Leveraging digital solutions to engage, attract, and retain Medicare Advantage members Strategies to close the gap to the future of health

15 minute read

08 October 2020

Medicare Advantage health plans continue to integrate digital solutions to better engage current—and attract new—members. Explore how plans gauge digital strategy success and how COVID-19 has impacted digital adoption in older adults.

Executive summary

Before 2020, Deloitte outlined a vision for the future of health anchored around stronger data connectivity; interoperable and open, secure platforms; increasing consumer engagement; and greater price transparency. Many Medicare Advantage (MA) plans had begun to work toward that vision by adopting digital solutions to engage with their members. Then, in March 2020, the 2019 novel coronavirus (COVID-19) put these plans into hyper speed. This period saw even more rapid adoption of digital solutions for at-home monitoring, care engagement, and communication regarding benefits and benefit changes. These recent developments, combined with a regulatory push toward greater interoperability and price transparency, have many MA plans racing toward the future of health faster than ever.

Learn more

Explore the health care collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

The Deloitte Center for Health Solutions spoke with professionals at MA plans and digital innovators that work closely with them to understand where these trends are headed and what might accelerate them even more in the future (see “Methodology” under sidebar “Methodology and definitions”). Generally, the interviewees agreed that:

- Digital solutions will be table stakes as member needs accelerate. Before COVID-19, many MA plans were increasing their adoption of digital solutions, but some were further ahead than others. The pandemic accelerated digital delivery—both of benefits (care and medicine) and of enrollment. This acceleration was partially in response to consumer demand, but also due to health plan leaders realizing that technology is a good way to keep their members out of the physician’s office but still cared for.

- MA plans gauge the success of their digital solutions using traditional, but measurable, metrics, including:

- Physician engagement

- Member stickiness metrics, such as member churn, growth, and net promoter scores

- Care and well-being metrics, such as clinical outcomes, quality measures, star ratings, and gap closure

- Cost metrics, such as reduction in member costs and operating costs

- COVID-19 moved drivers of health (social determinants of health)—supported in MA by expansion of supplemental benefits flexibility—from the back seat into the passenger seat. With added flexibility in benefits begun before COVID-19 and continued through the emergence of the pandemic, several health plans are offering digitally enabled supplemental benefits, such as transportation, drug delivery, food and nutrition, and social connector programs.

- Challenges exist but MA plans and innovators expect the rapid adoption that occurred during the pandemic to continue. Many plans are still struggling with the same issues as always, such as how to leverage the right data to measure outcomes and ROI of digital investments. But greater regulatory focus on interoperability and price transparency are pushing MA plans to develop more robust digital strategies.

As MA plans continue to refine their digital strategies and integrate technology into their future benefits products and processes, they should capitalize on the broader trends—consumer demand, physician engagement, and regulatory changes (e.g., impending interoperability regulations, telehealth flexibilities, supplemental benefit changes)—helping support them in this shift. MA plans should also revamp their marketing and enrollment processes to focus on digital care and communications.

The basis of competition is changing faster than ever before and creating an uneven playing field based on these capabilities. Adoption of digital solutions may not be an option but a requirement for all MA plans in the times to come.

Introduction

Digital technologies have rapidly penetrated many aspects of consumers’ interactions with health care organizations, including how they make health care decisions and interact with their health plan. For example, the average consumer today is much more likely than in previous years to use fitness trackers, conduct video calls with doctors, and use home-health devices, and is comfortable even with enrolling in an insurance plan online.1 And the same goes for older adults, many of whom are realizing the value of digital technologies in their health choices. For instance, in our recent survey of health care consumers, more than 60% of baby boomers said that their use of digital fitness devices led to a great or a moderate deal of behavior change. Additionally, more baby boomers expressed interest in using technology to access care, such as medication reminders and monitoring sensors and devices compared to previous years. 2 This trend is one that has led many older consumers to demand changes, both in the way they interact with their health plans for benefits communication and enrollment and in the types of technology interactions with clinicians they expect health plans to pay for.

