Advanced air mobility has been saved

Advanced air mobility Can the United States afford to lose the race?

24 minute read

26 January 2021

The United States has an opportunity to be a global leader in advanced air mobility (AAM), but the flight is not expected to be easy. To lead, it should have a clear national strategy for scaling the domestic market while delivering state-of-the-art AAM products that are safe, accessible, and secure.

Executive summary

For more than 100 years, the US aerospace and defense (A&D) industry has been at the forefront of innovation. Through early strides in aircraft design and engineering, a focus on safety throughout the process, and recruitment of top talent, the United States has established itself as the global leader in aerospace.1 From the first flight through the skies2 to the first steps on the moon,3 the industry has led United States’ economic and national security success domestically and internationally.4

Today, the A&D industry stands on the horizon of a new era of aviation. Advanced air mobility (AAM)—the emergence of transformative airborne technology to transport people and goods in new, community-friendly, and cost-effective aircraft in both rural and urban environments—represents the next inflection point in the aerospace industry’s ongoing evolution.5 AAM is expected to be the next significant change in mobility and perhaps the global economy, as it could lead to fundamentally new capabilities and applications that were previously not feasible. AAM technologies promise to transform how people and cargo are moved, driving the United States’ economic engine. In the country alone, the AAM market is estimated to reach US$115 billion annually by 2035, employing more than 280,000 high-paying jobs.6

Many aspects of AAM would also have dual-use, innovative applications of unmanned systems for national defense. But to be an essential element of overall national security, AAM capabilities must be secure, readily available, and cost-effective. Through the development of robust domestic capabilities, the industry can provide AAM products that meet both national security requirements and the need for secure and reliable domestic air traffic management (ATM) systems.

The United States should establish a comprehensive national AAM strategy that enables it to be first to market by developing and scaling the AAM domestic industry.

Learn more

Explore the Industrial Products collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

The country that develops its domestic capabilities and is first to deliver state-of-the-art AAM products that are safe, accessible, secure, and readily available at scale could emerge as the global leader. To achieve and sustain the global leadership role and successfully realize economic and national security benefits, the United States should establish a comprehensive national strategy that enables it to be first to market by developing and scaling the AAM domestic industry. And with thoughtful planning, it should prepare for and capture a significant global export market.

