Eurozone: A new dynamism has been saved

Eurozone: A new dynamism

08 December 2017

Less than a year ago, forecasts for the Eurozone unanimously looked bleak. However, a good year later, predictions now indicate the post-crisis period of feeble growth and persisting unemployment has ended. But is this recovery sustainable?

What a difference 11 months make. Rewind back to January 2017. Analyses of the Eurozone reserve the most space for political risks and expect—at best—a continuation of the anemic recovery. The euro is heading toward parity with the dollar and the general economic outlook for the Eurozone is clouded by political risks that weigh heavily on economic sentiment.

At the end of the year, the Eurozone is doing significantly better than predicted. Political risks did not materialize; the euro has appreciated substantially; and the Eurozone has taken a much more dynamic growth path. Current growth is becoming broader-based. While consumption remains the key driver, exports recently contributed more and corporate investments—hitherto the recovery’s Achilles heel—seem to have left the legacy of the financial crisis behind. The key question is whether the Eurozone can continue to expand at this speed.

Current situation: Rosy

The fourth quarter of 2017 brought unambiguously good news for the Eurozone’s economy. The post-crisis period with its feeble growth and lasting unemployment seems to have come to an end.

- The recovery has now lasted for 18 consecutive quarters and the Eurozone has been growing at the highest rate for the last 10 years.

- Unemployment has fallen to the lowest level since 2009 and employment figures are now above pre-crisis levels.1

- The sentiment indicators paint a rosy picture. The European Commission’s Economic Sentiment Index reached its highest level in 16 years; the same applies to its consumer confidence component.2

The main upside surprise in the last quarter came from exports. Driven by stronger-than-expected world trade and a synchronized upswing in world economic growth, the Eurozone’s exports accelerated and developed stronger than anticipated. So far, the strong euro has not been able to stop this trend. At the same time, corporate investments surprised positively, lending more stability to the hitherto consumption-based recovery.

