Perspectives

The Deloitte Research Monthly Report

Issue VIII

19 October 2015

Economics

How “weak” is the Chinese economy?

Q3 GDP, which came in at 6.9%, is actually quite assuring given that manufacturing sector’s deceleration (manufacturing sector investment growth of 8.3% of year-on-year) persists and external sector’s contribution to GDP is unlikely to sustain. Indeed, recent widespread skepticism about the quality of Chinese economic data means that how to get a better feel of the Chinese economy will become an increasingly important issue for external observers and investors. September’s trade data has confirmed the trend of economic deceleration. Exports fell by 1.1% (yoy) while imports were off by a whopping 17.7% (yoy). The sharp decline of imports is a reflection of sluggish domestic demand (mainly in investment not consumption) and hence quite normal. However, the stable performance of exports is perplexing. (Given the recent RMB exchange rate was so mild).

China’s official spokesperson of General Admission Customers has attributed the relatively strong showing of exports to the recent adjustment of the RMB exchange rate. However, given the very open nature of the Chinese economy (China boasts one of the highest ratios of external sector/GDP which is a crude gauge of openness) and the recently introduced PBOC measures to crack down on illegal capital outflows, firms have a greater incentive than ever to overstate imports as a means of hoarding dollars. The fact that this plausible overstatement of imports might have suggested China’s trade surpluses could be even larger (created by the slump in imports rather than booming exports) shows that domestic demand is indeed quite weak.

This would explain why the PBOC has decided to embark on a Chinese style QE by expanding the experiment of “pledged-credit asset re-lending” from two provinces to eleven provinces and cities. Contrary to the popular opinion (on internet especially), we think such unorthodox monetary easing is in fact quite a sensible policy, especially when taking into account the present benign inflation and reduced effectiveness of short term interest rates due to interest rate liberalization. Indeed, rapid growth of non-banking financial institutions and grass-roots interest rate deregulation underpinned by the Internet companies is making PBOC’s rate cuts less effective.

Would such unorthodox monetary easing work? The short answer is yes but it would also come at a price – worsening asset quality in the medium term (please see Tim Pagett, Financial Services Industry Leader’s short piece on “how to manage rising NPLs”). If we were to compare this form of Chinese QE with interventions on the stock market, I would argue that such a scheme of “pledged-credit asset re-lending” will result in fewer distortions. One of the lessons from the US sub-prime crisis is that the US Treasury chose to purchase toxic assets but did not buy stocks of commercial banks which were being plagued by toxic assets. The rationale being that purchasing toxic assets could make banks more willing to lend but would not result in any adverse effect on corporate governance. To put it simply, if the PBOC wants to inject liquidity into the economy, this is a more practical way to do it.

To conclude, the PBOC, in spite of many political and economic constraints, is doing its best to reflate the economy. But there are some downsides to this kind of quantitative easing. Worsening asset quality aside, another possible side effect is moral hazard. However, in the midst of interest rate liberalization, policymakers are expected to tolerate certain “failures” so long as such “controlled explosions” do not pose any systemic risks.

Which brings us to our final point – monetary easing. Has the RMB reversed its trend following seven consecutive winning sessions against the greenback? If history is any guide, the RMB often bucks the trend during Chinese presidents’ visits to the US or ahead of important events. In China, political considerations often take precedence over economic ones (one of the best examples of this was China’s decision to not devalue the RMB during the Asian Financial Crisis). With President Xi’s upcoming trip to the UK, movements on the RMB could be complicated by similar political factors. We stick to our view that another mild revaluation of the RMB against the dollar remains a viable option for enhancing monetary easing.

Financial Services

How to manage rising NPLs?

Chinese financial institutions continue to face a future of uncertainties amid a combination of factors - volatilities in the capital markets, industrywide structural reforms and an overall slow-down in economic activity.

Arguably, the biggest threat to the sector’s overall financial performance is the rise in the Non-Performing Loans (NPLs). It is likely that NPLs will hit their highest level since the global financial crisis, which should be a cause for concern for both investors and regulators alike. NPLs are an inevitable outcome of any lending business – not every decision is the right one and not every business is a success. Too much emphasis can be placed on the headline ratios and the impact on profits and capital strength to the neglect of the real challenge that lies ahead – what can be done about it. The real challenge for Chinese financial institutions is their ability to acquire and retain an appropriate level of capability in dealing with the increasingly complex and time-sensitive work-out processes and experience in valuation and provisioning as well as potential re-calibration of expected loss models. A systemic increase in NPLs presents opportunities for Deloitte in assisting with the identification, measurement and recognition of the NPLs and particularly, with the packaging and re-cycling of the loans back into the investment cycle.

