Aftermarket services has been saved

Aftermarket services Transforming manufacturing in the wake of the COVID-19 pandemic

17 minute read

14 May 2020

Paul Wellener United States

Paul Wellener United States Kerry Millar United States

Kerry Millar United States Oliver Bendig United States

Oliver Bendig United States- Aijaz Hussain United States

Manufacturers are increasingly turning their focus on aftermarket services, not only as a means to enhance customer satisfaction but also as a revenue-generating opportunity. In the wake of COVID-19-driven disruption, there is additional business sense in scaling aftermarket services at a time when new equipment orders are disrupted and capital spending comes into question.

Introduction

Manufacturers are increasingly starting to offer more aftermarket services, the broad category that includes the sale and delivery of maintenance, spare parts, and other value-added services. Changes in customer demands, increasing market maturity, cyclical fluctuations in new equipment sales, and pressure on pricing are among the major factors driving many manufacturers to seek new aftermarket services revenue opportunities.

Learn more

View additional MRO and aftermarket services insights for manufacturing resilience

Explore the Industrial products collection

Learn more about connecting for a resilient world

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

This shift appears to be taking place as more customers are emphasizing service level agreements (SLAs) that guarantee product uptime and are thus looking for service providers who can proactively support their equipment before it is out of service. In return, these customers are willing to pay a price premium.

And with the disruption from the COVID-19 crisis, manufacturers should consider leveraging the opportunity to scale their aftermarket services capability more rapidly. As new equipment orders are disrupted and capital spending comes into question, aftermarket products and services will be an increasingly essential and stabilizing part of the industrial business mix. Manufacturers should take advantage of this disruption to push through long-planned changes and innovations around aftermarket that can change the nature of their relationship with their customer base and channels.

We conducted a series of global executive interviews with 35 North American and European manufacturing leaders and subject matter specialists. Based on the findings, we offer several insights relevant to the current situation that manufacturers can consider in defining and executing their own aftermarket service strategy, including:

- Opportunities that aftermarket services provide for manufacturers in navigating the COVID-19 crisis

- The role of digitization in enhancing service offerings and creating transformational business models that center on value delivered

- Strategies for manufacturers to overcome the common challenges they face in aftermarket services

In past economic downturns, the aftermarket service business has been a consistent revenue source and profit stabilizer. Experience shows that manufacturers who focus on services have outperformed their peers and exited past crises stronger than before. We call them “Service Champions.” As the global economy heads toward another potential downturn, manufacturers that prioritize and drive aftermarket services may be more resilient during the crisis. A key to this aftermarket service growth comes from ensuring consistent and efficient delivery of those services.

Aftermarket services business becoming an imperative for manufacturers

Revenue share from new product sales for manufacturers has been declining over the past decade.1 Margins on new equipment sales are typically less than those on aftermarket services in global markets. Moreover, demand for new industrial equipment may decline significantly as companies focus on preserving cash and reducing capital spending to manage the short- and medium-term business impact of the COVID-19 pandemic.

