Deloitte’s 2019 Global Blockchain Survey Blockchain gets down to business

17 minute read

06 May 2019

The blockchain story is beginning a new chapter, one in which the questions executives are asking are tougher, more granular, more grounded, and more pragmatic. The question for executives is no longer, "Will blockchain work?" but, "How can we make blockchain work for us?"

Since the first blockchain advocates began promoting the technology’s capabilities over a decade ago, leaders across industries have often seemed unsure what to do with it. But in 2019, something unmistakable appears to be happening. What has emerged is a shared recognition that blockchain is real—and that it can serve as a pragmatic solution to business problems across industries and use cases. This is not some far-flung vision held by long-standing believers in the technology. Even leaders wary of tech-based solutions have come to see the larger, transformational importance of the technology.

Learn More

See more from the Blockchain collection

Learn more about the future of blockchain

Subscribe to receive related content

Though blockchain hasn’t reached its full potential, savvy executives surveyed for Deloitte’s 2019 global blockchain survey are confident about new and evolving use cases; they continue to see the technology as a connecting platform that can enable many business processes. Since our last survey,1 respondents report that overall corporate blockchain investment is growing across most sectors as new, practical applications gain traction.

Like young college graduates quickly adjusting their expectations after entering the workforce, executives have seen time and practical considerations refine and define their view of what is possible in using blockchain into what is plausible—and what is practical. What we’re seeing in 2019 is the continuing evolution of blockchain from a capable yet underdeveloped technology into a more refined and mature solution poised to deliver on its initial promise to disrupt.

The question for executives is no longer, “Will blockchain work?” but, “How can we make blockchain work for us?”

Overview and methodology statement

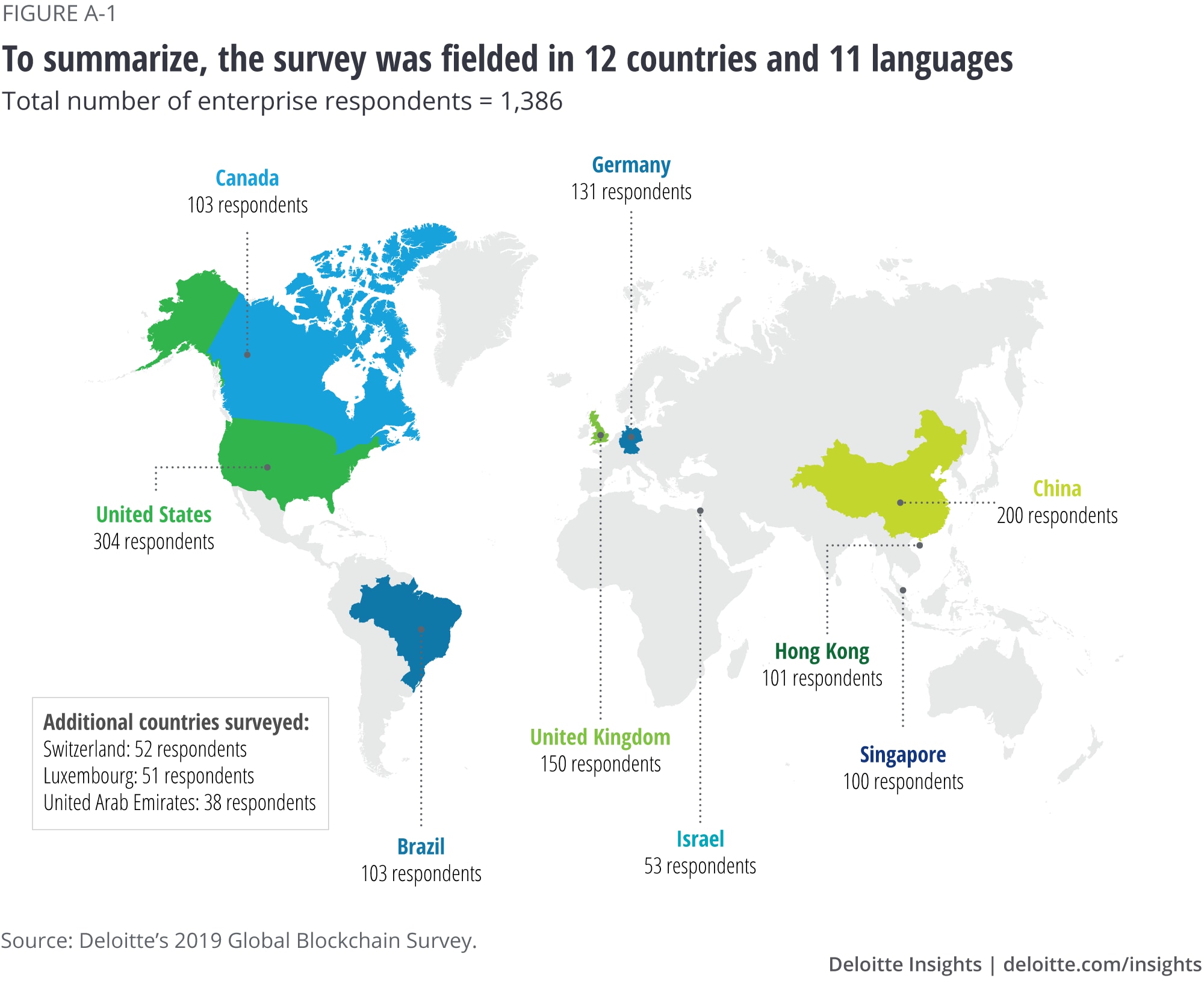

Deloitte conducted this survey between February 8 and March 4, 2019, primarily as a research vehicle to gain greater insights into the overall attitudes and investments in blockchain as a technology. The release of the survey highlights in this article reflects those opinions and perceptions around blockchain and the potential impact of the technology in the future. The information shared provides summaries of a subset of the overall data and insights collected.