The reputation of China’s financial services industry continues to be plagued by the adverse external views arising from the growth of the Shadow Banking sector in the wake of the global financial crisis and the long anticipated loan default. In what could be described as a continuous process of "controlled default", a progressive approach to fostering defaults within the sector is evident in instances where control appeared to be exercised when material default would result in systemic challenges and increased social unrest. Although sceptics would say this is "just kicking the can down the road", one could also argue, from a more informed perspective, that the overall impact would appear to focus on engendering an appreciation/awareness of default risks in investment decision making process which should ultimately lead to a greater sense of differentiation within the market for both credit and market risks. A more comprehensively educated and financially aware market is required to support the overall reform of financial markets as a whole.

In one of the clearest moves to date, the devaluation of the RMB signals yet another step toward currency internationalization which has become a matter of “not if but when”. And it is clear that there is a central policy resolve to move the RMB to support China's strengthening position within the global economy. In the face of the eventuality, the banking sector should be preparing, in particular, for a life characterized with increased volatility, unrestricted capital flows and multi-currency investment opportunities, borrowing and lending in deeper capital markets and overall trade finance and transaction banking opportunities. For many Chinese financial institutions, the road to success will be their ability to adapt both their business models and product portfolio to meet the rising demands of an ever-increasing globalized domestic client base. Central to that effort is the strategic expansion of their operations at critical overseas business locations.

The path towards a completely liberalized interest rate environment has seen many market participants focusing on the buildup of their own infrastructure. In a controlled interest rate environment there has been little need for the highly developed and sophisticated asset & liability management techniques. Liberalization of the relationship between funding and lending rates will inevitably create an environment for margin contraction – albeit the experience of similar paths on a global basis has been progressive and gradual instead of instantaneous. Critical to this has been the preparedness of the core financial institutions in their respective regimes. The ability to manage pricing, liquidity and potential contingency funding become core to the underlying operations of these institutions in the same way as the credit exposure management has been in the past. Further, increased volatility in interest rates will inevitably create demand for interest rate risk management products and give rise to an increasingly anticipatory focus on management of exposures derived from underlying business activities. With these increasing capital markets activities come along the potential opportunities for fees and non-interest rate margin income which can be used to offset the net-interest margin contraction.

A natural byproduct of the flow-on from the structural reforms is the increasing importance of the mid-tier financial institutions. The continued focus on the commercialization of all sectors of financial services is driving the pace of reform in capabilities, capacity and coverage – leading to significant opportunities to support transformation, consolidation and capital raising across the market in general. Preparing for a new world of global connectivity is on top of the agenda for all – and an opportunity for many at the same time. Despite continued downward pressure on the stock market, many market participants continue to move towards an inevitable monetization of their unique positions in the fabric of either the real economy or the capital markets.

Finally, liquidity and the stock market bubble. Deloitte has been largely concerned with the tenuous link between the stock market and the real economy. Clearly there had been an inappropriate and somewhat ill-advised build-up of leveraged or margin lending based speculation within the stock market. As soon as a downward spiral was triggered it should not be a surprise to anyone that systemic and contagion risks would be managed through a rapid and directed response to ensure liquidity to the securities market to avoid a market collapse. Whilst there are as many critics as supporters for this action – the one undeniable truth remains despite the thrust toward structural reform – the overall policy framework of financial services in China remains clearly and firmly in the hands of the central government. This undeniable truth is something to be understood, appreciated and factored into with the simplest of decisions as it is clearly a fact of life beyond reach and control of anybody.

Retail

Competition in Chinese internet retail market is heating up and becoming diversified

Global retail giants are actively seeking opportunities to team up with Chinese Internet retailers as competition in Chinese internet retail market is heating up and becoming diversified. In the last two months competition between Alibaba and JD became white-hot with both signing a series of merger and cooperation agreements. The latter indicate that the market is changing rapidly and the two giants are blazing new trails to drive business growth. In August, JD bought a 10% stake in Yonghui Superstores while Alibaba and Suning inked a cross-shareholding agreement. In September, Alibaba reached a cooperation agreement with Metro, the leading retail group in Germany. Almost at the same time, JD signed a strategic cooperation agreement with Lotte, a South Korean retail giant.

