Electric vehicles Setting a course for 2030

The sales of battery electric and plug-in hybrid electric cars tipped over the two-million-vehicle mark for the first time in 2019. In this Deloitte report, we take a new approach to market segmentation and exemplify how to seize opportunities and manage risks.

Before the COVID-19 pandemic shook up the automotive industry – along with every other industry – electric vehicles were moving steadily into the spotlight. The combined annual sales of battery electric vehicles and plug-in hybrid electric vehicles tipped over the two-million-vehicle mark for the first time in 2019. This much-anticipated milestone may have become overshadowed by economic uncertainty and changed consumer priorities, but there is value in taking stock of the electric vehicle market even now.

Learn More

Explore the Future of Mobility collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

Since Deloitte last presented a forecast for electric vehicle (EV) sales, in January 2019, the EV market has made great strides, and not just in terms of sales. OEMs have invested billions to deliver new electrified models, from R&D to factory redesign. Consumer attitudes have evolved. Government interventions have pushed forward and pulled back. But then COVID-19 completely disrupted global sales and manufacturing. In this context, a revised forecast based on updated data is needed.

By examining the current state of the EV market worldwide and noting the many factors fostering growth in various directions (Part 1 of this report), we have formed conclusions about how the market will take shape over the next decade. The significant growth of EVs leading up to 2030 will present major opportunities and challenges for traditional original equipment manufacturers (OEMs), new-entrant OEMs, captive finance companies and dealerships. In particular, traditional OEMs will find insights in this report that can help them re-prioritise their customers and strategies in a volatile competitive landscape.

Paramount to seizing opportunities and managing risks is taking a new approach to market segmentation. We detail one such approach in Part 2 and apply it as a use case to one major market, the United Kingdom, to inform and inspire OEMs and other stakeholders globally. By letting today’s insights fuel the journey for the next ten years, we can accelerate beyond the obstacles the pandemic has brought and toward a future where EVs take centre stage.

* In this report, we use the term electric vehicles (EVs) to refer to battery electric vehicles (BEVs), as well as plug-in hybrid electric vehicles (PHEVs).1 Unless specifically stated, our analysis has considered both forms of drivetrain.

- BEVs are powered solely by batteries. They use an electric motor to turn the wheels and produce zero emissions.

- PHEVs are capable of zero-emission driving, typically between 20 and 30 miles, and can run on petrol or diesel for longer trips. As the name suggests, they need to be plugged in to an electricity supply to maximise their zero-emission capability.

Part 1 – Global progress and forecast

The EV market’s collective accomplishments over the past two years offer hope, despite the short-term impact of COVID-19: a pattern of continued growth, which is expected to be sustained throughout the 2020s. As BEV and PHEV sales surpassed two million vehicles in 2019 (see figure 1), EVs staked their claim on a 2.5 per cent share of all new car sales last year.

Looking back at BEVs in 2019, they accounted for 74 per cent of global EV sales: an increase of six percentage points since 2018. This rise was partly stimulated by new, stricter European emissions standards that persuaded manufacturers to favour the production and sale of zero-emission vehicles. Another factor is the advanced state of the BEV market in China, compared to the rest of the world. Although BEVs are still the dominant EV technology in the United States and Europe, they command a smaller share of the market than in China.

Since the last time Deloitte reported on EV sales, significant regional disparities in growth have surfaced. For example, sales of EVs grew by 15 per cent in 2019 compared to 2018, driven by the growth of BEVs in Europe (+93 per cent), China (+17 per cent) and ‘other’ regions (+22 per cent). In contrast, the United States market for BEVs fell 2 per cent (see figure 1). Then, in the first half of 2020, COVID-19 slowed down the growth rate of EV sales, or sent it into decline, across various regions. The speed of recovery is expected to vary by region.

But generally speaking, the course seems clear for growth over the next decade, despite the potential lasting impact of COVID-19 on total car sales over the next three years. To understand how things might continue, we need to understand what’s been taking place across the various regional markets over the past year.

EVs in regional markets

Europe

Europe’s EV sector saw significantly more growth than other regions in 2019. The Nordics and the Netherlands continued to lead the way; Norway achieved 56 per cent market share, and two of the top ten best-selling cars in Holland were BEVs.3 The United Kingdom and some other countries reported triple-digit growth for the year. Favourable government policies and a change in consumer attitudes were the catalysts, driven primarily by growing concerns about climate change.

