How the shale revolution is reshaping the US oil and gas labor landscape

20 September 2018

Not only has the shale revolution transformed production in the US oil and gas industry, it is reshaping the composition of the industry’s workforce in ways that will fundamentally redefine tomorrow’s oil and gas job opportunities.

The shale revolution in the US oil and gas sector has received much attention, and rightly so, as the sector has defied history to create a new one. A combination of hydraulic fracturing and horizontal drilling technology as well as large-scale commercial exploitation in key basins, such as the Permian and Appalachian, have pushed overall crude oil and natural gas production in the United States to all-time highs of 10 million barrels (bbl) per day and 80 billion cubic feet per day, respectively.1

Learn More

Subscribe to receive more economics content

Led by shale resources, the US oil and gas sector has witnessed a remarkable transformation in terms of productivity and innovation since early 2000s, thereby easing US energy security concerns and altering the geopolitics of crude oil and natural gas. With the shale revolution structurally transforming the oil and gas sector, how has the labor market shaped in the past 15 years? What changes have the recent innovations and technology gains brought about in terms of skill requirements and labor demand? How will changing labor-market dynamics affect employment opportunities in the future?

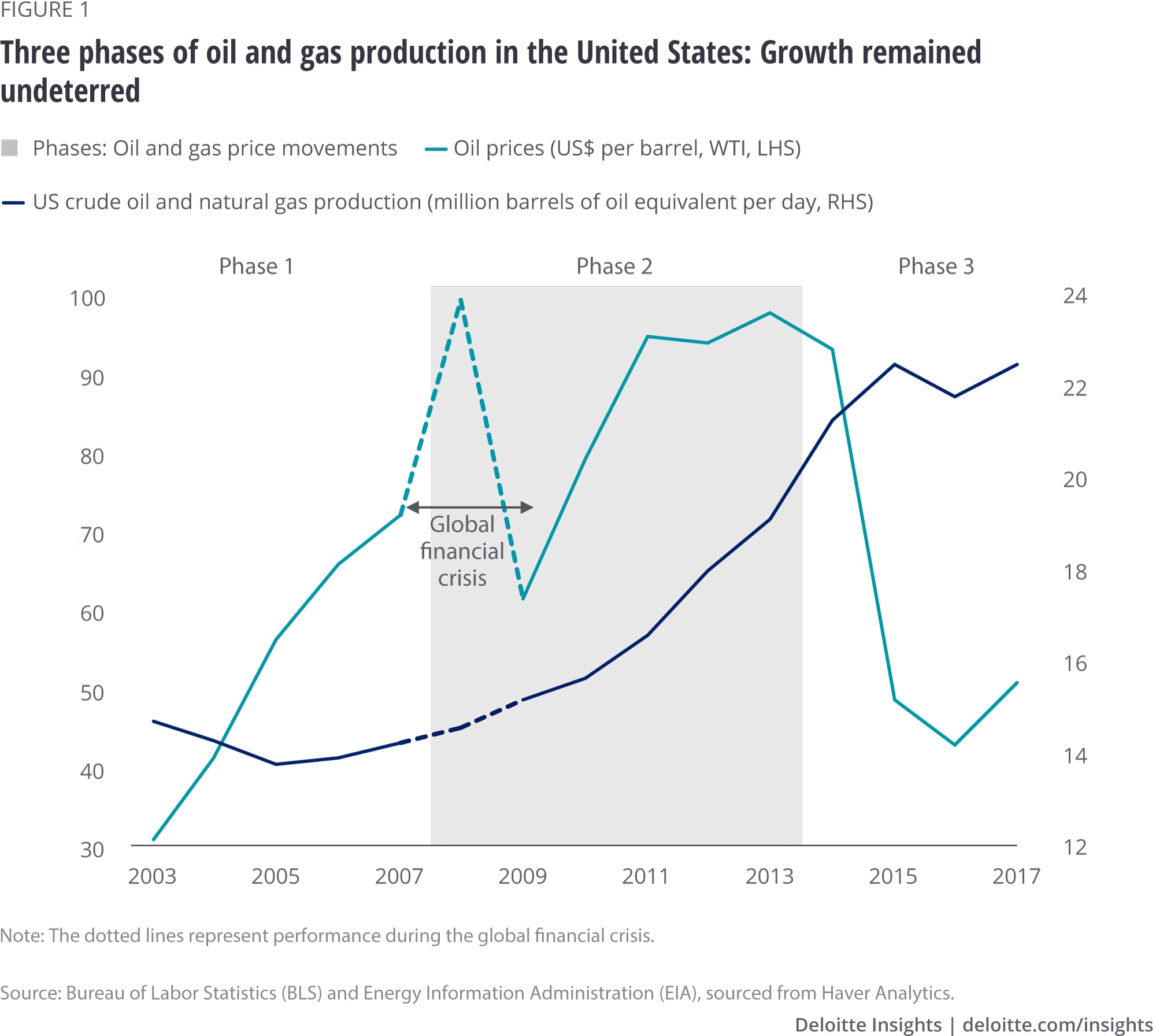

This article delves into the two subsectors—exploration and production (upstream) and oilfield services (OFS)—and analyzes the overall employment trend over the past 15 years.2 Our analysis, covering the three phases of oil price movements and the progress of the shale revolution, indicates that the structural changes in the sector