On top of these existing trends, the COVID-19 pandemic has created an urgency to adopt digital technologies for many organizations. There is a focus on engaging one of the most vulnerable populations in this pandemic—older adults—as health care organizations strive to keep this population healthy and safe in their homes. This has created huge opportunities for digital solutions to enable care in the home.

Many new MA health plan start-ups have built their business models around leveraging digital technologies to engage their members—solutions for digital health, digital medicine, and digital services and communications (see “Defining digital solutions” under sidebar “Methodology and definitions”). To understand more about MA plans’ digital solution adoption trends, the impact of the COVID-19 pandemic on these trends, and the path forward, we interviewed leaders from health plans with significant MA business. In addition, we also interviewed the digital health innovators that partner with these health plans to provide the digital solutions (see sidebar, “Methodology and definitions”).

Methodology and definitions

Methodology

The Deloitte Center for Health Solutions interviewed leaders from MA plans, including several digital start-ups, and digital innovators working with MA plans from April–May 2020. Interviews focused on understanding what plans consider to be table stakes when it comes to digital solutions (see definition below), what measures they use to gauge success with digital adoption, how flexibility from the US Centers for Medicare & Medicaid Services (CMS) around supplemental benefits and more recently telehealth have changed their strategy, and what impact COVID-19 has on the speed of adoption of digital solutions.

Defining digital solutions

We divided digital solutions into three broad buckets:

- Digital medicine that delivers evidence-based software and hardware products. Examples include digital therapeutics, digital diagnostics, biomarkers, and digital companions and devices.

- Digital care, which includes technologies and solutions that engage consumers for lifestyle, wellness, and care purposes. Examples include telehealth, lifestyle apps, fitness trackers, personal health records (PHRs), medication reminder apps, etc.

- Digital services and communications, which are tools and technologies that are used for marketing to, enrolling, onboarding, and communicating with consumers on matters related to benefits and plans.

Findings

Digital solutions will be table stakes as member needs accelerate

Deloitte’s vision for the future of health is that by 2040, health care will shift to a focus on health, driven by stronger data connectivity; interoperable and open, secure platforms; increasing consumer engagement; and greater price transparency. As that future unfolds, we already see health care organizations, including MA organizations, accelerating their adoption of digital solutions.

“COVID has been a game changer. None of this was table stakes six months ago. As we go into the next open enrollment, if you don’t have telemedicine, you’re going to hurt.”—Medicare sales lead at an MA plan

In March 2020, the United States began putting in place precautions to limit the spread of COVID-19. Health care organizations across the country shut down many elective procedures and shifted many services—including primary and specialty care and enrollment and benefits communication—to digital solutions. As that happened, many health plans offered consumers more flexibility with regard to telehealth options and moved to digital solutions for benefits communication and enrollment. They did this partially in response to consumer demand, but also due to health plan leaders’ realization that technology is a good way to keep their members out of the physician’s office but still under their care.

