Industry 4.0 engages customers has been saved

Industry 4.0 engages customers The digital manufacturing enterprise powers the customer life cycle

16 December 2016

As customers grow used to ever-greater personalization and convenience, many manufacturers have been lagging behind in this area. The digital manufacturing enterprise, powered by Industry 4.0, can help manufacturers drive better engagement and interaction throughout the customer life cycle.

Introduction

About 50 percent of S&P 500 firms will likely be replaced over the next 10 years due to new digital disruptors and inability of established firms to reinvent themselves.1 How companies choose to evolve, explore new avenues for growth, and better engage their customers can make the difference between thriving and extinction.

Across all stages of the customer journey, advanced digital technologies are creating new opportunities for innovation and growth, and producing novel ways to improve and customize the customer experience. This digitally driven evolution—which lays the foundation for what Deloitte calls the digital manufacturing enterprise (DME)—is enabled by the rise of Industry 4.0.

Across all stages of the customer journey, advanced digital technologies are creating new opportunities for innovation and growth, and producing novel ways to improve and customize the customer experience.

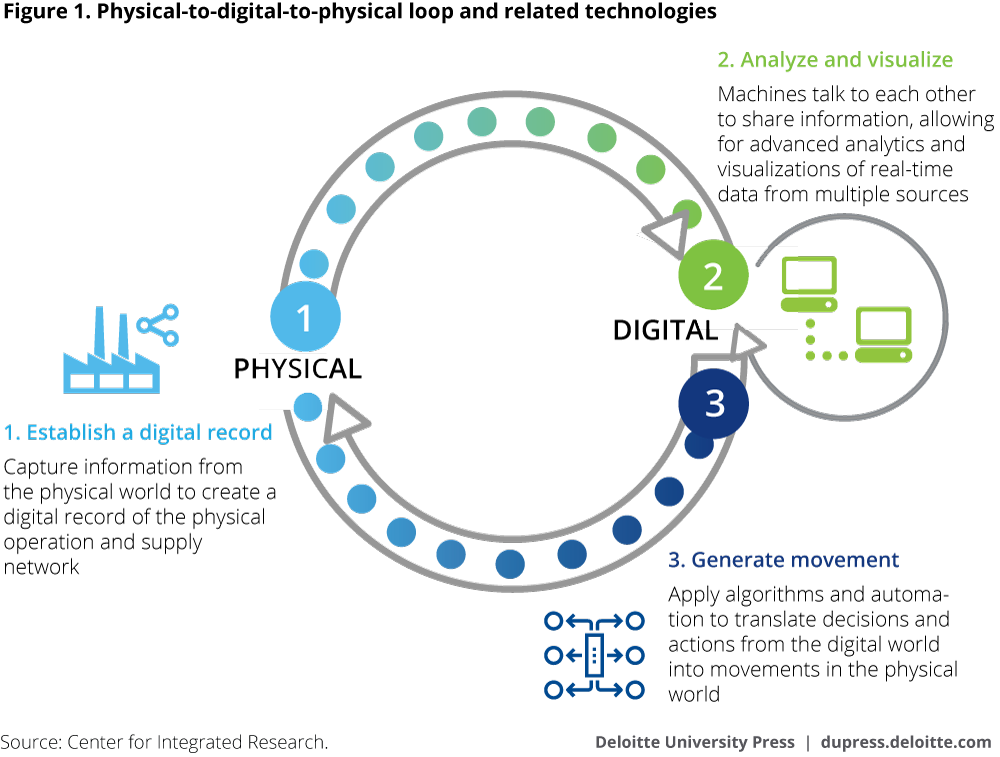

In Industry 4.0, manufacturing systems and the objects they create are not just connected, drawing information from the physical world into the digital realm. Instead, Industry 4.0 takes this concept one step further: That digital information is then analyzed and used to drive further intelligent action in the physical world, completing a physical-to-digital-to-physical loop of action and informed reaction.2

This loop of intelligent, autonomous digital activity—and the Industry 4.0 technologies that drive it—affect the ways in which companies engage with their customers and meet customers’ ever-changing preferences. Further, and perhaps most importantly, it enables manufacturers to shift their value proposition from products to ongoing, data-driven services. Indeed, from initial research and sales to account management and aftermarket service, connected technologies create opportunities to improve efficiency and enhance customer experiences, helping manufacturers attract and retain customers as well as drive significant, service-driven value.

