Key factors to improve drug launches Why drug launches miss market expectations and what to do about it

15 minute read

26 March 2020

Jeff Ford United States

Jeff Ford United States Tom Fezza United States

Tom Fezza United States Natasha Elsner United States

Natasha Elsner United States Ankit Arora United States

Ankit Arora United States

Getting a drug launch right is critical for its overall success. And many factors that contribute to lower-than-expected sales at launch can be mitigated through planning and disciplined execution.

Executive summary

With the growing costs of developing new drugs, increasing competition, and shortening times to peak sales, the importance of getting a drug launch right has never been greater. As payer influence grows and new therapies target smaller patient populations with complex needs, developing and executing a winning launch strategy becomes increasingly difficult. We analyzed actual and forecast sales for novel drugs approved in the United States between 2012 and 2017, and found wide variability in launch performance. In their first year, more than a third of all drugs (36 percent) failed to meet market expectations. At the same time, a sizeable proportion (26 percent) far exceeded expectations. More detailed findings include:

Learn more

Explore the Life sciences collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

- Most new drugs continue with the revenue trajectory set at launch. About 70 percent of products that miss expectations at launch continue doing so in subsequent years, and around 80 percent of products that meet or beat expectations continue to do so afterward.

- Three product characteristics are strongly associated with meeting or beating market expectations: products receiving priority review by the US Food and Drug Administration (FDA), specialty, and orphan drugs. These products typically address high unmet needs in the market, the regulatory approval process tends to be faster, and manufacturers’ pricing leverage can be greater than in drug categories with a well-established standard of care.

- Drugs launched by large companies underperform compared to their counterparts. This difference holds even when we account for product characteristics most associated with strong launch performance. Several possible factors may contribute to this: functional silos that prevent large companies from developing a clear focus and comprehensive expertise in a specific disease area, a one-size-fits-all approach to launch, and incentives that create tension between functional and enterprise goals.

- The three most common reasons for missing expectations were:

- Limited market access (e.g., lack of coverage, use of formulary restrictions like step edits, greater than expected expenses on discounts and rebates, or high patient cost-sharing due to unfavorable placement on formulary)

- Inadequate understanding of market needs (e.g., underestimating the difficulty of converting customers—prescribers and patients—from existing therapies)

- Poor product differentiation (e.g., the product’s proposition didn’t offer a compelling enough value, or the product formulation created hurdles that were not offset by the additional clinical benefit, in the customers’ view)

While pharma companies may not be able to control every single element at launch, many factors that contribute to missing expectations can be mitigated with thorough planning and disciplined execution. Some of these approaches include:

- End-to-end strategic planning: Identify a set of therapy areas where the company can be a market leader, build long-term relationships, and gain a competitive advantage. Break down internal silos, ensure cross-functional input around market needs, and align functional and enterprise goals around these needs.

- Portfolio strategy: Develop a rigorous methodology to define the probability of technical, regulatory, and market access success for each product. Revisit incentives to minimize tension between functional and enterprise goals and to encourage bold decisions (e.g., to end a clinical development program).

- Innovative approaches to market intelligence and stakeholder engagement: Employ new tools to more accurately and efficiently size and segment the market. Consider the perspectives of different types of payers, positioning for different benefit designs (medical vs. pharmacy), and opportunities to take on risk. Seek early input on target product profiles, and incorporate that input into clinical trial design.

- Disciplined execution: Establish a cross-functional approach to launch execution that balances consistency and flexibility. Clearly articulate customer value proposition and points of differentiation across customer types and segments. Monitor performance using consistent metrics across the product portfolio.

Getting product launches right is more critical than ever before

Even though the number of drugs approved by the FDA has increased from an average of 23 per year between 2000 and 2010 to 38 per year between 2011 and 2018, the average revenue per drug has declined significantly. 1 The latter trend is expected to continue: Average peak sales forecasts for late-stage pipeline assets have declined by more than 50 percent since 2010.2 The declining average peak sales and intense competition limit the opportunity to maximize returns from new launches.

While the industry needs to improve its overall launch performance, the job of commercial teams has only gotten harder due to the rising influence of payers, declining access to physicians, intense competition, and a shift away from primary care drugs toward specialty therapy areas.

Our analysis paints a mixed picture—with many manufacturers in recent years missing launch expectations for a large portion of their products.

Quick facts about this study

The Deloitte Center for Health Solutions analyzed 149 new drugs (new indications for both small molecules and biologics) launched in the United States between 2012 and 2017 to determine if they met market expectations for each of the three years after launch. For our analysis, we considered analyst forecasts to be a general reflection of market expectations for new products and used consensus forecasts, as identified by EvaluatePharma, available at the time of FDA approval.