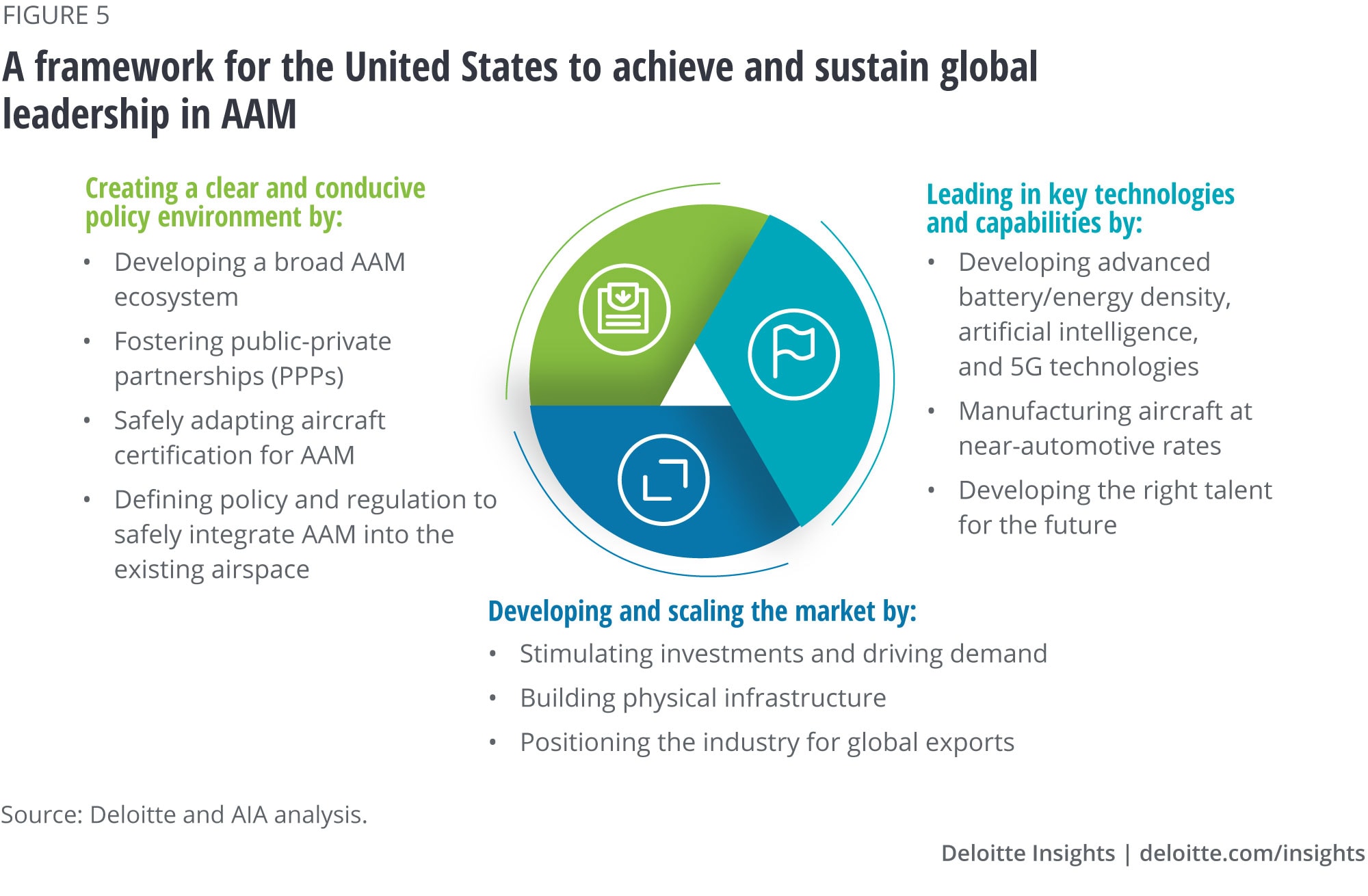

Three major focus areas for the United States to consider to develop and sustain a leadership role in AAM include:

1. Creating a clear and conducive policy environment by:

- Developing a broad AAM ecosystem

- Fostering public-private partnerships (PPPs)

- Safely adapting aircraft certification for AAM

- Defining policy and regulation to safely integrate AAM into the existing airspace

2. Leading in key technologies and capabilities by:

- Developing advanced battery/energy density, artificial intelligence, and 5G technologies

- Manufacturing aircraft at near-automotive rates

- Developing the right talent for the future

3. Developing and scaling the market by:

- Stimulating investments and driving demand

- Building physical infrastructure

- Positioning the industry for global exports

This report (see sidebar, “Study methodology”) offers several insights into how the United States could achieve and sustain a leadership position in AAM and provides recommendations on how to fill the current gaps. It also underscores the role of federal, state, and local authorities and the importance of PPPs in facilitating aerospace commerce and securing the national airspace system. It reflects both forward-thinking optimism and the challenges of embracing this new technology.

Study methodology

Deloitte and the Aerospace Industries Association (AIA) conducted a series of executive interviews with more than 50 senior American aerospace and automotive industry leaders to examine the global race in the space and the key steps and conditions required for the United States to achieve leadership in AAM. Deloitte also conducted an executive survey with responses from 102 senior industry and policy executives in the United States to study the market potential for AAM and analyze the principal technologies required for developing AAM products and services.

Advanced air mobility (AAM): The next disruption in aerospace

Technology and innovation are rapidly changing how we live. Just a few decades ago, it could take more than 25 hours to fly across the United States by passenger plane. Today, it takes less than five. Now, there is a change coming that is expected to revolutionize aviation again and build on the incredible progress the industry has made. That change is AAM, which ushers in cutting-edge, dual-use technologies that promise to provide affordable mobility across various commercial, civil, and defense uses. Whether through the delivery of goods in urban environments, linking of rural areas to population centers through passenger and cargo mobility, or an entirely new passenger travel mode within a city and its surrounding areas, AAM can make these flights a part of daily life.