have had significant implications on employment, demand for different kinds of skilled professionals, and wages across occupations, although to varying degrees. Nonetheless, the past may not be the best prologue to what lies ahead, given the uncertainty around how the labor market will likely shape up in the future as the sector adopts new technologies to increase well productivity and change cost structures.

Phase 1 (2003–2008): The beginning of the US shale revolution

Although the history of shale goes back to 1850s, the shale revolution began in early 2000s when drilling and production for natural gas in shale formations gathered strong momentum. Rising natural gas prices and strong demand from power- and energy-intensive industries motivated the US oil and gas sector to explore new reserves of natural gas through a combination of horizontal drilling and hydraulic fracturing. As the number of unconventional natural gas wells rose, the dramatic increase in production revived the natural gas industry and resulted in significant economic implications. While the natural gas component has remained important right until now, the early success in discovering shale gas resources gradually paved the way to the exploration of shale oil reserves by using the new techniques in the mid-2000s.3

Coincidentally, crude oil prices posted one of their biggest rallies between 2003 and 2008—from US$31/bbl to more than US$130/bbl.4 This likely happened due to soaring oil demand from emerging nations, especially from China that was rapidly ramping up its industry and infrastructure, rising energy security concerns worldwide, and the escalating cost of exploring and developing reserves. High oil prices and depleting reserves likely drove US companies in the sector to explore and develop new oil resources by investing in new technologies.5

