Pricing innovation in retail banking has been saved

Pricing innovation in retail banking The case for value-based pricing

05 October 2016

Banks have invested heavily in efforts to improve the customer experience, but most have done little to innovate their pricing strategies. Are they missing out on an opportunity? Our latest research reveals some clear advantages to adopting a value-based approach to pricing—and tips for getting started.

Price is what you pay. Value is what you get.1 — Warren Buffet

With all the talk of disruption and innovation in retail banking today, one topic does not get the attention it deserves: strategic pricing. Bankers rarely discuss pricing innovation as a tool for competitive differentiation and raising profitability. This report will argue why they should, and how.

In the past decade, pricing in banking has captured attention for all the wrong reasons, inviting intense regulatory and public scrutiny. Faced with new regulations on product structures (for example, qualified mortgages), fee income (for example, the CARD Act2 or the Durbin Amendment), and capital and liquidity standards (for example, Basel III), banks have generally reacted by modifying their pricing tactics to focus more on costs and risks (see figure 1).

Learn More

Explore the infographics about pricing innovation for:

Meanwhile, other industries such as airlines, ride sharing services, hotels, and digital media continue to experiment with innovative pricing strategies, and their customers seem to have accepted the new pricing schemes with little resistance.

Effective pricing “cannot be reactive and simplistic.”3 We believe it is high time that retail banks in the United States innovate pricing to reflect the way that consumers actually perceive and receive value.

Of course, the notion of value-based pricing in retail banking is not new, at least in the credit card business.4 A few banks made strategic pricing a core discipline, and have become dominant players in the industry.

In this report, we suggest how banks may consider adopting and refining value-based pricing strategies for three products—checking accounts, credit cards, and mortgages. First, we quantify the potential impact of different product and price attributes on consumer choice. We then identify gaps in the communication of value regarding these attributes, and highlight differences in choice behavior across demographic and credit segments. These insights are based on choice experiments and a survey among 3,001 bank consumers (see sidebar, “Interpreting the results of the discrete choice analysis”).

Our research reveals that price attributes dominate consumer choice, and the trade-offs consumers make among price and non-price attributes are somewhat counterintuitive. Also, value perceptions vary starkly across products and affect choices differently across demographic segments and credit profiles, but we also observed consistencies in behavior. We were surprised by some results, such as the strong correlation between price sensitivity and age, gender differences, and the general ineffectiveness of fee waivers.

In the following sections, we present the results of our choice experiments and compare these findings with consumers’ stated preferences for choosing checking accounts, credit cards, and residential mortgages. We also run simulations to assess consumers’ sensitivity to certain key product attributes, and then offer suggestions for ways that banks should rethink their pricing strategies based on customers’ choice trade-offs and value perceptions.

Interpreting the results of the discrete choice analysis

In our study, each respondent participated in choice experiments for two of three products—checking accounts, credit cards, and mortgages. They were presented and asked to choose between three randomized product configurations (and a “none” option). Respondents repeated this task four times for each product.

We analyzed the data from this exercise using discrete choice modeling, a method of conjoint analysis, to infer the trade-offs consumers make between different attributes (and specific levels within each attribute). We also estimated shifts in consumers’ likelihood of choosing an offering with changes in product configuration.

To illustrate the key insights from this analysis, we first present the overall choice probability for a “test” product, one roughly replicating a standard market offering. We then show shifts in this choice probability as the levels of each product attribute are changed, and focus our discussion on the key attributes that contribute the most variation in choice probability. Finally, we offer some recommendations for new pricing approaches.

A detailed description of the modeling methodology, along with a full list of product attributes and attribute levels, are shown in the appendix.

Price check!

Checking accounts are the most essential financial tool in modern American society. In 2013, 92 percent of US households, roughly 115 million, had access to a checking or savings account.5 Demand deposits, a reasonable proxy for checking account deposits, totaled more than $1.5 trillion at the end of March 2016.6 While this sum represents only about 14 percent of US domestic deposits, 7 checking accounts are fundamental anchors of customer relationships in several ways. They help banks access funds at low cost and support cross-selling. Checking account customers are also quite loyal: Our survey showed that more than one-half of all respondents had their primary checking account with their current bank for more than 10 years.

Pricing of checking accounts has a checkered history in the United States. Overdraft fees, in particular, have been subject to intense scrutiny in recent years.8 When banks attempted to raise monthly fees in the past, consumer backlash forced some banks to backtrack on fee increases.9 However, checking account fees have peaked recently, as “free” accounts have become rarer than ever.10

Consumers are obsessed with monthly fees . . .

When presented with a test checking account that is quite common in the market today (figure 2), 53.5 percent of study respondents chose this product. Foremost, our modeling simulations show that monthly fees are by far the most significant driver of consumer choice for checking accounts (figure 3), with consumer preference dropping dramatically as fees increase. For instance, raising the fee on our test checking account from $10 to $25 caused choice probability to drop by 26 percent; dropping it to “zero” (that is, “free”) increased customer choice likelihood by 36 percent.

