Making the future of mobility work: How the new transportation ecosystem could reshape jobs and employment Deloitte Review, issue 21

31 July 2017

Burt Rea Global

Burt Rea Global Stephanie Stachura United States

Stephanie Stachura United States Laurin Wallace United States

Laurin Wallace United States Derek Pankratz United States

Derek Pankratz United States

From truck drivers to eldercare professionals, occupations of all sorts are facing shifts driven by the future of mobility’s vision of widespread ridesharing, autonomous vehicles, and the seamless integration of different modes of transportation.

The basic fact is technology eliminates jobs, not work. —Report of the National Commission on Technology, Automation, and Economic Progress, 19661

Employment and jobs in the future of mobility

LEARN MORE

Subscribe to receive Future of Mobility content

Visit the Future of Mobility collection

Read Deloitte Review, issue 21

The future of mobility promises to transform the way people and goods move about, as shared and autonomous vehicles could offer the opportunity for faster, cleaner, cheaper, and safer transportation. Accompanying those potential changes could be dramatic shifts in the workforce. When transportation modes are profoundly changed, what are the implications for the almost 7 million US auto workers and nearly 4 million professional drivers? How might the future of mobility affect the numerous ancillary jobs that largely hinge on how transportation is provisioned, such as warehouse workers and public works employees? As mobility is expected to increasingly shift from being product-centered to being service-centered, and data could play an ever-greater role, how can companies and governments prepare and adapt their workforces to meet those potentially changing demands?

This article explores how the future of mobility could impact companies’ talent needs and the broader workforce. It begins by examining the social and technological shifts that seem to be leading to a new mobility ecosystem. It then identifies the overarching trends that are likely to impact labor across the mobility landscape. Finally, the article looks at a handful of specific sectors—automotive, trucking, and eldercare—to provide a glimpse at how these trends might play out in different contexts. The aim is to examine which jobs are likely to be most affected, what new opportunities could arise and what skills would be needed to realize them, and how organizations can prepare themselves and their people for both the future of mobility and the future of work.

Over the long run and in the aggregate, there is reason for optimism. As MIT economist David Autor notes, while “there is no fundamental economic law that guarantees every adult will be able to earn a living solely on the basis of sound mind and good character,” historically the demand for labor has tended to increase as technology advances.2 The journey is seldom a smooth one, however, with disruption often leading to wage polarization3 and the potential for significant economic, political, and social turmoil.4 As stakeholders in the emerging mobility ecosystem ponder how to forge tomorrow’s workforce, it’s worth remembering that the Luddites were not protesting against technology per se but, rather, against its application: “They wanted these machines to be run by workers who had gone through an apprenticeship and got paid decent wages. Those were their only concerns.”5

To that end, stakeholders across the mobility ecosystem would do well to “embrace the disruption” of increased automation and innovation for their business models and workforces. Bringing employees along for the journey is essential to capitalizing on these opportunities: To navigate this technological frontier, companies can look to create continuous learning, evolve skill sets, and retune and rethink jobs.

Historically the demand for labor has tended to increase as technology advances. The journey is seldom a smooth one, however.

Understanding the future of mobility

Understanding how changes in transportation could affect workers first requires an understanding of how the mobility ecosystem might evolve. Converging social and technological trends—in particular, shared mobility and the prospect of autonomous vehicles—are reshaping the way people and goods move from point A to point B.6 In urban areas in particular, shared autonomous vehicles could be integrated with other types of transit, creating a mobility ecosystem that offers seamless, intermodal travel on demand (figure 1).