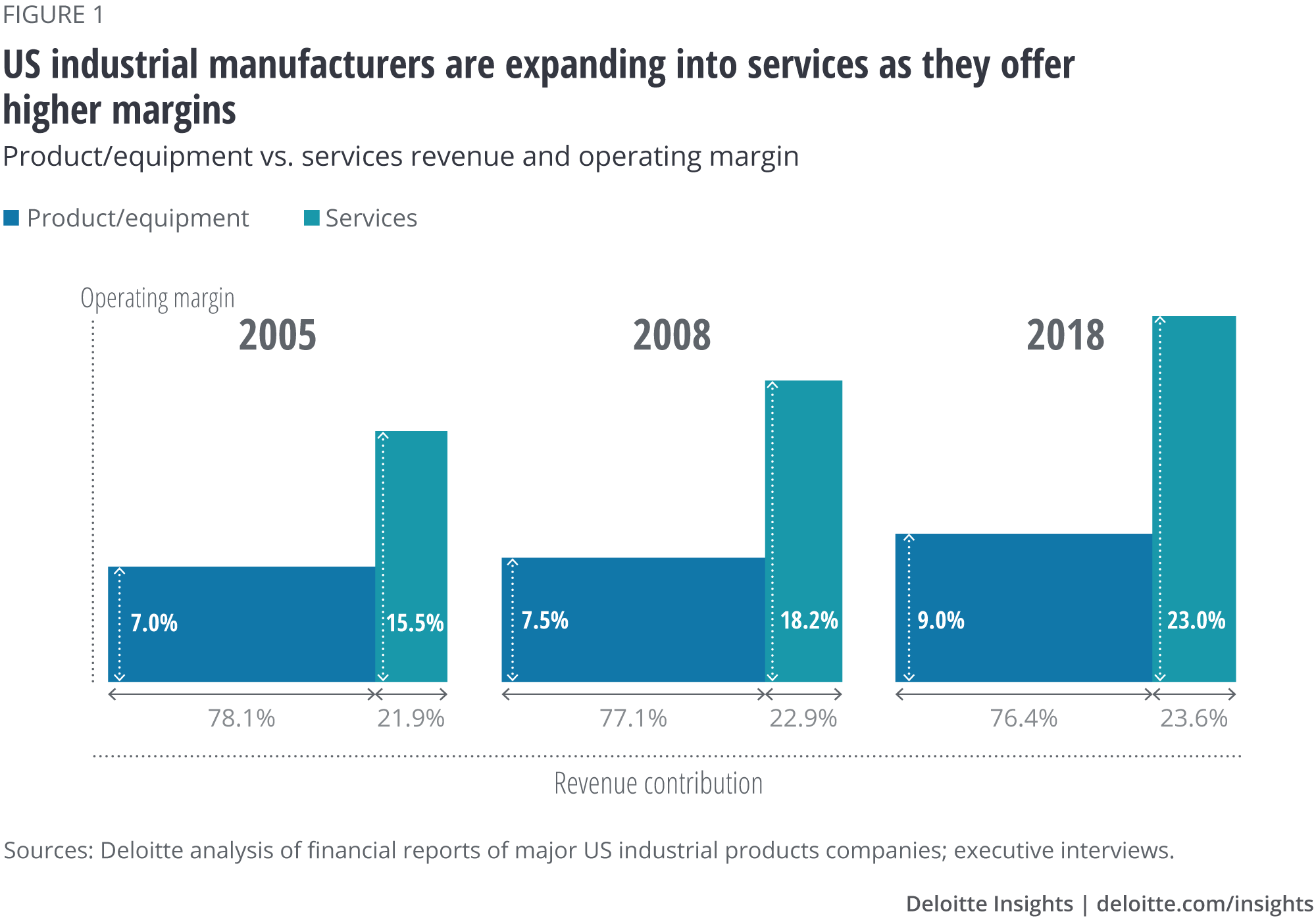

Aftermarket services may help offset these pressures on original equipment margins, as these services are typically less impacted by changes in the external environment and can provide stable cash flows in times when economic activity is slow. Today, the average operating margin from the aftermarket business globally is about 2.5 times the operating margin from new equipment sales (figure 1).2 From an operator perspective, postponing investments in the latest technology is a valid option for industrial manufacturers in uncertain times. However, maintaining existing equipment or selectively investing in upgrades in production can be a much-needed strategy during uncertain times.

For some manufacturers, aftermarket already accounts for the entire profit generated by the company. In many cases, new equipment is no longer sold to generate profits for the firm, but to fuel the future aftersales business on the installed base. Many manufacturers generate 40–50% of their overall profits from services.3

Many large original equipment manufacturers (OEMs) who have not focused on the aftermarket in the past seem to realize the value they can generate and are trying to expand their service offerings. For example, a leading manufacturer intends to double its services revenue in the next six years. The company has nearly one million of its machines connected to the cloud and sees an opportunity to provide services to customers leveraging the connected equipment.4 With uncertainty ahead, the expansion of aftermarket services is likely not a choice, but rather an imperative for all but a few manufacturers.

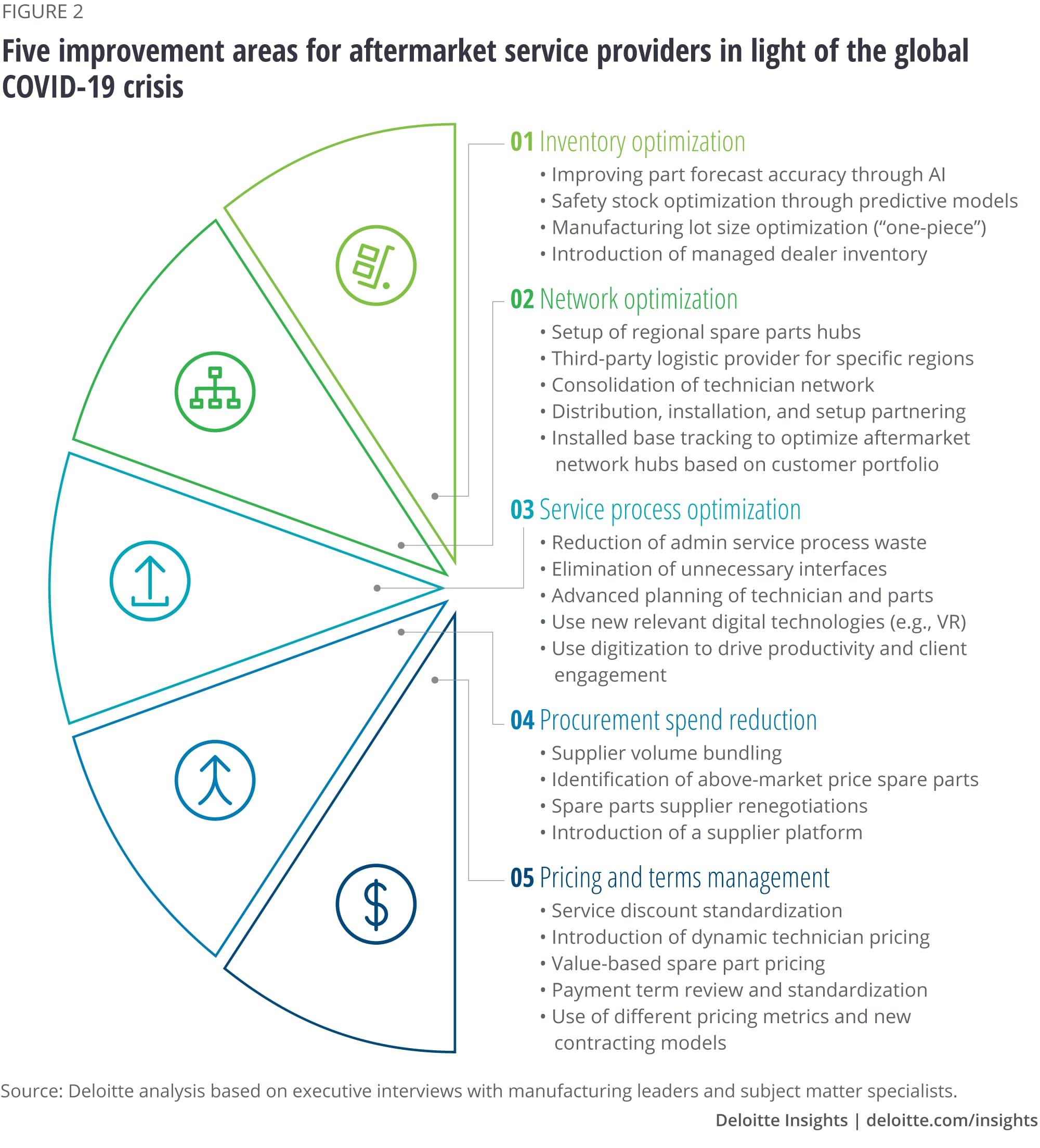

Aftermarket services could help manufacturers stabilize their business during and in the aftermath of the COVID-19 downturn and prepare for future growth rapidly by:

- Driving recurring revenue streams: Manufacturers that focus on services often have 80%+ of their installed base under service contracts, allowing them to continue delivering constant revenue streams.5

- Securing high margins from spare parts: Aftermarket parts and services will likely continue to deliver over 50% of a manufacturer’s profit with an upward trend in light of COVID-19.6

- Prioritizing relationship-building: Aftermarket services offer OEMs the ability to support customers in different ways, such as building trust by supporting longer equipment lifespans during this downturn. So, manufacturers should think of switching selected customers to usage-based business models, which provide recurring cash flow.

- Ensuring continuous support: In this crisis, customers may decide to switch to self-service, but now, more than ever, is the time for OEMs to stay connected with their customers and ensure business continuity by providing remote assistance.

- Staying connected closely with the customers: Through off-site service delivery, OEMs can maintain close connect with customers. Service technicians are likely the most important representation of a manufacturer and in the current crisis; they are even more critical to make sure they can continue providing services and keep equipment running.

“In times of crises when it becomes difficult to dispatch field service technicians to address customers’ critical equipment needs, remote assistance capabilities are crucial to ensure business continuity of our customers by directly accessing their machines and solving 80% of electrical problems online—quickly and efficiently.”—Julien Laran, head of service at Bobst Group SA

Manufacturers are being driven by a shift toward selling outcomes

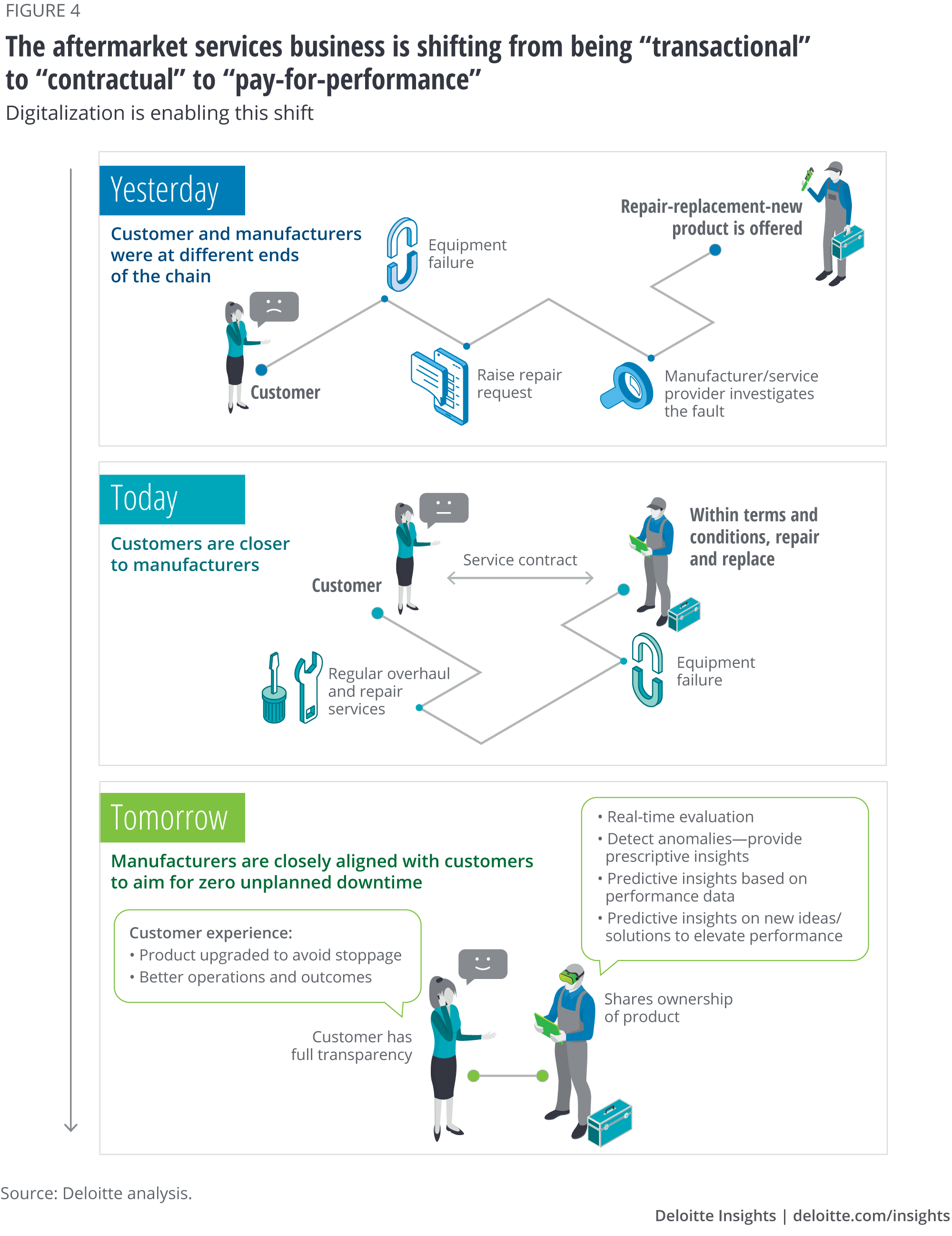

Traditionally, manufacturers have focused on selling equipment, while aftermarket services remained as an ancillary business, and so the overall business models were mostly transactional in nature. However, over the past few years, due to the changing market conditions, many manufacturers have been moving towards a relationship-based business model, selling outcomes. But, as a result of the unprecedented crisis, manufacturers must focus on delivering advanced connected services, viewing themselves as solution providers who improve business outcomes for customers (figure 4). Manufacturers should work toward selling uptime and partnering with customers