Artikel

Digitalisation and IT - an opportunity within M&A processes

Challenges, trends and advice on IT within the M&A process

Published: 29-09-2023

Understanding the value, potential and risks related to IT when facing a transaction is a prerequisite for successful M&A deals in today’s world. IT is often the biggest operational challenge in a separation1 or integration, whilst also being a driver for both costs and synergies. How well IT is managed before, during and after a transaction can therefore be crucial for whether a transaction is successful or not, particularly in times of a weaker economy, when cost synergies and lower running costs become all the more important. As advancements in technology and digitalisation are made, new business and delivery models are emerging, affecting the M&A process as a whole, and the role of IT in particular.

The value and complexity of IT in M&A deals are often underestimated

IT is inherently complex and time-consuming when undergoing change. IT often connects processes and business units internally and customers and suppliers across the entire value chain externally. IT is often the business function or workstream with the longest lead times in a deal, yet its complexity and lead times are often underestimated, whilst the value that IT can contribute to the deal is overlooked.

This leads to IT being managed on an ad hoc basis and the IT function being involved late in the process, creating challenges in meeting target dates and deadlines. This makes it difficult for the IT function to have time to adequately plan and prepare for the separation or integration, which risks adding further complexity and cost to the transaction and increases the risk of the business’ identified synergies not being realised.

This often results in long and costly Transition Service Agreements (TSA2) to ensure that the acquired company has the necessary functionality in place when the deal goes through, as well as an IT landscape that does not deliver the value required to realise the expected benefits and synergies.

IT is often the business function or workstream with the longest lead times in a deal, yet its complexity and lead times are often underestimated, whilst the value that IT can contribute to the deal is overlooked.

TSAs often pose a challenge as there is a risk that the scope and price are incorrectly defined, which over time risks eroding the value of the deal. For the seller, this may result in overcommitment, meaning that they need to spend time and resources on providing services to the buyer at too low a price. For the buyer, it may result in an insufficient service at an inflated cost for a long time, whilst the services do not add the value or efficiency required for the transaction to develop according to plan.

TSAs also run the risk of limiting the possibility for both sides to further develop the services that fall under the TSA, which in the long term reduces the value that IT can deliver and extends the timelines for the intended synergies to be realised. TSAs are often unavoidable and necessary to expedite the deal, but their scope and length can be significantly limited by proper preparation by both the seller and the buyer.

When IT is overlooked in an M&A transaction, the effects are often manifested in high operational IT costs some time after the deal is done, when the buyer’s systems and infrastructure have expanded and the task of rationalising the IT landscape remains outstanding. For the seller, corresponding stranded costs relate to residual components that could not be transferred to the buyer and at times an oversized IT landscape for the remaining business. IT and digitalisation are important value drivers for many companies today and it is therefore important to adapt the IT landscape and operating model as quickly as possible after the transaction in order to realise synergies and business value through IT.

Consider new opportunities to successfully manage IT within M&A processes

As advancements in technology and digitalisation are made, new business and delivery models are emerging, affecting the M&A process as a whole, and the role of IT in particular. Software and technology are increasingly significant components in a deal and cloud services, automation and AI are changing the way separations and integrations are implemented. Developments in technology has made IT a central part of the transaction process, where mature actors leverage technology to increase the value of the deal and to address operational challenges. Below we highlight four trends and related advice for successfully managing IT within M&A processes.

The value of IT and software – a critical aspect in the valuation

The value that IT contributes to the business has become an increasingly important part of the M&A process. It is therefore important that potential buyers conduct a thorough IT due diligence and gain an understanding of how IT can be managed early in the process in order to provide the most value to the business. Given the increased interest in the value of IT as part of the business, it is equally important that the seller focuses on clarifying and describing the current IT landscape and on how the future IT landscape might look in order to deliver value to the buyer in an optimal way.

In cases where proprietary software and technology constitute an underlying driving force behind the transaction, there is another critical aspect to consider, namely the software and technology in question. The software and technology should be carefully reviewed to ensure that it is reliable, scalable, and supportable in the long run, so that the buyer does not pay over the odds for something that is costly to scale or maintain over time. In addition to reviewing the technical architecture and its standard, functionality and limitations, a code review ought to be conducted to gain an understanding of any complexity in future development and management, and to identify whether the software contains any open-source code. This is because there may be regulatory restrictions and licensing requirements associated with the open-source code, which may cause complications if it is not discovered in time. Finally, the number of attack vectors in a transaction naturally increase the risk of, for example, phishing, data loss, process disruptions or other security loopholes, which are mitigated by increased monitoring and a response capability during the transaction itself to protect its value and to avoid delays.

All in all, the business value of IT has become increasingly important to highlight and consider, which places greater demands on both a deeper due diligence process prior to the transaction and a clear picture of how IT will contribute business value post transaction.

Cloud services can expedite the separation and integration process

Leading buyers and sellers are increasingly turning to outsourcing and standardised cloud solutions to expedite and/or simplify the separation or integration process. In a separation, the acquired company often does not bring sufficient IT skills or technical components to be fully self-sufficient in terms of systems and infrastructure. If the acquired company is to be standalone and not integrated, standardised cloud solutions can be a desirable alternative to quickly set up, for example, HR, financial or business systems based on standardised processes and configurations. Because cloud-based systems (SaaS3) require no hardware and only minimal configuration, a medium-sized company can be up and running faster than if implementing a traditional on-premise IT landscape that requires a full-scale infrastructure. In this way, the length of IT TSAs can be reduced and IT can create value for the business at an earlier stage in the process. Cloud solutions also replace traditional infrastructure and high investment costs with scalable environments and running costs based on usage, a model which has become a valued solution for many companies by enabling them to scale or reduce their IT landscape more efficiently according to their current needs.