This paper explores the ways in which manufacturers can use Industry 4.0 technologies across their enterprise to transform customer relationships and create new value for both customers and channel partners. Indeed, many opportunities exist across the customer life cycle to better engage and interact with both customers and channel partners; the trick is identifying those openings and harnessing them effectively. To do so, companies should first understand how to apply Industry 4.0 technologies to their current customer engagement practices, move from being a traditional manufacturer to a DME, and set a course toward digital transformation.

A brief introduction to Industry 4.0

Industry 4.0 combines the Internet of Things (IoT) and relevant physical and digital technologies, including analytics, additive manufacturing, robotics, high-performance computing, artificial intelligence and cognitive technologies, advanced materials, and augmented reality, to integrate digital information from many different sources and locations, and drive the physical act of manufacturing.3

The concept of Industry 4.0 incorporates and extends the IoT within the context of the physical world: the physical-to-digital and digital-to-physical leaps that are somewhat unique to manufacturing processes (figure 1). This physical-to-digital-to-physical circuit mirrors and draws upon the Information Value Loop that characterizes Deloitte’s view of the IoT.4 It is the leap from digital back to physical, however—from connected, digital technologies to the creation of a physical object—that constitutes the essence of Industry 4.0.5

Deloitte has developed in-depth research and analysis focused on Industry 4.0, how it relates to the IoT, and its role within Deloitte’s Information Value Loop. For further information, visit Industry 4.0 and manufacturing ecosystems: Exploring the world of connected enterprises.6

The defining traits of DMEs

How is a digital manufacturing enterprise different from a traditional manufacturer? DMEs use Industry 4.0–enabled technologies to drive their processes across the value chain. Where many focus their analysis of Industry 4.0–enabled technologies on solely the factory setting, Deloitte uses the term DME to demonstrate that these new technologies often have widespread impacts across the entire enterprise. The results of Industry 4.0–enabled technologies can include new or improved products and services, connected supply chain and manufacturing processes, and more informed customer engagement.7

In particular, DMEs differ from traditional firms in three key ways: the audience they engage, the degree of connection they maintain, and their monetization of the products and services they provide. Each DME trait is intrinsically tied to the physical-to-digital-to-physical leap detailed in figure 1.

Audience

Leading DMEs leverage expanded customer and stakeholder audiences to better design and communicate the value of their offerings. Rather than prioritizing and focusing on just one stakeholder group, multiple groups—from manufacturers who buy technologies to the end users who interact with them—should be assessed and influenced throughout the product development and selling process. Through their use of connected, Industry 4.0–driven technologies, DMEs can better understand how to serve these expanded audiences and adjust their business processes to meet their needs.

This capability can lead to increased customer loyalty, as customers are more loyal to brands that create differentiated and personalized experiences.8 That loyalty can, in turn, lead to considerable savings, as the cost to acquire a customer is much greater than the cost of retaining one.9

Connection

As DMEs can use data from connected, smart tools to understand a product’s performance and customers’ interactions with it, the connection, and thus relationship, with customers and partners often deepens. As a result, companies can be better positioned to deliver value to end users at every digital and physical interaction, ranging from simple product performance alerts (such as regarding a predicted malfunction) to services throughout the customer life cycle (such as product exploration, education, buying, service, and maintenance). Further, digital solutions that connect manufacturers to customers, and customers to each other, can create considerable network effects.

Currently, industrial manufacturers lag significantly behind other consumer sectors, which have made massive investments in digital connectivity.10 This laggard status may actually prove to be an opportunity, however; the other, first-mover industries may offer valuable templates and lessons for industrial firms to follow—and pitfalls to avoid.

As DMEs can use data from connected, smart tools to understand a product’s performance and customers’ interactions with it, the connection, and thus relationship, with customers and partners often deepens.

Monetization

As industrial offerings generate more data and grow “smarter,” they open up new monetization opportunities in the form of services and smart solutions. In some cases, users will find that the data and insights derived from products carry greater value than the product itself. FedEx, for example, has noted that the data about their packages are more valuable than the physical package itself, and it offers data-driven services to provide added insight.11 Indeed, digital features from smart objects can be monetized in multiple ways—subscription, licensing, or consumption fees—or included as value additions.

This ability to monetize data and uncover new streams of revenue can be particularly important as companies increasingly find their sectors and competitive set upended and disrupted. In one industry after another, from automotive to banking to travel, hospitality, and leisure, new entrants have stepped between a capital-intensive incumbent and their customers to capture a share of value without costly capital investments.12 By incorporating advanced technology that enables them to be more nimble and proactive, DMEs may be more likely than traditional manufacturers to head off disruption.