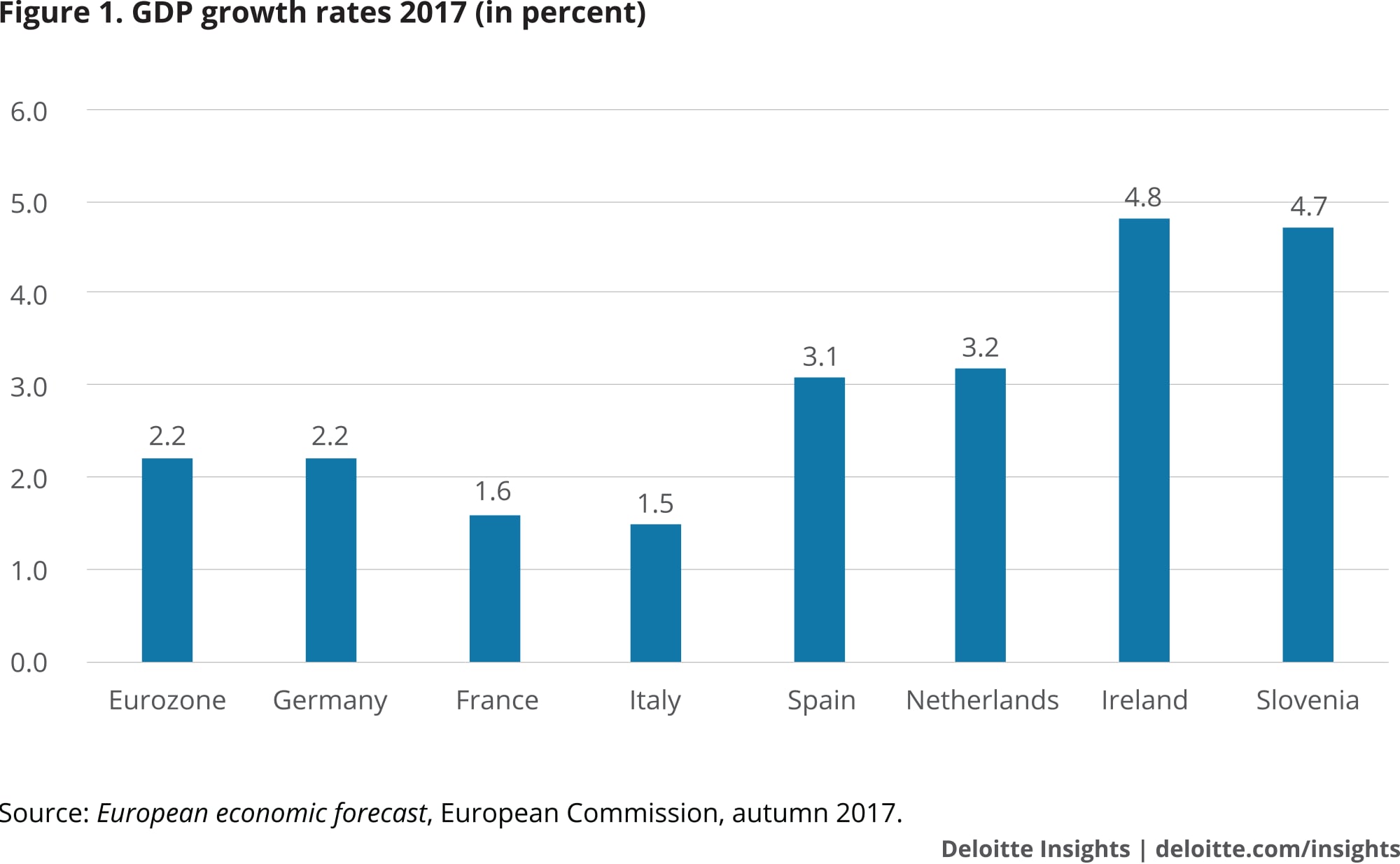

Consequently, GDP projections for 2017 had to be revised upward. The Eurozone economy is now projected to grow at 2.2 percent instead of 1.7 percent (figure 1). Among the bigger Eurozone economies, the Netherlands and Spain are the growth leaders, followed by Germany, France, and Italy. Some countries such as Ireland or Slovenia have reached impressive growth rates of almost 5.0 percent.

The improvement in labor markets greatly supports household spending, so far the essential pillar of the recovery. While employment is now higher than before the crisis in 2008, the number of unemployed fell by 1.5 million between autumn 2016 and autumn 2017. Accordingly, the unemployment rate fell to 8.9 percent, down from more than 12 percent in 2013.3

All well?

After elections in France and the Netherlands earlier this year, federal elections in Germany posed a potential threat from political disruption in the Eurozone. Indeed, for the first time in the post-war era, a right-wing party made it into the German parliament. The anti-immigrant, anti-euro party Alternative for Deutschland (AfD) won more than 12.0 percent of votes. Although the political climate might change as a result, the immediate economic impact appears limited. All other parliamentary groups have credibly excluded a coalition with the AfD, for now and in the future. Forming a coalition after the election is difficult though—the first coalition talks have failed. At the time of writing, a minority government (unseen in post-war Germany), new elections, or a renewed grand coalition seem the most likely outcome.

On the monetary policy side, the European Central Bank (ECB) changed its course somewhat. By deciding to slow down its bond-purchase program from EUR 60 billion to EUR 30 billion a month, it cautiously initiated an exit from the quantitative easing program. Consequently, the program is continuing at a slower speed, so this decision is unlikely to affect the economic outlook of the Eurozone significantly.

Monetary policy continues to stay very loose—and some may argue too loose for the current economic situation—mainly because the recovery has not led to the ECB’s target inflation rate of 2.0 percent. One of the underlying reasons is that the improving situation in the labor market has not resulted in corresponding wage increases yet, leaving inflation rates to languish at around 1.5 percent. This may have to do with weak productivity increases or an underutilized workforce. In any case, problems in the labor markets have not disappeared despite the overall positive trend. From a regional perspective, unemployment rates continue to differ widely in the European Union, between less than 3.0 percent in the Czech Republic and 21.0 percent in Greece.4

Is the recovery sustainable?

The auspices for a continued recovery in 2018 are relatively good, as a look at the growth components shows. Unemployment in the Eurozone is expected to fall further, supporting consumer demand as a primary source of the upswing. In addition to the risk of a protectionist turn in global trade policy, there are some uncertainties on the trade side. Although the stronger euro has had no effect on exports so far, it might change; it also remains unclear if world trade can maintain its current growth rate.