AAM uses electric vertical takeoff and landing (eVTOL) aircraft that are usually short range, runway independent, and highly automated. They incorporate nontraditional electric or hybrid propulsion for piloted or automated operations. Electric motors and simplified electronic controls can improve on complex transmissions, flight-critical components, and mechanical reliability while also substantially reducing the manufacturing, operating, and sustainment costs. This aircraft design innovation could enable many new complex missions in urban, suburban, and defense environments, some of which are now conducted by ground vehicles, traditional helicopters, and fixed-winged aircraft.

AAM technology is being developed by the traditional aerospace, automotive, and technology companies as well as by startups around the globe. Government agencies such as the National Aeronautics and Space Administration (NASA) and the Federal Aviation Administration (FAA) have taken leading roles in key research and policy areas. Incremental developments in different fields such as energy storage, electric propulsion, and sensors, which are critical pieces of AAM, are also in the works. Consequently, AAM is poised to break out and be a mobility mainstay in the 2030s.7

A key factor in determining this timeline will likely be the success of a variety of stakeholders—eVTOL aircraft manufacturers, fleet operators, governments at all levels, policymakers, trade associations, the entire value chain with multiple layers of suppliers, investors, and academia—who are partnering to integrate AAM safely into the general public’s daily commutes. They are largely focusing on two primary applications in the civilian AAM market:

- Passenger mobility applications: Passenger transportation from point A to point B within urban areas and from urban to suburban or rural areas, either on demand or as a scheduled service.

- Cargo mobility applications: Logistics and cargo transportation services within and between communities, including last-mile package delivery.

New capabilities—especially when autonomous flight operations are achieved—can trigger missions beyond passenger and cargo mobility, including public safety, humanitarian relief, infrastructure inspection, remote sensing, and others yet to be recognized. It has become clear that due to economic, social, and national security reasons, the AAM market will likely continue to mature and create the next disruption in aviation and aerospace.

Economic and national security benefits AAM can bring to the United States

AAM technologies such as eVTOL aircraft represent new and extended business opportunities for companies operating across the aircraft manufacturing, infrastructure, supply chain, fleet management, and software space. Deloitte expects the AAM market for passenger and cargo mobility in the United States to reach approximately US$115 billion by 2035 (figure 1).8 This is equivalent to 30% of the US commercial aerospace market and 0.5% of the country’s GDP in 2019.9

The AAM passenger mobility market is expected to reach US$57 billion by 2035 (figure 1)10 and is likely to experience significant growth between 2035 and 2040. Correspondingly, the AAM cargo mobility market is expected to be US$58 billion by 2035.11 While the cargo mobility market will likely be the first to grow and achieve scale, the passenger mobility market is expected to start slowly but catch up and exceed the former beyond 2035.

More than half of interviewed industry executives believe that beyond 2035, more than 16% of passengers using private and public transportation today will likely use AAM for commercial passenger mobility.

In addition to equipping cities with alternatives to current commuting options and inter-modal connectivity, AAM can expand access to goods and services and lead to job creation through new markets and services. With an estimated 280,000 jobs in 2035, the AAM workforce could represent about 8% of America’s A&D workforce.12 Of the total 280,000 jobs, 234,000 are expected to be focused on the US domestic market and 46,000 on export markets.13

Four jobs are likely to be created for every million dollars in AAM’s direct sales revenue. Collectively, the industry could pay about US$30 billion in wages and benefits in 2035.14 These jobs could provide higher-than-average compensation and support their local communities. The AAM industry could contribute US$8 billion in taxes by 2035—US$6 billion in federal tax revenue and US$2 billion in state and local tax revenue.15 The US economy could also generate US$20 billion in AAM exports by 2035.16

With its electric propulsion technology and new green fleet, AAM can advance progress toward zero-emission aerospace, enabling the United States and its aerospace and aviation industries to lead in the creation of a more sustainable mode of transport. Six in 10 industry leaders believe that AAM will be a more sustainable and environmentally friendly solution to transportation compared to the current modes of aerial mobility.

