Made in America: The economic impact of LNG exports from the United States has been saved

Made in America: The economic impact of LNG exports from the United States A report by the Deloitte Center for Energy Solutions and Deloitte MarketPoint LLC

25 January 2013

- The Deloitte Center for Energy Solutions, Deloitte MarketPoint

United States LNG exporters might benefit from selling to foreign buyers, but how would such exports impact domestic consumers of natural gas?

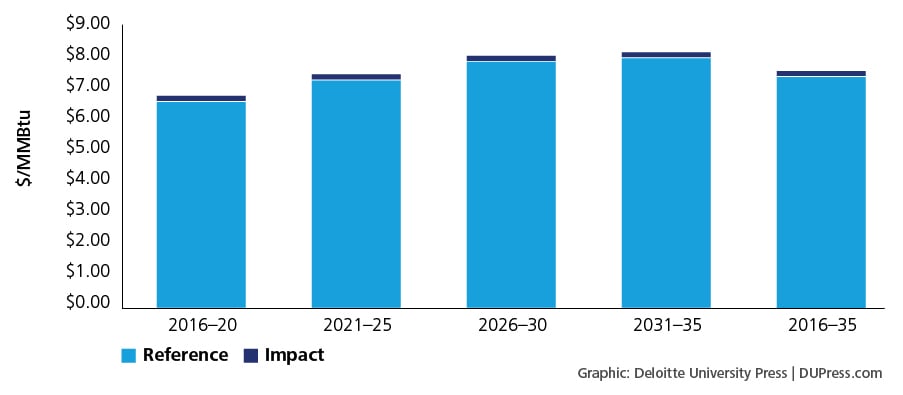

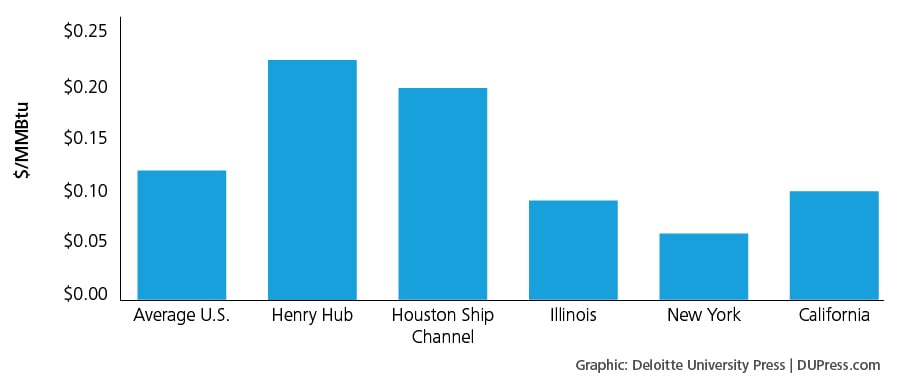

Deloitte MarketPoint applied its integrated North American Power, Coal, and World Gas Model to analyze the price and quantity impacts of LNG exports on the U.S. gas market. Given the model’s assumptions, the World Gas Model projects a weighted-average price impact of $0.12/MMBtu on U.S. prices from 2016 to 2035 as a result of the 6 Bcfd of LNG exports. The $0.12/MMBtu increase represents a 1.7 percent growth in the projected average U.S. citygate gas price of $7.09/MMBtu over this time period. The projected impact on Henry Hub price is $0.22/MMBtu, significantly higher than the national average because of its close proximity to the prospective export terminals. The projected price impacts diminish with distance away from the Gulf. Distant market areas’ projected price impacts are less than $0.10/MMBtu. Focusing solely on the Henry Hub or regional prices around the export terminals will greatly overstate the total impact on U.S. consumers.

The results show that the North American gas market is dynamic. If exports can be anticipated, then producers, midstream players, and consumers can act to mitigate the price impact. Producers will bring more supplies online, flows will be adjusted, and consumers will react to price change resulting from LNG exports.

Deloitte MarketPoint LLC (“DMP”) is pleased to provide an independent assessment of the potential economic impacts of LNG exports from the United States. Exporters might benefit from selling to foreign buyers, but how would such exports adversely impact domestic consumers of natural gas? Increased competition for supplies and accelerated resource depletion will likely raise domestic prices, but by how much? Will the level of exports being considered raise prices enough to cause economic damage as some objectors contend? After all, natural gas is a depletable resource, and what is exported is made unavailable to domestic uses. Under the assumptions outlined in this paper, we shall see that the magnitude of domestic price increase that results from export of natural gas in the form of LNG is likely quite small.

Some arguments in support of or objecting to LNG exports center around whether there are adequate resources to meet both domestic consumption and export volumes. That is, does the United States need the gas for its own consumption or does it possess sufficiently abundant gas volumes to provide for both domestic consumption and exports? In our view, this question only begins to address the export issue because simple comparisons of total available domestic resources to projected future consumption are insufficient to adequately analyze the economic impact of LNG exports. We believe the real issue is not only one of volume, but more of price impact. If price is not significantly affected, then scarcity and shortage of supply are not significant issues.

