Taking tax to the cloud Why leading businesses are putting tax at the center of their ERP cloud migration

15 minute read

15 June 2020

In the wake of the COVID-19 pandemic, organizations are speeding their move to cloud-based ERP solutions—and leaders are increasingly recognizing the importance of seating tax at the planning table.

Introduction

As the COVID-19 crisis has made crystal clear, agility is key to survival in the face of disruption. Those organizations foresighted enough to have digitized, automated, and cloud-enabled their back-office processes have been able to pivot toward recovery. Those still pushing paper and working with on-premise systems have struggled. In a matter of weeks, the benefits of cloud-based back-office environments became painfully obvious.

Learn more

Explore the digital transformation collection

Tax: Embrace change. Lead with confidence.

Explore the global tax and legal COVID-19 resource center

Recovery and the data-enabled tax department: The key to effective digital transformation

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Perhaps unsurprisingly, the pandemic has catalyzed many organizations to step up their move to cloud-based enterprise resource planning (ERP) solutions. And leaders are increasingly starting to recognize that, if tax isn’t at the planning table, organizations may be missing out on significant upside opportunities. They could even be opening themselves up to new and unforeseen risks.

The reality is that, since the start of this crisis, the tax function has become a cash generator for many enterprises; indeed, in some organizations, tax has been the only source of cash while operations remained closed. The pandemic also demonstrated the benefits of integrating the tax function into organizationwide ERP and enterprise project management systems. To chart a path forward, leaders have needed tax to develop and articulate the tax implications of a range of different scenarios—and many tax functions have floundered to get timely access to the enterprise and tax data necessary to run those sophisticated scenarios.

Faster toward the future

The pandemic has accelerated a journey that was already underway. Long before this crisis, the major ERP vendors had signaled they would be phasing out their on-premise solutions in favor of cloud-based solutions.1 Some were planning to stop supporting older generations of their solutions altogether, albeit with an option to pay for individual support extensions.

At the same time, many leaders were already looking for increased agility and better market insights for business functions across the organization, including the global tax function. They understood that the world was unpredictable—and they knew they needed to prepare their organizations for uncertain futures. Leaders also increasingly recognized that their existing technologies, processes, and data-management approaches were dated; there were already newer technologies and capabilities that offered better, faster, and cheaper ways of doing things.

The onset of the global pandemic sped up these existing trends. At the same time, tax leaders are now challenged to operate departments virtually while reacting to changing deadlines, regulatory changes, and business disruption.

Journey to the cloud

With business leaders now keen to capture the improved agility and functionality that cloud-based infrastructures and applications offer, many see moving the finance function (inclusive of tax) toward a cloud-based environment as the natural first step in the direction of transformation.

Recognizing these realities, many executives, particularly CIOs and CFOs, have begun to think much more critically about their organization’s transformation journey.2 They are starting to put together teams, map processes, create implementation road maps, and develop work plans. As the pressing needs resulting from the pandemic shift the dynamics of industries around the globe, leaders may need to enhance or reallocate budgets and consider and formalize new system requirements.

