Ecosystem-driven portfolio strategy Building a portfolio of digital industrial solutions leveraging powerful business ecosystems

14 minute read

09 March 2020

For companies undergoing digital industrial transformation, are there shortcuts to developing end-to-end solutions? This article, ninth in a series, looks at leveraging business ecosystems and venturing beyond traditional company boundaries.

Digital industrial transformation offers an opportunity—and an imperative—for growth. But few organizations are prepared to innovate new solutions at a pace and scope necessary to keep up with Industry 4.0 developments.1 As a result, market leaders in the digital industrial space are increasingly relying on business ecosystems to offer and deploy a complete solution set. Well-structured and well-managed business ecosystems have become a source of competitive advantage for those that can execute well, as customers demand holistic, well-integrated solutions that can help them quickly realize results.

Learn more

Explore the Digital transformation collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

What is a business ecosystem? Much like real-life ecosystems, software-based business ecosystems involve complex interactions across multiple parties, in which each fulfills a particular role contributing to the system’s overall success.2 An ecosystem’s value is that it brings together multiple players of different types and sizes in order to create, scale, and serve markets in ways beyond any single organization’s capacity,3 and business ecosystems are helping many of our clients tackle pressing problems. Navigating and leading ecosystems can be complex due to the various business model, operating model, and go-to-market implications, but companies that successfully do so enjoy significant upside in the form of accelerated participant performance improvement.4 Research conducted by Deloitte and OpenMatters shows investors placing higher enterprise value on companies deemed network orchestrators than on those seen as participating in traditional industries and value chains.5

Enterprise resource planning (ERP) and customer relationship management (CRM) are both digital solutions that showcase the power of the ecosystem. Just as in the digital industrial context, ERP and CRM customers desire end-to-end solutions that work in their complex operating realities that include both digital and legacy components. In the ERP ecosystem, large solution providers, such as SAP, rely on a broad network of system integrators, independent software vendors, and value-added resellers. These organizations bring global reach, customer knowledge, and delivery, implementation, and transformation experience to ensure last-mile customer success.6 ERP and CRM companies have also courted app developers on their enterprise app stores to continuously offer customers the latest innovations.

The ERP and CRM ecosystems built by companies such as SAP and Salesforce can generate tremendous value for all parties involved: Salesforce reports that every 2017 dollar it earned resulted in US$3.67 earned by the surrounding ecosystem, a figure that is expected to increase to US$5.18 by 2022.7 Observing the ERP and CRM ecosystem and the different value each player brings to the others reveals a blueprint for how such an ecosystem could work in the digital industrial context. In this article, we explore how digital industrial companies can take an ecosystem-driven approach to building their end-to-end solutions.

Building a digital industrial solution

While digital transformation is top-of-mind for many leaders, most organizations are just beginning to drive forward with these changes.8 One challenge for Industry 4.0 solution providers is creating a complete and forward-looking solution that will attract customers along different phases of their transformation journey. Failure to do so may result in siloed solutions that customers will outgrow.