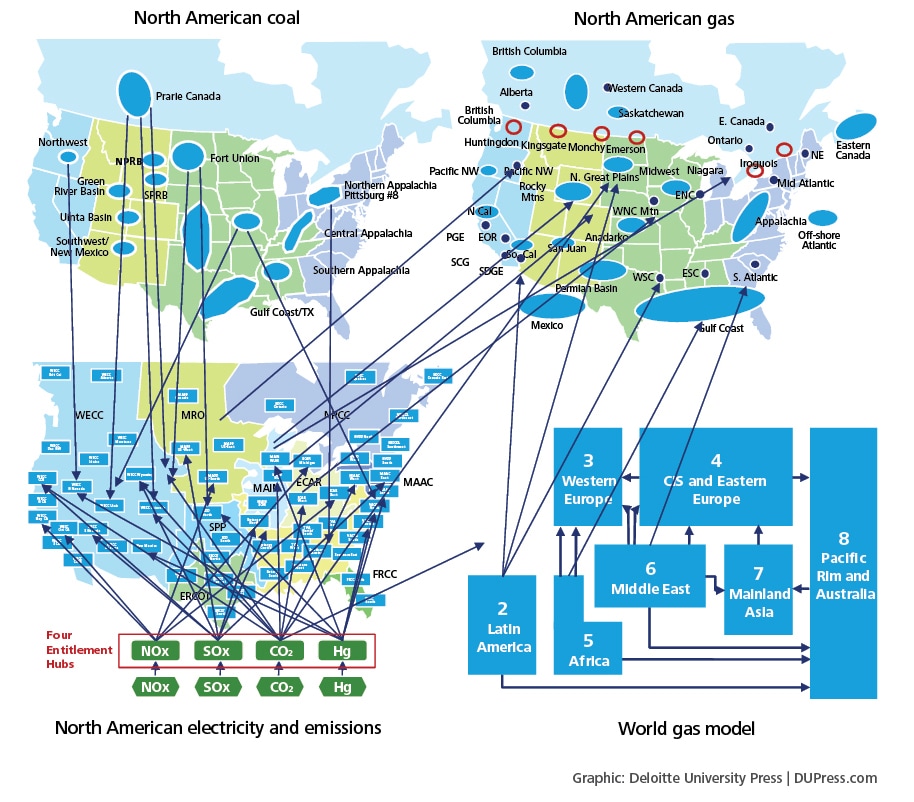

DMP applied its integrated North American Power, Coal, and World Gas Model (“WGM” or “Model”) to analyze the price and quantity impacts of LNG exports on the U.S. gas market.1 The WGM projects monthly prices and quantities over a 30-year time horizon based on rigorous adherence to accepted microeconomic theories. It includes disaggregated representations of North America, Europe, and other major global markets. The WGM computes prices and quantities simultaneously across multiple markets and across multiple time points. Unlike many other models which compute prices and quantities assuming all parties work together to achieve a single global objective, the WGM applies fundamental economic theories to represent self-interested decisions made by each market “agent” along every stage of the supply chain. More information can be obtained from DMP.

Shale gas production has grown tremendously over the past several years. However, there is considerable debate as to how long this trend will continue and how much will be produced out of each shale gas basin. Rather than simply extrapolating past trends, the WGM projects production-based resource volumes and cost, future gas demand, particularly for power generation, and competition among various sources in each market area. It computes incremental sources to meet a change in demand and the resulting impact on price. Based on our existing model and assumptions, which we will call the “Reference Case,” we developed a second case, which we will call the LNG Export Case, to assess the impact of LNG exports. Both cases are identical except for the LNG export volumes. In the LNG Export Case we represented 6 billion cubic feet per day (Bcfd) of LNG exports, approximately equal to the total volume of the three LNG export applications at Sabine Pass, Freeport, and Lake Charles LNG terminals. Since the WGM already represented these import LNG terminals, we only had to represent exports as incremental demands, each with a constant of 2 Bcfd demand, near each of the terminals. Comparing results of this second case to the Reference Case, we projected how much the exports would increase domestic prices and affect production and flows. Given the model’s assumptions, the WGM projects a weighted average price impact of $0.12 per million British thermal units (MMBtu) on U.S. prices from 2016 to 2035 as a result of the 6 Bcfd of LNG exports. The $0.12/MMBtu increase represents a 1.7 percent growth in the projected average U.S. citygate gas price of $7.09/MMBtu over this time period. The projected impact on Henry Hub price is $0.22/MMBtu, significantly higher than the national average because of its close proximity to the prospective export terminals. The projected price impacts diminish with distance away from the Gulf. Distant market areas’ projected price impacts are less than $0.10/MMBtu, such as the New York and Chicago areas. Focusing solely on the Henry Hub or regional prices around the export terminals will greatly overstate the total impact on the U.S. consumers. The results show that the North American gas market is dynamic. If exports can be anticipated—and clearly they can with the public application process and long lead time required to construct an LNG liquefaction plant—then producers, midstream players, and consumers can act to mitigate the price impact. Producers will bring more supplies online, flows will be adjusted, and consumers will react to price change resulting from LNG exports.

Deloitte MarketPoint applied its integrated North American Power, Coal, and World Gas Model to analyze the price and quantity impacts of LNG exports on the U.S. gas market.

Gas prices in the eastern United States, historically the highest priced region in North America, could be dampened by incremental shale gas production within the region. Eastern bases to Henry Hub are projected to sink under the weight of surging gas production from the Marcellus Shale. The Marcellus Shale is projected to dominate the Mid-Atlantic natural gas market, including New York, New Jersey, and Pennsylvania, meeting most of the regional demand and pushing gas through to New England and even to South Atlantic markets. Pipelines built to transport gas supplies from distant producing regions—such as the Rockies and the Gulf Coast—to northeastern U.S. gas markets may face stiff competition. The expected result is displacement of volumes from the Gulf, which would depress prices in the Gulf region. Combined with the growing shale gas production out of Haynesville and Eagle Ford, the Gulf region is projected to continue to have plentiful production and remain one of the lowest cost regions in North America.

Overview of Deloitte MarketPoint Reference Case

The WGM Reference Case assumes a “business as usual” scenario, including no new CO2 emission regulations for power plants and no new regulations for hydrofracking operations in shale gas production. U.S. gas demand growth rates are consistent with the U.S. Energy Information Administration’s (“EIA”) Annual Energy Outlook (“AEO”) 2011 projection, except for power generation, which is based on the DMP electricity model. (There is no intended advocacy or prediction of any events. Rather, we use these assumptions as a frame of reference. The impact of LNG exports could easily be tested against other scenarios, but the overall results would be rather similar for reasons articulated later in this document.)

In the Reference Case, natural gas prices are projected to rebound from current levels and continue to strengthen over the next two decades, although nominal prices do not return to the peak levels of the mid-to-late 2000s until after 2020. In real terms (i.e., constant 2011 dollars), benchmark U.S. Henry Hub spot prices increase from an annual average of $4.15 per MMBtu in 2011 to $6.00 per MMBtu in 2020, before rising to $7.16 per MMBtu in 2030 in the Reference Case. Our Henry Hub price forecast for 2011-2035 averages $6.23. Bear in mind that this is the Reference Case, which includes no LNG exports.

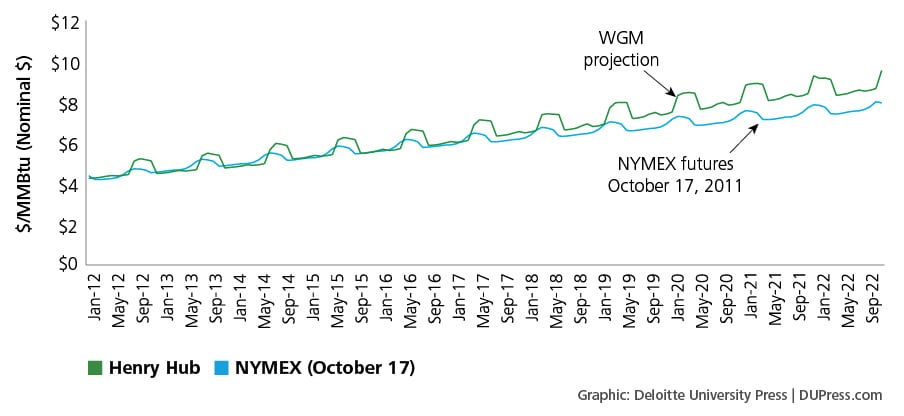

Escalating real prices by an annual inflation rate (estimated at 2.0 percent2) yields nominal prices, which can be compared to NYMEX futures prices. The WGM projection of monthly Henry Hub prices is compared to NYMEX futures prices as of October 17, 2011 in figure 1. Prices are shown in nominal terms (i.e., dollars of the day including inflation). Near-term projections are fairly consistent, but in the longer term, projected prices from the WGM rise significantly higher than the NYMEX futures prices. On an annual average, the projected prices are a dollar higher than the NYMEX futures prices in the longer term.