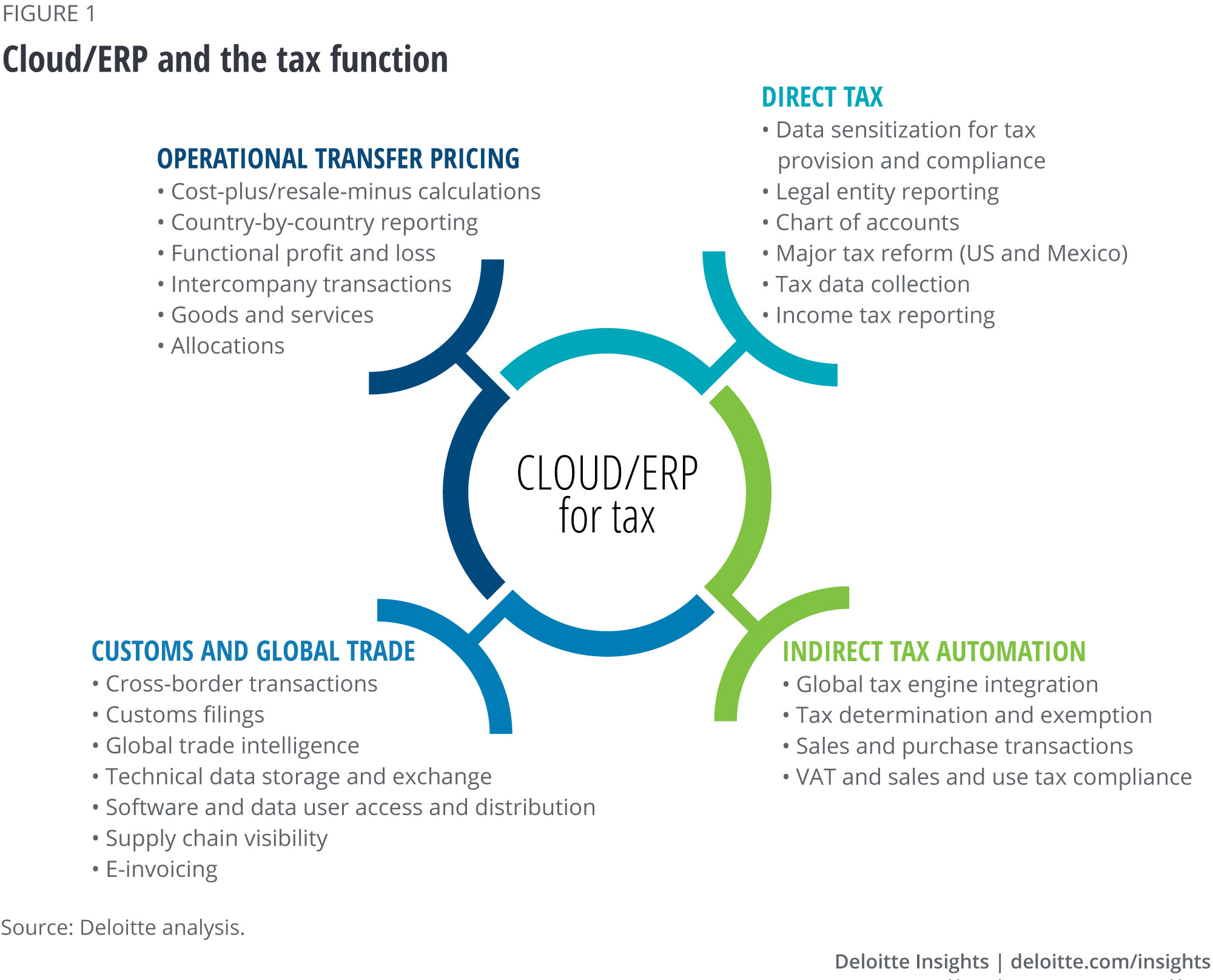

If tax isn’t at the table (and with its own digital road map) at this stage in the planning process, it should be. Otherwise, the entire business may find itself losing out on functionality that could be embedded to ensure the business can meet global tax planning, compliance, forecasting, and reporting requirements in the future. It will also influence the ability to assess the tax implications of strategic decisions with agility in the face of future disruption.

Reserve that seat

The tax function can provide valuable strategic advice on, for example, structuring agreements, contracting licenses, working with cloud service providers upfront, and working with subcontractors.3 That being said, there are three long-term financial and business benefits that support tax needs to be represented in the very early stages of a company’s planning for a cloud transition.

1. You could save money. The first and perhaps most obvious reason is functional: Tax professionals should always have a seat at the table when significant global technology contracts are being discussed. The tax function can identify ways to use cloud-based ERP systems’ functionality and data capabilities to find and secure tax cash savings for the organization, which can also help defray the investment cost. Millions of dollars in technology and tax costs could be saved right at the outset.

2. You can reduce complexity. The second reason is more operational. In virtually every organization, tax is the greatest consumer of enterprise data; almost every business process includes some element related to tax. But the tax function rarely “owns” that data—more often than not, tax is seen as a user of data that is owned by the business or by a specific finance process such as procure-to-pay or order-to-cash.

At the same time, the introduction of a new cloud-based ERP system will necessitate that business and finance leaders examine and document their existing process across the enterprise so they can understand what it will take to migrate to a new environment. This applies not only to all core processes but across the entire supply chain. Defining these requirements upfront can help to automate tasks and get essential data to the tax department in the format that it is needed—potentially in real time.

Today’s challenge is that the business, and the leaders of those finance processes, often do not understand what is required to ensure that processes and data are properly tax-sensitized.4 The reality is that tax was largely underrepresented during the last round of ERP implementations 15 to 20 years ago, which is why many tax functions are still struggling with manual processes and workarounds, increased risks, and wasted time (challenges that became particularly acute during the recent lockdowns).

