seeing is the natural healing process that occurs in economies as the worst effects of shocks wear off. This is forming a base for a more resilient recovery around the world and higher international trade volumes—so long as no new shocks materialise.

Second: Merchandise trade values have been depressed by deflationary forces, which are now easing, while leading indicators suggest volumes are ready to lift as well.

It hasn’t just been trade volumes which have experienced subdued growth in recent years. Trade values (the combination of both volumes and prices) have also been depressed. That has been worsened by downward pressure on prices generally, including in relation to commodities and energy (see chart 9).

Softness in prices has been driven by a lack of demand in the global economy, evidenced by weak global growth and very subdued levels of investment. Two additional factors are also relevant when considering weak trade value growth:

- Second, China has been exporting excess industrial capacity to other countries in the region, which has caused a new wave of deflationary pressures on manufactured goods prices.

Each of these factors is expected to have a diminishing impact on prices. Commodity and energy prices appear to have bottomed, and indeed, the prices of some commodities, such as coking coal, have increased sharply in recent months. The US dollar may climb further against other major currencies, but only modestly. Manufacturing capacity is expected to continue to shift from China to lower-cost producers in the region, but, in time, wage rates will rise in lower-income Asian economies as well.

At the same time, trade volumes will rise again. New export orders are climbing around the world, though the expansion is somewhat patchy:

- If not for labour strikes in Korea, a global export powerhouse, new export orders would probably have been much stronger there too.

- The latest indicators of export demand and import orders in China also suggest improvement following a poor 2016. Indeed, weakness in China’s trade growth over the last 12 months has undermined trade growth in Asia more generally, but there are genuine signs of a turnaround.

- Electronics components demand, another leading indicator of trade volumes, is also rising. A slew of measures for demand in the tech sector—semiconductor sales, book-to-bill ratios for semiconductor equipment manufacturers, and US orders for electronic components—are all rising, some at the fastest rate since 2013, powered by booming consumer interest in new products such as wearable technology and larger-screened cellular devices.

- Sea cargo and air freight volumes are another leading indicator of trade that is rebounding. Container volumes have been climbing steadily since mid-2016 (see chart 11), while growth in air freight volumes is on the rise.

That’s good news. The value of world trade is therefore likely to trend upward in the near to medium term, as negative price effects from the tumbling commodity and fuel prices bottom out, while leading indicators for volume growth also suggest a bump in trade volumes is looming.

The value of world trade is likely to trend upward in the near to medium term, as negative price effects from the tumbling commodity and fuel prices bottom out, while leading indicators for volume growth also suggest a bump in trade volumes is looming.

Third: China’s cyclical recovery will aid global trade, but structural changes will continue to exert a drag.

China has seen growth moderating from double-digit figures to relatively placid sub-8 percent growth in recent years. The softening trajectory of China’s economy can be attributed to a difficult but necessary transition from an investment-fueled, export-led, and manufacturing-based economy to one that is more reliant on services and consumer spending. Furthermore, the build-up of debt, particularly in the corporate sector, continues to weigh on business sentiment.

However, policymakers have shown a willingness to unleash large-scale stimulus measures in a bid to inject growth impetus into the economy, including massive monetary easing and concerted fiscal spending. As a result, economic growth has held up relatively well, even though private investment levels continue to trend downward steadily. This greater vigor in aggregate demand will in turn feed into regional trade and production networks (of which China is a key node), thereby boosting trade volumes across Asia.

But structural changes also mean the Asian trade environment is increasingly reliant on China. We use the concept of global value chains (GVCs) to analyse China’s influence on economic activity in the region, as it provides a good measure of trade’s actual impact on an economy. This value-added-to-trade approach measures value creation at different stages of the production process and identifies those who capture that value. This is a superior approach because it is now clear that it is intangible activities such as research and development or marketing that command higher value, while low-cost manufacturing adds the least value.

GVCs optimise the entire production process but are also a double-edged sword as imports are fed into exports of another country. As value chain concentration builds in China, the country’s dependence on foreign value added in Chinese exports has decreased: More value is being created within the country (see charts 13 and 14).

Asia is increasingly plugged into China-centric value chains. Related to that, we find that, across Asia, domestic value added in exports has fallen away over time. Table 1 shows the actual dependence of major Asian economies on China for trade value creation.

This table shows that, should there be a major contraction in Chinese trade, the main losers will be Taiwan, Korea, Japan, and the Philippines. In contrast, India has relatively modest dependence on China for trade value creation. These structural trends in intra-Asian trade are a potential vulnerability: They present a growing risk to Asian prosperity should further global (or Chinese) shocks occur.

Many see other structural challenges, most notably the rise of nationalistic politicians and the potential for more liberal trade policies to be unwound. The first few months of the Trump presidency are expected to reveal the extent to which these concerns are justified.

In general, however, there are offsetting factors at play. At the same time that dependency on China for Asian trade has expanded, manufacturing capacity has been shifting to other countries in the region. Given the broader transition under way in China—from investment-led growth to consumer- and services-led growth—this shift in capacity is important.

However, it is happening more slowly than many realise. Chart 15 shows that China has continued to increase its share of global clothing and textiles exports in recent years, despite evidence that manufacturers are already voting with their feet and shifting production sites away from higher-cost regions of China, such as the Pearl River Delta near Hong Kong.

One estimate suggests that the number of factories owned by Hong Kong companies in the Pearl River Delta fell by around 33 percent between 2006 and 2013,2 while a recent survey shows that just over one-third of the manufacturers in the region plan to shift production capacity to cheaper locations within China or to other countries in Southeast Asia, Bangladesh, India, or Sri Lanka.3 Much of the manufacturing capacity moving away from higher-cost regions of China, however, is simply moving to lower-cost regions within the country, not least because of government incentives.