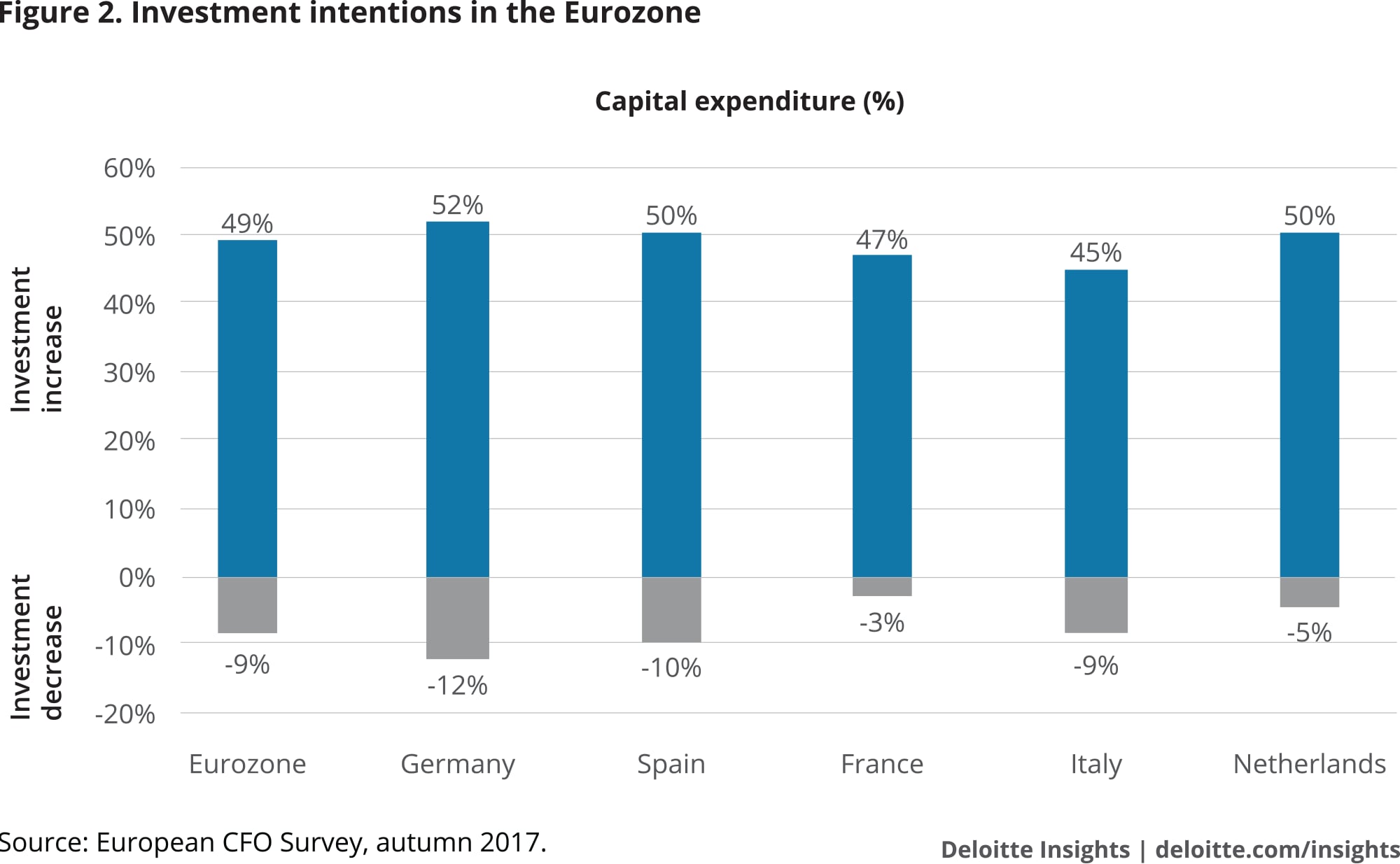

Nevertheless, the biggest signs of hope come from the corporate investment side. The recent upswing in investment has substantial upside potential, given the receding fears of populist governments in the Eurozone and a positive business sentiment. According to the Deloitte European CFO Survey of 1,546 participants, the investment intentions of European corporates for the next 12 months continue to point upward all over the Eurozone (figure 2). Almost half of the European CFOs in the Eurozone intend to increase their investments, with only 9.0 percent intending to decrease them. In Germany, for example, investment intentions reached their highest level in six years.

Therefore, the baseline scenario sees a similar growth rate to this year at around 2.0 percent. Downside risks to this outlook are not hard to find. Political risks have not yet disappeared: Italy’s general elections in early 2018 might result in a populist government. The crisis in Spain around the Catalan independence movement has escalated and it remains to be seen whether the elections that the Spanish government slated for late December will result in a solution. The difficult coalition-building in Germany and the possibility of new elections has slowed down political initiatives for the European Union and the Eurozone and is adding to political uncertainty. Also, the threat from growing protectionism is likely to remain a key risk in 2018.

But a much more positive scenario for the development of the Eurozone is conceivable—more so than in the preceding years. If the downside risks do not occur, their absence could energize the recovery. The key variable here is corporate investments; two factors could have an impact on them. First, receding fears about populism might result in even higher business confidence and a push for corporate investments. Second, the same may happen if the synchronized upswing in the world economy continues, protectionism fails to materialize, and the expansion of world trade accelerates. Also in this scenario, the result could be a sharper increase in investments and therefore a better growth momentum than that predicted in the forecasts. In short, risks to the Eurozone outlook are no longer automatically tilted to the downside.