Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue LX

21 September 2020

Economy

Beijing's policy options when faced with a weak dollar

Though US-China tensions continue to dominate the headlines, global financial markets remain bullish notwithstanding the recent heightened volatilities of NASDAQ. Is their optimism justified? Before we can decide, certain issues need to be examined more closely: 1) how strong is the global economic recovery;2)how will the dollar’s weakness affect the Chinese economy; and finally, 3) against the backdrop of a prolonged low interest rate environment, asset bubbles and likely provocations from the Trump Administration in the run-up to the election (November 3, 2020), what are Beijing’s policy options?

Let’s start with the global economy. This is clearly on the mend despite a resurgence in COVID-19 cases in certain major economies (e.g., France, the UK and Spain). Moreover, as a second lockdown is unlikely to be accepted by the people, most governments are opting for mitigation rather than elimination of the virus. Hence, it is unlikely that this recovery will be reversed in the near future. Perhaps the most telling sign of a global recovery is the surge in Chinese exports in recent months. The accelerated pace of exports by China (7.2% YoY in July and 9.5% YoY in August) suggests that China's export machine is not just being powered by personal protective equipment (PPE) as in Q2 of 2020. In other words, external demand has broadened out.

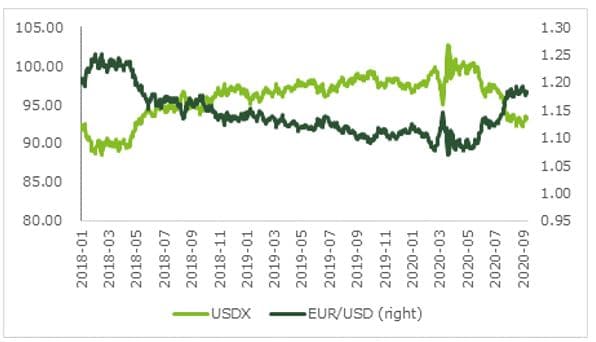

Meanwhile, the global cyclical recovery has further dampened demand for the US dollar. It is an understatement to say that the greenback has been on a roller coaster this year. The year began with a bull-run, with the US dollar going from strength to strength after the pandemic broke out in late January. At the time, the dollar's rally was propelled by extreme risk aversion amongst investors and their growing fears of a debt crisis in some emerging markets and many low-income countries. (Indeed, the dollar's elevated value was seriously affecting the debt-servicing capabilities of many low-income countries, fanning intense speculation over IMF's capacity to bail them out.) But by late March, investors were reassured by many central banks' bazooka tactics (unprecedented commitment of helping consumers and companies). Risk-aversion subsided, and the pressure on the dollar began to tail off, albeit at a lofty level. Though it is clear that the pandemic has reignited protectionism (e.g., export controls of PPE and food by some countries) and deepened mistrust among national governments, on a more positive note, it has also accelerated economic integration in the Eurozone. Thanks to the leadership of Germany and France, and to the EU Recovery Fund which was created on July 21, 2020, the Eurozone has at last been able to make significant progress towards fiscal union. The Euro's rally (EUR/USD has hit 1.20, a 2-year high) was another catalyst for further correction of the USD exchange rate.

Chart: Firm euro, on newly found solidarity in Eurozone, is weighing on the USD

China's cyclical recovery, which is already stronger than most have anticipated, continues to unleash pent-up demand. This, combined with the global economic recovery and a sustained period of low interest rates has set the US dollar exchange rate on a downward trajectory. Of late, the Federal Reserve's signal of weighing more on the labor market (an implicit admission of holding interest rates at current levels for a long period and therefore tolerating a higher inflation) has sown doubt in the minds of investors over the central bank's independence, especially since the presidential election is a mere two months away. Against a backdrop of the market's increasing distrust of fiat money, gold and certain commodities have seen their prices surge, so a sharp rebound of the RMB on the back of the dollar's weakness is hardly going to be surprising.

