Utility decarbonization strategies Renew, reshape, and refuel to zero

30 minute read

21 September 2020

The power, utilities, and renewables sector is the focus of this transition: Its decarbonization will enable that of other sectors that are electrified or electrifying.

View sections

The utilities driving decarbonization

An energy transition like no other

Learn more

Explore the Energy transition series

Explore the Power, utilities & renewables collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

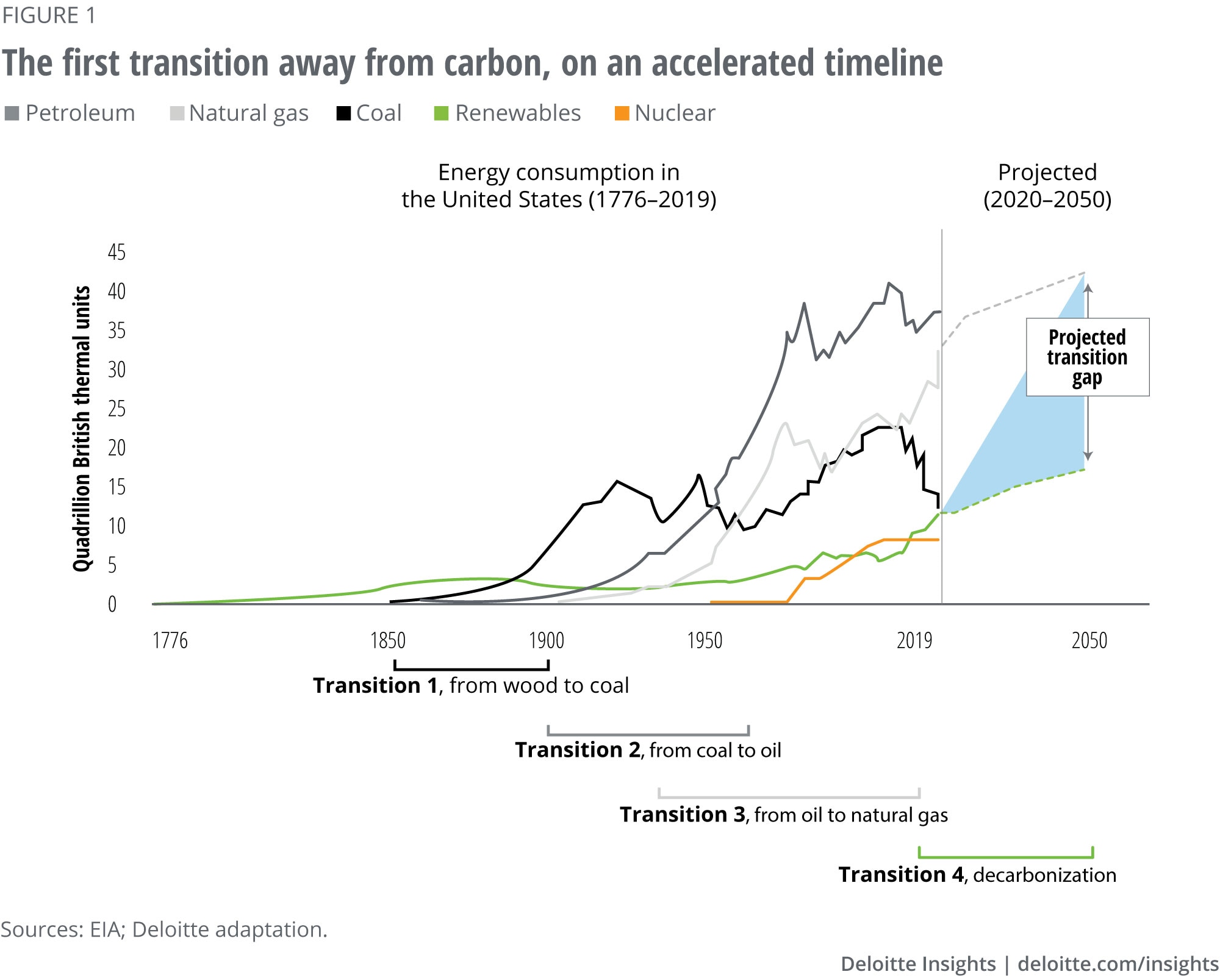

All energy transitions are significant, but the current one seems more significant than previous ones for a number of reasons. First, this energy transition is predicated on the elimination of an integral component of all the energy sources that defined past transitions, namely their carbon content. Second, it is the first one to respond to a global imperative: limiting potentially catastrophic global warming to 1.5 degrees Celsius above preindustrial levels—a target that requires achieving net-zero carbon emissions by 2050.1 Third, previous transitions were mostly additive, but this transition involves abruptly stemming the growth of currently leading and competitive energy sources, and substituting them. Finally, if successful, the fourth transition would be the first one to unfold over just three decades, versus the two to three generations needed for the transitions from wood to coal, to oil, and to natural gas (figure 1).2 That is a big “if.” While the U.S. Energy Information Administration (EIA) projects that nonhydroelectric renewables consumption will grow at the fastest pace through 2050, it also projects that natural gas consumption will continue to grow, forestalling a transition.3

The electric power sector’s challenge

As explored in Deloitte’s recent report, Navigating the energy transition from disruption to growth, the electric power sector is the focus of the current transition: Its decarbonization could enable that of other sectors that are electrified or electrifying. Deloitte’s recent energy transition survey indicates that the sector seems to understand this role and is poised to continue leading the energy transition—more than half of US power sector respondents reported having board or executive-level commitments and accountability in implementing their low-carbon strategy (see sidebar, “The energy transition study”).

The energy transition study

Deloitte began work on the energy transitions study in January 2020 to garner the perspectives of key decision makers among energy and industrials companies around low-carbon trends and strategies.

As part of this study, Deloitte and Wakefield Research surveyed 600 C-suite executives and other senior corporate leaders from around the world in March 2020. Twenty-one percent of the respondents identified themselves as C-suite executives (chairman, CEO, COO, CFO, among others); another 31% self-identified as senior vice president or vice president, 16% identified themselves as senior-level managers such as directors, and the remaining 32% included environmental officers, health and safety officers, regulatory compliance officers, and business units or department heads.

About 20% of the surveyed executives indicated company revenues between US$100 million and US$500 million, 60% indicated revenues between US$500 million and US$10 billion, and the remaining 20% indicated revenues of more than US$10 billion. The executives represented different industry sectors, which were broadly classified as oil and gas, chemicals and specialty materials, power and utilities, and industrial manufacturing (including broader industrial manufacturing, aerospace, heavy equipment, and diversified industrials). The results shared in this report are from surveyed US power and utilities executives.

According to respondents, the two leading drivers of the industry’s transition toward a sustainable, low-carbon future are, to an equal extent, consumer support for reducing emissions and new business models and value-creation opportunities. These commitments and drivers may help the sector face a big challenge: The US electric grid relies on carbon-emitting fossil fuels for 63% of its generation.4 Additionally, the EIA projects that the sector’s emission reductions will plateau, rather than accelerate as would be needed to achieve full decarbonization by 2050 (figure 2). Our analysis will show why this is the case and how utilities embarked on the arduous journey to full decarbonization might close the gap.

The investor-owned utilities that have taken up the gauntlet

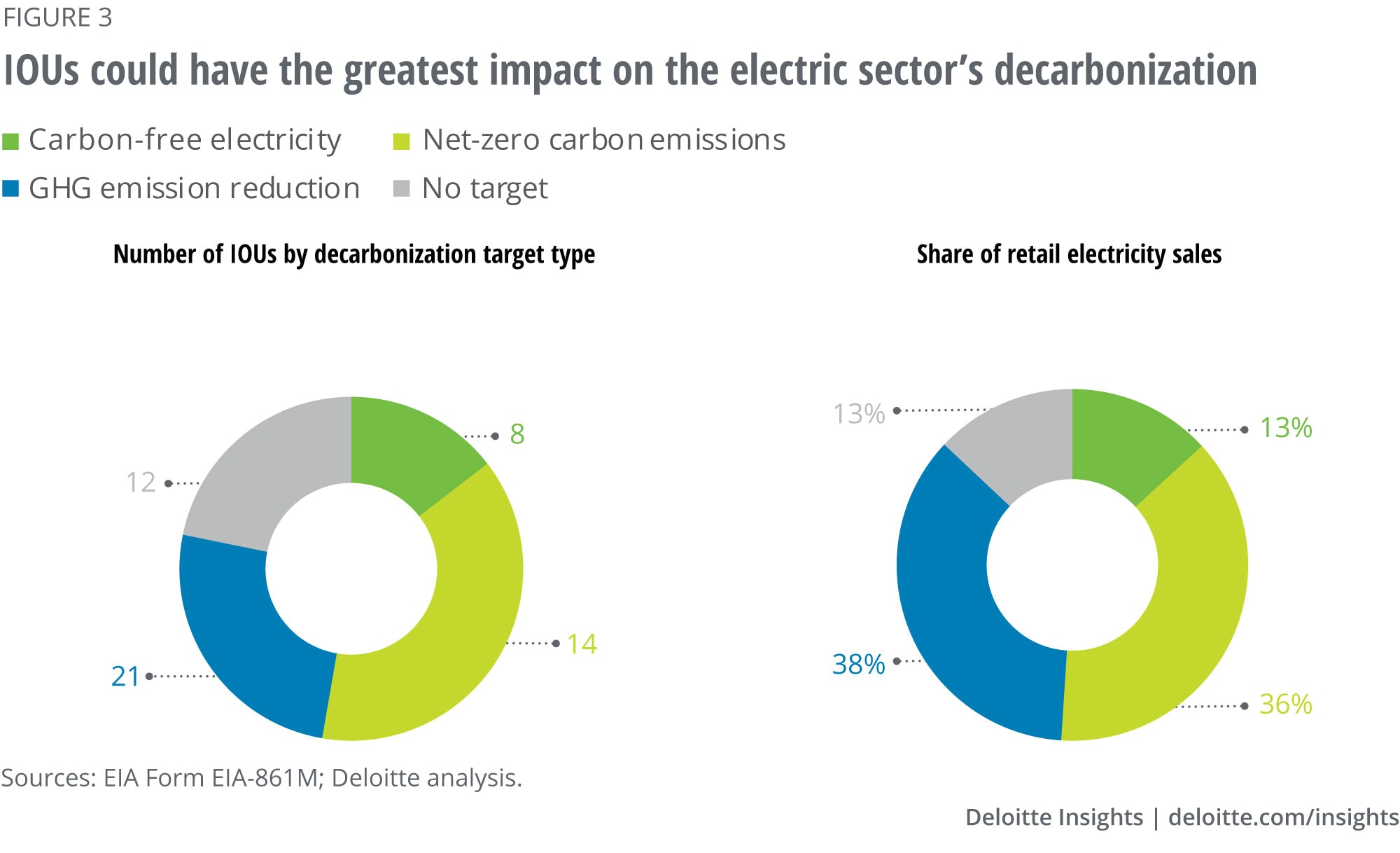

Investor-owned utilities (IOUs) are expected to have the greatest impact on driving a full transition as they account for most electricity sales and serve three out of four electric customers.5 As for their emissions reduction targets, of 55 parent IOUs operating in the United States, a majority (43) have emissions reduction targets and 22 have net-zero or carbon-free electricity goals (figure 3).6