We applied the following criteria and definitions:

Criteria

Performance against analyst expectations:

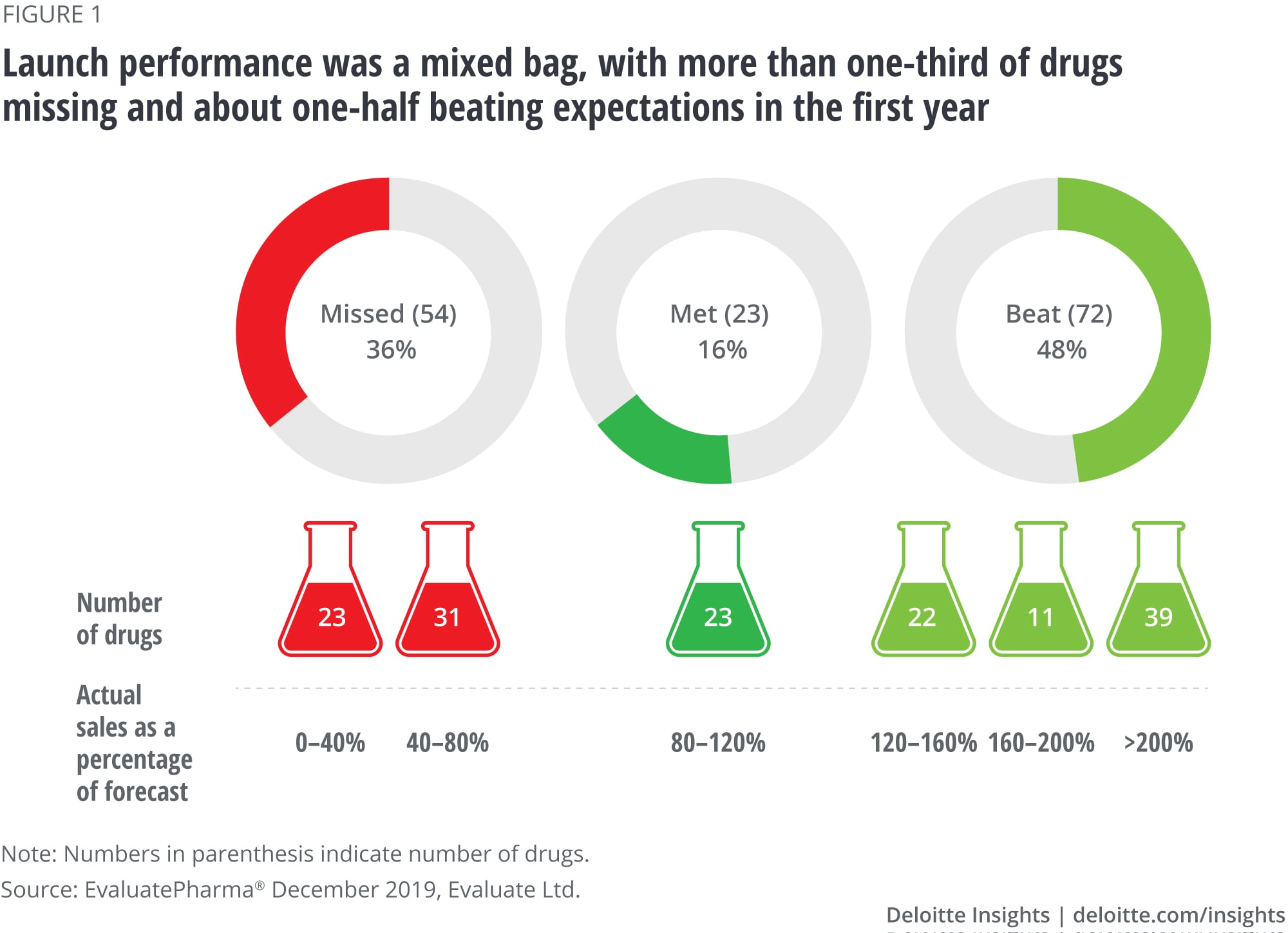

- Missed: Drugs generating up to 80 percent of expected sales

- Met: Drugs generating between 80 to 120 percent of expected sales

- Beat: Drugs generating more than 120 percent of expected sales

Company size based on annual revenue at the time of each product launch:

- Small: Less than US$1 billion

- Medium: Between US$1 and US$25 billion

- Large: Greater than US$25 billion

Definitions

- Launch year or year 1: The year of a product launch or immediately following it

- Specialty drugs: Drugs categorized as specialty by major payers in our analysis

- Orphan drugs: Drugs receiving the orphan drug designation from the FDA

- Rare disease: Diseases with extremely low prevalence (fewer than 6.37 in 10,000 people)

For additional details about the methodology, please refer to the appendix.