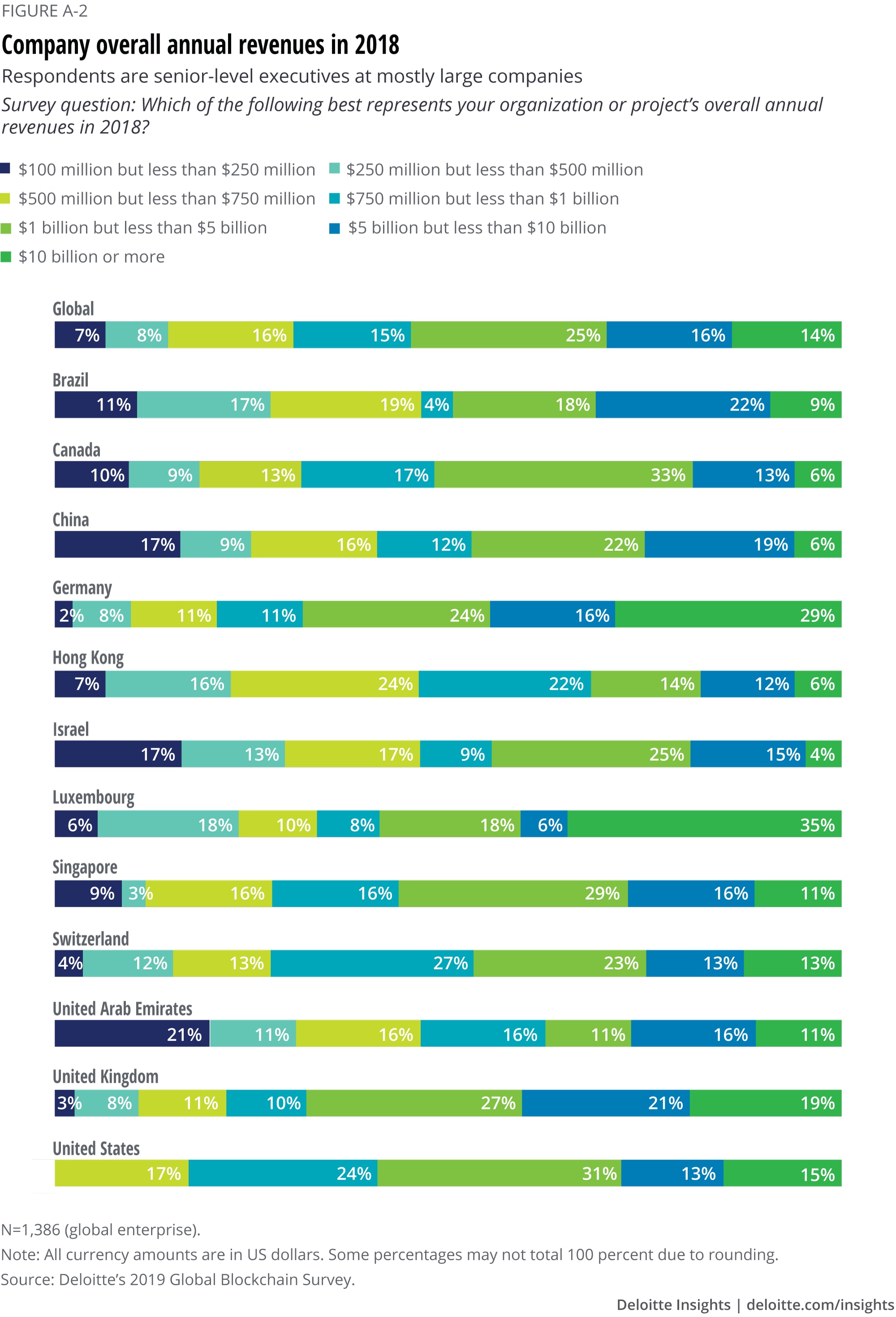

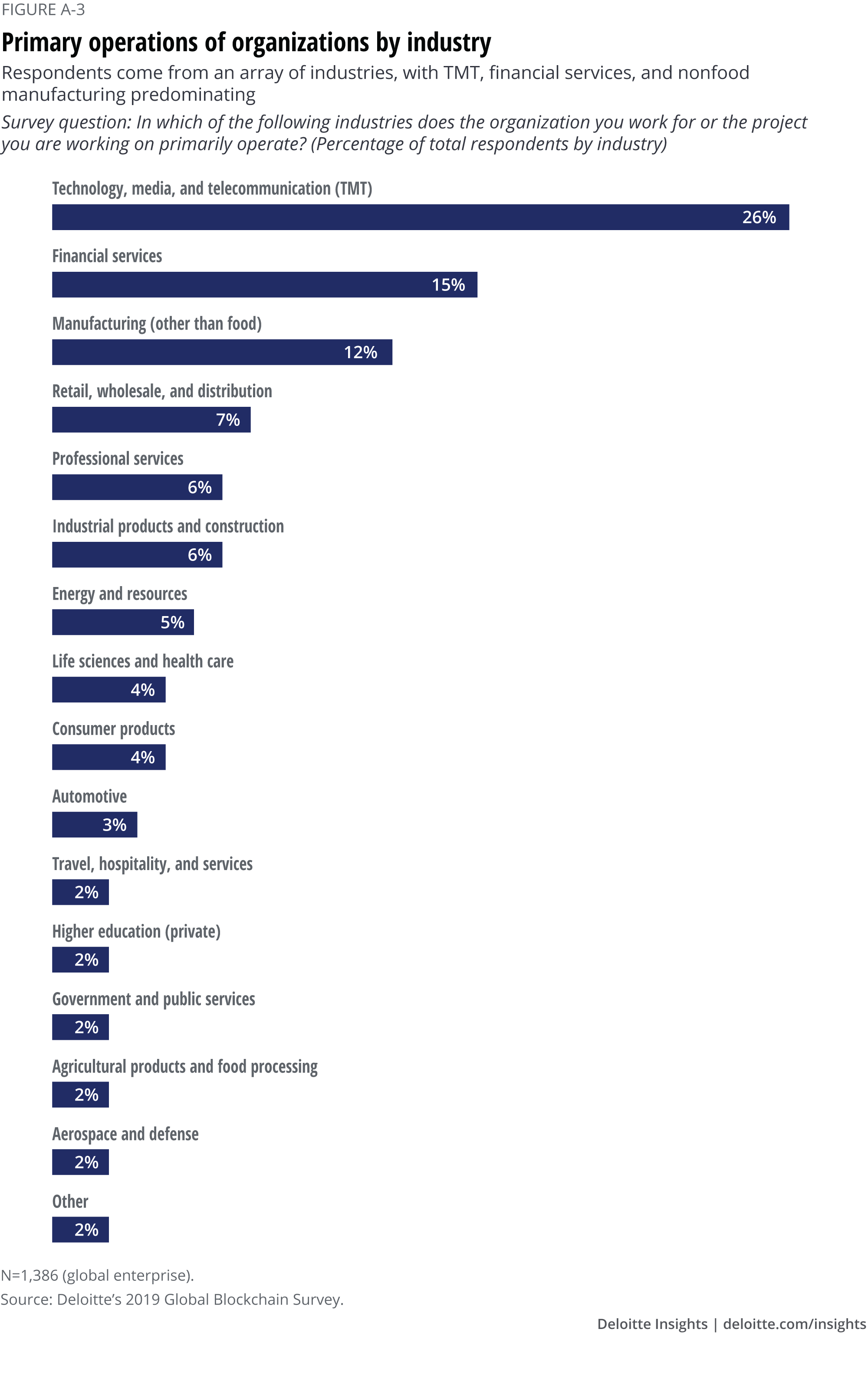

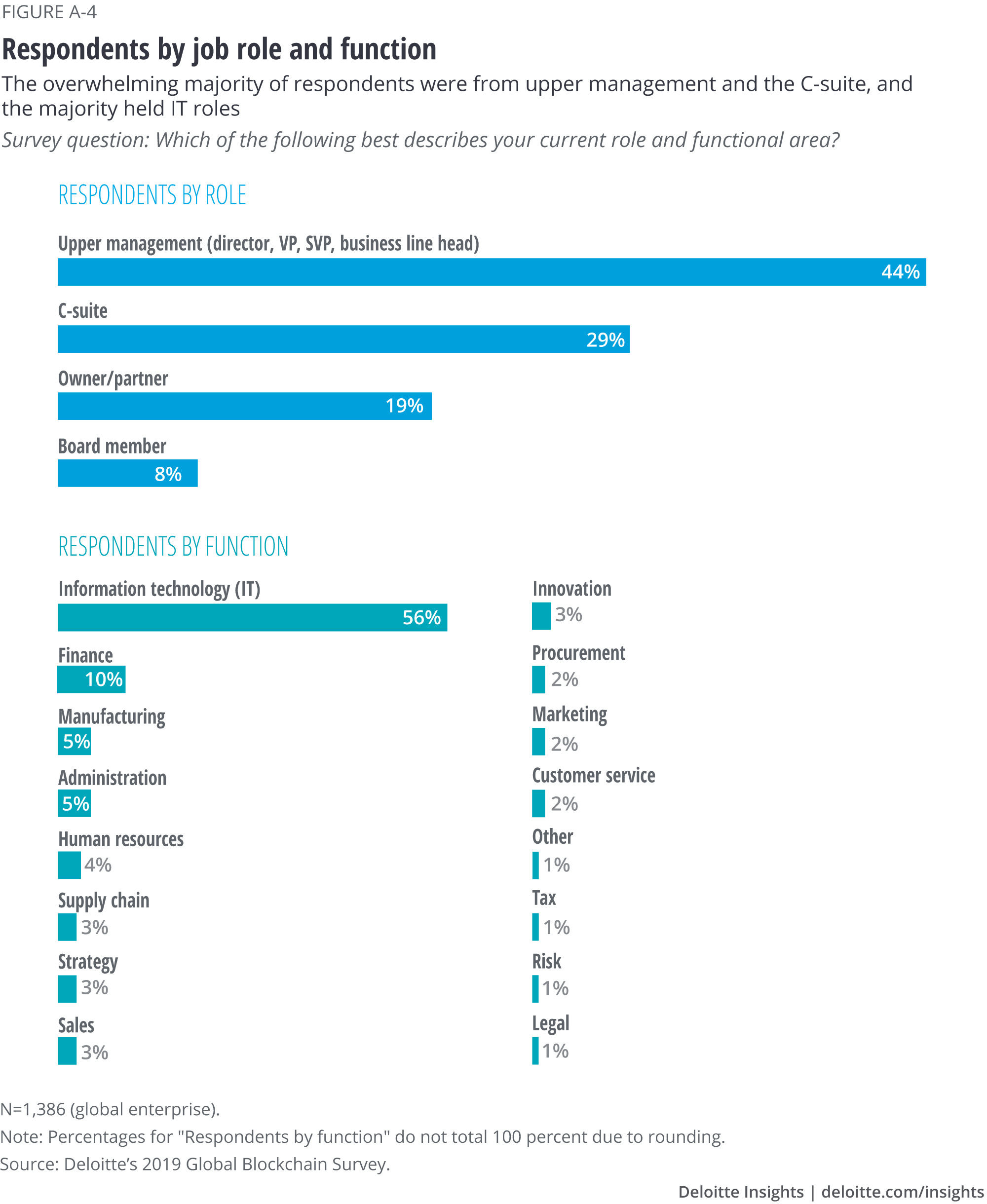

The survey polled a sample of 1,386 senior executives in a dozen countries (Brazil, Canada, China, Germany, Hong Kong, Israel, Luxembourg, Singapore, Switzerland, United Arab Emirates, United Kingdom, and the United States) at companies with US$500 million or more in annual revenue for US respondents and at companies with US$100 million or more in annual revenue for respondents outside of the United States. Respondents had at least a broad understanding of blockchain and were familiar with and able to comment on their organizations’ investment plans.

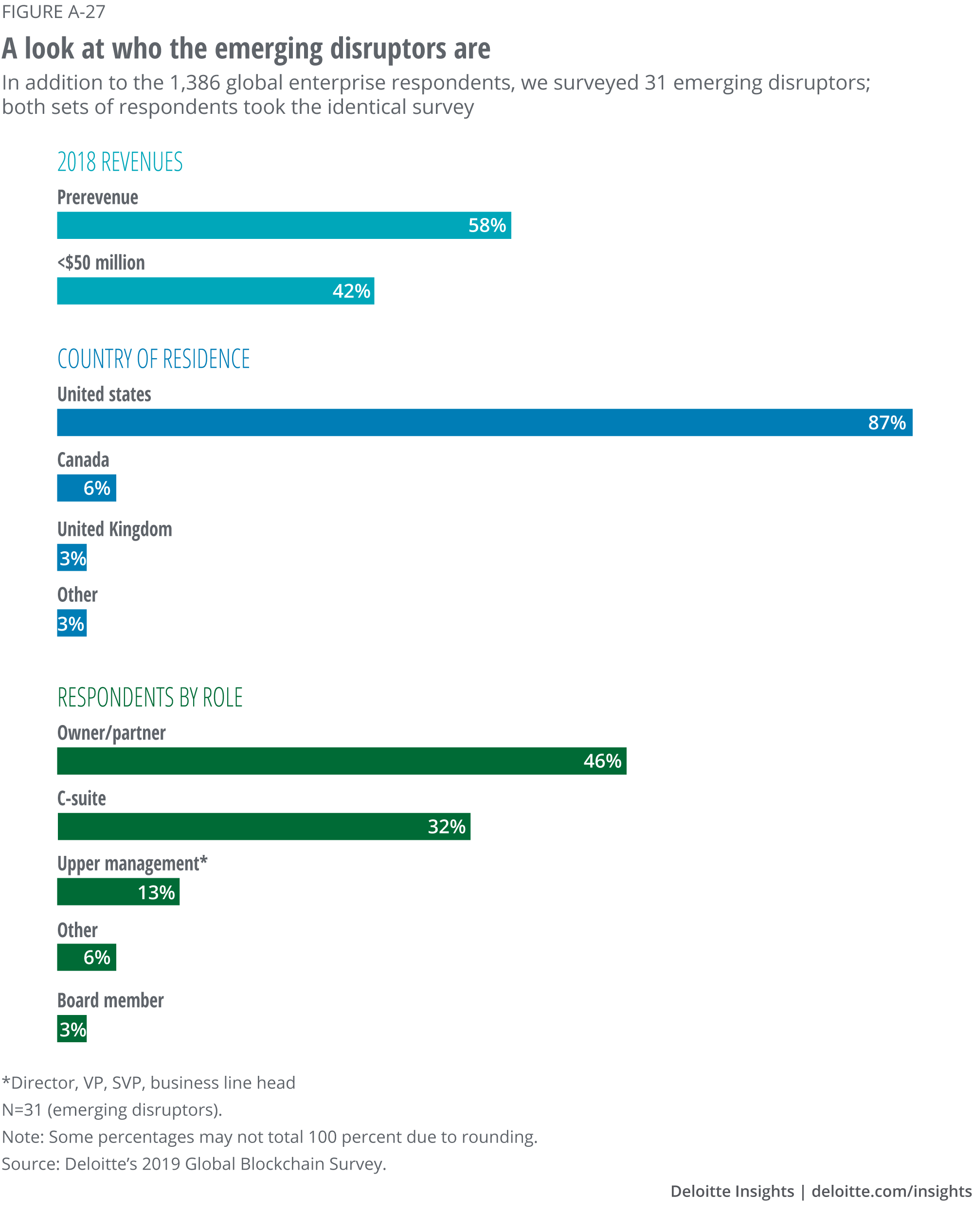

Between February 18 and March 8, 2019, we also administered the survey to executives at a group of 31 blockchain emerging disruptors to gauge their attitudes and investments in blockchain as a technology. All of these emerging disruptor respondents had revenue of less than US$50 million.

2019 survey highlights

Last year’s survey showed blockchain adoption reaching a turning point: Momentum had begun shifting from “blockchain tourism” and exploration toward the building of practical business applications. Financial services and, more specifically, the financial technology (fintech) sector were leading in blockchain development, while other industries were cautious in their search for use cases to provide a return on investment to justify the cost and effort of implementing blockchain solutions.

Today, fintech remains a blockchain leader, but more organizations in more sectors—such as technology, media, telecommunications, life sciences and health care, and government—are expanding and diversifying their blockchain initiatives. Still, despite these advances, progress remains measured in the wake of blockchain’s first cyclical rise and fall, and the resulting attitude shifts following the initial blockchain buzz.

