Predictions

US TV: erosion, not implosion

TMT Predictions 2016

Executive summary

Deloitte Global predicts that the US traditional television market, the world’s largest at about $170 billion in 2016, may see erosion, but not implosion, on many fronts.

Pay-TV cord cutting. Deloitte Global predicts that the number of US subscribers who cut the cord (completely cancel pay-TV service from a cable, satellite or phone company) is likely to be just over one percent in 2016, perhaps 1.5 percent in 2017, and around two percent in 2018. By 2020, we predict that there are likely to be around 90 million US homes which are still paying for some version of the traditional bundle which, while down from the peak of 100.9 million subscribers in 2011, will be 18 million higher than the 72 million US cable and satellite subscribers in 1997.

Pay-TV penetration. Deloitte Global predicts that pay-TV penetration (or reach) will fall more than two percentage points to 81 percent in 2016, to under 79 percent in 2017, and around 70 percent by 2020. The expected decline in penetration rate is largely due to a steady 1.1-1.3 million forecast increase in the number of US households between 2015 and 2025. But another factor is the growing number of millennials (18-34 year olds) who have never had a pay-TV subscription. These are not cord cutters, but cord nevers, and in one US survey represent 11 percent of 18-34 year-olds.

Average monthly pay-TV bill. Deloitte Global predicts that the monthly TV bill in 2016 will be about five percent higher than the average $100 per month bill in 2015, or lower than the historical growth rate of over six percent, reflecting the combined effects of small numbers of cord shavers and fewer consumers adding channels.

Antenna instead of pay-TV. Deloitte Global predicts the number of antenna-only homes (or antenna plus Internet TV) to increase by less than one million in 2016, to about 13.5 million homes, and to about 18 million homes by 2020.

Average daily TV viewing, live and time-shifted. Deloitte Global predicts that daily TV minutes for the adult population will continue to fall at a slow but steady rate in 2016, to 320 minutes per day in Q1. On average, adults in the US watched over 330 minutes of traditional live and time-shifted TV per day in Q1 2015 on a TV set. This is 14 minutes down from 2014, and 10 minutes lower than in 2013.