Figure 1. Comparison between projected Henry Hub and NYMEX futures prices

The WGM projects the U.S. power sector to increase by about 50 percent over the next decade, accounting for nearly all of the projected future growth. Based on assumptions in the WGM, gas will become the fuel of choice for power generation.

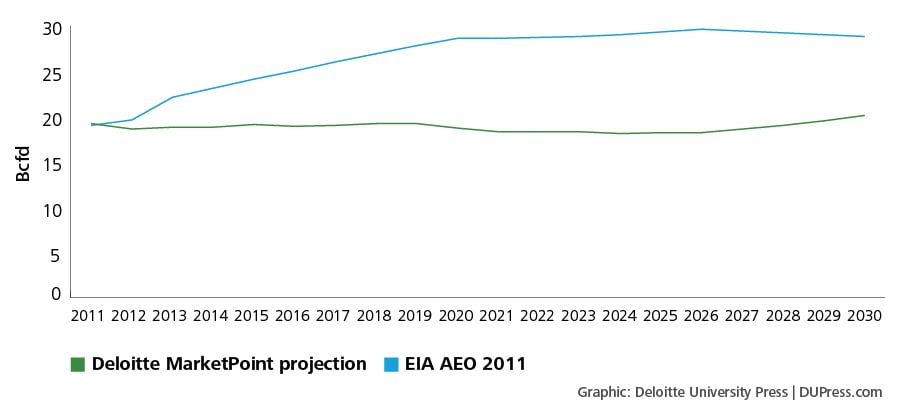

One possible reason why the WGM forecasts prices higher than market expectation (i.e., NYMEX futures) is because the WGM’s forecast of gas demand for power generation is considerably higher than the publicly available EIA forecast. Based on our electricity model projections, we forecast natural gas consumption for electricity generation to drive North American natural gas demand higher during the next two decades.

Figure 2. Diverse projections of the U.S. gas demand for power generation

As shown in figure 2, the DMP-projected gas demand for U.S. power generation is far greater than the demand predicted by EIA’s AEO 2011, which essentially forecasts no change. The WGM projects the U.S. power sector to increase by about 50 percent (approximately 10 Bcfd) over the next decade, accounting for nearly all of the projected future growth. Based upon assumptions in the WGM, gas will become the fuel of choice for power generation for a variety of reasons, including: tightening application of existing environmental regulations for mercury, NOx, and SOx; expectations of ample domestic gas supply at competitive gas prices; and the need to back up intermittent renewable sources such as wind and solar to ensure reliability. Like the EIA’s AEO, our projection does not assume any new carbon legislation in the Reference Case.

Our electricity model, fully integrated with our WGM and coal model, contains a detailed representation of the North American electricity system, including environmental emissions for key pollutants (CO2, SOx, NOx, and mercury). The integrated structure of the models is shown in figure 3. The electricity model projects electric generation capacity addition, dispatch, and fuel burn based on competition among different types of power generators given a host of factors, including plant capacities, fuel price, heat rates, variable costs, and environmental emissions costs. This integration captures global linkages and also inter-commodity linkages. Integrating gas and electricity is vitally important because U.S. natural gas demand growth is expected to be driven almost entirely by the electricity sector, which is predicted to grow at substantial rates.

Figure 3. DMP North American representation

Hence, the WGM projection will be less favorable to the gas question of LNG export than if we had assumed a lower gas demand. The higher gas demand will push projections of price and quantity impacts of LNG export to be more “conservative.” However, the real issue is not the absolute price of exported gas, but rather the price impact resulting from the LNG exports.

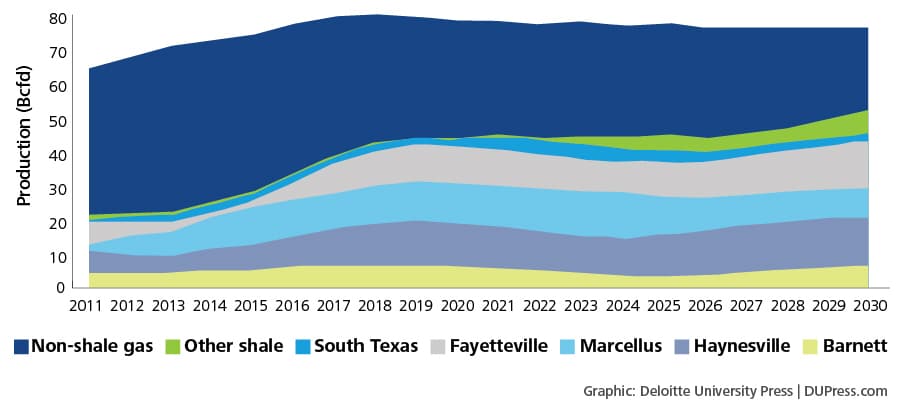

Buffering the price impact of LNG exports is the large domestic resource base, particularly shale gas, which we project to be an increasingly important component of domestic supply. As shown in figure 4, the Reference Case projects shale gas production, particularly in the Marcellus Shale in Appalachia and the Haynesville Shale in Texas and Louisiana, to grow and eventually become the largest component of domestic gas supply. Increasing U.S. shale gas output bolsters total domestic gas production, which grows from about 64 Bcfd in 2011 to almost 80 Bcfd in 2018 before tapering off.

The projected growth in production from a large domestic resource base is a crucially important point. Many upstream gas industry observers today believe that there is a very large quantity of gas available to be produced in the shale regions of North America at a more or less constant price. This would imply that they also believe that natural gas supply is highly “elastic,” that is, the supply curve is very flat.

Gas production in Canada is projected to decline over the next several years, reducing exports to the United States and continuing the recent slide in production out of the Western Canadian Sedimentary Basin. However, Canadian production is projected to ramp up in the later part of this decade with increased production out of the Horn River and Montney shale gas plays in western Canada. Further into the future, the Mackenzie Delta pipeline may begin making available supplies from northern Canada.