As industrial offerings generate more data and grow “smarter,” they open up new monetization opportunities in the form of services and smart solutions. In some cases, users will find that the data and insights derived from products carry greater value than the product itself.

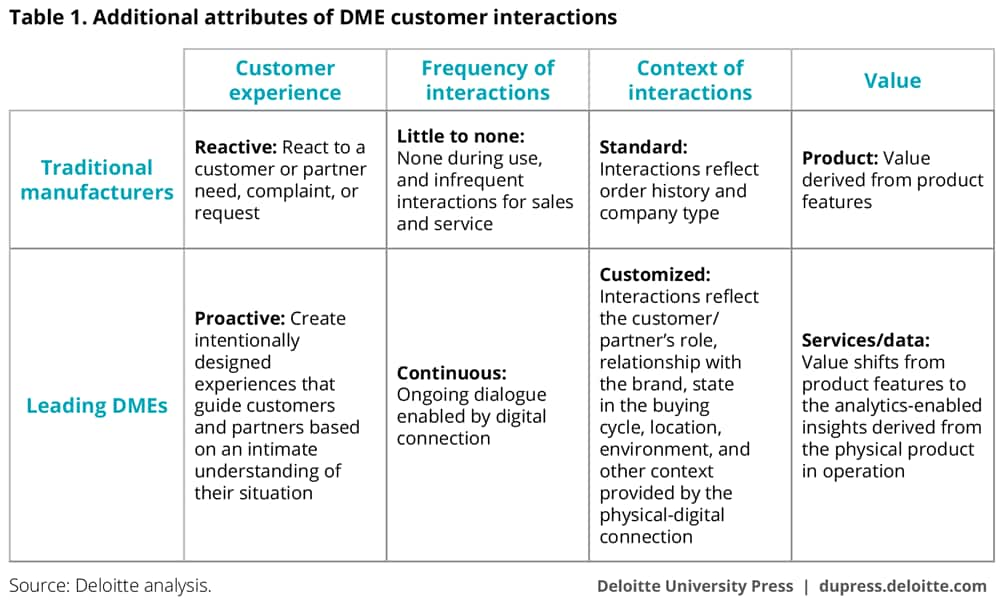

Beyond these three core attributes, DMEs represent an evolution over traditional manufacturers in other, somewhat subtler ways. Table 1 compares DMEs with traditional manufacturers across four additional areas, ranging from the experience they can provide to the customer to the ways in which they can derive value.

Across the customer life cycle: Industry 4.0 technology applications

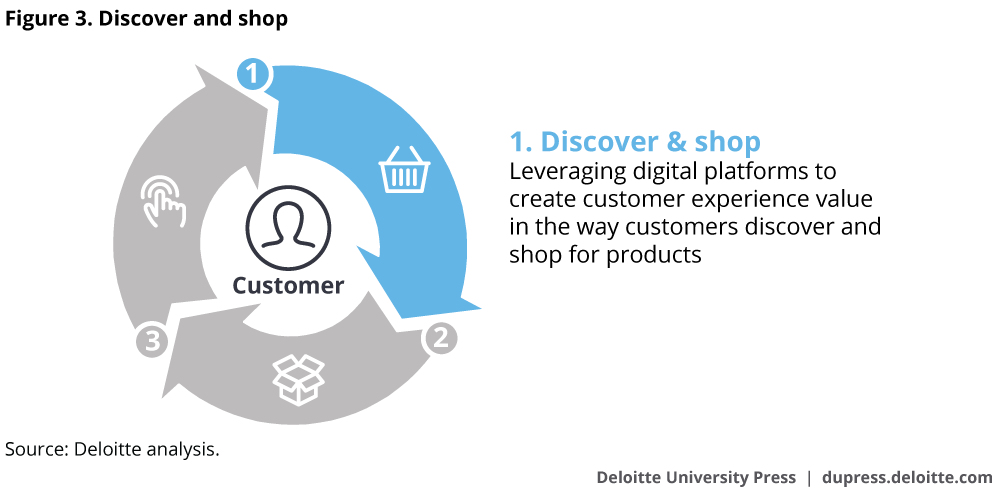

In order to develop a complete picture of the ways in which DMEs can use Industry 4.0–driven technologies to influence customer engagement, it can be helpful to examine the topic within the context of the customer life cycle framework. This framework depicts a conceptual view of the stages of a customer relationship. The three phases of the customer life cycle are discover and shop, buy and install, and use and service, as outlined in figure 2.