That said, the widening cost differential and growing sophistication likely means that these incentives are simply delaying the inevitable. Indeed, Deloitte’s 2016 Global Manufacturing Competitiveness Index noted that, by 2020, Malaysia, Indonesia, Thailand, India, and Vietnam are all expected to rank among the top 15 countries in terms of manufacturing competitiveness. These countries are already featuring in the minds of global executives seeking an alternative to China.

The timing and extent of a shift in manufacturing to emerging Asian countries outside China will depend not only on relative labour costs but on the degree to which China continues to seek to encourage relocation of factories within its borders (rather than within Asia) and the pace with which alternative countries establish the infrastructure and regulatory requirements needed to support an expansion of the manufacturing industry. Manufacturing labour costs in these five Southeast Asian economies (Malaysia, Indonesia, Thailand, India, and Vietnam) are already well below costs seen in China. For example, manufacturing labour costs in Indonesia are currently around one-fifth of the level in China, while costs in Vietnam and India are approximately half the level in China.

There are also longer-term competitive advantages that Southeast Asia has over China. For example, over the next 30 years, the working-age population in the ASEAN region is projected to expand by almost 85 million people. Over the same period, China’s working-age population is projected to shrink by more than double that amount (around 175 million people).

It therefore seems likely that other Asian economies are ready and able to fill at least part of the gap that China’s rebalancing toward consumption and services means for trade. This appears particularly true because the pace of relative decline in manufacturing in China is slower than it is broadly understood to be, while the longer-term labour force dynamics in Southeast Asia are favorable.

Will services trade surprise as well?

The structural strength in the demand for services is accepted wisdom in economics—over time, a rising share of global incomes are being spent on services. That has benefited countries, such as India in particular, that have prioritised services rather than manufacturing as a platform for economic development, while services trade is also far more likely to escape any effects of populist protectionism in the coming years.

Although the gains in services will be a story for the ages, it has long been evident in the trade data. Rapid growth in services has meant big strides in exports of services too. This has been possible in the last decade due to the information and communication technology revolution of mid-1990s and a boost to growth in technology, transportability, and tradability that have in turn changed the nature and tradability of services.

Furthermore, exports in services have kept pace with changing global dynamics and a shift toward more technology adoption in all areas of the global economy, including business and professional services. This has underpinned service exports in a number of major Asian economies. For example, India’s major service export is computer services, followed by business services and then technical and trade-related services. India’s IT exports have more than doubled over the last six years, and exports now account for more than two-thirds of total revenue for the Indian IT sector.4 As chart 16 below shows, ICT services exports also account for around two-thirds of total services exports from India, a far higher share than most other Asian economies. It is no surprise, then, that Indian service exports are more sophisticated than the average level seen across high-income countries.5

These technological advancements have also had a broader impact on services exports, with rapid growth being facilitated by the fact that many of these services do not require face-to-face interaction and have the potential of being stored and traded digitally.

In fact, over the 12 years to 2013, global commercial services exports grew at an average annual rate of 10 percent, with India helping to lead the way with average growth of 20.1 percent, followed by China at 16.5 percent. As a result, India is now the world’s eighth-largest services exporter and the third-largest in Asia (see chart 17).

The most recent performance of the services sector has been more circumspect in light of the subdued growth in developed economies. There has been moderation in the rate of growth of some important services while others, such as computer services, have improved. This performance is expected to improve in the coming years as developed economies record more robust growth.

There are further reasons to be upbeat on services trade in the medium term. The rising share of services within trade flows overall mean that there has been a growing focus on services within free trade agreement (FTA) negotiations. India again provides a clear example, with the country making significant progress on signing comprehensive bilateral trade agreements that cover services, including with South Korea, Japan, Malaysia, and Singapore. Further, India’s FTA with ASEAN came into effect in mid-2015, while the wider Regional Economic Comprehensive Partnership includes India, along with the 10 ASEAN countries and the remaining five FTA partners: Australia, China, Japan, South Korea, and New Zealand.

Overall, the growing influence of services trade globally will have an increasingly positive effect on Asian trade into the future.

Longer-term tailwinds

So we can point to short-term positives. But there are longer-term tailwinds of importance as well. Two stand out:

- The rising Asian economic giants have been shifting their trade policies toward greater openness and global engagement. Their rising will underpin further trade gains through Asia and the world in the decades ahead.

- The global swing away from goods and toward services is increasingly evident in trade trends too. The gains from trade in services remain substantial.

Conclusion: What’s next?

Cyclical and structural factors have caused trade expansion to underperform global growth in recent years. That has created a degree of pessimism about the future of trade, and those fears have been further stoked by the election of an avowedly protectionist US president.

But these fears have been overstated. Although some of the bad news on trade is here to stay, much of it has been due to factors that are now fading:

- World trade volumes were temporarily damaged by successive crises and shocks, the effects of which are finally wearing off. Trade values have been depressed by deflationary forces that are now easing, while leading indicators suggest volumes are ready to lift as well.

- A boost in the advanced economies is also likely to benefit trade in services.

- Finally, China’s recovery will aid global trade.

All this will help reinvigorate trade growth in 2017, which will be a clear positive for Asia.

And there are longer-term gains on the trade menu as well, with the rise of India and the rise of services likely to prove a dynamic duo for trade prospects in the years to come.

© 2021. See Terms of Use for more information.