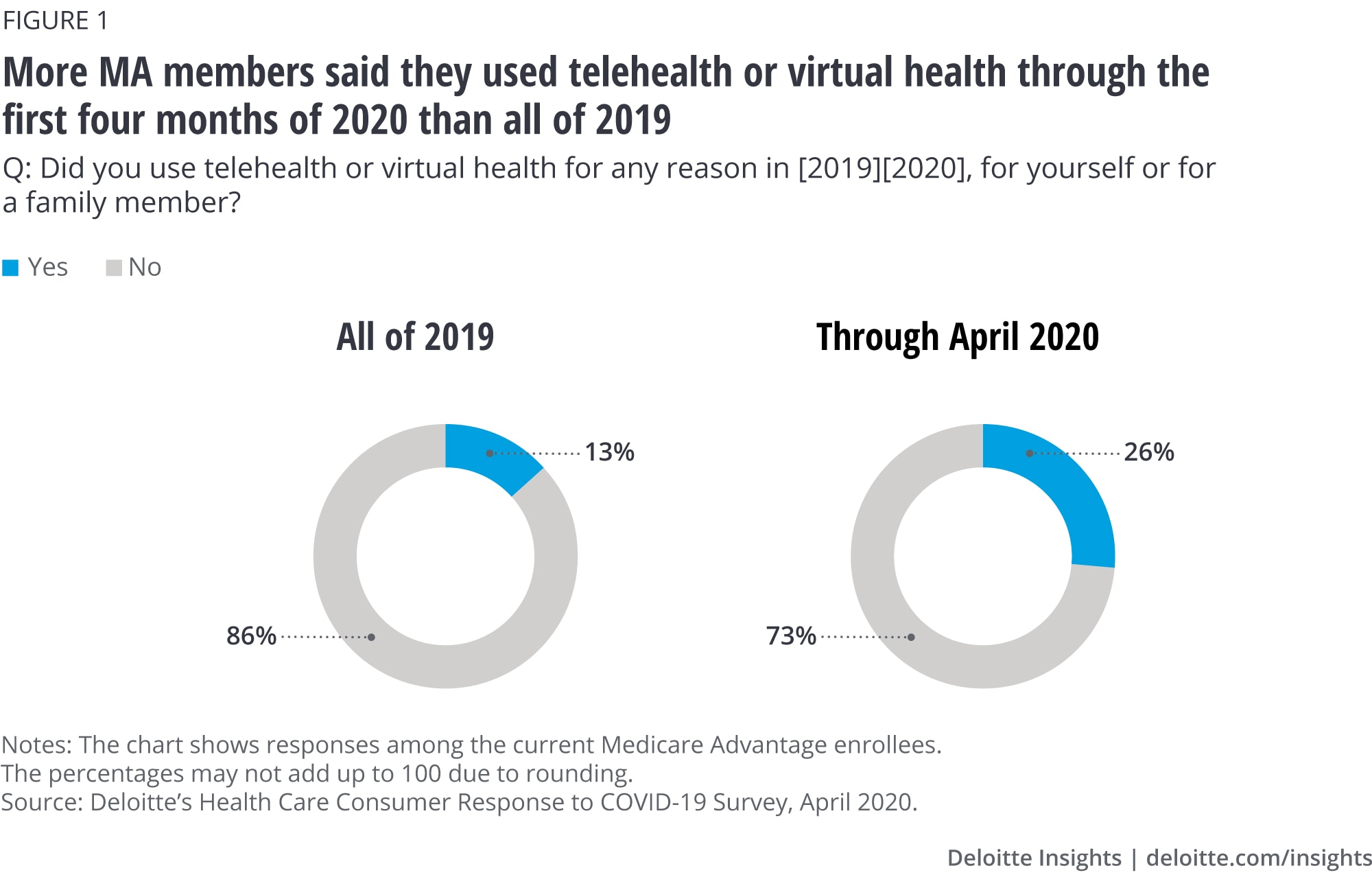

Indeed, COVID-19 accelerated the use of digital solutions for engaging with clinicians. As one example, Deloitte’s COVID-19 survey showed that as of April 2020, more MA enrollees used telehealth or virtual health in the first part of the year than in all of 2019 (figure 1).3

Keeping track: Measuring the success of digital solutions

MA plans gauge the success of their digital solution initiatives using traditional, but measurable, metrics, including member satisfaction and stickiness, clinical outcomes, total costs, stars and gap closure, and net promoter score. The interviewees consider their digital initiatives a success if they can move the needle on:

Physician engagement

Physicians are key stakeholders for MA plans’ digital solutions. Digital solutions may fail if they are not onboard or do not remain engaged. Health plans have aimed in recent years to provide physicians with members’ claims and utilization, and data from wearables and remote monitoring devices that members receive as a part of their benefits. This has helped physicians remain engaged with their members.