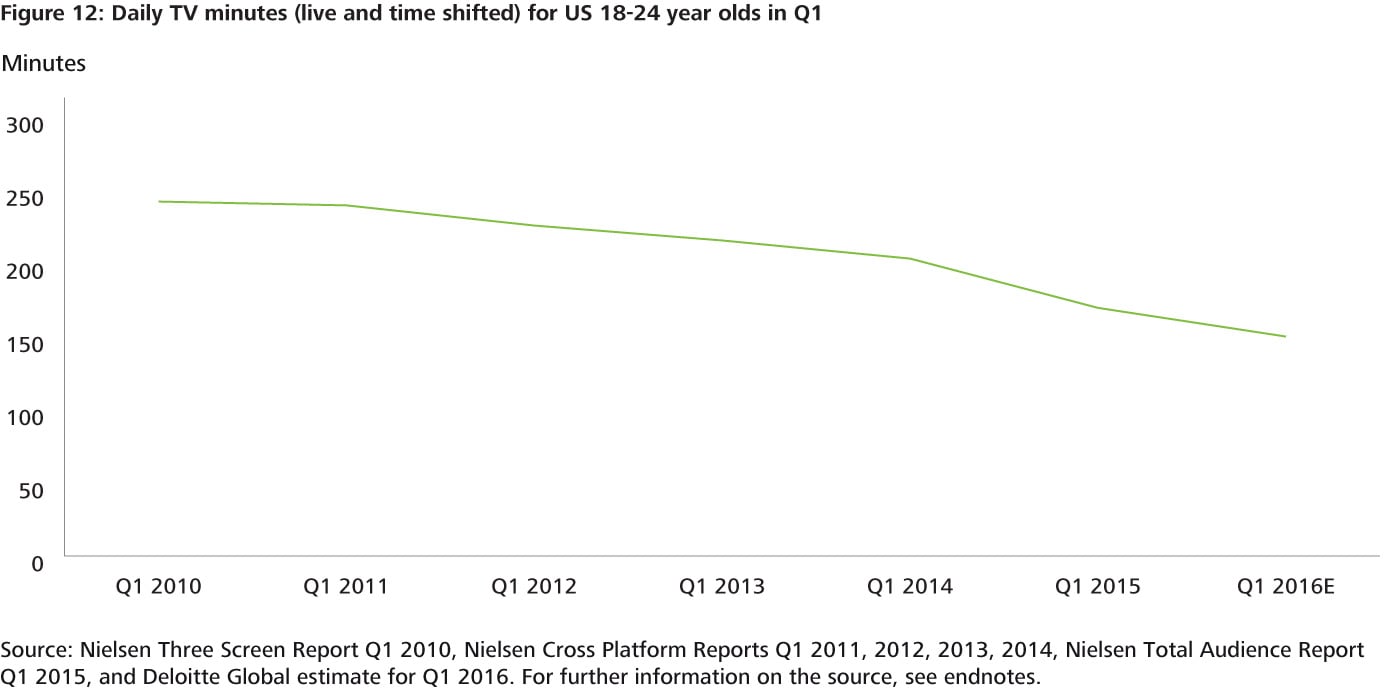

Average daily TV viewing, live and time-shifted trailing millennials. Deloitte Global predicts that 18-24 year-olds will watch about 12 percent less traditional TV in Q1 of the 2016 broadcast year than in the same quarter of the previous year, or about 20 fewer minutes daily, down to an average of 150 minutes, still well over two hours. Deloitte Global further predicts that erosion in viewing time will continue, and that 18-24 year-olds will be watching less than two hours of TV daily by 2020, but more than 90 minutes. Younger Americans have always watched considerably less TV than older demographics, but the gap is widening: in 2008 18-24 year-olds watched 58 percent as much live and time-shifted TV as those over 65, while by 2015 that age group was watching only 36 percent as many minutes of live and time-shifted TV on TV sets, and about 42 percent as many minutes of all video on all devices as Americans 65+.

Although media coverage of these trends was very high in 2015, they have been ongoing since about 2010/2011, which in some ways was ‘peak TV’ in the US. With the rise of over-the-top (OTT) services offered from non-traditional providers like Netflix, download services like iTunes, clips from services like YouTube, and the continued usage of pirate sites (streamed or downloaded), talk of the imminent collapse of traditional TV of the traditional advertising and subscription-funded TV model is understandable. However, TV’s decline is more likely to happen at a slow, steady and predictable rate. An apocalypse is not around the corner.

1 For a complete list of references and footnotes, please download the full PDF version of the TMT Predictions 2016 report.

Deloitte Global predicts that the US traditional television market, the world’s largest at about $170 billion in 2016, will see erosion on at least five fronts: the number of pay-TV subscribers; pay-TV penetration as a percent of total population; average pay-TV monthly bill; consumers switching to antennas for watching TV; and live and time-shifted viewing by the overall population, and especially by trailing millennials (18-24 years old).

Although media coverage of these trends is very high in 2015, they have been ongoing since about 2010/2011, which in some ways was ‘peak TV’ in the US. Despite many forecasts of the imminent collapse of the traditional advertising and subscription-funded TV model, it is likely to erode at a slow, steady and predictable rate. Television is not growing the way it used to: for example, pay-TV penetration in the US rose from over 76 percent in 2000 to nearly 90 percent in 2010, and has fallen slowly since. Traditional TV is not dying, disappearing, or irrelevant. As of May 2015 TV reached 208.5 million Americans over the age of 18, or 87 percent of the adult population; and they watched 468 billion minutes of TV in the average week, which is about four times as many minutes as adult Americans spent on their smartphones, in apps or on the web (but not including talking or SMS texting).

Pay-TV cord cutting. Deloitte Global predicts that the number of US subscribers who cut the cord (completely cancel pay-TV service from a cable, satellite or phone company) is likely to be just over 1 percent in 2016, perhaps 1.5 percent in 2017, and around 2 percent in 2018. By 2020, we predict that there are likely to be around 90 million US homes which are still paying for some version of the traditional bundle which, while down from the peak of 100.9 million subscribers in 2011, will be 18 million higher than the 72 million US cable and satellite subscribers in 1997. The rise of cord cutting has been the most discussed trend around traditional TV viewing for years, and is likely to remain so in 2016. In 2010, nearly 90 percent of US consumers watched almost all their TV via a signal provided by a ‘distributor’, that is a cable, satellite or phone company. Pay-TV is typically sold as part of a bundle, and costs the average subscriber $100 per month for TV only in 2015, with broadband or voice service costing additional amounts. For many years around seven percent of pay-TV consumers have said that they were thinking about cancelling or would cancel their subscriptions within the next 12 months.