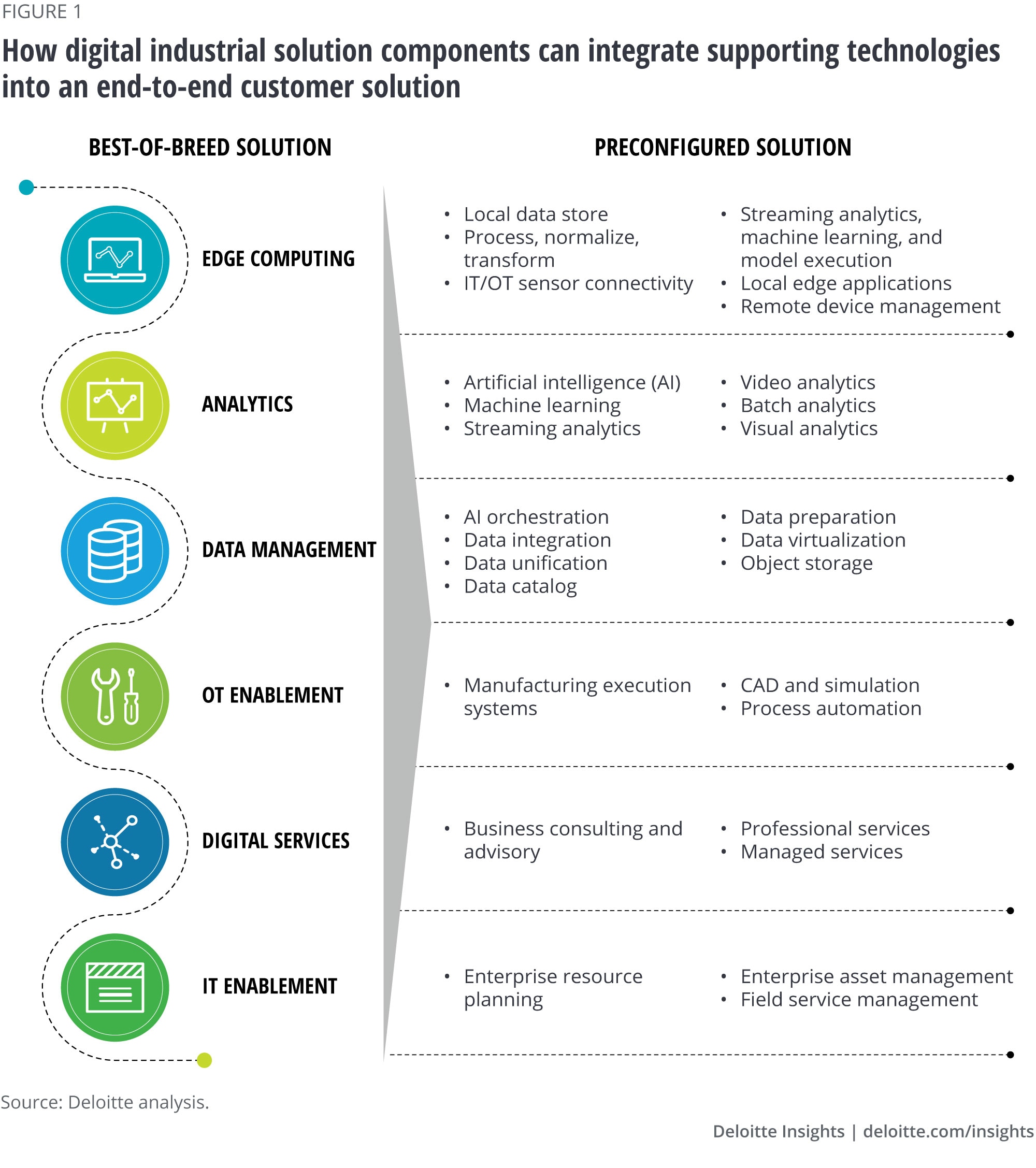

Thus, digital industrial solution providers must offer a wide array of solution components, seamlessly working together to deliver customer outcomes. Even a standard offering, such as predictive maintenance, needs to weave together analytics, visualization, reporting, and automation. Furthermore, digital industrial solution providers must also build or integrate front- and back-office systems, processes, and internal capabilities that enable packaging, selling, and delivering offerings in more flexible consumption models, such as pay-per-use or outcome-based billing. We call these technology components, processes, and internal capabilities the digital business architecture.

Figure 1 offers a sample of the solution and digital business architecture components necessary to provide a complete digital industrial offering. This figure highlights a salient challenge confronting digital industrial solution providers today: While it is unlikely that any single player can provide this full spectrum of components, customers continue to demand end-to-end solutions. And solution providers must integrate with customers’ existing environments.

The fast track to market proof points

Building out this full solution stack, given the complex and interrelated nature of each component, can feel like a daunting task in terms of resources, investments, and time. At the same time, digital industrial solution providers must quickly develop and test solutions in-market, in order to achieve commercial proof points and establish brand credibility.