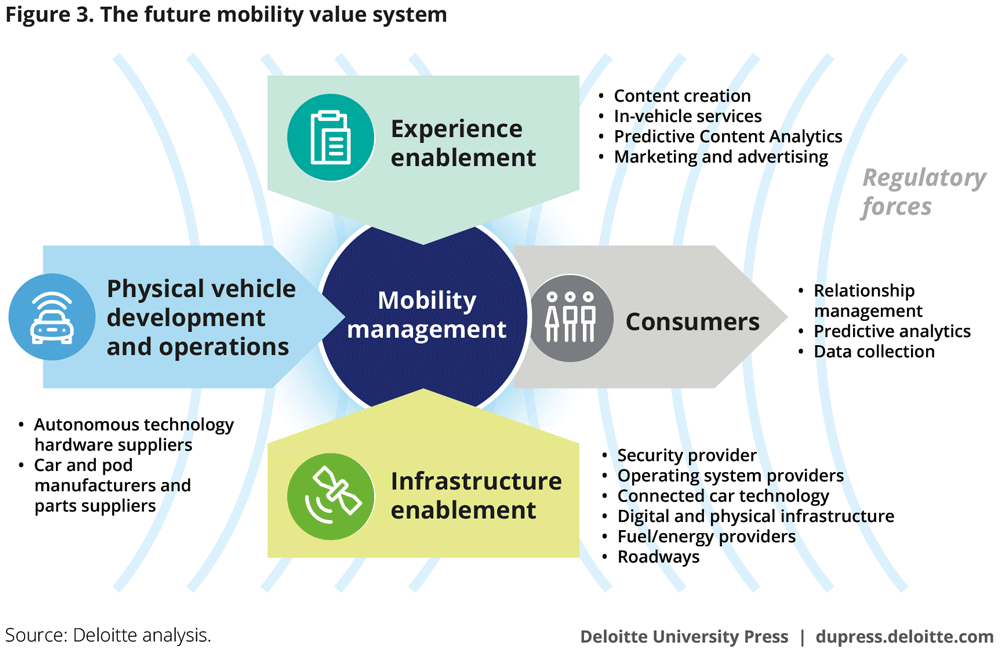

Making that system work will likely require a diverse set of players. Vehicle development is expected to remain critical. The carmaking business will likely give rise to new products, from small utilitarian autonomous “pods” to highly customized, personally owned self-driving cars, which could be even more amenable to automated production than today’s already highly robotized industry. The in-vehicle transit experience could become central: In the United States, drivers spend roughly 160 million hours per day behind the wheel, and much of that time would be freed up by shared and autonomous mobility. “Experience enablers”—including content providers, data and analytics firms, advertisers, entertainment equipment providers, and social media companies—would rush to fill this vacuum and make travel relaxing, productive, and entertaining.

Physical infrastructure enablers could look to provide smart tolling and dynamic road usage pricing as well as traffic flow management. Energy providers and retailers could find themselves managing an increasingly complex supply chain, including battery recharging and replacement. A parallel digital infrastructure could be every bit as critical, as data become the new oil. To succeed in this area, companies likely need to offer seamless connectivity, network security, and a horizontal operating system shared across the ecosystem that can bridge vehicles as well as mobile devices and Internet of Things architectures.

Mobility management will likely be another vital component in the ecosystem. Mobility advisers could aim to enable a seamless intermodal transportation experience, ensuring easy access, a top-notch in-transit experience, a smooth payment process, and customer satisfaction. They could use customer preferences, traffic data, and more to tailor the most convenient and cost-effective mobility plan for each trip. That means developing mobility data collection, predictive analytics, user control, and relationship management.

Clearly, the effects of these changes are expected to spread far beyond the automotive industry, touching everything from insurance and finance to government, energy, and beyond. And as the new mobility ecosystem transforms the way people and goods move about, so too could it transform the nature of work in many areas. Demand for some jobs might fall, existing job tasks could change, new types of jobs will likely be created, and the skills it takes to succeed may shift.

Three drivers of change in the mobility workforce

We see three overarching trends emerging from the future of mobility that could impact what and how work gets done.

Automation and augmentation

Automation is hardly new in the extended global automotive industry. Arguably, it was founded on automation. The assembly line, which segmented and partially automated routine tasks, enabled manufacturers to bring the automobile to the masses roughly a century ago,7 and auto original equipment manufacturers (OEMs) have been at the forefront of deploying many new production processes. But the emergence of increasingly sophisticated cognitive technologies, coupled with the growing ability to cheaply monitor all manner of objects via the Internet of Things,8 suggests the scope of tasks open to machine control could increase considerably.

For the future of mobility, that trend could manifest most dramatically and obviously in the emergence of autonomous vehicles. Self-driving cars and trucks pose a challenge to the more than 3.8 million professional motor vehicle operators in the United States (a figure that likely undercounts the many thousands of part-time and contract drivers for ride-hailing and other services).9 The technology is several years away from market readiness, and adoption is likely to be highly uneven and contingent on both regulation and consumer attitudes.10 Nevertheless, the effects could be profound. Deloitte’s projections indicate that by 2040, more than 60 percent of passenger miles traveled could be in fully autonomous vehicles.11 It’s no surprise that some professional drivers are already organizing to blunt the impact.12

The implications for taxi drivers and truckers may capture headlines, but the effects of artificial intelligence and related technologies on other occupations within the mobility ecosystem would likely be no less profound. For example, vehicle assembly—already highly robotized—is becoming even more automated as industrial robots gain capabilities (such as the ability to “see” using sensors) that enable them to tackle more tasks or take on new forms to assist human workers (such as the “robo-glove” that reduces hand stress from repetitive motions).13 Everything from insurance underwriting to parking enforcement to auto loan origination could see an array of discrete tasks increasingly being executed by some combination of sensors, data analytics, and cognitive technologies.