Increased Canadian production makes more gas available for export to the United States. The North American natural gas system is highly integrated so Canadian supplies can generally access U.S. markets when economical. This increase in available gas for export to the U.S. could be supplemented even more if the Alaskan Gas Pipeline were to penetrate Alberta, but that would likely not happen within the time horizon of this scenario and is thus not considered. Increasing production from major shale gas plays, many of which are not located in traditional gas-producing areas, is projected to transform historical basis relationships during the next two decades. Varying rates of regional gas demand growth, the advent of new natural gas infrastructure, and evolving gas flows may also contribute to changes in regional basis, though to a lesser degree. This is a very important point as well. If LNG is exported from one particular geographic point, the entire eastern part of the United States reorients production and flows and basis differentials change substantially. Basis differentials are not fixed and invariant to LNG exports or other demand changes. On the contrary, basis differentials adjust to LNG volumes and help ensure economically efficient backfill and efficient prices. The advent of large quantities of shale gas in heretofore nonproducing areas will cause the basis to those areas to fall. The increased supply will also make more gas available for export and help mitigate the price increases due to exports. Most notably, gas prices in the eastern United Sates, historically the highest priced region in North America, could be dampened by incremental shale gas production within the region. Eastern bases to Henry Hub are projected to sink under the weight of surging gas production from the Marcellus Shale. The Marcellus Shale is projected to dominate the Mid-Atlantic natural gas market, including New York, New Jersey, and Pennsylvania, meeting most of the regional demand and pushing gas through to New England and even to South Atlantic markets. Pipelines built to transport gas supplies from distant producing regions—such as the Rockies and the Gulf Coast—to northeastern U.S. gas markets may face stiff competition. The expected result is displacement of volumes from the Gulf, which would depress prices in the Gulf region. Combined with the growing shale gas production out of Haynesville and Eagle Ford, the Gulf region is projected to continue to have plentiful production and remain one of the lowest cost regions in North America.

Figure 4. U.S. gas production by type

Given our basic assumptions, the WGM projects LNG exports will cause a volume-weighted average price impact of $0.12/MMBtu on U.S. citygate prices from 2016 to 2035 as a result of the assumed 6 Bcfd of LNG exports out of the three Gulf Coast terminals. The $0.12/MMBtu increase represents a 1.7 percent growth in the projected average U.S. citygate gas price of $7.09/MMBtu over this time period. The projected increase in Henry Hub gas price is $0.22/MMBtu during this period. It is important to note the variation in price impact by location. The WGM projects that the impact at the Henry Hub will be much greater than the impact in other markets more distant from export terminals.

Potential impact of LNG exports

Given our basic assumptions, the WGM projects LNG exports will cause a volume-weighted average price impact of $0.12/MMBtu on U.S. citygate prices from 2016 to 2035 as a result of the assumed 6 Bcfd of LNG exports out of the three Gulf Coast terminals. The $0.12/MMBtu increase represents a 1.7 percent growth in the projected average U.S. citygate gas price of $7.09/MMBtu over this time period. The projected increase in Henry Hub gas price is $0.22/MMBtu during this period. It is important to note the variation in price impact by location. The WGM projects that the impact at the Henry Hub will be much greater than the impact in other markets more distant from export terminals. To put the impact in perspective, figure 5 shows the price impact on top of projected Reference Case U.S. average citygate prices over a 20-year period. The height of both bars represents the projected price with LNG exports. The WGM’s projected price impact might not be as large as some might expect because that is not what they observe in the short term. For example, even a 1 Bcfd increase in demand during a peak winter day can cause spot prices to shoot up. However, in this analysis we are considering long-term impacts, when changes in supply and demand can be anticipated. Unlike short-term markets, in which supply and demand are both largely fixed, both supply and demand are far more elastic in the long term. Producers can develop more reserves in anticipation of demand growth, such as LNG exports. Indeed, LNG export projects will likely be backed by long-term supply contracts, as well as long-term contracts with buyers. There will be ample notice and time in advance of the exports to make supplies available. The price impact is then determined by how supply costs will change as a result of more rapid depletion of domestic resources. As previously stated, the projected impact of LNG exports on price varies by location, as shown in figure 6. The price impact attenuates with distance from the LNG export terminals. The impact is greatest at the Henry Hub, situated near all of the export terminals, about $0.22/MMBtu on average from 2016 to 2035. The impact at the Houston Ship Channel is nearly as much, about $0.20/MMBtu. By the time you move to downstream markets, such as Illinois, New York, and California, the projected price impact is generally about $0.10/MMBtu or less. If we weight the price impact in each market by the volume of gas demand, we can compute a weighted average price impact of $0.12/MMBtu for the United States. This analysis illustrates the interconnectivity of the North American system and the need to analyze not only Henry Hub and other price points near export terminals, but prices throughout the U.S. in order to fairly gauge the impacts from LNG exports. Analyses that focus just on Henry Hub prices will likely overstate the impact.

Figure 5. Impact of LNG exports on average U.S. citygate gas prices

Figure 6. Price impact varies by location (average 2016–35)

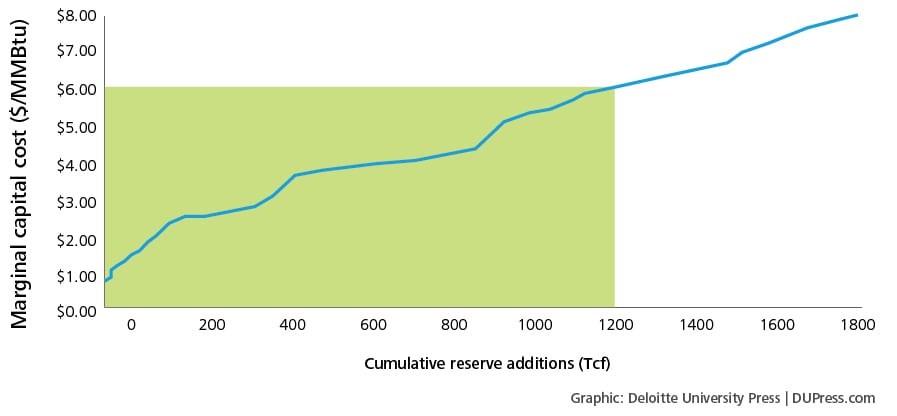

Figure 7 shows the aggregate U.S. supply curve, including Alaska and all types of gas formations, assumed in the WGM. It plots the volumes of reserve additions available at different all-in marginal capital costs, including financing, return on equity, and taxes. The marginal capital cost is equivalent to the wellhead price necessary to induce a level of investment required to bring the estimated volumes on line. The WGM includes over 100 different supply nodes representing the geographic and geologic diversity of domestic supply basins. The supply data is based on publicly available documents and discussions with credible sources such as the United States Geological Survey, National Petroleum Council, Potential Gas Committee, and the Department of Energy’s EIA. The area of the supply curve that matters most is the section below $6/MMBtu of capital cost because wellhead prices are projected to fall under this level during most of the time horizon considered. These are the volumes that are projected to be produced over the next couple of decades. The Reference Case estimates about 1,200 trillion cubic feet (Tcf) available at wellhead prices below $6/MMBtu. To put the LNG export volumes into proper perspective, it will accelerate depletion of the domestic resource base, estimated to include about 1,200 Tcf at prices below $6/MMBtu in all-in capital cost, by 2.2 Tcf per year (equivalent to 6 Bcfd). Alternatively, the 2.2 Tcf represents an increase in demand of about 8 percent to the projected demand of 26 Tcf by the time exports are assumed to commence in 2016. The point is not to downplay the export volume, but to put exports into perspective versus the overall available supply base. The results of this analysis demonstrate that the magnitude of the assumed total LNG exports is substantial on its own, but not very significant relative to the entire U.S. resource base or total U.S. demand. In the WGM, supply and price are inextricably linked. With regard to the potential impact of LNG exports, the absolute price is not the driving factor but rather the shape of the aggregate supply curve that determines the price impact. Figure 8 depicts how demand increase affects price. Incremental demand pushes out the demand curve, causing it to intersect the supply curve at a higher point. Since the supply curve is fairly flat in the area of demand, the price impact is fairly small. The massive shale gas resources have flattened the U.S. supply curve. It is the shape of the aggregate supply curve that really matters.

