COVID-19 and the investment management industry Investment management operating at the speed of the markets

4 minute read

17 March 2020

Without fresh information, processed at the speed at which markets are moving, investment professionals could be operating suboptimally—at a critical time.

COVID-19’s impact on individuals, communities, and organizations is rapidly evolving. Although there are many unknown factors, Deloitte recommends that firms take 10 actions when faced with the uncertainty of an outbreak like COVID-19.1

Learn more

Learn more about connecting for a resilient world

Read COVID-19 potential implications for the banking and capital markets sector

Read Potential implications of COVID-19 for the insurance sector

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

While COVID-19’s impact on the investment management industry is not nearly as high a priority as protecting people’s health and well-being, it is still important for investment professionals to learn from these challenges. Eventually, when people turn their attention to their investments, they will likely hope that their investment professionals were diligently working to safeguard their portfolios during these turbulent times.

COVID-19 is driving market volatility and, in many instances, meaningful changes in asset valuation on a daily basis. It may also change how some investment managers run their investment operations. We believe that some managers may need to consider how to reposition investment portfolios and reassure investors that the firm is managing through the volatility professionally in tighter time cycles.

Let’s explore how analyst research reports served investment managers in early 2020. While analyst reports are certainly not the only information source to inform investment decisions, they are an important one. In addition, how analyst reports are used also varies widely among buy-side firms, from background to backbone information. That said, these reports are a costly and well-utilized resource in the industry.