Further, organizations that fail to include tax at the start of their cloud journey risk missing out on the opportunity to revisit their existing processes to transform tax through better data, processes, and controls while—in parallel—executing tax planning ideas that may not have been viable in the past due to costly system change requirements. They also run the risk of having to reconfigure—or, worse, work around—their system requirements down the road, which will surely be costlier than doing the due diligence upfront.

3. You can better manage (and predict) risks. The third and most important reason for tax to seize upon a shift to cloud-based ERP is about managing risk. Business and tax leaders recognize that, notwithstanding the COVID-19 crisis, the global tax environment was already rapidly changing with tax authorities moving toward a real-time, digital tax environment.5

In Brazil, for example, corporations must disclose full invoice details before they can obtain a valid invoice number from tax authorities.6 The United Kingdom’s “Making tax digital” initiative envisions total tax submission digitization in the next few years.7 The 2017 US tax reform sparked a tsunami of ERP data analysis and insight requirements that continue to evolve.

These types of changes in tax authority expectations will require business and tax leaders to fundamentally rethink their tax operating models, value propositions, and underlying processes. Indeed, in a digital tax environment where tax authorities are receiving data in real time, companies must have control and centralized visibility over the entirety of their tax-relevant data.

What many companies found when applying for emergency tax measures in many jurisdictions was that they lack visibility into their enterprise financial and tax data, the systems they rely upon are not integrated, and data is not tax-sensitized.

In the immediate aftermath of the crisis, the risk of getting this wrong (or being too slow to respond) was significant to the business. In the future, it will be no less important. Indeed, there is a real danger of assessed fines, penalties, and interest. And it could cause businesses reputational damage. It’s a risk worth avoiding.

Why tax needs the cloud in the digital era

If the business benefits for bringing tax to the table are strong, the benefits for the tax function are overwhelming.

The COVID-19 crisis demonstrated the value of cloud-based, digitized, and automated systems and processes. During the lockdowns, many tax leaders found themselves struggling to ensure their tax professionals had access to the right systems, tools, and data to maintain compliance and deliver strategic advice to the business. Many now see the shift to cloud-based ERP systems as a clear path toward becoming the digitized, automated, real-time, forward-looking, strategic adviser that the business expects.

The reality is that—in today’s world of rapidly changing tax, business, and public expectations—tax functions can no longer be looking in the rearview mirror. And in an era of remote work, virtualized tax processes, and cloud-based data, they can no longer be struggling with manual processes and inaccessible data.

Today’s tax function—and certainly the tax function of tomorrow—requires tax professionals to have access to real-time, transaction-level data. And they need to be able to trust its accuracy. Only then can tax provide the C-suite with the type of strategic advice and guidance that is increasingly expected.

The tax function also needs cloud-based ERP systems in order to become masters of its data. By providing the tax function with a common data source, recorded in a standard language and syntax, cloud-based ERPs can eliminate most of the heavy lifting and data mining that tax functions would, in normal circumstances, perform manually.

This not only helps accelerate the shift toward a virtual and digitized workforce—it frees up a massive amount of resource time and provides tax professionals with greater confidence in the data they are using and analyzing. No more manual inputting into spreadsheets. No more data reconciliation work. No more manipulating numbers.

Less time working manually with data can then free skilled tax professionals to spend more time on analytics, scenario planning, and providing strategic advice to the business. It can also allow decision-makers to see across various tax types to develop a clearer picture of their decisions’ tax impact. And this can allow the tax function to become a truer, fuller strategic partner.8

For multinationals with large global footprints and tax exposures, the journey offers even greater value, since each of the aforementioned drivers is magnified. Tied together by a common system, standardized data formats, and reduced manual workloads, a move to the cloud can allow group-level tax leaders and head office executives unprecedented insight into the company’s global tax positions, risks, and opportunities.

Most tax leaders already understand the direction of travel for tax authorities. They see the expansion of digital frameworks such as SAF-T. And they are starting to realize what it will require to ensure they remain compliant as various tax authorities move toward their own digital futures. In an age of virtual working, continuous compliance, real-time reporting, and tax authority automation, in which every piece of data and calculation can be analyzed, errors that were once easily remedied can quickly become fatal mistakes.

At Deloitte, we believe that in the future, cloud-based systems will be critical to timely and accurate tax reporting, and tax leaders will need to plan ahead for local requirements. This includes chart of account design, data granularity, complex and dynamic supply chain and intercompany transaction support, and integration of specialized cloud-based tax software.