Discover and shop refers to the upfront research and offering exploration that a customer does before buying. Buy and install refers to the process of purchasing the right products in the right configuration at an agreeable price. Use and service refers to the performance of the product or solution itself and any associated post-sale interactions that customer may have. The physical-to-digital-to-physical leaps described in figure 1 can happen throughout every stage of the customer life cycle, depending on the types and degree to which Industry 4.0–enabled technologies are utilized.

The following sections explore each component of the customer life cycle in more detail, outlining how Industry 4.0 technologies create new opportunities for manufacturers. While we use the customer life cycle framework to orient our analysis, the key objective of this section is to illustrate the impact of DME for manufacturers.

Discover and shop: Exploring digital solutions at the start of the sales cycle

At the beginning of the sales process, customers typically search for information that will help them make purchasing decisions (figure 3). For years, consumer brands have led the way in developing compelling digital customer experiences at this stage; many digital commerce platforms have shaped customer expectations around the ability to easily research, evaluate, buy, and service purchases online across devices.

Industrial manufacturers have lagged behind in this area, often due to the complexity of their products. However, driven in large part by business-to-consumer buying experiences, customers’ (especially Millennials’) expectations of their business-to-business (B2B) purchasing experiences seem to be changing. Ninety percent of B2B buyers now use online resources to research industrial products, and close to 60 percent of the B2B buying process is now completed online before a salesperson first meets with a customer.13 Beyond simply researching products, the majority of B2B buyers prefer to purchase industrial products online.14

Despite their customers’ increasing preference for digital engagement, few B2B manufacturers have made significant investments in digital commerce capabilities.15 This means that sales representatives and channel partners often lack sufficient insight into their buyer’s journey, due to a lack of integrated systems and automated processes for sales.16

Despite their customers’ increasing preference for digital engagement, few B2B manufacturers have made significant investments in digital commerce capabilities. This means that sales representatives and channel partners often lack sufficient insight into their buyer’s journey.

Many manufacturers have built high-touch sales and account management teams, often with considerable technical sales and account management capabilities.17 In some situations, however, manufacturers may be able to scale back investments in high-touch teams as new digital platforms are used in both direct and indirect sales. In other cases, manufacturers may find it more practical to simply refocus their sales teams on higher-value, personalized, and unpredictable activities while digitizing other more standardized, predictable parts of the sales process. Xerox, for example, automated its sales and support tasks to enable sales teams to focus on closing sales while creating digital solutions to address some of the more common initial questions occurring earlier in the sales cycle.18

Companies will also likely need to adjust to how digital technologies have blurred functional roles and democratized organizational structures. In part as a response to this shift, some companies are reshaping their sales teams to shift away from business unit or product orientation toward more integrated solutions.19

Discover and shop: Which digital technologies create value?

In light of these shifting customer behaviors and preferences and the ways in which sales teams continue to evolve, three Industry 4.0 technologies appear to be emerging as particularly key at the discover and shop stage:

Artificial intelligence (AI)

Companies are deploying AI technologies around their products, solutions, and services to facilitate a natural-language Q&A dialogue with customers online and through mobile applications.20 AI-driven platforms can aggregate information across systems to make recommendations based on a broad swath of data regarding customers, applications, and offerings, making them potentially intelligent—and valuable—sales partners.

Augmented reality and virtual reality (AR/VR)

Motivating a customer to come to a showroom or location to physically experience a product can be challenging. More companies are exploring how to either enhance the physical experience or bring it to their customers. In some cases, the AR/VR platforms enable customers to try out products and quickly narrow down their preferred features in a realistic, immersive experience, rather than viewing a limited set of products in a more constrained environment.

Online to offline intelligence

For most manufacturers, customer information resides in one, or possibly several, databases that contain interaction history, order history, customer relationship management (CRM), and web interaction data. Companies are starting to fuse these online and offline data to gain a more complete view of their customers. This broader view can help create a demand barometer running from the beginning of the sales cycle (such as initial website visit) to purchase (such as order data), detecting patterns in purchase intent and facilitating more effective product recommendations.21

The benefits of going digital

Customer-facing and sales enablement digital technologies such as those listed above can create business value in several key ways:

- Lowering selling costs. Many industrial manufacturers have product portfolios that include standard, high-volume components, in addition to more complex, custom-engineered offerings. Digital platforms such as AI and AR/VR smart configurators can provide a lower-cost sales channel for standard offerings and potentially reduce the buying cycle, freeing up resources to focus on more customized products.