Climate change rose to the top of many European governments’ agendas. The United Kingdom committed to a target of net zero emissions by 2050, and proposed a ban on the sale of all polluting vehicles by 2035.4 Germany plans to cut greenhouse gas emissions by 40 per cent by the end of 2020, by 55 per cent by the end of 2030 and up to 95 per cent by the end of 2050, compared to 1990 levels.5

Despite the growth seen in 2019, mainstream adoption of EVs has been, so far, hindered by the limited number of models available to the European market and consumer perceptions regarding insufficient charging infrastructure in some regions.6

The outbreak of COVID-19 and national lockdown measures impacted total car sales in Europe, as showrooms closed their doors and manufacturers halted production, but EV sales have held up well in comparison to their internal combustion engine (ICE) equivalents. In the first four months of 2020, in the European Union (EU), demand for new passenger cars contracted by 38.5 per cent, but in April 2020 – the first full month with COVID-19 restrictions in place – registrations of new passenger cars in the EU posted a year-on-year decline of 76.3 per cent, with some major markets reporting declines of over 95 per cent year-on-year.7 But EV sales in Western Europe only fell by 31 per cent in April, with some countries actually reporting modest year-on-year growth – albeit against a low base.8

China

China continues to dominate the EV market, accounting for half of all vehicle sales. Sales in the second half of 2019 turned out lower than previously expected after some subsidies available to Chinese consumers were halved.9 This considerably eroded the consumer demand for EVs, and total yearly sales dropped: PHEV sales fell by 9 per cent and BEV sales fell to a 17 per cent growth rate from 2018 to 2019.10 On a positive note, a slowdown in the sales of ICE vehicles in the region means that the EV market share in China actually increased.

China’s slowdown in the second half of 2019 affected global EV sales figures, but neither the slashed subsidies nor the impact of COVID-19 should impact EV sales significantly in the long term. Chinese authorities announced they would refrain from more subsidy cuts in 2020.11 Meanwhile, other incentives (for example, number-plate privileges in Tier 1 cities) remain, investment is being made in China’s charging infrastructure and there is a continued focus on encouraging Chinese manufacturers to produce and market EVs.

As a result of the COVID-19 pandemic and lockdown measures in place, China saw a 45 per cent decline in passenger car sales in Q1 2020.12 EV sales fell at a faster rate than the total market (by 56 per cent), as consumers stayed home and showrooms closed their doors.13 But the rate of recovery has been swift. By March 2020, Chinese factories had recovered to achieve a production rate of 75 per cent, with 86 per cent of employees returning to work. By April 2020, production had basically been restored to pre-pandemic levels.

Although sales have remained depressed in certain Chinese provinces, recovery has been accelerated by pent-up demand, favourable policies put in place by Chinese authorities and the ability to purchase cars online; total sales actually reflected year-on-year growth in April. This brings hope for a ‘V-shaped’ recovery in China, with many individual EV manufacturers already benefitting from the release of new models.14

United States

After an encouraging start to 2019, falling fuel prices in the United States (a market that already enjoys comparatively cheap private transportation) led to a disappointing second half of the year for EV sales. The United States EV market is almost singlehandedly being carried by the success of the Tesla Model 3 – alone responsible for almost half of all EV sales.15

As in Europe and China, United States car sales fell sharply in the first three months of 2020 as the pandemic took a toll on demand; job losses increased and large swathes of the population were ordered to stay home. The recovery in EV sales is likely to be slower in the United States than in other major regions, as manufacturers delay the launch of new cars and consumers take advantage of low oil prices.

Rest of the world

The world outside Europe, China and the United States is lagging behind in terms of EV sales, for various reasons: a lack of government commitment to EVs, insufficient or unsuitable charging infrastructure, unavailability of EVs and cultural differences regarding mobility models. For example, Japan is a major global car market, but new car sales are dominated by domestic OEMs that have not yet developed the same range of EVs as their European and Chinese competitors. Meanwhile, India, like many markets, is dominated by mass- and low-cost mobility models: an area that OEMs haven’t been able to penetrate so far, because of EVs’ comparative higher price.

2030 sales forecast

With one eye firmly on progress so far, Deloitte has analysed the most recent indicators to develop an up-to-date prediction of the EV market for the next ten years. We know that BEVs already outperform PHEVs globally, and predict that by 2030, BEVs will likely account for 81 per cent (25.3 million) of all new EVs sold. By contrast, PHEV sales are expected to reach 5.8 million by 2030. A recovery from COVID-19 will see ICE vehicles return to growth, up to 2025 (81.7 million), then experience a decline in market penetration thereafter.