to avoid equipment breakdown. Consequently, manufacturers are moving from a transactional to a relationship-based business model that can include long-term incentivized, pay-per-use contracts. While this bears significant potential for many manufacturers, it can require them to take on the extended responsibilities, risks (operational and reputational), penalties, and revenue payments linked to use. However, it allows manufacturers to work closely with their customers and ease the pressure on part prices caused by customers searching for cheaper spare parts at online wholesalers.

“Companies need to become solution providers in the future. The ultimate goal is to develop our organization in a way that we sell solutions to our customers’ problems.”—David Windhager, senior vice president, Customer Service & Digital Solutions at Rosenbauer Group

Usage-based services are expected to become a mainstay for many traditional aftermarket service providers in the future. Manufacturing customers are increasingly looking to improve their overall equipment effectiveness (OEE), the percentage of manufacturing time that is genuinely productive, a crucial measure of manufacturing productivity.

Today, an increasing number of manufacturing customers have defined zero unplanned downtime as their topmost priority. They are shifting their focus from a capex (capital expenditure) to opex (operating expenditure) model, i.e., from making significant capital investments to obtain equipment ownership and capabilities, to paying expenses to use the equipment and related capabilities as a service.

Manufacturers should work closely as partners with their customers in achieving the targeted outcomes. Many manufacturers are increasingly focusing on usage-based service-focused business models, such as subscription-based pricing or pay-per-use contracts (figure 5). For instance, Heidelberg, one of the leading manufacturers of printing machines globally, is currently transforming its operations toward pay-per-use models.7

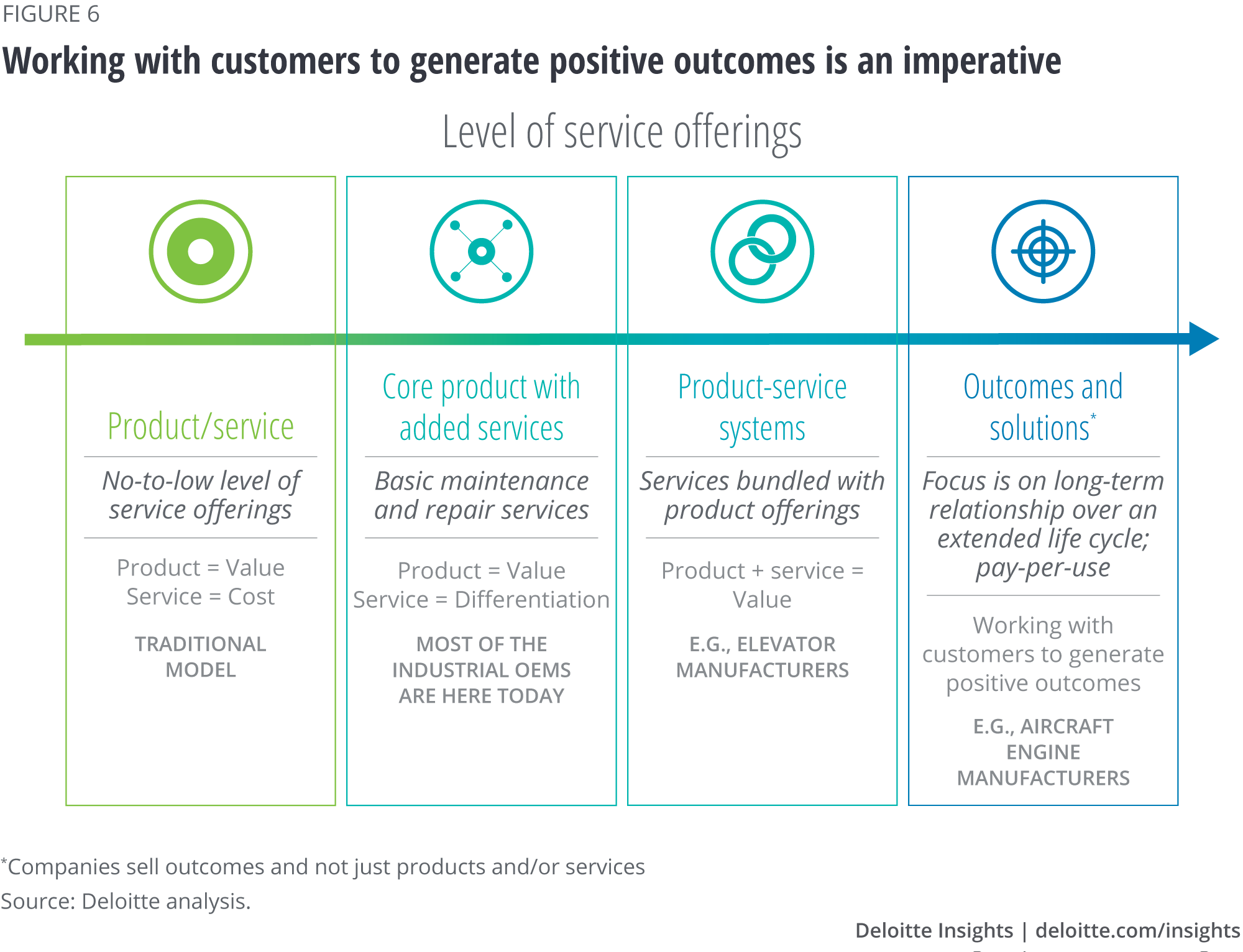

Manufacturers can create more value by focusing on long-term relationship-based business

The financial uncertainties caused by COVID-19 may compel manufacturing industry customers to defer or cancel new equipment deliveries. So, manufacturers should consider moving from pure products to selling outcomes that customers want, which could be a win-win for both manufacturers and customers (figure 6).