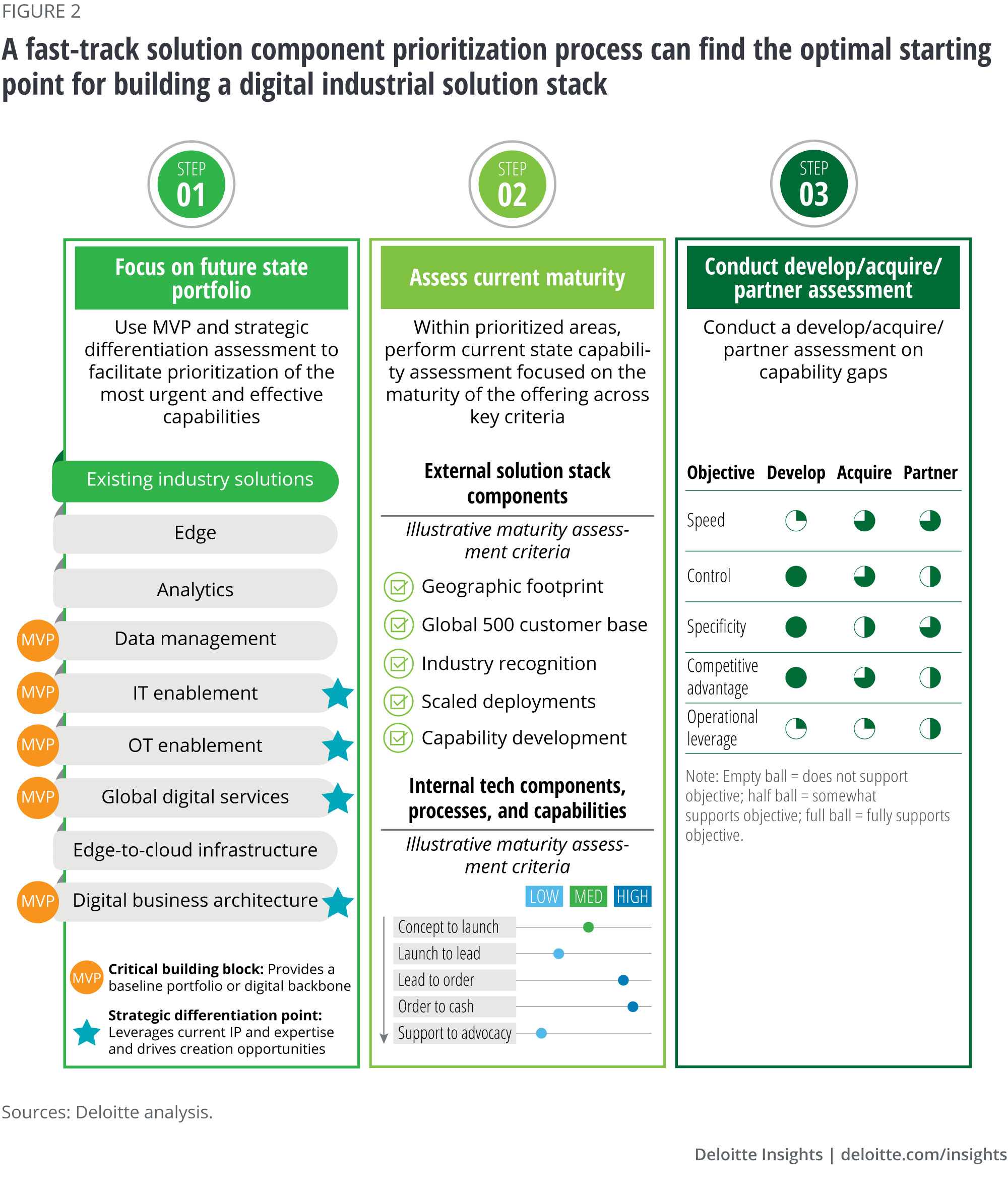

Knowing the right place to start is critical in striking a balance between building an end-to-end solution and accelerating market traction. We suggest using a three-step approach to help determine the right starting point. The process depicted in figure 2 enables companies to drive focus on the most critical solution stack components, and the best tactics to obtain capabilities aligned to those areas.

Step 1. Focus: Decide on the “what”

The first step in the prioritization process is to instill focus on the most vital critical solution stack components, keeping in mind your digital transformation north star9 and your business model10 (introduced in the first and second articles in our series). For example, what are your long-term objectives in the market you plan to pursue, and how will you measure success? What are your current strengths that serve as stepping-stones to future growth? Digital industrial solution providers should answer these questions as prerequisites to defining the digital solution stack.

Once ready, digital industrial solution providers can then determine, by answering the questions below, whether the solution component constitutes either a critical building block or a strategic differentiation point:

Critical building block. Does the solution component provide:

- A baseline of digital products/services to offer to customers?

- Portions of the digital business architecture backbone to make, sell, deliver, transact, and provision digital solutions as a service?

Strategic differentiation point. Does the solution component:

- Leverage and accelerate your organization’s current intellectual property and expertise that will drive business outcomes?

- Drive end-customer value creation and, as importantly, capture value through monetization of noncommoditized, higher-margin digital products and services?

Solution stack components that qualify as critical building blocks or strategic differentiation points should proceed to the next step in the prioritization process. Digital industrial solution providers should postpone addressing components that do not meet the above criteria until the subsequent phases of solution-building.

Step 2. Assess: Determine the gap

After focusing on the solution components that comprise either a critical building block or a strategic differentiation point, companies should assess their own maturity and ability to develop differentiated offerings in each of those components.