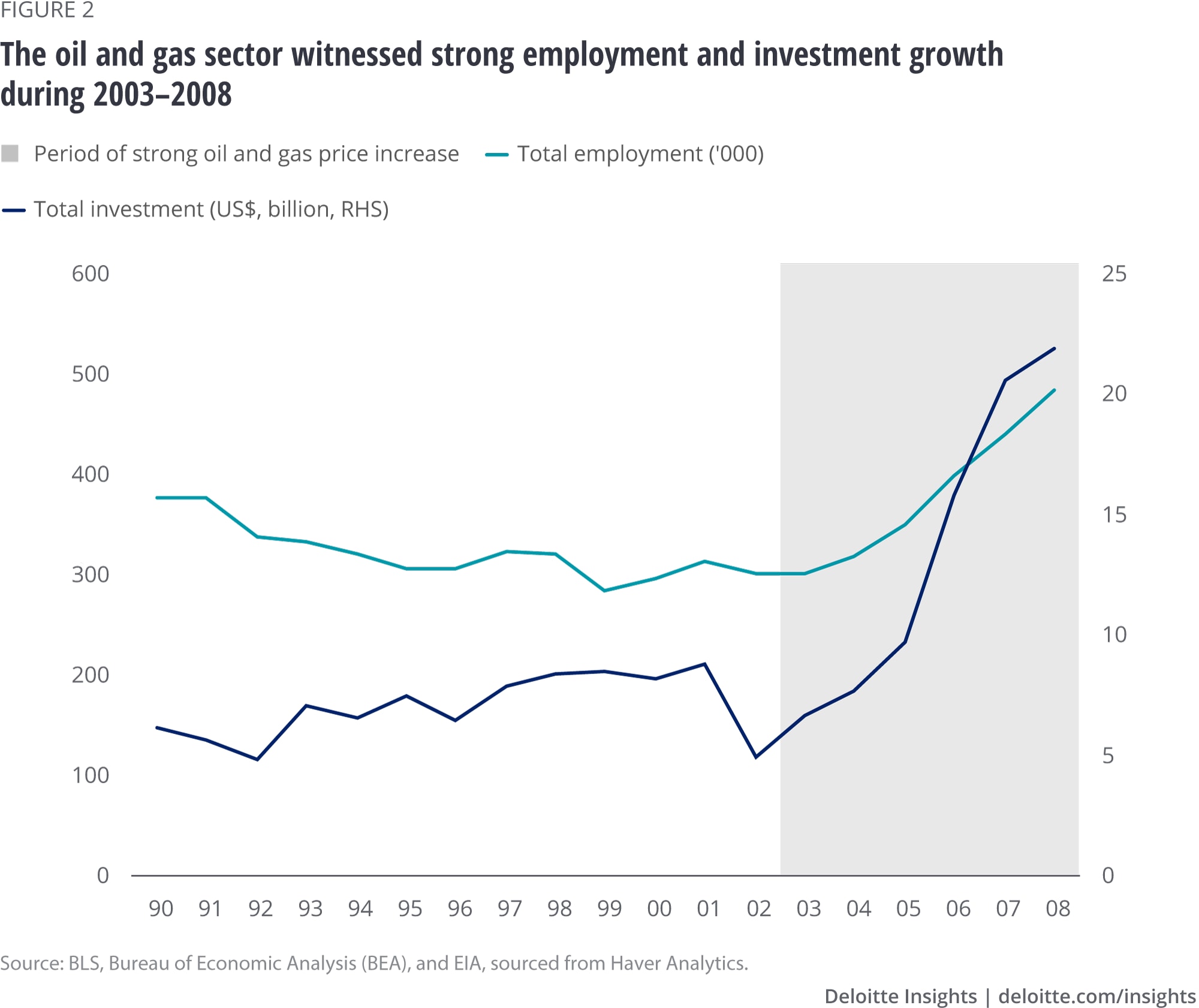

Development of shale resources resulted in strong growth in investment and employment in the sector, with both spiking to the highest levels since 1990 (figure 2).