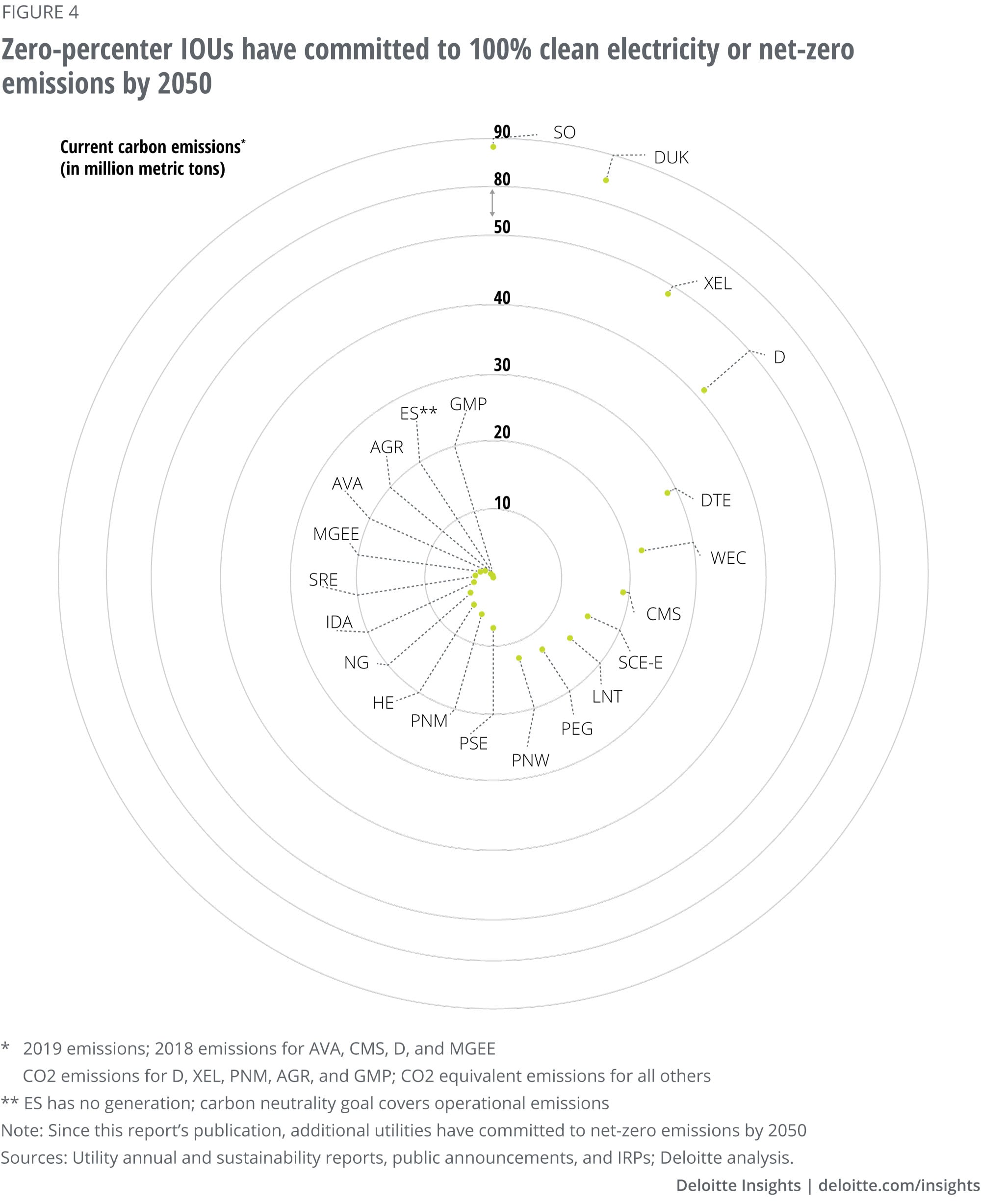

In addition to the pressure from states and customers with clean energy targets that affect all utilities, IOUs also face shareholder activism. Some major investor groups, such as Climate Action 100+, are pushing IOUs to commit to ambitious greenhouse gas reduction targets as a fiduciary duty. In February 2019, a Majority Action campaign with a US$1.8 trillion investor coalition kicked off by calling on the 20 largest publicly traded utilities to commit to full decarbonization.7 Only a couple had voluntarily made such a commitment at the time. Since then, a growing number of IOUs have committed to 100% clean electricity or net-zero emissions by 2050, if not earlier (figure 4). We will refer to this group as the “zero percenters” in this report.

Sections

A utility decarbonization framework: Renew. Reshape. Refuel.

Three cross-cutting trends: Fossil fuel fade, solar and wind sweep, and infrastructural innovation

Three trends have already started shaping utilities’ decarbonization opportunities.

First, a fossil fuel fade is underway, as all fossil fuel emissions will need to be phased out if the power sector is to completely decarbonize, allowing utilities to reach their stated goal of net-zero emissions by 2050.

Second, a solar and wind sweep is rapidly increasing the share of variable renewable resources on the grid. Looking back, renewables’ share of US generating capacity has already risen from 12.8% to 23.1% over the past decade. And looking forward, wind and solar are on course to account for more than three quarters of planned US electric generating capacity additions this year.8

Third, infrastructural innovation is helping to enhance the electric and gas system’s ability to support decarbonization. Specifically, additional flexibility will be needed to integrate the growth in intermittent resources, distributed energy resources (DER), and new fuels.

Value-creating strategies to capitalize on the three trends: Renew supply, reshape demand, and refuel end uses

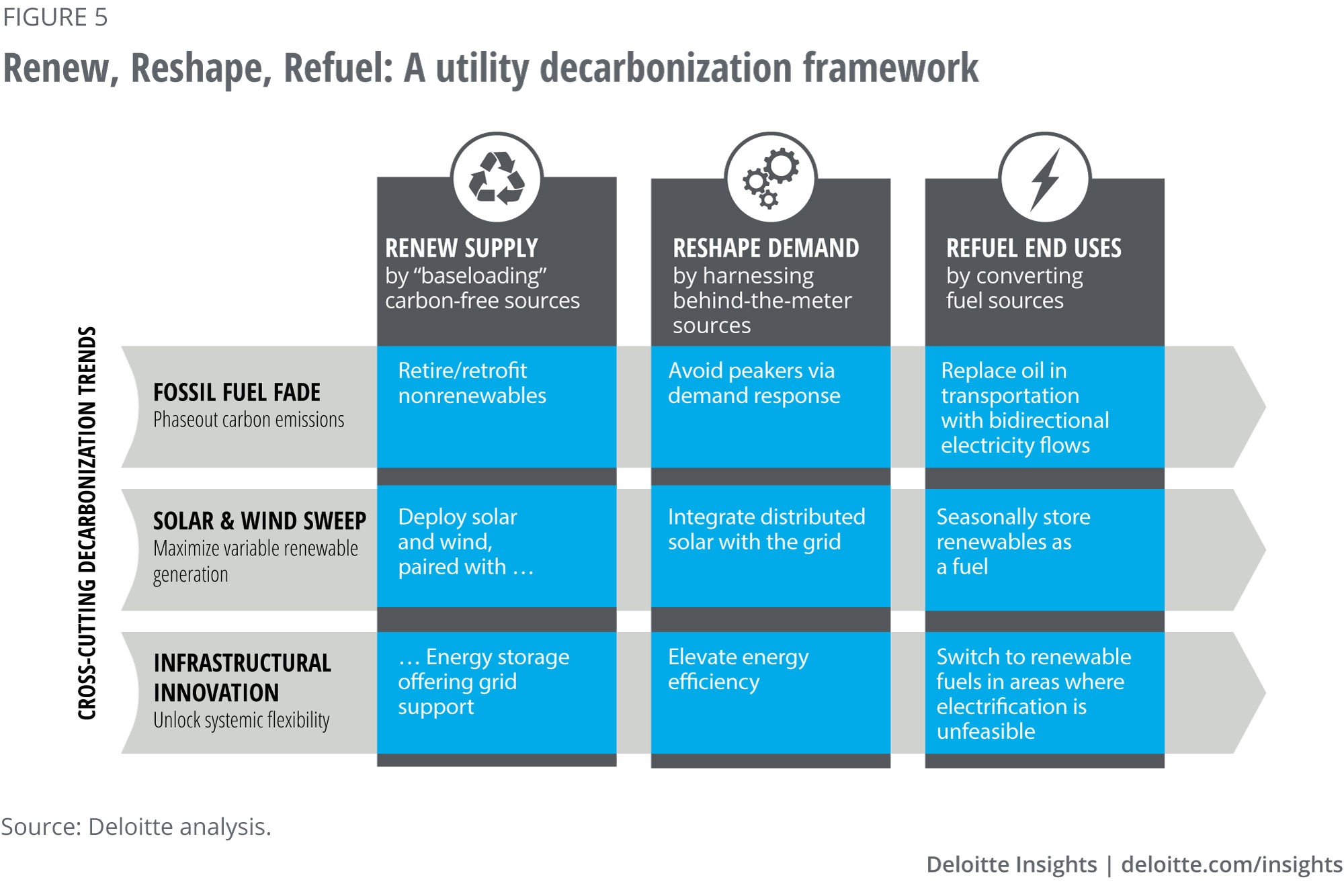

Deloitte has developed a utility decarbonization framework encompassing the aforementioned trends and three strategies that utility companies can pursue to fully decarbonize (figure 5).

Renew supply by “baseloading” carbon-free sources

Fossil fuel fade: Renewal can first be characterized in the negative—it means retiring or converting nonrenewable plants and capturing or mitigating the emissions from any remaining or additional fossil-fueled plants.

Solar and wind sweep: Retirements can pave the way for the continued record deployment of utility-scale solar and wind, as fuel-free, carbon-free, lowest-cost energy sources.

Infrastructural innovation: The influx of intermittent renewables can require the deployment of storage on the grid to provide greater system flexibility.

Reshape demand by harnessing behind-the-meter sources

Fossil fuel fade: Demand response (DR) can be used to avoid carbon electrons from fossil-fuel peakers by shaving and shifting demand.

Solar and wind sweep: DER, such as rooftop solar, can reduce demand while providing utilities with a new source of carbon-free electrons if they are connected to the grid.

Infrastructural innovation: Utility-driven energy efficiency measures can further complement the flexibility provided by DR and DER by avoiding the production of any superfluous electrons. Combining the three can yield a non-wire alternative to building power plants.

Refuel end uses by converting fuel sources

Fossil fuel fade: Electricity could eventually need to replace most of the oil and natural gas in fueling the transportation, heating, and industrial sectors in order to achieve systemwide decarbonization.

Solar and wind sweep: Maximizing the use of renewables at high levels of penetration while minimizing wasteful overbuild and curtailment would require their seasonal storage via conversion to hydrogen or thermal fuels.

Infrastructural innovation: In areas that will be most difficult to electrify, it may be more cost effective to convert the infrastructure to carbon-free fuel instead.

Assessing and addressing the gaps across the framework

The COVID-19 catalyst

While the pandemic has affected utilities’ loads, operations, and costs, it does not appear to have affected the decarbonization goals of either utilities, states, or corporations, many of which have continued to announce 100% goals amidst the pandemic. Consumers also continue to steadfastly support renewables. Not just that, the COVID-19 pandemic has even catalyzed the clean energy transition in some ways, demonstrating the grid’s ability to operate with unprecedently high shares of renewables, and providing a vehicle for green infrastructure investment stimulus.

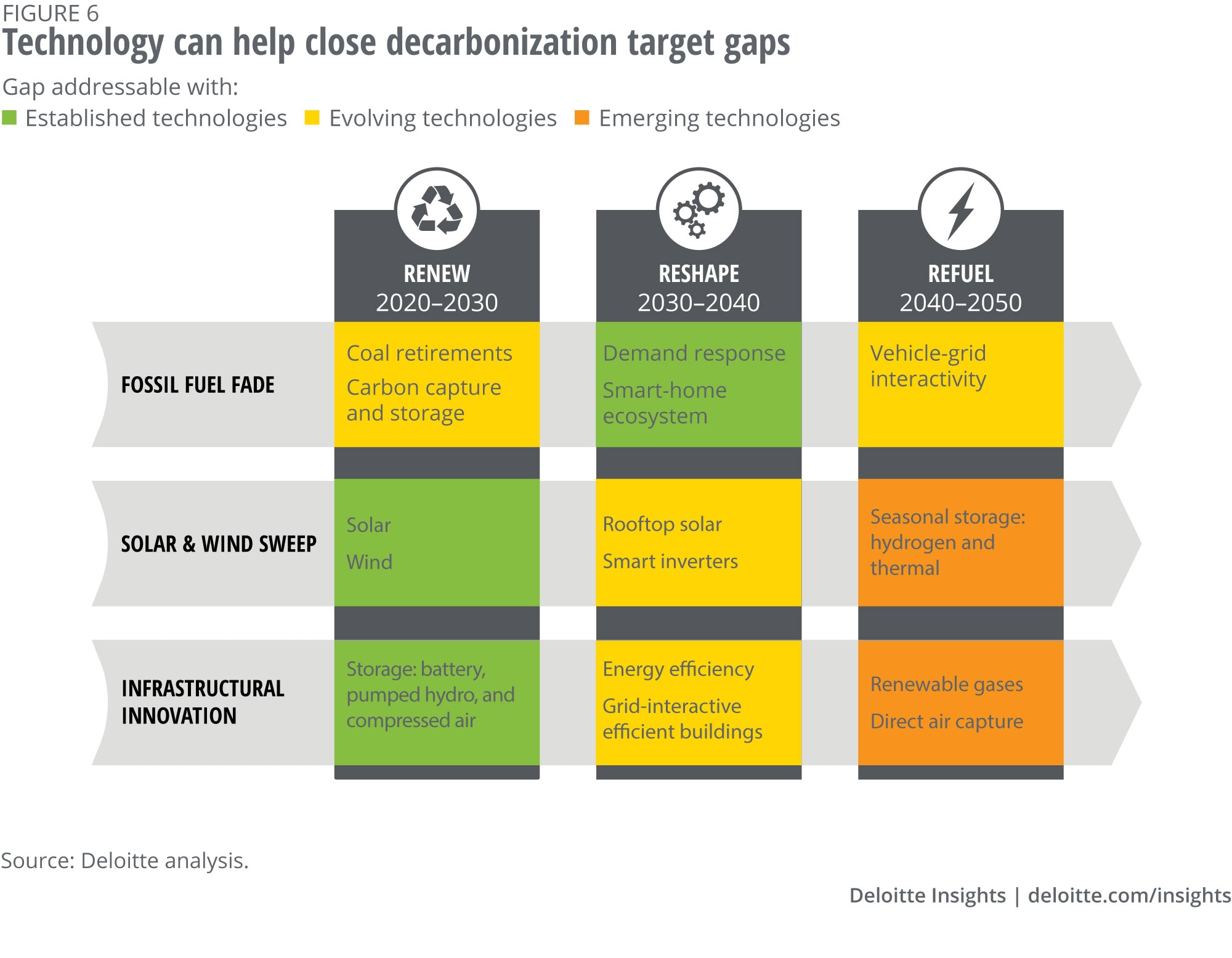

Mind the gap

The zero percenters’ current levels of carbon abatement fall short of their potential in the nine action areas lying at the intersections of the three trends and proposed strategies to renew, reshape, and refuel (figure 6). There are significant gaps between decarbonization targets and the scheduled fossil-fuel plant retirements, renewable additions, and flexibility requirements needed to achieve full decarbonization. The math doesn’t yet add up.