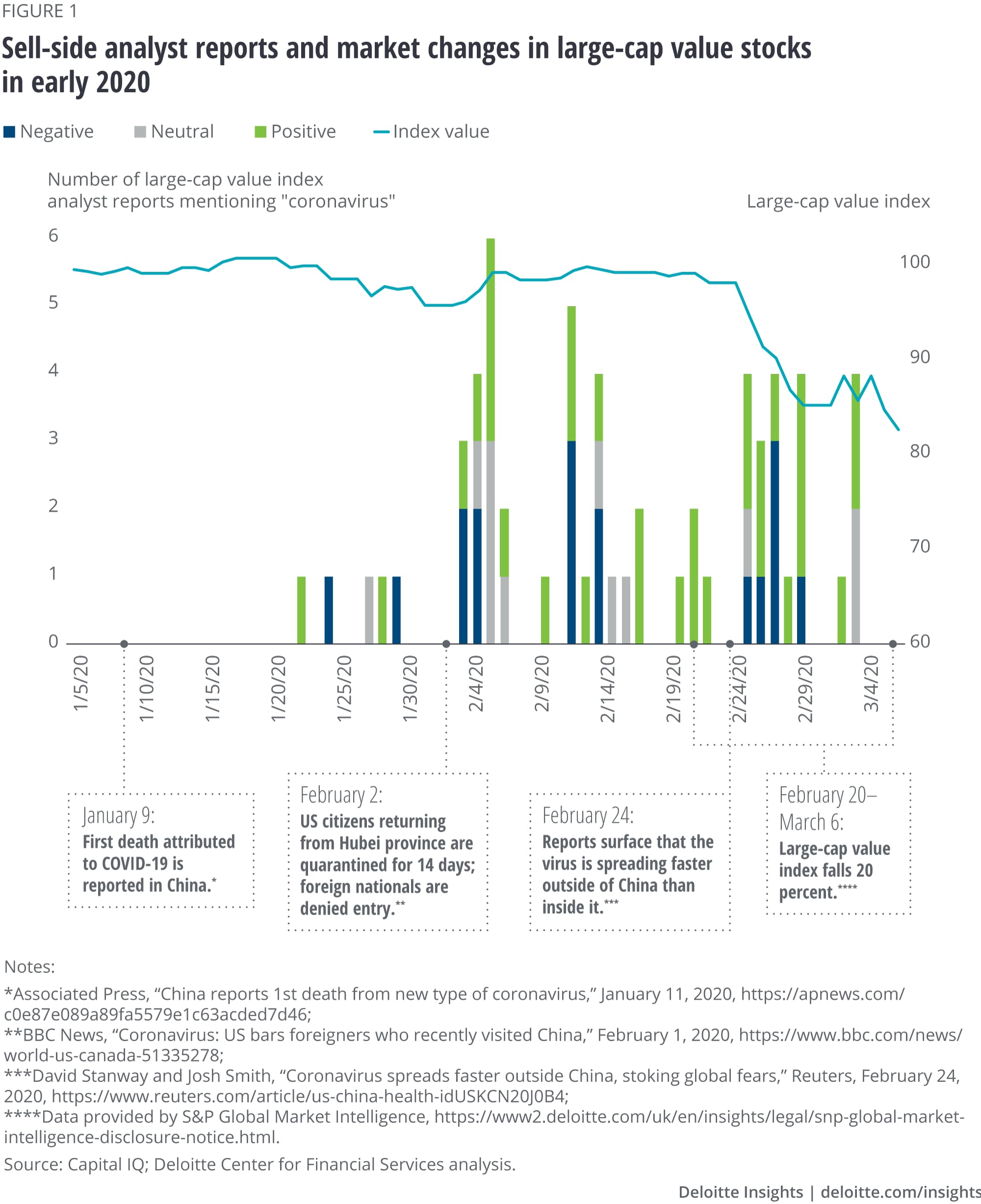

Looking at various analyst reports that were published between January 1 and March 6, only a small percentage mentioned COVID-19. Among the reports we reviewed that did mention COVID-19, 28 percent were negative, 52 percent were positive, and 20 percent were neutral. It appears that many analysts did not see the outbreak as a bearish trigger for large-cap value stocks.2

To measure how this basket of stocks performed during this time, we constructed an equally weighted index of the 139 large-cap value stocks and American depositary receipts (ADRs) listed on major US exchanges. In figure 1, we plotted the daily index value alongside the analyst reports published from January 2020 through March 6. This analysis illustrates a steep drop in index value during the last part of this period (20 percent), after holding relatively steady throughout the month of January and the beginning of February.

Many of the research reports for investment professionals, as a group, did not signal an impending drop in the market as a result of COVID-19. If analyst reports are either indicative of other inputs into the investment decision or a key ingredient to the process, then when priorities shift from near-term to medium-term, we believe the investment decision process may need to be revitalized.

During the month of February, news stories revealed that many businesses were facing direct impacts, and business metric data revealed rapid declines in consumer activities. The application of advanced analytics to these data sets may have provided more real-time insight into the risk associated with COVID-19 for the stock market.

Market-moving events such as the COVID-19 outbreak stress systems. These include the investment management process, a system that uses information and experience as inputs, and trading decisions as outputs. In order to fulfill client expectations, it is important that the information supply for investment managers keep up with how fast the market is moving. Data with tight cycle times, that measure real-world activity, are the desired inputs.

In this way, COVID-19 may be illustrating a key lesson for the investment management community: Even investment managers with long investment time horizons occasionally need to feed their investment decision processes with information that is refreshed faster than the timing of their standard process. Without fresh information, processed at the speed at which markets are moving, investment professionals could be operating suboptimally—at a critical time.

These new, more-timely inputs may also require the investment decision engine to adapt. The new information may be large and unstructured, it may need to be processed in the cloud, and/or new analytical techniques such as machine learning may need to be applied.

The recent events may facilitate organizational change as people seek solutions to prevent recurrences. The COVID-19 outbreak may serve as a wake-up call to challenge traditional thinking. People may go beyond their comfort zones to create and utilize information from new sources in time cycles that have not been seen in the past.

In the coming weeks, Deloitte will be following up with insights that may help evaluate the extent of this timeliness issue. We will explore ideas and potential steps that could be taken to help active investment managers operate at the speed of the markets, even as markets accelerate. As the dust settles from COVID-19 and Q1 2020 market action, priorities can begin to shift to longer-term issues, such as modernizing the investment decision process.

© 2021. See Terms of Use for more information.

Explore

-

Potential implications of COVID-19 for the insurance sector Article5 years ago

-

China economic outlook, February 2023 Article2 years ago

-

A view from London Article1 week ago

-

Connecting for a resilient world From Deloitte.com

-

Finance and the future of IT Article5 years ago

-

Women in the financial services industry Collection5 years ago