Key findings

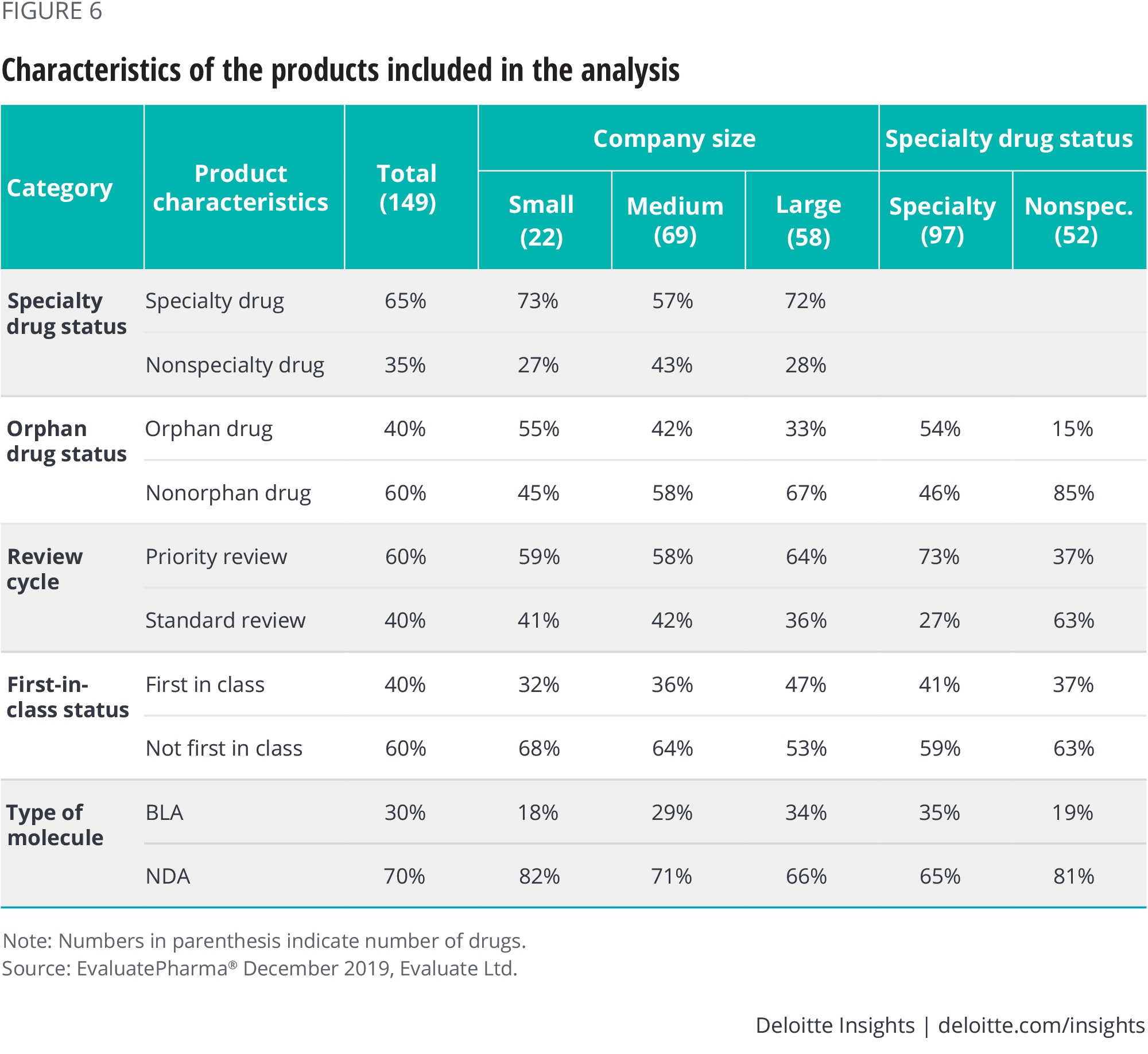

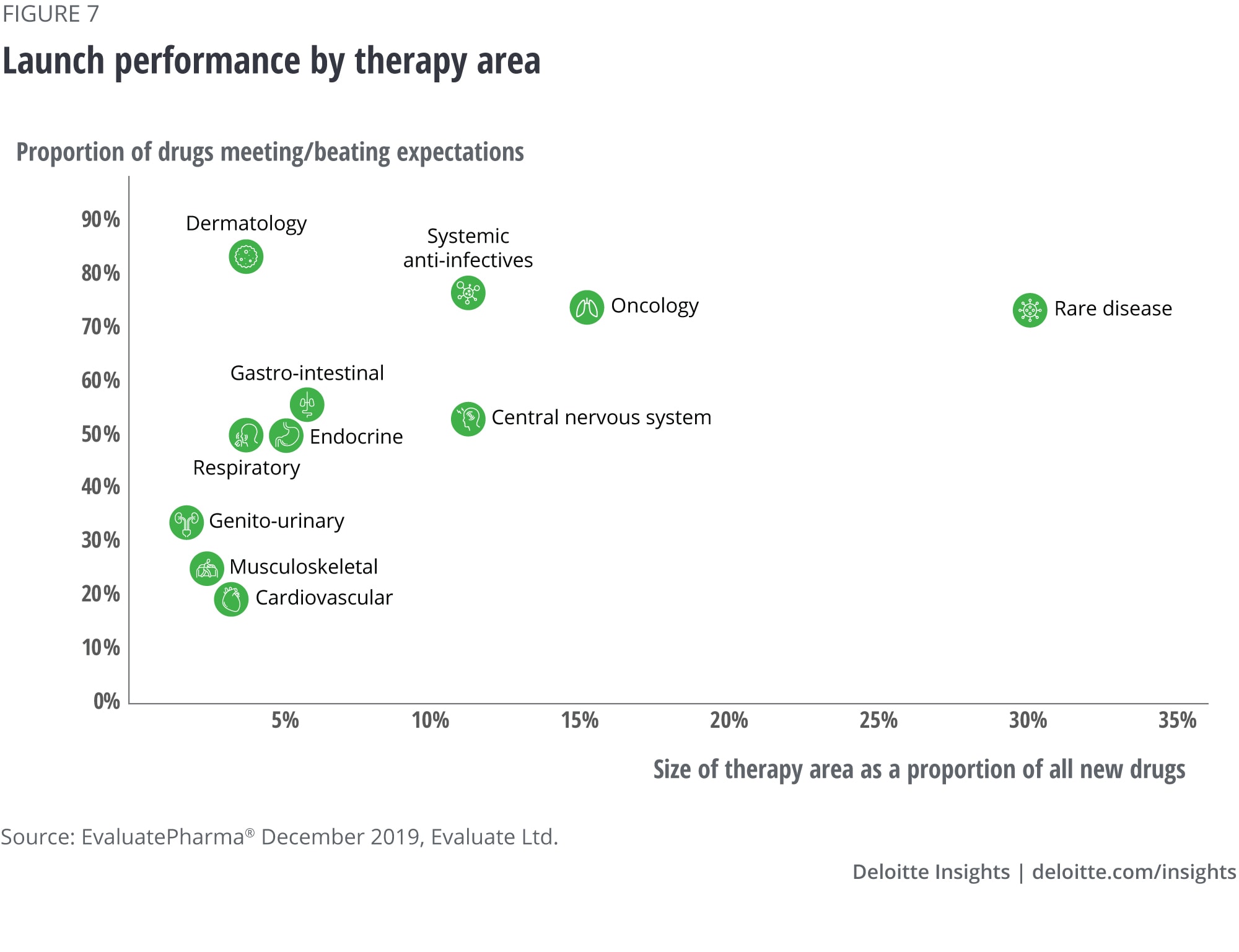

Most of the new drugs launched in the United States between 2012 and 2017 were specialty drugs (65 percent); a large number received priority review (60 percent), while a sizeable portion were for treatment of orphan diseases (40 percent). Three in 10 (30 percent) products were approved for rare diseases (figures 6 and 7 in the appendix).

Finding No. 1: There is a large variability in launch performance

While more than one-third (36 percent) of the drugs underperformed in the first year following launch, about half (48 percent) beat analyst