The two transactions in August are signals that internet retailers are moving to expand business offline by utilizing the brick-and-mortar stores and logistics storage resources of traditional retailers in the face of slowing growth of the internet retail business. The two big cross-border tie-ups in September show that Alibaba and JD are strengthening capacity in different aspects of the business: Alibaba will benefit from Metro's complete supply chain system and brick-and-mortar stores and Metro will get access to Alibaba's business infrastructure in various sectors, including cross-border services, logistics, marketing, rural access and online supermarket sales. Furthermore, global cooperation will enrich Alibaba's product and service offerings and Metro will also become an important partner for Alibaba's European strategy. Cross-border e-commerce and big data application are also an important part of their cooperation. For JD and Lotte, on the other hand, cooperation focuses more on the expansion of available products and services on JD's global shopping platform. With its’ strategic cooperation agreement, JD will become the sole strategic partner of Lotte.com in the Chinese mainland for five years. Lotte.com will integrate Lotte Group's branches to establish a "Lotte hall" on JD.com. Lotte will not only sell infant products, cosmetics, and fashion products, but also offer household products and home appliances while Lotte’s bricks-and-mortar stores could provide support to JD. Furthermore, in the future the two parties will implement cooperation in tourism and service O2O.

In conclusion, under pressure from fierce competition, internet retail giants are seeking multi-faceted development options. Online and offline integration, products and services improvement and cross-border cooperation could well be the forces behind future growth.

Life Science & Healthcare

Policy should focus more on the efficiency of regulation and evaluation

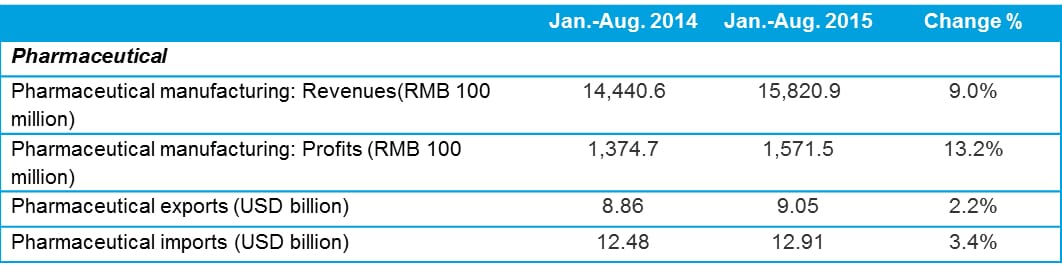

After the notification requiring pharmaceutical firms to conduct self-vetting of clinical trial data in July, the government again issued policies to further regulate the industry and promote evaluation efficiency. As for pharmacy, CFDA recently enumerated the reward and punishment measures for the consistency evaluation of generic drugs for the first time amongst which punishment measures warrant special attention because of the severity of the punishments. The measures stipulate that generic oral solid preparations on the national essential drug list that will not have passed the evaluation prior to 2018 shall not be sold on the market; permits for drugs that fail to pass the evaluation after the expiration of such permits will be revoked; and drugs that haven't passed the evaluation won’t be selected in public bidding and medical insurance if there are no less than 3 enterprises with the same drug passing the consistency evaluation. As for medical devices, the Center for Medical Device Evaluation (CMDE) issued a notice about returning partial applications which stated that `all applications that hadn’t responded to the supplementary requirements issued prior to Oct. 1st, 2014 would be identified’ and that no review action would be taken on those applications that could not comply with the supplementary requirements’. This round of returns is unprecedented in its size involving 1,154 medical device evaluation applications, and is very likely a response to the State Council's demand to clear up backlogs and improve evaluation efficiency. Further, the CFDA's directive indicates a tightened evaluation and approval system which will be more objective and rely less on human judgments. Finally, the reform of the healthcare system has also entered uncharted waters. 63 large hospitals have been on the review list since NHFPC issued the inspection plan of large hospitals. Inspection of large hospitals indicates that the reform has gradually stepped into the phase of exploring and solving deep-rooted problems, which will not only help change the structure of the healthcare system, but also provide powerful support for future reforms.

