${title}

The early 2000s marked a significant milestone for bancassurance in Asia Pacific. Following the high-profile launch of a partnership between a global insurer and a regionally headquartered bank, the region was swept up by a tsunami of interest in bancassurance tie-ups seeking to offer customers banking and insurance products under a single financial institution.

Fast forward to today, bancassurance partnerships are the norm rather than the exception, with many insurers willing to fork out huge sums for exclusive access to a bank’s extensive customer base and distribution network. The sobering reality, however, is that not all bancassurance partnerships have performed, or will perform, as anticipated.

In this report, we will distil the observations gleaned from our extensive experience supporting insurers and banks on their bancassurance partnerships in Asia Pacific and beyond to elucidate the key execution and relationship issues on this journey, and provide some recommendations on the way forward.

Throughout our analysis, we will also draw on our findings from a roundtable dialogue conducted with industry leaders from the banking and life insurance sectors, whose inputs have enabled us to hone an even more nuanced understanding of the opportunities and critical success factors of bancassurance partnerships.

It takes two to tango

Trust should be the cornerstone of any bancassurance partnership, and both parties must play their part in forging and maintaining the relationship. To this end, it might be worthwhile for both sides to take a step back to consider whether their partners are sufficiently equipped with the tools they need to participate meaningfully in the partnership.

Challenge #1: Execution effectiveness

From the perspective of execution effectiveness, we have observed several key challenges and thereby, opportunities for innovation. Broadly, these opportunities can be understood as 10 types of innovation, which can be further classified into the three categories of Offering, Experience, and Configuration, in no particular order of importance.Types of innovation

- Product Performance: Distinguishing features and functionalities

- Product System: Complementary products and services

One area of significant divergence between banks and insurers in a bancassurance partnership lies in differing assessments of the suitability of an insurance offering for distribution. While banks tend to be more segment-centric in their orientation and prefer transactional offerings that can be sold in large volumes, insurers are relatively more product-focused and emphasise long-term protection as key to their profitability and return on investment.

To better capitalise on the opportunities of longer term products, insurers should consider collaborating with their banking partners on the development of joint offering or proposition roadmaps. These roadmaps could be calibrated to specific segment and channel needs for a more seamless customer experience.

Within a partnership, the bank and insurer must also be able to align their perspectives on the customer and their needs. Having this shared view is critical to informing the joint development of cohesive financial solutions and customer experiences to not only create ‘wow’ moments for the customer, but also enable the customer to develop an emotional connection to the shared bancassurance value proposition.

Types of innovation

- Service: Support and enhancements that surround offerings

- Channel: How offerings are delivered to customers

- Brand: Representation of offerings and business

- Customer Engagement: Distinctive interactions

It is widely acknowledged that banks have an edge over insurers in the realm of digital capabilities. As a result of this asymmetry, few bancassurance partnerships have been successful at delivering a seamless customer experience, let alone seamless end-to-end transactions. To make it work, both sides must commit to putting customers at the centre and invest in the development of capabilities and resources fluent in both sides of the banking and insurance equation.

Other potential opportunities for collaboration also include areas such as data and analytics. Banks and insurers both have massive and under-utilised databases that can be leveraged to better understand their customers and financial priorities. By working together to develop the capabilities to analyse this data, bancassurance partners can benefit from more meaningful insights on how they can better provide the right advice, products, and services to their customers, and enhance their reputation as trusted financial service providers.

Types of innovation

- Profit Model: The way in which profit is generated

- Network: Connections with others to create value

- Structure: Alignment of talent and assets

- Process: Signature methods for delivering work

Managing the end-to-end customer sales journey from lead management to application submission is more art than science. Every bank has its own set of processes that could vary even within the same bank at a market or regional level. Such variation poses a fundamental challenge for insurers engaging in bancassurance partnerships, as there is never a one-size-fits-all solution.

It is also for this reason that we have witnessed in our own experience an abundance of ‘hand-offs’ in bancassurance sales processes that invariably result in lead leakages and low conversion rates – and with these, higher operating costs and loss of revenue opportunities. One potential solution to keep a customer engaged and informed throughout the process is to develop and introduce a common platform. This could help to minimise the number of ‘hand-offs’ and enable leads to be more effectively harnessed.

However, pursuing this option will first require a thorough, hands-on review of the end-to-end process to identify critical gaps and uncover meaningful insights on the customer experience and bank relationship managers’ selling pain points.

${panelContent4}

${panelContent5}

${panelContent6}

${panelContent7}

${panelContent8}

${panelContent9}

${panelContent10}

${panelContent11}

${panelContent12}

${title}

Challenge #2: Relationship issues

While performance issues are complex, relationship issues might prove to be even trickier to navigate. Cultures and motivations inevitably differ between organisations – and these differences tend to become more pronounced in an exclusive bancassurance partnership.Common sources of friction include, for example, the fact that insurers may be more focused on bottom line profitability given their product-centric sales approach, while banks are more focused on fees and commissions given their transaction-based sales approach. At the same time, while insurers may be more interested in seeking access to a captive customer base, banks may prefer to leverage their distribution channels to generate risk-free income – and both sides may find it difficult to appreciate each other’s point-of-view.