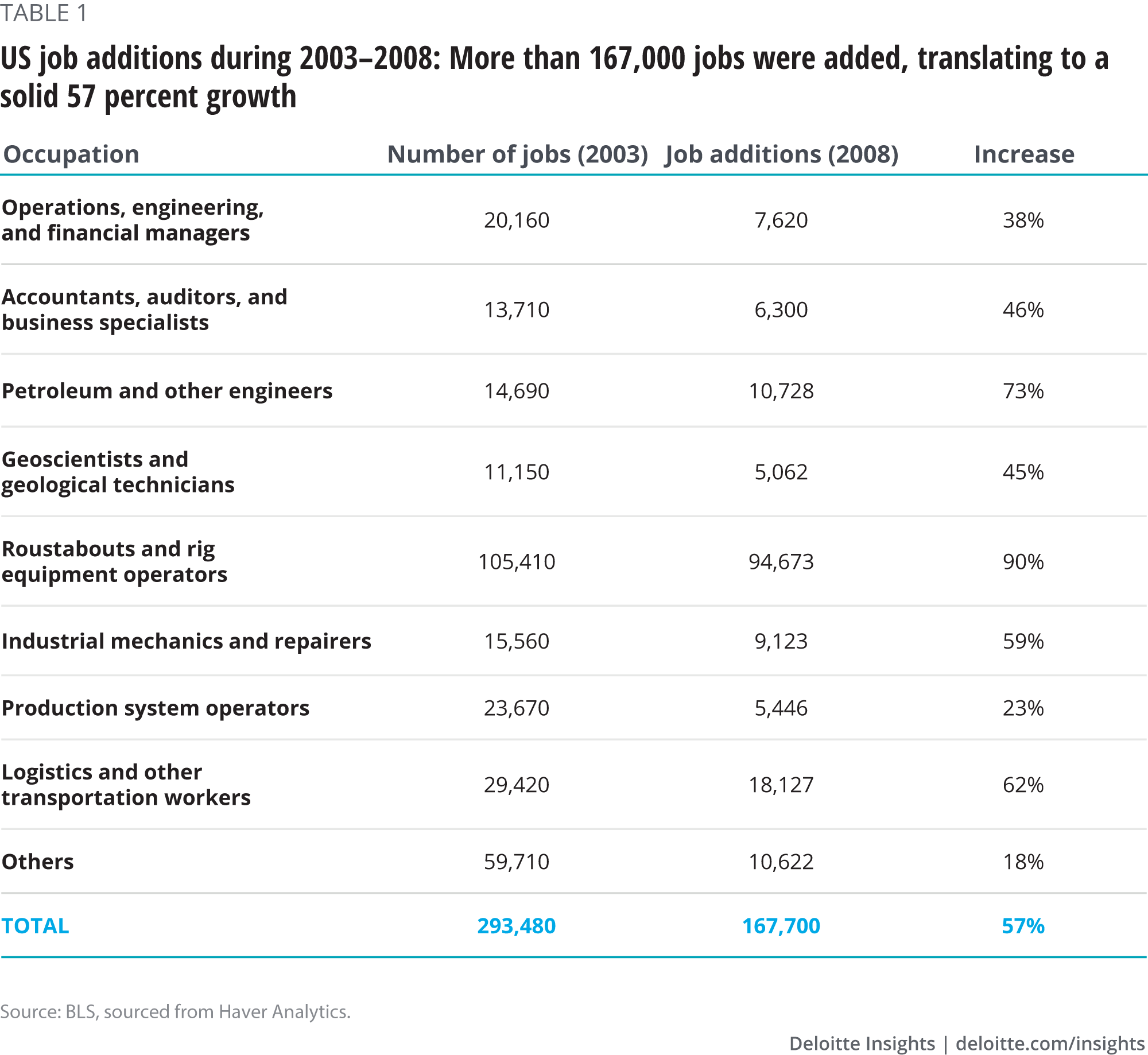

More than 167,000 jobs were added between 2003 and 2008 (table 1). While the increase was seen across all occupations, demand for certain specific skills was exceptionally high. Employment of rig roustabouts and operators increased by an impressive 90 percent, primarily in the OFS subsector, owing to a sharp increase in the investment-led drilling activity. This demand started with offshore and then progressed to onshore conventional and shale.6 Simultaneously, demand for petroleum engineers also increased by about 75 percent, as oil producers focused on improving their field-development plans to raise output from existing and new resources.7

Phase 2 (2008–2014): Big focal shift in the shale revolution and employment trends

Even as the shale gas revolution remained strong until 2012, the sector witnessed a gradual shift from gas to tight oil production during this phase.8 The focus of drilling activity shifted to oil, and once oil prices stabilized around US$100/bbl after the crisis, US crude oil production soared and grew at the fastest pace between 2012 and 2014.9 Several interesting trends emerged in the labor market as the sector underwent structural changes.

Employment

The global financial crisis caused temporary jobs losses, primarily in the OFS subsector (figure 3). During 2008–2010, employment among mid- and low-skilled professionals fell faster in the OFS subsector than the US industry average (figure 3, second column, lower panel). In contrast, the upstream subsector was still hiring strongly (figure 3, second column, upper panel).

Employment rebounded strongly after 2010, as oil prices revived and stabilized. During 2010–2014, employment growth across skills in both the subsectors (with the exception of growth for low-skilled labor in the upstream subsector) was stronger than the average US industry employment growth (1.5 percent y-o-y) (figure 3, third column). By 2014, total employment had risen to a record 612,000 due to strong investment in technology, exploration, and drilling activity (the number of US drilling rigs doubled to an all-time high of 2,000 during 2010-2014).