However intent was rarely matched by action and the decline has been much more muted. The number of pay-TV subscribers has been declining slowly since 2012, falling by 8,000 in 2012, 170,000 in 2013, and 164,000 in 2014. The annual incremental change in total subscribers was steady at around 150,000 fewer for most years between 2010 and 2014, but it is accelerating sharply in 2015 with pay-TV subscribers estimated to fall by just under one million, on a base of roughly 100 million homes subscribing to a pay-TV package. There is also likely to be some cord shaving, where consumers pay less money for fewer traditional channels, which is discussed further below: in a Deloitte US 2014 survey, just over half of existing US pay-TV customers said they would prefer to pay only for the channels they watch regularly. However, as noted above, there has tended to be a disconnect between stated intention and follow-through.

Pay-TV penetration. Deloitte Global predicts that pay-TV penetration (or reach) will fall more than two percentage points to 81 percent in 2016, to under 79 percent in 2017, and around 70 percent by 2020. That is a 20 percentage point decline in reach from the 89.4 percent in 2010, but the installed base would likely still be markedly higher than for most other countries, and about the same level as US pay-TV penetration of 72 percent in 1997.The expected decline in penetration rate is largely due to a steady 1.1-1.3 million forecast increase in the number of US households between 2015 and 2025.

But another factor is the growing number of millennials who have never had a pay-TV subscription. These are not cord cutters, but cord nevers, and in one US survey represent 11 percent of 18-34 year-olds. There have always been Americans who have never paid for TV, but the older demographics tended to watch over-the-air broadcast TV with an antenna. They weren’t paying for a monthly subscription, but they still watched traditional TV, and usually with all the advertisements. Some of the new generation of cord nevers may be using antennas (one cable company includes an OTA antenna for customers who subscribe to broadband but don’t want pay-TV), but many may be using broadband only for their video needs. The exact number of millennials who don’t pay for TV and don’t have antennas is not known, but as of 2015 the number of households in the US who had broadband only and no antenna or pay-TV subscription was only 3.3 million, although that was up over a million from 2014, or more than 50 percent.

Average monthly pay-TV bill. Deloitte Global predicts that the monthly TV bill in 2016 will be about five percent higher than the average $100 per month bill in 2015, or lower than the historical growth rate of over six percent, reflecting the combined effects of small numbers of cord shavers and fewer consumers adding channels. The average US bill for pay-TV grew by 6.1 percent per year between 1995 and 2015. Deloitte Global further predicts that the bill growth is likely to decline by about one percentage point per year so that by 2020 ARPU is likely to be under one percent, and may even have begun to decline, although still at a relatively slow rate.

The number of channels available to the average US pay-TV subscriber has increased by almost 50 percent since 2008, from under 130 channels to nearly 190. Over that period the number of channels watched by the average viewer has declined from 15 channels in 2012 to 11 in 2014. As some 90 percent of channels that are being paid for are unwatched, some subscribers may be thinking about cord shaving: choosing packages with fewer channels, or fewer packages, with the result being lower monthly spend.

A few cord shavers may be substituting a traditional pay-TV package with a lower-cost subscription video on demand (SVOD) service. Were this behavior widespread, we would have likely seen a decline in monthly pay-TV bills, but this has not happened. In fact average bills are still rising, rising from $89 in 2014 to over $99 in 2015, according to one survey. Another 2015 survey shows that over 80 percent of pay-TV subscribers are spending the same or more as in 2014, and that they are remarkably stable in the services they are buying: 64 percent kept the same services as last year, 17.8 percent added services, and 18.6 percent cut services – for a net annual change of only 0.8 percent.

Antenna instead of pay-TV. Deloitte Global predicts the number of antenna-only homes (or antenna plus Internet TV) to increase by less than one million in 2016, to about 13.5 million homes, and to about 18 million homes by 2020.