“We have a primary care provider-centric view of technology. That’s our tech strategy. We arm our PCPs with as much tech as possible. The best product or tool to engage the seniors are the PCPs.”

—Chief technology officer at an MA plan

Member stickiness

In general, health plans consider member growth and retention a key measure of success. It isn’t any different for their digital initiatives. One of the most common metrics is the correlation between the older adults who used their digital solutions and their remaining enrolled in a given plan—member stickiness. Some MA plans are using advanced analytics to better understand this correlation. For instance, many look at the likelihood of continued enrollment among older adults using their digital solutions regularly vs. those who used them just once or twice. They also measure net promoter scores—members’ ratings of their health plans—and usually find that the scores given by the highly digitally engaged members were higher than those who did not adopt digital tools.

Improved quality of health

For digital innovators, improvement in their health plan partners' member outcomes is a key goal. For instance, interviewees revealed that they gave their members access to digital companions and devices and fitness trackers to monitor their health. With continuous monitoring at home, older adults, especially those with chronic care needs, do not have to step out of their homes. Based on data from connected digital devices, members find virtual conversations with their physicians both convenient and beneficial to their overall health.

In addition, MA plans have placed emphasis on closing care gaps—which, in turn, helps improve their Medicare star rating. They do this by using analytics, digital interventions, and communication through digital bots, automated outreach, and self-scheduling options for members. For MA plans, gap closure is a key indicator of success of such initiatives for quality of care of their members.

Reduced costs

Reducing member costs, particularly for members with chronic diseases such as diabetes, is one of the key metrics for both the digital innovators and health plans. Members with diabetes have disproportionately higher costs, and digital interventions have resulted in cost reductions of 20%, according to one of the digital innovator interviewees. Digital technologies are helping health plans keep members out of physician offices, and over time, reducing the cost of care. For instance, health plans are creating special digital programs for members with chronic diseases such as diabetes. Such programs include continuous digital monitoring of diabetes members’ blood glucose levels, and digital interventions through virtual well-being coaches, or their physicians.

COVID-19 moved drivers of health from the back seat into the passenger seat

Almost all MA health plans offer supplemental coverage—benefits above traditional services offered to fee-for-service beneficiaries. In 2019 and 2020, CMS expanded the definition of these benefits to include nonhealth benefits that may impact health, such as in-home support services, meal delivery, and nutritional food.4 The uptake of these new benefits has been low but growing among MA health plans. While only 1% of MA health plans included in-home support services for the 2019 benefit year, more than 240 MA plans offered special supplemental benefits for the chronically ill (SSBCI), including pest control, transportation, meals, and even pet support in 2020.5

As the COVID-19 pandemic disproportionately impacts older adults, there has been an even larger focus on using this benefit flexibility to address drivers of health in recent months. In a rare move, in April, CMS allowed MA plans to make changes to their supplemental benefits midyear due to the pandemic. For instance, MA plans are now able to provide smartphones or other video devices to facilitate telehealth as a supplemental benefit.6 This is helpful for members’ access to telehealth benefits, especially for those who are not able to afford smartphones.7

“When you think about food security—the statistics were that 5%–10% of the MA patients we visit had a food security issue before COVID. COVID put that food in the car for the first time instead of just giving them phone number.”—Chief growth officer at a digital innovator that works with MA plans

When asked about the impact of the current crisis on the supplemental benefit offerings for the coming years, there was a consensus among the interviewees that health plans are and will increasingly offer digitally enabled supplemental benefits to tackle drivers of health. The most common ones they discussed were:

- Transportation: Partnering with app-based cab companies to provide convenient transportation options for their members

- Drug deliveries: Doorstep deliveries of drugs from local pharmacies via digital and phone options

- Food and nutrition: Partnering with food banks and other catering providers to ensure food and nutrition support for postdischarge, long-term, and even routine needs of their members through phones or digital apps

- Social connector programs: Regular virtual outreach and engagement programs to ensure their members do not feel socially isolated, especially as social distancing measures for COVID-19 are in place

In addition to the above benefits, some health plans are also experimenting with need-based benefits such as broadband support, air conditioners for certain patient types, such as those suffering from COPD, and even spa and salon services. Many interviewees, however, noted taking a measured approach to adopting these new benefits, based on factors such as market size, population mix, and competition.