From a defense and national security standpoint, AAM capabilities should also be considered for military and civilian government uses (e.g., public health and safety). To be viable from a long-term perspective, these dual-use technologies must be readily available, secure, cost effective, and scalable. To accomplish this, the United States should have domestic capabilities that can be produced at scale (thereby reducing the cost per unit/aircraft) for commercial, defense, and civil customers. Without a robust domestic industrial base for AAM, military and civil customers could either look elsewhere, which can create significant security risk, or develop sub-scale domestic capabilities dedicated to defense and civilian uses, thereby increasing costs. Furthermore, over time, the United States can support AAM deployment with a secure and reliable unmanned air traffic management (UTM) system. The country needs scalable domestic capabilities for implementation, operation, and sustainment for AAM to be widely available and cybersecure.

AAM could be coming sooner than most expect

Today, more than 200 companies worldwide are developing transformative eVTOL aircraft, with more than a dozen projects receiving significant private industry investment.17 As of September 2020, private players had invested more than US$2 billion globally in developing these aircraft; this includes both traditional aerospace companies and new entrants with little or no prior aerospace experience.18

AAM capabilities are being developed through a graduated set of applications, beginning with less challenging cases for developing aircraft and networking schemes. As the industry finds solutions to some fundamental issues (e.g., collision avoidance systems, on-board sensors, and cognitive systems), complexity would gradually increase, with AAM applications moving into more rural and suburban and then urban environments with large populations, obstructions, and traffic density. Eighty-two percent of study respondents expect less complicated commercial operations in a few cities, with advanced automation to begin by 2034 (figure 2) and commercial operations in multiple cities with full automation to happen by 2042.

Several new commercial test operations involving package delivery and new piloted passenger carrying aircraft were unveiled over the past few years. For instance, Joby Aviation plans to launch air taxi services by 2023 as the company aims to be one of the first to commercialize eVTOL aircraft for passenger use in the United States.19

It is important to note that even though the technological factors driving passenger and cargo mobility are similar, the adoption curves will likely be different, primarily due to the uncertainties surrounding regulation and overall societal acceptance. Cargo mobility could have significantly greater near-term adoption than passenger mobility due to the lower degree of psychological barriers and fewer regulatory hurdles related to safety. The primary driver for cargo AAM adoption and usage will likely be the level of autonomy, speed, and efficiency under which cargo eVTOLs can operate.

Transporting people in autonomous eVTOL aircraft could build on the success of transporting cargo. Furthermore, the success of initially piloted eVTOL operations will be the major driver for advances in autonomy. It could take off as an alternative mode of transportation, with operations primarily at airports and some dense urban systems. But over time, as the technology and infrastructure evolve, with denser vertiport buildout across cities, trips could become progressively longer, driving down the cost per mile to more affordable levels.

The intensifying global race for AAM leadership

Many countries have prioritized AAM as strategic and critical to their aerospace industries due to its potential economic impact and national security implications. Achieving AAM leadership and market share seems to be a priority among the United States, China, Germany, and South Korea (see sidebar, “Significant AAM-related developments in major global markets”). Significant progress is being made outside of the United States in piloted and unpiloted flights and country-level AAM development plans. Government assistance in Europe and China, including financial aid, supportive regulatory controls, and friendly technology-protection policies, drive competition for the United States.