Many North Americans are unaware that many of the channels they would like to watch are available for no monthly charge with the installation of a digital antenna that allows for over-the-air (OTA) TV viewing, either live or time-shifted if they have a recorder. For some Americans, this may require a more expensive roof-mounted antenna, but for the more than 80 percent who live in urban areas, the antenna can be indoors near a window or exterior wall and costs less than $20. OTA digital TV is commonplace in Europe, but only about 12.7 million US homes were receiving broadcast as of Q2 2015, or 651,000 higher than the same period in 2014. There are many articles that specifically address cord cutters using antennas, and some distributors fear that they will see a surge in OTA homes, as cord-cutters cancel traditional distribution bundles; get some channels from their antenna and buy a small bespoke selection of OTT services.

There is some evidence of this trend, but it is much smaller than most people expect. OTA-only homes in the US were more or less flat at just over 11 million from 2010-2013, but the number has recently begun growing, and at a faster rate: 500,000 additional homes went OTA-only in 2014 and nearly a million in 2015 (although the year-over-year growth was highest in Q1 – in Q2 and Q3 it was less than 700,000). The modest rise in OTA viewing affects each of the parts of the traditional TV industry differently. Cable, telco and satellite providers of TV packages are likely to see a small effect on subscriber numbers and revenues (although only 53 percent of broadcast-only homes are broadband subscribers, so that partially offsets the decline). However, TV broadcasters and their advertisers are not affected by a move from traditional pay-TV bundle to OTA: as long as viewers are watching their programs (and the ads) then they are largely indifferent to the distribution method.

Average daily TV viewing, live and time-shifted. Deloitte Global predicts that daily TV minutes for the adult population will continue to fall at a slow but steady rate in 2016, to 320 minutes per day in Q1. On average, adults in the US watched over 330 minutes of traditional live and time-shifted TV per day in Q1 2015 on a TV set. This is 14 minutes down from 2014, and 10 minutes lower than in 2013.

Deloitte Global further predicts that this moderate decline will continue, but average daily viewing in the US will likely still be over 240 minutes in 2020, that is greater than in most other countries, despite the fall. Four hours would be exactly the same amount of traditional TV as watched in the 1998-99 broadcast season.

Average daily TV viewing, live and time-shifted trailing millennials. Deloitte Global predicts that 18-24 year-olds will watch about 12 percent less traditional TV in Q1 of the 2016 broadcast year than in the same quarter of the previous year, or about 20 fewer minutes daily, down to an average of 150 minutes, still well over two hours. Deloitte Global further predicts that erosion in viewing time will continue, and that 18-24 year-olds will be watching less than two hours of TV daily by 2020, but more than 90 minutes. Some portion of their video consumption over that time period will likely be shifting from traditional TV on TV sets to other devices, such as multimedia devices (Apple TV digital media extender, Chromecast, etc.) smartphones, computers and tablets.

But video consumption on those devices, while it has been growing, has not been offsetting the decline in traditional TV-watching by trailing millennials. In 2015, all video watched on devices other than TV sets was 32 minutes daily, up from 28 minutes in 2014. Those additional four minutes are much less than the 33 minute decline in traditional TV on TV sets that 18-24 year-olds watched over the same two periods.

Specific subsets of the US audience are shifting viewing habits faster than the average. Trailing millennials aged 18-24 watched 29 percent fewer minutes of TV daily in 2015 than they did in 2011 (see Figure 1). This is an 8.3 percent compounded annual decline, which is six times faster than the 1.3 percent decline seen for the population aged 2+ in the same period.

Source: Nielsen Three Screen Report Q1 2010, Nielsen Cross Platform Reports Q1 2011, 2012, 2013, 2014, Nielsen Total Audience Report Q1 2015, and Deloitte Global estimate for Q1 2016. For further information on the source, see end notes.

Younger Americans have always watched considerably less TV than older demographics, but the gap is widening: in 2008 18-24 year-olds watched 58 percent as much live and time-shifted TV as those over 65, while by 2015 that age group was watching only 36 percent as many minutes of live and time-shifted TV on TV sets, and about 42 percent as many minutes of all video on all devices as Americans 65+. As TV time for 18-24 year-olds drops under two hours per day, we may end up nearing a tipping point where TV viewing for that demographic may begin to decline more sharply than for the population as a whole: there may be a threshold or minimum daily viewing time below which media consumption changes more abruptly.