- Enhancing sales and account management efficiency. In many cases, sales enablement systems, such as CRM and Configure Price Quote, have become table stakes over the last decade. New digital tools, such as sales coaching, planning, gamification, market insights, and data-driven territory and quota management solutions, can continue to improve the efficiency and effectiveness of sales and account management teams, enabling sales organizations to do more with less.

- Improving customer retention. More granular customer information captured through digital commerce and service platforms can help manufacturers better understand the risk of attrition or service defection within their existing customer base—and potentially address it preemptively.

Many manufacturers are beginning to pursue solutions like the ones described above on a limited experimental basis (see the sidebar “Discover and shop: Chevy finds new roads” for an example). But many more significant investments are likely needed for manufacturers to capture the full potential of the digital enterprise through the discover and shop phase of the customer life cycle.

Discover and shop: Chevy finds new roads

Chevy is one of the largest automotive brands, with over 4 million vehicle sales a year across 115 countries.22 The brand has a long heritage of design innovation and affordability in arguably one of the most competitive segments in the global automotive industry. As such, it is continuously looking for innovation applications to engage new drivers.

In 2016, Chevy released the website findnewroads.com to engage consumers through a personalized Global Positivity System. The system employs IBM Watson’s AI capabilities to score an individual’s positivity based on social conversations in their Facebook and Twitter accounts.23 The scores spark a broader social conversation about the power of positivity, while the AI capability profiles a user’s top three personality traits and links those traits to a recommended experience.24 Ultimately, the goal is to increase consumer affinity for the Chevy brand and spark further interest in a new vehicle purchase.

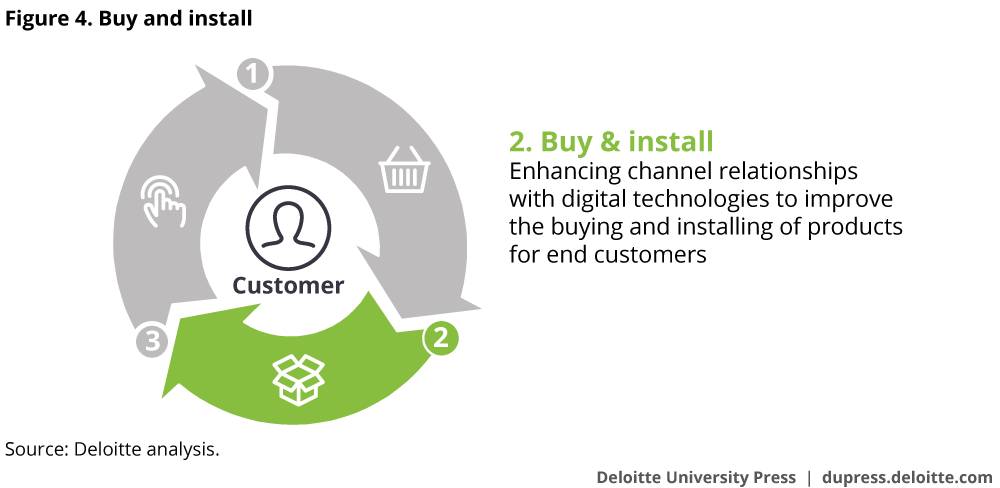

Buy and install: Using Industry 4.0 technologies to enhance channel relationships

In the buy and install phase of the customer life cycle, Industry 4.0 technologies can have a significant impact, particularly on managing the challenges associated with channel partner relationships (figure 4).

Many manufacturers rely on channel partners, such as dealers or distributors, to identify, develop, and deliver their products to end customers. And they can wield tremendous influence: According to the sales vice president of a large industrial manufacturing company, its customers embrace 90 percent of the recommendations made by the channel partners.25

In many cases, it is the channel partner who owns the relationship with the end customer. Even after the initial sale of an industrial product, most channel partners continue to maintain the relationship with the end customer, including advising on the best ways to operate products, selling spare parts, and providing scheduled and unscheduled service.26 It is thus important to recognize the impact of channel partners, and focus on improving their experience and loyalty.