Some companies are modeling their services business after automotive OEMs and dealers to sell extended service agreements along with equipment. Some manufacturing dealers are bundling subscriptions along with other monthly fees for maintenance and repairs based on the number of hours the equipment is expected to operate. For instance, one of the largest dealers of a large manufacturer plans to have most or all its equipment sold across Canada, the United Kingdom, and South America, connected to the manufacturer’s cloud services. Providing dealers with access to digital tools, including service information systems, parts inventory optimization tools, and remote troubleshooting tools, can enable dealer technicians to read live equipment diagnostics and remotely identify and solve equipment problems.

“Competition is likely to be more intense in the aftermarket space over the next three to five years and the differentiating factor for manufacturing customers could depend on who can bring the most value to the customer.”—Joseph Odekerken, director, Sustainment Business Transformation at Lockheed Martin Corporation

Manufacturers face multiple challenges in delivering aftermarket services efficiently

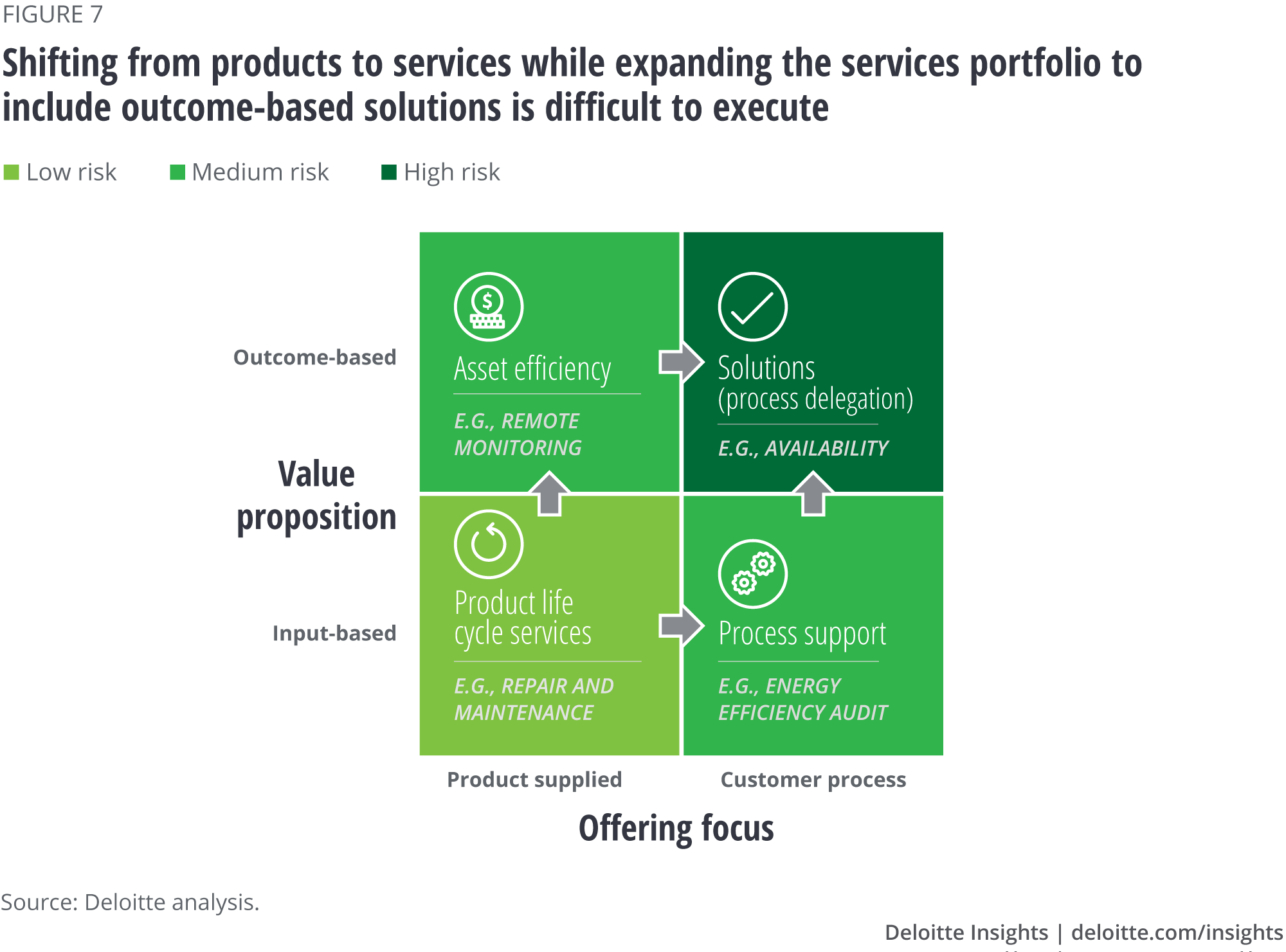

In addition to the immediate impact of COVID-19, manufacturers face multiple challenges in moving from their core business model of manufacturing and selling products to selling services and outcomes that completely transform their business (figure 7). Optimizing overall equipment effectiveness (OEE) for customers, securing the availability of production by providing more remote services, enabling machine operators to conduct maintenance tasks themselves without waiting for a technician, or offering insights from machine data will be the name of the game in the future. At the same time, it should allow manufacturers to intensify proximity with customers and eventually make a difference when customers decide on a new machine.