Close the gap

Established, evolving, and emerging technologies could be critical to closing these gaps (figure 6). The Renew strategy will mostly be deployable over the next decade since established technologies exist to address the gap. Many technologies are still evolving but can be expected to play a greater role in enabling decarbonization in the Reshape strategy, in the 2030–2040 time frame. Finally, technologies to close the Refuel strategy’s gaps are still emerging, but likely to make all the difference in meeting 2050 targets in the final decarbonization decade.

Utility executives may reevaluate the pace of their plans as these technologies commercialize. Indeed, more than half of the power and utility respondents (55%) in our energy transition study (see sidebar, “The energy transition study”) cited technological innovation as a key factor that would be most likely to make them change their goals, or set goals if they do not have any yet.

Price the gap

A slightly higher majority of power and utility survey respondents (58%) selected incremental costs or savings as a factor that would be most likely to make them change or set goals. Clearly, the cost of carbon abatement technologies could heavily shape the prospects for their deployment over the immediate term, midterm, and net-zero term. Deloitte calculated the carbon abatement values of these technologies by comparing the differences in their energy costs and emissions versus coal for the equivalent amount of electricity generated.9 These values vary dramatically across technologies, ranging from net savings vis-à-vis coal for the five most cost-effective technologies (energy efficiency, utility solar photovoltaic [PV], onshore wind, and the latter two paired with storage) to costs in hundreds of dollars per ton of CO2 for some evolving and all emerging technologies identified in this report (figure 7). While emerging technologies currently have the highest abatement costs, they also have some runway for significant cost decreases by 2040, when their deployment could be most critical to decarbonization.

Sections

Utility decarbonization strategy I: Renew supply by baseloading intermittent resources (2020–2030)

Fossil fuel fade: Retire or retrofit nonrenewables

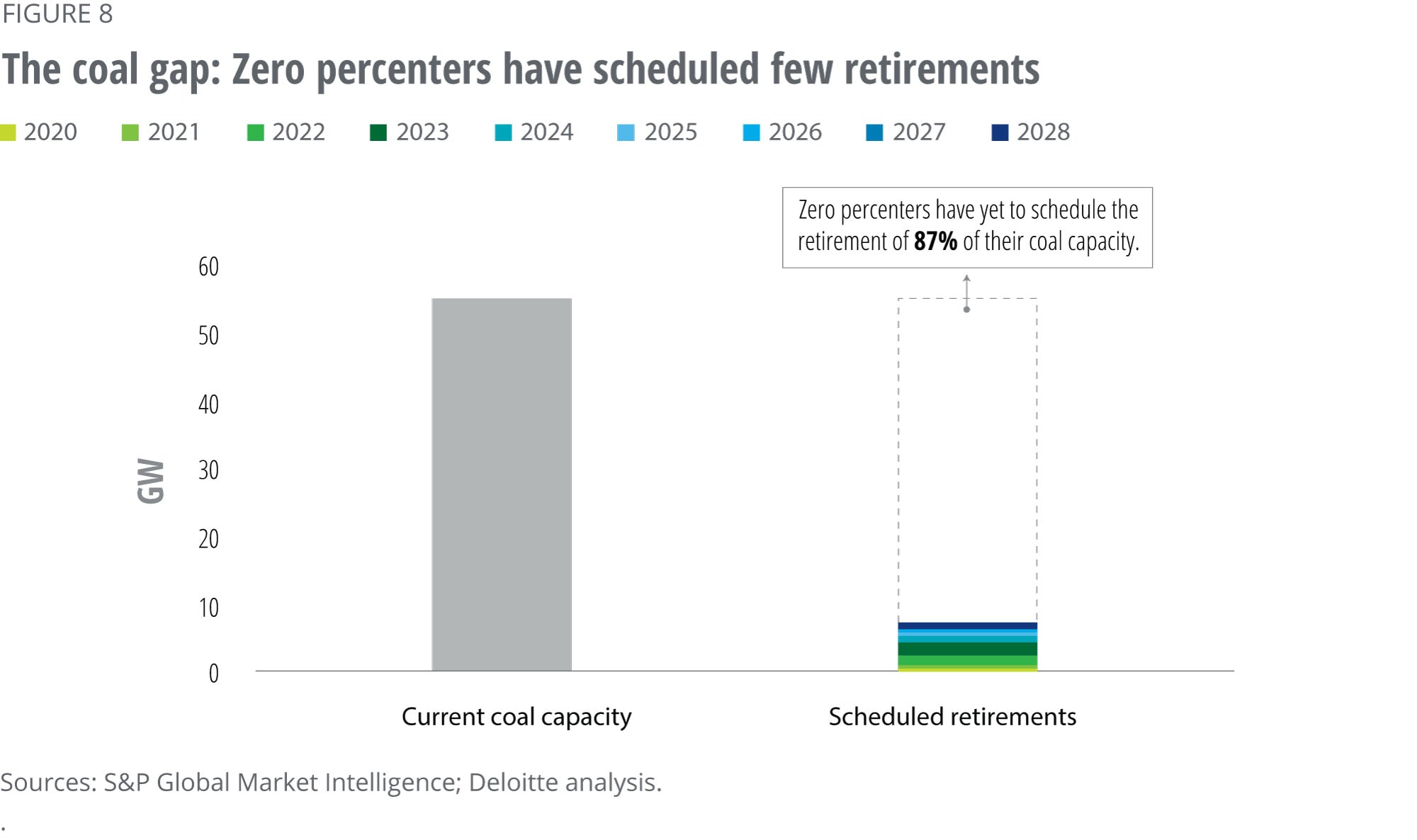

The coal retirement gap

Coal retirements are the low-hanging fruit for decarbonization as the rationale for this solution is primarily cost competitiveness. According to a recent Rocky Mountain Institute (RMI) study, 79% of the US coal fleet is uncompetitive, costing customers US$10 billion annually.10 Customers bear the costs of self-commitment rules that allow utilities to dispatch and recover the fuel costs of uneconomic coal plants even when they could procure lower-cost electricity from the wholesale market.11 Despite this support, coal plant capacity factors have dropped from 74% to 54% over the past decade, challenging their status as baseload power.12 Coal’s prospects are dimming from an investor’s perspective too, as a growing number of financial institutions and insurers are announcing they will no longer finance, invest, or insure utilities with shares of coal generation above 30%.13 Finally, coal plants face mounting maintenance, compliance, cleanup, and legal costs related to fighting challenges to their operations. Retrofits could help abate coal emissions, but investments in uneconomic coal plants might be considered imprudent by state public utility commissions and therefore ineligible for cost recovery by regulated utilities.

Yet not all the zero percenters have committed to a timeline for retiring all their coal capacity. While they have to various extents announced plans to eventually retire it, there is a large gap between current coal capacity and scheduled retirements over the next eight years (figure 8).

Coal retirement is a decarbonization solution that does not require technology, but rather financing solutions that regulators can enable. Where the fuel costs of running existing coal plants exceed the cost of building new renewable capacity, utilities can pursue Xcel’s pioneering “Steel for Fuel” approach. It offsets the capital costs of building renewables with the fuel savings from accelerating the depreciation and retirement of uneconomic coal plants, benefitting the bottom line of utilities, shareholders, and customers.14 In other cases, utilities could refinance their plants via securitization by issuing ratepayer-backed bonds to cover undepreciated coal plant balances. This would free up low-cost capital to reinvest in capital-intensive replacements that could grow regulated utilities’ rate base and earnings, while also securing funds to help coal communities transition. Securitization is already legislatively authorized in around half of US states.15

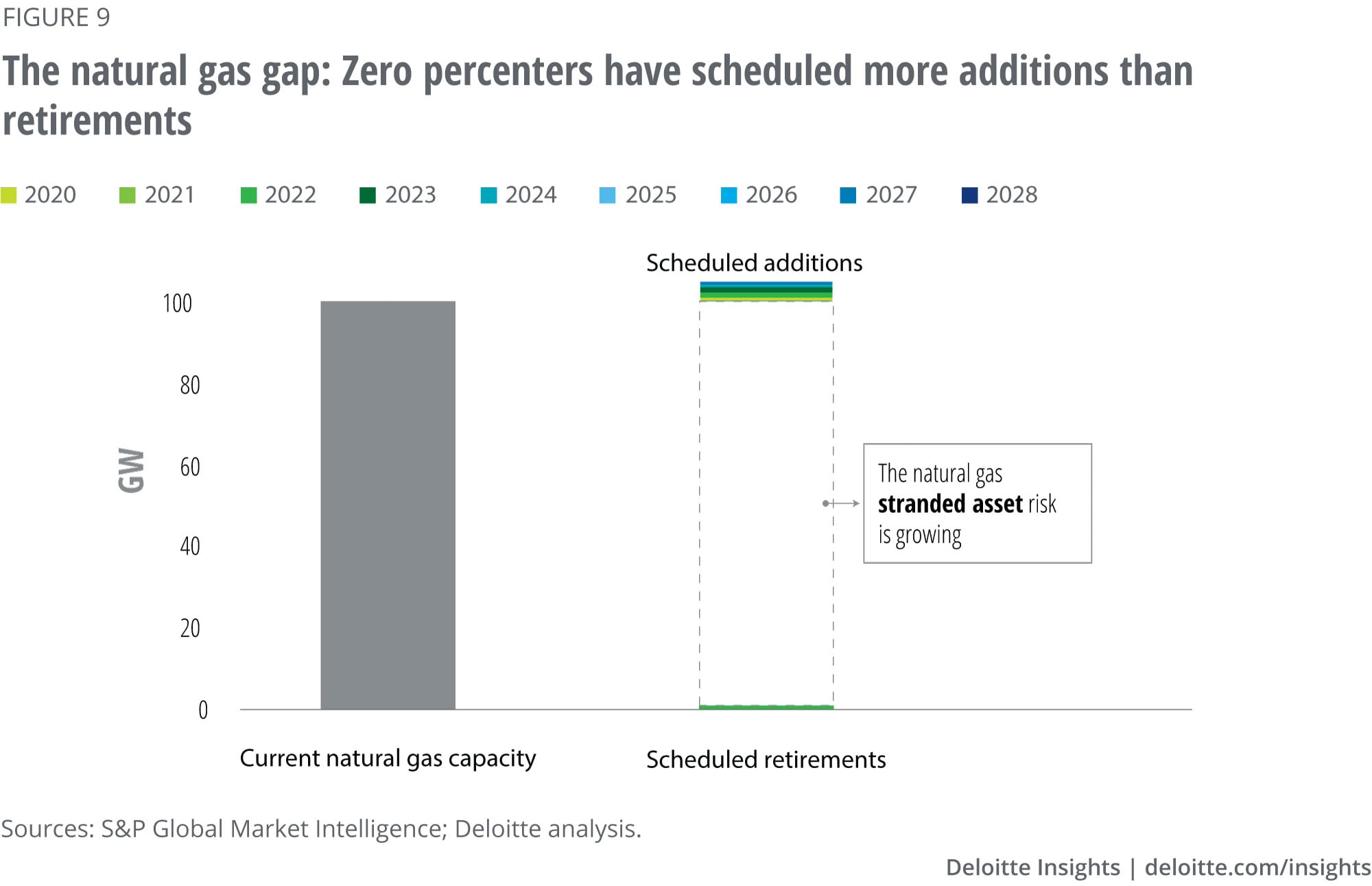

The natural gas retrofit gap

Natural gas plant construction is booming to fill the gap left by current and anticipated coal retirements, having already replaced most of the retired coal to date. However, the emissions from these plants will also need to be eliminated or offset to reach decarbonization goals. Gas accounts for most of the undepreciated value of US fossil fuel capacity, 80% of which will reach depreciation maturity by 2035, assuming a typical 30-year schedule.16 Asset life may not allow full depreciation for the US$70 billion worth of natural gas generation planned over the next few years.17 Facing supply-side competition from renewables and demand-side pushback as a growing number of cities consider bans on new natural gas hookups, gas plants risk becoming stranded assets.