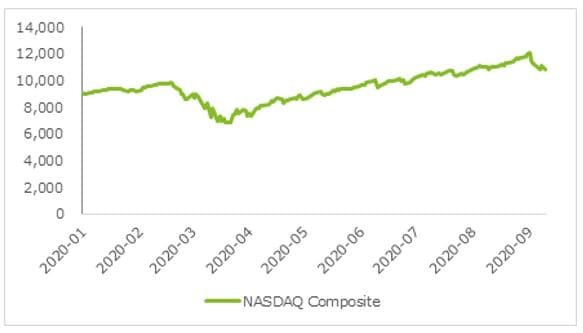

Going forward, how far the greenback falls will depend on factors other than a firm euro and a possible flare-up of inflation. The US market, particularly large Tech companies, could well be susceptible to profit-taking pressures following recent volatility on valuation concerns.

Chart: US-listed tech shares are vulnerable to profit-taking

Could the US Federal Reserve double back on its dovish stance? High valuations of almost all asset classes and ultra-low interest rates have left investors scrambling for yields again. On the other hand, relatively high interest rates in China (10-year government bond yields are over 3% comparing to that of the US at 0.7%) underpin the RMB. Should the dollar tumble further, which currencies are likely to assert themselves? The Euro is an obvious candidate. But there is still a long way to go for Brussels to achieve a true fiscal union. And a COVID resurgence could still see a re-imposition of barriers between member states in the South and the North of the Eurozone. Will investors then turn to the Japanese Yen? The Yen tends to get stronger when there are geopolitical flash-points, but Abe's main policy goal is to reflate the economy which requires a slightly weaker yen. His successor Yoshihide Suga is highly unlikely to change Abe's course. Lacking candidates for safe-haven currencies implies that the dollar's slide could well be flooring soon. If so, what about the RMB? In a post-COVID era, some of China's economic strengths such as a large domestic economy, low dependence on overseas tourism and the capacities of executing economic policies, will become more pronounced. In the absence of overseas travel (equivalent of $250bn per year), China's balance of payments is showing additional upward pressure as the capital account restrictions show no signs of easing anytime soon. If we extrapolate upon overseas travels by Chinese consumers in previous years, we could easily see a reduced demand for the dollar of around $200bn in 2020 assuming there won't be any Chinese tourists for the rest of 2020. The key question for China is how to leverage its vast potential domestic demand while hedging external shocks such as a protracted period of trade tension.

In our view, the best strategy for China at this time is to accelerate trade liberalization. For example, with the Regional Comprehensive Economic Partnership (RCEP) very much close to the finishing line, for China, the bar could be set at the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which entails much greater trade of services. Regardless who will win the US election on November 3, China is likely to be stuck with high tariffs between China and the US in 2021. Should China bring down tariffs with Europe, or cut them uniformly? At a key meeting between China and EU (a virtual summit between EU leaders and President Xi) on Sept 14, 2020, the EU admitted to seeing China as a "systemic rival" who nonetheless offers great opportunities. If Biden wins the US election, Washington could well take a fresh look at CPTPP, implying greater pressure for China to liberalize its trade sector. In short, pressure for China to improve market access on the ground of "reciprocity" is unlikely to go away. Assuming the global economy recovers in 2021 and cross-border restrictions are to be eased as well, China could also see a mild current account deficit in 2021. In this vein, it would be better for China to increase imports by lowering tariffs. Moreover, as this will be seen as continued commitment on the part of Beijing to keep the phase-one trade deal with the US relevant, this will win kudos. In conclusion, a strong RMB could anchor portfolio inflows and lay the ground for the PBOC to cut reserve requirement rates (another two to three times in the foreseeable future). As China could easily see a reversal of higher demand for the greenback in 2021 which would weigh on RMB, a too-strong RMB would therefore be less desirable since China values the relative stability of yuan exchange rate.

Energy

China's Oil trade goes from import spree to export push

In the months to come China's imports of crude oil will be slowing down while exports of refined products are set to increase.