Besides exploration, the sector also focused on developing and testing new technologies to tap the bountiful shale oil reserves, thereby causing the demand for highly skilled professionals, such as geologists and petroleum engineers, to firm up (figure 3).11 Robust drilling activity also resulted in increased hiring of highly skilled professionals among roustabouts and rig operators as well as industrial mechanics and repairers.

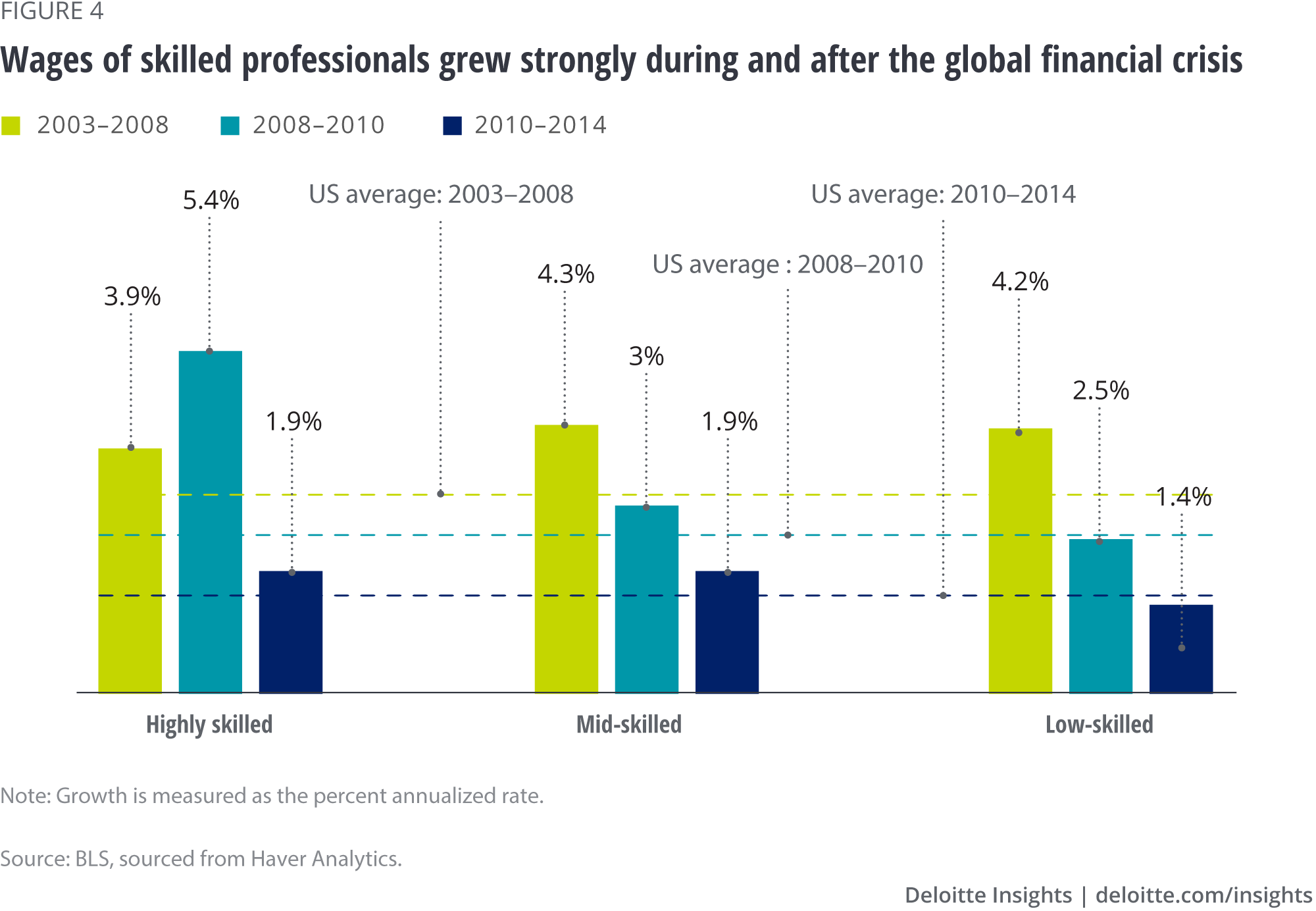

Wages paid to the highly and mid-skilled professionals grew much faster than the overall US industry average (figure 4), especially during the global financial crisis. The annualized wage growth for highly skilled professionals increased 4.9 percent in 2008–2010, almost twice the overall US industry annualized wage growth of 2.5 percent.