To help ensure dominance, the United States should bring together industry, investor, and government communities to accelerate commercialization. An example of this is Agility Prime—launched by the United States Air Force—which focuses on accelerating the commercial eVTOL industry’s development to establish the United States’ dominance in AAM.20

Significant AAM-related developments in major global markets

China is ensuring that it supports the AAM ecosystem by providing the necessary regulatory approvals. In July 2020, China permitted Ehang, a Chinese manufacturer of autonomous aerial vehicles (AAVs), to conduct test flights.21 The company commenced trial passenger flights over the city of Yantai, primarily to demonstrate the safety and reliability of these vehicles.22 Ehang has signed cooperation agreements with Guangzhou in China and Linz in Austria.23 It has also received an operational flight permit from the Civil Aviation Authority of Norway and a special flight operations certificate from Transport Canada Civil Aviation for its passenger-grade AAVs.24

Two German AAM companies, Volocopter and Lilium, are progressing swiftly on aircraft development. Volocopter expects certification by early 2023 and is looking to launch operations in at least one market in 2023.25 The company is planning to start testing its eVTOL in France in 2021.26 It is also working with various cities, including Singapore, to launch aerial ride-sharing services and recently announced a partnership with Grab to explore viable cities and routes to deploy air taxis in Southeast Asia.27 Volocopter is accepting bookings for demo flights, which are likely to be scheduled in the first 12 months of the commercial launch.28 Lilium aims to commercialize its electric aerial ride-sharing services in cities across the globe by 2025.29 The company is working with several governments around the world, including the United Kingdom.30

South Korea, too, has made several announcements indicating the speed at which it is progressing toward making AAM successful. The country has set up a public-private consultative team—Urban Air Mobility Team Korea—aimed at commercializing aerial ridesharing and autonomous flights by 2025 and 2035, respectively.31 The team includes established companies, such as Hyundai Motor Corp., which announced its plans to enter the AAM market in late 2019.32

A country that has a large potential domestic market would be at an advantage in the AAM race. But it must be first to serve that market, which would help it in setting or influencing the regulatory framework. While the United States has a potentially large domestic market and has been a global aerospace regulatory leader, it faces competition from countries such as China, which is also competitive across all three dimensions (figure 4).33

The United States should establish a comprehensive national strategy for AAM

While the United States has an opportunity to be the leader in the global AAM market, achieving sustainable success will likely not be easy. To lead in this new market, the country should have a clear national strategy with the industry’s and government’s commitments to execute on it. The critical elements of the strategy should likely entail being the first to accomplish these three objectives:

- Establishing domestic demand for AAM at scale for cargo and people movement

- Fulfilling that demand using the existing domestic aviation/aerospace and automotive industrial base

- Supporting and preparing the new/extended industrial base for exports at scale

While the FAA has a mandate to regulate and promote safety in the National Airspace System, there is no entity within the United States government with a clear directive to promote the development, adoption, and commercialization of new aerospace technologies and applications such as AAM. So, the national strategy should lay out clear, comprehensive, and concrete steps for developing and scaling AAM. To effectively execute this national strategy, the US government, including FAA and NASA, should collaborate with other stakeholders to manage responsibility and accountability across the various ecosystem stakeholders participating in this market.

Achieving global leadership in AAM could be difficult without significant coordination and agreement between the government and the industry. Therefore, the national strategy should address these principal issues in a tangible, timely manner:

- Facilitating eVTOL aircraft testing and development under conditions that require purpose-built test ranges in restricted airspace

- Accessing and modifying ground infrastructure to support multiple flight-testing scenarios

- Safely streamlining the aircraft certification system that has evolved over the decades to address more traditional forms of air transport

- Safely integrating AAM operations into the current airspace system at high-traffic densities

- Developing industry standards to harmonize internationally

- Establishing best practices for flight operations, surveillance, communications technologies, and ATM systems

Also, contingency management, the ability to manage the unexpected, and the capability to recover from unforeseen events could be the keys to success. Local governments, the communities they serve, and their partners should have major roles in this process. Failure to have an integrated and coherent national strategy can hinder a successful AAM implementation.