Working with and through channel partners presents a variety of challenges for most manufacturers, however, including:

- Educating channel partners on new product offerings and collaborating to develop go-to-market strategies

- Managing the complexity of touchpoints across functions, business units, and geographies

- Streamlining the pricing approval process and improving the average deal size

- Agreeing on the suggested order and optimal model mix that balance the goals and incentives of both the original equipment manufacturer (OEM) and the individual channel partner

- Communicating changes and updates to planned delivery schedules for both original equipment and spare parts

- Providing seamless sales, service, and support that is responsive to the changing usage patterns of the customer’s environment

These challenges often persist despite the fact that manufacturers and their channel partners are generally connected by a number of transactional and milestone-based systems intended to synchronize activities. While these systems may do an adequate job of capturing and communicating the basic information each party requires, as changes occur, they may struggle to reflect these changes and respond in real time.27 There are several reasons for this: These systems often rely on manual inputs and updates, the exchange of data is often handled through outdated mechanisms running no more than once a day, and information presented usually requires a good bit of tribal knowledge to interpret.28

Buy and install: Which digital technologies create value?

Industry 4.0–driven digital platforms can play a part here, increasing the frequency and granularity of information sharing between manufacturers and channel partners, and helping to address coordination challenges that often hamper channel performance. Three technologies are especially relevant:

Partner relationship management (PRM) platforms

PRM platforms can synchronize insights across partners and manufacturers. By anonymizing certain key data elements, they can also avoid compromising each partner’s competitive position while providing necessary information to manufacturers to optimize their activities. (See the sidebar “Buy and install: Enterprise software company incorporates personalization to deliver an innovative user experience.”)

Radio-frequency identification (RFID) and Global Positioning System (GPS)

Real-time delivery updates enabled through RFID or GPS technology can help dealers coordinate with customers and schedule their crews in advance, increasing resource utilization and improving the customer experience.

Predictive analytics

Manufacturers can leverage digital platforms to analyze real-time data from their channel partners, using them to predict issues and make better operational decisions. For example, a sudden spike in similar repairs on products across multiple dealers can help identity a quality defect yet to be identified in a production run.

The benefits of going digital

Significant benefits usually exist for both manufacturers and their channel partners in using Industry 4.0 technologies to deliver better customer experiences:

- Timely and reliable delivery information to end customers. Industrial customers are often frustrated by long lead times on made-to-order purchases, and they may have limited insight into the status of their order or delivery.29 Providing customers with better real-time supply chain information is a significant opportunity that requires strong coordination between manufacturers and their channel partners.

- Quality and consistency of channel experience. Customers want a seamless experience.30 Manufacturers and channel partners can leverage new digital platforms to improve the consistency and timeliness of information flows and ease process hand-offs. This can help address inefficiencies in many channel partner relationships and create significant value for customers by shortening order times and building better trust and relationships across the value chain.

- Reduced selling and administrative costs. More efficient management of channel partner interactions through PRM tools and other digital platforms can reduce the administrative costs associated with channel partner management. Resources can be repurposed to other more valuable activities.

Buy and install: Enterprise software company incorporates personalization to deliver an innovative user experience

An enterprise software company automates processes and works to bridge gaps between enterprise applications and processes. It does so by providing partners and customers the visibility and control needed to improve financial performance, reduce risk, and ensure flexibility.

The company implemented an end-to-end PRM solution leveraging a popular CRM platform.31 This solution provided a 360-degree view of customers, including detailed and relevant insights into leads, accounts, and opportunities; access to consolidated and intuitive content, including product documentation and knowledge; multilanguage support for global outreach; a customizable portal that is accessible via desktop, tablet, and mobile devices using responsive design and updated with the company’s current branding standards.

The PRM solution improved collaboration with distributors, giving the firm visibility into channel pipeline and real-time metrics that improved resource deployment and, ultimately, sales effectiveness.

Use and service: Reinventing the aftermarket experience through digital

The third, and potentially most significant, area in which manufacturers can realize value from Industry 4.0–driven technologies is the aftermarket, also known as use and service (figure 5).

The term “aftermarket” refers to the full stream of services, spare parts, and customer interactions that take place after the original sale has occurred. Many industrial manufacturers have built their profit models around the aftermarket, where customers are locked into their equipment and must use it to operate their businesses.32 As a result, customer willingness to pay is typically high, and margins are healthy for OEMs and service partners.