Here are some common challenges (figure 8) manufacturers face in delivering aftermarket services efficiently:

Macroeconomic forces

COVID-19 pandemic. Predicting customers’ equipment spending decisions in response to COVID-19 and the subsequent effect on aftermarket services is not possible at this time, given the pandemic’s evolving nature. While there are many unknowns about the extent of the COVID-19 crisis and the ultimate impact to the global economy, the near-term outlook for manufacturing industry is weak.

Industry dynamics

Increased competition. The level of competition is growing in the industry as manufacturers are operating in a complex environment with multiple stakeholders, including suppliers and partners. This is becoming more pronounced as many OEMs are aggressively trying to increase presence in aftermarket services, thereby intensifying competition for smaller players. Along with growth in counterfeit parts, low-cost rivals are raising their game where service and parts operations are facing intense price competition.

Talent shortage. Manufacturers are facing a shortage of talent with new skillsets. As technology advances and equipment gains additional features, the repair and refurbish process is becoming more complex, and many companies are facing challenges in having skilled technicians who can gauge and solve service problems accurately. The aging workforce, especially in aerospace and defense, can also leave a gap in aftermarket service talent.

Entry of new players. As usage-based business models are new to many OEMs, they come with significant additional risks. As a result, new players from other industries are emerging to capitalize on this opportunity. For instance, reinsurer Munich Re is designing specific offerings to participate in the attractive industrial aftermarket.8

Organizational concerns

Delivering quality service. Lack of experience in designing service packages and limited visibility in the supply chain are critical factors affecting the quality of service delivered by many traditional manufacturers. Many customers even resist the move toward services, thus requiring significant effort by the manufacturer to gain customer interest, especially as many customers are still hesitant to pay for services.

Lack of a service-oriented culture. Lack of a focused service organization and a resistance to change are important issues affecting many manufacturers. Many companies are finding it difficult to move away from their product-/manufacturing-oriented mindset toward a more customer-focused services mindset.

Although customer service is mostly a local business, manufacturing is one of the most globalized sectors in the world economy. Many international manufacturing companies, regardless of their headquarters, have their after-sales business evenly spread across Americas, Asia, and EMEA. Our study revealed that the service-related challenges for the leading manufacturing companies in both North America and Europe are nearly identical. And even more important, customer needs in manufacturing are completely global and typically require globally consistent solutions and offerings. Serving aftermarket customers is local, but offerings should be globally consistent.

Digital technologies could be the differentiator for immediate and sustainable success in aftermarket services

In times of crises, such as the one manufacturers are facing with covid-19 today, it becomes difficult to dispatch field service technicians to address customers’ critical equipment needs, digital technologies, especially remote assistance capabilities, to help ensure business continuity. Leveraging these capabilities, manufacturers and service providers can directly access the equipment and solve many problems remotely, quickly, and efficiently.

Many manufacturers are making the shift toward aftermarket services by leveraging digital technologies to offer capabilities such as proactive and predictive maintenance. Digital service offerings are helping manufacturers gain a competitive edge and provide an enhanced customer experience. In a recent Gartner survey of CIOs of heavy manufacturers, new products/services and digital enablement were two of the top four business priorities.9

As manufacturing transitions toward other business models such as usage-based services, digital technologies are expected to play a crucial role, especially in enhancing aftermarket service offerings. In a recent study conducted by Deloitte, over 20 manufacturing leaders expect as many as one-third of manufacturing companies to be disrupted in the next decade. About two-thirds of the executives said that digital services would be the significant driver of future revenues. Moreover, manufacturing leaders believe that over the next decade, the fundamental business model will be 50 percent products/equipment and 50 percent outcomes, compared to a 75:25 percent mix in favor of products at present.

“Customers primarily look at transparency and speed to resolution when it comes to aftermarket services. To improve the customer experience, we are investing in digital platforms that will enhance customers’ visibility into our production and material systems.”—Mark Schmidt, vice president, Aftermarket Business at Eaton Corporation Inc