Achieving and sustaining global leadership in AAM

There are three major areas (figure 5) the United States should focus on to accomplish and sustain global leadership in AAM:

1. Creating a clear and conducive policy environment

2. Leading in key technologies and capabilities

3. Developing and scaling the market

1. Creating a clear and conducive policy environment

To support the scaled deployment of AAM, the government—at all levels—and the industry should collaborate on developing robust policy and regulatory frameworks. Once these frameworks are in place, the industry can finalize the development of the key capabilities and products necessary to implement AAM. Policy areas the United States should focus on include supporting the development of a broader AAM ecosystem, fostering various forms of PPPs, streamlining vehicle testing and certification, and seamlessly integrating AAM into the existing airspace system.

a. Developing a broad AAM ecosystem

The United States should establish a broad AAM ecosystem that contains the essential capabilities, which, when effectively connected, creates a network of investors, developers, integrators, suppliers, government agencies, fleet operators, infrastructure providers, investment firms, academia, and research labs. This ecosystem can provide a dynamic, adaptive, and holistic network through which original equipment manufacturers (OEMs) can connect with and utilize all the value chain participants and form stronger relationships with all stakeholders. This ecosystem should include and promote collaboration with other sectors, such as automotive, which is also working toward advancing critical technologies such as electric propulsion and autonomous technology.

b. Fostering public-private partnerships

No single entity, public or private, has all the capabilities or resources necessary to develop and deploy a holistic AAM system. This is particularly true in developing and deploying a unified UTM for AAM and the necessary physical infrastructure (such as vertiports, navigation, communications, and electrical grid). Given the expected rapid growth in demand for AAM over the next decade, the existing aerospace and aviation industries alone aren’t expected to be able to develop, deploy, and scale this technology. The US government (FAA, NASA, and others) should work as a catalyst and identify critical areas where industry partnership can accelerate AAM deployment. For example, in July 2019, Kitty Hawk and the FAA collaborated to launch B4UFLY, an application to ensure drones’ safe integration into the airspace. Such partnerships could be critical to the work ahead.

c. Safely adapting aircraft certification for AAM

FAA’s aircraft certification processes are well established and ensure aircraft are safe to operate in the National Airspace System (NAS). However, current certification processes (such as testing and simulation) should evolve to adequately support the certification of a wider range of complex, software-intensive autonomous/semi-autonomous systems anticipated for AAM. The FAA should continue to advance its policy requirements and certification processes to meet the anticipated technology and operational demands of AAM aircraft certification—high levels of automation, increased information exchange capabilities and dependencies, differentiated pilot in command roles, high volume and range of aircraft types—because:

- Traditional hazard analysis and safety engineering modeling and analysis tools may not be appropriate or capable to evaluate the full range of complex AAM systems for certification

- The role of data and digital systems in mission-critical functions will continue to accelerate, and a wider variety of organizations will support these functions (i.e., there will be more critical data, and it will be handled by a greater variety of organizations). As a result, new cybersecurity methods and approach will be required to ensure the security and safety of mission-critical AAM operations

- The existing airworthiness certification process does not entirely accommodate AAM platforms

There is a need to institute new approaches beyond conventional testing and simulation with specific guidelines to help AAM applicants demonstrate safe and reliable performance during the certification process, including:

- Developing new and more robust safety analysis tools and hardware systems

- Facilitating the certification process by enabling the industry to create performance-based standards

- Establishing use cases that could lead the way to supportive regulations

- Developing software and hardware certification techniques and guidelines to validate aircraft performance, including nondeterministic functionalities

d. Defining policy and regulation to safely integrate AAM into the existing airspace

To successfully accommodate scaled commercial operations, the United States should seamlessly integrate AAM into the current airspace systems. Civil aviation authorities; federal, state, and local governments; and air navigation service providers should collaboratively establish commercially viable policy and regulatory approaches that enable AAM vehicles to operate safely within the existing airspaces. This includes extending ATM systems to accommodate the emerging AAM traffic in the appropriate airspace classes and developing architectures, requirements, and supporting technologies. Once AAM is fully operational, aircraft would need to constantly broach the airspace dividing line between UTM and ATM control systems, currently at an altitude of 400 feet. The full integration of these two systems would need to ensure the safety of the airspace and passengers. Further, to ensure that interoperability and standards are in place, the airspace system should have an integrated infrastructure with different complexity levels that can use the technology to network all aircraft types to control traffic, separation, and paths.