The size and scope of the impact would likely vary by industry, but figure 2 suggests that a number of mobility-related occupations could be highly susceptible to automation (or “computerization,” in the terminology of the economists who calculated the measure).14 These estimates are meant to be illustrative, not exhaustive or determinative, but it seems clear that automation will likely affect a number of roles across the mobility ecosystem.

From physical to digital, goods to services

Even as new technologies may automate and augment how work gets done, an equally fundamental shift could take place in why work gets done. As personally owned vehicles may be decoupled from the concept of individual mobility, especially in urban areas, so too could value increasingly shift away from physical assets and toward the digital capabilities that enable safe, clean, efficient, and customized travel on demand (see figure 3). As a result, data, networks, software, and services are likely to grow increasingly important in all facets of transportation, which could come at the expense of traditional manufacturing.

There have already been some indications of this shift—for instance, the (pre-IPO) value of ride-hailing service provider Uber exceeds that of long-established automakers.15 Deloitte’s analysis has found that the breadth of future mobility use cases requiring connectivity is expected to generate data traffic of roughly 0.6 exabytes16 every month by 2020—about 9 percent of total US wireless data traffic.17

As value likely shifts from the physical to the digital and from goods to mobility services, so too could what skills are in demand and how they are valued. Those with fluency in the technologies and services essential to the future mobility ecosystem are expected to be sought after and rewarded accordingly—to take just one example, in the auto supply sector, “computer systems software engineer” has been the most-advertised job opening for several years in a row.18 But there is also a challenge: While the technology-focused jobs that will likely define the future of mobility require higher skills, offer better wages, and promise increased productivity, there may be far fewer of them relative to today’s extended transportation industry. That suggests there could be a real need for policy mechanisms to help smooth that transition, including programs such as retraining and income assistance.

Better mobility could drive demand for more mobility

To the extent that technology complements—rather than simply replaces—labor, it can often create a powerful engine for increased productivity and overall job growth. Deloitte’s analysis suggests there is tremendous potential value to be unlocked from a reimagined mobility ecosystem. The cost per mile of transportation could drop by two-thirds relative to today in a world of shared autonomous vehicles.19 As mobility potentially becomes cheaper, faster, and more convenient, new population segments (such as the elderly) can gain access, and overall demand could increase. Deloitte estimates that total US miles traveled could increase by 25 percent by 2040.20 Trucking volumes have increased steadily since 2000, driven in part by the rise of e-commerce,21 and show few signs of abating.

All of this could point to significant demand for jobs, with at least the potential to offset or even negate any attrition that automation or shifting sources of value creation might cause. That employment may come from a greater need for existing types of work, but it is just as likely to be generated from entirely new classes of jobs that have yet to emerge. In economic terms, even in cases where households ultimately spend less on a good (in this case, mobility), they can allocate those funds elsewhere (toward, say, in-vehicle content consumption or mobility management services)22—and jobs tend to follow spending.

Preparing a workforce for the future of mobility

How these three trends might play out could differ dramatically by sector, and so too could best practices for preparing organizations’ workers. Here we explore just a handful of salient examples of how different industries might be impacted, and how companies might best respond.

Auto OEMs and suppliers

Consecutive years of record sales23 are allowing automotive companies to invest aggressively as they start to define their place within the future of mobility. As they explore new business models, alliances, and technologies, this frenzy of activity may also create change and friction within the workforce. New autoworker roles, with different skills and needs, could emerge alongside new organizational constructs such as crowdsourcing and flexible internal talent markets. Catering to these new roles would invariably affect how companies engage and retain the legacy workforce that has defined the automotive industry for decades. The challenge is likely to create a forward-thinking talent model that meets the evolving need to attract, retain, and develop a new digital workforce, while balancing the resulting cultural and operational shifts with the broader needs of the organization.