Tax leaders increasingly see cloud-based ERP as representing a unique window of opportunity to create a tax function flexible enough to meet the future needs of tax authorities and business executives. They know that simply lifting and shifting their existing processes into the cloud may lead to missing out on real benefits for the tax department.

Getting tax what it needs

How can tax leaders and executives help their department fully seize the opportunities that a move to the cloud offers? The first thing you should do is to make sure that tax is properly involved throughout the journey to a cloud-based ERP system.

In our experience, companies benefit most from seating tax at the table (virtual or otherwise) early on, allowing them to help business data owners develop and refine their processes and system requirements to meet the function’s future data needs. During implementation, it helps for tax to partner with IT and business stakeholders to ensure that requirements are being properly translated and addressed. Post-implementation, tax leaders should aim to work closely with the organization to identify any gaps and remediate them. Tax has an important role to play at every step of the journey.

Deloitte’s global experience working with tax functions at multinational corporations suggests that tax directors and decision-makers should be taking five steps to help ensure a more efficient, strategic, and value-generating transition to the cloud. Get acquainted with the latest functionality. Talk to key stakeholders. Map out a future talent strategy. Design a digital operating model. Develop a digital tax road map.

Get educated and future-ready

Cloud-based ERPs differ substantially from ERP suites of the past 20 years, and cloud technology has evolved significantly since its early days: Cloud offers the same robust functionality as its on-premise predecessors, forging new roads to connectivity to data in applications inside and outside the corporate firewall. Some leaders may struggle to fully understand what evolved data integration might mean for their tax teams going forward, considering their people have spent so much of their careers collecting, manipulating, and reconciling data from systems that may soon become obsolete.

Decision-makers would be well advised to invest time in getting acquainted with the new functionality and value propositions. Most may find that some preconceived notions—particularly around cloud-based ERPs’ data security, availability, and applicability—quickly fall away.

More specifically, tax leaders should look to familiarize themselves with the various product suites that are now on the market. Each offers a different set of tools and apps tailored to the tax function. Oracle ERP Financials Cloud, for example, includes a tax provisioning tool called Oracle Tax Reporting Cloud Service that may offer significant benefits to tax operations worldwide.9 SAP S4/HANA Enterprise Cloud has a suite of cloud-based tax services tools focused on four transaction tax pain points: real-time reporting, periodical reporting, tax calculation, and controls.

If they have not done so already, leaders should also be taking time to understand the future direction of travel of relevant tax authorities. The OECD’s efforts around the digitization of tax offer a clear forecast of where things are headed: a more real-time, automated, digital, and analytical tax environment.10 Knowing what will be expected of businesses in the future will be key to planning a robust cloud journey for tax.

At the same time, the recent crisis reinforces the need for tax functions to be able to operate in a world in which transactional data is available in real time and accessible for future-oriented decision-making and modeling. This will require a completely different skill set from the past. For their part, tax leaders will want to use the next few months to prepare for a world in which tax will be fully digital.

Talk to key stakeholders

A cloud-based ERP implementation is an enterprisewide endeavor and one of the largest one-time IT investments an organization may undertake in the next several years. Tax leaders and key decision-makers across the organization should identify stakeholders already thinking about the enterprise journey and ask some important questions: When is our planned shift to a cloud-based ERP system? What ERP package are we implementing? At what stage is the planning and contracting? Understanding who in the organization is driving the plan and some of the essentials around timing is key.

Next, tax leaders should start talking to the business partners who own the processes that generate tax data. Are they already thinking about their process migrations? If so, tax leaders should work with them to refine their system requirements to ensure their data is tax-sensitized from the start—and, where appropriate, encourage their business partners to rethink existing processes. Help them to understand the impact and benefits resulting from the shift from historic reporting to real-time reporting—and work alongside these leaders to rethink the transformation approach and the budget allocated for tax requirements.

This is also the point at which tax leaders should be getting their hands on any current organizationwide cloud transformation plans, particularly from key stakeholders and influencers such as IT and finance. Much of the tax transformation journey will rely on the activities of these key stakeholders, so understanding and monitoring the plans and progress will remain essential.

Focus on tomorrow’s tax leaders

Tax leaders and decision-makers may be fantastic at managing numbers, ensuring compliance, and operating processes, but they often lack the time and skills to properly assess and plan a journey of this scale. The focus and necessity of managing the tax function of tomorrow requires technology, analytics, communication, and project management skills.11 Tax accountants and lawyers—groups often reluctant to embrace uncertain change—will need to start adapting.