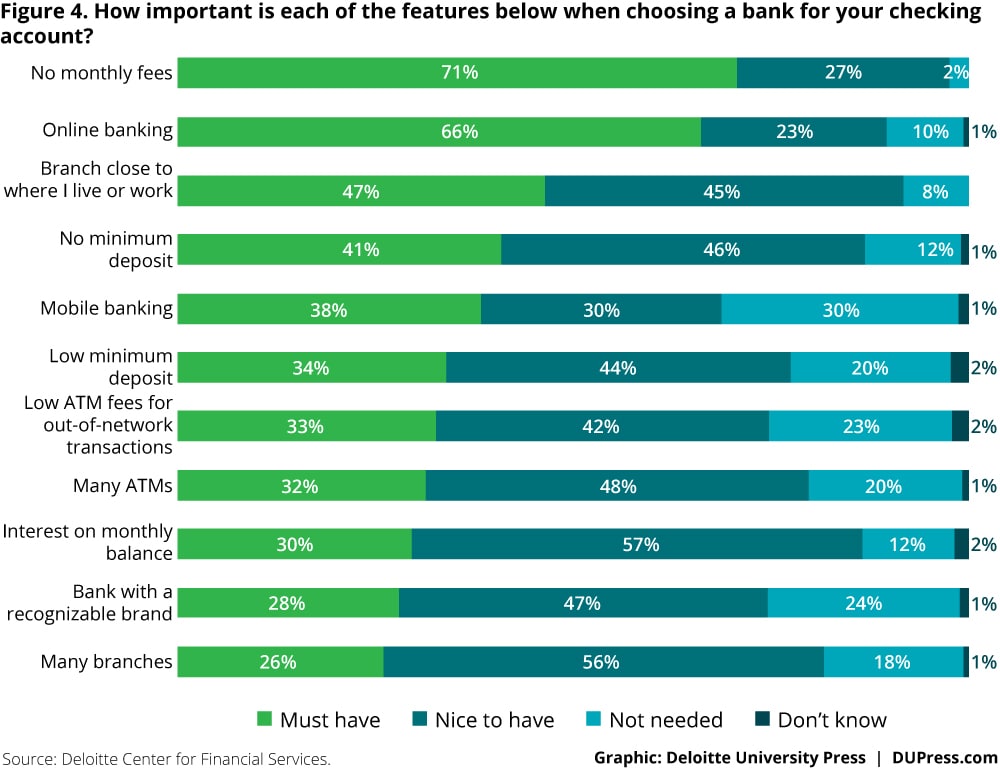

Consumers’ survey responses also underscored the sensitivity to fees (see figure 4). More than seven in ten stated that “no monthly fees” are a “must have” when choosing a checking account. The aversion to fees was particularly pronounced among older respondents and women, trends we witnessed across credit cards and mortgages as well. Also, consumers with high credit scores showed a greater preference for no fees.11 And, not surprisingly, consumers insisting on “no minimum deposit required” and “no monthly fees” overlapped significantly.

. . . Even though most consumers don’t pay these fees!

Consumer focus on fees is puzzling because nearly 80 percent of our respondents hadn’t paid monthly fees in the last year, consistent with other research on this topic.12 Banks generally make it easy to avoid paying fees, with minimum cash-flow or deposit requirements.

Equally perplexing is that Millennials are least averse to paying fees, despite the fact nearly four in ten of them did pay fees in the last year. We believe older age groups’ price sensitivity is due to the fact that they were accustomed to free checking accounts for a long time.13 Our survey findings support this theory—respondents who paid fees in the past were more tolerant of fees. Of those who paid monthly fees in the last one year, only 40 percent insist on no fees, compared to nearly 80 percent of those who didn’t.

As for fee waivers, which are ubiquitous in the industry, our study shows that they materially impact choice, although not nearly as much as monthly fees. Requirements that are “easier” to satisfy were decidedly more popular. Changing the test product’s waiver requirement of “$1,000 in monthly direct deposits” to “$20,000 in deposits at the bank” reduced choice probability by 14 percent.

Bank size and brands matter

Among non-price attributes, bank size had the most influence on choice in our test checking account. Survey respondents did not think a bank “with a recognizable brand” and “many branches” was that important. But when we changed the bank type in our test product from a large national bank to a small community bank, choice probability declined by 8 percent. These results mirror what’s happening in the industry today: As large banks step up their digital offerings, customer satisfaction is indeed improving,14 and the 10 largest banks by deposits in the United States control over half the deposit market.15

The preference for bigger banks held for midsize banks and community banks as well—respondents preferred the larger institutions here as well. Importantly, we found that consumers are not so much into online-only banks, yet; changing the bank type to online-only drove choice probability down by a remarkable 35 percent. These data suggest that small, and especially online-only institutions, need to differentiate on price competitiveness through lower fees or paying interest on balances and value-added services, such as eliminating out-of-network ATM fees, to attract customers.

Branch location remains fundamental, even for Millennials

For decades, branch location had been the most important reason Americans chose their primary bank.16 Interestingly, this remains true even today when digital banking is expanding rapidly.17 In our simulation, as we increased the distance to the branch from “5 minutes away” to “15 minutes away,” choice probability declined by 7 percent; if the location was “more than 30 minutes away,” choice likelihood dropped 13 percent.

Across generations and income categories, consumers wanted “a branch close to where I live or work.” As expected, only those who currently had an account with an online-only bank were indifferent to branch location.

