Monetizing data in the age of connected vehicles

8 minute read

04 January 2019

Connected services and data monetization have long been seen as a big opportunity for automotive companies facing an uncertain future. However, the path to success may require new thinking in terms of where to play and how to win.

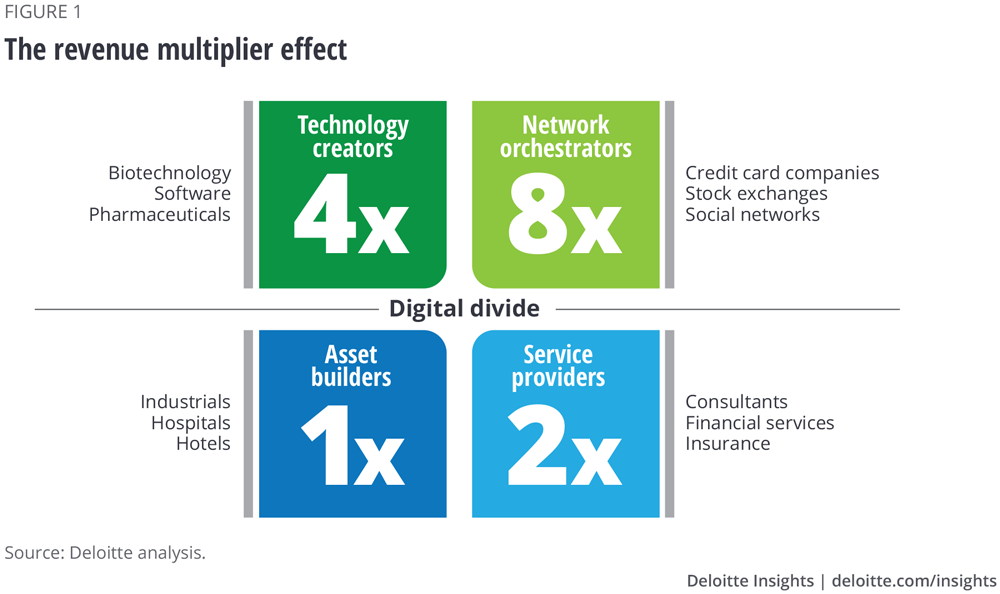

For decades, automotive original equipment manufacturers (OEMs) have been able to find success in the relative comfort of building assets for personal consumption. But outside the industry, companies in areas such as financial services, biotechnology, and social media were hard at work finding new ways to generate revenue and grow shareholder value. Many biotechnology companies, for instance, found their niche as “technology creators,” while social media players and other “network orchestrators” created asset-free revenue models based solely on bringing supply and demand together in a market exchange environment.

Learn more

Explore the Future of Mobility collection

Subscribe to receive related content

Download Deloitte’s 2019 Automotive News supplement

The differences among these business models and their implications for corporate value and investor interest can be defined by the “revenue multiplier effect,” which describes how each of four core business models has twice the value of the preceding model (figure 1).1 One of the key drivers of this phenomenon is that marginal costs are significantly lower for technology and information-based companies, making it easier for such companies to scale.2

Although OEMs have introduced countless innovations over the years, they have never really been credited as “technology builders” by the investment community. In fact, their valuations still hover around those of the lowest “asset builder” quadrant. So how can traditional automotive companies start moving up the revenue multiplier ladder? The answer may be found in new business models that promise to leverage the increasing amount of data being generated, captured, and shared by the vehicle itself.

The amount of data a vehicle generates is set to explode

One major trend emerging in the global automotive sector is vehicle connectivity. Vehicles are now able to capture and share many types of data, including geolocation, vehicle performance, driver behavior, and biometrics data. Though GPS functionality has supported navigation systems for years, smarter applications of the data are adding significant value in the form of real-time traffic updates and road safety alerts. Uses for vehicle health and operational functionality data are also spreading as vehicle manufacturers continue to develop app-based tools to monitor key maintenance statistics. And while the use of advanced biometric data is still in its infancy, new sensors in the cockpit can allow vehicles to monitor key attributes of their occupants, including stress levels, heart rhythms, alcohol consumption, and fatigue.

However, monetizing this tremendous increase in operational and behavioral data is easier said than done—and OEMs have largely been lagging behind market disruptors entering this space. There is also good reason to wonder whether a critical mass of consumers see the increase in vehicle connectivity as a good thing. Recent study results suggest that while 79 percent of consumers in China believe increased connectivity will be beneficial, only 35 percent of German consumers feel the same.3

One of the first decisions for companies aiming to monetize vehicle data is where to play in the connected vehicle value chain. Potential roles exist for companies to act as:

- Generators, making end products capable of capturing data

- Transmitters, safely delivering the data to a central repository

- Manipulators, aggregating data from different sources into a usable format

- Developers, designing end-user offerings that leverage the data

- Providers, marketing the service offerings to both B2C and B2B audiences

Not every company is well-placed to succeed in each part of this value chain. For new entrants in particular, it can be difficult to create value further down the chain without access to the data being generated further upstream. Here lies one of the central issues that is currently preventing the vehicle data monetization ecosystem from developing to its full potential. Many OEMs have the data, but because they want to control every point in the value chain—even though they are not generally well positioned to do so—they are reluctant to make the data available to anyone else.

OEMs can find opportunities in data, but challenges exist

OEMs can potentially realize enormous benefits from knowing which parts of a vehicle are likely to fail and when. Real-time data sent from vehicle sensors can identify problems early, and predictive analytics can allow companies to get out in front of potential warranty and recall issues. This kind of data can also help OEMs and dealers optimize their parts inventory and technician resourcing strategies. Further, a deeper understanding of how customers use their vehicles can help OEMs design better, more customized customer experiences to improve brand affinity and loyalty.

