Addressing the people and tax implications of hybrid and remote work

Working unleashed: Optimizing your remote work infrastructure

Enable remote work for your people

The future of work is going to look very different from the present. The pandemic tested the flexibility and responsiveness of work and culture everywhere. Since the disruption, hybrid and remote-working models have become the norm more quickly than anyone envisioned pre-pandemic, for example, 78% of tax leaders say that they are here to stay1.

As you look beyond the pandemic, Deloitte can show how the tax function can play a bigger role to help protect and create value for your business. Our experienced tax and human capital professionals and innovative technology solutions can support you. Together, we can align your strategy, policy, and operations to address the potential talent and tax implications of hybrid and remote work.

Seamlessly transform how your employees work

Demand for remote work has been rising for years. But the global pandemic turned it from request to requirement almost overnight—and companies stepped up. Seventy-nine percent of respondents to a Deloitte survey1 reported that at least 75% of their workforce has been able to work remotely during the COVID-19 pandemic. And 69% said their company’s ability to manage and support a remote workforce was good or excellent.

Your teams are likely to have questions about going back into the office post-pandemic. It may be time to stop thinking about remote work as a special category. You need the right policies and infrastructure in place today to support them to take advantage of the benefits they present.

Taking on the potential talent and tax implications of remote work

Deloitte can help tax leaders evaluate and establish temporary and future remote work programs. We can help analyze your current remote workforce approaches—including those implemented rapidly in response to COVID-19. We can also help your organization develop and execute a future-forward remote work strategy that aligns with business objectives: Employees may benefit from increasing their well-being, job satisfaction, and work-life balance, and the business benefits from lowering overhead costs and becoming more attractive to top talent.

We do this through the three major components of our remote work approach:

Our thinking

The intersection of talent and technology

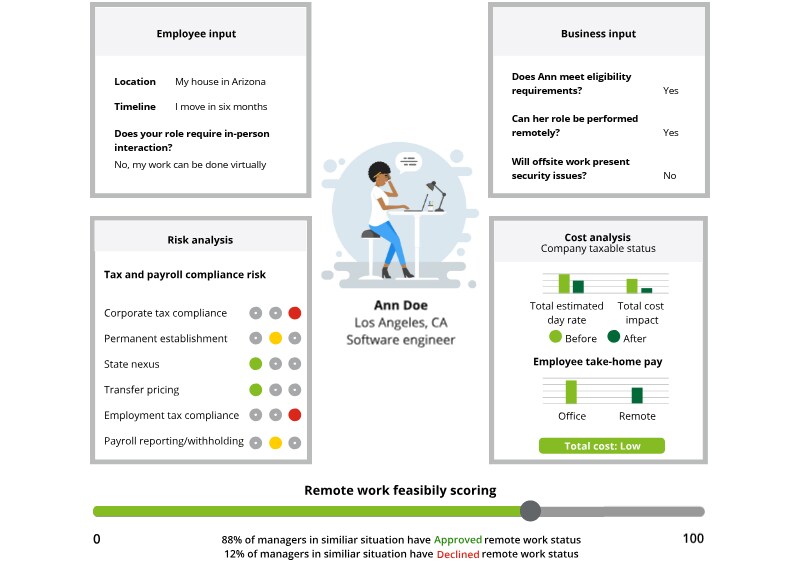

Human insights, combined with cutting-edge technologies, can help you achieve the potential benefits of incorporating remote work arrangements into your organization. The process starts by identifying where your people are today, including allowing workers to preclear their desired work arrangement. Our proprietary, custom-built technology uses key employee and employer information to analyze remote work requests from various risk and cost analysis perspectives, enabling you to make informed decisions and determine if they fit the remote work plan your organization has developed.

The intersection of talent and technology