Not interested in interest (for now)

One of the more surprising findings from the choice experiment is that interest rates on checking accounts were not a major determinant of choice. Most checking accounts today offer close to zero percent interest. But when we tested if a rate of 0.5 percent would meaningfully impact preference, it did not—choice likelihood rose only 12 percent. In our survey, less than one-third of respondents rated earning interest as a “must have.” This lack of enthusiasm for interest income could prove temporary—as rates finally do rise, sensitivity to interest income may also increase.

If you want me, show me I’m worth it

The only other attribute of note in consumer choice was the new account offer—choice likelihood declined 10 percent when there was no initial joining offer. Consumers have come to expect incentives for changing banks, given that switching costs are high. Our survey revealed that even younger checking account holders remained with the same bank for many years.

Sensitivity analysis

As additional analysis, we ran choice simulations to test for sensitivity to checking account fees and interest rates.

The price threshold for monthly fees at $0 is significant, well beyond the threshold for any of the other products. First, we observe that the “zero-price” effect is very prominent. An increase in monthly fees from $0 to $1 led to steep drops in choice probability for all age groups (figure 5), despite the fact that most consumers do not pay any fees. This behavior is consistent with research in behavioral economics showing that when consumers feel they are “getting something for nothing,” a material spike in demand follows.18

Another striking result from the checking choice simulation is that fee sensitivity increases with age. The differences in choice probabilities across age groups are notable even at $0 (zero price).

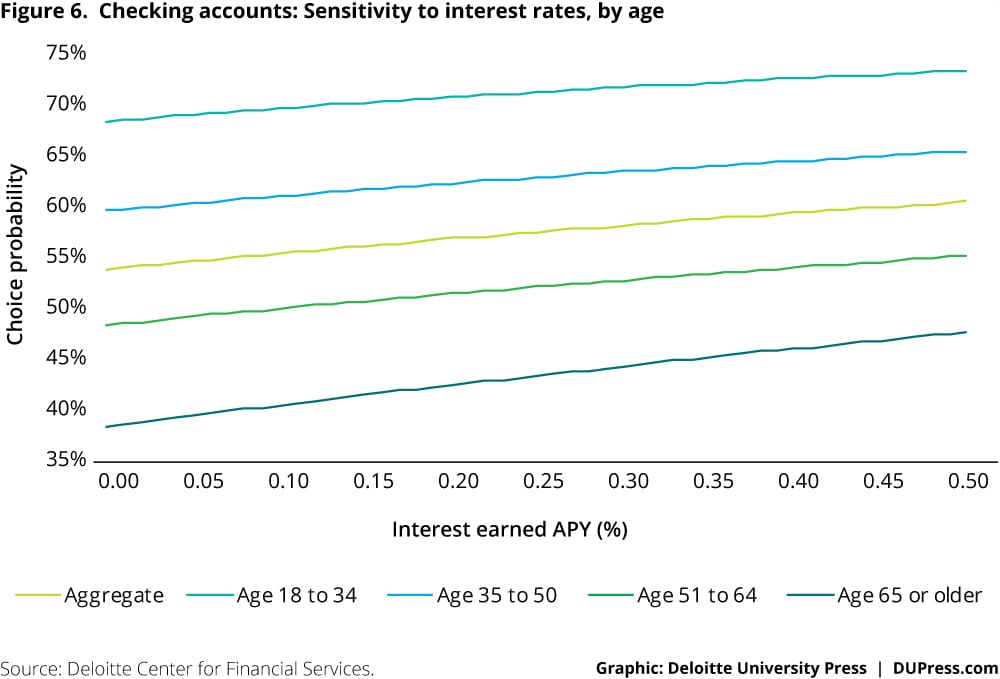

As for the effect of interest rates, we notice that consumer demand is linear, with no sharp increase in choice as interest rates rise. Age differences are also evident in this simulation (figure 6).

What should banks do about pricing checking accounts?

Checking accounts serve retail banks in three important ways: They are a crucial funding source; they anchor customer relationships; and they yield fees from various service charges, such as overdraft fees. With these facts in mind, the following checking account pricing strategies should be considered:

- Increase value perception by raising monthly fees on premium accounts. Because of waivers, most customers don’t actually pay any monthly fees on checking accounts. So why not increase the fees (sticker price) but make it easy to obtain fee waivers for premium accounts? With this approach, banks will likely see an increase in customers’ perceived value without any real change in revenues. We acknowledge this strategy is possibly controversial, but using price to signal quality is common in many industries.19

- Consider reframing “monthly service fees” as maintenance charges, or even penalties, for failing to meet minimum requirements. The message to consumers: The account is free, but a maintenance charge is applied if minimum requirements aren’t met. Following this strategy could increase product attractiveness (due to the free offering) and provide stronger deterrence for inactive accounts.

- Reduce or hold down rates, but also lower fees. Our study found that in the current interest rate climate, checking account consumers across the board tend to place little importance on interest income. So banks may consider holding rates low even as the Federal Funds rate gradually rises, but focus any pricing inducements on fees.

- Do a better job communicating value. Inform customers of the various services offered and the associated costs to help reduce price sensitivity and amplify non-price attributes. Our 2013 study of checking account pricing found that more than one-third of customers had no idea about what it cost to service their accounts.20 Educating consumers more could also influence perceptions of fairness and transparency.