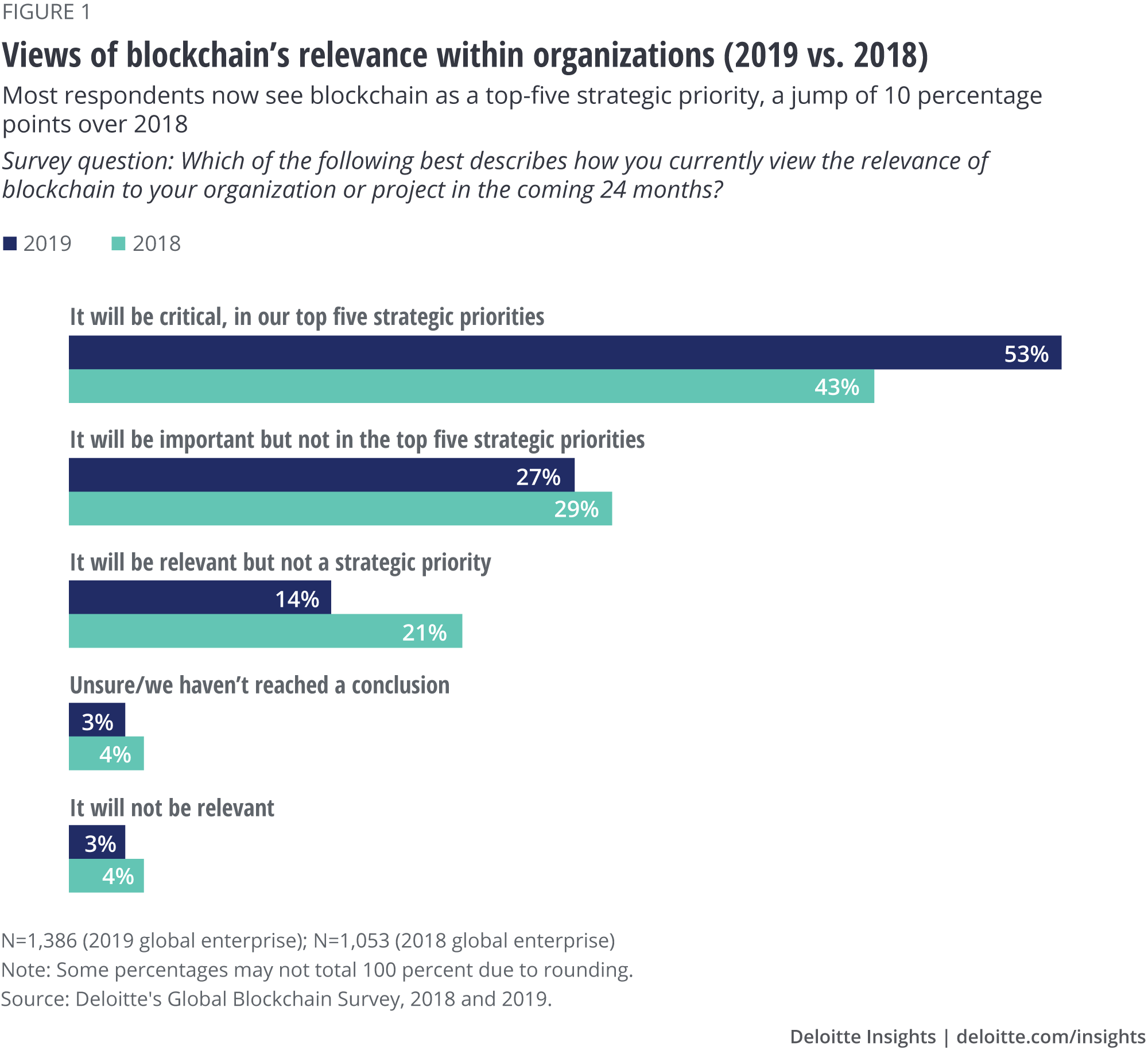

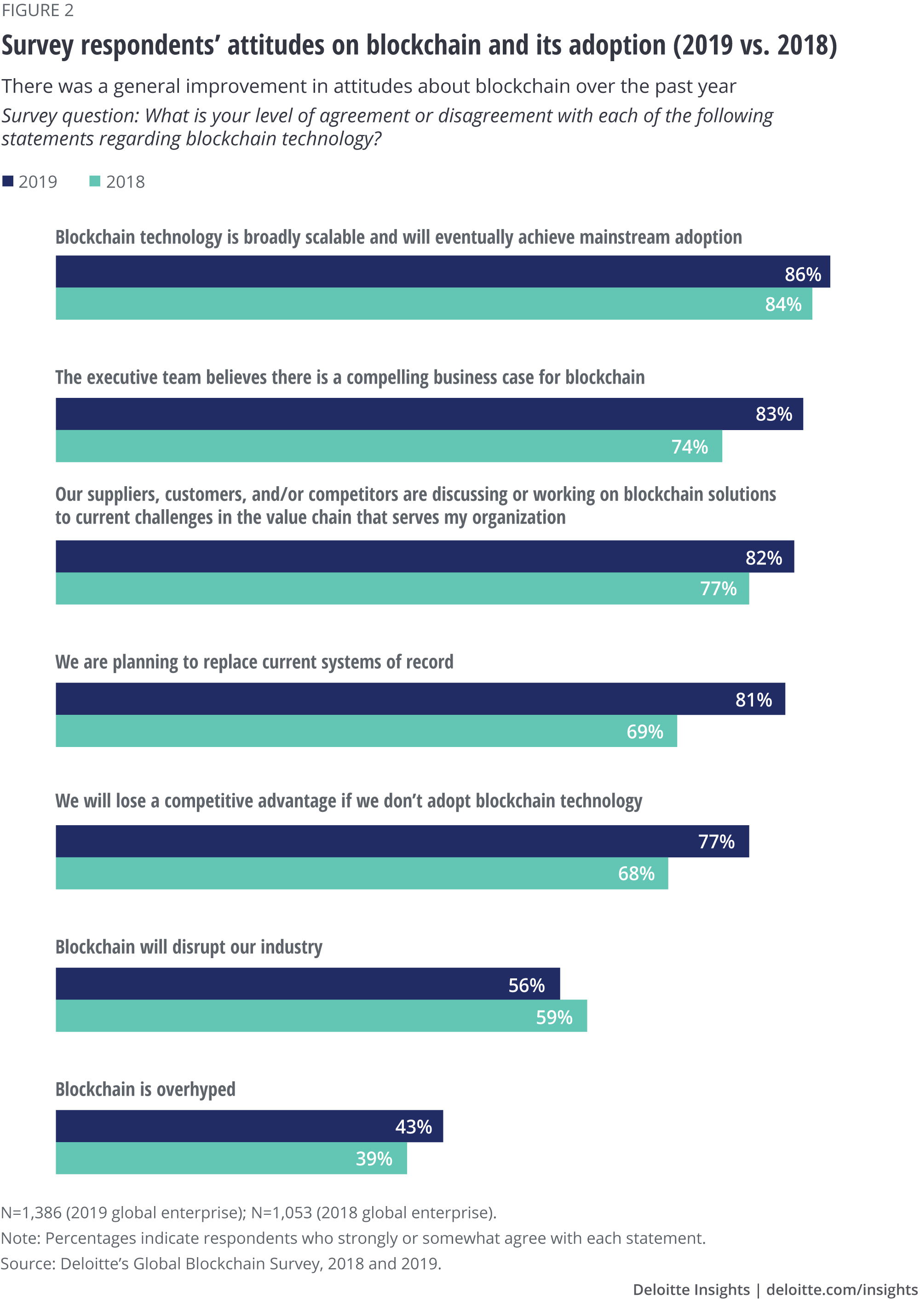

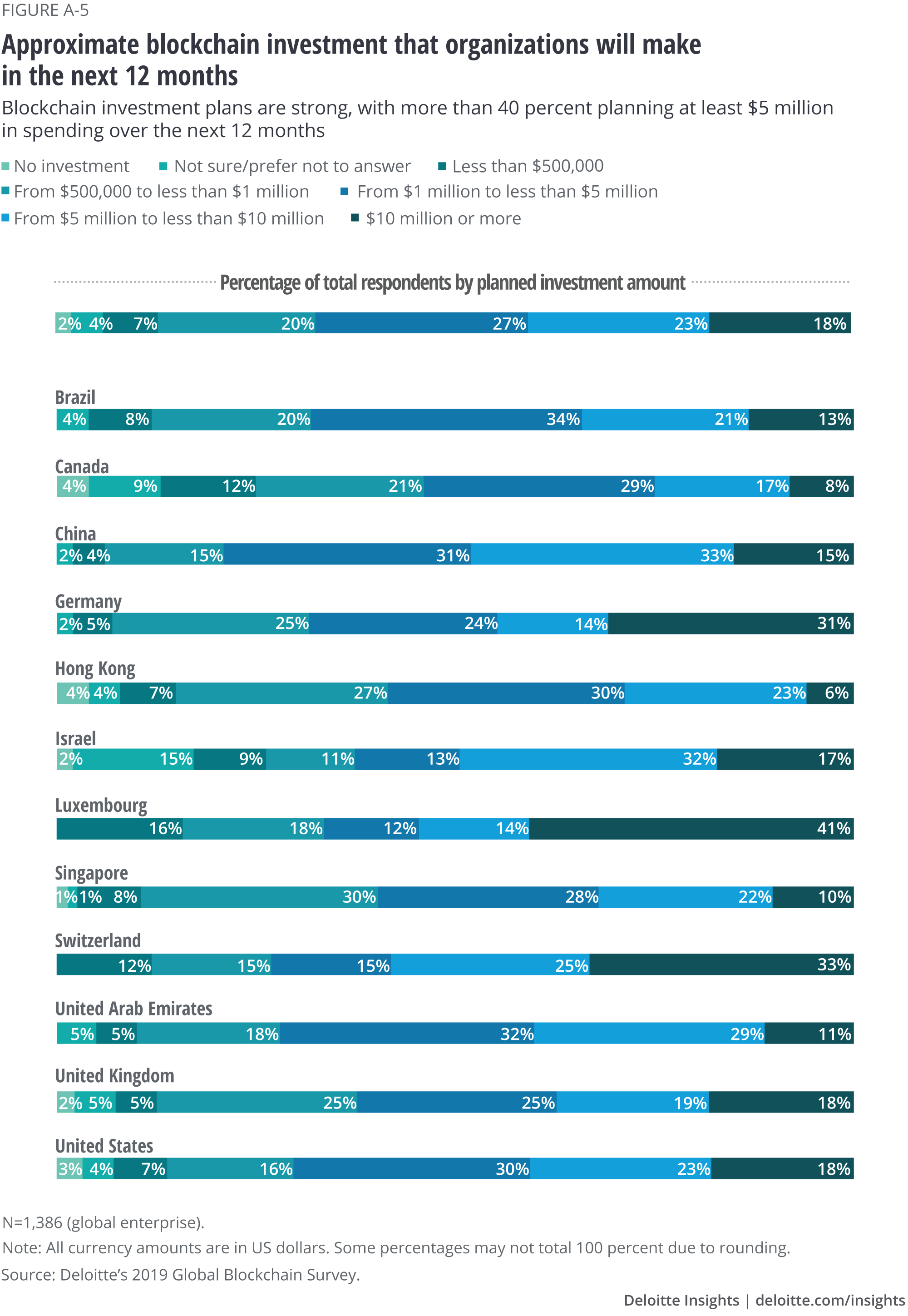

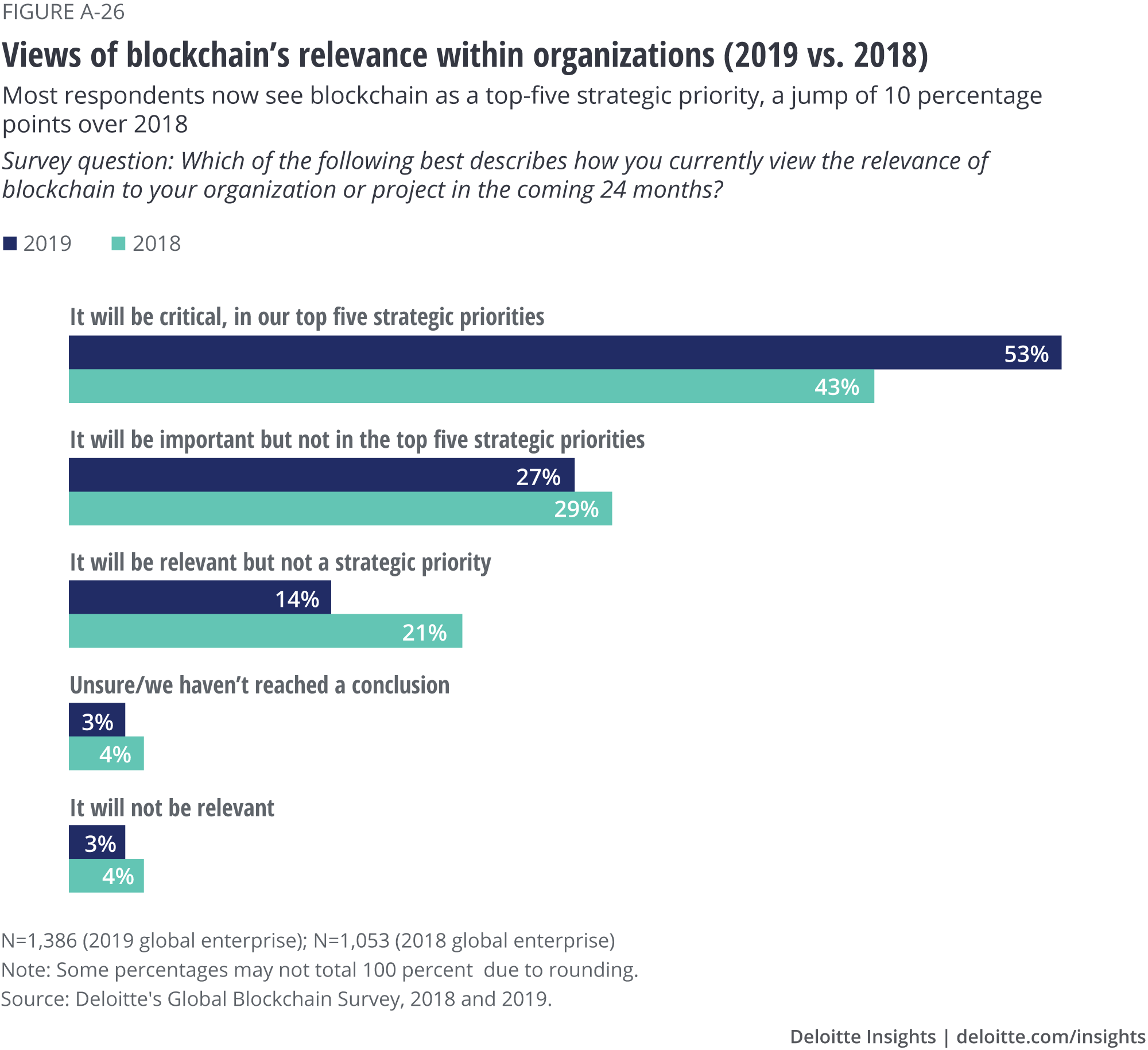

On a positive note, this year’s survey reveals continued strong investment, with those willing to invest US$5 million or more in new blockchain initiatives over the next 12 months, holding steady at 40 percent (up a point from 2018). Simultaneously, 53 percent of respondents say that blockchain technology has become a critical priority for their organizations in 2019—a 10-point increase over last year (see figure 1). Moreover, 83 percent see compelling use cases for blockchain, up from 74 percent (figure 2), and respondents’ overall attitudes toward blockchain have strengthened meaningfully.