Our global EV forecast is for a compound annual growth rate of 29 per cent achieved over the next ten years: Total EV sales growing from 2.5 million in 2020 to 11.2 million in 2025, then reaching 31.1 million by 2030. EVs would secure approximately 32 per cent of the total market share for new car sales (see figure 2). Annual car sales are unlikely to reach pre-COVID-19 levels until 2024. However, the pace of recovery is forecasted to be a result of a slowdown in ICE sales; EVs will continue to have a positive trajectory during the COVID-19 recovery period and may well end up capturing a disproportionate share of the market in the short term.

Deloitte expects that by 2030 China will hold 49 per cent of the global EV market, Europe will account for 27 per cent, and the United States will hold 14 per cent.

The share of new car sales taken up by EVs will vary considerably across markets (see figure 3). We forecast China to achieve a domestic market share of around 48 per cent by 2030 – almost double that of the United States (27 per cent), and Europe should achieve 42 per cent. But this doesn’t tell the whole story. Growth in Northern and Western Europe is expected to outstrip that in Southern and Eastern Europe as wealthier countries (such as the United Kingdom, Germany, France, the Netherlands, Nordic countries) likely invest more in infrastructure and offer greater cash and tax incentives to accelerate initial growth.

EV growth beyond 2030

Beyond 2030, we expect the rate of growth in EV sales to slow. Some markets will be unable to support the transition to EVs in the same way that wealthier nations will over the next decade. Consider that, beyond 2030, one of the key factors in sustaining growth will be the implementation of suitable charging infrastructure. This requires multi-billion-dollar capital investments – achievable in some markets through a combination of public and private investment, but unlikely to be achieved uniformly around the world. In countries that cannot invest in charging infrastructure, we expect the market for ICE vehicles to remain for some time.

Four factors driving growth

Despite the pressure exerted on the market by the COVID-19 pandemic, the long-term outlook for EVs is strong. The significant shift in expected volume of BEVs and PHEVs by 2030 is based on four factors: consumer sentiment, policy and regulation, OEM strategy and the role of corporate companies. All four of these factors saw major changes in direction over the last year, prior to the emergence of COVID-19, and have since been shaped further by the pandemic.