While automotive companies pursue autonomous vehicles and new business models centered on ridesharing and mobility services, they should also think through the skills they need to capitalize on these big plays. Many have turned to acquisitions as a quick way to build out their ranks in critical areas, but retaining that purchased talent means that automotive companies must cater to a tech-focused talent market that values flexibility, purpose, and experiences.24 These digitally savvy workers are typically comfortable with independence and transparency.25 In return, they often expect a “complete end-to-end experience”26 designed around teams, productivity, and empowerment.27 This could span everything from the ability to seamlessly shift between assignments to using digital platforms that create talent experiences focused on meaningful and purpose-driven work. Career development and internal mobility can start to take on heightened importance, requiring their own frameworks to manage thousands of individualized experiences that are moving just as quickly as the technology surrounding them evolves.

Integrating new types of workers, skills, and capabilities into a legacy tried-and-true model is often no small feat. Campaigns such as Michigan’s “We run on brainpower” aim to pivot perceptions and convince new generations that a Midwestern automotive career can be just as rewarding as one in Silicon Valley.28 But simply adopting the trappings of tech players—coding workdays, onsite childcare, flexible work settings—is unlikely to be sufficient. Automotive companies will likely need the right infrastructure to support this potentially new type of worker and to create the experiences that enable success. Ultimately, middle managers may have to create a new culture of “always on” learning and development through engaging experiences to transform today’s talent model into a flexible and open talent market that can effectively accommodate emerging talent needs.

Even as their talent pool shifts and expands, automakers will likely continue to rely on manufacturing-line veterans and the front offices that have kept the lights on for decades. Even there, however, the numbers and skills of those workers could shift as both the types of vehicles being built (such as relatively simple autonomous “pods”) and their volumes could change. These workers, just as critical to automakers’ success in the future of mobility, often have a different definition for career development, and auto companies would need to balance these different perspectives as they seek to get the talent equation right. That means both building on the rich history already in place and creating a very clear vision for the future—an exciting future that is technology-enabled and customer-focused.

Human resources organizations have a big role to play in driving a new workforce-planning mind-set. The need to forecast skills requirements around analytics, robotics, artificial intelligence, and beyond requires longer-term thinking about how technology could shift the way that work gets done; when new and emerging skills will likely be needed to enable these shifts; and where these skills might sit in the organization. Creating a more flexible model to “right speed” HR to support a changing spectrum of needs can be critical for organizations, as the pace of change is only expected to accelerate.

Managers and HR leaders can start by:

- Unleashing networks of teams. Consider leveraging start-up thinking and breaking down functional silos by building organizational ecosystems through focused, autonomous, and less hierarchical teams that may more quickly incubate targeted and cross-functional outcomes.29

- Rethinking your hierarchy. As organizational networks replace traditional hierarchies, consider revisiting the meaning of “career” and what it takes to develop one by exploring multi-role, flexible career paths rooted in ongoing learning. This can be particularly applicable for parts of the organization engaged in exploring innovative mobility opportunities.

- Developing digital leaders. Risk-taking seems to have become one of the most important drivers of high-performing leadership cultures, and leaders not learning new digital skills are six times more likely to leave their organization within the next year.30 That can make it somewhat critical to develop bold leaders who are comfortable with new tools and management approaches across digital mediums and virtual platforms.

- Pulsing your people. Consider using internal crowdsourcing and hackathons to collect ideas for how to organize and approach performance management, engagement, and rewards to build a compelling employee experience.

- Creating a culture of real-time measurement. Consider investing in applications that provide real-time metrics on engagement, recruiting, and turnover to help your organization make informed and in-the-moment talent decisions.

- Recognizing learning is everyone’s job. Learning has become an imperative that must be embedded seamlessly in each part of the organization. Through formal and informal knowledge sharing (such as impromptu lunch groups or on-demand, open-source platforms), consider creating a learning culture to foster an environment in which employees want to continue their development journey. This may become an imperative as new vehicles, new assembly techniques, and entirely new business models could play increasingly important roles in the auto industry.

This is a challenging and exciting time for automakers, as the next generation of talent has the opportunity to reshape an industry defined by iconic global brands. It seems to be time for the auto industry to break with the past, apply grit and dedication, and paint a new chapter for the future autoworker.