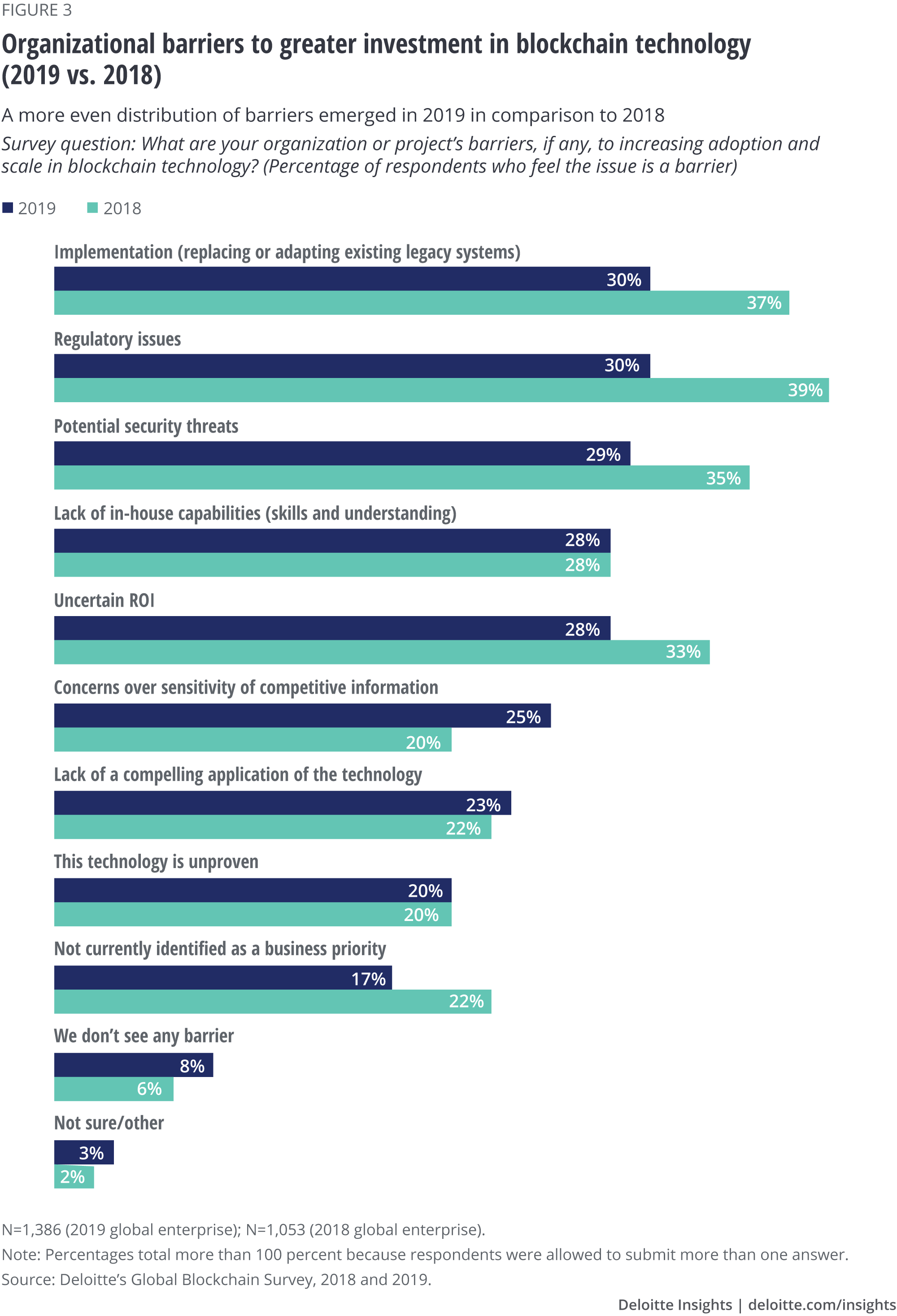

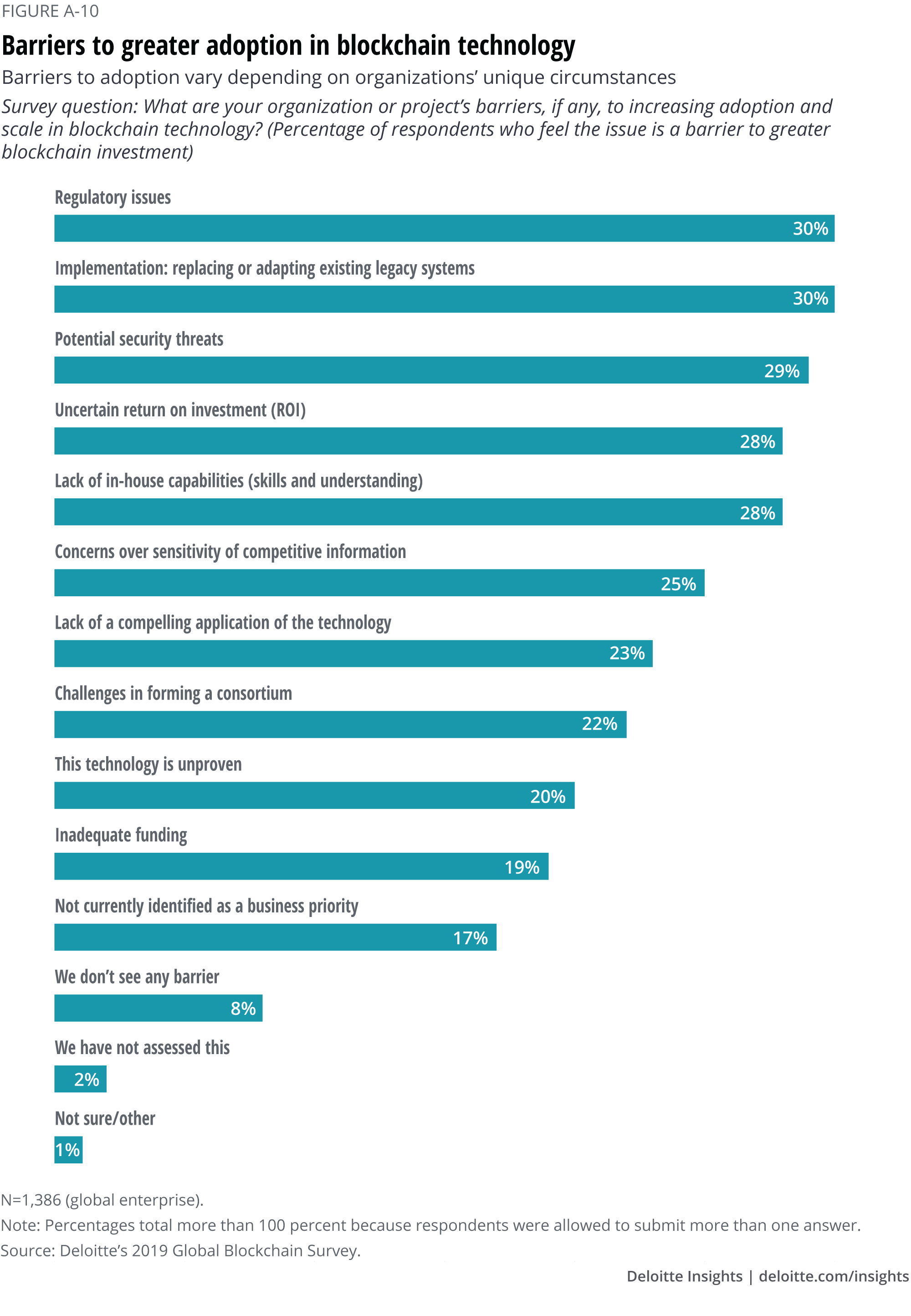

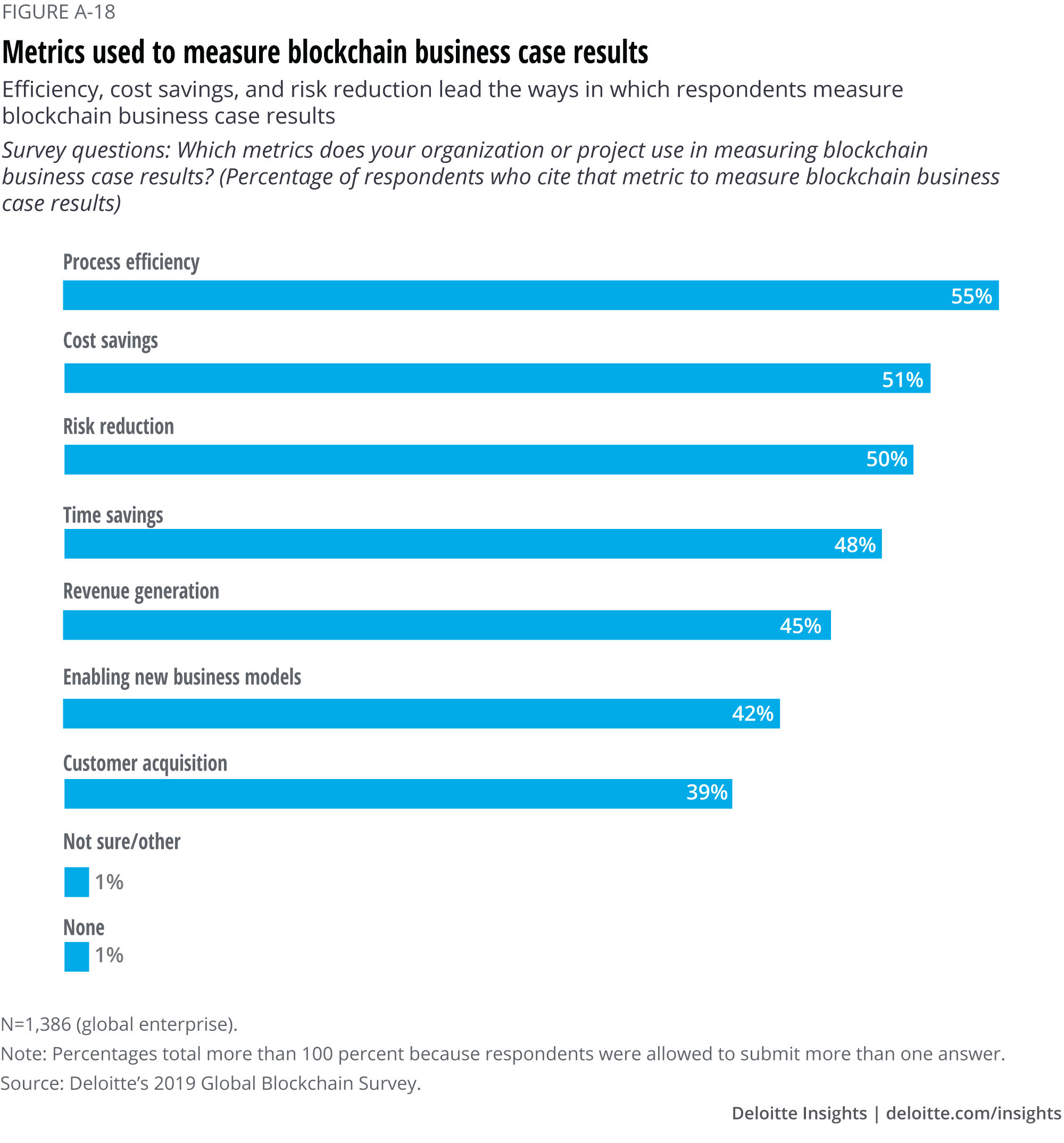

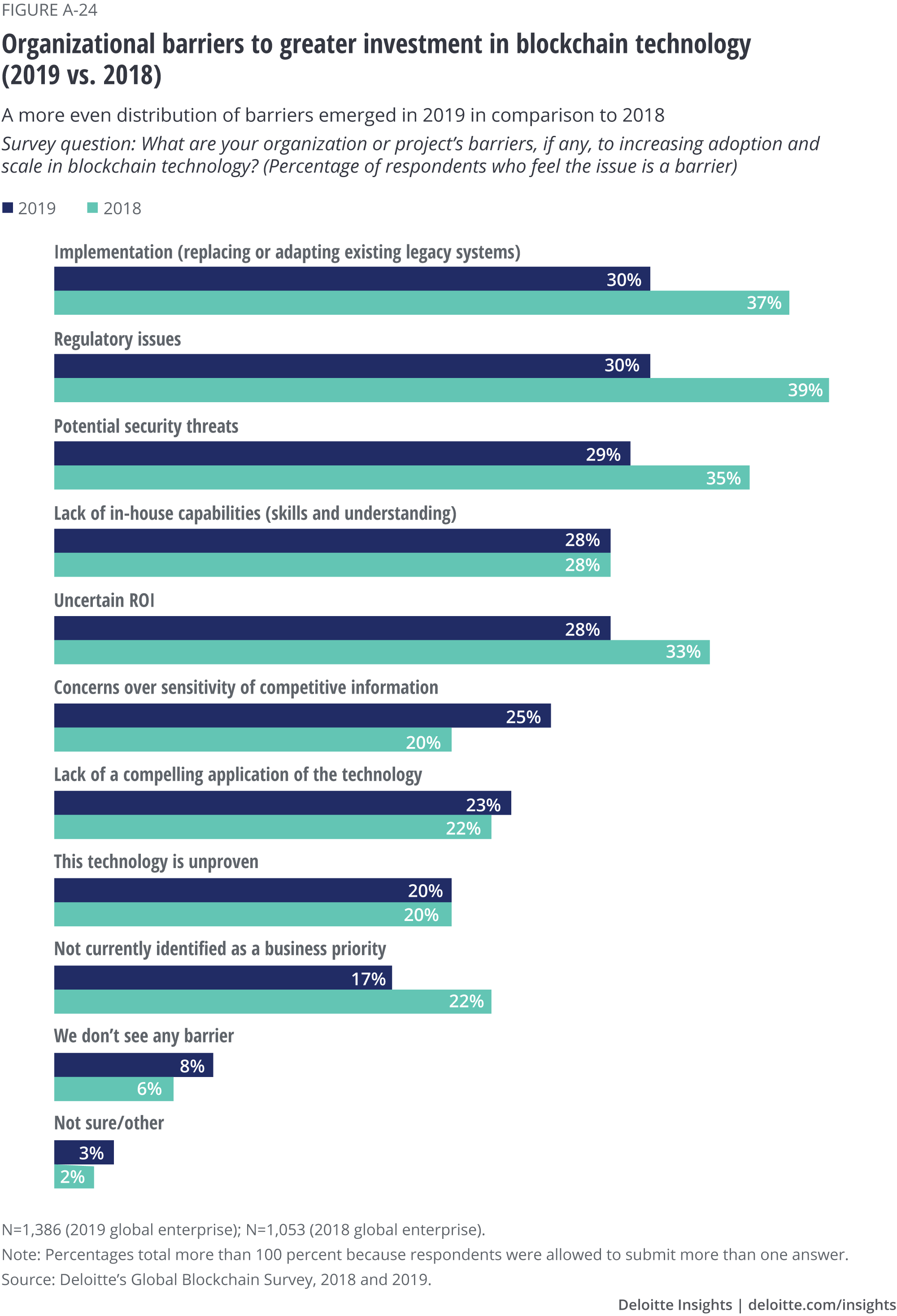

Other 2019 survey data points to signs of blockchain’s increased maturity. For example, respondents saw blockchain providing more diverse advantages than in 2018. Similarly, the increasing diversification of potential use cases for blockchain—and the wider array and greater parity of identified barriers to blockchain adoption (figure 3)—suggest further signs of maturation.

Anecdotally, and taken as a whole, we read these responses as demonstrating that blockchain is maturing in the eyes of many executives and decision-makers who are increasingly seeing the technology’s real promise. But not everyone is fully on board. Though a majority of respondents call blockchain a top-five priority, only 23 percent have already initiated a blockchain deployment—down from 34 percent. Attitudes about blockchain may be improving (see figure 2), but 43 percent still see blockchain as overhyped, up from 39 percent last year.

Are these attitudes as counterintuitive and contradictory as they seem? The dissonance could reflect a growing pragmatism—one that we first noted last year. As blockchain is expected to continue along a traditional path of maturation and self-discovery, signs of dissonance and caution may reflect the technology’s health as it likely evolves into a more grounded business solution.

Indeed, blockchain is gaining traction and acceptance in more industries, from fintech to technology to media to telecommunications to government to life sciences and health care. Our research shows executives increasingly expressing confidence in blockchain’s importance and its disruptive potential that matches some of the most ambitious and far-reaching claims about its transformative potential.

This reflects a “seasoning” of the collective opinion toward blockchain based on increased exposure to the technology and a better understanding of its abilities and drawbacks in practical, day-to-day business use cases.

Blockchain hype, promises, and challenges

New! Improved! Faster! Stronger! Better! Marketers wield such adjectives and exclamations to capture the attention of influencers and potential customers, and tout the development and release of new products and services.

Beyond simple marketing, superlatives can be the language of adoption. Without hype, early movers likely wouldn’t know about—let alone try—new technologies such as blockchain. They would be released with the hope that someone might stumble upon them, try them, and find them useful, which is hardly a practical way to do business or to technologically advance processes, companies, or industries.

Of course, few products and services fully live up to their marketing; it’s rare that a single tool or solution can do everything that others claim it can do. Even so, many of these new tools and solutions turn out to be useful or even game-changing.

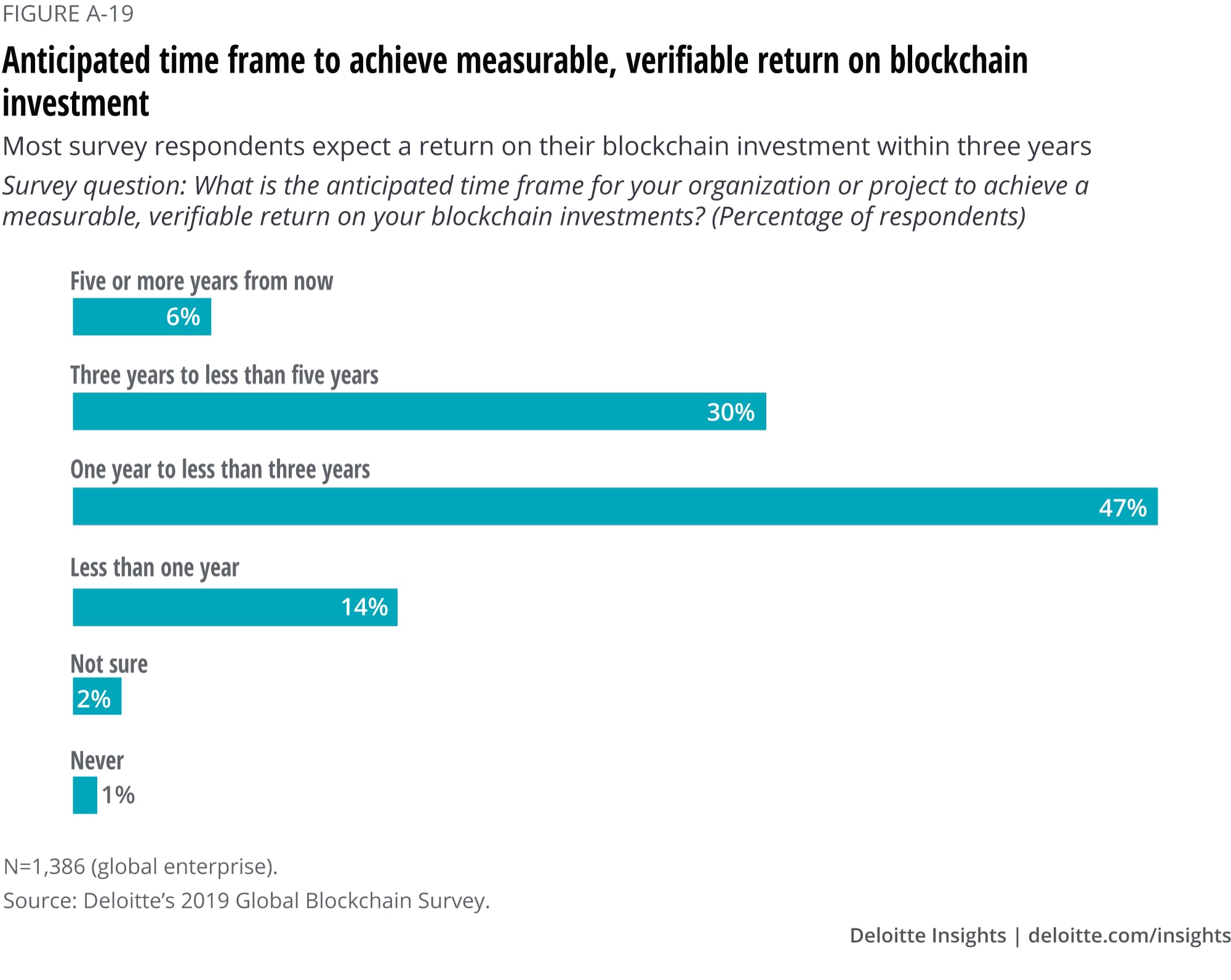

Such is the case with blockchain, which appears poised to disrupt industries and business models. The business community remains upbeat though increasingly grounded about the technology’s future: Three-fifths of respondents want blockchain to prove itself with measurable, positive results over the next three years.