expectations. Notably, one in four (26 percent) of all drugs far exceeded expectations, generating more than twice the expected sales (figure 1). The smallest proportion of drugs (16 percent) fell in the middle: meeting expectations within a 20 percent margin.

Finding No. 2: Performance in the first year sets the tone for long-term product outlook

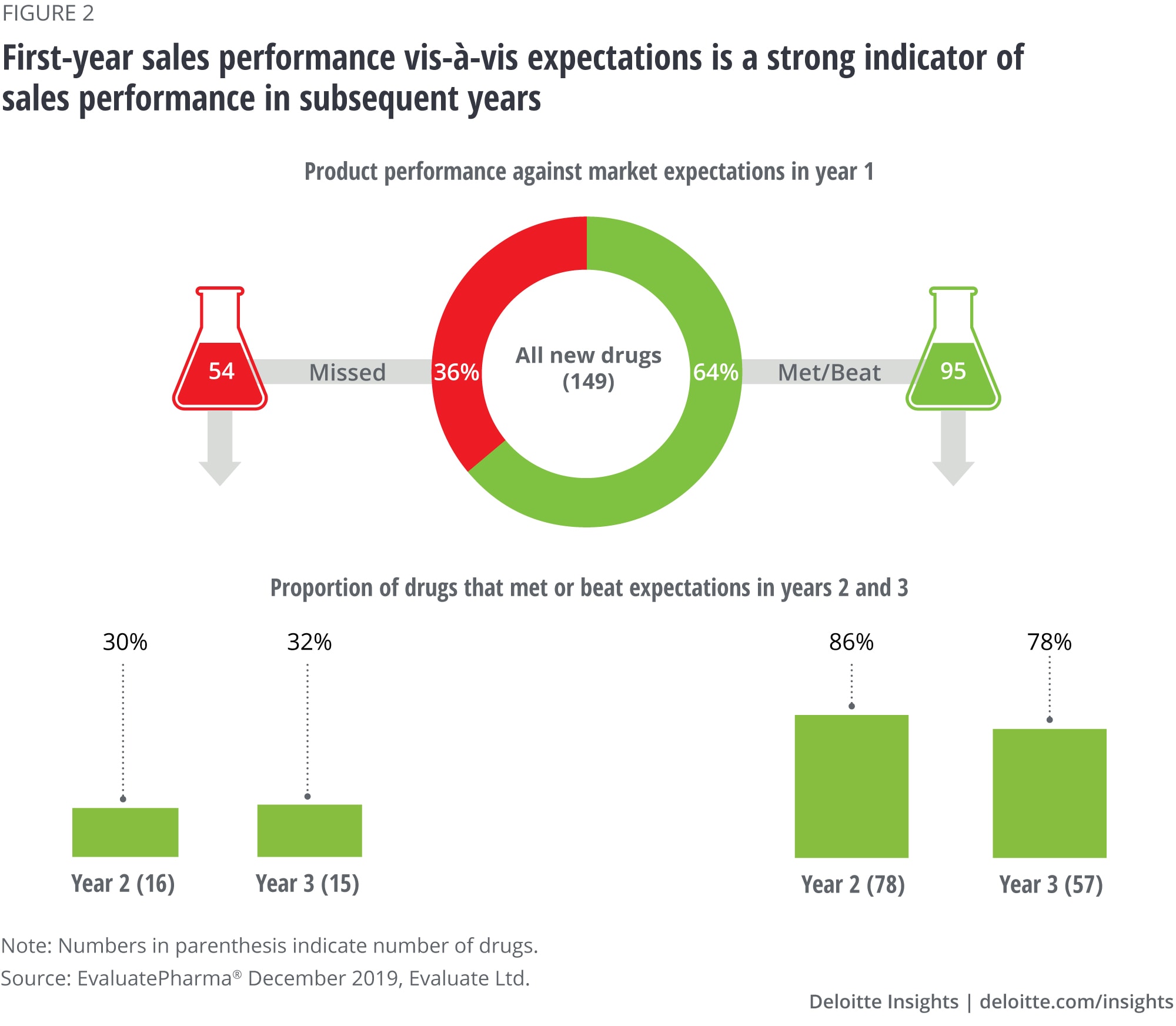

Our analysis of the impact of the launch year on future performance revealed that:

- Of the 64 percent of drugs with a strong performance in the first year, 86 percent and 78 percent continued to meet or beat analyst expectations in year 2 and year 3, respectively.