Indeed, the aftermarket is often the most profitable component of a manufacturer’s business: Analysts estimate that aftermarket services and spares represent over 8 percent of US GDP.33 A recent study found that while aftermarket products and services account for 24 percent of revenues for a particular set of manufacturers, they made up 45 percent of those manufacturers’ gross profits.34

While the aftermarket is extremely important for many manufacturers’ businesses, some of these manufacturers struggle with a variety of practical challenges around planning and delivering within their aftermarket businesses.35 A few of the most common issues include:

- Lack of visibility into customers’ usage of the manufacturer’s products, leading to an inability to predict maintenance requirements and the potential to affect uptime and performance

- Difficulty forecasting and stocking spare parts across the global installed base, leading to unplanned outages and delays in customers receiving their orders; in one instance, an automobile manufacturer had such poor coordination between its spares warehouses and dealers that nearly 50 percent of consumers needing repairs faced delays because dealers could not supply the parts necessary to fix them36

- Customer gaming of order priority to reduce delays in receiving their orders, leading to an unreliable set of aftermarket demand signals

- A wide variety of sourcing and production challenges created by long product in-service life cycles and low-volume intermittent demand signals

As a result of these and other issues, customers are often dissatisfied with their aftermarket experience. One study found that satisfaction levels for aftermarket services were 10–15 percent below customers’ expectations.37

Use and service: Which digital technologies create value?

When incorporated into manufacturers’ products, Industry 4.0 technologies can transform how the aftermarket functions and performs. Many manufacturers are developing connected devices, pervasive sensing, and, ultimately, “intelligent products” that can be monitored to analyze their performance.38

Intelligent products create what some analysts call “digital exhaust”: a stream of information that includes usage data such as cycles, speed, and uptime; process characteristics such as temperature, pressure, fuel, or energy consumption; and environmental factors such as ambient temperature, moisture, and vibration.39 This stream, combined with the plummeting cost of sensor technology in recent years, has led some manufacturers to incorporate instrumentation into new products and retrofit some legacy products to take advantage of the opportunities to capture data.40

This digital exhaust can provide analytics-driven insights to manufacturers, helping them create solutions that can transform their customers’ aftermarket experience. Some examples include:

- Creating insights for fleet managers and operators to understand uptime, productivity, and maintenance requirements at the individual asset level in real time

- Optimizing efficiency for aircraft, building sensors, and equipment repairs by gathering data on failures to quickly discern the root cause and plan steps for remediation

- Offering outcome-based services that monetize the value of an asset in another form than the asset itself (for example, price per kilometer, hours of operation or power per day)

The benefits of going digital

Transforming the aftermarket experience can create opportunities for many industrial manufacturers to capture value. Some such opportunities include:

- Optimizing customer use. Industrial manufacturers’ products can drive customers’ economics, particularly customers that operate large fleets of assets. Manufacturers who can help end customers achieve better throughput from their products in the aftermarket may attract customers more willing to pay for an integrated product service offering.

- Improving customer uptime. On a similar note, downtime is often exceedingly costly for customers, whose economics often rely on continuous operation with minimal unscheduled downtime. Helping customers maximize uptime presents an opportunity for differentiation and value capture for manufacturers.

- Increasing services and spares capture. One major source of value “leakage” for manufacturers is customers’ choice of non-OEM parts or uncertified providers to perform both routine and special-purpose repairs and service. Manufacturers with in-depth usage data may be able to identify and respond to these cases of service defection by using advanced technical support to predict and prevent customers’ opting for low-cost, non-OEM providers, thus forging stronger customer relationships.

Manufacturers who can help end customers achieve better throughput from their products in the aftermarket may attract customers more willing to pay for an integrated product service offering.

These are hardly the only opportunities that intelligent products and their digital exhaust will present for manufacturers (see the sidebar “Use and service: Case New Holland wrings value from digital exhaust” for an example). Other opportunities may include:

- 3D-printing spare parts, particularly for challenging use cases such as remote mining sites

- Creating digital self-service platforms that enable customers to manage their aftermarket services in one place: making warranty claims, scheduling service, checking delivery schedules, and so on

- Using AR to enhance customer support functions, such as using interactive, wearable devices to improve repair processes

- Transforming aftermarket pricing and fulfillment to a dynamic pricing model, where factors such as availability and urgency influence pricing and fulfillment decisions41

Use and service: Case New Holland wrings value from digital exhaust

CNH Industrial, a global producer of agricultural, construction, commercial vehicles, and powertrain technologies, has invested heavily in new, connected, digital vehicle solutions that strive to create significant value for its customers.