Redistribution of jobs between subsectors

The oil and gas sector witnessed reprioritization and redistribution of jobs as the sector underwent rapid structural transformation. Considering shale reserves are widely spread across the country, upstream companies relied more on OFS companies to drive and manage production growth through increased contracting and subcontracting. Consequently, upstream companies were seen laying off those in low-skilled occupations after 2008 (figure 3). At the same time, in addition to employing a larger proportion of the medium- to low-skilled workforce, the OFS companies also started building capabilities in highly skilled areas, and started employing—along with upstream companies—petroleum engineers, geoscientists, etc. Consequently, the share of the OFS subsector in the overall sector’s employment mix rose from 60 percent in 2003 to about 70 percent by 2014.12

Onsite support system

Increased production led to higher demand for onsite support systems, including demand for truckers and pumpers, among others. This strongly boosted the employment demand in logistics and transportation.13 These occupations primarily employed mid-skilled professionals across remote areas of the United States, and added close to 17,000 jobs, mostly in the OFS subsector, during 2008–2014.

Phase 3 (2014–2017): The oil downturn and shale’s responsiveness to oil prices

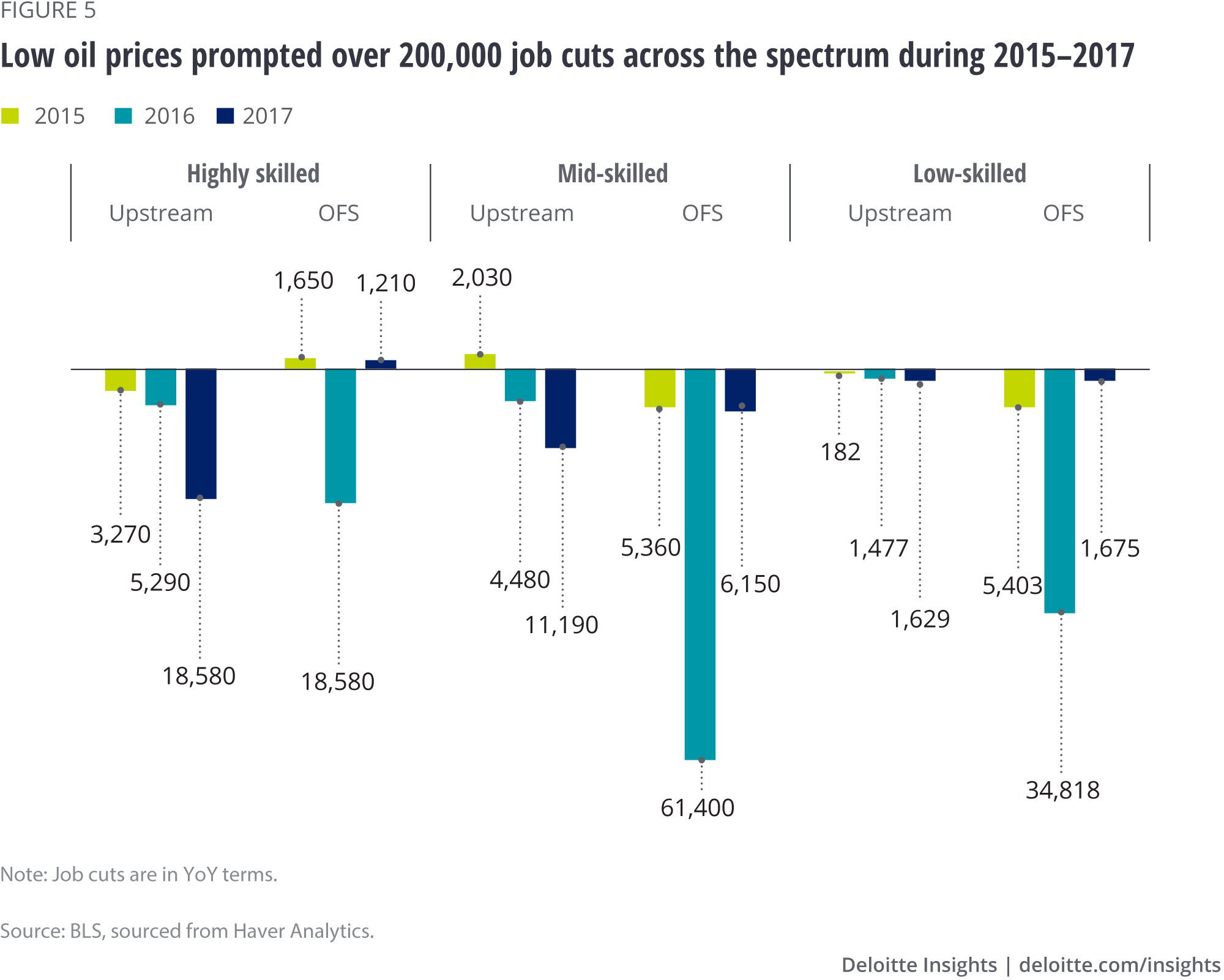