Some utilities and state utility commissions see the writing on the wall, as did the 30% of our power and utility survey respondents who stated that stranded assets were a barrier restricting the development of a low-carbon strategy. Could natural gas be the next coal? Already, state lawmakers and utility commissions are pushing utilities to revise submitted integrated resource plans because they are too reliant on natural gas. This was recently the case in Virginia and New Mexico, where utilities’ revised plans replaced significant planned natural gas capacity with a combination of renewables and storage. The levelized cost of energy (LCOE) range for solar is already lower than that of natural gas peakers, as is the LCOE range for wind vis-à-vis combined cycle gas turbine (CCGT) plants. Of course, cost is not the only relevant comparison factor since natural gas plants are dispatchable, enhancing their current value. But even a comparison of their value-to-cost ratios using the levelized avoided cost of electricity (LACE) shows higher values for wind and solar than for natural gas for new generation entering service (see sidebar, “LCOE, LACE, and value-cost ratio”).18 Fuel price risk must also be priced in and safety protocols may be costlier than for renewable sources.

LCOE, LACE, and value-cost ratio

The LCOE is a measure of the cost of generation resources, while the LACE is a measure of their value. The value-cost ratio provides the net economic value of a generation resource. The EIA uses this ratio to provide more of an apples-to-apples comparison between dispatchable and nondispatchable energy resources.19

Despite these headwinds the zero percenters have scheduled additions but barely any retirements of natural gas, which accounts for significantly more of their generation capacity than coal (figure 9).

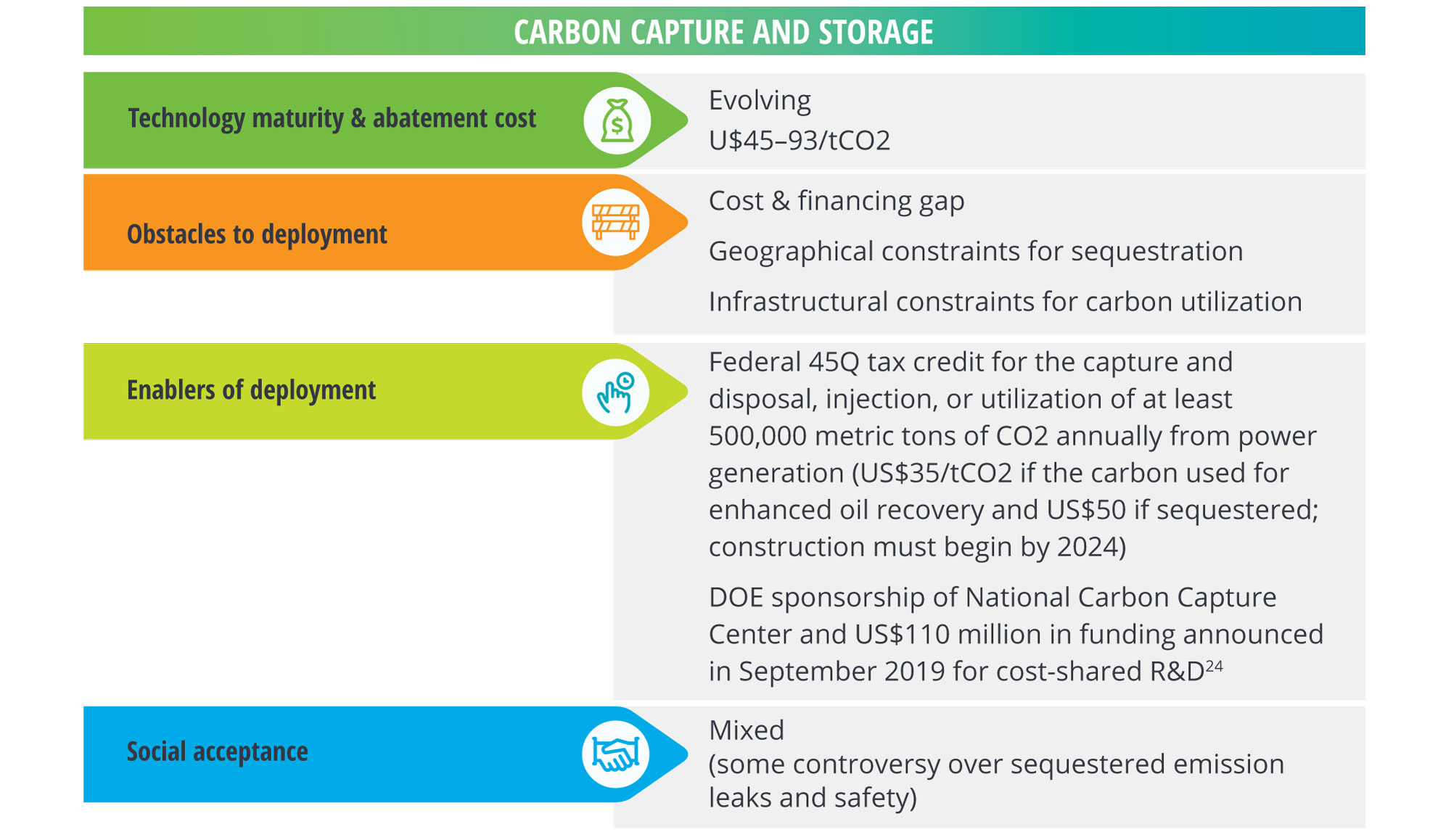

Evolving carbon reduction technologies, such as carbon capture and storage (CCS), could play a role here, but at considerable cost. CCS was the top pick among measures that surveyed power and utility executives believe will enable a low-carbon future strategy (34.8%). However, past test projects have not met cost goals, and despite the recently implemented 45Q tax credit to incentivize CCS, a significant financing gap remains for the cost-effective deployment of CCS.20 The country’s only commercially operational CCS project attached to a coal plant was mothballed at the end of July 2020 after falling short on CO2 capture, enhanced oil recovery, and economic viability targets.21 Furthermore, CCS technology cannot fully abate emissions (the current potential is up to 90%) and does not address methane leaks (see sidebar, “Offshore wind wind has an overall low-emission profile”).22 Finally, the infrastructure for utilities to sell and transport carbon for utilization in other industries is undeveloped, closing off a potential source of revenue that could help offset CCS costs. Zero percenter Southern Company, which plans to retain natural gas in its energy mix through 2050, announced in May 2020 that its National Carbon Capture Center, run in partnership with the Department of Energy (DOE), will expand its research and development focus to carbon utilization.23

The country’s only commercially operational CCS project attached to a coal plant was mothballed at the end of July 2020 after falling short on CO2 capture, enhanced oil recovery, and economic viability targets.

The role of nuclear and hydropower

Nuclear power is a carbon-free source of generation that is likely to continue operating throughout utilities’ decarbonization timeframes. Many of the zero percenters with nuclear capacity plan to request additional extensions for their nuclear plants scheduled for retirement. But nuclear power is also increasingly uncompetitive vis-à-vis natural gas and renewables, and new builds are unlikely due to high cost, long development timeframes, controversy over radioactive waste, and risks of accident. Keeping nuclear in service may require subsidization and/or policy support, such as the zero-emissions credits offered in New York and Illinois. Hydroelectric power is expected to continue as an important cost-effective source of low-carbon baseload power, but major new build is unlikely as few sites remain that could be economically developed without significant environmental impact and social opposition.25

Solar and wind sweep: Deploy wind and solar, increasingly offshore and paired with storage

Solar and wind power have become the preferred energy resources to replace coal. Power and utility executives responding to our energy transition survey stated that cleaner energy sources and fuels including renewables are one of the leading enablers of their clean energy strategy. The majority of respondents (55%) have committed to providing more electricity sourced from renewables for their customers. Respondents claimed to be doing so due to pressure from environmental organizations (53%); consumer organizations (47%); distribution utilities, and commercial and industrial customers (tied at 42%); and regulators (40%). And the top three groups that respondents indicated power and utility organizations have partnered or cooperated with to provide renewable/clean energy are environmental organizations (59%), large commercial customers (53%), and renewables developers (49%).

Not only have renewables become the lowest-cost source of new generation in many areas on an unsubsidized basis, but their deployment is also propelled by customer demand and state renewable portfolio standards that set renewable generation targets. A Berkeley study modeled the technical and economic feasibility, by 2035, of achieving 70% wind and solar (and 90% carbon-free) generation combined with storage, existing hydro and nuclear, and no new natural gas.26 To achieve this, solar and wind resources paired with storage would need to be deployed at a much faster pace. Without other decarbonization solutions, they would also need to be able to meet three to eight times peak demand to ensure adequate generation when sun and wind resource availability is lowest (figure 10).27 Co-locating solar and wind plants in hybrid deployments can also increase capacity factors. Another tactic is connecting more wind and/or solar resources across a larger geographic area through transmission lines.

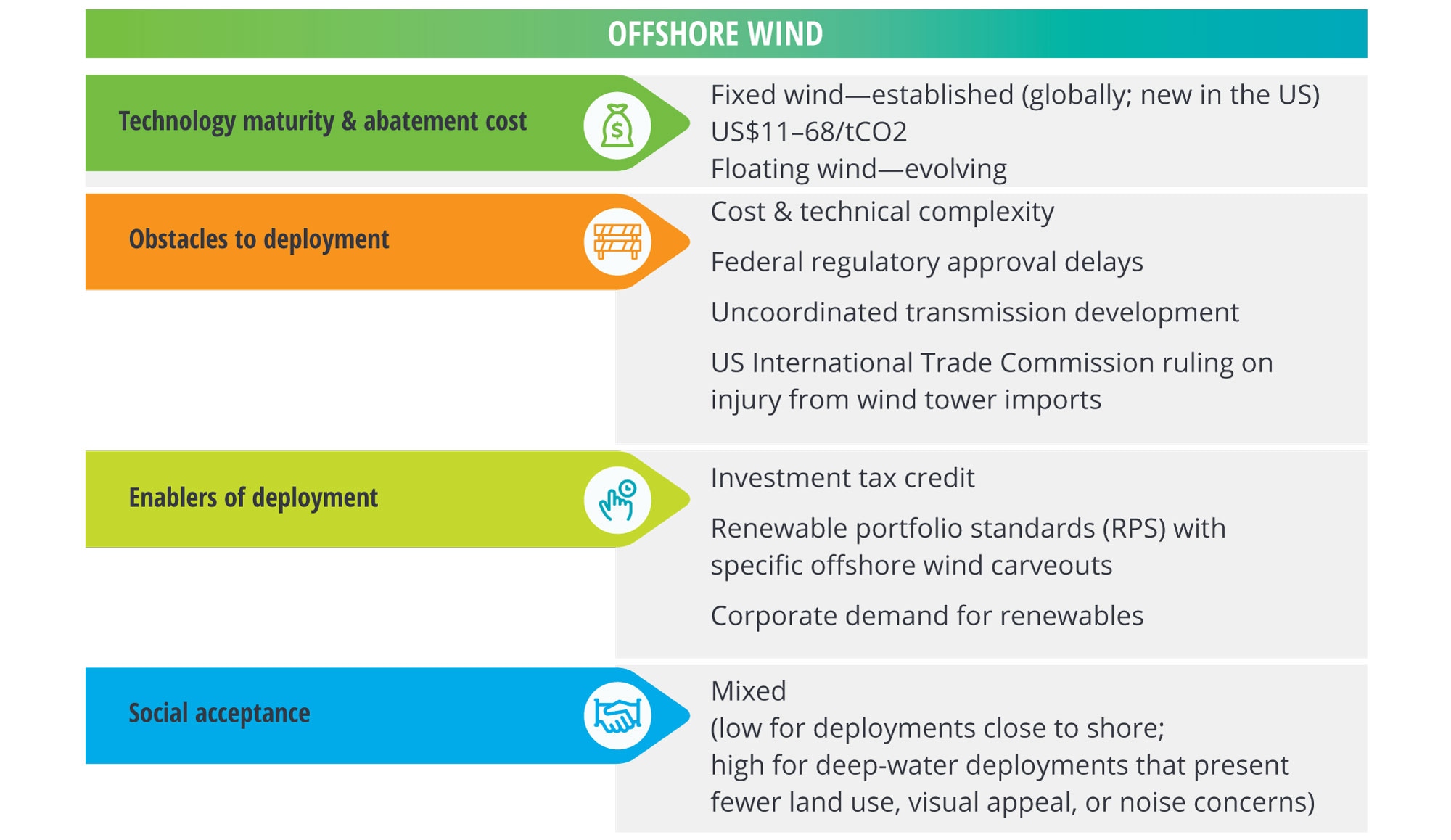

Offshore wind is most advantageous in meeting this goal since it has a relatively high and rising capacity factor and deployment potential. The evolution of wind technology is toward taller and larger turbines, and a key evolving technology—floating wind—could enable deployment in deeper water, opening the entire US coast, in proximity to the bulk of electric demand. The DOE and US Department of Interior have estimated the US offshore wind potential to be double the country’s total electric demand.28 While the carbon abatement cost of offshore wind is currently much higher than that of onshore wind and solar PV, its cost curve is rapidly falling: offshore wind has seen a 67% LCOE reduction since 2012, and notwithstanding pandemic-related decreases in solar PV and onshore wind investment, offshore wind attracted a global record US$35 billion in investment in the first half of this year.29 Wood Mackenzie’s midrange forecast for offshore wind is 25GW by the end of the decade, when offshore wind is also projected to overtake onshore wind deployments.30

While solar and wind installations are growing, total capacity additions may need to surpass total existing electric generating capacity to make up for the coal share that needs to be replaced, as well as planned and retiring natural gas.31 Wind and solar also require solutions such as pairing with storage or deploying dispatchable DR to match the reliability of gas and coal-fired plants.