Trucking

There is perhaps no other industry that the future of mobility could more visibly and dramatically affect than the extended transportation sector. The prospect of an 18-wheeler—80,000 pounds of steel and freight—cruising the highway, guided entirely by sensors and software and with nary a driver in sight, likely excites shipping companies and worries gearjammers.31

The transportation sector accounts for a significant portion of the US economy and is expected to represent $1.6 trillion of total GDP by 2045.32 The trucking industry, which accounts for the largest movement of freight, is expected to increase freight movement tonnage by 43 percent by 2040 (from 13.2 billion to 18.8 billion).33 Accommodating this growth would place tremendous pressure on every component of the industry, including its already-strained workforce. Since the 1980s, the trucking industry has experienced a high degree of voluntary turnover, much of it attributed to low wages, an aging workforce, and the deleterious health effects associated with long-haul driving. Those challenges are manifesting in the industry’s compliance and safety record: Hours of service violations remain one of the top issues plaguing the trucking industry,34 with crashes involving large trucks ticking up in recent years, though they remain low by historical standards.35 Absent significant changes to its business model and talent pool, it can be difficult to see how the trucking industry could attract the 890,000 new drivers that the American Trucking Associations estimate will be needed through 2025 to meet rising demand.36

The advent of autonomous vehicle (AV) technology could improve or eliminate many of these labor issues. Much of the impact will depend on whether future vehicles are only partially autonomous, employing driver-assist technologies, or truly driverless, with no need or expectation that a human will be in the cabin.

Even relatively modest levels of automation, such as adaptive cruise control for highway conditions, could lead to major reductions in hours of service violations—assuming regulations keep pace and recognize that the toll on a “monitoring” driver is less than that on one actively at the wheel. In the near term, driver shortages and turnover could decrease dramatically if drivers are able to rest more, improving overall health and wellness; younger drivers are attracted to the industry because of the new and sophisticated technologies being used; and wages are increased due to a more sophisticated skill set required to operate and maintain AV technology.

Farther in the future and as AV technology could begin to penetrate the trucking industry, fully autonomous systems may allow the “driver” to be completely absent from the truck, perhaps instead providing remote oversight over several trucks from a central operations center, or in the lead vehicle in a platoon of trucks but focused on planning and logistics while in motion. Duties that require human intervention—such as client relationship management, equipment management, route planning, and cargo management—could gain new importance.

However, new and expanded responsibilities will likely require a shift in skills and potentially the type of jobs needed to manage, operate, and maintain fleets of AVs. For example, “fleet monitors” working at a central hub would need to understand how to use tracking systems, dynamic routing, and AV technologies to ensure that vehicles on the road are operating smoothly. Inspectors and even law enforcement would need to be aware of the new technology and understand the state and federal regulations that govern the new technology. Mechanics, who work for carriers, would need to learn how to perform repairs on increasingly sophisticated autonomous operating systems.

The pace at which the industry adopts AV technologies will likely depend heavily on levels of investment, changes in regulations, and the emergence of supporting infrastructure that would allow the trucking industry to see tangible benefits. Widespread use of even partial autonomy will likely take at least several years, with fully autonomous trucks perhaps a decade away or more.

That said, the industry likely needs to begin preparing its workforce today. To address a world of partially autonomous vehicles, trucking companies should consider:

- What are the economics of incorporating autonomous systems into their fleets? Depending on the distance and complexity of a carrier’s routes, its predominant type of freight, and the nature of its labor challenges, investing in partially autonomous vehicles may not make sense. We expect the technology’s biggest payoffs to come from reduced driver fatigue, fewer accidents, and improved fuel economy (via platooning) during long-haul trips. Those focused on last-mile delivery may see less upside from upgrading legacy systems.

- Will this influence the owner-operator labor model and affect contract terms and conditions, including the heavy debt burden that independent contractors traditionally incur? In the short term, partially autonomous vehicles may allow owner-operators to drive further and longer.

- For large carriers, what is the most effective way to train a widely dispersed pool of drivers on new technologies? Companies should consider various e-learning options as a starting point, or look to capitalize on natural workforce turnover to bring aboard those familiar with the latest systems.

- Will this impact the compensation model so that trucking companies can increase what they pay employees? If new licensing or technical competencies are required to operate partially autonomous trucks, labor costs could rise.

Over the longer run, as fully autonomous systems may begin to replace drivers altogether, carriers would need to radically reshape their labor forces. Key questions to consider:

- How can employers attract the high-skill, highly educated workforce that would be required to maintain, operate, and oversee a fleet of self-driving trucks?

- What becomes of owner-operators? Without the need for a driver, the viability of the business model for small owner-operators—and the trucking companies that rely on them to haul freight—could be in doubt.