China’s import of crude to slow

In July 2020 China imported 51.29 million tonnes (376 million barrels) of crude oil, a big increase of 25% year-on-year. This comes on the back of strong growth in crude imports. From January to July, China's crude imports grew 12% to 320 million tonnes (2,346 million barrels) even though the domestic market took a massive hit in QI during the COVID-19 lockdown and more recently, due to flooding in some parts of China.

The increase of imports was primarily driven by strategic stockpiling as China capitalized on the crash in the price of crude oil. Both State-owned and private players in the sector were encouraged to participate in the nationwide stockpiling efforts. There has been a growing number of oil tankers off China's ports being used as floating storages.

However, China's buying spree is losing steam as storage space gets filled up. According to industry analysts, as of July, China's strategic petroleum reserves and commercial storage is showing signs of having reached their capacity. Bloomberg also reported in July that China had begun to sell crude oil from its storage facilities which it purchased at very low prices in the spring.

Another factor that affects China's oil imports is independent refiners, who have been among the most active buyers. Oil imports of independent refiners have dropped up to 40% compared to the May-June period as they have run out of import quotas, according to ICIS-China.

Some industry observers may argue that China will continue boldly buying from the U.S. as China has agreed to purchase at least US$52.4 billion worth of US energy products in 2020 and 2021 as part of the Phase One trade deal. We believe, however, the record-high monthly imports of oil from the U.S. was not so much driven by China's motivation to fulfill its agreement obligations as the result of bargain-hunting for cheap oil during the March-April price rout. To what extent China will fulfill its phase-one obligations remains unclear as tension between two countries has escalated.

Competition to intensify in oil product exports

As the stockpile of crude increases, refiners have been maintaining relatively high run rates to digest inventories. But the current sluggishness of the domestic market will most likely push refiners to look for new export markets. Hence, China is expected to export 1.3 - 1.5 million tonnes (10.8-12.5 million barrels) of gasoline in August while gas-oil exports could possibly hit 2 million tonnes (16.7 million barrels), according to Platts. In comparison, China exported only 676,000 tonnes (5.6 million barrels) of gasoline and 1.45 million tonnes (12 million barrels) of gas-oil in May.

The tipping point where exports are concerned will come when the new refinery capacity of 800,000b/d is brought online over the course of 2020. In addition, a lifting of the export ban for private refiners is expected in the latter half of 2020. If implemented, it may be a game changer for China's non-State refiners, incentivizing stronger runs and more investments.

Geopolitical issues are also likely to intensify competition in the export market. India announced that it will halt oil product imports from China, which means that Chinese refiners may find it harder to find overseas buyers for their surplus output.

Potential risks exist

The slowdown of China's crude imports will be a test of the resilience of the global oil market. There is the potential risk of another wave of oil price volatility as most of the world is still in lockdown and OPEC+ members will add supplies after production cuts.

Trade risks are also likely to increase. China will need to import 1-3 million b/d to fulfill Phase One provisions, a significant increase compared to the 192,000 b/d from the US over the 2018-2019 period. Meeting the trade deal targets in full is challenging for China under current price conditions.

Meanwhile, competition in the refinery sector continues to grow. China has the largest refining capacity in Asia and ranks second in the world, behind the US. Growing competition from commissioning of new refineries both within and outside Asia will require continued investment in upgrades.

Education

New challenges and opportunities for vocational education

China’s vocational education system is divided into two main categories: the diploma track and the non-diploma track (vocational training). The diploma track is parallel to high school and a bachelor's degree in the general education system while vocational training includes vocational skills training for individuals, vocational credentials training and internal management training of enterprises. With a relatively large variety of course offerings targeted at an audience group who is either already employed or about to enter the workforce and who has the ability to pay and to learn independently, vocational education will thrive given the persistent demand.