Factor 1 – Changing consumer sentiment

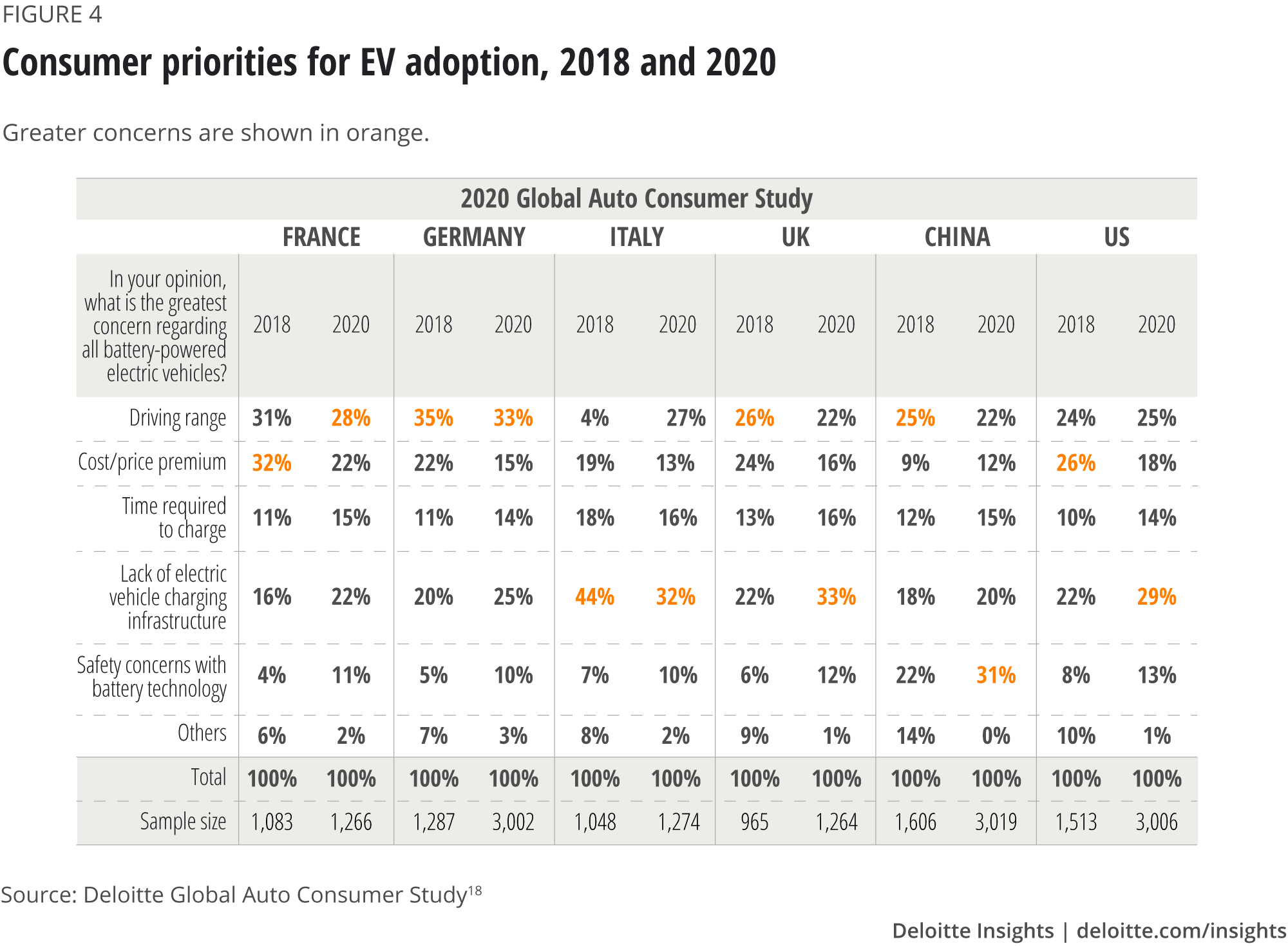

Consumer demand will fuel the growth of EVs but, at the moment, there are several reasons consumers haven’t swapped their ICE vehicles for equivalent EVs. However, as the barriers to adoption are rapidly removed, EVs are increasingly becoming a realistic and viable option. Figure 4 shows how consumer concerns regarding BEVs have changed, and in many instances diminished, since 2018.

From 2018 to 2020, there were some noticeable changes in consumer attitudes toward EVs. Concerns over the cost/price premium have diminished in every country apart from China (+ two percentage points), which has seen cuts in EV subsidies.

Driving range has remained the number-one concern in Germany, and became number one in France, but there are now fewer consumers citing it as a concern in those two markets. Elsewhere, the lack of charging infrastructure has become the top priority for consumers, reflecting the possibility that they are starting to see EVs as a realistic option and are considering the practicalities of ownership.

Over the next few years, we expect some barriers to be completely removed. EVs’ driving range is already comparable to that of ICE vehicles; price has already reached parity, if you consider subsidies in various markets and total cost of ownership; and the number of models available is increasing. As EV sales continue to grow and consumers see more of them on the roads, or travel in EVs owned by family or friends, we expect personal experiences to trump concerns. The expected proliferation of commercial EVs (such as vans, trucks, lorries) should also play a part in reassurance, as will the rise of mass-transit options (such as electric buses).

Measures that governments take in their COVID-19 recovery plans could also affect consumer sentiment. As part of a $146 billion economic recovery plan, Germany has designated $2.8 billion to EV charging infrastructure and announced new legislation that will oblige all fuel stations to have an EV charging point.19 This is significant progress in a country where driving range and lack of charging infrastructure are the two biggest barriers for consumers. China has made similar commitments, announcing an additional $378 million investment in charging infrastructure as part of a COVID-19 recovery plan.20

Factor 2 – Policy and legislation

Government intervention continues to play an important role in driving EV sales, as shown by the successes in Norway, fluctuating sales in the Netherlands and changing fortunes of the Chinese EV market.21 Not only are there economic benefits for states that support a transition to electric, but the positive environmental impact has made the widespread adoption of EVs a necessary step toward achieving climate-change goals, such as those of the 2015 Paris Agreement. Several policies and regulations are helping encourage the growth of EV adoption:

Fuel economy and emission targets

These differ across markets and are under constant review and consultation by governments. Recent Deloitte analysis shows that with the phasing-in of new European CO2 emission targets, which will be fully implemented in 2021 and bring punitive fines,22 half of car manufacturers are facing related penalty payments. They’ll owe a total of $0.5 billion in 2020 and $3.7 billion in 2021,23 which could cost the industry approximately $39 billion, based on recent emission levels.24 Such government intervention is shaping OEM strategy: to avoid fines and reputational fallout, OEMs are seeking ways to reduce emissions through increased electrification.