In part, this shift will require tax decision-makers and leaders to work closely with their talent functions to plan out the talent strategy for the road ahead. While tax professionals have traditionally been largely operational, today they need to be much more analytical. Physical location will matter far less than in the past. Data processing was once the bulk of the job; robots and automation are beginning to take over that strain.

What this means is that talent teams need to focus on bringing in a new breed of tax professionals who can combine STEM skills with a technical knowledge of tax to deliver the types of value-added insights the business will require in the future. Shifting the tax function’s capabilities will take time.

In the meantime, tax leaders and tax professionals should seek opportunities to develop their own technology capabilities and experience by undertaking small projects that help move the tax function toward the digital future.

Consider, for example, how the application of robotic process automation may help free up resources to focus on driving the recovery effort or the transformation agenda, or how a tax data sensitization project may prepare your data streams for future analytics.12 With each new project, the tax function can learn and invest time and resources into helping employees become more comfortable applying technology.

Design your future tax digital operating model

The lessons learned from the pandemic suggest that yesterday’s tax operating model is no longer fit-for-purpose in a post-coronavirus environment. Tax leaders should therefore be starting to leverage what they can do to plan for a more agile, sustainable, agile tomorrow. Now is the time to start contemplating a future tax operating model. The shift to cloud-based ERPs will have deep ramifications for the way the tax function operates, the capabilities it requires, and the value it delivers. This is an opportunity to radically rethink the tax function operating model.13

External factors—in particular, expectations for future tax authority requirements and approaches—should almost certainly shape the future operating model. Tax authorities will likely be looking for tax to become more digitized, more data-intensive, and more responsive in real time. Tax leaders will need systems, processes, and operating models that reflect that reality.

The model should also be influenced by recent shifts in ways of working. Tax leaders should be thinking about how to create and manage tax functions that are much more virtualized, decentralized, and automated.

Predicting the future expectations of the business will also be key to developing a robust operating model. Tax leaders should allocate some of the time they spend with stakeholders to understanding how they can create value for the business in a cloud-enabled world. And they will want to ensure that their ways of working align with those of their business partners and stakeholders.

Develop your digital tax road map

Following the previous four steps should give tax leaders and decision-makers most of the information necessary to develop a well-informed road map to cloud-based ERP enablement for tax. The really good news is that this shift should be far less daunting than most organizational transformation efforts: With the right information, leaders can draft a good road map in a matter of days.