For the digital business architecture components—the internal front- and back-office systems, processes, and internal capabilities that enable packaging, selling, and delivering offerings in more flexible consumption models—the maturity assessment is more of an internal view. For solution stack components directly offered to customers, the maturity assessment should be based on progress made toward piloting and scaling associated offerings. Through Deloitte’s experience supporting and cocreating with digital industrial solution providers, we’ve found that many companies already have proofs of concept with their most strategic customers. Consider a sample list of scoring criteria below based on a recent engagement with a global digital industrial player:

- Geographic footprint. Do you have customers across multiple constituencies for this solution component’s associated offerings, or is your market traction confined to regional impact?

- Global customer base. Are your customers Fortune 100 companies or industry insurgents?

- Industry recognition. Do external analysts recognize any of your offerings as best-in-class?

- Scaled and deployed projects. Are your products niche offerings, or do you have a critical mass of proven, at-scale deployments?

- Capability development. Do you have the R&D capabilities to rapidly innovate and the ability to create market-valued offerings?

Once the most critical gaps in solution components have been identified, digital industrial solution providers can move to step 3 of the process.

Step 3. Choose: Chart the path to closing the gap

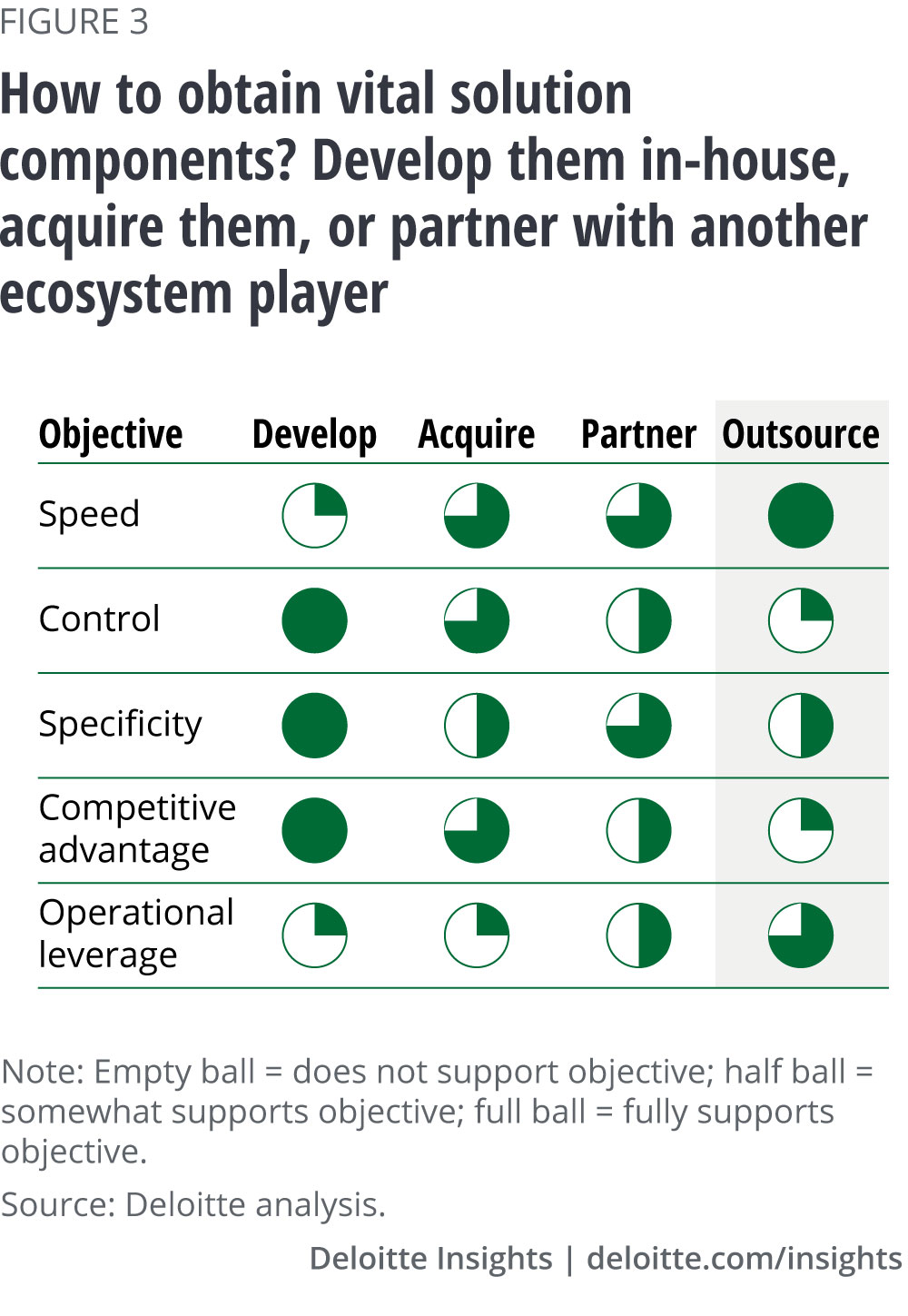

Now, we have filtered down to the solution components that are not only the most vital (either critical building block or strategic differentiation point) but also where there’s the largest gap. To determine how to close that gap, we refer back to a framework introduced in our fourth article and summarized in figure 3.11 One key distinction: Because of the importance of the solution stack components that remain at this stage in the process, companies are less likely to outsource these capabilities, so we are de-emphasizing that option here.