The third phase saw the longest and one of the deepest downturns in oil prices. Three consecutive years of decline led to the slashing and deferring of investments in areas deemed expensive to drill and develop (figure 2). Despite high production, the sector shed over 200,000 jobs across occupations, with OFS initiating layoffs, followed by upstream in 2017 (figure 5). The OFS subsector cut down 2.5 times more jobs than the upstream subsector. The highly skilled geoscientists and petroleum engineers lost jobs faster than others.

Concerns arose regarding shale resources’ sustainability when the oil price fell below US$50/bbl.14 Debt overhang and high capex requirements put pressure on the financial health of shale producers, especially those in noncore basins, leading to a fall in drilling and production in early-2016.15 However, both shale drilling and production recovered their losses from late-2016 after the oil price stabilized above US$50/bbl.16

What does the emerging employment trend indicate?

The 2014–2017 period provides an intriguing insight into the changed equation of production, investment, and employment in the US oil and gas sector. The sector witnessed strong production, despite falling investment and employment. Although there was always a need for shale companies to become capex light and production efficient, the oil price downturn compelled them to adopt new technologies and focus on the best resources to strike a new balance in the equation.

What does the future hold? Will the elevated role of new and efficient shale technologies moderate the positive impact of the recent oil price recovery to US$70/bbl on the sector’s employment landscape? What do the next 6-18 months hold for the sector—will employment surge to levels seen between 2003 and 2014?