Figure 7. Aggregrate U.S. natural gas supply curve

Figure 8. Impact of higher demand on price

If that is the case, leftward and rightward movements in the demand curve (where such leftward and rightward movements would be volumes of LNG export) cut through the supply curve at pretty much the same price. Flat, elastic supply means that the price of domestic natural gas is increasingly and continually determined by supply issues (e.g., production cost). Given that there is a significant quantity of domestic gas available at modest production costs, the export of 6 Bcfd of LNG should not significantly increase the price of domestic gas because it should not dramatically increase the production cost of domestic gas.

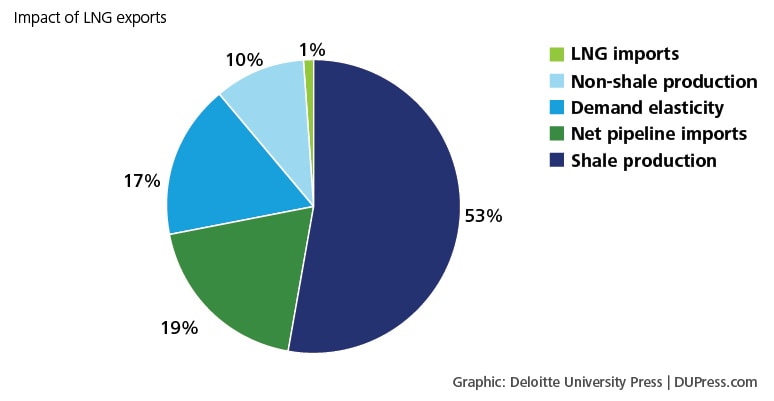

The projected sources of incremental supply used to meet the assumed export volumes come from multiple sources, including domestic resources (both shale gas and non-shale gas), import volumes, and demand elasticity. As shown in figure 9, the bulk of the incremental volumes come from shale gas production. Including non-shale gas production, the domestic production contributes 63 percent of the total incremental volume. Net pipeline imports, comprised mostly of imports from Canada, contribute another 19 percent. Higher U.S. prices would be expected to induce greater Canadian production, primarily from Horn River and Montney shale gas resources, making gas available for export to the United States. The U.S. net exports to Mexico decline slightly as higher cost of U.S. supplies will prompt more Mexican production and reduce the need for U.S. exports to Mexico. Higher gas prices are also projected to trigger demand elasticity, so less gas is consumed, representing about 17 percent of the incremental volume. Most of the reduction in gas consumption comes from the power sector as higher gas prices incentivize greater utilization of generators burning other types of fuels.

Figure 9. Project sources of incremental volume

Finally, there is a small increment—1 percent—coming from LNG imports. Having both LNG imports and exports is not necessarily contradictory since there is variation in price by terminal (e.g., Everett terminal near Boston historically has much higher prices than the Gulf terminals) and by time. The WGM projects seasonal arbitrage of global LNG flows. U.S. LNG imports are expected to be higher during summer periods as LNG shippers take advantage of plentiful storage capacity and large summer load for power generation in the United States and weaken during the winter when European and Asian demands peak. An important point to bear in mind is that the North American natural gas market is highly integrated and all segments will work together to mitigate price impacts of demand changes.

Responses to concerns about LNG exports

In response to LNG export applications to the DOE made by several entities to date, some concerns have been raised regarding the viability of exports and the impact they may have on the U.S. gas market. The opposing arguments to LNG exports center around two main points: (i) allowing exports will cause U.S. gas prices to rise to levels equal to world gas prices, and (ii) exports should be prohibited in order to suppress domestic prices because suppressing domestic prices is good for employment and the U.S. economy. These two main points have prompted parties to raise more specific concerns and questions, which we will address one at a time. Based on the WGM analysis conducted and based on our knowledge and experience, DMP provides the following observations in response to these concerns.

Concern: Contribution of shale gas to U.S. market could be grossly overestimated.

DMP analysis: Abundant shale gas resources and commitment by energy majors to develop those reserves will likely ensure strong future growth of shale gas production.

Despite the rapid growth in shale gas production during the past several years, there is still some degree of skepticism about how long the trend will continue. The EIA forecasts shale gas will comprise 47 percent of total U.S. production in 2035, more than double the 23 percent share in 2011.3 Our Reference Case forecasts that shale gas will become the dominant domestic source, hitting 50 percent as early as 2020. There is little debate over the massive volumes of shale gas. The debate is really over the production cost of shale gas. Some have estimated massive volumes to be available at very low prices (under $4/MMBtu). The shale gas supply curves in the WGM are less optimistic and represent the diversity of shale gas plays, including some in “sweet spots” with very low production costs, but more in higher-cost areas. The WGM supply curves were developed based on best available data and talks with leading supply experts from industry and governmental agencies.

The price forecast from the WGM based on the various assumptions reflects the long-run marginal cost of domestic supplies and is higher in the long term than the current forward price curves. Regardless of the exact share of total production, many expect shale gas to be an important component of domestic supply and prices will reflect production costs. Higher shale gas production cost estimates do not necessarily mean that shale gas will not be produced because prices will tend to rise in order to sustain their development.

Another factor that will help maintain the growth in shale gas development is the huge amount of capital that companies, particularly the majors, have poured into acquiring shale gas acreage and developing fields. The capital expenditures represent sunk costs and lower the marginal cost of future production. That is, the incremental cost of production is lower because part of the total cost has already been paid. Some examples of major expenditures are:

- ExxonMobil paid $34.9 billion to acquire XTO, which specialized in shale gas development, and later purchased two small shale gas exploration companies (Bloomberg, June 9, 2011).

- Chevron acquired Atlas Energy Inc. and its 622,000 acres in the Marcellus Shale for $3.58 billion and subsequently purchased additional acreage from smaller operators (Bloomberg, May 4, 2011).