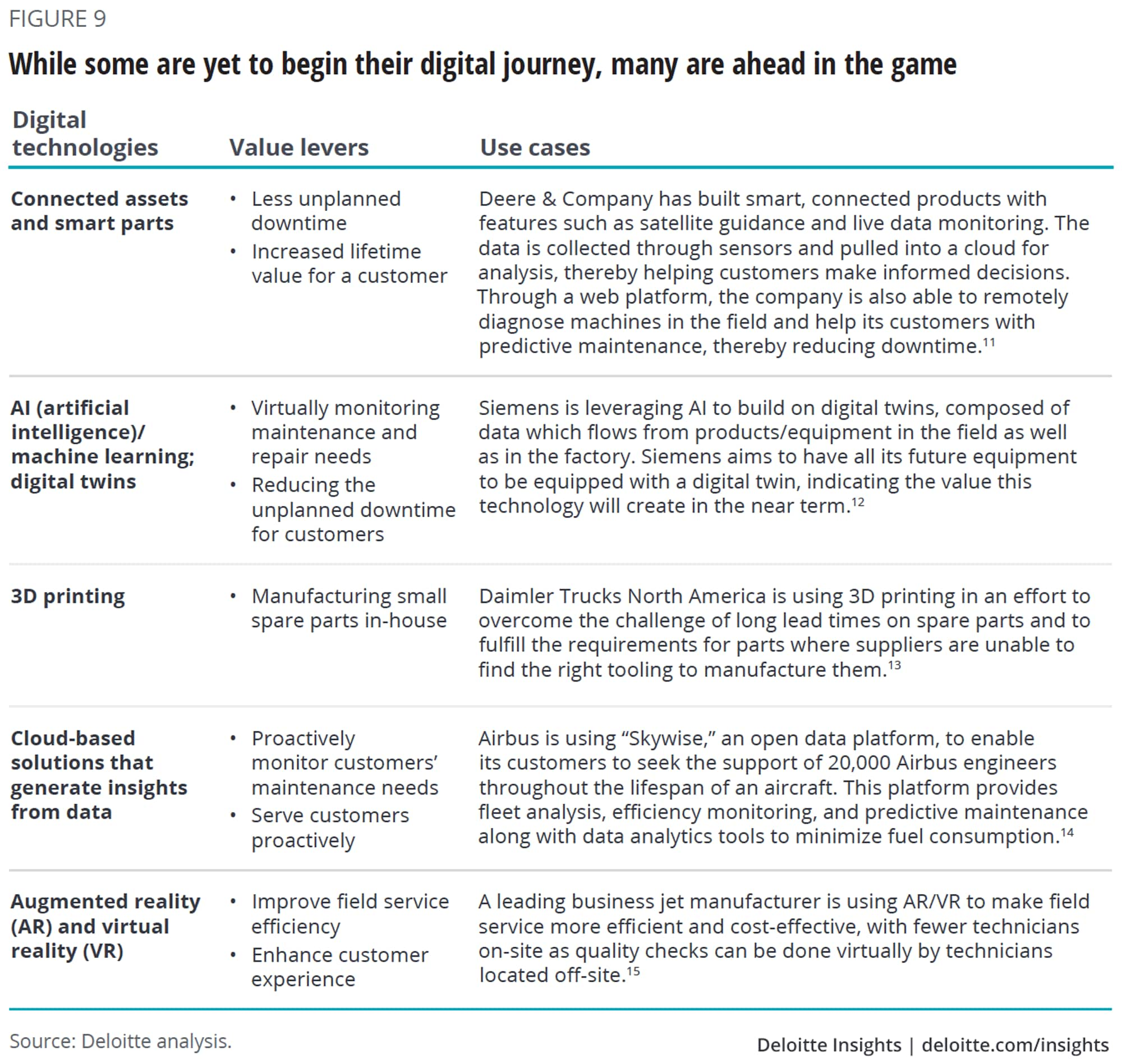

Therefore, prioritizing digital transformation could be critical to enhance aftermarket services, especially due to the COVID-19 crisis. In a survey conducted by The Service Council, 30 percent of service leaders at manufacturing and services businesses strongly agreed that it was vital for them to become a “digital” business. Besides, the survey findings suggested that service leaders are focused on customer-centric outcomes in their digital strategies (figure 9).10 To bring in efficiencies and differentiate their services, manufacturers are already harmonizing internal processes by leveraging digital technologies.

However, headwinds persist in the digital journey of aftermarket services as manufacturing companies are facing multiple challenges in effectively deploying digital technologies for their aftermarket services.

- Tracking of the complete installed base: Knowledge of and access to an entire installed base remains a challenge as legacy equipment is not connected to enterprise systems.

- Equipment integration and seamless communication: Even as companies work toward connecting their installed base, there are issues related to smooth integration and seamless communication across the value chain.

- Limited visibility of data: Data collected from smart products remains mostly proprietary to the manufacturers, and operators/service providers have restricted data access or none in some cases.

- Ability to leveraging data effectively: Although many companies have progressed in their goal to connect devices and are able to collect vast volumes of data, they have not been able to derive the insights they need to develop new services.

- Differences in service standards: Global companies are experiencing variations in digital maturity between regions, leading to variances in service standards.

To drive smoother digital transformation, manufacturers should focus on two areas. First, they should use connected enterprise systems and data analytics to surface insights to improve visibility, which is the backbone for delivering cutting-edge aftermarket services. Second, they should continuously use and monetize insights generated from data, which can help in developing better solutions, and, at the same time, help build a competitive advantage.

Winning in aftermarket services may require a multipronged approach

The aftermarket services business includes a diverse set of companies from large OEMs to pure-play service providers. While large players have evolved through years of growth and consolidation, COVID-19 represents one of their most significant challenges in decades. Smaller providers are likely to face a range of threats to their business. The COVID-19 pandemic has resulted in significant short-term demand erosion, and as a result, many manufacturers might take years to recover. What may help set apart winners in the wake of the COVID-19 crisis will be companies’ ability to manage their aftermarket services business efficiently and engage customers continuously. These manufacturers should be in a much stronger position to capitalize on emerging opportunities as they begin to materialize in the future.

Furthermore, from a longer-term standpoint, it is challenging to successfully shift from products to a combination of products and services, while expanding the service portfolio to include outcome-based solutions. Every manufacturer begins its aftermarket services transformation journey from a different starting point and, therefore, has a different path. There cannot be a single road map for transforming aftermarket services. To be successful in expanding into and delivering aftermarket services effectively, manufacturers generally require a multi-pronged approach.

Collaborate within the ecosystem, including with customers and channel partners

Within aftermarket services, the parts business tends to be the most attractive segment with the most competition from rivals and smaller companies. As a result, the most significant competitor is the customer itself, who may be doing maintenance and repairs themselves. Addressing the intensifying competition requires having an ecosystem view to work cooperatively and collaboratively with all the ecosystem players, including customers and competitors, to protect and grow business through enhanced customer service and loyalty.