Fast-track solution prioritization process in action

Consider two Deloitte clients that have employed the fast-track solution prioritization process to build end-to-end digital industrial solutions.

Digital industrial conglomerate

A multinational digital industrial conglomerate defined its long-term objective to become a leading digital industrial solution provider and move toward a XaaS business model, but the sheer scope of the digital solution components it needed to obtain the objective seemed impossibly broad. The process helped leaders determine where to start and focus.

First, executives prioritized critical building blocks and strategic differentiation points. They considered the company’s existing strengths, which included emerging data management and IoT solutions and a global professional services organization, and quickly decided to focus on further building on those areas. The company also looked to invest in its underlying digital business architecture capabilities to provide future solutions in as-a-service models. When executives considered the additional objective of achieving significant IoT market revenues within three years, they decided to focus on larger M&A targets that could provide a mixture of IoT solutions, digital services, and digital business architecture.

Next, the company analyzed areas with the largest maturity gaps. Within IoT solutions, the company discovered that it most sorely lacked technology capabilities in predictive maintenance and seamless integration of IT and OT data. On the digital professional services side, it most critically needed domain expertise and digital solution cocreation capabilities. In the digital business architecture realm, it required technology and processes to support product strategy, solution design, lead management, and a customer 360-degree view.

Last, leaders had to determine how best to obtain those capabilities. Given the criticality of many of these solution stack components, the company decided to employ a hybrid develop, acquire, and partner approach. The preceding analysis then translated seamlessly into target-screening criteria.

Global electronic test and measurement company

Executives embarked on an ambitious multiyear journey to position the company for growth by embracing new market verticals, especially in the realm of 5G. To become a single-solution provider and provide end-to-end testing capabilities, this company designed its future-state portfolio and then assessed its current capabilities in the context of that portfolio. Leaders reviewed the critical building blocks and strategic differentiation points that could become the key growth drivers in their critical markets. Strategic acquisitions were used as a key tool for entering new markets and obtaining critical capabilities that were lacking in the company’s current portfolio. Leaders were realistic about the company’s existing strengths and systematically analyzed its ability to build certain portions of the solution stack to identify the gaps to fill through acquisition and partnering. Discipline was a key factor for this company as leaders reviewed their acquisition targets against strategic alignment, growth, and value creation criteria.

With multiple acquisitions across five years, the company engaged in a systematic expansion of its portfolio, acquiring companies with specific capabilities—in wireless R&D, electrical/mechanical/physical calibration services, device testing, security solutions, and electronic component testing—across a wide range of industries and global markets. In public statements, leaders frequently referenced their growth and market expansion motives, as well as how each of the acquired companies would strategically complement the company’s current portfolio. By reflecting on its own capability gaps, this company was able to systematically expand its services to rapidly scale into a single-solution provider with strong footholds in the United States and Europe.

Develop, acquire, partner considerations

Both companies cited as examples above are now in various stages of executing on solution stack development. Through Deloitte’s extensive experience in helping these companies and many others as an adviser and a collaborator, we have summarized some key considerations for each of the tactics below.

Develop: Longest path to monetization but ensures control of outputs

For companies that are just starting off on the digital transformation journey, this path is the longest and most winding—but the one that ensures the greatest control and specificity. The time required to bring a product to market should be carefully considered, since most customers will not wait if a competitive solution were to appear first. However, companies in the early stages of digital maturity tend to struggle with conceptualizing how digital technologies can affect the business.12 As a result, leaders often spend time and effort iterating on products and initiatives that don’t translate to financial benefits. This path should be reserved for capabilities that are considered strategic differentiation points and where critical and enabling in-house expertise already exists.

Acquire: May be complex and expensive but allows immediate ownership of talent and potentially at-scale products

A buy strategy is most advantageous when speed to market and control over capabilities are both important. An important consideration for buy strategies is the size of the target: tuck-in versus scale.

