When moving from on-premise software to Software-as-a-Service, companies should think hard about the financial reporting implications of digital transformation up-front, especially the balance between CAPEX & OPEX.

For most of Deloitte’s Nordic clients the cloud ERP direction is very clear. They are no longer asking if they should invest in cloud ERP technology, but when and how. While the timing and degree of adoption may vary, almost all companies now recognise cloud ERP’s extraordinary capabilities and flexibility and are making it an integral part of their technology infrastructure and business platform strategies.

SAP S/4HANA® is just one technology that is at the heart of the global move from on-premise software to cloud. RISE with SAP, for example, is a service offering that combines a set of SAP products and services with SAP Business Technology Platform (BTP), Digital Supply Chain and S/4HANA Cloud as the main components, allowing companies to run their cloud ERP infrastructure in either an SAP data centre or a hyperscaler of choice.

However, although cloud transformation is compelling, accounting for cloud computing service costs can be complex and challenging. The model selected by a cloud customer may significantly affect pricing metrics, cost profiles and the related accounting treatment. Some CFOs may even hesitate to champion the adoption of cloud computing because, in theory, it involves a shift from CAPEX to OPEX models, which has a negative impact on Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA).

On the other hand, the accounting complexity surrounding cloud adoption also gives CFOs a unique opportunity to steer conversations and strategies around the potential implications of cloud migration – and thus proactively define and drive their company’s cloud strategy.

Two major decisions on cloud ERP accounting principles

With the massive adoption of cloud technology over the last decade, it was becoming increasingly necessary for the IFRS Interpretations Committee to reach a decision that clarified how cloud and SaaS arrangements should be accounted for. They did so in 2019 and, more thoroughly, in 2021.

The overall principle is that if companies incur expenditure on connecting their business to a cloud-based solution, they do not control that asset, and for that reason they cannot capitalise costs incurred in customising or configuring that software.

Only in limited circumstances, certain configuration and customisation activities may give rise to a separate intangible asset where the customer controls the IP of the underlying software code, for example, the development of bridging modules to existing on-premises systems or bespoke additional software capability. But, as a starting point, configuration and customisation costs will be an operating expense.