- Shell acquired East Resources for $4.7 billion to double its reserves of shale gas (Bloomberg, May 28, 2010).

- Statoil signed deals with Chesapeake and Talisman for shares in the joint development of shale gas plays with these companies (Reuters, October 10, 2010).

Not only are these investments large, but the arrival of majors signals a new era in the development of shale gas. Unlike in the past when smaller independent companies worked shale gas fields in response to high prices, energy majors have the resources to remain committed to development through the vacillations of gas prices. They have staying power. Furthermore, they have the resources to invest in continued improvements of shale gas technologies and procedures. Their involvement will likely continue to drive down the cost of shale gas production, making more volumes available economically.

Even if shale gas production does not reach the projected levels because costs turn out to be higher than estimated, it does not necessarily mean that the impact of LNG exports would be much higher. Lower shale gas production would likely be the result of the discovery of another, more economical, source of supply. Very important, it is the shape of the supply curve, rather than the absolute cost level, that determines the price impact. Figure 10 illustrates that simply having a higher supply cost estimate (i.e., shifting the supply curve up) does not necessarily imply a greater price impact from a demand change.

Figure 10. Impact of higher cost supply curve

Concern: High level of uncertainty exists whether shale gas can be produced as modeled due to concerns including regulatory issues, access issues, and environmental issues.

DMP analysis: Regulations will likely push best practices already adopted by leading companies and restrict fracking in only the most sensitive areas.

The U.S. EPA and a few states, primarily those without a history of large-scale gas production, are examining hydraulic fracturing (“fracking”) practices and considering new regulations designed to ensure safe operations. Improvements to fracking technology and its combined use with horizontal drilling helped drive down the cost of shale gas production and turn it into an economical resource. Fracking involves drilling a well and propagating fractures in the shale source rock by injecting large amounts of fluid. The fluid is primarily water mixed with sand and a small amount of chemicals. While most fracking operations have been performed without incident, some fear that accidental leakage of waste water or uncontrolled fracturing might contaminate groundwater aquifers. Potential regulations might drive up the cost of hydrofracking or restrict areas for drilling. Although tighter regulations might impose additional cost to shale gas development, it is unlikely that they would kill shale gas growth. The fracking process includes installing multiple layers of cement and casing to protect against leakage into groundwater and subsurface.

Furthermore, groundwater aquifers are typically located at much shallower depths than the production zone. When employing best practices, hydrofracking operations have demonstrated to be safe and reliable. More stringent regulations will most likely enforce adoption of best practices in hydrofracking operations. As such, they would not be expected to impose significant added cost to those already employing best practices. If a ban on fracking is imposed, it is likely to be restricted to highly sensitive areas, such as near sources of drinking water or population centers. For example, New York’s Department of Environmental Conservation recently lifted a fracking ban on all but the most sensitive areas, leaving 85 percent of the state’s Marcellus Shale open to drilling. 4

Furthermore, fracking regulations may likely be imposed at a state level. Some major shale gas producing states, including Texas and Louisiana, have a long history of oil and gas production and may be unlikely to impose new regulations on hydrofracking. These states have experienced an economic boom due to rapid growth in shale gas production in the Barnett, Haynesville, and Eagle Ford basins located in their states and are unlikely to restrict future prospects with additional regulations. Therefore, most shale gas operations are unlikely to be greatly affected by new fracking regulations.

Finally, additional costs imposed by new fracking regulations will be partly borne by producers and partly passed on to consumers in the form of higher prices. Shale gas is a vital resource, and prices will reflect a level necessary to support their production. Therefore, new fracking regulations are unlikely to drive up costs to the point of making shale gas uneconomical to produce.

Concern: Exporting gas will result in a significant increase in the price of gas for U.S. industry, causing them to be uncompetitive in global markets, leading to a loss of jobs.

DMP analysis: The modest price impact from proposed export volumes is unlikely to cause the U.S. to be uncompetitive in global markets.

The WGM results indicate that U.S. prices will not significantly increase due to LNG export. The projected change in the average U.S. price is a rather modest $0.12/MMBtu, a 1.7 percent increase over the Reference Case without LNG exports. The projected impact is greatest near the export terminals but dissipates with distance away from the Gulf region. The price impact is less than $0.10/MMBtu in most downstream markets. Given the projected price impact, it is highly unlikely that it would cause U.S. industry to be uncompetitive in global markets and lead to a loss of jobs. The United States has lower gas prices than most industrialized countries and is projected to continue to have lower gas prices, in part due to continued growth in shale gas production. An increase in gas price of less than 2 percent is unlikely to change U.S. competitiveness in global markets.

Furthermore, even with exports, U.S. prices will be lower than those in the importing countries. Otherwise, export would be uneconomical. The high cost of constructing a liquefaction plant plus the high transportation cost of a LNG tanker is estimated to require a spread of at least $3.00/MMBtu to Europe and over $4.00/MMBtu to Asia in order to make LNG export economical to those regions. Exporting LNG from the United States is being considered now because the price spreads from the U.S. Gulf to Europe and Asia are well above those levels. However, the key point is that even with LNG exports, the United States has a built-in cost advantage for natural gas because of the cost differential to get LNG to European and Asian markets. LNG exports alone cannot elevate U.S. prices to European and Asian price levels because of the cost differential.

To illustrate this point, compare the Gulf to the Mid-Atlantic regions that are connected by major pipelines. However, Mid-Atlantic prices are still substantially higher than Gulf prices because of the transportation costs. At specific market hubs, such as New York City, prices can skyrocket during extreme peak demand days because of deliverability constraints on the pipeline system. Even though markets are connected, deliverability constraints can and will decouple their prices during peak periods. The total European gas demand is nearly as large as the U.S. demand. The LNG export volume being considered represents a small fraction of European demand, as well as U.S. supply. The proposed LNG export volumes are inadequate to bring these markets to parity because of transportation costs and capacity constraints.

Concern: Exporting gas will result in a significant increase in the price of electricity for U.S. consumers and industry, causing them to be uncompetitive in global markets, leading to a loss of jobs.

DMP analysis: The projected impact on electricity prices is projected to be even smaller than the projected impact on gas prices.

DMP’s electricity model is integrated with the WGM so we can also estimate the impact of LNG exports on electricity prices, as natural gas is also a fuel for generating electricity. Since our integrated models represent the geographic linkages between the electricity and natural gas systems, we can compute the impact of the LNG exports in local markets where the impact would be the greatest.

Comparison of electricity prices with and without LNG exports shows that projected electricity prices increase by 1.2 percent in Louisiana where most of the LNG exports are assumed to occur. The impact is far less than the projected 3.3 percent Louisiana gas price impact. In power markets in other regions, the impact is projected to be much less because the gas price impact is much less. For example, Midwest gas prices increase by less than 1.0 percent and result in electricity prices increasing by much less than 1.0 percent.