Tuck-in. This represents a deal where larger digital industrial companies acquire significantly smaller targets, usually for specific talent and/or niche capabilities. Digital industrial companies must often make a string of consecutive acquisitions and, then, invest additional capital to integrate the capabilities into a cohesive platform. The acquisitions will likely not contribute significantly, if at all, to the acquirer’s immediate top line.

Scale. Acquisitions of this type involve targets that have mature offerings and can provide an immediate impact to revenues for the acquirer. The capabilities acquired may be less aligned with the acquirer’s specific requirements but are usually already market-ready without additional investment.

We will discuss integration considerations in a subsequent article, but it is important to recognize that the newly acquired assets will look and behave differently than the acquirer’s core business. Often, the target companies bring an agile and innovative culture that must be treated with care. Integration considerations play an important role, as introducing a hierarchical governance structure can stifle innovation in high-growth companies. Acquirers must strike a delicate balance between achieving synergies and not stifling the targets’ innovation and growth.

Another common risk for acquirers is the possible magnitude of goodwill in any acquisition. Our research and experience suggest that digital targets are typically rewarded for their growth potential and command a significant EBITDA multiple: 8x for software versus 3x for traditional service companies. Acquirers must keep in mind that the ultimate reason for the acquisition is to access sources for innovation-led growth, and weigh that against the potentially outsized cost of the acquisition.

Partner: Potentially shortest path to value creation by unlocking the power of a tailored business ecosystem

Ecosystem-driven partnerships have become increasingly popular as a path to growth, and not just in the digital industrial space. Corporations that pursue this path can decide on the intensity and nature of engagement that they wish to have with their ecosystem partners. Deloitte’s Center for the Edge offers a helpful taxonomy and decision-making framework for the different types of ecosystems in which companies can participate.13

There are three key benefits that companies can enjoy with an ecosystem-driven approach to building their solution stack:

Specificity. Partnering allows digital industrial solution providers to bypass committing significant capital when acquiring a whole company, while still targeting niche products that they want to incorporate into their portfolios. The reduced capital requirement allows companies to establish relationships with several leading niche players rather than committing to just one.

Flexibility. The speed of change with Industry 4.0 breakthroughs is one of the key reasons companies are choosing inorganic options. Partnerships come with the benefit of being able to more easily unwind any commitments should the logic or benefits change.

Learning. Engaging with a diverse set of ecosystem players increases the network effects of mutual learning, paving the way for more creative solutions that can scale better and faster—and can weather the dynamic nature of the shifting market landscape.