Challenges exist but MA plans and innovators expect pandemic-level rapid adoption to continue over time

Many MA plans are currently working to address some of the challenges that still exist in leveraging digital solutions more effectively.

According to previous research, many plans still struggle to connect the data they collect (from devices to reporting systems such as quality/STARS data, care management, and risk adjustment) and align it to better inform their care improvement strategy. Some organizations are optimizing their data strategies and enhancing their processes around gleaning insights from this data to inform member engagement and investments in digital solutions. Two ways in which plans are doing this include using an enterprisewide strategy (including risk adjustment, quality/stars, and care management) to coordinate data and processes at the relevant functions and automating some aspects of data collection and reporting using tools such as robotic processing automation, natural language processing, and artificial intelligence. Recent interoperability and price transparency rules that require even greater data aggregation and sharing with consumers will likely push plans to focus on developing solutions to these problems.

Interviewees agreed that the industry may see long-lasting change past the COVID-19 pandemic. They expect consumers’ and physicians’ attitudes toward and preference for virtual health will continue to mature and give health plans an impetus to adopt and improvise on digital solutions to deliver benefits.

Implications

Pay attention to shifting consumer priorities, especially among the future member population

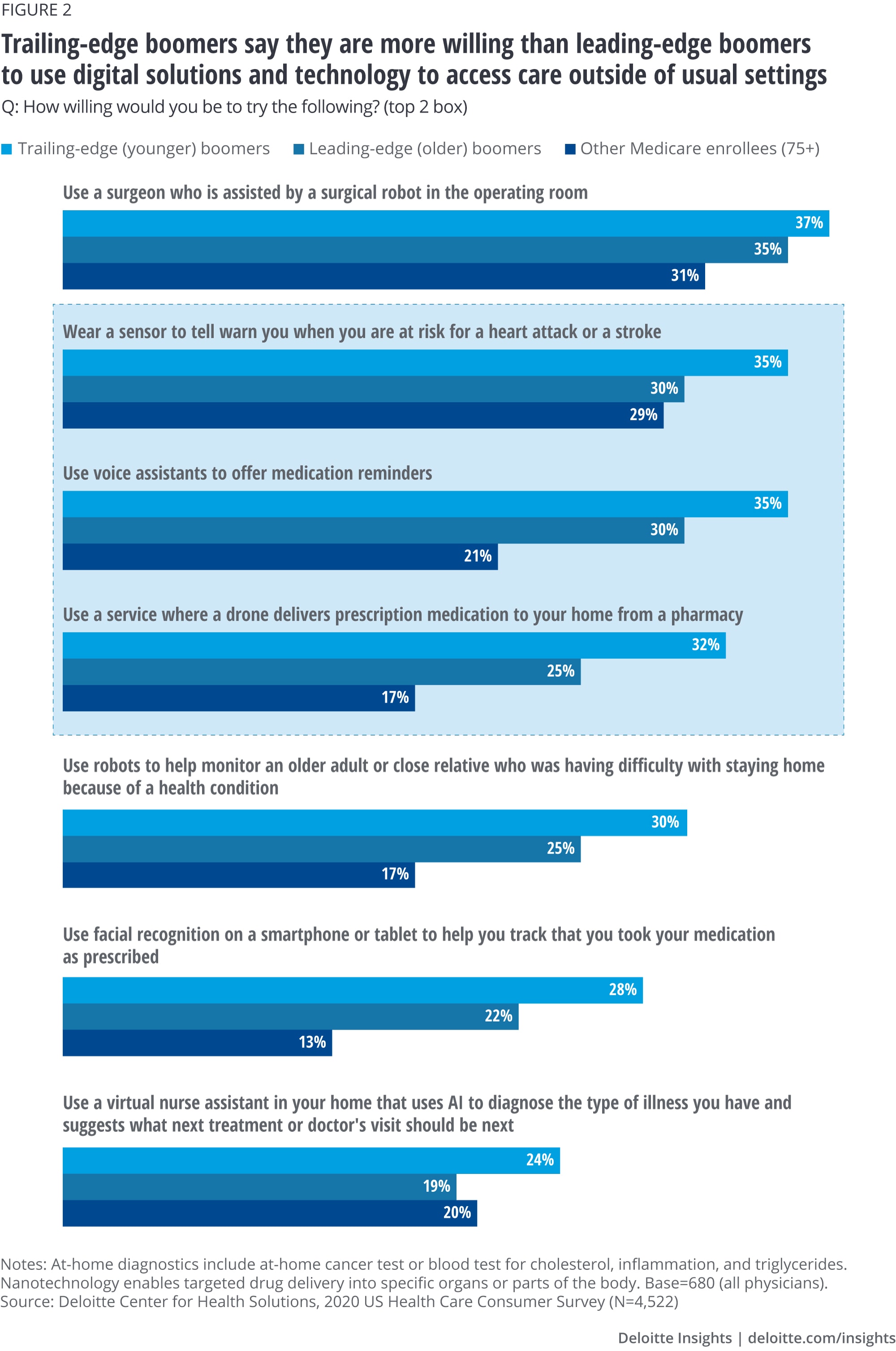

Even before the COVID-19 pandemic, consumer interest in using digital solutions to engage with their clinicians was on the rise. As a result, many plans are finding new ways to provide these technologies as part of their benefits and care management programs and to connect the data from these sources back to the clinician for more informed decision-making. Deloitte’s 2020 US Health Care Consumer Survey found that 42% of all consumers have used digital technology to track fitness and health improvement goals, and 28% have used