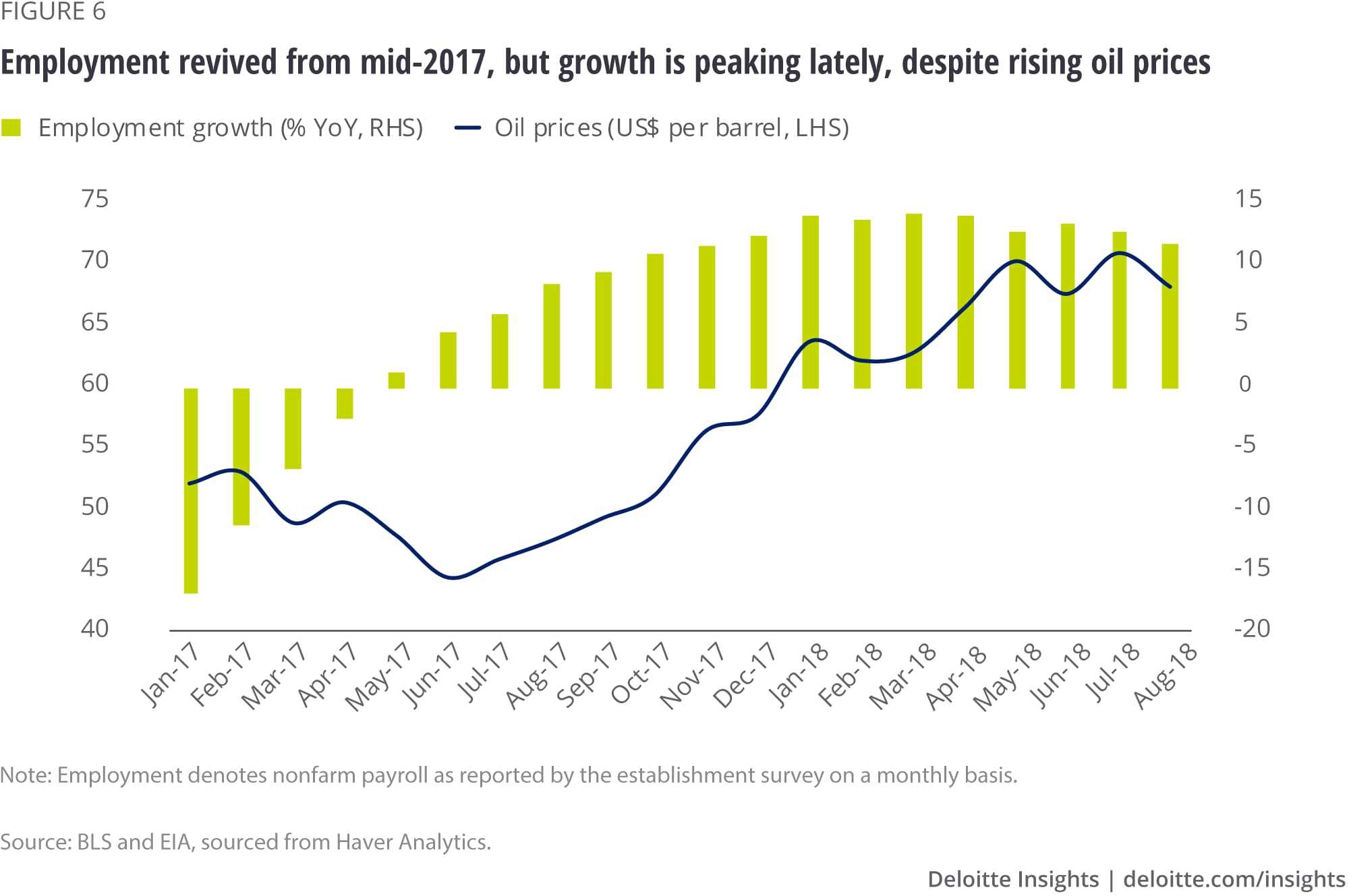

The early 2018 data on employment has been encouraging, but not conclusive. Strong employment growth after May 2017 owing to oil price recovery since 2016 seems to be peaking lately, probably due to oil-price volatility and uncertainty regarding the sustainability of this recovery (figure 6). Additionally, infrastructure constraints in the Permian basin are limiting new drilling, and probably new job additions, in this key shale basin.

According to the Energy Information Administration, 2019 is likely to be the year of record production, which may result in higher employment demand over the next 18 months .17 Production growth may depend on complex factors—that include lower well completion despite new drilling activities, and higher conversion of drilled-but-uncompleted shale wells into producing wells. The latter could result in higher employment gains as well completions require more labor.

Redistribution of jobs between the subsectors will likely continue, while new employment opportunities may emerge across the oil and gas value chain and related industries. Thus far, growing domestic production has led to increased investment in downstream industries (such as petroleum refining and chemicals) and export terminals planned across the Gulf Coast. According to the Interstate Natural Gas Association of America, about half of total investment (US$80 billion) in export facilities between 2018 and 2035 would likely happen in 2018 and 2019 alone.18 These new, mega facility-based investments in the sector may support employment growth in heavy and civil engineering industries.

Higher productivity stemming from technology gains and a better understanding of the resource base may cap employment growth. Nonetheless, technology and automation will likely help companies create unimagined, new, and unique work profiles. Ben Williams, Chief Information Officer, Devon Energy, sums it up succinctly, “Every time there has been a big inflection point in technology in the world, there’s always been this fear. It has never ended up with fewer jobs on the other end of these industrial transformations. We do not expect there to be fewer people in the workforce, but I for sure envision many of the jobs that even our most senior technical people do are going to be influenced by these highly available and very effective technologies. The workforce of the future is not the same as the workforce of today.”19

© 2021. See Terms of Use for more information.