Cloud services can also be used during integrations where, for example, test and staging environments can be set up quickly for testing purposes. In other cases, the integration can also be used as a lever for a major transformation where the buyer's own organisation gradually moves systems, platforms and infrastructure to the cloud. Leveraging cloud services in M&A transactions leads to an increased focus on transformation, which has become a clear trend amongst leading buyers and sellers.

Finally, cloud services can be a useful way of analysing in a structured way where to get the most bang for your buck for the focus of the transformation through greenfield cloud stand ups, searchable data repositories for regulatory data requirements and avoiding costly data migrations or integrations.

The current business climate indicates that the technology dimension in M&A continues to be leveraged

In recent years, technology-heavy companies and start-ups have experienced several radical market events. The decline in valuations (-5% series A, -39% series B, -50% series C, -24% series D+)4 combined with the collapse of crypto currency by 60-85% (Bitcoin, Ether, Coinbase) in 20225 and the collapse of four prominent tech banks with Silicon Valley Bank at the forefront in 2023, all contributed to the lowest valuations in more than 10 years6. The fact that valuations have fallen is not entirely negative, but undoubtedly leads to investors becoming more cautious, especially with regard to IT and technology. As investors see risks increasing and technology companies frantically search for profitability so as not to fully disqualify themselves from financing, IT M&A continues to be a lever to mitigate risk and to remove a dimension of increased uncertainty in transactions.

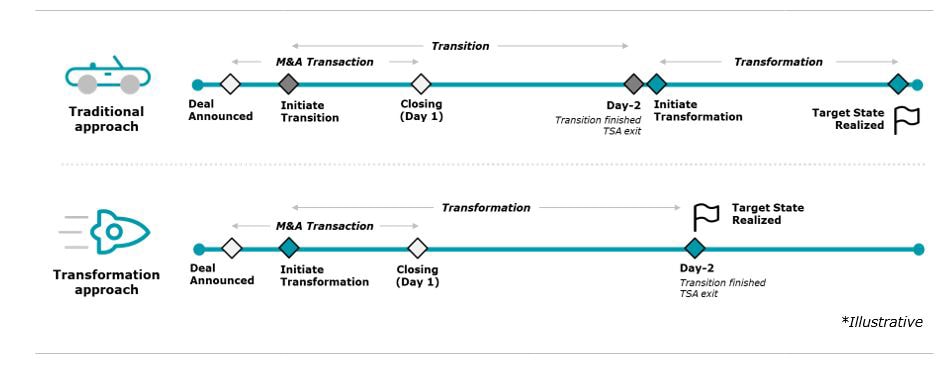

Transforming while transacting allows for an earlier realisation of the target state through an early focus on transformation

On the purchasing side, the traditional process from an IT perspective has involved separation and integration strategies that focus on those parts of the IT landscape that underpin the day-to-day business and not on the long-term business value that IT can contribute. The approach has been 'transition then transform'. Once a separation or integration was complete, additional value seekers started a transformation journey to focus on long-term improvements within the IT landscape. Leading actors have today begun to question this sequential approach and instead started to think about the transformation much earlier in the process. At Deloitte, we call it "transforming while transacting", where the transaction is used as a lever for a larger transformation that interconnects the separation/integration and transformation work. By working on a separation/integration and transformation in parallel, parts of the activities can be coordinated or in some cases exchanged for transformation activities that enable the buyer to realise synergies and reach the final target state faster and at a lower overall cost. Instead of allocating resources to move legacy IT, the acquired business receives IT services through well-formulated TSAs, whilst the main focus is placed on transforming the IT landscape and migrating the business’ data. An important part of this transformation work is to adapt the operating model and to rationalise the technical landscape from a cost perspective, which in times of a weaker economy can help to keep operational costs down.

The benefits of an early transformation focus will not come about of their own accord but require the CIO and business leaders to carefully consider the direction of the business, to identify areas to be transformed and then to form a detailed plan based on a parallel and interlaced separation/integration and transformation process. It is important to establish and anchor a coherent target state for business and IT architecture (enterprise architecture) early on, which then steers the transformation. Without a clear target state from the outset, there is a risk that business processes and systems are implemented without a holistic mindset and that redundant system functionality and inefficient processes emerge. In addition, it is important to quickly establish a plan, project governance and a Project Management Office in order to drive the project towards the target state. Successful actors also have strong commitment from and involvement by representatives from the business to ensure that the transformation has their support and delivers the maximum possible business value.

A successful concept within cloud transformation is “the peeling of the onion”, where many actors have achieved success by starting from the outside layers of an organisation and working towards the core by choosing SaaS/outsourcing to a greater extent for support functions such as HR, sales, the salary department etc. which is well-aligned with the approach of selectively transforming over time to achieve the best effect in the shortest time with the lowest cost.

Separations and integrations are complex M&A events, where IT is often a major challenge and a prerequisite for a successful deal. Successful separations and integrations take IT into account early on in the process and M&A players at the forefront of the industry have a focus on transformation as part of the deal, where cloud services are used as a lever to expedite the process and achieve the final target state earlier.