“If there’s a rather successful company having a good maintenance and repair coverage, we are collaborating with them and making them an authorized service partner, after providing them necessary trainings.”—Ronald Pschenitschnigg, business unit head, Engineering at VAT Group AG

Move away from a “reactive” to a “proactive” approach toward customer service

To help customers improve their overall OEE, manufacturers should establish processes that are proactive and integrated end-to-end from suppliers to customers. Manufacturers should be proactive, agile, and adapt to customer needs by aligning the resolution speed in line with customer expectations. This likely entails focusing on supply chain responsiveness to improve speed-to-resolution and prioritizing quality service to provide better customer experience and improve customer engagement. Manufacturers could work to make replacement parts feed data, alerting operators when replacement or changes are needed as part of moving from a “reactive” to a “proactive” approach to service.

“Services need to add additional value for the customer. They should go beyond repair and maintenance.”—Peter van Altena, vice president, After-Sales and Services EMEA (Europe & Asia) at ATS Automation

Invest in digital technologies to develop new capabilities and expand offerings

Manufacturers should make strategic investments in digital technologies, including IoT and connected products to expand service offerings; implement cloud-based tools to increase visibility (e.g., spare parts inventory levels) along the entire value chain; leverage advanced digital tools such as AR/VR and digital twins to enhance customer experience and field service efficiency; and deploy AI and machine learning to provide proactive remote asset monitoring and predictive capabilities.

Effective operationalization of digital investments and technologies includes building and operating an effective knowledge management system to share customer and aftermarket service knowledge across functions and teams. By setting up connected data warehouses and data hubs for seamless intracommunication capabilities, manufacturers and service providers can leverage data to generate continuous insights.

Focus on building long-term customer relationships

Building and managing long-term relationships to offer customized solutions for different products and markets could be instrumental in having a profitable aftersales service business, especially in the COVID-19 environment. Through long-term service agreements and contracts with customers for life cycle services, manufacturers could lock in customers and lock out potential competitors.

Developing effective long-term relationships with customers requires manufacturers to work toward delivering quality the first time. Manufacturers should incentivize field technicians to build and manage strong relationships with their customers. Moreover, initiatives such as providing customizable self-care platforms can help customers resolve issues immediately, while conducting training and workshops can help improve customer support and build customer trust. Alignment with customers can facilitate cocreation opportunities, and manufacturers could pilot new service offerings before selling them more widely.

Establish a coherent talent strategy

Developing a strong aftermarket services function requires focusing on encouraging a culture of service and innovation within the team, and creating a team of relationship builders who are service-centric and technically adept. To keep up with new and emerging technologies, companies should consider multiple strategies to attract and retain talent. These include providing continuous training to upskill the workforce, especially on digital technologies and tools, rethinking the existing ecosystem and investing in startups and ventures to get access to new technology and talent, leveraging acquisitions to gain the desired talent, and partnering with educational institutions to recruit talent with Industry 4.0 skills.

“Even if we digitize customer experience, we keep people as an interface.”—Jacques-Olivier Guichard, head, New Digital Services & Big Data; and James Kornberg, director innovation at Air France Industries KLM Engineering & Maintenance

Build and operate a service-focused organization

Garnering top leadership sponsorship and support for aftermarket services is important to provide more autonomy and independence for the service function. This includes creating separate functions that focus on the aftermarket, with independently managed business units that are integrated and streamlined with the business/product units.

As the industry is moving to sell outcomes, the services function should be closely streamlined with the product and engineering divisions to deliver integrated offerings in the longer term. To drive aftermarket revenues, manufacturers should build and augment these capabilities to meet the demands of higher transaction volumes derived from services.

Shift from a product-based mindset to a usage/solutions-based mindset

From an overall enterprise perspective, manufacturers should move from their conventional product or engineering/design mindset to one where they act and are regarded as solution providers (figure 10). This requires companies to put customers first, basing innovation around client needs versus efficiencies, and viewing service as a value creation opportunity rather than as a cost.

Moreover, manufacturers should institutionalize performance measurement systems that replicate customers’ performance measures and identify customer touchpoints to monitor progress and gain feedback using customer surveys. This helps in measuring the impact of services on customer retention and customer margins and in making appropriate changes to processes where required.

“Before changing the customer mindset, it is important for companies to change their mindset and culture internally.”—Stephen Lovass, executive vice president and officer at Nordson Corporation

Accelerating the next wave of growth

While past crises presented immense economic challenges for manufacturers, COVID-19 is proving to be an even greater threat because of the significant impact on customer demand and the uncertainty around a return to normalcy. Aftermarket services is an increasingly valuable part of a manufacturing business that may help to offset the impact of the crisis on the sale of manufacturing equipment. It is a critical driver for stabilizing the business and helps ensure more constant revenue flows during times of economic slowdown and global crises. With customers facing financial pressures and prioritizing business continuity, speed-to-resolution, transparency, and visibility into performance data, manufacturers should also prioritize digital transformation to help enhance aftermarket services and the customer experience. Leveraging digitalization to focus on outcome-based service offerings, such as predictive maintenance and “pay per output” solutions; emphasis on a relationship-based model; and having a solutions-oriented mindset, can help manufacturers gain a competitive edge and protect and grow their business through improved customer service, better margins, and greater customer loyalty.

Explore our COVID-19 content

-

The essence of resilient leadership: Business recovery from COVID-19 Article4 years ago

-

The heart of resilient leadership: Responding to COVID-19 Article4 years ago

-

COVID-19 implications for commercial real estate Article4 years ago

-

Opportunities for private equity post-COVID-19 Article4 years ago

-

Confronting the crisis Article4 years ago

-

Small positive signs in the consumers’ dual-front crisis Article4 years ago