Offshore wind has an overall low-emission profile32

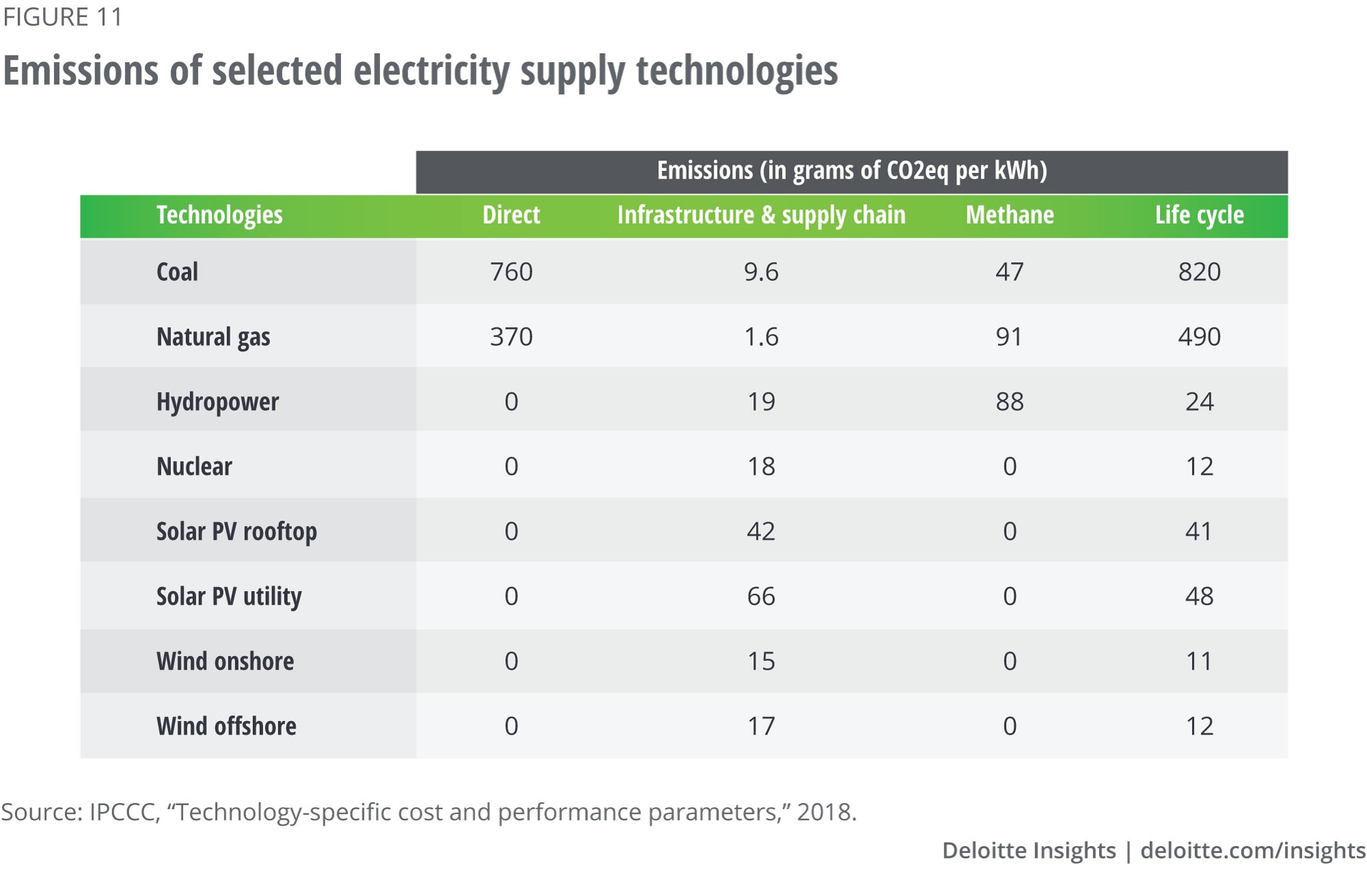

Another advantage of offshore wind is its low-emission profile beyond direct emissions. While this report only covers direct emissions when calculating carbon abatement costs, it is worth noting there are other types of emissions related to various energy sources, including infrastructure and supply chain emissions, which are highest for utility solar PV, and methane emissions, which are most significant for natural gas and hydropower (figure 11).

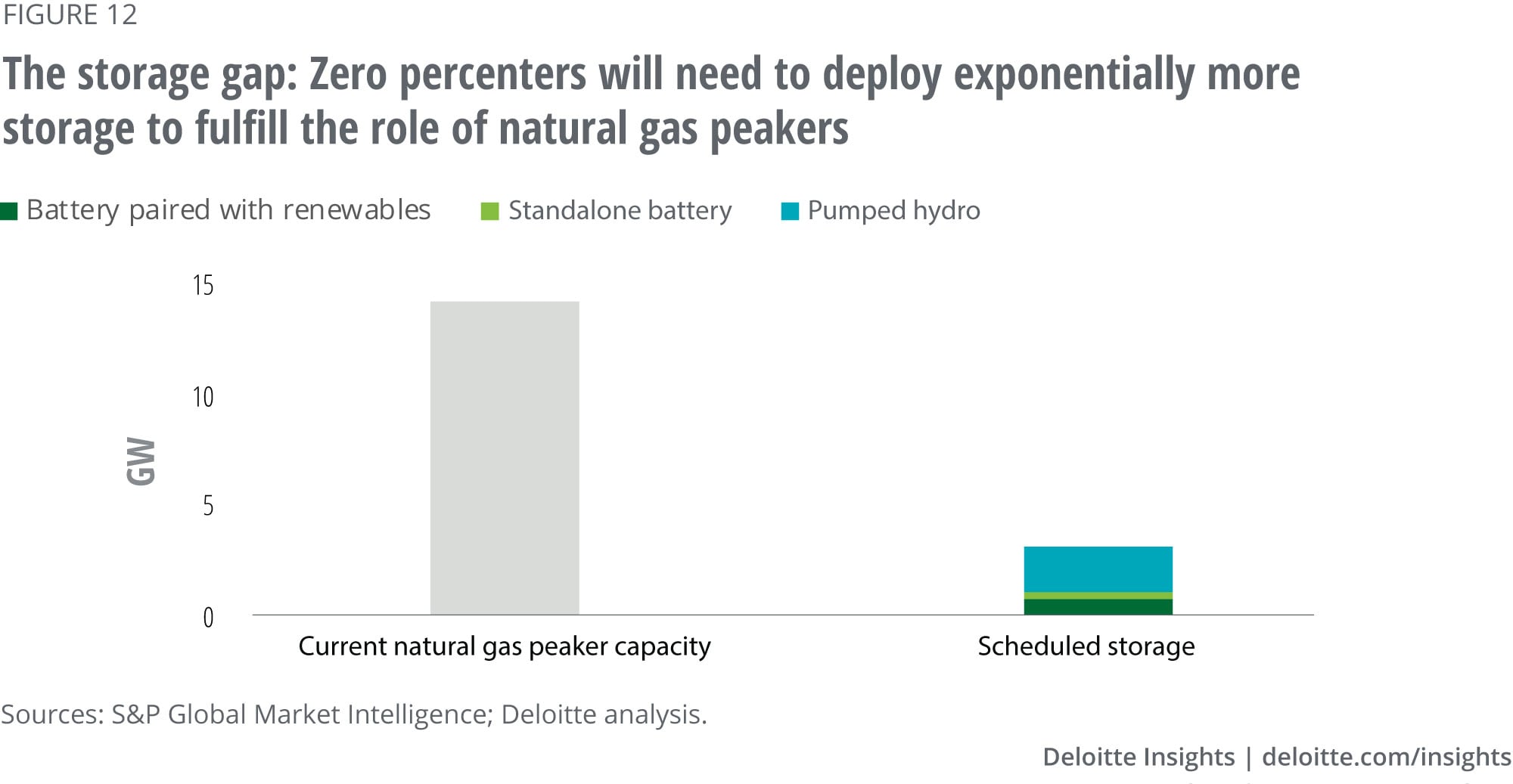

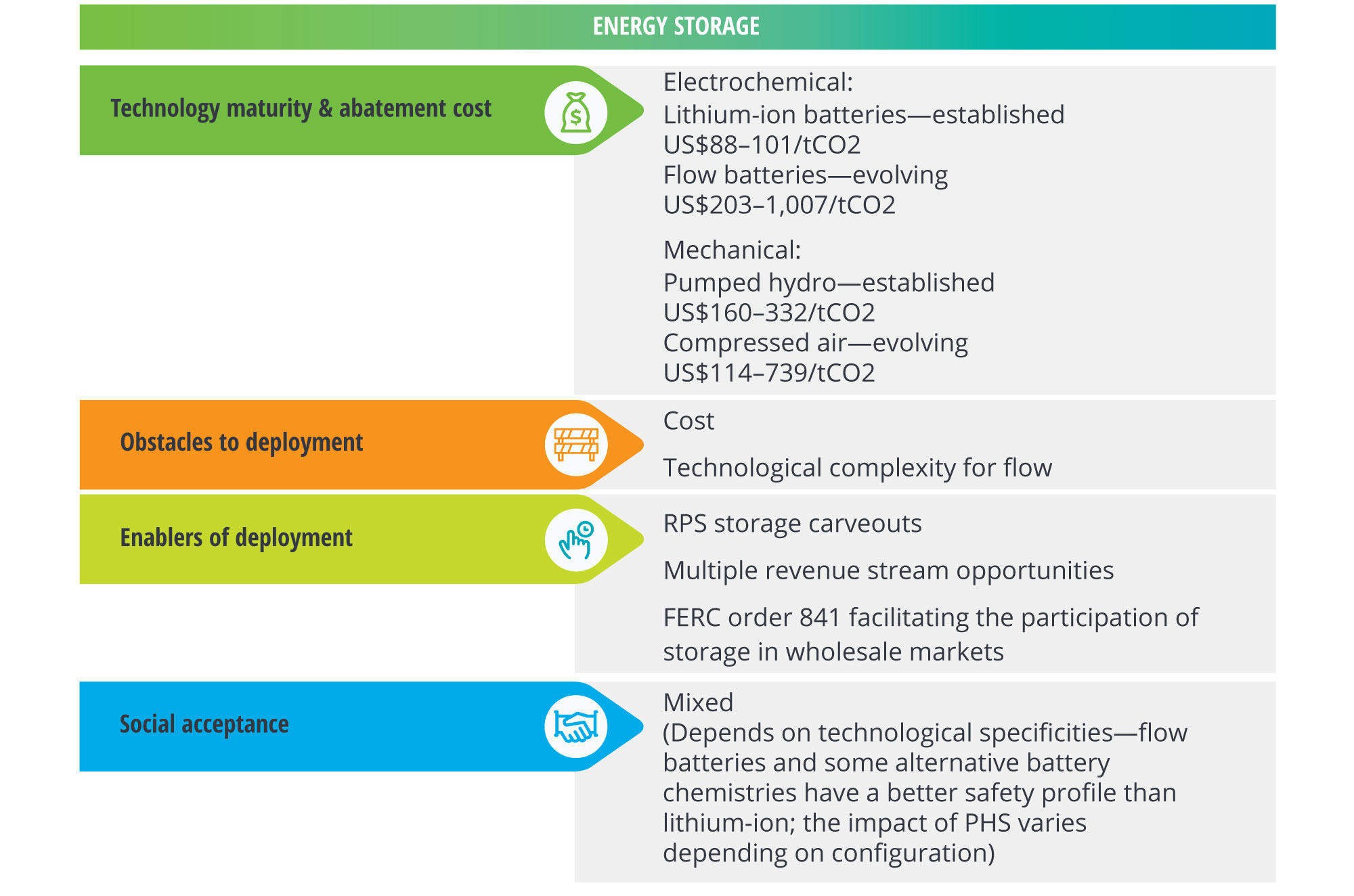

Infrastructural innovation: Energy storage to support grid

The surge of renewables on the grid will require energy storage to enhance system flexibility. If energy storage were to fill the gap for natural gas peakers, capacity would need to grow exponentially (figure 12). Even total nationwide installed battery storage—899 MW—is a small fraction of the total capacity that the zero percenters would need to deploy.