In terms of external revenue opportunities, OEMs and other industry players are exploring a wide variety of data-based products and service offerings, including user-based insurance, mobile commerce, mobility-as-a-service (MaaS), behavioral and geo-based advertising, infotainment, and personal health monitoring. However, many OEMs are already showing their collective vulnerability to new and existing entrants looking for ways to go around them. In the case of user-based insurance, for instance, the addition of a simple plug-in allows insurance companies to gain access to vehicle usage data, thus circumventing the need to interface with OEMs. Vehicle manufacturers may also face an uphill struggle with significant consumer concern over the collection of biometric data. For example, recent survey data suggests that 63 percent of US consumers are at least somewhat concerned about biometric data being captured and shared with external parties.4

Fundamental questions are keeping automotive companies up at night

The complexity and dynamism that characterize the emerging connected vehicle industry has made it difficult to make decisions regarding where to play and how to win. Complications to consider include:

- Who owns the data and who gets to use it? The most interesting data sets are often the ones that are shared across connected ecosystems that include consumers, OEMs, and service providers. However, recent study data suggests that consumers are not fully comfortable with any one type of company managing their connected data.

- Are consumers willing to pay for connected data services? Consumers have come to expect basic services and free apps, so how can they be motivated to pay? Our belief is that the full spectrum of services will include both free and paid services.

- How and with whom should we work? For years, many OEMs have attempted to build the entire mobility data ecosystem within their four walls. However, many are now looking to adopt open platform strategies developed in conjunction with partners outside their organization.

- How can data be protected? Consumers may be more willing to share data for services and features that have a perceived benefit. Tech companies have been taking advantage of this for some time, so OEMs may have much to learn from them. However, any company will likely quickly lose customers’ trust if the data they share is compromised.

The importance of driver consent

By Lisa Joy Rosner, CMO, Otonomo

As original equipment manufacturers (OEMs), other data generators, and companies in the connected data ecosystem explore the possibilities for monetizing data by offering new apps and services, managing driver consent has emerged as a critical issue. Drivers own not only their connected car, but also their connected car data, and they expect that their personal data will stay private unless they give explicit consent for its use.

Research shows that many drivers are, in fact, amenable to sharing their data if they see enough benefit in it. In 2018, a joint Otonomo-Edison Research survey of 514 current American connected car drivers6 found that approximately 80 percent of the drivers who expressed interest in a number of services based on connected car data—including real-time alerts of dangerous driving conditions, early detection of maintenance and repair needs, and faster response times for emergency responders in the event of an accident—were willing to share anonymous or personal connected car data in order to gain access to these capabilities.

But despite this, the drivers in the study still had general concerns about sharing data with apps and services. About two-thirds of respondents had chosen not to use an app or service because of concerns about how their personal information would be handled. Given that Deloitte’s latest Global Automotive Consumer Study found that 31 percent of US consumers trust “no one” to secure the data being generated and shared by a connected car, these findings suggest that automotive manufacturers and other data generators have a clear need to protect drivers’ privacy and proactively manage consent.

When deciding whether to allow an app to collect data, the Otonomo-Edison Research study found that the most important factors that drivers consider are:

- How trustworthy they perceive the company to be (66 percent indicated this was “very important”). It’s encouraging that the Deloitte study found that 31 percent of consumers trust their OEMs most—but just as many trust no one.

- Whether they are told exactly what the data is being used for and who has access to it (62 percent indicated this was “very important”). In light of this finding, OEMs should consider developing consumer-facing transparency apps that are easy for drivers to understand and use.

On the anonymization front, connected car data presents numerous new complexities. Considerations include:

- Removing traditional personally identifiable information (PII) is not enough to preserve anonymity. Trip data—such as the route one takes from home to the office—and location data also can be used to identify a driver.

- More than one person may drive the same vehicle—yet hold different views about what data they are willing to share.

When communicating with drivers and asking for consent, data generators need to be sure that they are addressing these and other considerations in their data anonymization strategies as well as with consent management technology.

Knowing where to focus is half the battle

The journey to creating new value from the growing amount of vehicle data starts by setting an ambition and charting a path to success. Most companies are performing “random acts of science” rather than focusing the organization on an aligned ambition. Leaders should understand both consumer trends and potential disruptors in order to uncover winning ideas. With that foundation in place, they can then set new aspirations and establish a portfolio of concepts to guide value creation. These concepts can be organized into three segments with a well-established framework called the Innovation Ambition Matrix,5 which can enable an organization to think through monetization concepts across varying levels of abstraction from the current business model.

As companies move from concepts to tactical plans, they should ask several key questions for each opportunity they identify, including:

- What data collection, standardization, curation, privacy and analytical capabilities are required?

- Where is the value in these activities (i.e., data standardization, consent management, anonymization)?

- What critical technologies are in place, and which would have to be built?

- What should be done in-house versus outsourced to an ecosystem partner?

- How could a concept be prototyped for validation?

- What level of investment would be required to scale the concept?

Getting started isn’t as easy as simply picking a team and starting a conversation. The best innovation can come from a cross-functional team that is highly skilled in today’s business environment, enlightened by external research, and willing to challenge their own thinking.

© 2021. See Terms of Use for more information.

Explore the Future of Mobility

-

Future of Mobility Collection

-

The future of mobility: Ben's journey Video8 years ago

-

The future of freight Article7 years ago

-

The future of auto retailing Article9 years ago