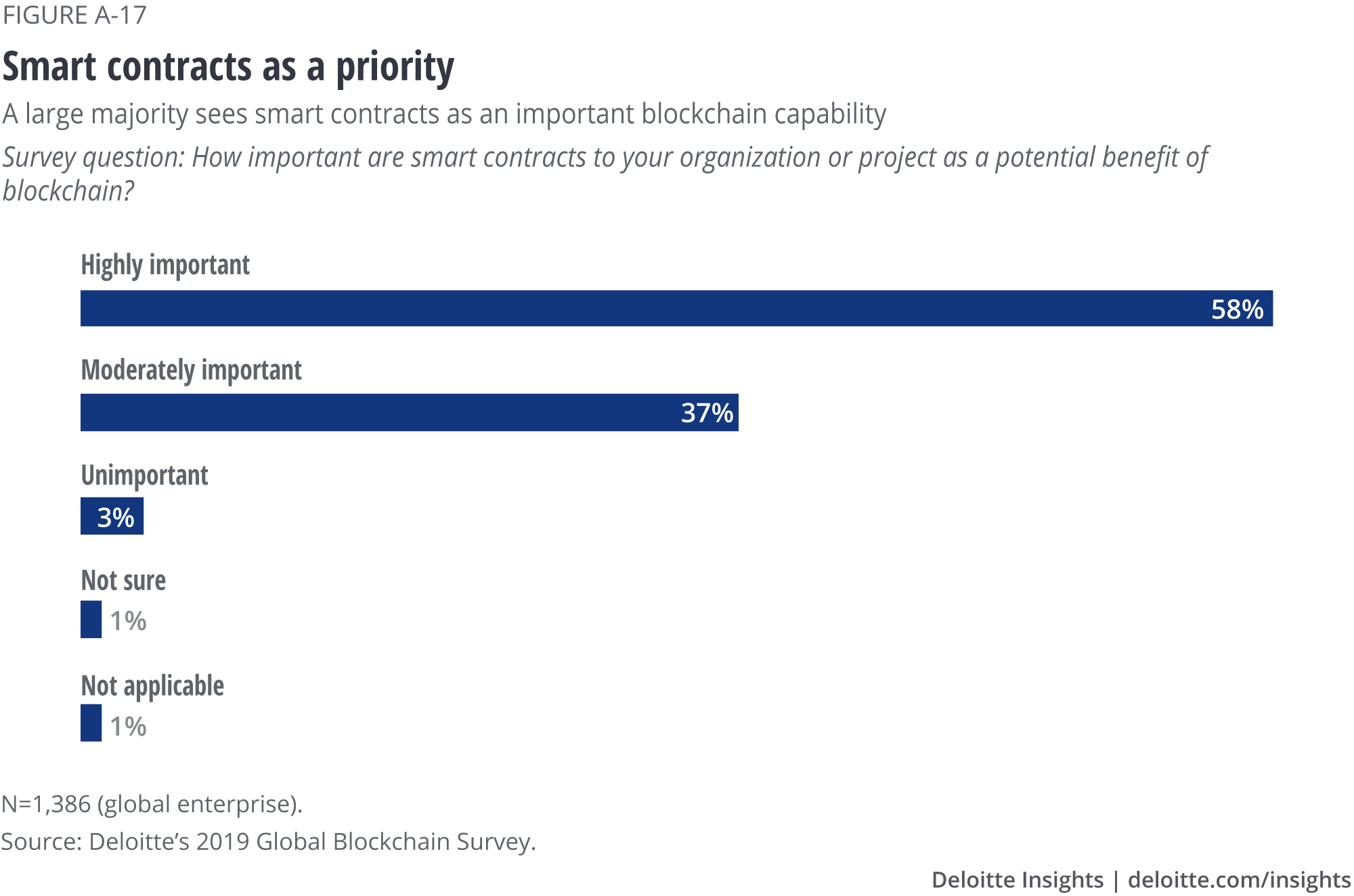

Blockchain’s maturation is expected to continue as overall investment increases or, at least, remains at current levels (13 percent of respondents plan to decrease investments in the next 12 months). Further supporting this viewpoint is the fact that nearly 60 percent of respondents are confident in blockchain’s long-term potential due to the implementation of new solutions. For instance, smart contracts and other token-based transactions can help ensure that artists, agents, producers, and other creatives receive their share of revenues generated by their work, no matter how it is used or repurposed. In addition, they can help by increasing blockchain’s use in such areas as intercompany transactions and warranties financing—for instance, trade finance, letters of credit, and invoice factoring.

A technology in search of additional use cases

Survey respondents, while remaining generally optimistic, are tempering their overall opinions toward blockchain now that early adopters have had time to look under the hood, discover the technology’s limitations, and see beyond the initial buzz. The question: What have they found?

Most people first heard of blockchain through its connection to bitcoin, which inextricably linked the technology to cryptocurrency. Enthusiasts promoted it as a driver of a new distributed economy in which users of token-based currencies would cut traditional banks and brokers out of peer-to-peer and B2C transactions. As such, blockchain advocates were slow to show how it could be used to disrupt and revolutionize other business sectors.

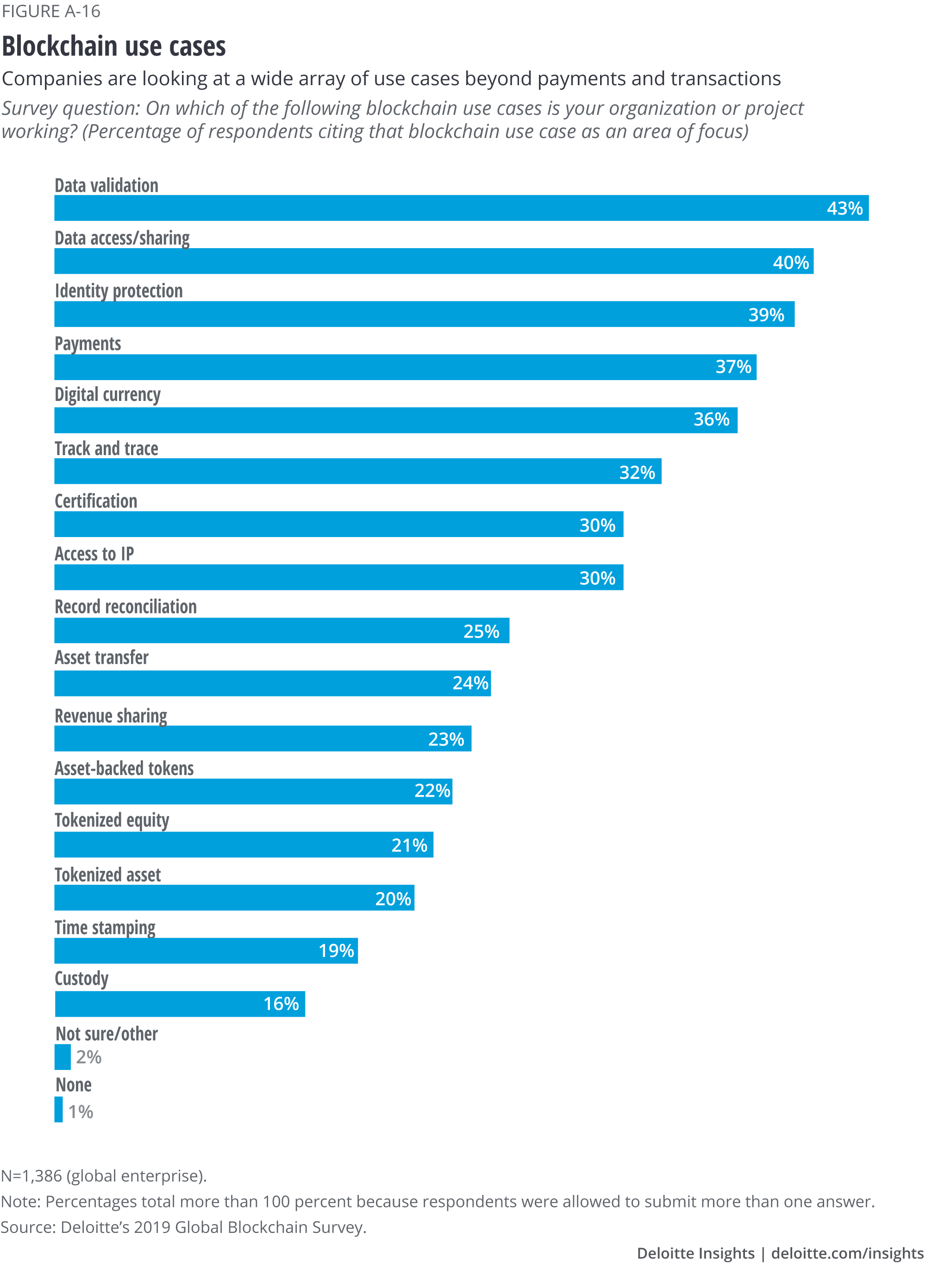

Years later, to the frustration of speculators, cryptocurrency adoption remains a slow-moving revolution. But this slowdown has boosted blockchain’s adoption elsewhere, as other use cases have emerged and begun to drive innovation. In short, as organizations look at blockchain more critically, it is becoming more well-rounded and, potentially, useful to a wider group of users. There also exists a wide range of applications that don’t require the use of a coin, including management of loyalty points, digitizing physical assets, and creating virtual wallets for finance management and reconciliation.

Cautious optimism

While many respondents suggest that blockchain is gaining traction in additional sectors outside of fintech—and finding more use cases within more types of businesses—executives appear to be taking a more pragmatic approach toward its adoption.

This is a familiar path for emerging technologies. Take 3D printing, for example. Just six years ago, many analysts and industry experts viewed 3D printing as an interesting tool with questionable broader potential beyond hobbyists and limited prototyping applications. Since then, major manufacturers have widely adopted the technology to change how they design and make products, and to streamline their supply chains and reduce expensive downtimes caused by having to wait for deliveries of hard-to-find specialty parts by creating what they need, when and where they need them.2

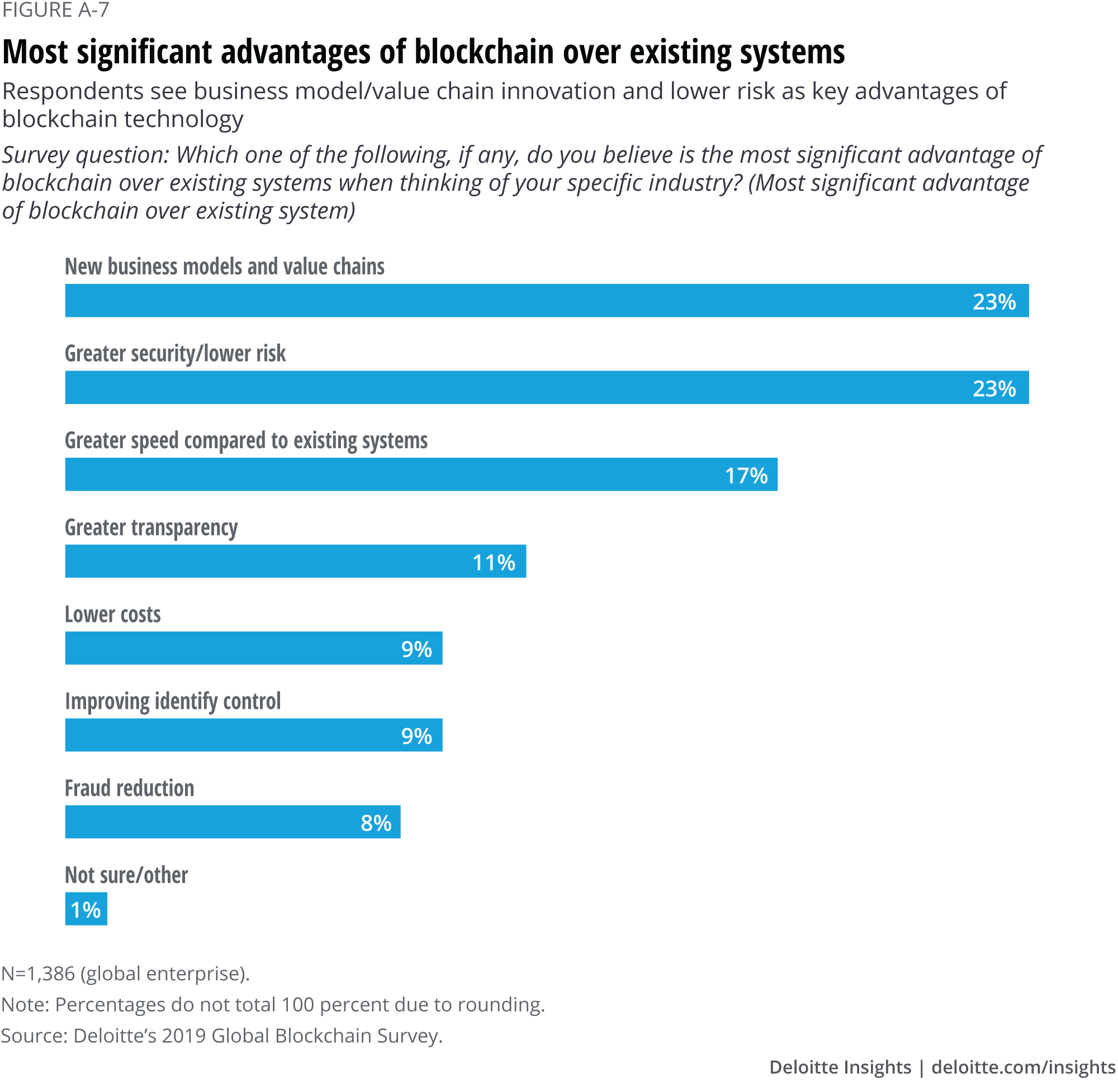

This is reminiscent of where we see blockchain today. Survey respondents are taking a less myopic view of blockchain than they did before and are focusing on business advantages such as increased security and lower risk (23 percent), new business models and value chains (23 percent), and greater speed toward production or delivery (17 percent). We are also seeing diversification in blockchain use cases, models, and regulatory concerns.

In other words, organizations seem now less concerned about whether the technology will work and have begun to focus on what business models it might disrupt. To that end, “we believe executives should no longer ask a single question about blockchain but, rather, a broad set of questions reflecting the role blockchain can play within their organizations,” says Deloitte Consulting LLP principal Linda Pawczuk, Deloitte consulting leader for blockchain and cryptocurrency.

“We believe executives should no longer ask a single question about blockchain but, rather, a broad set of questions reflecting the role blockchain can play within their organizations.”—Linda Pawczuk, Deloitte Consulting LLP principal and Deloitte consulting leader for blockchain and cryptocurrency

Such questions may include:

- How are blockchain-enabled processes changing the way my sector does business?

- How can blockchain reshape my industry? What are my long-term objectives and strategies?

- Does blockchain create the potential for new market ecosystems, and what role should I play?

- How do I leverage the inherently open nature of blockchain?

- What opportunities does blockchain generate for cocreating new markets?

- Where are my biggest blockchain blind spots?

As blockchain adoption moves steadily forward on its journey from the possible to the practical, most respondents say they plan to maintain or even increase their blockchain investments over the next year. But they are expected to do that only if accompanied by the kind of pragmatic understanding that answers to these and similar questions provide.