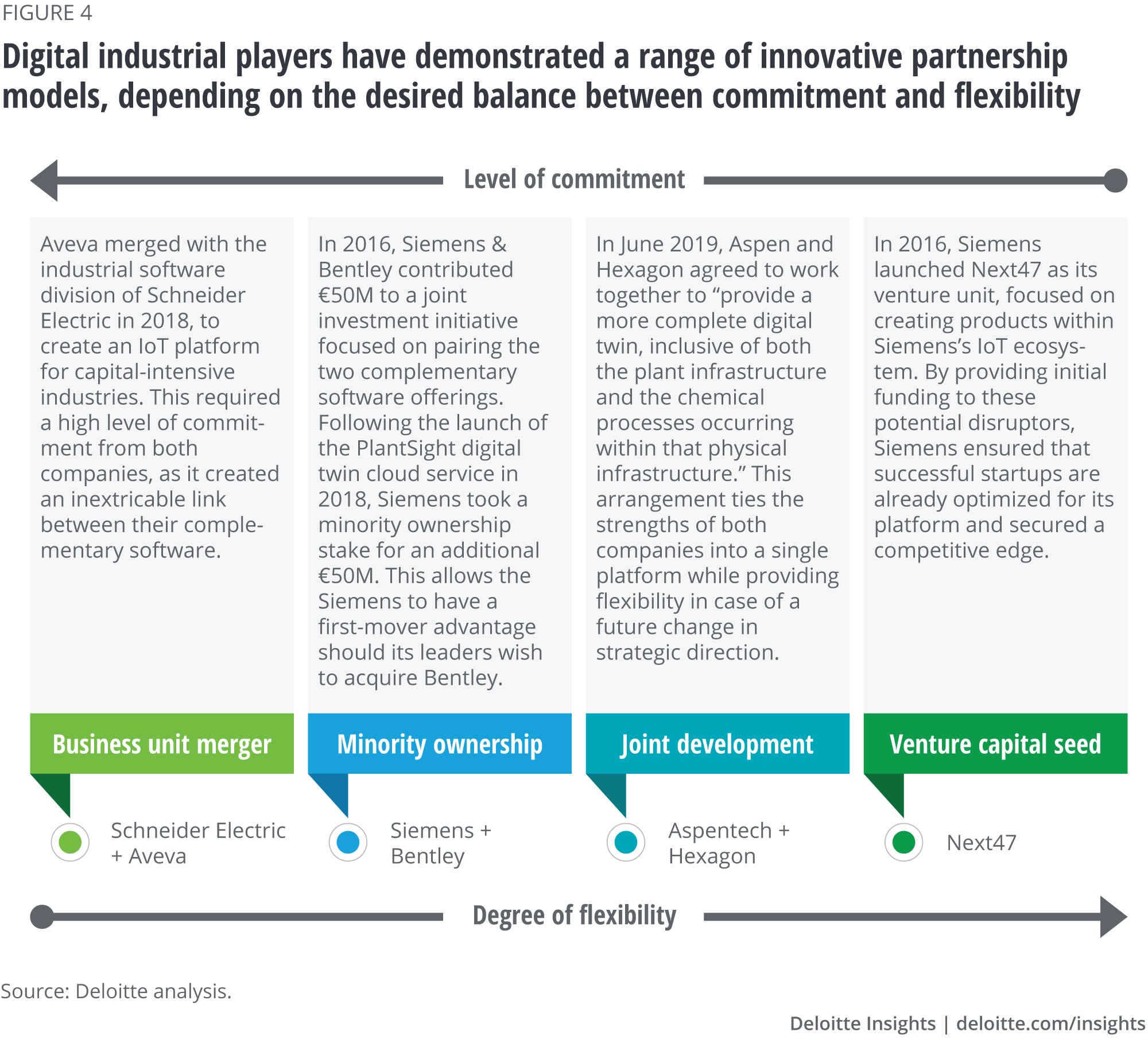

Looking across the digital industrial transformation landscape, we’ve seen examples of several innovative types of partnerships, as described in figure 4.14

Two common concerns surface as companies consider participating in an ecosystem of partners: losing control of monetizing the relationship with the end customer, and disclosing valuable intellectual property. While not completely unfounded, companies should balance this risk against the potential rewards of greater innovation and more creative problem-solving that comes from collaborating with others. The benefits often manifest in the form of shorter time to revenue and stronger solutions that capture higher margins and generate greater customer loyalty. Furthermore, leaders can usually mitigate these two risks through thoughtful approaches in structuring the partnership, such as explicit revenue-sharing agreements contingent on agreed-upon milestones or modularizing the sharing of IP. Future articles in this series will delve deeper into the concepts outlined here and present a framework to help leaders balance flexibility and commitment.

Warehouse automation ecosystem example

Honeywell serves as an example of a company that established a digital industrial ecosystem.15 By combining develop, acquire, and partner tactics in a way that best supports its strategic objectives, the company has delivered a complete solution in warehouse automation to its customers.