Credit card resurgence

Despite a more stringent regulatory climate, the credit card business in the United States remains strong. Predictions about the negative effects of the CARD Act did not come true.21 In fact, the business is the most profitable among commercial banking activities.22 The average rate on accounts that pay interest is 13.5 percent,23 with overall default rates hovering just above 2 percent (though inching up recently).24 Borrower confidence has pushed outstanding balances to almost $1 trillion,25 and, among households that carry credit card debt, the average balance is $16,000.26

The credit card industry is quite concentrated; more than 85 percent of purchase volume is concentrated among the top 10 issuers.27 Still, consumers have a bewildering range of options, from local community banks to large financial institutions to affinity groups. And digital payments options and mobile wallets are further transforming the space.

As we mentioned earlier, the credit card business is perhaps the most advanced at using data and analytics to market to consumers, but there is still room to improve consumer value.

Fees matter most, but waivers barely do!

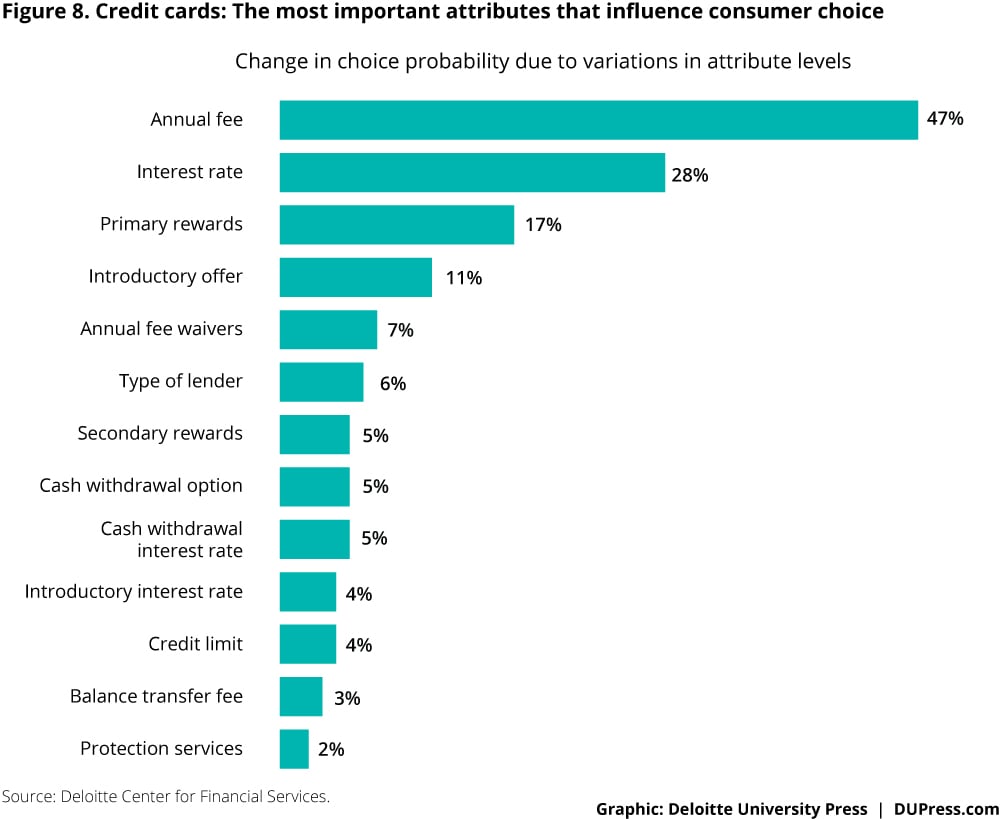

Our test credit card elicited a choice probability of 61 percent (figure 7). Annual fees were the most important driver of choice among credit cards, outstripping every other attribute (figure 8)—though not to the same degree as with checking accounts. Raising the fee on our test card from $50 to $100 decreased the choice probability by 22 percent; and making the card available for free yielded a 25 percent increase. Curiously, the influence of waivers to annual fees was small—eliminating the waiver and ensuring that consumers had to pay a $50 fee each year reduced choice probability by only 7 percent! This finding raises questions about how banks communicate, and consumers perceive, credit card fee waivers.