- Of the 36 percent of drugs that missed expectations at launch, 70 percent and 68 percent also missed expectations in year 2 and year 3, respectively, and only about 30 percent managed to reverse course (figure 2).

These results are consistent with prior studies that found that if a product fails to meet launch year expectations, its probability of recovering revenue in subsequent years declines sharply.3 Given that the average time frame from launch to peak sales is about five years and continues to shrink, the importance of the launch year for the overall product life cycle will continue to grow.4

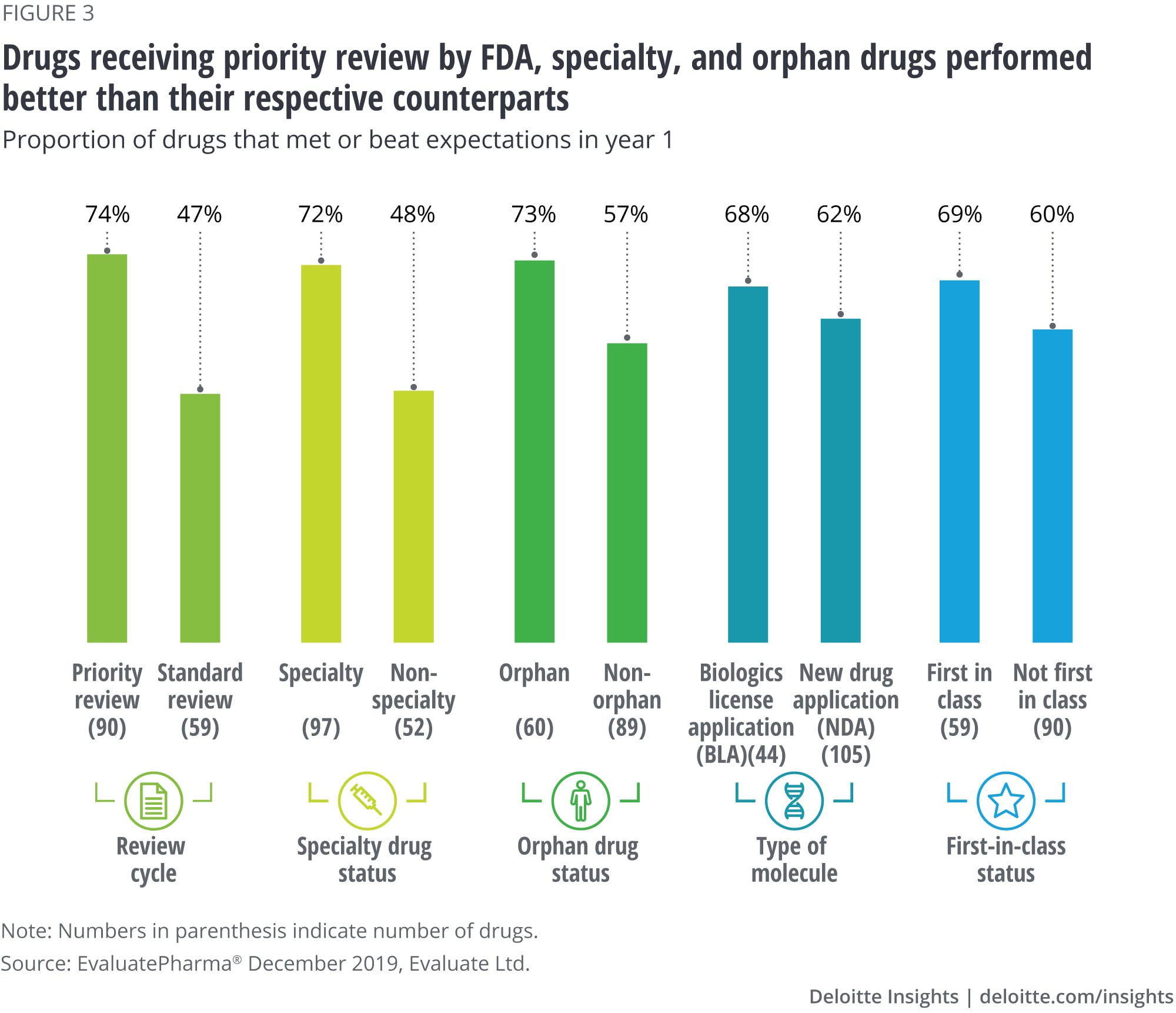

Finding No. 3: Three product characteristics are strongly associated with launch performance

Our analysis identified three product characteristics that have statistically significant associations with the likelihood of meeting or beating analyst sales forecasts: products receiving priority review by the FDA, specialty drugs, and orphan drugs. Two other product features have a positive but not statistically significant relationship with product performance at launch: first-in-class and biologics (figure 3).