Since 2019, there has been an increasing amount of policy support for vocational education. Policies to expand the scale of vocational colleges of higher learning, post-secondary school and master's degree programs have been introduced one after another. During the Two Sessions in May, Premier Li Keqiang in the government’s key work report proposed once again to expand enrollment at vocational colleges of higher learning to 2 million students between 2020 and 2021, and vocational skills training to more than 35 million people. In July, the central government allocated funds worth RMB 25.711 billion for their modernized `vocational education quality improvement’ plan, an increase of 8.4%, or RMB 1.99 billion, over the previous year.

Given the favourable policy environment, capital markets are also expected to embrace vocational training enterprises coming to the market for funding, especially after the successful IPO of the vocational education and training company Dongfang Education. Their success also bodes well for future IPOs of more enterprises in IT training, automotive services, financial accounting and other niche fields. At the same time, the rapid development of vocational education has also attracted many companies across different industries. As cross-industry representatives of Internet companies, online recruitment companies such as Zhaopin, online service companies such as Meituan, and Kuaishou (a short video company) have entered the field of vocational education.

Adapting to the development of new models and new business formats

At present vocational education remains rather traditional and focused on awarding diplomas and degrees. It needs to be more career oriented and provide training for careers in new technology related fields. The new generation of information technology promotes the transformation and upgrading of traditional industries. Moreover, it has given birth to new models of business and industrial formats, and created not just more jobs but new categories of jobs such as "Internet Marketers", "Blockchain Engineers", "Digital Workers" and "Artificial Intelligence Trainers". This was even announced by the Ministry of Human Resources and Social Security, a sure badge of recognition for the new technology related job opportunities. In August, the Ministry of Education announced that it will carry out a revision of vocational education professional catalogs and promote the upgrading and digital transformation of vocational education majors to dovetail with the demands of new industries, new models, new technologies and new occupations.

Moreover, in recognition of the fact that learning has no age limit, vocational education is being extended to all age groups and industry segments. As people's quality of life improves and we witness a greater differentiation in lifestyle and occupational choices, the size of niche and segmented occupational groups will expand as well. Demand for skilled professionals such as electricians, carpenters, bartenders, photographers, etc. will grow, giving rise to a demand for more types of vocational training. In addition to vocational skills training, people have also begun to pay attention to hobby education. According to the "2019 white-collar vocational training satisfaction survey", white-collar purchase of hobby training reached 26.84%, second only to adult education and skills upgrade. At the same time, the establishment of new technical specialties and the integration of new technology also make China's vocational education industry more diversified as vocational education will gradually have to cater to all age groups and industry sectors. This includes adult/juvenile vocational skills education, adult education, adult hobby education and so on.

New challenges for vocational education

The rapid development of China's economy requires a rapid evolution of vocational education and higher education. There are two major challenges in the current vocational education system.

- First, there exists a current shortage of technical talents nationwide. Of the nearly 170 million skilled workers (skilled laborers) in China, less than 48 million are highly-skilled workers, leading to a technical talent gap of about 20 million, which, to a certain extent, has become a prominent factor restricting the improvement of China's industrial structure. In the future, the country will focus on cultivating practical, professional and skilled talents to fill the gap, especially in fields that are of vital national interest.

- Second, there is a big gap between the skills provided by educational institutions and the needs of enterprises. The development of modern technology, particularly information technology, has made operation of a business more complicated. This puts much greater pressure on vocational education as the skills formation process has to be not only about training people to master a simple set of skills but also about a comprehensive training of mental and intellectual abilities. At present, the demand for skilled workers in emerging strategic industries, 5G, artificial intelligence, machinery/manufacturing and other industries that adapt to the current state of development of society is growing. If the vocational education system wants to achieve long-term growth, it should find, meet and create demand in these emerging strategic industries.