Zero percenters’ planned energy storage deployments are dominated by electrochemical lithium-ion battery technology and mechanical pumped hydro storage (PHS)—two technologies that are in many ways at opposite ends of the spectrum of established energy storage options. The dynamic lithium-ion battery technology can competitively provide four-hour storage almost anywhere and is experiencing rapidly falling costs, increasing density, and other material and chemical advances. Meanwhile, PHS is a longstanding but geographically constrained technology with higher, stable costs that has recently seen an uptick in deployments as it can provide longer duration storage (even up to seasonally, although capacity constraints will most likely limit its role to the grid-supporting shorter duration storage explored here—see section, “Solar and wind sweep: Seasonally store renewables as a fuel” for a discussion of seasonal storage options). In between these two types of energy storage technologies are a host of evolving mechanical and battery storage technologies offering hourly, intraday, interday, and even weekly storage, and supporting the grid in different ways.

While lithium-ion battery technologies excel at primary response (frequency regulation and control), energy arbitrage, and peaker replacement, flow batteries are more competitive for durations above six hours, and more highly suitable for secondary response (following, spinning and nonspinning reserves, and renewables integration) and distribution and transmission deferral.33 Opening additional revenue streams across these use cases could help accelerate the deployment of storage on the grid. These new revenue opportunities include DR, bringing us to the next strategy.

Sections

Utility decarbonization strategy II: Reshape demand by harnessing behind-the-meter resources (2030–2040)

Fossil fuel fade: Avoid peakers via DR

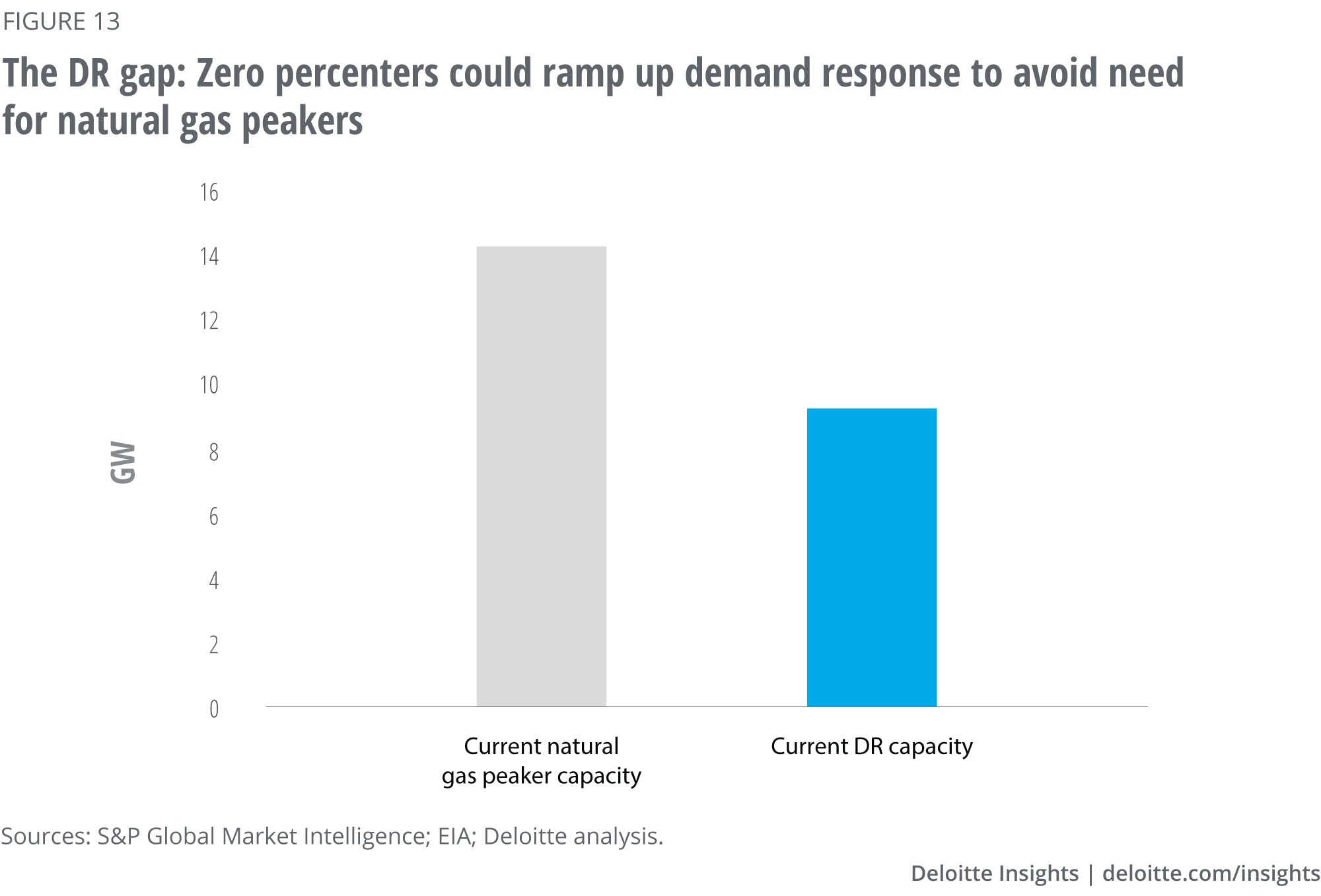

Another way to address the gap in meeting fossil-fueled peak capacity is to reduce it. DR turns power demand into a behind-the-meter energy source that can be automatically dispatched when the utility has direct control, or voluntarily dispatched by customers. However, to meet current natural gas peaker capacity, the zero percenters would need to more than double their current DR capacity (figure 13).

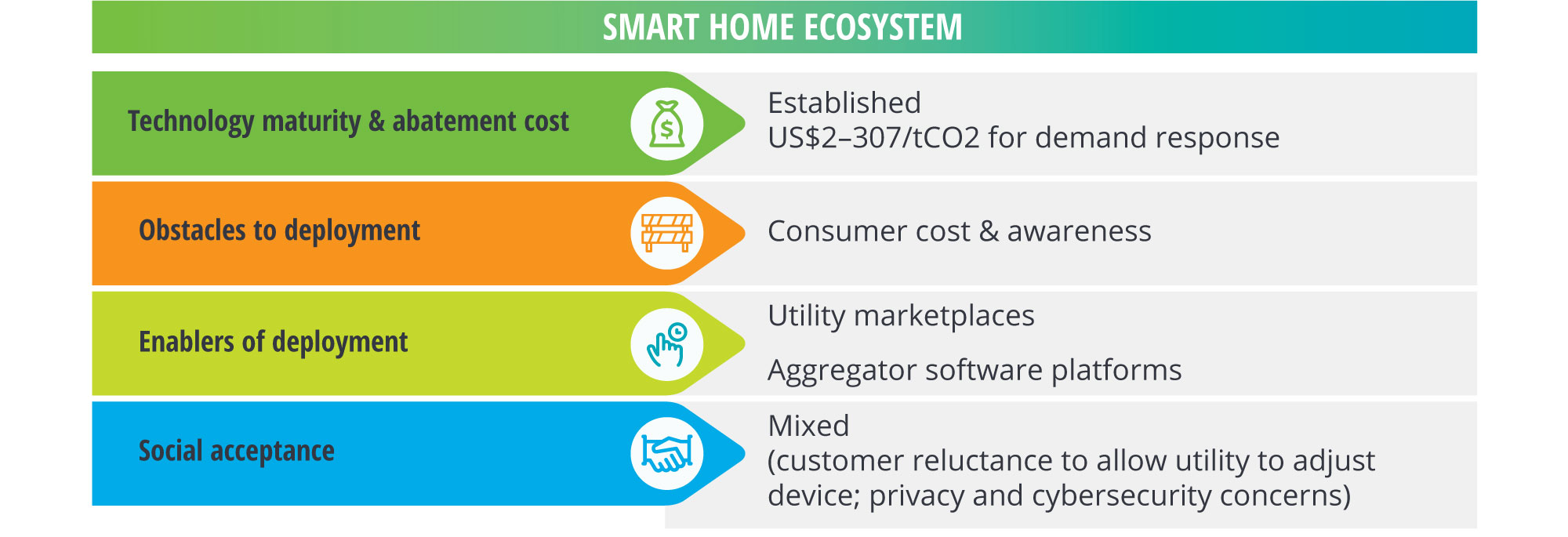

While commercial and industrial customers currently account for the bulk of DR participation, automated smart home technologies predicated on customer engagement form the greatest potential growth area for DR programs. Smart thermostats are an established anchor technology of the smart home ecosystem, but they are currently deployed in only 13% of broadband households, leaving significant room for growth. Other smart home ecosystem technologies that can be harnessed for DR include smart water heaters, behavioral DR programs, and electric vehicle (EV) charging. These technologies can be further enabled by time-of-use rates and other forms of dynamic pricing.

DR can also be inverted to avoid the curtailment of renewables by shifting demand to times of excess renewable generation from wind, utility, solar PV, and distributed solar.