Priority review: Three in four (74 percent) priority review drugs and less than half (47 percent) standard review drugs met or beat expectations in year 1. The priority review designation from the FDA not only allows a shorter regulatory review cycle but also communicates to the market an expectation for significant advancement over existing therapies for a serious condition. In our study, most of the drugs receiving priority review (79 percent) were also specialty products.

Specialty: Seventy-two percent of specialty drugs and 48 percent of nonspecialty drugs met or beat expectations at launch. Specialty drugs are typically prescribed by specialists and have distinct handling, administration, and monitoring requirements. They often garner higher prices than nonspecialty medicines and many use a limited distribution model. In our study, the average three-year revenue from a specialty drug was in excess of US$1 billion, more than double the revenue from a nonspecialty product. This makes specialty an attractive area for pharma companies and accounts for a growing share of industry revenues and pipeline assets.5

Orphan: A higher proportion of orphan drugs (73 percent) compared to nonorphan drugs (57 percent) met or beat analyst forecasts for year 1. Again, there is considerable overlap between orphan and specialty products: Eighty-seven percent of orphan drugs happen to be specialty products. The Orphan Drug Act provides tax incentives and extended market exclusivity for pharma companies that develop medicines to treat small patient populations. 6 Research shows that manufacturers are able to charge premium prices for orphan drugs: In 2018, the average price for orphan drugs was 4.5 times higher than nonorphan drugs.7 Moreover, given small patient populations, payers tend to be less inclined to limit market access. The higher profitability and a longer exclusivity period8 have attracted commercial interest from pharma companies and resulted in a significant growth in the number of orphan drug approvals in recent years.9

Finding no. 4: Large companies’ products are less likely to meet market expectations than products from smaller companies

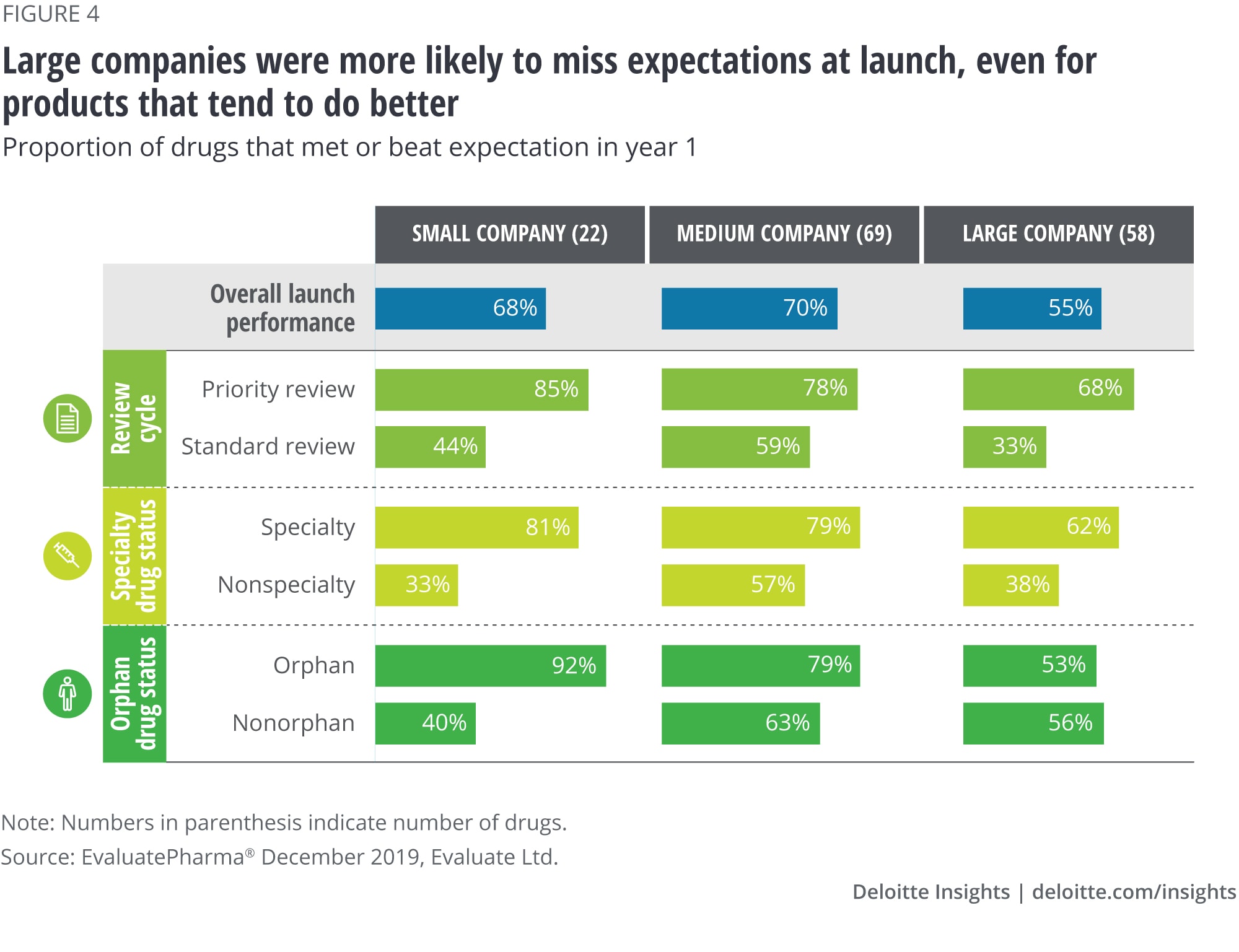

We found that drugs launched by large companies underperform compared to those launched by small and medium-sized companies, even when controlling for product characteristics.