The policies issued over the past few months involve all the aspects of the medical system and are highly practicable, which indicate tighter industry supervision in the future. Thus those which operate normatively will stand to benefit.

Telecommunication

The telecom industry needs an in-depth market revolution

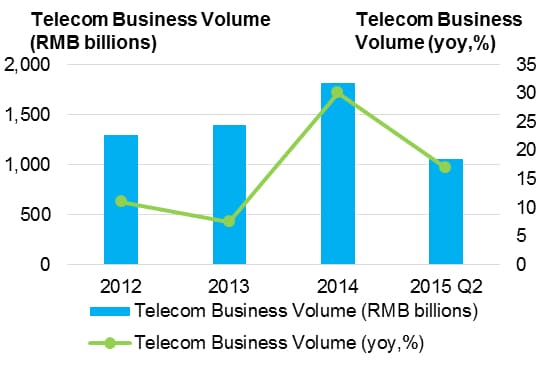

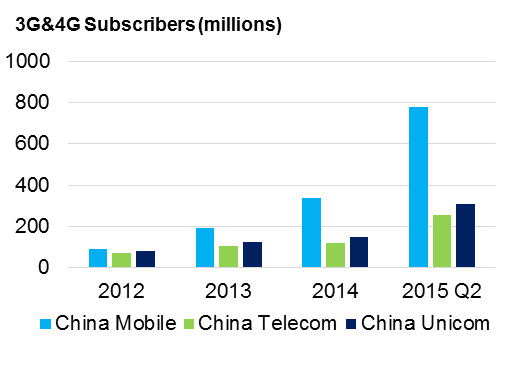

In October, telecom operators began offering mobile phone packages in which one-month data traffic would not be set to zero ("Non-zero balancing"). Although these measures can ease their fierce conflict with consumers, they cannot completely resolve the problem of unreasonable data traffic charges for mobile phone services. What this means is that for operators, revenues and net profits will be negatively impacted. For operators such as China Mobile, whose revenues are hundreds of millions each year, the loss is little, but for China Unicom and China Telecom, the loss will be far from be small. While the "Non-zero balancing" plan is just an intermediate victory in customer relations for the Big Three, the real challenge requires them to accelerate technological changes and expand the user base amidst deepening competition. Meanwhile, the regulators need to introduce substantive policy guidelines to accelerate the process. The "Non-zero balancing" plan is a small step in the right direction in terms of loosening the market but it is only the beginning.

In addition, riding on the back of the successful 4G rollout, "4G+" further expands the network spectrum and network quality, significantly increasing the network uplink and downlink rate. In terms of evolution of technologies, "4G+" is the only transition stage from 4G to 5G whose speed can reach up to 300Mbps, 3 times the speed of 4G. From the announced schedules, all three carriers will realize the 4G+ network commercialization in 2016. Meanwhile, consumers care more about continuity and stability of network services. Which is why, in 2015, all the three operators will spend more than RMB200 billions in capital expenditure on 4G and 4G+. Since 5G won't materialize until 2020, operators will continue capital expenditure on 4G and 4G+ technologies in the next 1 to 2 years. However, 4G+ network domination is only a necessary requirement in the short term. If operators want their development to be sound and sustainable, they need to consider strategic design, management framework, operational mechanisms and other factors.

Furthermore, the Big Three have made significant personnel changes in August. MIIT Vice Minister Shang Bing replaced Xi Guohua, Chairman of China Mobile. Chairman of China Unicom Chang Xiaobing and China Telecom Chairman Wang Xiaochu swapped their positions. However, despite the personnel change at the top, the telecommunications industry needs a new revolution.

For the last few years the three carriers have occupied an increasingly complicated position within the market as they are in fact both listed public companies and state-owned enterprises whose primary task is to increase the value of State-owned assets. Massive price cuts have led to a need for serious consideration of several issues. Under the current situation, cost control and performance assessment are the key issues that must be considered. Personnel changes at the top are not enough to turn things around as the telecom industry as a whole needs to ride on the coattails of the State-owned enterprise reforms in search of a solution to the issue of regulations and confusing value propositions, and in doing so, accelerate the process of price reductions.