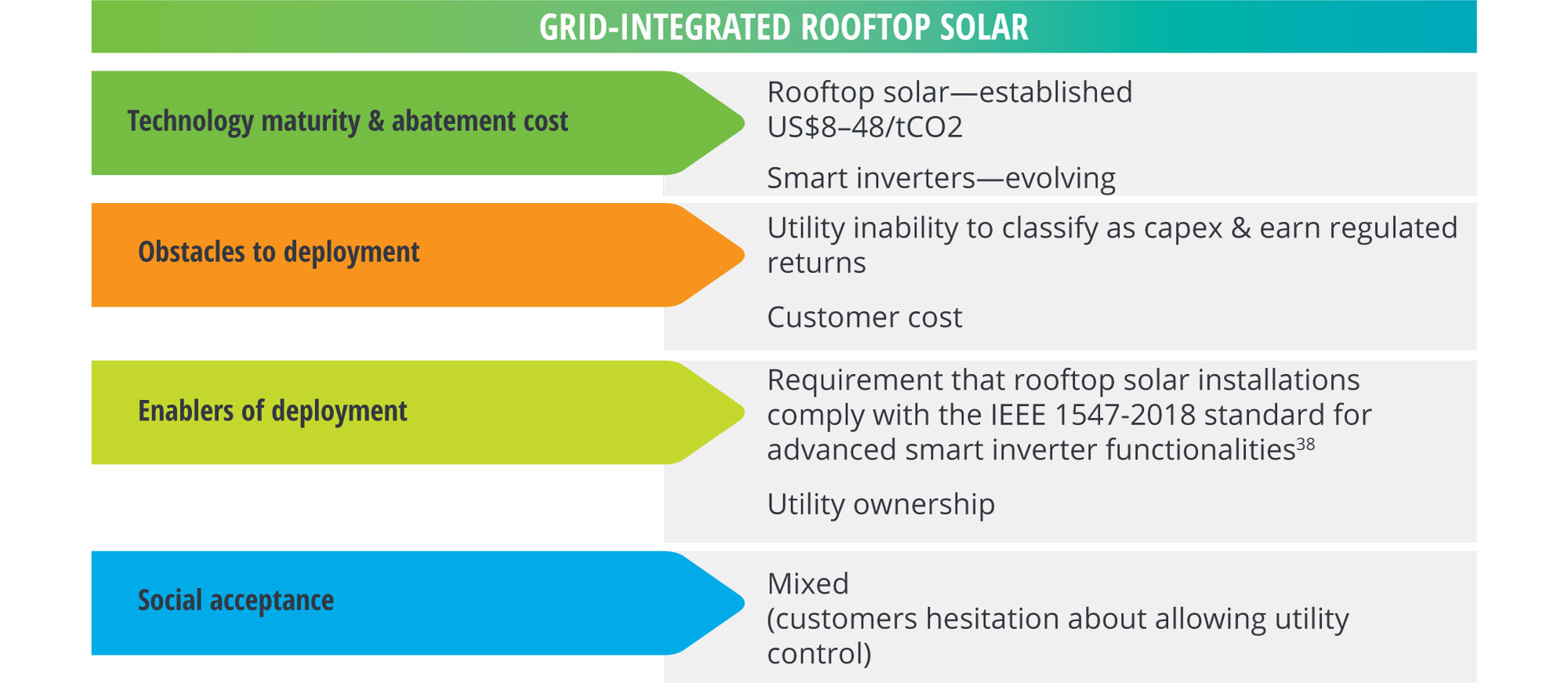

Solar and wind sweep: Integrate distributed solar with the grid

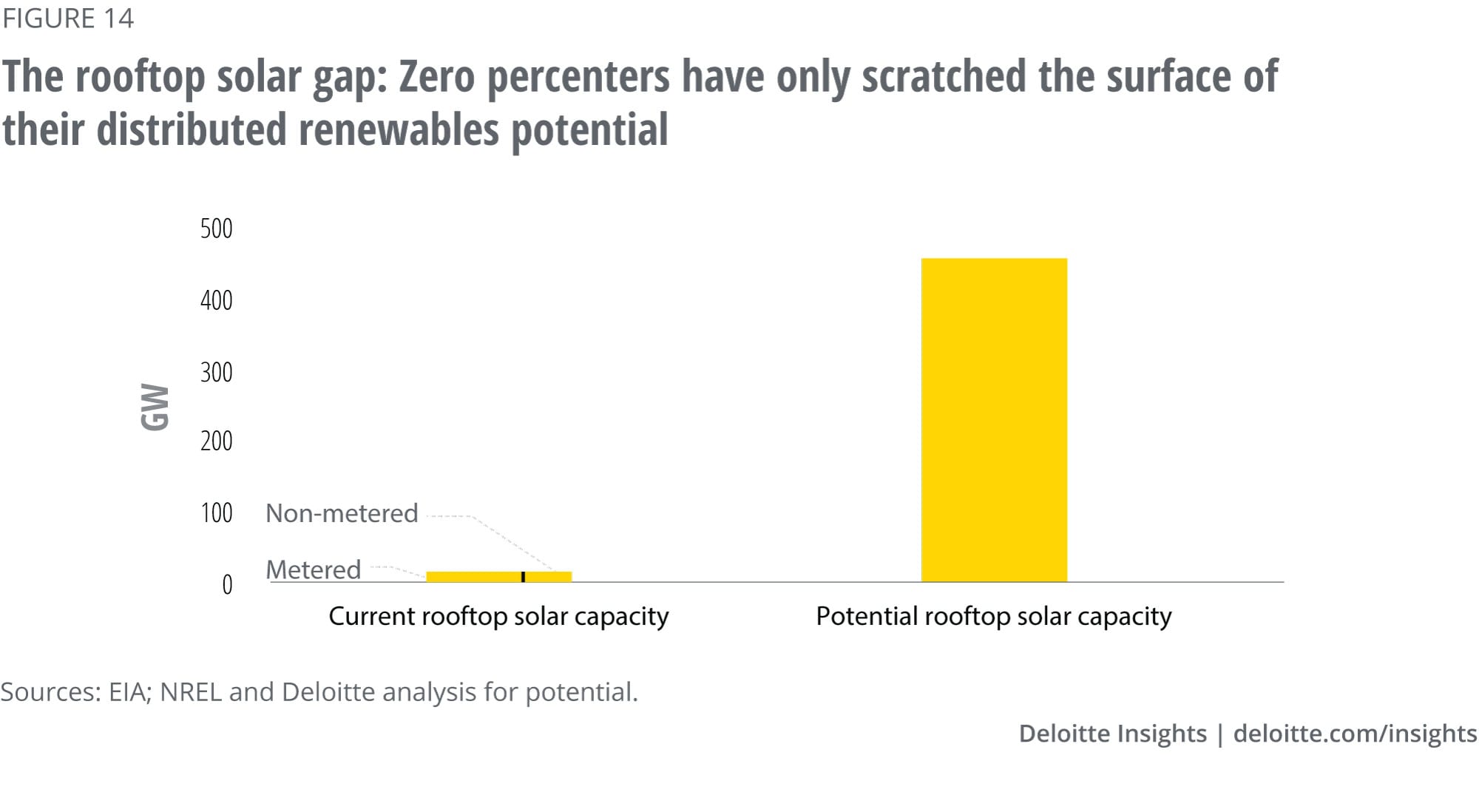

Distributed solar resources could help meet utility decarbonization targets but are currently only contributing a fraction of their potential. Zero percenters have harnessed only 9 GW out of a 400 GW potential in their territories, conservatively calculated drawing on NREL’s landmark 2016 study estimating the rooftop solar potential across the United States (figure 14).

Some zero percenters are paving the way by setting distributed solar targets in their decarbonization plans. Hawaiian Electric already relies on rooftop solar, installed on 20% of single-family homes across its territory, to meet almost half of its renewables portfolio, and plans to double its rooftop solar capacity to 160,000 systems by 2045.34 Meanwhile, zero-percenter Southern California Edison (SCE) specifically anticipates meeting a quarter of its planned solar-plus-storage deployments from distributed sources. SCE recently partnered with Sunrun to network 300 residential solar-plus-storage systems into a virtual power plant to support the utility’s decarbonization goals.35 Most small grid-connected rooftop solar capacity is net-metered (i.e., utilities provide the rooftop solar owner a bill credit for solar energy added to the grid), providing a customer engagement tool that utilities could leverage to further integrate these resources into the grid.

A key technology to integrating distributed solar is smart inverters that can provide the utility with visibility into the rooftop capacity connected to the grid, enabling rooftop solar systems to provide services to the grid rather than burden it. Smart inverters have been around for a while but are still an evolving technology because their deployments have only scratched the surface of their potential grid services, including voltage regulation enabling improved power quality, and coordinated controls to defer transmission and distribution upgrades. With coordinated smart inverter controls, rooftop solar penetration could grow from 15% to 100% of a circuit’s load, allowing distributed solar to fully reach its grid-integrated potential and account for a much greater share of renewable deployment.36 Zero-percenter Arizona Public Service Electric is at the forefront of exploring these advanced inverter functionalities via cross-DER aggregation: Smart inverters are enabling its coordinated deployment of utility-owned rooftop solar systems and smart home ecosystem devices to help stabilize the grid and maximize the use of excess midday solar generation.37

Zero percenters have harnessed only 9 GW out of a 400 GW rooftop solar potential in their territories.

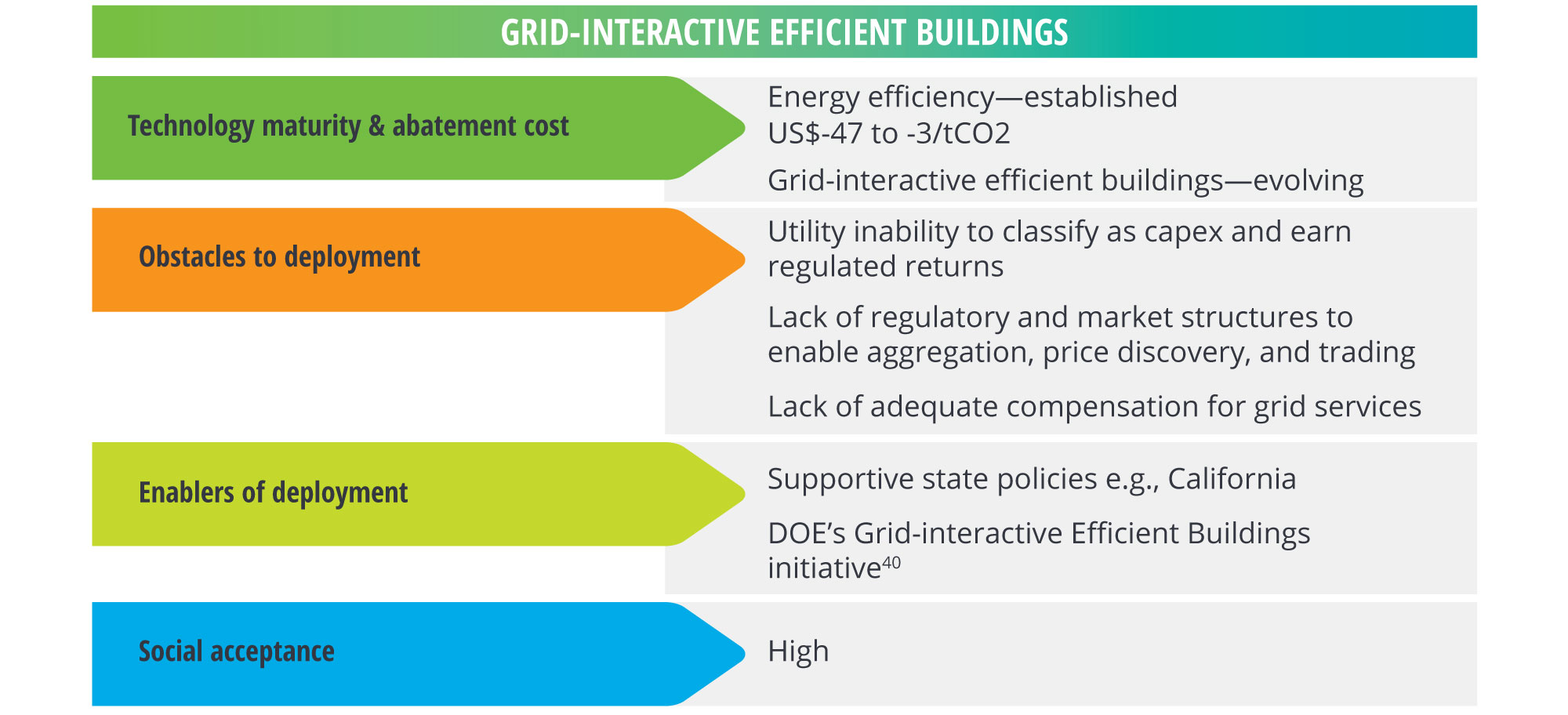

Infrastructural innovation: Elevate energy efficiency

The top goal that 62% of the power and utility organizations surveyed have embraced is helping customers increase energy efficiency. Respondents ranked energy-efficient equipment and processes as the second enabler for a low-carbon strategy. Yet here again, the zero percenters are only achieving a fraction of the energy savings they could secure if they matched the savings that the top-performing utility achieved—3.75% in 2019 (figure 15).

Already the lowest-cost resource on its own, energy efficiency could provide even greater resource synergies if combined with DR and DER to offer non-wire alternatives to new generation via clean energy portfolios (CEPs). A recent RMI study found that as of 2019, CEPs combining energy efficiency with demand flexibility, solar, wind, and storage cost less than 90% of proposed gas plants.39 A key evolving technology that could help unlock this fuller potential of energy efficiency in CEPs is grid-interactive efficient buildings. These buildings use smart controls to flatten their load, manage energy to maximize onsite and offsite renewable energy use, and optimize interactions with the grid by providing and monetizing flexibility as a grid service.

Sections

Utility decarbonization strategy III: Refuel end uses by converting fuel sources (2040–2050)

By the 2040s, the established building blocks of a decarbonized grid will likely be in place, the aforementioned evolving technologies are expected to be mature, and emerging technologies could be key to closing the “last 20%.”

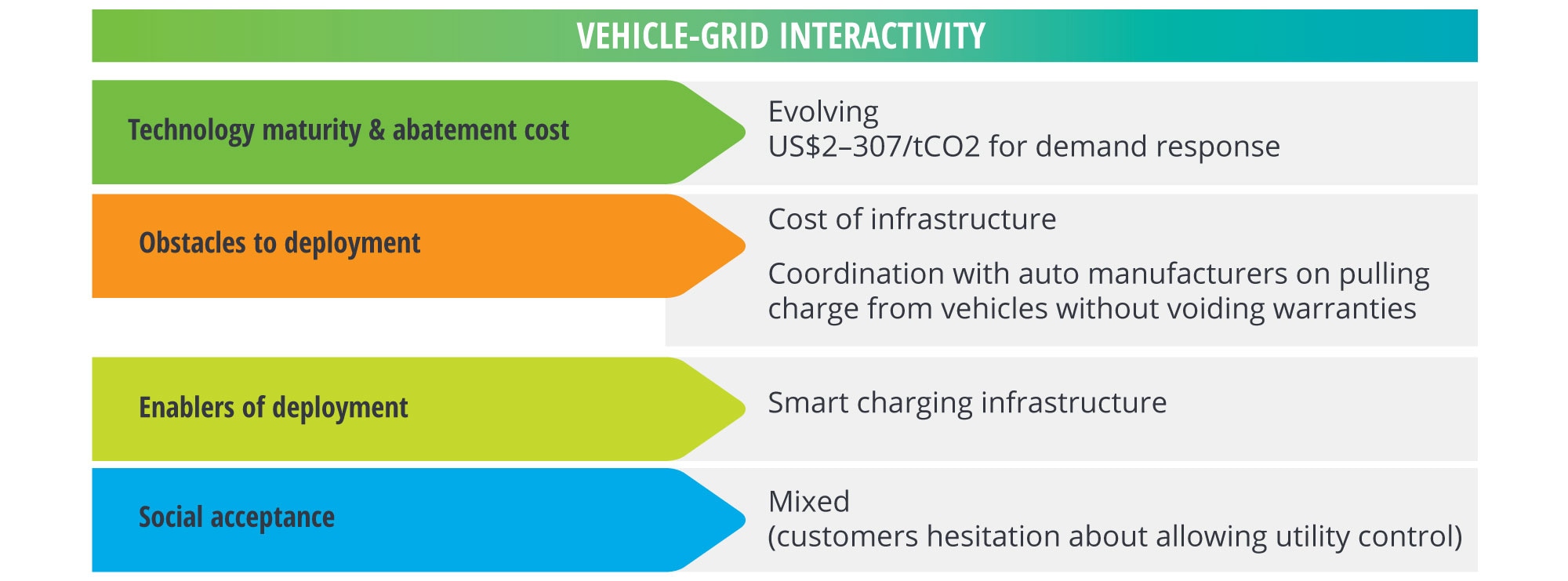

Fossil fuel fade: Replace oil in transportation with bidirectional electricity flows

The heating and industrial sectors anticipate transitioning away from natural gas, and the transportation sector from oil. They are expected to increasingly “refuel” with electricity as heat pumps replace gas furnaces in buildings, advanced electro-thermal technologies replace gas in industrial processes, and EVs replace conventional fossil-fueled vehicles. This means that utilities will likely be contending with the most difficult and costly phase of decarbonization at a time when demand growth for electricity accelerates due to electrification across sectors, increasing load by at least 30% by 2050, per EIA projections. The power demand growth from EVs alone will likely be substantial, with an estimated 12.1%—14.7% CAGR between 2019 and 2050 (figure 16).