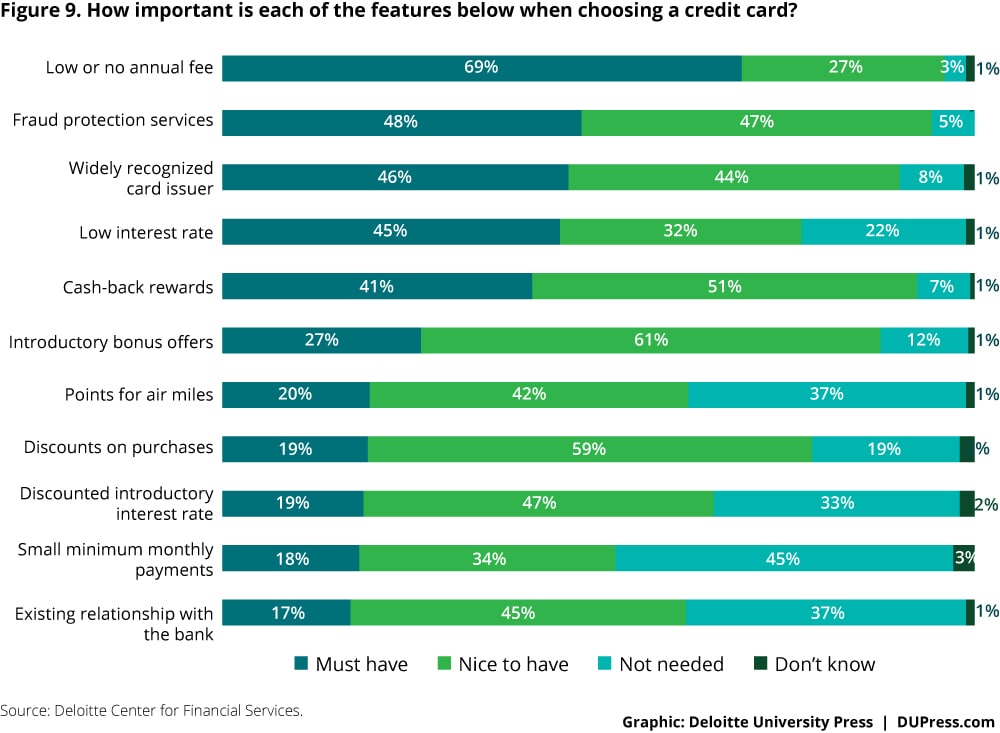

Consumers’ survey responses were consistent with the elevated sensitivity to annual fees. Nearly 7 in 10 respondents rated “low or no annual fee” as a “must have” (figure 9). A majority of respondents across all segments insisted on low or no fees, but some statistically significant differences emerged between groups.

Here, older consumers and women had stronger preferences, again indicating their higher sensitivity to prices. So did consumers who bank with midsized regional banks and community banks, who tend to be older than the overall sample (another notable finding). Respondents with the highest credit scores also had a stronger aversion to annual fees. Millennials were more tolerant of fees, probably because of their attitude toward credit: Nearly 60 percent of 18- to 34-year-olds said they were comfortable using credit to pay for things they couldn’t afford with their monthly income.

Higher rates matter more than lower rates!

Interestingly, consumers were more sensitive to increases than they were to decreases in credit card rates. Raising the rate on our test card from 12 percent to 20 percent yielded a 22 percent drop in choice probability. Yet lowering it to 8 percent, well below the current national average of 12.3 percent,28 increased the choice likelihood by only 6 percent. This asymmetric response suggests a strong internal reference price (a “fair rate” in the consumer’s mind), with rates above that threshold viewed as unacceptable.

Clear generational differences were apparent in credit card choice: Older customers surveyed focused on annual fees, while younger customers prioritized lower rates, probably due to their greater need for, and higher comfort with, credit. Among those aged 65 and over, 40 percent didn’t see any need for low interest rates, compared to a mere 8 percent among Millennials. Since lower credit scores are typically skewed toward the young, it is no surprise that those with lower credit scores prioritized low rates in choosing credit cards.

Give me cash (back)!

Rewards are nearly ubiquitous in credit card marketing. Of all the non-price attributes we tested, they had the most influence on credit card choice. Eliminating rewards from the test card led to a 17 percent decline in choice probability. This large drop underscores why cards that offer minimal or no rewards are generally offered free.

Among the types of rewards, cash-back rewards were more effective than points-based incentives, perhaps because they are easier to understand, and give consumers greater spending flexibility. Our survey confirmed the popularity of cash back—it was far more desired than “points for air miles” (figure 9). This preference suggests that consumers recognized the potentially superior value proposition of cash-back cards.29 Millennials and consumers with the highest credit scores specifically expressed a more pronounced preference for cash-back rewards.

Introductory offers were also important, although the type of offer appeared to have less of an impact on choice. Excluding an introductory offer from the product configuration reduced the choice probability by 11 percent. Similarly, the lack of a cash withdrawal option resulted in a 5 percent drop in choice likelihood, indicating that some consumers view their credit card as an emergency liquidity source.

Similar to checking accounts, respondents preferred credit cards from large national banks. However, consumers did not differentiate between regional banks, community banks, and online-only lenders in their choice of a credit card. Credit limits also had a muted impact on choice,30 probably because most card holders already had limits that met their needs.