City access restrictions

City governments have led the way on imposing bans, or punitive taxes, on users of older combustion engines, addressing increasing concerns about toxic air pollution. In 2019 more cities followed the path already taken in Madrid, Mexico City, Rome and Seattle: Amsterdam, Brussels and Barcelona all took action to reduce the number of ICE vehicles on the road. Several United Kingdom cities also brought forward plans for bans and zero-/low-emission zones. Throughout 2020 we expect this trend to continue as cities worldwide grapple with air pollution and confront their relationships with combustion engines – and private cars in general.

Financial incentives

Many governments have offered compelling financial incentives to make the electric switch, such as providing cash subsidies to consumers buying low-emission vehicles, reducing taxes on EVs and increasing or maintaining taxes on ICE vehicles. But as EVs reach price parity with ICE vehicles, some governments have explored rolling back such incentives; this can have a dramatic and immediate effect on EV sales, as seen by the recent fluctuations in sales in China and the Netherlands.

Instead, in light of COVID-19, the need to stimulate total new car purchases has prompted a range of new financial incentives introduced across major markets, some of which clearly favour EVs. For example, in Germany the government has temporarily lowered VAT from 19 per cent to 16 per cent on low-emission vehicles and doubled existing subsidies to almost $7,000 on EVs costing less than $45,000.25 In France, private consumers who buy electric cars (that cost up to $50,000) now receive an almost $8,000 incentive, up from around $7,000; those looking to get rid of their old cars now receive double the previous value offered by a scrappage scheme, which was designed to get less-efficient models off the road.26 Under both schemes, a consumer replacing an older car for a new EV could be eligible for up to $13,500. Meanwhile, in China, EV subsidies and tax break policies set to expire in 2020 were extended to 2022 in a direct response to the economic impact of COVID-19.27 In the long term, the viability of financial incentives will need to be reconsidered as the economic recovery from the pandemic becomes clearer and governments try to manage other concerns, such as potential lost fuel-tax revenues.

Factor 3 – OEM vehicle strategy

In the past year, some prominent OEMs have announced strategic commitments to EVs (see figure 5). New models have been announced, production targets increased and sales targets moved forward and multiplied.

In the short term, COVID-19 may hinder some OEMs in their reach for these targets, as they conserve cash and divert investments elsewhere in the business. But in the long term, we expect these targets to continue as priorities for OEMs. The impact of the investment and targets shown in figure 5 will represent a seismic market shift over the next decade, in terms of availability and affordability of models.

Availability of models

Recent company announcements have made it clear that there will be substantially more EV models commercially available over the next decade than previously thought. According to statistics cited by the European Federation for Transport and Environment, Europe should expect 33 new models in 2020, 22 in 2021, 30 in 2022 and 33 in 2023.29 This means that BEV models available in the EU will surpass 100 in 2022 and reach 172 in 2025. In the United States, IHS Markit predicts there will be 130 available models by 2026, offered by 43 brands.30

Affordability of models

Achieving price parity with, or even savings over, ICE vehicles will play a big role in speeding up EV adoption, especially as model ranges and marketing priorities adapt to manufacturer emission targets. A key takeaway from monthly sales figures in 2019 is just how sensitive consumers are to the relative total cost of ownership when it comes to EVs versus ICE vehicles. This includes upfront costs (as seen in the Chinese EV sales drop when subsidies were cut) and short-term costs, like fuel (as seen in the United States, where EV sales dipped right along with fuel prices). Based on recent company announcements, over the next decade we expect to see EVs – particularly BEVs – become available at the low-cost end of the market, but the roll-out of EVs across all parts of the market is likely to be uneven.

Even with more OEMs offering affordable EV models, consumers are still unwilling to pay a premium for an EV instead of its ICE equivalent. However, we expect the existing price premium associated with EVs to be consigned to history sooner rather than later. In some cases, the total cost of owning a BEV or PHEV for private buyers is already less than for the ICE equivalent, and the annual cost of ownership is also balancing out. Meanwhile, for businesses and customers that use company car schemes, favourable tax schemes have already created an environment where EVs can offer savings.