Retail

Retail demand gets a renewed impetus

In July, total retail sales of social consumer goods continued to show signs of recovery as the decline narrowed to -1.1%. Online sales in July, however, saw a steep decline when compared with June figures, but this was due mostly to consumers, stimulated by overwhelming discounts and sales in June and having indulged in shopping sprees, deciding to make a pause in July. Meanwhile, offline product sales (through brick-and-mortar outlets) increased by 4.2% month-on-month in July. This was mainly due to the continuous growth of consumer demand for personalized products based on offline experience and services. In terms of product categories, most categories showed growth in retail sales. The exceptions were household goods, household appliances, apparel, footwear and accessories. The Mid-year sales festival, the “618 Promotion Campaign” and other deep-discount events in June successfully capitalized on the pent-up demand of the previous lockdown period. Plus, summer is normally the off-peak season for categories of household goods, household appliances, apparel, footwear and accessories.

Overall, we can say that driven by consumer retail technology and national policies, the Chinese consumer market has started to show the following new trends:

- Private online domain traffic channels are favored by consumers. At present, online shopping mini programs based on WeChat or Alipay are fast becoming an emerging channel for consumers to shop online. Since the outbreak of the pandemic, consumer brands and retailers have increasingly become aware of the importance of consumer data, as it provides valuable information about their consumers and their lifestyles. As a result, they built private online domain traffic channels such as the WeChat `mini program’ so that they can track changes in consumer’ behavior and keep up with changes in demand. What took them a little by surprise was the number of consumers who purchased goods as a result of the WeChat mini programs. As of the end of June, total monthly active users of the WeChat Mini Program for online shopping exceeded 586 million. Among major horizontal e-commerce players, 24% of Pinduoduo monthly active users and 22% of JD monthly active users come from WeChat mini programs. In addition, the WeChat mini programs also aided the rapid development of fresh produce e-commerce after the outbreak. At the end of June, both volume and growth rate of fresh produce e-commerce users using WeChat mini programs were significantly higher than those of other fresh produce e-commerce apps.

- New developments in retail demand, supply and business models create a resurgence after the pandemic. The pandemic provided an opportunity for China's new consumer brands to restructure the marketing and supply side of their businesses. The resurgence of demand after the lockdown was lifted gave these businesses the opportunity to test their new marketing and supply structures under normal market conditions. Three months on, consumer demand for personalized and high-quality products continues to increase rapidly; on the supply side, data-driven consumer goods companies are better able to adapt to changes in consumer behavior, improve products and even introduce new demand driven products while simultaneously tweaking their marketing strategies; in addition, social media such as live-streaming and short videos also boost the visibility of China’s emerging brands. This has led to greater interest in capital markets. According to ITjuzi, after the outbreak, cosmetics, food and beverage, and apparel and footwear brands including Perfect Diary, GOSO, Simple Love Yogurt, Wang Baobao, and iHuayin each raised no less than RMB100 million in new rounds of funding.

- The Duty-free economy booms. To stimulate a post-epidemic recovery and boost consumption, the Chinese government has taken steps to push the development of the duty-free economy. First, a new duty-free policy was launched in Hainan Province. Subsequently, the department store group “Wangfujing” successfully obtained a duty-free license. According to the official website of the General Administration of Customs, since the beginning of the new duty-free shopping policy for visitors, until July 27 the Customs office had welcomed 281,000 shopping visitors and handled a total of RMB 2.219 billion in duty-free sales on the Hainan islands, an increase of 234.19% and 42.71% respectively compared with the same period last year. This phenomenon clearly indicates that Chinese consumers have a strong appetite for quality and high-end products. In the coming months, we expect to see rapid growth in the duty-free sector. Not only will we see a transformation of traditional offline businesses on the Hainan islands, duty-free business and intra-city duty-free businesses and online duty-free businesses based on information technology retail will also shown robust growth. China Duty Free Group recently launched its WeChat mini-program online flash-sale while the Duty Free Shops Group (DFS), a subsidiary of LVMH Group, recently acquired a 22% stake in the duty-free cross-border e-commerce brand iDuty Free of Shenzhen International Freedom Group to enter into the online duty-free business.