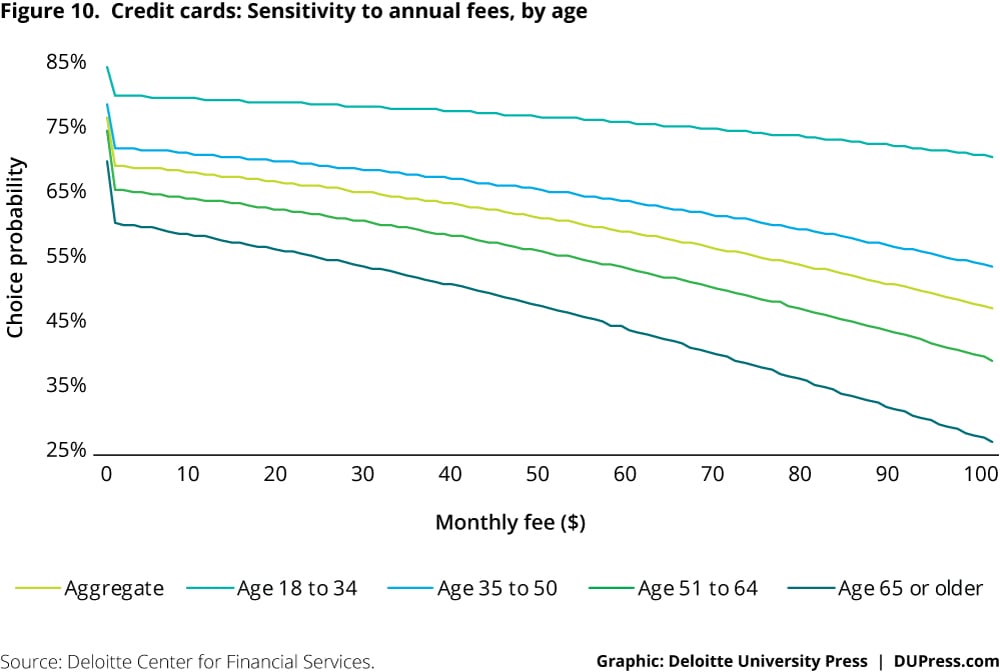

Sensitivity analysis

Our sensitivity analysis focused on annual fees (figure 10). As with checking accounts, we note the effect of going from “free-to-fee”—increasing the price from $0 to $1 caused a steep drop in choice probability. The size of this effect and consumers’ sensitivity to marginal fee increases rose with age.

However, in an important contrast to checking account fees, choice probability declined in larger increments with each marginal fee increase.

Simulations by gender revealed that women were generally more sensitive to increases than were men. And consumers with high credit scores exhibited more sensitivity, which could be attributed to their financial savviness.

What should credit card issuers do?

Credit cards are perhaps the least commoditized retail banking product in the market today; they are offered in multiple variations and cater to a vast array of target segments. The goals of issuers, processors, and affinity partners are also highly divergent. For instance, banks structure offerings to maximize fees and net interest income, but cards issued by or co-branded with affinity groups generally focus on promoting loyalty. Our guidance reflects this product heterogeneity:

- Consider eliminating annual fees at low dollar values. As predicted by behavioral economics, our study sample clearly showed the zero-price effect, with demand dropping steeply as fees increased from $0 to $1. For cards with low annual fees, such as up to $25, banks may consider eliminating fees, to help meaningfully increase the card’s appeal. Here, lost fee revenue could possibly be recovered through resulting market share gains.

- Raise consumer focus on fee waivers. In our simulations, consumers placed little value on fee waivers. Issuers should consider either eliminating or reframing them. One strategy, though untested, would be to reframe waivers as rebates, with consumers receiving something back in return for meeting a certain spending threshold.

- Increase the value associated with premium credit cards by raising the fee, yet make it easy to meet any waiver requirements. This would likely result in a higher value perception without affecting revenues. As with checking accounts, we acknowledge that this strategy is possibly controversial, but using price to signal quality is common in many industries.31

- Reframe points-based rewards in dollar values. Our study showed that cash back was preferred over any other reward type. For cards that offer points (or miles), communicating the value in dollar terms can help match the perceived simplicity and transparency of cash-back rewards.

- Create incentives that target online and mobile wallet spends. As transactions migrate to digital channels, a consumer’s spending might consolidate to one or two “default” or “preferred” cards. Banks should design rewards or fee waivers that would encourage credit card holders to choose their card as a preferred option on digital wallets.

A new mortgage paradigm

The mortgage industry in the United States has undergone radical shifts in the past decade. While securitization and product innovations expanded the market significantly ahead of the crisis, regulations affected all aspects of the business thereafter.

As of 1Q 2016, residential mortgages in the United States exceeded $11.1 trillion.32 However, commercial banks’ wariness to commit capital and the costs of regulatory compliance have led their share of originations to drop from 74 percent in 2007 to 52 percent in 2014, and likely lower in 2015.33 Nevertheless, mortgages remain a fundamental and long-term credit requirement for most Americans, and continue to hold appeal for many banks.

Meanwhile, borrowers are in the most advantageous position in over a decade. Rates have never been lower, and mortgage availability is close to post-crisis highs.34 Product options are also expanding—for instance, government-sponsored entities now purchase qualified mortgages with 3 percent down payments.35 The link between macroeconomic conditions and housing investment and financing suggests that consumer choice dynamics in mortgages may be more fluid than in either checking accounts or credit cards.