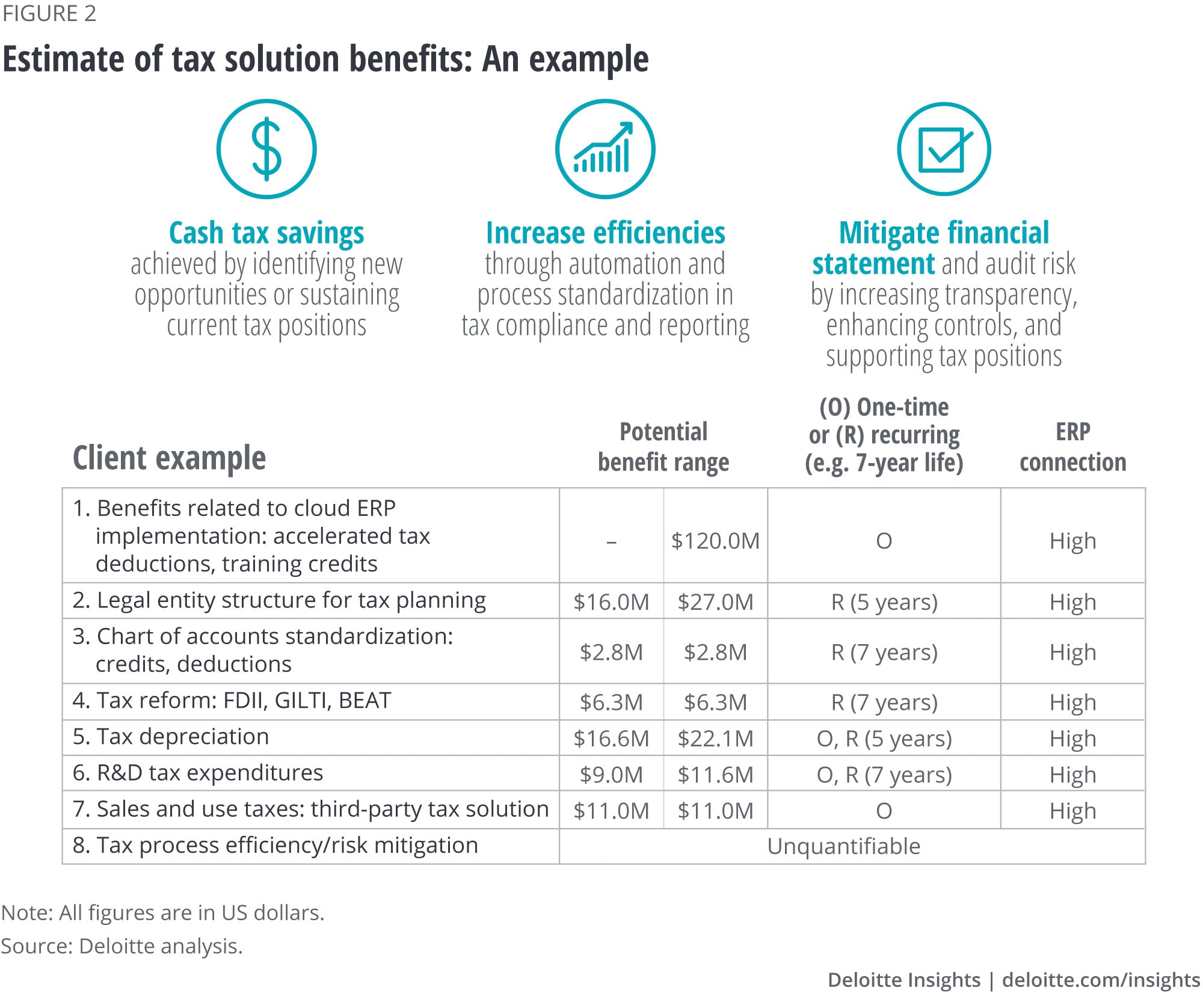

Perhaps somewhat tougher is the development of the business case or “Phase zero assessment”: a pivotal step in the planning and strategy for the enterprise and tax. This is when the tax function has the ability to quantify, qualify, and package the benefits, tax savings, risks, and opportunities of tax as part of the cloud journey.

To develop this business case and road map, and to ensure implementation success, the tax journey will need to align with those of other key stakeholders such as IT and finance; tax leaders will need to work closely with these stakeholders to articulate, align, and iterate on their own plans. They must also make sure their transformation plan aligns with other organizational planning, such as a digital transformation agenda, a finance transformation agenda, or a customer-centric transformation program.

At the same time, tax leaders can begin looking for opportunities in the initial phase of the business case and in the development of the road map to begin the transformation journey, considering what can be done ahead of the wider organization and drafting the function’s road map. Many will now be looking at improving their medium-term cloud capabilities as the COVID-19 crisis continues. As noted earlier, leaders can look to pre-implementation activities and proof-of-concept exercises to develop stronger technology and project management connections and capabilities within the tax function.

Finally, tax leaders can socialize their cloud transformation road map with leadership and executives, helping them understand how tax fits into the broader value proposition and what is required to unlock the function’s value. The key is putting forward a strategic plan for implementing and a strong case why tax needs to be at the table.

Don’t miss out

The recent crisis has made it very clear that business leaders cannot afford to miss this opportunity to allow the tax function to influence the direction of travel and help drive the requirements they know will be most beneficial to the company.

The shift to a cloud-based ERP system represents a once-in-a-generation opportunity for tax leaders to define strong, tax-sensitized data and business processes that fundamentally transform their team’s value to the organization. It coincides at a time when crisis has combined with a plethora of internal and external pressures to drive the demand for tax functions to digitize, modernize, transform, and change their tax operating model. Tax leaders and business executives would be remiss to let this opportunity pass.

Deloitte’s advice to tax leaders and business executives is to make sure the tax function is properly represented at the table throughout their organizationwide cloud transformation journey—and that they are allocated a budget for this journey that reflects the value the tax function brings to the transformation.

The most important thing is keeping tax informed, involved, and integrated into the wider organizational plan. Including tax can create game-changing value, and organizations should not miss out.

© 2021. See Terms of Use for more information.

Explore more on digital transformation

-

Scaling up anything as-a-service Article5 years ago

-

How cocreation is helping accelerate product and service innovation Article5 years ago

-

Ethical tech Article5 years ago

-

Ecosystem-driven portfolio strategy Article5 years ago

-

Radically transforming your support models Article5 years ago

-

A new approach to soft skill development Article4 years ago