A key reason why the electricity price impact is less is that gas price will impact electricity price only if gas-fired generation is at the margin. When gas-fired generation costs less than the marginal. source, then a small increase in gas price will only impact electricity price if it is sufficient to drive it to the margin. If it costs more than the marginal source, then increasing gas price will have no impact because it still would not be utilized. If gas-fired generation is the marginal source, then electricity prices will increase with gas price but only up to the point where some other source can displace it as the marginal source.

Every power region has numerous competing generation plants burning different fuel types, which will mitigate the price impact of increase in any one fuel.

Figure 11 shows the 2010 power supply curve for the SERC Reliability Corporation (SERC) region that includes Louisiana. The curve plots the variable cost of generation and capacity by fuel type. Depending on where the demand curve intersects the supply curve, a particular fuel type will set the electricity price. During extremely low demand periods, hydro, nuclear, or coal plants will likely set the price. An increase in gas price during these periods would not impact electricity price in this region because gas-fired plants are typically not utilized during these periods. During moderate or moderately high demand periods, coal or gas could be the marginal fuel type. If it is gas on the margin, price can rise only up to the cost of the next marginal fuel type (e.g., coal plant). If gas remains on margin, then the following calculation demonstrates the expected electricity price impact. At the projected gas price impact of $0.22/MMBtu, a typical gas plant with a heat rate of 7,500 would cost an additional $1.65/MWh (=$0.22/MMBtu x 7500 Btu/MWh x 1 MMBtu/1000 Btu). Remember, that is the most that the gas price increase could elevate electricity price. Power load fluctuates greatly during a day, typically peaking during mid-afternoon and falling during the night. This implies that the marginal fuel type will also vary and gas will be at the margin only part of the time.

Figure 11: Power supply curve for SERC region

Concern: LNG exports will cause U.S. gas prices to trade at global price levels.

DMP analysis: The volume of LNG exports, as well as the high cost of LNG exports, is inadequate to cause U.S. prices to trade at globalprice levels.

Based on our analysis, it is unlikely that a limited amount of LNG exports would cause U.S. gas price to be set at global price levels. For one thing, there is no world gas price, in contrast to the oil market in which there is a world oil price. Natural gas, unlike oil, is highly unlikely to ever have a world price. The cost of transportation, on a unitized energy basis, is much higher for gas than it is for oil. Therefore, global gas markets will remain partially interconnected regional markets with prices within each region determined by regional supply and demand balances.

Furthermore, even if there were a global gas market, having a fixed export capacity would not necessarily mean that domestic prices would rise to global price levels. For example, the current European prices (e.g., Zeebrugge, Belgium) are more than double the current Henry Hub price. Exporting 6 Bcfd to Europe would not mean that Henry Hub price would rise to the level of European prices minus the transportation costs differential. Limited transportation capacity would prevent prices from coupling. The same phenomena occur in the United States during peak winter days when there are often huge differences between Henry Hub and New York City prices. The basis differential between Henry and New York can rise to many times greater than the transportation cost between the regions. Transportation bottlenecks along the route from the Gulf to New York City prevent Henry prices from rising along with New York City prices and cause these basis blowouts.

As stated previously, even with exports, U.S. prices will be lower than those in the importing countries. Otherwise, export would be uneconomical. The high cost of constructing a liquefaction plant plus the high transportation cost of an LNG tanker would require a spread of at least $3.00/MMBtu to Europe and over $4.00/MMBtu to Asia in order to make LNG export economical to those regions. Exporting LNG from the United States is being considered now because the spreads to Europe and Asia are well above those levels. However, the key point is that even with LNG exports, the United States has a built-in cost advantage for natural gas. LNG exports alone cannot elevate U.S. prices to European and Asian price levels because of the cost differential.

Concern: Exporting gas will make U.S. prices more volatile as it will link them to global oil markets.

DMP analysis: The relatively low volume of LNG exports is unlikely to cause significant change in U.S. price volatility.

Whether exports will increase U.S. price volatility involves close examination of seasonal demand, deliverability, supply contracts, and storage operations. Europe—which along with Asia is expected to be the primary targets for LNG exports—has a highly seasonal demand and little storage capacity relative to the United States, which translates to highly seasonal prices.

We believe a better question to consider is whether U.S. prices could be pulled up by LNG exports to prices in global markets during peak periods. The price volatility in foreign markets might then be transmitted to U.S. prices.

An examination of historical prices reveals that European prices are no more volatile than U.S. prices. There is a misconception by some that European gas prices are more volatile because they are higher than U.S. prices. This is not true. In fact, during most of the past 20 years, the United States had the most volatile prices of all major gas consuming countries.5 One reason for this is because European countries have long-term supply contracts to meet most of their peak loads and their markets are far more regulated than the U.S. market. Japanese prices are the least volatile because most of their supplies are from long-term contracts that have price smoothing mechanisms (e.g., three-month rolling average price) designed to reduce sharp price swings. Furthermore, the Japanese gas demand is primarily for power generation, which is not highly seasonal.

Nevertheless, could connecting to other countries increase the price volatility in the U.S ? For many of the same reasons described in the previous sections, limited LNG exports are unlikely to cause U.S. prices to be more volatile. The volume of exports is relatively small compared to the entire size of the U.S. supply and small relative to the entire European market. If demand increased with a concomitant increase in supply, price and volatility could increase. However, LNG exports will be anticipated by producers and supplies will be made available when they are needed. In fact, prospective LNG exporters are already lining up potential gas suppliers to provide gas for liquefaction. The concern that LNG exports will increase volatility may be based on observations of price spikes when demand surges during peak days. Temporal supply-demand balance can cause short-term price volatility. When the balance is tight, prices tend to rise, and when the balance is slack, prices tend to fall. However, it is an entirely different matter to say that well-anticipated demand growth will cause a tighter market that is more prone to price run-ups during peak periods. Short-term price volatility arises from shortterm inelasticities in supply and demand. For example, when demand spikes suddenly, more gas supplies cannot immediately be produced. Productive capacity is fairly fixed in the short term. There is a long lead time before reserves can be added and produced. However, when new demand is well anticipated, productive capacity will rise to meet it. Hence, the absolute level of demand has little bearing on price volatility. As an example, consider the price volatility of this year, when U.S. demand is trending towards a historical high, compared to the volatility in 2008, when demand was lower. Price volatility this year has been far lower than in 2008, which saw huge gyrations in price. This demonstrates that gas price volatility is not a simple function of absolute gas demand level because gas productive capacity will be developed to match the anticipated demand level. Some point to the volatility in world oil prices, which translates to volatility in domestic oil and gasoline prices, as a reason for not exporting LNG. However, this is a poor comparison. The cost of transportation, on a unitized energy basis, is much higher for gas than it is for oil. Therefore, global gas markets will remain partially interconnected regional markets with prices within each region determined by regional supply and demand balances. It is possible that LNG exports might actually work to decrease, not increase, U.S. price volatility. This is counterintuitive but quite possible because LNG exports, with their well-known export capacities, will prompt incremental supplies that could be utilized to meet peak domestic demand. During peak periods when domestic prices shoot up, it might be more advantageous for LNG exporters to not export but rather keep the supplies in the United States. Finally, arguments against LNG exports purely on the grounds of increased prices or volatility could just as well be made against any type of domestic demand. After all, a given volume of demand increase, whether it is for domestic consumption or export, will have the same impact on price.