Factor 4 – The role of corporate companies

We are seeing an increasingly important role for corporates to support the transition to EVs, using the three factors highlighted above to their advantage. Sales of new cars to businesses represents a significant proportion of all cars sold. For instance, Deloitte previously predicted that corporates would account for 63 per cent of total new car sales across Western Europe by 2021.31

In the past year, purpose has continued rising to the top of the corporate agenda, with an increasing number of companies seeking to differentiate themselves by acting as a force for positive change. Because travel is a major avenue for businesses to alleviate emissions, more and more companies are considering how they can support a shift to EVs.

Traditional company car schemes are ripe for reinvention: By exploring broader mobility options, businesses are finding value not just in emissions reduction, but in cost savings and improved employee satisfaction. Government tax schemes that target company cars put the emphasis firmly on businesses to lead the way in the shift to EVs.

In light of COVID-19, investment in fleets has stalled dramatically as corporates reduce their expenditure and prioritise other investments. Before a comprehensive transition to EVs can take place, business confidence needs to be restored and funds made available again. Corporates also need to consider how fundamental changes to how and where work is done will affect the structure of their mobility schemes.

Part 2: New landscape, new approach

In our previous report, we identified unprecedented levels of competition that threatened incumbent OEMs as the shift to EVs began taking shape.32 That threat has reduced somewhat over the past year as those OEMs doubled down on their investment in the sector, and as the reality of competing in the automotive industry hit home for new market entrants.

In China, for instance, 486 registered EV manufacturers have raised over $18 billion in funding since 2011, but their collective manufacturing capacity is unsustainable – considering all reasonable sales forecasts.33 As a result, we expect to see consolidation of the market; some new entrants will fail, and the number of partnerships and joint ventures between Chinese manufacturers and Western OEMs will rise. Outside China, many established OEMs are actually investing in start-ups to take advantage of the capabilities they’ve built.34

Despite the marginal decline in the threat from new entrants and start-ups, there hasn’t been a consistent speed at which incumbent OEMs have reacted to, and planned for, the growth of EVs. The ability of some manufacturers to swiftly accommodate the future of EVs, and trade in their traditional approaches for creative thinking, means that the competitive landscape will likely re-arrange itself accordingly.

Segmenting the market

In an increasingly competitive marketplace, all automotive industry stakeholders – established OEMs, new entrants, captive finance houses and dealerships, for example – should consider how they can convince consumers to purchase an EV – or, specifically, their EV. The obvious choices are to ensure current customers remain loyal during the transition from ICE to EV, or to convert new customers to an EV brand or product. A valuable exercise to achieve either objective (or both) is through a refreshed customer segmentation approach: Targeting consumers by their behaviour and needs.

In the sections that follow, we’ve used the United Kingdom as a use case for market segmentation, based on Monitor Deloitte’s GrowthPath® Action Segmentation®.35 Although there are significant differences worldwide when it comes to the structure of the automotive industry, the retail market, the readiness for EV adoption and consumer attitudes and behaviours, the principles of segmentation outlined below can be applied to many major markets. For those where they cannot, the central tenet remains true: Refreshing your consumer segmentation approach can benefit EV sales, stimulating the overall growth of the market.

Use case: United Kingdom

In November 2019 Deloitte conducted a survey of 1,496 United Kingdom residents who are thinking of buying a car in the next three years. More than half of respondents were considering an EV – significantly more than those considering a petrol or diesel car (35 per cent). But their intention doesn’t mean an automatic conversion into purchases. Although sales of EVs in the United Kingdom are rising, BEVs and PHEVs combined still only commanded a 3.1 per cent share of the market in 2019.36

It’s clear that there is an opportunity here to put consumers under the microscope, discerning certain characteristics that will aid in market segmentation and boost EV conversion. Our goal of meaningful and actionable segmentation begins with the United Kingdom survey results: Based on the opinions of these buyers, we can create a segmentation framework based on driving behaviour and a mix of consumer and demographic variables (see figure 6).

In the United Kingdom, the most prominent differences in behaviour and attitudes identified in our survey were determined by how old a consumer is, how much they spend each month and whether they currently own a car or not. Behaviour and attitudes also varied significantly, based on how respondents plan on using their next car and the distances they regularly travel.