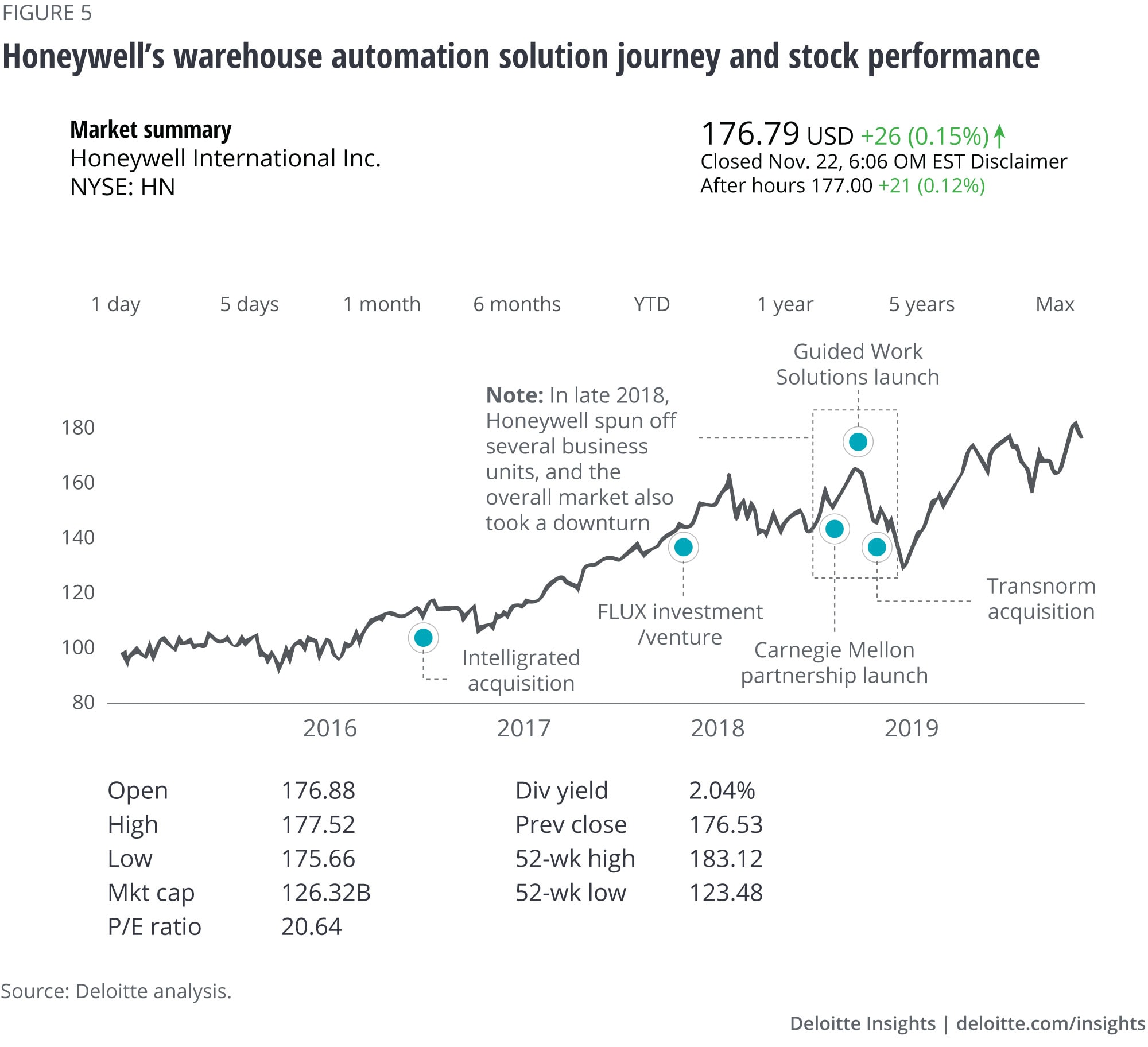

Figure 5 shows Honeywell’s warehouse automation solution journey. Starting with the acquisition of Intelligrated Inc. in 2016, Honeywell rapidly positioned itself in warehouse automation. In order to enter the Asia-Pacific market, in 2017 the company purchased a 25 percent stake in a Chinese warehouse management and supply chain software provider—Flux Information Technology—and also launched a joint venture with Flux. This allowed for rapid market entry, while mitigating potential geopolitical and economic risks in the region through the joint venture. Then, in late 2018, Honeywell announced a forward-looking partnership with Carnegie Mellon University to research AI and the future of supply chain automation. Around the same time, leaders announced the launch of the company’s Guided Work technology in collaboration with SAP, bringing voice-guided technology onto the warehouse floor. Honeywell developed this capability by leveraging its existing software and SAP’s Business One system to extend voice-guided solutions to small- and medium-sized warehouses. Finally, in December 2018, the company acquired Transnorm, enabling quick expansion into the European market and adding the offerings of an experienced market leader to its ecosystem.

By strategically developing, acquiring, and partnering, Honeywell rapidly scaled its supply chain automation capabilities. The benefits of the company’s warehouse automation ecosystem has been lucrative: For Honeywell Intelligrated, leaders forecast double-digit CAGR through 2023.16 This ecosystem allows Honeywell to operate in an e-commerce market that is rapidly growing (15 percent CAGR expected through 2023),17 and service roughly two-thirds of the top 50 US retailers and 60 percent of the top 100 global retailers.18

Conclusion

As the digital industrial revolution progresses at a dizzying pace, solution providers should take an increasingly ecosystem-driven approach to provide end-to-end offerings, and will likely need to employ a mix of develop, acquire, and partner tactics. Right now, companies frequently overlook, or purposely avoid, even the possibility of innovative ecosystem partnerships, not wanting to lose control or feeling too daunted by the complexity. But the potential benefits of participating and shaping ecosystems are tangible and indisputable. Ecosystems hold the key to unlocking growth: accelerating time to market, providing learnings, and generating enterprise value.

© 2021. See Terms of Use for more information.

Explore more on Industry 4.0

-

Trend 9: Leadership in an Industry 4.0 world Article5 years ago

-

Ethical tech Article5 years ago

-

Industry 4.0: At the intersection of readiness and responsibility Article5 years ago

-

Tech Trends 2025 Article4 months ago

-

The connected defense: Elevating the fight against financial crime Article5 years ago

-

Steering into Industry 4.0 in the automotive sector Article5 years ago