Concern: Exporting gas decreases U.S. energy security.

DMP analysis: The assumed volume of exports is insignificant compared to total U.S. resource potential.

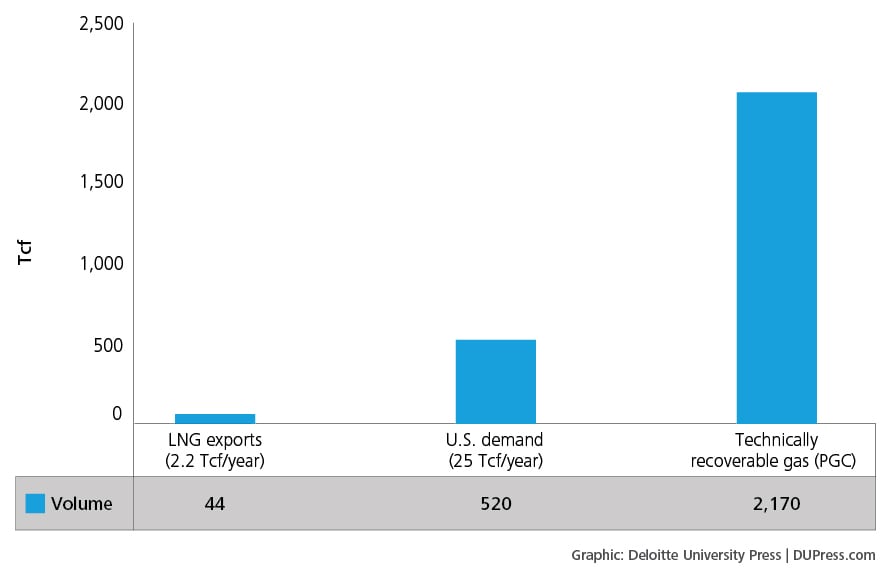

The energy security issue is based on the fear that exporting LNG will deplete domestic resources, leaving the United States dependent on foreign suppliers in the future and vulnerable to price manipulation or supply curtailment. However, the incremental 2.2 Tcf (6 Bcf/day x 365 days/year) of LNG annual exports are fairly insignificant compared to over 2,170 Tcf of technically recoverable gas in the United States as estimated by the Potential Gas Committee.6 (The EIA’s latest estimate is even higher: 2,587 Tcf of technically recoverable gas in the United States.)

Figure 12 illustrates the relative magnitudes of LNG export volumes and U.S. demand for a 20-year period compared to the technically recoverable gas resources in the United States. This comparison demonstrates that export volumes pale in comparison to both total demand and total domestic supply.

Of course, this simple calculation does not tell the whole story because it ignores the impact on supply cost. However, it underscores the point that economics, not security, is the concern. The volume of LNG exports and projected price impact based on the various assumptions in the WGM are inadequate to pose a security issue. Unless the United States is able to convert oil usage to natural gas (i.e., automobiles) to reduce dependence on foreign oil, the issue becomes more one of economics rather than one of energy security.

Figure 12: Comparison of volumes

Concern: There are insufficient reserves to allow exports to continue without impacting the market over the term of those exports.

DMP analysis: The projected volume of LNG exports is insignificant compared to total U.S. resource potential.

As we described in previous sections, the impact of LNG exports would be fairly small on domestic gas markets and almost imperceptible on the power market. The domestic gas resource base, represented by the supply curve in figure 13, is estimated to be adequate to supply projected demand levels for at least 50 years at moderate prices. The volume of LNG exports represents a relatively small increment to the total demand. Furthermore, technological advancements will likely continue to drive down production costs, thereby reducing the high cost end of the supply curve. Some of the largest energy supermajors have committed to shale gas development and improvement in technologies and procedures to drive down their costs. This implies more economically recoverable gas and a prolonged period of relatively low gas prices with or without LNG exports.

It is important to note that the volume of “reserves” is not the issue but rather the volume of “resources.” Reserves are volumes of resource that have been “proved up” and ready for production. Resources, on the other hand, are the total volumes that are in the ground, most of which have yet to be proved up or even discovered, but can be reasonably estimated based on geological and other factors.

Figure 13. U.S. supply curve

Concern: LNG exports are inconsistent with the U.S. policy of energy independence.

DMP analysis: Large domestic gas supplies will maintain natural gas independence even with exports.

There is a frequently expressed desire for energy independence in the United States, but there is no official U.S. policy for energy independence. The United States is largely independent of non-North American natural gas supplies. The energy dependency that the general public has in mind usually relates to oil imports and the resulting export of dollars to the oil-exporting countries. Perhaps the thought is that gas can displace the oil imports and help alleviate U.S. dependence on foreign oil. If this is the goal, then it would require retrofit of millions of vehicles and thousands of refueling stations. This has been much discussed but never done because of the tremendous costs involved. Due to the high density of oil, it is a near-perfect fuel for transportation. Natural gas, although much cheaper and domestically available, lacks the desired properties of oil and therefore is unlikely to capture a significant share of the transportation market.

Furthermore, natural gas is not a substitute for oil to a significant degree in any other sector. There are very few oil-fired power plants, and those generally have low utilization rates. Very few industrial boilers burn oil because of its high cost and emissions. Indeed there is very limited oil-gas substitutable demand. Therefore, at present, there is little that natural gas can do to alleviate the country’s dependence on oil imports.

Finally, energy exports from the United States are not without precedent. The United States has been exporting coal for years, as well as exporting LNG from Alaska. The U.S. also exports gas to Mexico. The attention on LNG exports on security grounds seems inconsistent with these other examples.

Concern: Exporting gas will reduce U.S. ability to maximize the use of gas domestically.

DMP analysis: There are sufficient volumes of domestic natural gas for both domestic consumption and LNG exports.

As we discussed earlier, there are sufficient volumes for both domestic use and exports. As stated previously, the domestic gas resource base is estimated to be adequate to supply projected demand levels for at least 50 years at moderate prices. The volume of LNG exports represents a relatively small increment to the total demand. This concern would be more relevant if the United States did not possess the abundant shale gas resources that it does, but then again, there would be no talk about LNG exports if that was the case.

One could argue that allowing export of LNG is making maximal use of domestic gas because producers are finding a market for gas that would otherwise not be produced.

© 2021. See Terms of Use for more information.