Key issues

Emerging disruptors

Where enterprise organizations seek ways to integrate blockchain into their existing business models—or, more accurately, how to transform existing processes and systems to work with blockchain—emerging disruptors built their businesses around blockchain from the start. This makes them potentially more fluid and agile than competitors and less constrained by similar challenges that inhibit adoption among their more established competition.

In fact, we’re seeing signs of these abilities as organizations enter the second phase of disruption, in which most are no longer strictly focused on blockchain but are, instead, reinventing existing business models to create dynamic, blockchain-enabled solutions to reduce friction across organizations and industries.

For this year’s survey, we targeted a small sample of emerging disruptors to gauge their attitudes and practices.3 Given their exclusive focus on blockchain solutions, it is unsurprising that they are more advanced in their deployment of blockchain than are enterprise organizations, and in developing and implementing new solutions to leverage blockchain’s potential in new ways.

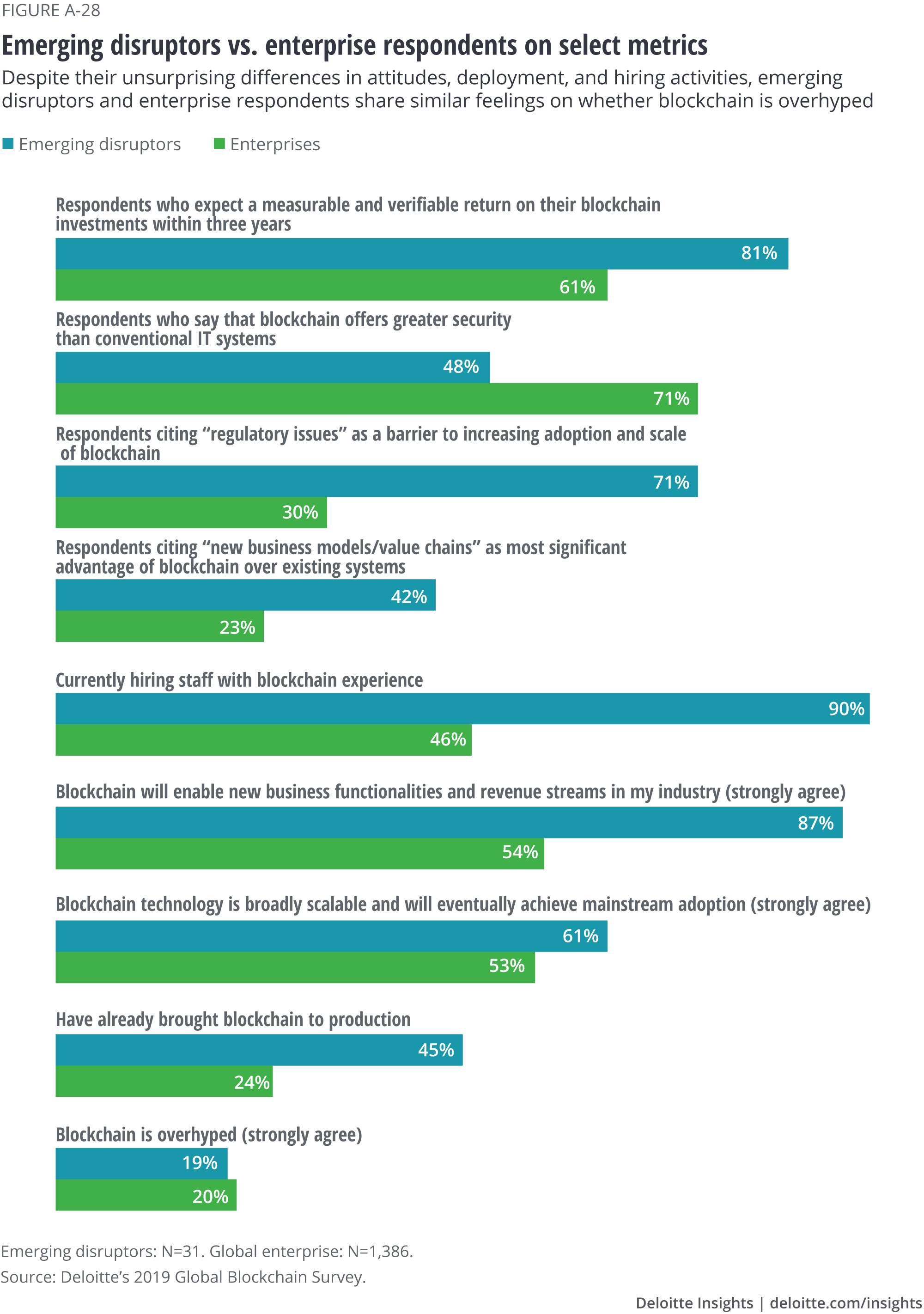

What is interesting, however, is that the survey results show nuance. For example, when asked for blockchain’s most significant advantage over existing systems, respondents from enterprise organizations showed relative parity among several advantages, including new business models and value chains (23 percent), greater security/lower risk (23 percent), and greater speed compared to existing systems (17 percent). In contrast, emerging disruptors were more focused on new business models and value chains, which 42 percent cited as the most significant advantage.

In practice, examples of this creative, innovative thinking can be observed in a different realm: on-demand ridesharing services that have helped to democratize transportation for those who have difficulties hailing or even locating traditional taxis. While there is nothing inherently new in the concept of ridesharing services, disruptive thinking has made possible an entirely new way to access and pay for those services. Some might refer to this as a democratization of access.

In a similar regard, there is little new in blockchain’s underlying technology—for instance, cryptography or data transaction. What is fresh is the disruptive potential that emerging disruptors are driving in the way organizations get things done. One might call this disruption a democratization of trust.

Conversely, when asked what barriers enterprise respondents see in adopting blockchain technology, they see little consensus, with the most frequently cited choice garnering only 30 percent. In contrast, the emerging disruptors overwhelmingly (71 percent) chose regulatory issues as the greatest barrier to blockchain adoption, raising theoretical concerns about new rules that could hamper blockchain’s continued adoption.

Another interesting difference between emerging disruptors and enterprise organizations is their attitudes toward security offered by blockchain. Enterprise organizations overwhelmingly (71 percent) believe that blockchain provides greater security than conventional IT solutions, while only 48 percent of emerging disruptors feel the same. While we cannot fully explain these differing viewpoints, it is still a noteworthy difference that merits further consideration.

Despite these and other differences, emerging disruptor and enterprise executives hold many similar opinions on issues of blockchain models of focus, the emphasis of future activities, what they value in consortia, metrics of success, and individual regulatory concerns.

Interestingly, because emerging disruptors generally are accustomed to moving faster—and often with smaller staffs and limited financial resources—than enterprise organizations, four-fifths of our emerging-disruptor sample say they expect to see results from blockchain implementations within three years. Three-fifths of enterprise organization respondents, meanwhile, expect to see results within the same time frame.

While emerging disruptors remain nimble, our research suggests that they, like the larger enterprise respondents, are approaching blockchain with caution. Despite the innovative vitality that emerging disruptors bring to the blockchain world, they, too, reveal a measure of skepticism, with nearly 20 percent saying blockchain is overhyped, a figure comparable to enterprise respondents.

So as emerging disruptors move on their blockchain journeys, many show pragmatic impulses. Blockchain represents an investment in resources that emerging disruptors hope will provide a measurable return. As pioneers of blockchain exploration and implementation, emerging disruptors play an important role in the larger ecosystem. They are among the first to identify and test viable solutions that larger organizations may then adopt on a wider scale. And in that way, the two kinds of organizations form a symbiotic relationship that drives continued blockchain innovation.

Emerging disruptors are among the first to identify and test viable solutions that larger organizations may then adopt on a wider scale, forming a symbiotic relationship that drives continued blockchain innovation.

“Emerging disruptors are facing big company challenges at an early stage,” says Rob Massey, Deloitte Tax LLP partner and Deloitte tax leader for blockchain and cryptocurrency. “Their innovations can quickly grab the attention of a market and a large user base, putting strain on their technology infrastructure and business processes.”

A brief look at consortia: Benefits and challenges

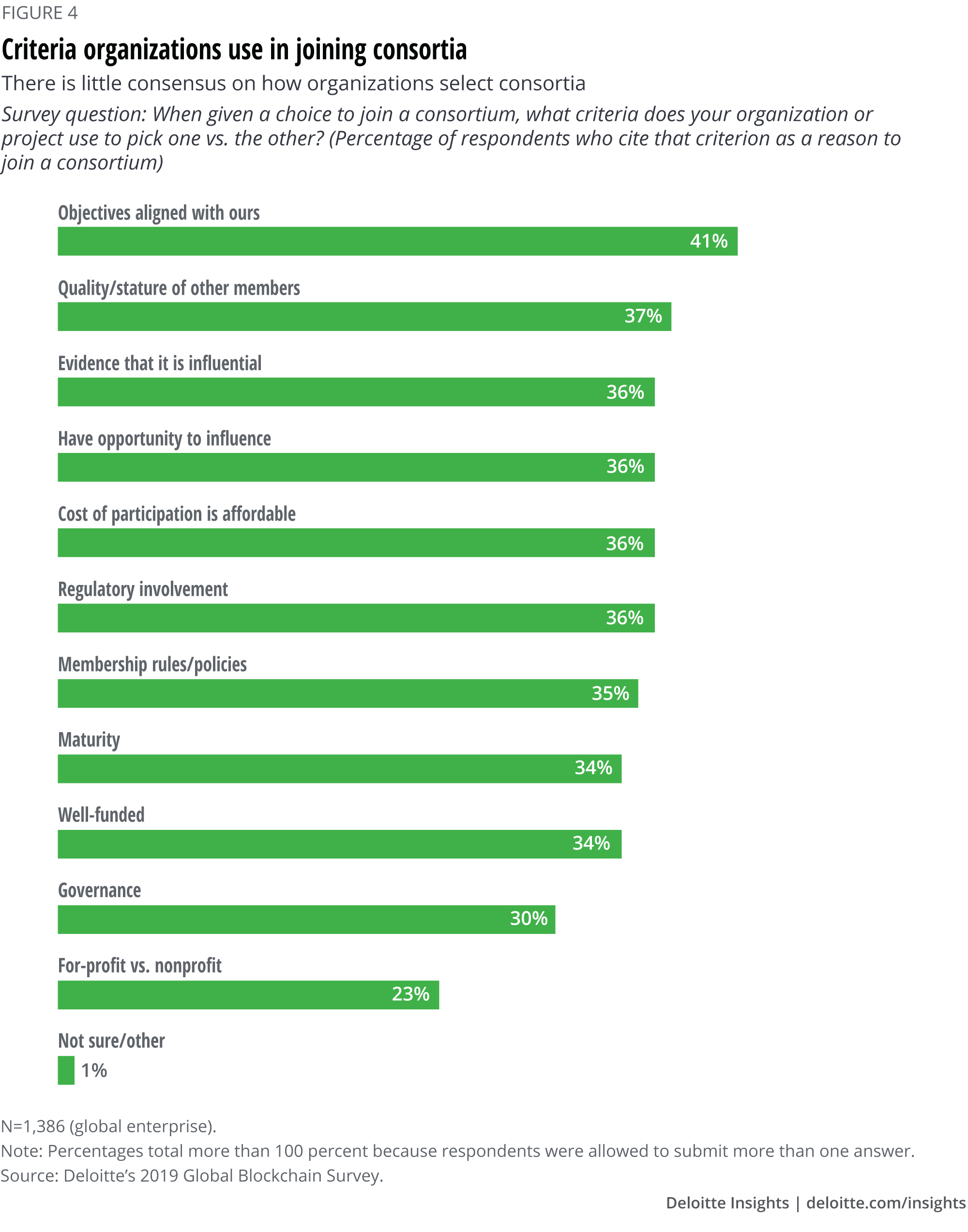

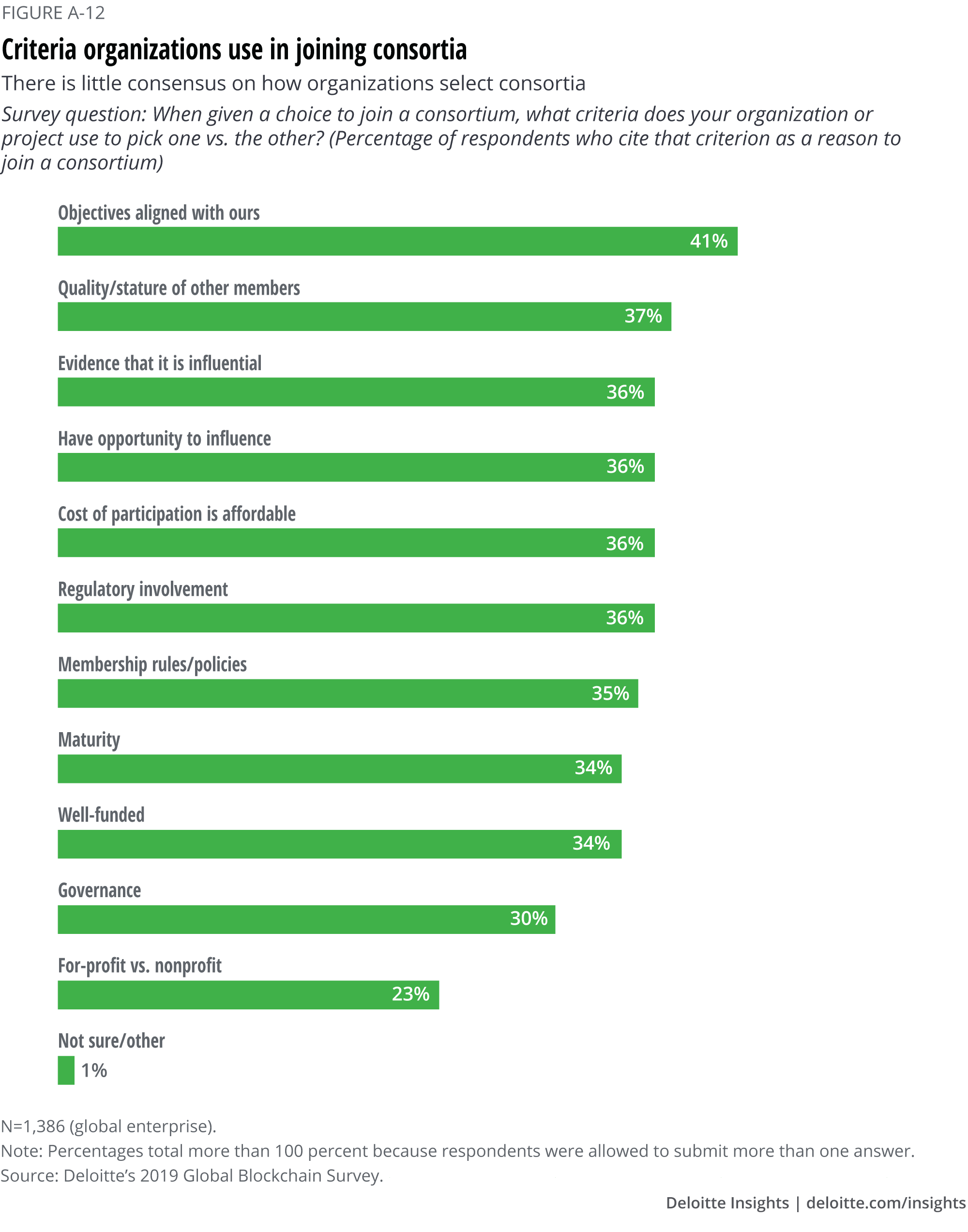

Much of the discussion around blockchain revolves around the complexities and entry barriers of adopting the technology. Joining consortia—coming together with others in your horizontal or vertical ecosystem, in common purpose—arguably may be blockchain’s largest barrier to entry. Why is this so-called co-opetition so difficult? Primarily, consortia require a shift in mindset: You must ally within your ecosystem—whether direct competitors or not—and work toward some greater good. Getting to that place can be difficult to reconcile.