Utilities are already preparing for this future, with 60% of power and utility survey respondents reporting that they are encouraging customers (through education, advocacy, promotion, and incentives) to further electrify energy use in industrial processes, and an equal share encouraging customers to do so in buildings.

In the transportation sector, the greatest source of emissions, 67% of power and utility executive respondents surveyed reported they are encouraging customers to further electrify energy use. A key challenge for utilities here will be to turn EVs into grid assets that can flexibly charge and discharge and provide advanced DR. Some zero percenters have already started pilots of such programs with vehicle fleets. For example, zero-percenter Dominion is testing the use of 50 EV school buses for load balancing when they are not in use. Widespread deployment of managed charging would be required to mainstream such programs.

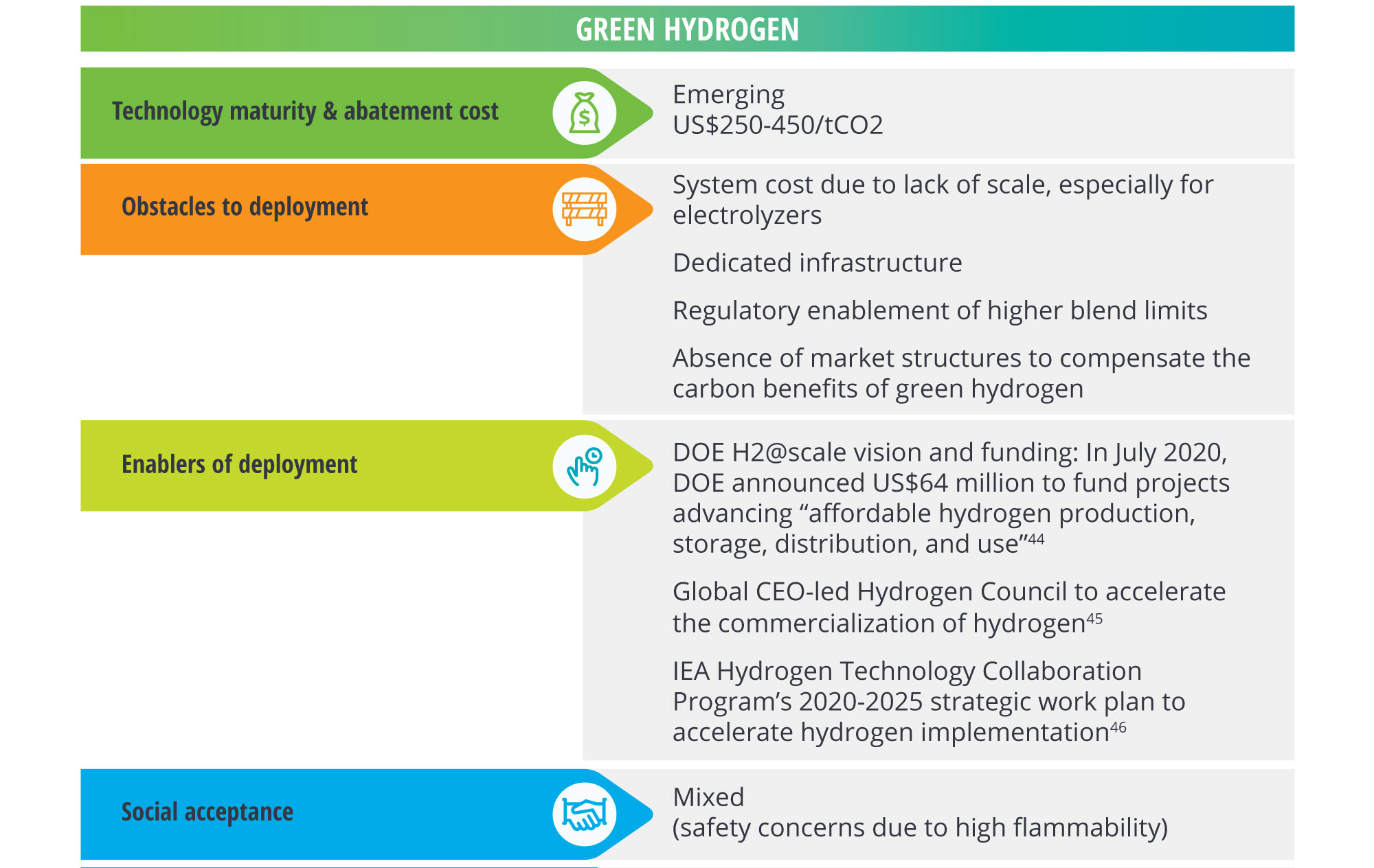

Solar and wind sweep: Seasonally store renewables as a fuel

As renewable penetration crosses the “last 20%” threshold, integration challenges become much greater. Significant overbuilding and curtailment of renewables may occur in the absence of a massive buildout of transmission—a challenging proposition. Alternatively, seasonal storage could capture excess renewable production to be used when renewable production drops for long periods of time. Thermal storage and green hydrogen are among the few viable candidates for this type of storage.41 In the latter case, excess renewables would power electrolysis to split water molecules into hydrogen and oxygen. The hydrogen could then be stored in liquid or gas form, or even in a chemical form (such as ammonia) for months and converted back into power in a hydrogen power plant when needed—otherwise known as power-to-gas-to-power (P2G2P) technologies. There are currently no commercially operating hydrogen power plants in the world. However, utilities could also cost-effectively retrofit natural gas plants to partially or fully run on hydrogen.42 Seasonal storage would need to produce an estimated 10% of the projected renewables generation to provide maximal value by minimizing overbuilding and curtailment (figure 17).43

The city of Los Angeles has announced plans to store hydrogen in underground salt caverns to provide seasonal storage by 2045. The first phase of this plan would also involve mixing hydrogen with natural gas, as described in the next section.

Infrastructural innovation: Switch to renewable fuels in areas where electrification is unfeasible

Direct air capture (DAC) may be deployed to address any remaining unmitigated carbon emissions from electric generation at this stage of the transition. DAC differs from the previously mentioned carbon capture in CCS because the carbon is captured from the air rather than in the combustion process.

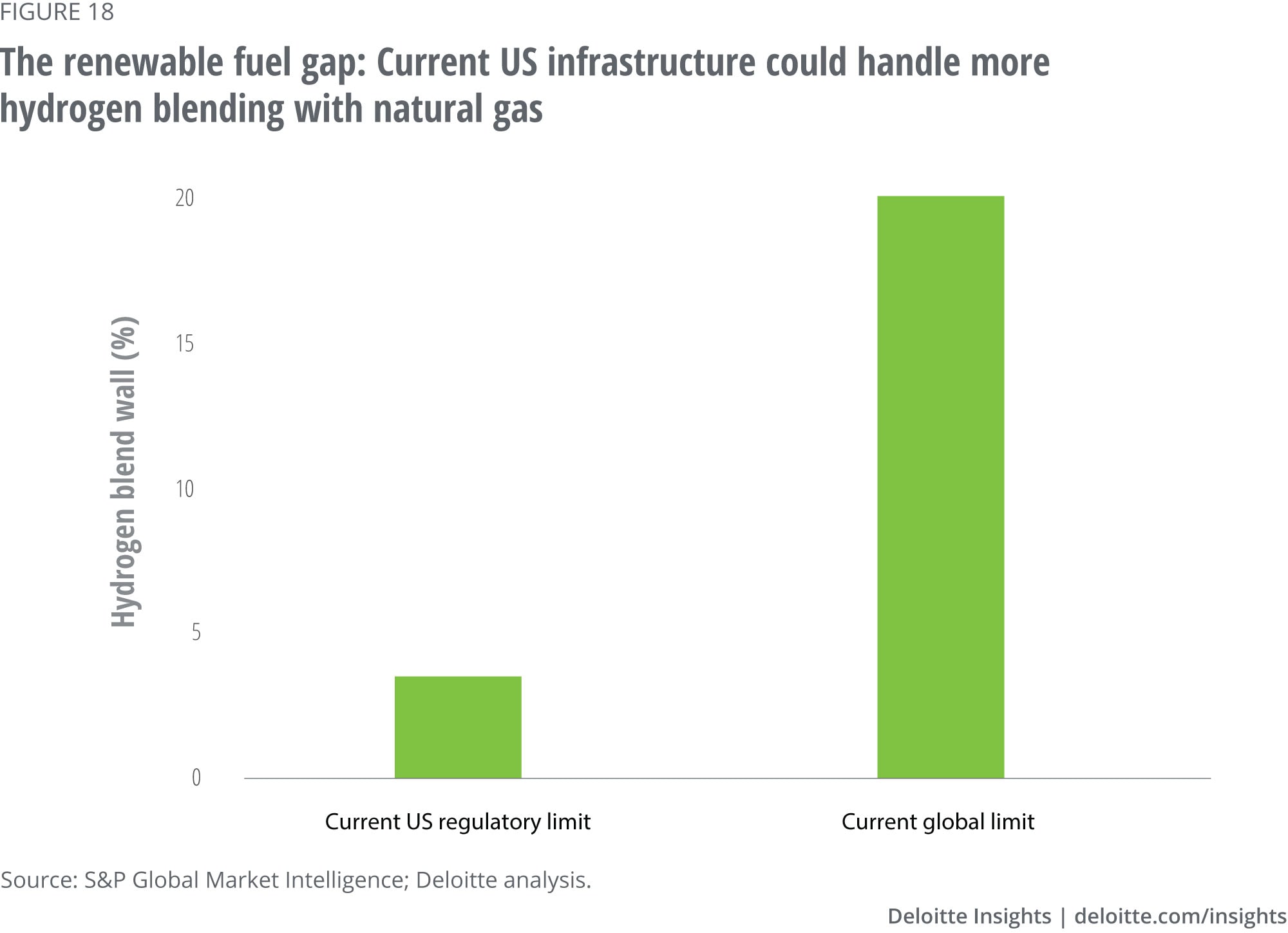

In areas where electrification is least feasible, renewably produced fuels could eventually refuel the country’s natural gas infrastructure. Green hydrogen can be mixed with natural gas without any infrastructural change. The United States has deployed a fraction of currently feasible hydrogen blending that could help decarbonize natural gas infrastructure, if renewably produced (figure 18). Current regulations limit the share of hydrogen that can be blended in natural gas pipelines to under 4% (including pilots).47 Based on current global practices, this share could be increased to 10% in transmission pipelines and 20% in distribution pipelines.48

Renewable natural gas produced from biomass can be fully interchangeably used with conventional natural gas, although deployment may be constrained by the availability of biomass.49

Some mixed utilities, such as zero-percenter DTE Energy, have started extending their electric utility carbon emission targets to their gas utilities, which would be the key players in this area of decarbonization.

Sections

Conclusion

Our analysis has shown that there appear to be significant gaps across the board between the 22 zero-percenter utilities’ stated goals and the scheduled capacity retirements and additions, and flexibility requirements needed to achieve full decarbonization by 2050. The Renew strategy is mostly deployable over the next decade with the help of established technologies. Evolving technologies in the Reshape strategy could have a greater impact in the 2030–2040 timeframe. Technologies to address the Refuel strategy’s gaps are still emerging but have some runway to mature by 2040–2050, when they are expected to be most needed to close the last 20% gap.

Current abatement values vary dramatically across these technologies. Utilities should consider capitalizing on available and affordable technologies to achieve near-term progress over the coming decade. Utility executives may also consider adopting a portfolio mindset to benefit from synergies between the technologies. And it’s a good idea to keep a careful watch on the emerging technologies they anticipate needing decades from now to achieve their 2050 targets. Signposts to watch include the uptake of EVs, and of hydrogen technology outside the power sector, which could expedite the maturing of technologies deployable in the power sector. Policies, such as a potential US clean energy stimulus package and carbon tax, could also quickly change the pace of development and deployment of technologies, and their costs. Finally, customer pressure and engagement will likely become an increasingly important driver of the current, highest-stakes energy transition.

© 2021. See Terms of Use for more information.

More in Power, utilities & renewables

-

Digital innovation Article5 years ago

-

Energy management: Paused by pandemic, but poised to prevail Article4 years ago

-

A framework for the utility customer of the future Article5 years ago

-

Energy-as-a-Service: The lights are on. Is anybody home? From Deloitte.com4 years ago

-

Global renewable energy trends Article6 years ago

-

Renewables (em)power smart cities Article6 years ago