2. Leading in key technologies and capabilities

To help in securing a global leadership position, the United States should focus its R&D in key areas, including: advanced battery/energy density, artificial intelligence, and 5G technologies; manufacturing aircraft at near automotive rates of production; and developing the right talent for the future. By aligning public and private R&D in certain key areas, the country can establish sustainable leadership in both the domestic and global markets for AAM.

a. Developing advanced battery/energy density, artificial intelligence, and 5G technologies

By specializing in advanced aerospace-grade battery technologies, rapid charging systems, and energy density technologies, the United States can take an early and sustainable lead in carrying multiple passengers and higher cargo payloads over meaningful distances in a single charge at speeds that significantly reduce current travel time. It should also work toward building leadership in artificial intelligence and 5G technologies (figure 6). To support the development of these technologies, the country could fund research programs such as Agility Prime and the NASA AAM National Campaign that will continue to enable the industry.

The United States should also leverage advances in autonomy in adjacent industries such as automotive and invest in advanced technologies such as augmented reality/virtual reality (AR/VR) and high-performance computing. Some companies have already made significant progress in these technologies. For instance, Bell is leveraging AR/VR technologies to design the future of flight. The company is using AR/VR to develop the concept and reduce the time for prototyping new products, including the Nexus eVTOL.34

In addition, eVTOL aircraft will require traditional aviation safety equipment that runs on internationally designated spectrum bands to ensure interference-free communications. However, with new technologies such as 5G for mobile devices requiring further spectrum allocations, the risk of interference on traditional aviation safety equipment is growing. These new technologies must be rolled out safely for both traditional and emerging forms of aviation. Before any reallocation of the spectrum, the Federal Communications Commission (FCC) and industry must work together to test the new devices’ impact on the incumbent users of the specific band, as well as any adjacent spectrum band.

b. Manufacturing aircraft at near-automotive rates

To be commercially viable and meet the potential demand, eVTOL manufacturers should scale their production capacities to levels not seen in the current aircraft manufacturing industry. As the materials used by the aircraft industry are generally more advanced and comparatively scarce, suppliers of eVTOL aircraft materials in the United States must demonstrate that the manufacturing processes developed for new materials can produce the needed quantities at aviation-grade to satisfy demand. All new high-grade fabrication processes designed should be fully reproducible and able to maintain high safety standards. To drive cost effectiveness, the United States should enable a robust supply of materials with stable procurement costs, fabrication flexibilities, and scrap disposition and recycling capabilities. Two areas are critical to strengthening the AAM supply chain network: developing the capability to analyze and predict future needs and building a frictionless electronic platform for credentialed suppliers and OEMs. To achieve these goals, the NASA Aeronautics Research Institute (NARI), part of NASA’s Aeronautics Research Mission Directorate (ARMD), is supporting its AAM mission to promote the development of a resilient and robust supply chain that can scale as the market matures.35

c. Developing the right talent for the future

The United States should start addressing the future need to find qualified talent to close any potential skills gap in advancing AAM. With the shift from combustion to electric/hybrid-electric propulsion, piloted to autonomous, and centralized to distributed propulsion, the aerospace industry will need access to a new skillset. The industry is expected to need some 280,000 new workers by 2035, many of them with these new skill requirements. The Vertical Flight Society estimates the requirement of up to 1,000 engineers for each eVTOL manufacturer.36 The AAM industry will likely be competing with the helicopter industry, which is also likely to seek thousands of engineers over the next decade for both civil and military rotorcraft development projects, for similar talent.37 Therefore, OEMs should partner with federal agencies and academia to attract, train, and hire skilled workers to meet current and future talent needs. The path forward includes OEMs forging long-term partnerships with public and private education, industry associations, and agencies to develop programs that build a strong connection with the AAM industry, creating a skilled workforce for the future.