From the framework, we can see nine potential segments that can categorise future car buyers, all with various meaningful characteristics, behaviours and needs to target and address (see figure 7). To calculate an approximate market size for each segment, a recent industry study offers insight: 56 per cent of adults (17 years and older) believe they will definitely or probably purchase a car in the next three years – a total addressable market of about 30 million people.38

* Using the annual average GBP/USD exchange rate for 2019, <£299/month = <$382/month and +£300/month = +£383/month

Key behavioural differences

This kind of segmentation provides a detailed understanding of modern automotive consumers’ needs, wants and behaviours. Before defining the nuances of each United Kingdom segment by creating Customer Portraits®, let’s consider the obvious differences in key behaviours and attitudes:

- Brand loyalty: Segments E and G are the most brand loyal, usually buying the same brand (47 per cent and 46 per cent, respectively, versus the average 27 per cent); this translates to their intended purchasing behaviour – both types of consumer believe they would buy an EV from their current brand (48 per cent and 64 per cent, respectively, versus the average 37 per cent). Segments F and I are most likely to consider switching brands to find a more suitable EV (47 per cent and 49 per cent, respectively, versus the average 36 per cent). Segment A is most likely to consider choosing either an EV start-up brand (42 per cent versus the average 25 per cent) or an existing brand not currently associated with automotive products (12 per cent versus the average 5 per cent).

- Research: Segment E is most likely to already know what car they intend to buy prior to researching (50 per cent versus the average 28 per cent). Segment A and Segment I are the least likely to know (40 per cent each versus the average 26 per cent).

- Ownership benefits: Segment B is the most likely to think environmental reasons are the biggest advantage to EVs (22 per cent versus the average 17 per cent). Segment A considers driving experience to be the biggest advantage (36 per cent versus the average 27 per cent).

- Price sensitivity: Most segments would pay more for an EV. Segment E is the most likely to pay £100 ($128) or more per month (15 per cent versus the average 5 per cent). Segments F and I are the least likely to pay more for an EV (28 per cent and 35 per cent, respectively, versus the average 23 per cent).

These characteristics are worthy of careful consideration in the next step of the segmentation exercise: building Customer Portraits.

Customer Portraits: Driving a change in behaviour

Building a Customer Portrait for each target segment invites insights into key aspects of a consumer that, when viewed collectively, explain their behaviour. It outlines what they do and why they do it, identifying the motives for, and barriers to, behavioural change – or lack thereof. Ultimately, this allows an OEM, captive finance company or dealership to effectively target and encourage desired behaviours by revising marketing and activation strategies.

A detailed analysis of survey responses and additional qualitative research informs the individual profiles. Each illustrates a typical consumer in a segment, defines their key characteristics, and then uses the distilled information to present ways that persona can be specifically targeted. As an example, we built three Customer Portraits for segments of United Kingdom–based consumers, complete with suggested actions for OEMs.

Prioritise to drive purchases

Having developed these nuanced Customer Portraits, OEMs and other stakeholders can drill down into the observations to draw conclusions about who is likely to buy what. This will highlight segments to prioritise and where marketing and proposition development budgets can be deployed most effectively.

Some segments are naturally more interested in purchasing an EV than others; OEMs and their partners may look to target them first – if the right product mix, capabilities and insight are available to do so effectively. In our United Kingdom example (see figure 8), Segment G is the most likely to consider buying an EV (69 per cent versus the average 50 per cent) – perhaps not surprising, given the relatively higher price tag of EVs up to this point and the greater likelihood of those consumers having off-street parking (77 per cent versus the average 72 per cent).

Segment C is also significantly more likely than other segments to consider an EV, but these consumers’ motives seemingly relate to the distance they regularly travel and their awareness of potential ownership savings (e.g., through lower fuel costs and reduced maintenance costs).

The impact of COVID-19 on consumer behaviour

Deloitte’s segmentation of the United Kingdom market was performed prior to the emergence of COVID-19. It is important to consider how shifting priorities, in light of the pandemic, may affect the different segments.

In the United Kingdom, lockdown measures took consumers out of the automotive retail market for an extended period of time. Even as restrictions are eased, financial concerns may shape how people re-engage with the sector, and to what extent. Lingering health concerns will likely also play a pivotal role in consumer behaviour.

Short-term demand for EVs is likely to change, within and across segments. According to consumer research carried out by Deloitte bi-weekly, throughout the pandemic, close to half of United Kingdom consumers now plan to own their current vehicles for longer than originally intended.42 (The number of consumers aged 18 to 34, or 55 and over, who expressed this sentiment is marginally lower than other age groups.)