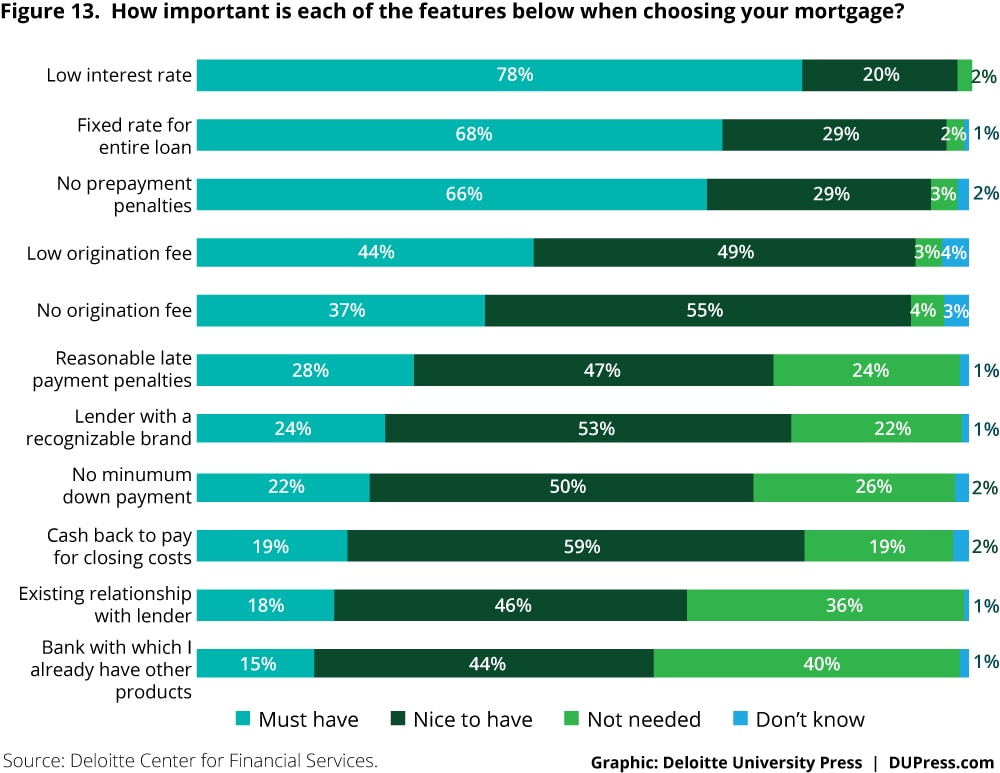

Consumers prize fixed payments, even over interest rates

Our test mortgage (figure 11) reflected popular offerings available in the market, and had a choice probability of 60 percent. Our simulations showed that a fixed-rate structure was the most important driver of choice, even eclipsing interest rates (figure 12). Aversion to variable rates was high—choice probability dropped by 31 percent when the rate became variable after 10 years, and by 36 percent if the fixed-rate period was 5 years long. The lack of interest in variable rates is understandable as rates are only likely to go up in the future.

Consumers unequivocally preferred fixed rates. Nearly 7 in 10 respondents said a fixed interest rate is a “must have” when choosing a mortgage. The preference was more pronounced with age—56 percent of 18- to 34-year-olds said a fixed rate through the whole term was a “must have,” vs. 80 percent for respondents aged 65 and over—and reflected younger borrowers’ capacity to tolerate financial uncertainty. Respondents with the highest credit scores also demonstrated a stronger preference for a fixed rate.

Rates are the fundamental driver of choice in mortgages

Raising the interest rate on our test mortgage to 5.5 percent from 3.5 percent reduced choice probability by 17 percent. Conversely, if the rate dropped to 2.5 percent, choice likelihood rose by 10 percent. Interest rates might have even greater influence than our model results suggest. Respondents may not have fully appreciated the impact of shifting rates on monthly payment amounts—the payment on a $500,000, 30-year-fixed mortgage at a 5.5 percent interest rate is 26 percent higher than that on a similar loan with a 3.5 percent rate.

In our survey, nearly 80 percent of respondents insisted on a “low interest rate.” As with most price attributes in our study, older respondents and women preferred lower interest rates more than their counterparts. And once again, consumers with the highest credit scores showed greater insistence on low interest rates.

Loan term preferences may not be what you think!

The 30-year mortgage has long been the bread-and-butter of the US mortgage industry. Yet here’s one of the most counterintuitive observations from our analysis: Consumers actually preferred shorter-term loans.36

When the loan term was changed to 15 years, choice probability for our test mortgage increased by a substantial 16 percent; lengthening the term to 40 years caused a 10 percent drop in choice likelihood. These preferences toward shorter-term loans may reflect not only more debt-averse behavior following the financial crisis, but also the unprecedented low interest-rate environment. Lenders are currently offering 15-year fixed rate mortgages at APRs averaging 2.7 percent, a discount of about 70 basis points compared to present rates on 30-year loans.37 However, we suspect if lenders were to focus on and communicate monthly payment amounts more, which change drastically with loan terms, preference for longer terms would rise.

The preference for shorter terms was reflected in consumers’ insistence on “no prepayment penalties”—two-thirds of respondents rated them a “must have.” Recent regulatory changes apply a time restriction of three years to prepayment penalties,38 but consumers continue to want to pay off mortgages ahead of schedule. The long-understood prepayment risks associated with mortgage-backed securities only support this phenomenon.39

In a highly competitive, low-interest rate mortgage market, even small differences in origination fees created meaningful impact in mortgage preference. Dropping the 1-point origination fee on our test mortgage to zero increased choice probability by 8 percent; raising the fee to 2 points decreased choice likelihood by 7 percent.

Bank size and brands matter little

The size of the lending institution had little influence on consumers’ mortgage choice: Choice probability declined by 2 percent if the test mortgage was offered by a community bank and 4 percent if offered by a midsized regional bank. Variations in other product attributes easily overshadowed these differences. Brands were also not important—only 24 percent of respondents rated a “lender with a recognizable brand” as a “must have.”