As figure 4 shows, the observed differences are greatest for orphan drugs. Small and medium-sized companies outperform large companies for orphan drug launches: Ninety-two percent of orphan drugs launched by small companies and 79 percent launched by medium-sized companies met or beat expectations, compared to only about half (53 percent) of orphan drugs launched by large companies.

A possible explanation for the relatively better performance of smaller companies is that they may have a clearer focus and deeper expertise in a specific disease area, which contributes to a keen understanding of the market and credibility with the clinician and patient community. Although large companies have more resources and access to talent, multiple launch teams compete for these resources, cross-functional coordination is often lacking, and not all launches receive the same amount of attention. This phenomenon may be even more pronounced in companies with a diverse product portfolio spread across multiple therapeutic areas. Recognizing this challenge, many large pharma companies are reorganizing themselves around a smaller set of specific therapy areas to develop greater depth as opposed to breadth.10

Finding No. 5. Market access is the top reason for missing expectations

The product and company characteristics from the previous four findings are not the only ones or even the most important determinants of success. To understand what stands in the way of a successful launch, we reviewed analyst reports that discussed the launch performance of 50 (out of 54 total) drugs that missed expectations and for which information was available. Based on the frequency of mentions, the typical reasons for missing expectations fell into six broad categories outlined in figure 5, and for most drugs, multiple reasons were mentioned.

- Limited market access: Half (50 percent) of the analyzed products that missed first-year forecasts had issues with market access. This included unfavorable placement or exclusion from formulary, use of formulary restrictions like step edits, high price and patient cost-sharing, weak health-economic evidence to support the price, or higher than expected expenses on discounts and rebates.

- Inadequate understanding of market and customer needs: Nearly half (46 percent) of the launches that missed did so because of a lack of understanding of the types of patients who would respond well or the types of physicians who would be high versus low prescribers for the new drug, or underestimated the difficulty of converting customers (physicians and patients) from existing therapies, particularly in competitive drug classes or when generic treatments were available.

- Poor product differentiation: Forty-four percent missed expectations because the product’s proposition did not offer compelling enough value to physicians or patients, or product formulation (inconvenient dosing, need for titration, or in-office administration), created hurdles that in customers’ minds were not offset by the additional clinical benefit. This may reflect the tendency to progress the product through clinical development at the expense of eroding target product profile criteria, rather than ensuring the product meets the criteria needed for commercial success.

- Unfavorable safety profile: A little over a third (36 percent) of the misses were due to an unexpected finding in a clinical trial, resulting in a black box warning or physician reluctance to prescribe. In some instances, the uncovered safety concerns were class effects that could have been expected.

- Low prioritization or insufficient resource allocation: In 24 percent of launches that missed expectations, analysts called out inadequate sales force deployment, not having support programs in place to help early adopters with prior authorization hurdles, or leaving out large segments of prescribers from awareness and education campaigns until later. We believe our estimate for this category is on the low side, as these issues can be less apparent to industry analysts.

- Unexpected events: Six percent of cases mentioned patent litigation or manufacturing delays due to plant closure as the reason for the miss.

Deloitte’s client experience suggests that large companies might be more prone to these mistakes. In addition to having deep functional silos, it may be easy for them to fall into the following pitfalls: believing that they already understand the market from adjacent products, employing a one-size-fits-all approach to launch or replaying what worked before, or presuming that the learning curve is short for existing staff to build expertise in a new disease, therapy area, or market.

The case study (see sidebar, “Clinical superiority alone does not guarantee success”) illustrates the interplay among different reasons for missing expectations and articulates a few principles for a successful launch.

Clinical superiority alone does not guarantee success

Product X was a first-in-class agent from a large pharmaceutical company in a crowded cardiology market. The initial expectations for Product X were high due to its impressive clinical trial data, improved efficacy over the standard of care, and significant reduction in indication-associated acute events. However, early commercial results were disappointing, registering only one-tenth of industry analysts’ revenue forecasts. The product stumbled on multiple fronts.

- Payers: Despite the product’s widely recognized efficacy (defined as clinical superiority), Medicare plans—which cover almost 66 percent of cardiology patients—were slow to cover it and sought data that substantiated the cost of treatment. When payers did in fact cover it, they placed it on a high tier and/or included utilization management requirements, so patient cost-sharing was often high. Eight months after launch, the company entered into outcomes-based arrangements with select payers, which led to improved market access.

- Physicians: The company underestimated physicians’ reluctance to switch patients and went to market with only a modest sales force.

- Patients: The absence of an early direct-to-consumer advertising campaign resulted in little awareness and, thus, demand from consumers. Although sales increased 10 times by the third year, the company could have avoided the delay in initial formulary coverage by engaging payers prior to launch.