technology to monitor health issues (up from 17% and 15%, respectively, since 2013). Moreover, we also see higher demand among the younger Medicare population (ages 65–75) and the future age-in population (ages 55–64). Trailing-edge boomers, the age-in population that will enroll over the next 10 years, appears to be even more willing than leading-edge boomers to use technology to access care outside of the usual setting, such as the home, and will likely demand more digital solutions (figure 2).

The strategies MA plans use to both attract younger boomers and retain older ones should be viewed through a digital lens. In addition to considering changes to future products to add more digital care and medicine solutions, MA plans should consider revamping their communication, marketing, and enrollment processes. People who are enrolling for the first time, or who are seeking to switch plans, might want the ability to shop for coverage and enroll virtually. Messaging should emphasize the ability to access care from home and virtually. And, as care becomes more digitized, MA plans may also need to consider the extended care team, including unpaid caregivers, such as family and friends.

Bring physicians and provider organizations into the fold, especially around virtual health

Consumers are not the only ones getting on board with digitizing care. Physicians and health care provider leaders also believe that this is the way of the future.

Deloitte’s biennial physician survey, fielded before COVID-19 was impacting the country, found that physicians were gradually increasing their use of virtual health. For example, physician-to-physician consultations increased from 17% in 2018 to 22% in early 2020 and virtual visits from 14% in 2018 to 19%. COVID-19 has dramatically reshaped the landscape: Data from the spring of 2020 shows more physicians are using virtual health (with some practices reporting a 50%–70% increase in use). Moreover, in a survey of executives from hospitals and health systems, health plans, medical device and technology companies, and virtual-health vendors, 50% thought at least a quarter of all outpatient care, preventive care, long-term care, and well-being services would move to virtual delivery by 2040.