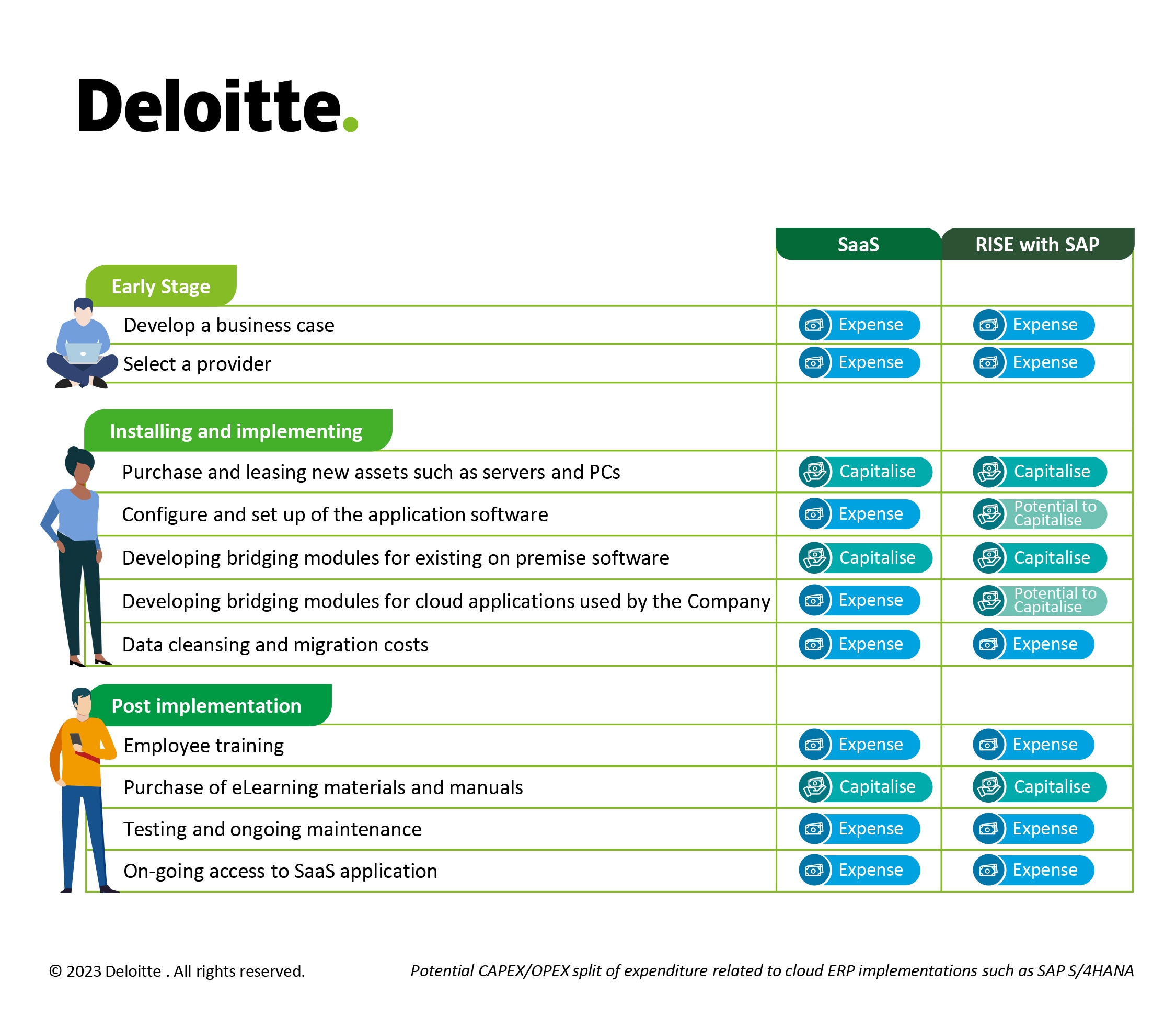

What this means is that, going through the different stages of implementation, the split between OPEX and CAPEX for Software as a Service will typically have a profile as depicted below. For companies running SAP and considering moving to RISE with SAP, there may be alternative CAPEX treatments possible as highlighted in the table:

It is important to point out that every SaaS & Cloud ERP arrangement is unique, and the above classifications are just guidelines. The analysis and determination of the appropriate accounting treatment of configuration and customisation costs require significant judgement based on a deep understanding of the technical aspects of the arrangement.

How to start

As with any other transformation effort, it is all about preparation when it comes to implementing a cloud ERP solution. At the outset of feasibility planning, companies should therefore ensure that the entity-specific financial reporting and budget implications of the variables are fully considered and evaluated, alongside the commercial, operational and IT inputs.