At a more tactical level, consortia require many important considerations that are not easily resolved in a group setting. Consider a few of these issues:

- What are the consortium’s goals (for instance, revenue play or cost-efficiency)?

- What is the participation structure/governance model?

- What is the funding model?

- How are decisions made on equal voting, rotational power, and other issues?

- Who owns the intellectual property (for instance, the association, royalty-free licenses for members, open standard, or source license)?

- What are the consortium’s business, technology, and regulatory risk factors?

- What products/services can the consortium offer to incentivize its members?

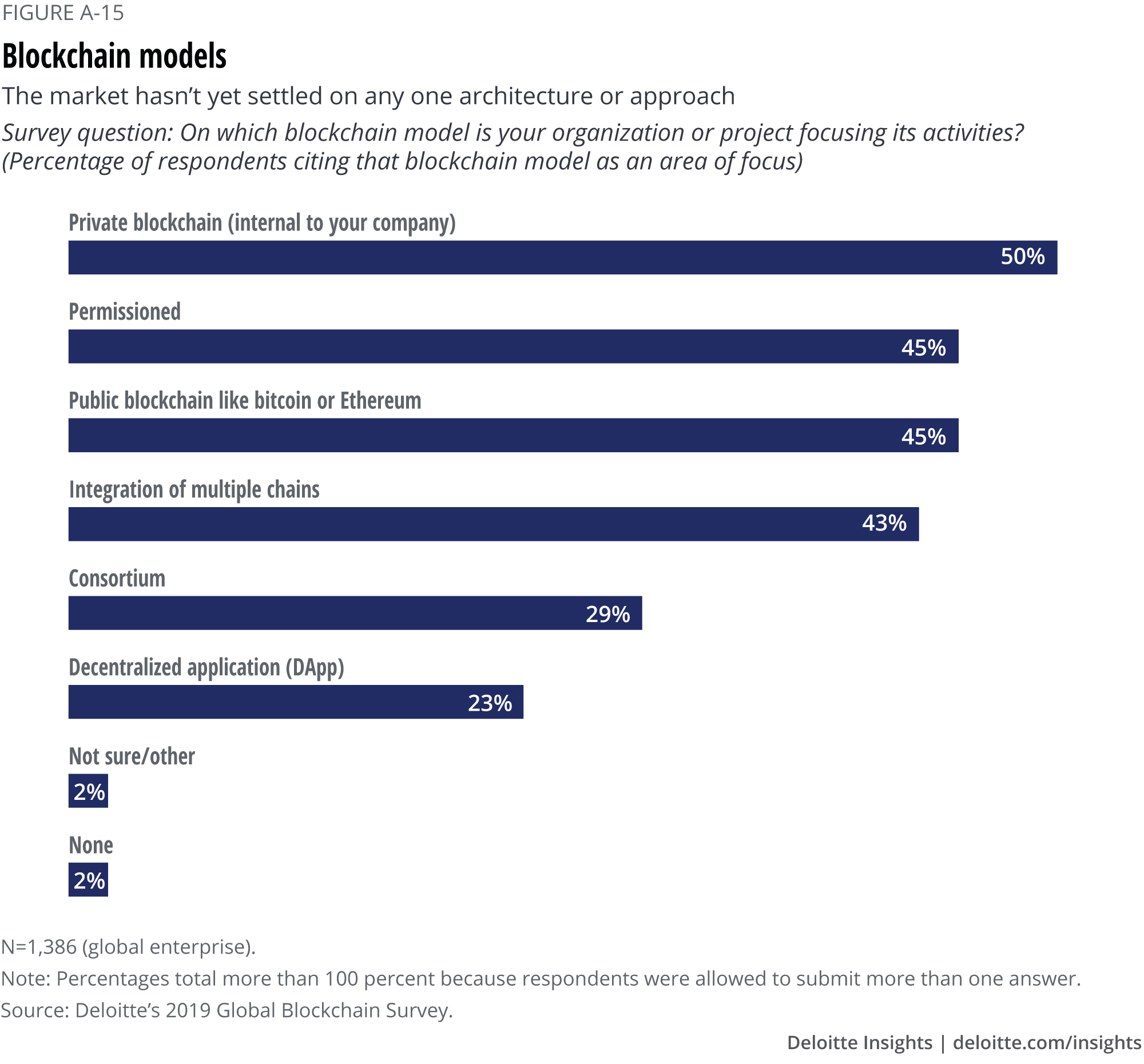

The list goes on, which helps explain why consortia are difficult to form and manage even when forming them seems in everyone’s best interest. So it may be unsurprising that our survey reveals the same basic story from last year: Consortia do not garner the same level of focus as such models as private and permissioned blockchains.

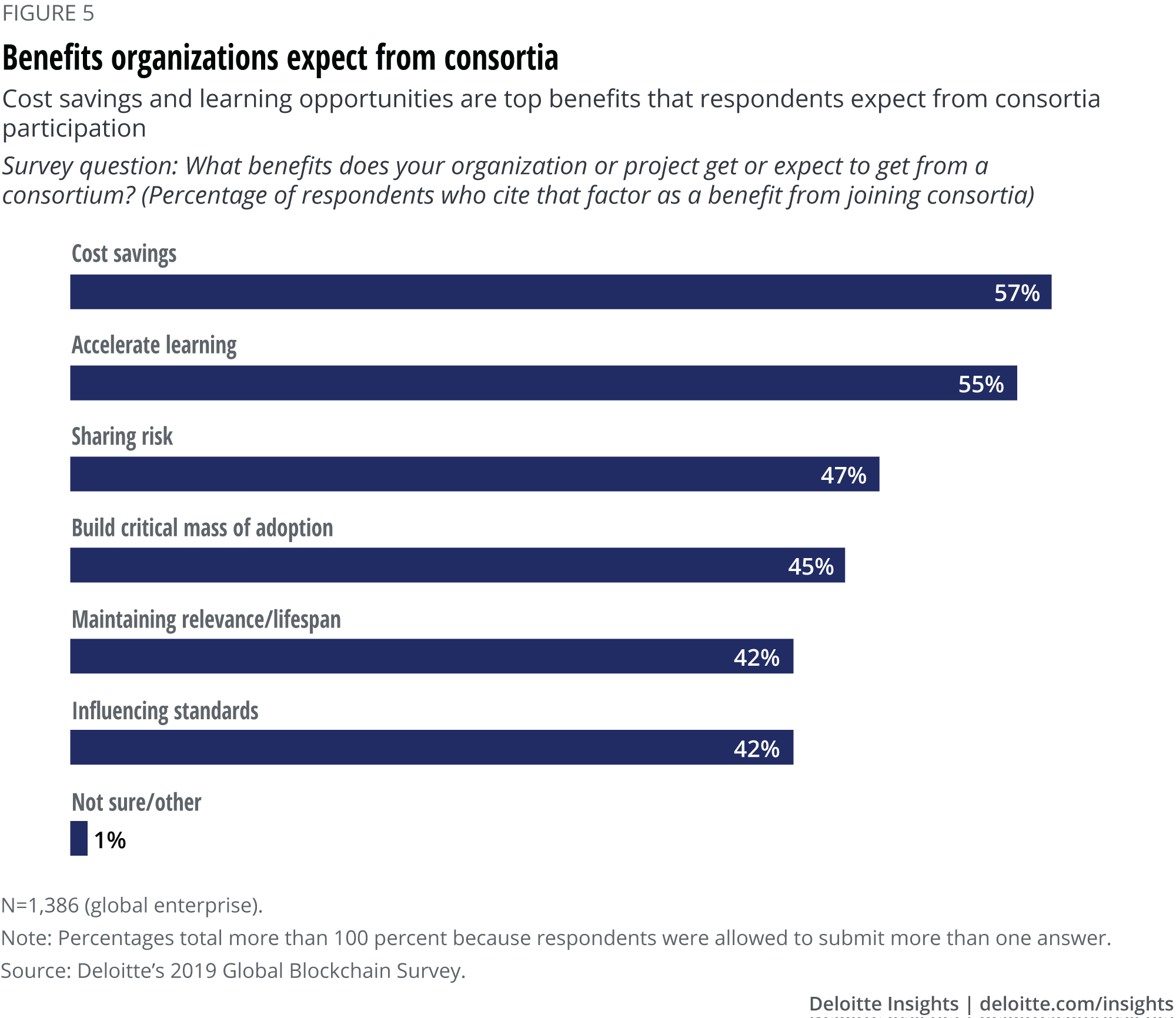

Still, less focus is not the same thing as indifference. The overwhelming majority (92 percent) of our respondents say they either belong to a consortium or plan to join one in the next 12 months. In doing so, they identify benefits such as cost savings, accelerated learning, and risk sharing. Despite their complexities, consortia are expected to continue to figure prominently in the larger blockchain ecosystem.

Blockchain regional analysis

Just as emerging disruptors are changing the dynamics of the industries and sectors in which they compete, new blockchain initiatives in different countries and regions are affecting how blockchain is implemented around the world.