To navigate these relationship issues, industry leaders at our roundtable emphasised the importance of setting the right tone at the top. At the working level, teams should also be encouraged to develop a clear understanding of their partner’s comparative advantages and disadvantages, as well as the skills and experience gaps that would need to be filled in order to enhance the partnership’s synergies.

Moving forward in lockstep

For a bancassurance partnership to succeed, the insurer and bank must share a long-term commitment beyond their initial investment – not least with the mutual agreement to undertake continual, ongoing efforts that will enable them to move forward in lockstep and grow with each other throughout the entire lifetime of their partnership.

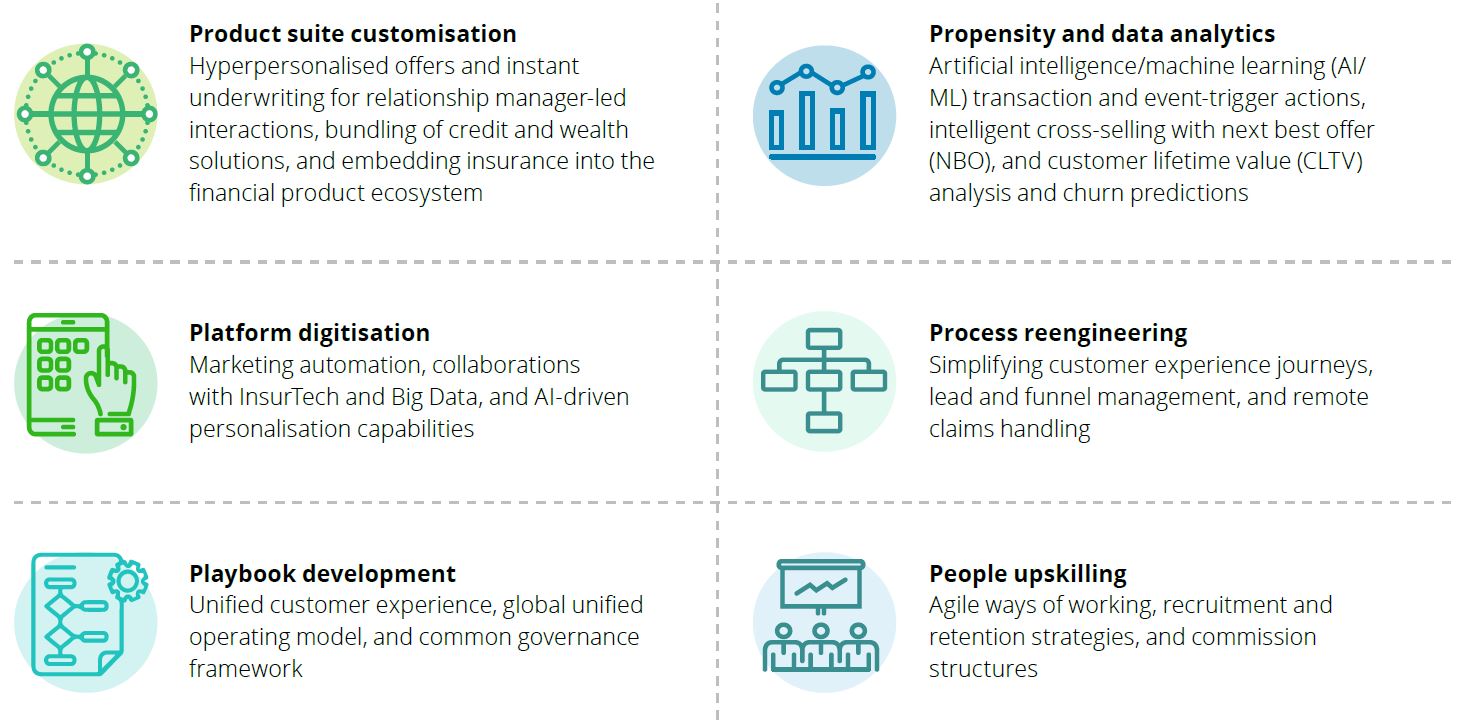

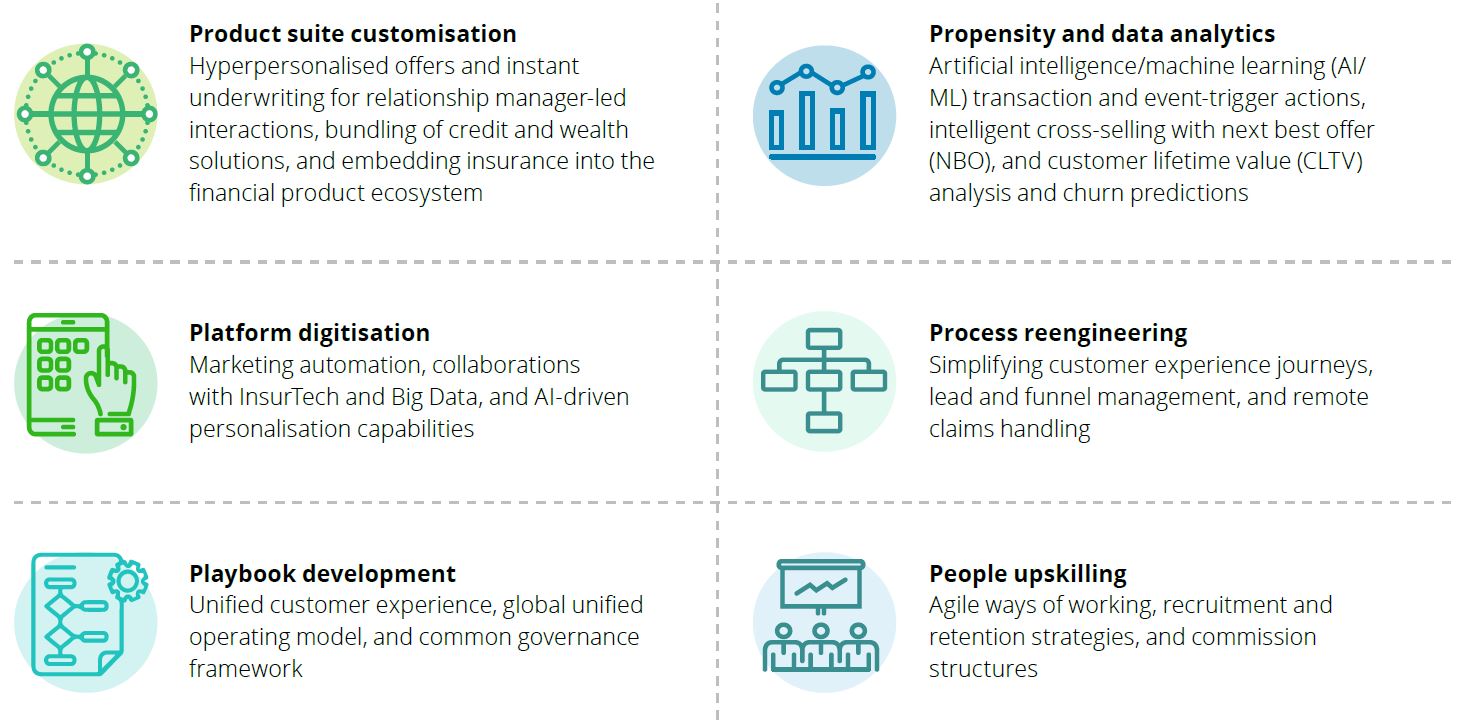

As an immediate next step, we propose that bancassurance partners commit to an objective, third-party review of existing systems – one that takes into account differences in timeline orientations, relevant regulatory requirements, and underwriting requirements – to assess whether their existing systems are fit-for-purpose, and identify areas where the partners can better align their capabilities with each other. Based on our cumulative experience, we recommend that these reviews focus on the following non-exhaustive list of long-term transformation enablers:

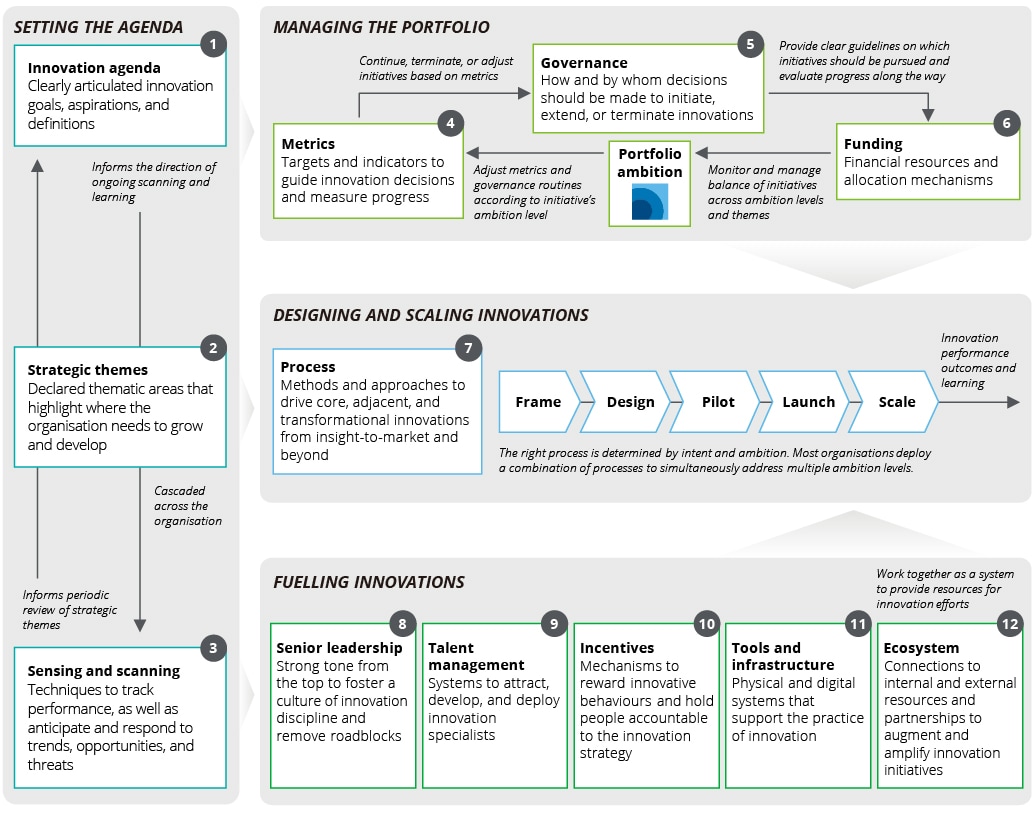

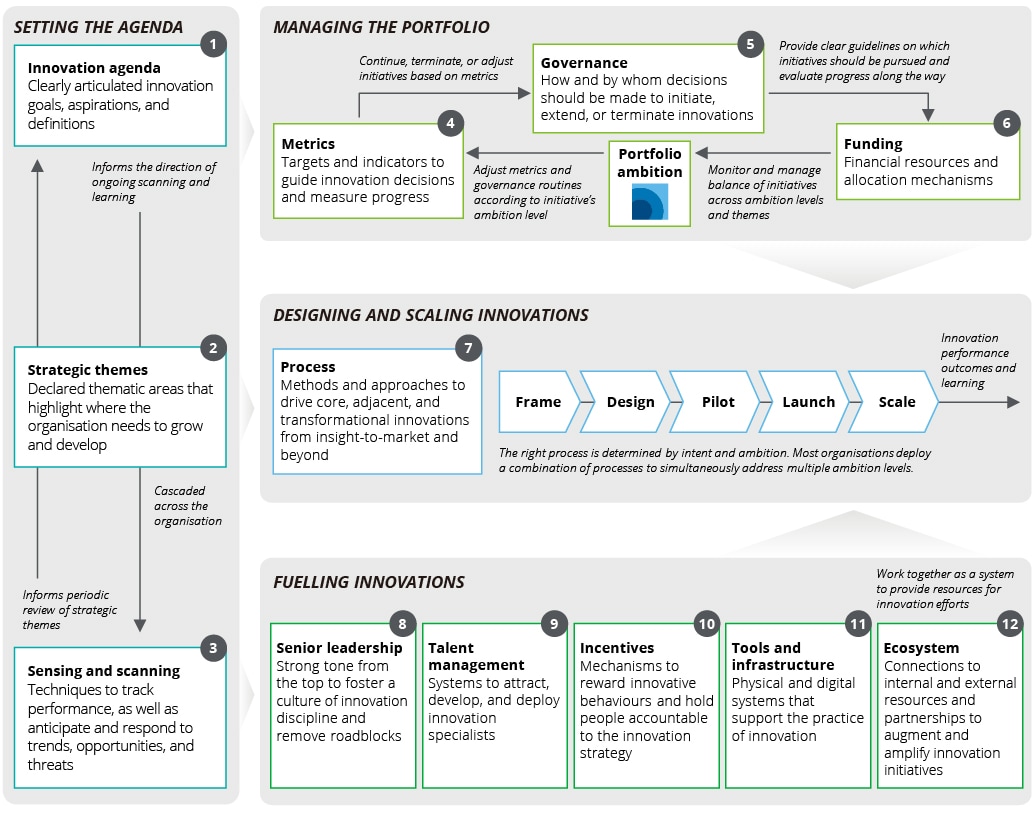

While tactical reviews are critical in the short-term to maintain ongoing momentum, strategic innovation should be the point of focus for bancassurance partnerships over a longer-term horizon. Having earlier alluded to the 10 types of innovation, we propose that bancassurance partners move forward on their innovation agenda by setting in motion several pathways towards a new bancassurance paradigm:

${panelContent3}

${panelContent4}

${panelContent5}

${panelContent6}

${panelContent7}

${panelContent8}

${panelContent9}

${panelContent10}

${panelContent11}

${panelContent12}