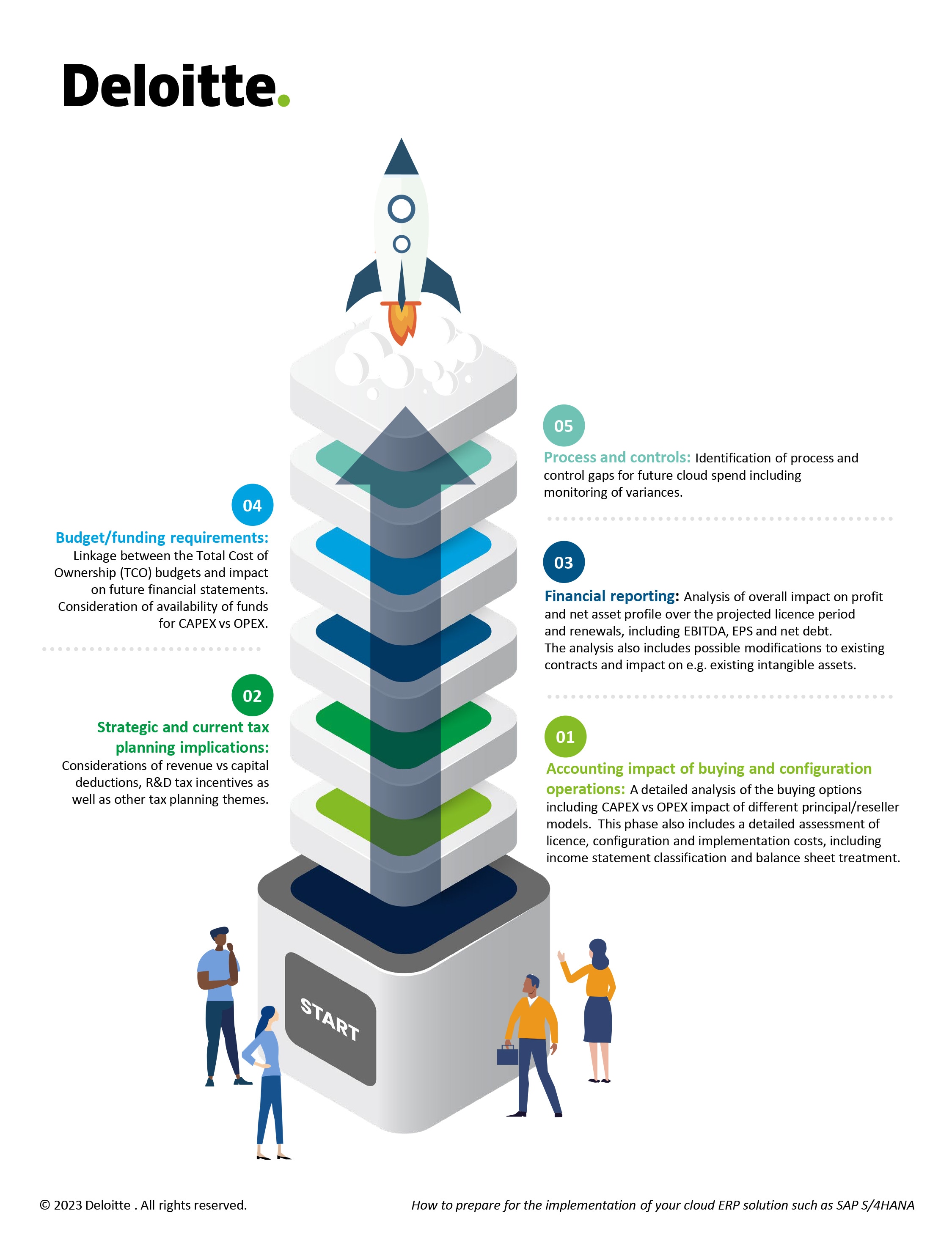

What we normally recommend are five interlinked preparatory activities:

Besides these initial considerations, we also strongly recommend ongoing implementation support, including process, controls and variance monitoring design for CAPEX/OPEX spend items, accounting papers and audit readiness as well as tax credit claim documentation.

This enables the finance team to be at the table, reducing the risk of any delay or disruption to the investment appraisal process from unforeseen financial reporting complexities. And it enables us as a transformation partner to proactively adjust and align our entire delivery model to fit the decisions that are being made.

Getting it right from the beginning

Accounting complexities might not always be top-of-mind for those of us that work primarily with digital transformation, but for CFOs these considerations are top of mind. Given the sizeable investments that usually surround cloud transformation, CFOs are extremely proactive in this area – and we already see that when we get the CAPEX/OPEX split right from the beginning, the financial side of the implementation becomes much smoother with active approval by the accountants and no unwanted delays.

So the simple advice is: talk to us! In all modesty, we have the knowledge, methodology and experience to support you in the feasibility stage and throughout the implementation process, timing our involvement to ensure a smooth business case approval process alongside your overall cloud solution implementation.

Further reading:

Forfatter spotlight

David Colgan

Ask me about: SAP, S/4 HANA, Digital transformation, IT strategy, Program management, Digital Finance function, Cloud David is a partner in Deloitte and the Nordic Lead of our SAP Practice. David has a background as a Chartered Accountant but has more than 25 years of experience with SAP transformation programs, where the underlying theme is SAP and financial & digital optimization. David works with Danish as well as Nordic companies advising on SAP-enabled digital transformations and delivering SAP S/4HANA.

Bjarne Iver Jørgensen

Bjarne er statsautoriseret revisor, og til daglig revisor og rådgiver for de største virksomheder i Danmark. Bjarne har bred erfaring med koncernrevisioner, rådgivning omkring regnskabsmæssige problemstillinger, optimering af processer i økonomifunktioner samt rådgivning i transaktioner. Udover revision har Bjarne et særligt fokus på regnskabsmæssig rådgivning. Han er leder for forretningsenheden IFRS and Accounting Services, der har ansvaret for al målrettet regnskabsmæssig rådgivning, som Deloitte leverer til de største virksomheder i Danmark. Bjarne har desuden i flere år været involveret i shipping, hvilket har givet et dybdegående branchekendskab. Han er leder af den danske branchegruppe for shipping ligesom han indgår i Deloittes globale branchegruppe for shipping.