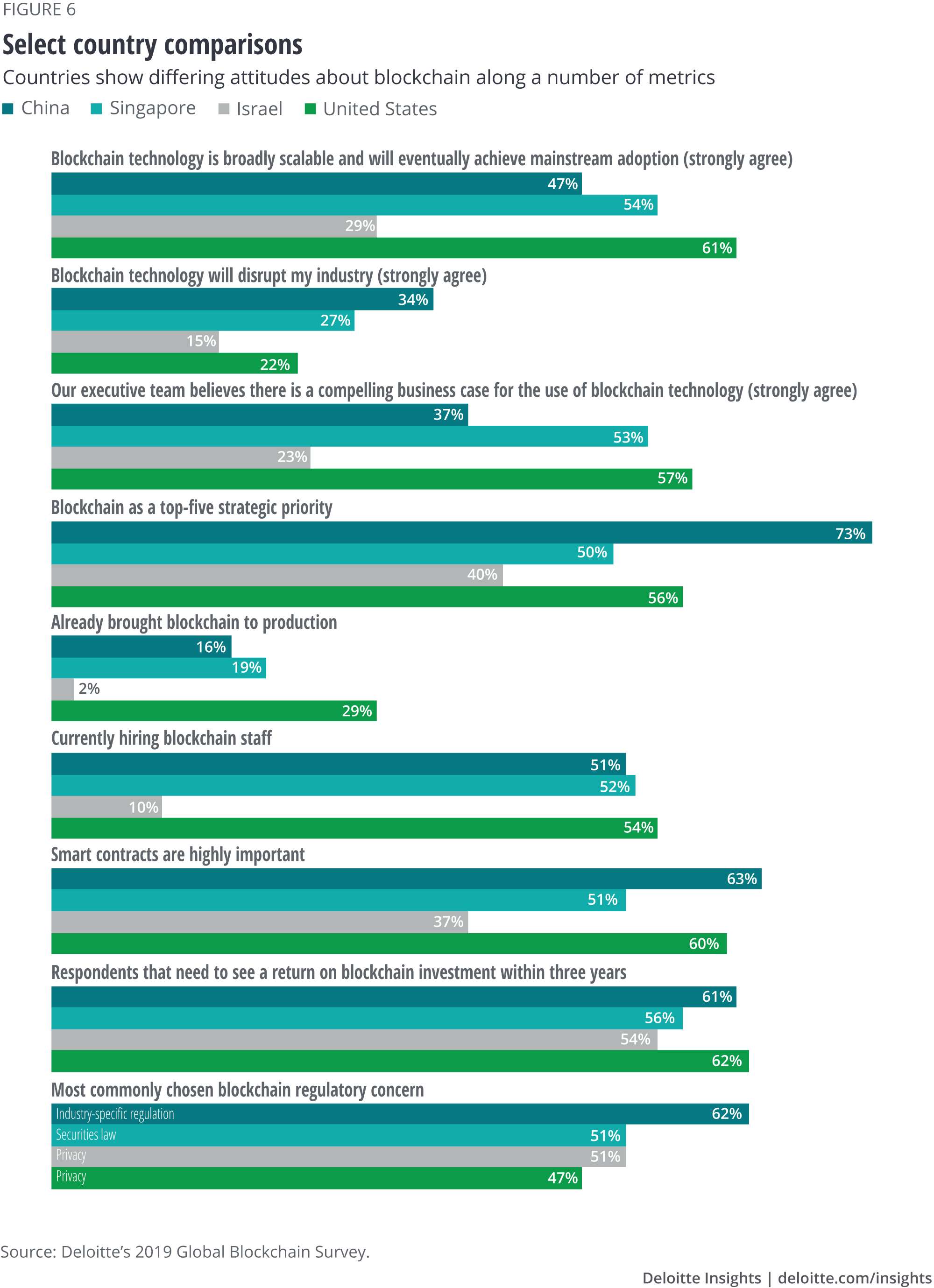

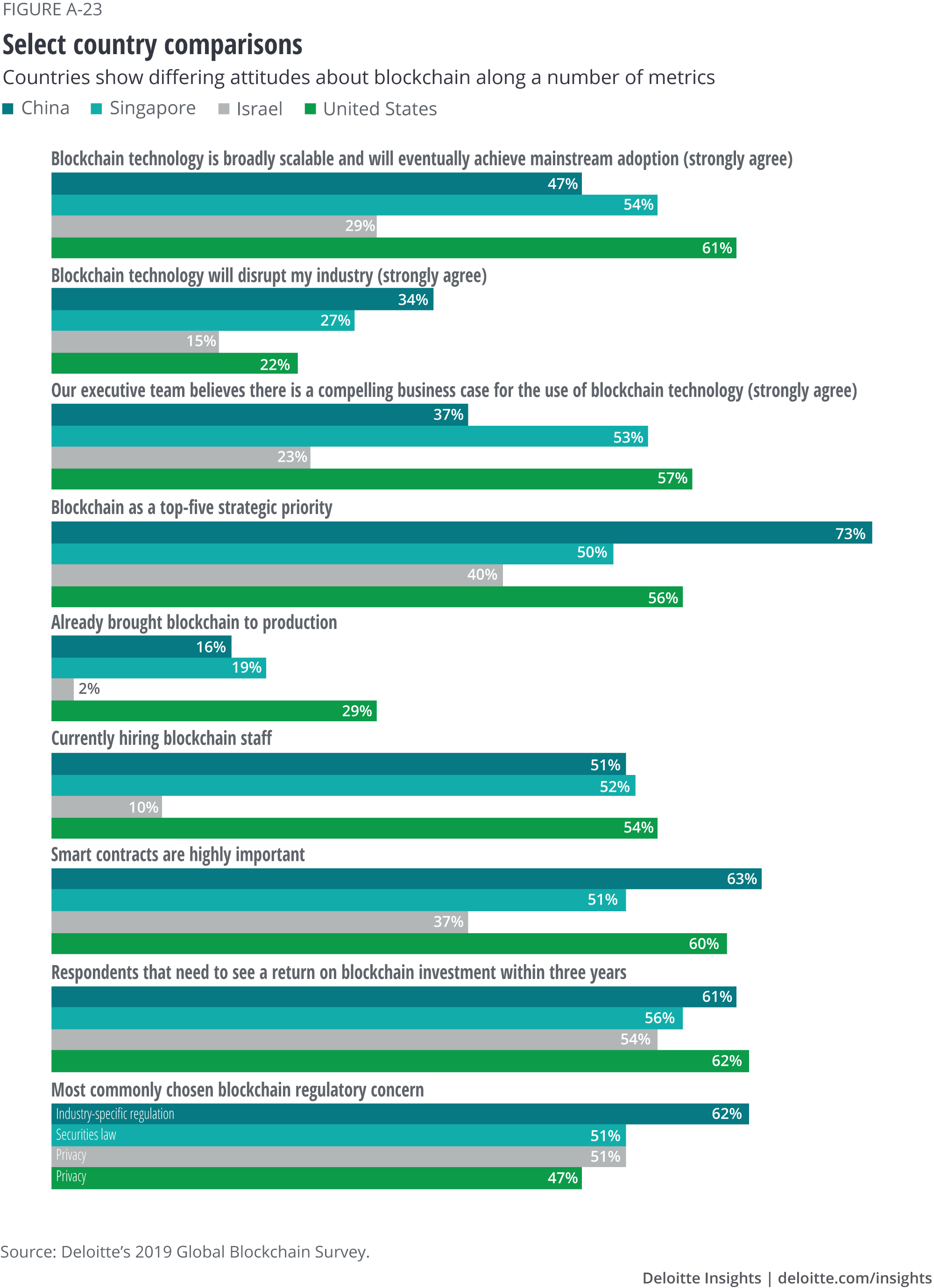

While we cannot generalize about the initiatives in specific countries (see figure 6 for a sense of how survey respondents expressed differing views on select issues), we can look at countries that appear to be emerging as hotbeds of new blockchain solutions, based on their own collective objectives, approaches, and cultural sensibilities.

The following profiles are examples of the drivers and attitudes that affect blockchain development and can serve as guides for organizations that are looking to do business with global partners. Specifically, these profiles show how innovation is informed by context, and why developing an understanding of the people and culture in which they live—the facts on the ground—is often imperative to success.

China

In China, the government recently established key strategic technology priorities in its 13th five-year plan for IT. A white paper published by the Ministry of Industry and Information Technology cited blockchain as a key driver of economic development. The paper further suggested that the “real economy” was an area in which blockchain could find long-term applications—for example, product traceability and copyright protection. Fintech was also noted as a technology that government regulators were developing along with blockchain solutions to carry out public functions.4

Survey respondents overwhelmingly agreed with this assessment, with 73 percent suggesting that blockchain is a top-five critical priority in China—a figure substantially higher than most other countries in our sample. And because China essentially bans cryptocurrencies, private blockchains—and to some extent, permissioned blockchains—could remain vital, especially given the size of Chinese industrials and their typically large numbers of subsidiaries.5

Some 34 percent of respondents “strongly” believe in the disruptive potential of blockchain, more than most countries in our sample. This is important, given China’s place in the global economy and the leadership role it has assumed in the Asia-Pacific region.

“China, more than anywhere else in the world, will use blockchain strategically instead of tactically,” says Paul Sin, consulting partner, Deloitte Advisory (Hong Kong) Ltd., and leader of Deloitte’s Asia-Pacific blockchain lab. “More projects are driven by top management who use blockchain as a strategic weapon rather than a productivity tool.”

Singapore

In light of China’s de facto ban, Singapore is positioning itself to promote cryptocurrency. Indeed, the government has been highly supportive of free public blockchain platforms. In fact, the Monetary Authority of Singapore has adopted a pro-blockchain stance with favorable tax treatments and public funding for blockchain development.6 The government, too, appears to be moving beyond its traditional regulatory role by announcing its understanding and acceptance of the importance of blockchain to the financial future. As such, the Monetary Authority recently called blockchain technology “fundamental” to economic development in Singapore. Coupled with the country’s high level of indigenous talent, entrepreneurial spirit, and fintech development, blockchain is expected to maintain an upward adoption trajectory in Singapore.7

It is thus unsurprising that Singaporean executives report a uniformly greater belief in the potential of blockchain than respondents from many other countries. Respondents from Singapore also tend to be more aggressive than their global counterparts in hiring for blockchain-related positions—and more patient in waiting for the technology to provide measurable results.

Israel

There is substantial blockchain activity within Israeli organizations, focused largely on digital assets—in particular, cryptocurrencies. Israel stands as a strong leader in entrepreneurial activity and R&D in areas such as cyber, cryptography, and intelligence, which, in turn, seems to create a natural affinity for blockchain. Toward that end, some see Israel as a hotbed of blockchain activity. Crypto activities might currently outnumber corporate blockchain efforts, but a shift may be looming. Israeli blockchain startups are pursuing projects in such other areas as DNA data storage, diamond registration, cybersecurity, and international shipping.8

For its part, an Israeli stock exchange is moving to develop blockchain applications.9 And the Israel Securities Authority, a governmental agency, has begun to adopt blockchain in its messaging system.10 This, too, demonstrates how the Israeli government appears to be adopting blockchain technologies and shifting from a strictly regulatory role to an end-user role—a theme that is becoming increasingly apparent across highly enabled blockchain nations.

While our survey results suggest that Israelis tend to be more circumspect about joining consortia than respondents from other regions, the country—and blockchain firms within it—have formed partnerships with other leading blockchain countries on matters related to codevelopment and regulatory development.11 Israel’s reputation as “Startup Nation” may serve it in good stead as its blockchain entrepreneurial sensibility evolves and matures.12

“Given its strengths in intelligence gathering and analysis, security, and cryptography, it is not surprising that Israel was one of the leading countries in the crypto revolution and remains a leader in blockchain-based data security and traceability technologies today,” says Hagai Zachor, Deloitte Israel’s strategy manager and head of blockchain.

Government as blockchain user—and regulator

Historically, blockchain-related regulatory attention has focused on cryptocurrencies, with regulators helping to shape the legal status of cryptocurrencies as they evolve. For example, a number of US federal court decisions have concluded that virtual currencies that are not otherwise deemed to be securities under the jurisdiction of the US Securities and Exchange Commission (SEC) are commodities under the jurisdiction of the US Commodity Futures Trading Commission.13 While this has added clarity to jurisdiction, regulations themselves are expected to take some time to emerge with regulators focusing on receiving input from the market and policing individual investor protection cases.14

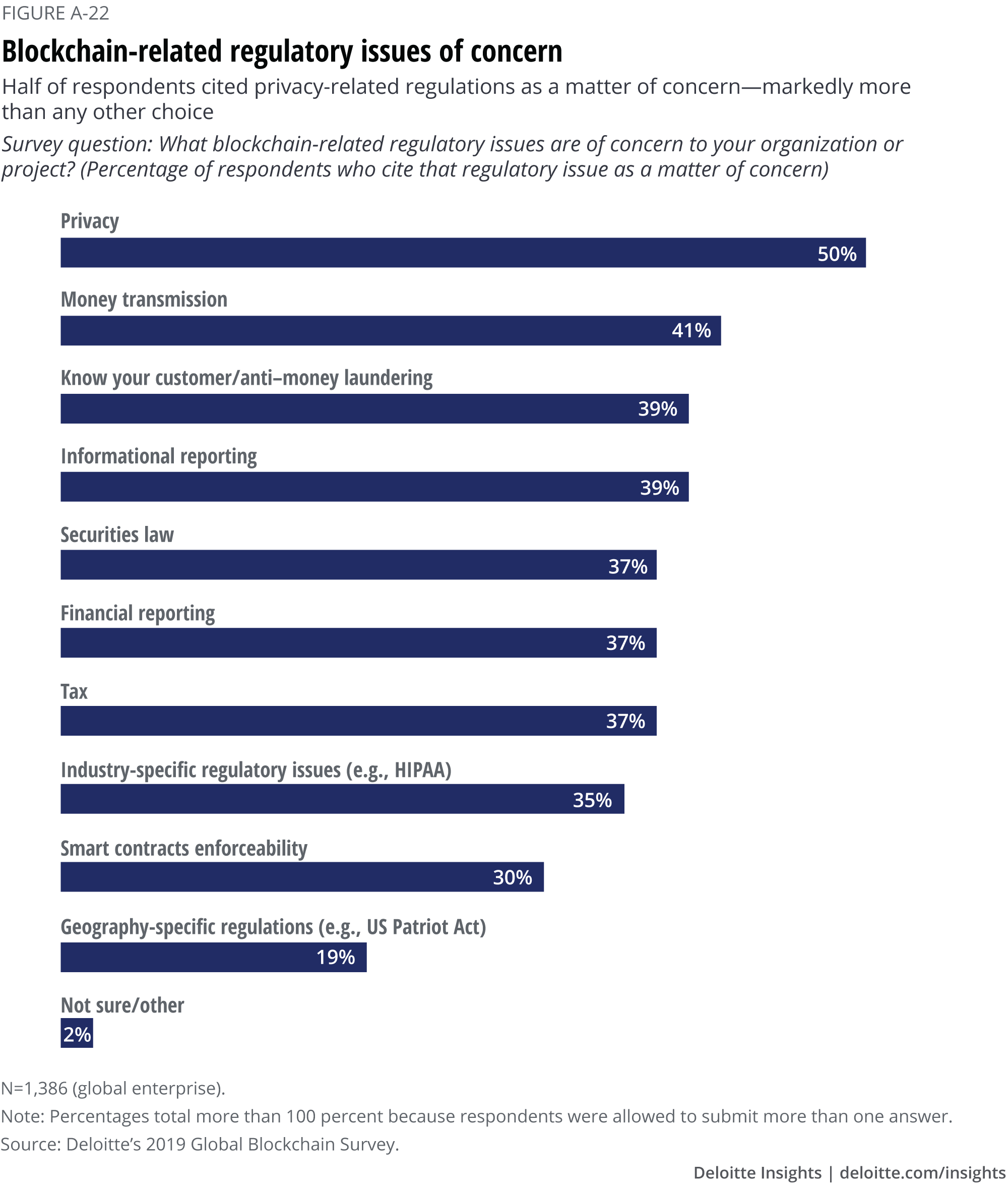

More recently, regulatory concerns about blockchain have gained traction outside of digital assets. For example, the General Data Protection Regulation (GDPR) places strict limitations on how personal data is stored and saved within the European Union. Some see the GDPR leading to an unavoidable clash with the intrinsic immutability of how data is stored on blockchain platforms.15 Similarly, in the United States, the Health Insurance Portability and Accountability Act limits how personal health information is handled, which may run afoul of blockchain-based solutions within the life sciences context.16 Indeed, our survey respondents cited privacy more than any other area of regulatory concern (50 percent). So it seems apparent that these and other privacy-based regulations could need to align with the evolving technology.

Moreover, though technically not a governmental entity, the International Organization for Standardization is creating a global framework for blockchain focusing on key areas, such as architecture, taxonomy, and ontology.17 In the United States, at least one state has passed regulations on the legal status of blockchain companies as limited liability companies while still others have passed laws on the enforceability of blockchain-based transactions.18 Additional regulatory developments are anticipated in other blockchain applications, such as supply chain tracking, voting records, and general information reporting.

At the same time, governments do more than merely regulate blockchain technology. They often advocate for and incubate new blockchain applications. Over the past several years, we have observed government blockchain participation that extends beyond education and tentative experimentation—specifically, moves toward tactical, bold plays that drive innovation. Representative public use cases include: digital currency/payments (Canada, Singapore, United Arab Emirates, Saudi Arabia); land rights (United States, Brazil, Sweden); voting in elections (United States, Australia, Japan, South Korea); shareholder proxies (United Arab Emirates); identity management (Switzerland, Estonia, United Arab Emirates, Singapore); health care (United States, Estonia); and defense/security (United States).19

Governments do more than merely regulate blockchain technology. They often advocate for and incubate new blockchain applications—specifically, moves toward tactical, bold plays that drive innovation.

Conclusion: An evolving landscape

The blockchain story is beginning a new chapter, one in which the questions executives are asking are tougher, more granular, more grounded, and more pragmatic. They are questions that show an emerging awareness that the technology seems ready for prime time. It works. Now executives must figure out how to make the technology work for them—how to leverage innovation created by emerging disruptors and how to align within the ecosystem.

Our survey seems to make clear this evolving landscape of pragmatism and maturation—more varied use cases and applications than last year, across a greater variety of sectors. Respondents show a more balanced view of expectations and concerns than last year, pointing to an increasingly practical sensibility. And indeed, what appears to be happening every day in the real world also appears to confirm what our survey is telling us: A day hardly seems to pass in which we do not read about new blockchain use cases or new ways to tokenize assets.20

Certainly, blockchain remains a subject of debate. But the tone and terms of the debate themselves seem to be shifting, reflecting more developed use cases and strategic visions of the future. Even those who may have looked askance at the technology in the past appear to be viewing blockchain with a new sense of possibility.

Of course, nobody can accurately predict the future, and we too will refrain from predicting a precise timeline on blockchain’s greater adoption. Yet the trajectory for blockchain in 2019 and going forward appears to point in a clearly upward direction. And that journey is the story of growth and potential that disruptive technologies characteristically take, offering adopters tangible strategic advantage in ways that few thought imaginable before.

Appendix

© 2021. See Terms of Use for more information.

Explore the Blockchain potential

-

How blockchain enables the digital supply network Article6 years ago

-

Capturing value from the smart packaging revolution Article6 years ago

-

Blockchain and the five vectors of progress Article6 years ago

-

Adapting to food labeling laws through blockchain and IoT Article6 years ago

-

Assessing blockchain applications for the public sector Article6 years ago