- How will organizational structures adapt? If erstwhile drivers assume dispatch or operations roles, they could affect companies’ asset mix and geographic footprint, potentially requiring new operations hubs to house them—or even a shift to a virtual workforce.

Eldercare

The workforce implications of the new mobility ecosystem extend to unexpected corners of the economy. Consider the eldercare sector, where the future of mobility could have a profound impact on the way seniors choose to live. Traditionally, a critical turning point for seniors has been the day they lose their driver’s license. This equates to a loss of personal independence that many seniors dread. The resulting dependence on loved ones to shuttle them to social events, shopping excursions, or doctor’s appointments has a significant impact on many seniors’ sense of self, sense of autonomy, and sense of happiness. This transition to “dependent mobility” often leads seniors and their families to make the move to assisted-care living.37 Yet the vast majority of seniors say they would prefer to stay in their own homes.38

With the advent of convenient and cost-effective ridesharing services, seniors now have the ability to stay in their homes despite the loss of personal driving abilities. With easy-to-use apps, a no-hassle ride experience, and the ability of family members to schedule rides for their loved ones from anywhere, today’s ride-hailing providers have improved upon many of the challenges seniors have long faced in utilizing traditional taxis.39 No more calling a dispatcher, waiting an unknown amount of time for the cab to arrive, or fumbling for cab fare.

With ridesharing models, no longer must many non-driving seniors rely on friends and relatives to take time away from work or school to provide a ride to an essential doctor’s appointment or weekly bridge club. Personal freedom and mobility can be restored. Major ride-hailing providers are already exploring this space, partnering with cities, health care providers, and others to offer transportation for seniors.40

In parallel, new ways of bringing products to seniors’ front doors with speed and convenience often eliminate the need to drive to the store or pharmacy. Mobility solutions that more easily bring goods and services to home-bound seniors are likely to increase in demand, and jobs involved in maintaining and operating these types of delivery services could grow.

How might this dynamic impact the workforce? Beyond the potential boon to ridesharing providers and the increase in demand for home delivery services, there are impacts specific to the eldercare sector. The United States has approximately 1.5 million full-time eldercare workers,41 but caring for an aging Baby Boomer population could demand as many as 5 million workers by 2020, creating the possibility of a severe shortage.42 But if more flexible mobility options allow more seniors to stay in their homes, this shortage could be lessened. There might also be a corresponding rise in demand for home-based care for seniors who do not need constant attention, yet would benefit from occasional help. These roles exist today but in limited numbers, as fixed, institutional roles dominate: Roughly 85 percent of eldercare workers are based in nursing homes and assisted living facilities, with just 10 percent providing home health services.43 (These home caregivers could benefit from the same ridesharing services that their clients enjoy to overcome the need to use a personal car to make “house calls.”)

As another result of slackening demand for residential senior care, we may see traditional nursing care and integrated care facilities reconfiguring their services to try to attract seniors who may not need to move to an assisted-care facility but who could be attracted by a more connected community experience, increased social activities, or other characteristics that these facilities can offer. Residential care facilities may choose to team with mobility services to bring seniors to their facilities on a daily basis. This may open up new or expanded job opportunities as these operators could seek to expand on the “customer experience.” These facility operators could add or expand roles in marketing, sales, promotion, community relations, communications, digital outreach, or directing social programs.

Ultimately, like many other sectors, eldercare is poised for disruption as a result of dramatic changes in personal mobility: New jobs could emerge, and many current jobs will likely shift or change their focus or manner of delivery. For eldercare, the opportunities for employment growth are already there, given current demographics—10,000 Baby Boomers on average retire each day44—and the shortage of labor in this space. So the impact is potentially a win-win, resulting in either a better-enabled eldercare workforce with more opportunity to choose a workstyle that fits their preferences, or an increase in job opportunities in the eldercare sector as new business models offer different and expanded types of jobs.

Making the future of mobility work

History shows that new technologies often lead to increases in workforce participation for impacted sectors. Famously, since the introduction of ATMs in the late 1970s, the number of bank tellers and bank branch employees has actually increased—but the nature of the work and the tasks they perform have changed.45 The real challenge for workers may lie not in being replaced by a machine but, rather, in how to reskill to work side-by-side with the new tools and capabilities that advanced technologies bring.

The labor implications of the new mobility ecosystem could be profound, and this article only scratches the surface. Deloitte plans to continue exploring the myriad ways that the future of work and the future of mobility might intersect to shape tomorrow’s workforce.

© 2021. See Terms of Use for more information.