This case example demonstrates that in the current landscape, a robust clinical profile is not enough; a sophisticated economic value proposition is a critical requirement to bring the payer community on board. Real-world data is essential for gaining a place in treatment guidelines and influencing physician practice. And an impactful marketing plan to educate physicians and consumers about the new drug is necessary to overcome inertia and facilitate adoption of the new standard of care.

Getting it right: Revamping product launches

In our view, many factors contributing to missing expectations can be mitigated with meticulous planning, innovative approaches to market intelligence and customer engagement, and disciplined execution. Here’s what can be done:

End-to-end strategic planning

- Identify a set of therapy areas where the company can be a market leader, build long-term relationships, and gain a competitive advantage. This could require a thorough understanding of unmet customer needs, disease areas and adjacent opportunities, customer values, and behaviors.11

- Break down internal silos, ensure cross-functional input around market needs, and align functional and enterprise goals around these needs.

- Ensure business development activities support and reinforce the therapy area strategy.

Portfolio strategy

- Rigorously estimate potential product value: Develop a methodology to define the probability of technical, regulatory, and market access success for each product. Build rigorous epidemiology and forecasting models, and apply risk scoring to assess product value and make strategic choices.

- Revisit incentives to minimize tension between functional and enterprise goals and to encourage bold decisions (e.g., to end a clinical development program).

Innovative approaches to market intelligence and stakeholder engagement

- Take advantage of real-world data and digital tools to more accurately and efficiently size the market potential, and to define impacted patient populations, key stakeholders, influencers, and decision-makers. Develop a customer segmentation approach and identify priority segments.

- Consider the perspectives of different types of payers (commercial, government, providers as payers), positioning for different benefit designs (medical versus pharmacy), and opportunities to take on risk.12

- Seek early input on the target product profile from payers and other stakeholders, understand what endpoints matter and which ones would be required for preferred access and quick adoption, and include these as clinical trial endpoints.

- Be prepared to help payers identify subpopulations where the drug will work best, and have a plan to generate real-world evidence to back it up.

Disciplined execution

- Establish a cross-functional approach to launch execution that balances consistency and flexibility. Ensure collaboration among functions, adequate staffing, and timely deployment of resources.

- Clearly articulate customer value proposition and points of differentiation across customer types and segments (e.g., patient, caregiver, physician, payer, institutional buyer).13

- Focus on priority segments (e.g., large customers and/or early adopters) or geographies.

- Anticipate launch risks by building a deep understanding of success factors and potential risks, proactively mitigate or minimize risks, and include contingency plans.

- Monitor performance using consistent metrics across the product portfolio.

The increasing diversity of product types and the market segments they serve calls for comprehensive disease area expertise, deep relationships with the clinician and patient community, a thorough understanding of the value drivers for key stakeholders (especially payers), and a nimble launch execution. Companies with these capabilities will be well-positioned to improve their overall launch performance.

Appendix: About the study

Study methodology

The study included all new drugs approved in the United States between 2012 and 2017 for which data was available in EvaluatePharma. Drugs with low actual sales (less than US$50 million over the first three years), diagnostic agents, and biosimilars were excluded from the project scope.

For this analysis, we considered analyst forecasts to be a general reflection of market expectations for new products and used historical consensus forecasts, as identified by EvaluatePharma, issued at the time of FDA approval. Later revisions to the original forecasts based on actual sales were not considered.

Actual sales and analyst projections for the United States were captured for three years. Year 1 (launch year) is considered from the first year when sales data was reported by the company. For products approved and launched in the last quarter of any calendar year, we treated the following calendar year as year 1 (or launch year): For example, for products approved and launched in the fourth quarter of 2012, 2013 is year 1 in our analysis.

In case of product transfer or company acquisition, actual sales data is captured from both the originator and the acquiring company, while company characteristics are from the company responsible for product launch.

We used the chi-square test to measure statistical significance between comparison groups.

To identify the reasons for missing analyst expectations, we used analyst reports from Thomson One and news reports from Vantage (EvaluatePharma). The information in the reports was available for 50 out of 54 drugs that missed expectations.

Criteria and definitions used in the study

Performance against analyst expectations:

- Missed: Drugs generating up to 80 percent of expected sales

- Met: Drugs generating between 80 to 120 percent of expected sales

- Beat: Drugs generating more than 120 percent of expected sales

Company size based on annual revenue at the time of each product launch:

- Small: Less than US$1 billion

- Medium: Between US$1 and US$25 billion

- Large: Greater than US$25 billion

New drugs: New molecular drug entities (NMEs), including New Drug Applications (NDAs) and Original Biologics License Applications (BLAs) approved by the FDA between 2012–17

Specialty drugs: Drugs classified as specialty by major payers14

Orphan drugs: Drugs whose initial indications received orphan designation from the FDA

Rare disease: Diseases with extremely low prevalence (fewer than 6.37 in 10,000 people)15

Descriptive data

Figure 6 details product characteristics for the drugs included in our study and figure 7 shows launch performance by therapy area and the size of the therapy area as a share of all new drugs.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

© 2021. See Terms of Use for more information.

Explore more on life sciences

-

Winning in the future of medtech Article5 years ago

-

Striving to become more patient-centric in life sciences Article5 years ago

-

Forces of change in health care Article5 years ago

-

Radical interoperability Article5 years ago

-

What will health look like in 2040? Video5 years ago