With work travel being a key component of our segmentation, it is also worth considering how COVID-19 is changing how we travel to and for work. The recent research highlights that over two-thirds of consumers plan to limit their use of public transportation in the future, and well over half plan to limit their use of ride-sharing apps. In the short term, this will likely accelerate demand for cheap second-hand cars, but in the long term this could translate into increased demand for EVs within Segment A.

COVID-19 might also prove to be a catalyst for the growth of online sales within different segments. Our COVID-19–related research shows that a fifth of consumers now plan to buy their next vehicle online (if possible). This figure is consistently higher among 18- to 34-year-olds, suggesting that Segments B, C, D and E could all demonstrate a significant jump in demand for online services.

Checklist for the journey ahead

Ultimately, it’s up to all stakeholders in the automotive industry to consider how they can best serve their prioritised segments. Consumer interest has been sparked, and the onus now lies with new-entry OEMs, captive finance companies, dealerships and, especially, established OEMs to feed the fire.

To maximise the opportunities presented by the growing demand for EVs, business leaders in all regions should examine the priorities they have defined according to the segmentation exercise and ask themselves the key questions shown below. The answers may help soften the blow COVID-19 is making on the market and/or aid in the recovery. They’ll also highlight how well-positioned the business is to help accelerate growth in the EV market and reap the benefits when EVs take centre stage.

Established OEMs:

- How well does our existing model range fit the segments we deem high priority, and on which segments should we focus future models?

- Do we have the right EV supply chains and order-to-delivery capabilities to realise our promises to customers, especially in the initial launch phase?

- Can we support, or even drive, change in our franchised dealerships by delivering more compelling in-store EV marketing and increasing model availability?

- How do we make sure that our franchised dealers are aligned with our EV strategy? How can we incentivise them to sacrifice the long-term, recurring profit of an ICE vehicle sale to support the growth of EVs?

- How well does our current branding support new EV model (and broader proposition) launches? Do we have the right marketing and campaign approaches to target specific segments?

- Do we have sufficient in-house capabilities, or the right partnerships, to offer a compelling charging proposition?

- How do we improve our current omni-channel experience?

- What innovative retail formats, online and bricks and mortar, should we invest in?

New-entrant OEMs:

- Some consumer segments will be identified as ‘easier wins’ to build brand and customer intimacy, so how can our product launch plans target these most effectively?

- How can new business models, unconstrained by legacy IT systems and physical footprints, provide an enhanced customer experience as compared to traditional OEMs?

- Will Chinese new entrants need different strategies for launching in Europe?

- How will we continue to engage with customers after a purchase, to receive product feedback and incorporate it into a refreshed sales strategy?

- How will we manage the after-sales business without established dealer networks?

- Are there additional partners that could support market entry and offer a more compelling value proposition, such as energy providers?

Captive finance companies:

- Which financing offers will appeal to which segment?

- What is the best way to manage the wave of incoming ICE vehicles and realise the expected residuals on these?

- Which finance solutions will address customers’ apprehension about switching (e.g., combined vehicle and wallbox-charger financing, or social offers, like cinema tickets)?

- Do we have a compelling offering for our fleet customers to gain regulatory and tax benefits?

- How can our marketing convincingly address ‘range anxiety’ and other barriers to EV ownership?

- Do we have the capability to understand and act on existing EV customers’ feedback and learnings to strengthen our retention programmes?

Dealerships:

- Can we effectively communicate the benefits of EVs to our customers?

- Do we understand which segments want to learn about environmental benefits and which are exclusively interested in technology and performance?

- Do we have the assets to support a more targeted approach to marketing?

- Do we offer a financially compelling reason to switch to EVs while maintaining an appropriate margin on the vehicles?

- Can we fully explain all the available government grants and financial packages available for EVs?

- Can we offer ongoing maintenance and service packages or deals that include funding for at-home charge points?

- Is our business set up to handle an increase in online sales?

- Can we offer collection and delivery services?

- Can we provide test drives to online customers?

- Can we use our existing regional footprint to effectively fulfil online sales?

- Is our business set up to deal with the potential loss of recurring revenue (after-sales service and parts)?

- Are our marketing and sales strategies fully aligned with those of our OEM partners?

Explore more on Future of Mobility

-

Software is transforming the automotive world Article4 years ago

-

Transformation and disruption for automotive suppliers Article5 years ago

-

Keeping London moving Article5 years ago