Bottom Line

With the rise of over-the-top (OTT) services offered from non-traditional providers like Netflix, download services like iTunes application program, clips from services like YouTube, and the continued usage of pirate sites (streamed or downloaded), talk of the imminent collapse of traditional TV is understandable.

But while the US TV market is not growing, it is not collapsing either. The best way of describing the outlook is gradual erosion: an apocalypse is not around the corner.

An obvious question is: “What do all these various erosions do to the size of the US television industry?” If it is about $170 billion in 2016, (of which $75 billion is advertising and $95 billion is pay-TV) how does that number change thereafter, and by how much?

The outcome is hard to predict with certainty. Putting it all together, the total picture is murky.

If one percent of current pay-TV subscribers discontinues service in 2016 this does not necessarily mean a one percent decline in revenues. Cord cutters are likely to be those on the lowest-priced pay-TV packages. Their departure may cause ARPU to rise and become more resilient: customers that remain may be those least sensitive to further price increases. Cord cutters are likely to include those watching the fewest minutes of TV, and may represent a smaller share of ad dollars to the industry than subscription dollars.

Some cord cutters are moving to OTA antennas, and may therefore end up watching more ads due to the lack of a DVR, and subscription losses may be offset by more effective advertising. Equally, cord shavers who get rid of channels they are not watching will likely have minimal impact on ad revenues.

Millennials aged 18-24 are a desirable demographic, and they are reducing TV minutes at a faster rate than the population as a whole, but are only a tenth of the US population. Further, advertisers often pay to target specific groups: if traditional TV watching becomes concentrated in certain age groups or other demographic slices, advertisers could be willing to pay more for that targeted audience.

As an example, there were concerns over weakness in the TV ad market in the summer of 2015, as the mid-point of the August US upfront estimates fell over two percent from 2014. However by October, total TV ad spend was up 10 percent annually.

The US is only one market, albeit the largest in the world, representing about 38 percent of the global TV market of around $450 billion worth of subscriptions, advertising and license fees. What happens in the US may or may not happen in the rest of the world.

Trends in Canada for cord cutting, cord shaving, pay-TV penetration and changes in viewing for the population as a whole, and for millennials, are roughly in line with the US data cited.

If we look at the UK TV market there are some similarities: viewing minutes are expected to fall between 2015 and 2020, but moderately, from 204 daily minutes to 191. The UK data also shows a 27 percent decline in viewing by 16-24 year-olds for the period 2010-H1 2015: from 169 daily live and time-shifted minutes to 123, very much in line with the US decline of 29 percent over (roughly) the same period. However, the forecast is for the peak decline in that youngest demographic to have occurred in 2014/15, and to “flatten out from 2016 onwards”. It is also worth noting that although TV minutes may be declining in the UK, the pay-TV market is growing strongly, both in terms of subscribers and revenues, and the UK TV advertising market grew eight percent in 2015, recording its best growth in 20 years.

Although pay-TV subscribers are expected to fall slowly in the US, the global picture remains in growth mode. From 950 million subscribers and 58 percent penetration in 2015, estimates for 2020 are for 20 percent growth to 1.14 billion subscribers and 63 percent penetration.

Our thesis of gradual erosion is based on recent history and incomplete data. As already mentioned, if there is a tipping point of viewing hours needed to sustain pay-TV subscription rates, we could see the number of millennials who have their own homes and who do not get pay-TV go from current levels of 20-25 percent to a much higher number in a short period of time. That hasn’t happened yet, but it could. Another wild card is likely to be the effect of popular channels that had formerly been available only as part of a pay-TV bundle being offered on a stand-alone basis over the top (OTT) through the Internet. One such service has already launched in the US, and has only seen about one percent of its pay-TV subscribers cancel pay-TV and switch to the OTT version. Should that service, or any others, see that substitution accelerate, the fragmenting of the traditional pay-TV bundle model will almost certainly see our predictions on cord cutting, cord shaving, and cord nevers prove too conservative. Finally, although the 18-24 year-old category is currently moving the fastest away from the traditional TV model, it is worth adding that older generations are also exhibiting some of the same shifts, albeit at lower levels. If those older age groups began to resemble millennials more rapidly in their pay-TV habits, our forecasts would again be too cautious.

@DeloitteTMT