The health plan leaders we spoke to said that physician engagement is a critical factor for the success of digital care and medicine programs. However, digital solutions need to be integrated into clinicians’ workflows to drive adoption. Health plans can help by supporting data integration, ensuring that data from virtual visits and other virtual solutions are seamlessly integrated into physicians’ current systems.

Get up to speed on changing regulatory requirements, especially around interoperability and price transparency

Beginning January 1, 2021, health plans administering government-sponsored programs (i.e., MA, Medicaid managed care, and the health insurance exchanges) will have to provide their members with two open-source application programming interfaces (APIs), or apps that allow different applications to talk to each other): patient access APIs and provider directory APIs. Using these APIs on devices such as smartphones, members would be able to get real-time claims and encounters information, comparison of costs of treatments (i.e., price transparency), and other clinical information through third parties.

This has ramifications for health plans at two levels. In the more immediate term, they may need to enhance their digital and interoperability initiatives to meet the deadline. In the longer term, members will expect nothing short of the highest standards of transparency and convenience as they become savvier users of digital health care tools. Health plans that fail to get on board with a comprehensive digital and interoperability road map may risk falling behind the competition and losing business.

Revamp marketing, enrollment, and member engagement processes to focus on digital care and communications

Health plans have the opportunity now to create a more effective digital consumer experience by investing in direct-to-consumer capabilities and solutions that span across the member journey and address members’ needs. Modern digital marketing technologies can change the way older adults engage in the full cycle of shop, buy, and enroll.

Due to the current situation surrounding COVID-19, many prospective and current members might want digital health and digital medicine benefits to be part of their coverage. Besides, MA plans are increasingly relying on virtual modalities for presales, enrollment, and postenrollment processes. Plans should ensure processes are seamless and convenient both for new enrollees and renewals. In their marketing and communications, they may want to emphasize the value and benefits of digital health and medicine, including accessing care from home and virtually, use of digital monitoring devices, and digital companions.

Conclusion

Leading MA health plans, in conjunction with digital health innovators and large disrupters, have gained a head-start on educating, acquiring, and retaining members in new and impactful ways through digital solutions. However, others, including some of the largest companies, are still operating in traditional ways or just beginning to invest in solutions. MA plans seeking to devise their digital solution strategies should consider three elements as they look toward the future of health:

Member-centric. Embrace a consumer-centric mentality across all operations to fundamentally change how older adults receive care and sustain health and well-being.

Key actions to consider:

- Make the health and wellness needs of older adults a priority. Build their trust, so that members view their health plan as a partner in helping them optimize their health.

- Deliver personalized and relevant information to members on their terms. Engage members in personalized ways through moments that matter and drive behavior change to deliver better outcomes for all stakeholders.

Digital capabilities. Become a true digitally enabled organization by investing in digital front-end capabilities for member engagement, as well as digital core and digital enterprise capabilities to power it.

Key actions to consider:

- Optimize existing business processes with new digital methods. Embrace a fail-fast, agile mindset using rapid prototyping, testing, and piloting.

- Implement a use case–driven mentality and focus on delivering value early and often. Define lagging and leading key performance metrics to measure progress.

Fully integrated. Break down organizational silos across the entire organization, strategically making build/buy/partner decisions to fully integrate digital solutions.

Key actions to consider:

- Craft a digital health ecosystem that allows for seamless integration of best-in-class enterprise and partner developed capabilities. Build flexibility into operations and systems to allow for rapid on- and off-boarding of ecosystem partners.

- Build an integrated digital platform with a data fabric that underpins organizational transformation and data interoperability.

The basis of competition is changing faster than ever before and creating an uneven playing field based on these capabilities. Adoption of digital solutions may not be an option but a requirement for all MA plans.

© 2021. See Terms of Use for more information.

Explore the Future of Health

-

Are consumers already living the future of health? Article4 years ago

-

How the virtual health landscape is shifting in a rapidly changing world Article4 years ago

-

The future of virtual health Article4 years ago

-

A consumer-centered future of health Article5 years ago

-

The health plan of tomorrow Article5 years ago