3. Developing and scaling the market

It is important for the United States’ global leadership that the country be the first to deploy AAM at scale and that domestic industries fulfill market demand. In doing so, the United States can extend the domestic industrial base to serve that market and enable a significant export market. To achieve these goals, the US government should stimulate investments and drive demand, help build the physical infrastructure, and position the industry for success in exports.

a. Stimulating investments and driving demand

All levels of the US government should stimulate the market through fiscal arrangements, subsidies, and national procurement programs. Regulators should make an inventory of impeding or stimulating measures and aim to remove impediments where possible. The government can help existing companies and startups with investments to drive technology readiness levels to reach market readiness levels. Specifically, there should be federal government support for the industry through funding programs such as Department of Energy (DOE) loans and grants. Moreover, to create awareness and drive demand, supportive policy and legislation aimed at advancing AAM would be needed. Government agencies, industry stakeholders, investors, and academia can communicate the benefits and the transformation AAM could bring in multiple industries such as passenger transportation, cargo logistics, and emergency response. This should help with improving public acceptance, community outreach, and demand.

b. Building the physical infrastructure

While widespread AAM flights may be a few years away, cities and states should begin upgrading physical infrastructure, including investing in vertiports and retrofitting existing aerospace infrastructure, aircraft hangars and maintenance areas, and electric recharging equipment. Buildings, parking garages, and other surfaces could be repurposed to allow for AAM operations but only with local governments’ active involvement. Communities should also work with the industry and focus on developing emergency landing sites and other safety procedures.

To enable the buildout, the FAA should collaborate with the industry to develop community-based standards for vertiport design and common infrastructure for different types of eVTOL aircraft. Congress should also work with local and state governments by opening funding sources to study and plan the infrastructure sites. Moreover, developing a robust distributed system with many vertiports serving a geographic region derives benefits from zoning, infrastructure, and airspace regulations that already exist at current airports and heliports. For instance, Hillwood announced the establishment of AllianceTexas mobility innovation zone in Dallas-Fort Worth.38 The company plans to use the innovation zone to test future transportation technologies and platforms and has collaborated with Uber to develop the North Texas infrastructure platform for Uber’s Elevate skyports.39

c. Positioning the industry for global exports

By being first to market, the United States may be well-positioned to lead in global markets. But there are several important aspects to consider as the country scales to serve the domestic market, specifically, the regional and global supply chain and import/export policies. The US AAM industry will need the ability to scale production and supply chain to drive exports as the market grows globally. It could require promoting international policies around supply chain and part manufacturing authorization, which would allow US-based manufacturers to increase production. Furthermore, there should be a trade or supply chain framework that enables access to parts from foreign manufacturers.

The United States can base its export strategy on leveraging its advantages, including the size of its potential domestic market, well-developed technology ecosystem, and low cost of some of its factor inputs, chiefly land. It can add to these advantages by upgrading its infrastructure and logistics capabilities and easing import/export controls. By developing an efficient and resilient supply chain, the US AAM industry can turn scale-driven specialization into a persistent competitive advantage. Also, exports can be developed in a regionally integrated fashion, based on an export production network that currently links leading aircraft manufacturing enterprises and their first-tier suppliers.

Continuing the legacy of aerospace leadership

There is an economic and national security imperative that the United States establish and sustain itself as a global advanced air mobility leader. Through a mix of supportive regulation, substantial investment in research, advanced technologies, physical infrastructure, and talent, the United States could be uniquely poised to lead in this new aerospace market.

While AAM promises many benefits, it will also bring the challenges that inevitably arise when pursuing such cutting-edge technology. Federal, state, and local governments should work collaboratively with the industry to safely integrate AAM into the national airspace infrastructure. To guide this effort, the United States should execute a coordinated, integrated, and layered national strategy for global AAM leadership.

More from the Industrial Products collection

-

Looking beyond the horizon Article3 years ago

-

Accelerating smart manufacturing Article4 years ago

-

Digital lean manufacturing Article4 years ago

-

Electrification in industrials Article4 years ago

-

From one to many Article4 years ago

-

Aftermarket services Article4 years ago