CNH Industrial’s vehicle connectivity and cloud platform enable remote monitoring of the product’s condition, operation, and external environment to facilitate proactive maintenance and performance optimization. The solution combines on-product sensor data with external third-party data providers (for example, regarding weather, mapping, and crop analytics) to improve operational optimization.

All of CNH Industrial’s product segments see value in these solutions, given their sensitivity to equipment performance and uptime. Early results suggest the new, proactive, service approach, combined with failure prediction models, could reduce unplanned machine downtime by up to 50 percent. This value is particularly significant for small and mid-sized customers who lack the resources for sophisticated, large-scale maintenance operations.42

The company is also working to integrate dealers and other third-party vendors into the solution through an open data architecture that accelerates the development of valuable collaborative partnerships, while at the same time providing the customer with full data access management and control.

The road to digital transformation: Overcoming key risks and challenges

Digital transformation likely requires significant change for most manufacturers. While many consider it necessary and exciting, each brings with it a number of challenges and risks that can make this transformation difficult. No issue is insurmountable, but each likely requires a thoughtful plan and approach to address. Some of these risks and challenges include:

- Data management. Building digital and customer analytics capabilities usually requires not only enormous quantities of new data but also effective use of existing customer data as well as the ability to combine both data types effectively. This can be a challenge for manufacturers who have not historically focused on maximizing the value of this asset.

Additionally, as organizations start adding sensors to their products and enable a connected ecosystem to monitor performance of their assets, they may generate a digital exhaust that runs the risk of exceeding the current data storage requirements of the organizations’ transaction system environment. Organizations could need to standardize data ingestions, curation, and distribution, and consider how they will store and manage these data moving forward.

- Talent availability. Many manufacturers lack the talent required to build new digital capabilities; in order to succeed with these investments, a strategic focus on attracting and developing digital talent can be critical. This may involve the addition of nontraditional roles such as developers, data scientists, and other digital experts.

- Collaboration across functions. Creating digital customer connections typically requires strong coordination between the chief marketing and information officers to marry the customer knowledge and sales and marketing processes with the information technology capabilities required to design and build new platforms. This may necessitate reevaluating the roles and responsibilities of IT and marketing.

- Return on investment. Because many digital technologies are emerging and unproven, the business case around return on investment may initially appear inconsistent or unpredictable, particularly given that certain technologies may have relatively short life expectancies (that is, faster development cycles). This challenge may lessen over time as technologies become more widely used and familiar.

Segmenting based on your customers’ digital wants, needs, and value potential is usually the first step toward defining your company’s digital aspirations and understanding where your company may play and how it can win in the market.

Getting started

As manufacturers develop new digital capabilities, some may focus on one phase of the customer journey more than others. Others may invest across the board. Regardless of a manufacturer’s focus and approach, there are practical steps all manufacturers can take today to address these challenges and get started on this path. Specifically, we recommend that manufacturing leaders challenge themselves and their teams to:

- Scan for disruptors. Imagine how a digital-first entrant could find ways to intermediate the company or its channel partners. This is generally a rapid way to identify sources of latent value in customer relationships, as well as vulnerability in the profit model.

- Develop a clear understanding of what value means to customers, and how it is created holistically across touchpoints. Once customer priorities and value drivers are understood, evaluating business value drivers is often the next essential step. Each potential digital customer experience or capability has a different impact on business value—reducing costs to serve, for example, or increasing customer retention—and analyzing potential investments at the granular segment level can help maximize returns. Segmenting based on your customers’ digital wants, needs, and value potential is usually the first step toward defining your company’s digital aspirations and understanding where your company may play and how it can win in the market.

- Develop use cases that align to where value is created. Create a list of specific digital solutions to explore for business and technical feasibility. This can allow key team members to make progress against something tangible while defining and designing your digital customer journey.

- Assess current customer-facing digital capabilities. Many manufacturers lack the critical talent, infrastructure, data, or partnerships required to execute enterprise-wide digital transformations. Conducting a digital maturity assessment can help to know your company’s starting point and inform the milestones along the journey.

The opportunities of the digital manufacturing enterprise are often a source of potential differentiation for most manufacturers: an opportunity to outmaneuver competition and more efficiently deliver best-in-class customer experiences to outperform others in the market. The window of opportunity likely won’t be open for long, however, as these technologies and capabilities quickly may become table stakes over the next several years. The future of your enterprise is digital: Don’t delay.

© 2021. See Terms of Use for more information.