However, consumers were skittish about mortgages with online-only lenders—choice likelihood declined 14 percent if the test mortgage was offered by a nonbank/online lender. We suspect consumers prefer in-person interactions with mortgage bankers due to the complex nature of mortgage transactions. Even consumers who would obtain or refinance a mortgage using email or over the phone may want the option to resolve any problems in person.

Among the other mortgage attributes, consumers did not view existing relationships with the bank to be material to their choice. This is probably due to the fact that financial considerations are predominant. And predictably, no minimum down payments were desired by younger consumers and those with lower credit scores.

Sensitivity analysis

Our sensitivity analysis focused on loan terms. Increasing the term from 15 years to 40 years produced significant shifts in the choice probability of the test mortgage (figure 14).

Declines in choice probability were steeper between 15-year and 20-year terms, and declined less sharply between 20-year and 30-year terms.

There was a pronounced drop in consumer acceptance of mortgages with terms beyond 30 years. This again signifies how attuned American mortgage borrowers are to the notion of a 30-year loan being the standard. This effect was least pronounced with Millennials, who obviously have more time to take on longer loans. Sensitivity to longer loan terms rose with age, except among those aged 65 and over, most of whom would already have paid off their mortgages.

What should mortgage lenders do?

Our analysis reaffirms the macro-driven nature of the mortgage business. Consumer preferences shift drastically in response to economic and financial conditions. Heavy regulation has likely contributed to a highly commoditized marketplace, one that demands scale and extreme price competitiveness. Our strategies below are framed in the context of this reality:

- Market share increases can only come from price-competitive offerings. In our survey, fewer than two in ten respondents insisted on an existing relationship with their mortgage lender. So banks should emphasize competitiveness of the offering over current relationships in any marketing efforts.

- Reduce sensitivity to origination fees by bundling other services. Even with fast conditional approvals, taking a mortgage through to closing is a challenging experience. Lenders should consider bundling services such as home appraisals, title exams, and property surveys with the origination fee to help increase customer convenience and potentially reduce customer sensitivity to the up-front fee.

- Make cross-selling central to mortgage pricing: Compared to specialty mortgage lenders, banks generally hold one crucial advantage—a large portfolio of products through which they can enhance customer profitability. They can trade off the weak returns on mortgages against savings of customer acquisition costs for other products, such as credit cards or low-cost deposit accounts. The latter will likely become particularly valuable once interest rates rise.

The need for customer value-based pricing innovation in retail banking

Our research clearly shows that prices are dominant drivers of consumer choice in retail banking, and that demand sensitivity varies considerably across attributes and segments.

Our fundamental message for banks is that they need to pay more attention to pricing innovation, and that they should seriously consider refining their pricing strategies to more fully and accurately reflect customers’ value perceptions. We recognize that such a transition is not easy.

In his 2008 paper, “Customer value-based pricing strategies: Why companies resist,” Andreas Hinterhuber identified the main obstacles executives from several countries faced when implementing value-based pricing strategies.40 The top three were: identifying the value that products create for consumers, communicating this value effectively, and segmenting the market based on consumers’ needs and preferences.

In our view, all three remain challenges for retail banks in the United States. Not all banking executives have a strong understanding of the drivers of value for their products. This, in turn, often results in ineffective communication of value to customers, and suboptimal profitability. Also, effective segmentation can be difficult to achieve, due to data limitations, current regulations, and product homogeneity.

For banks that aspire to leadership in pricing innovation, there are three fundamental prerequisites to revamping the design and execution of pricing strategies. First, it is crucial for banks to have the right analytical talent, experts who more accurately understand drivers of consumer choice. Second, banks should build access to high-quality customer data along with the right analytical tools to generate insight-driven pricing strategies. This may require additional resources, as many banks today lack the ability to even accurately assess the “cost to serve” individual retail customers. And third, banks would need strong leadership commitment to effectively implement innovative pricing strategies—easier said than done in highly competitive and commoditized marketplaces.

Pricing innovation as a discipline may seem formidable, but the potential benefits for retail banks—happier customers, stronger financial performance, and a more robust banking system—can be substantial and enduring. Now that’s valuable!

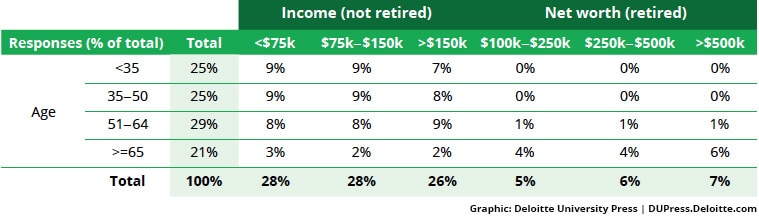

Appendix A: Methodology

For this study, the Deloitte Center for Financial Services worked with Advanis, a Canadian market and social research firm, to conduct a survey of 3,001 respondents based in the United States. Minimum quotas by age and financial parameters (income or net worth) were established at an overall survey level. Final distributions of participants within the stated quotas are displayed in the table below.

Each respondent was assigned to two of the three retail banking products covered in this study, with at least 1,400 respondents for each product. These requirements were stated to ensure that the survey sample captured a population of bank consumers who had access to both savings and credit products, across generations and financial profiles.

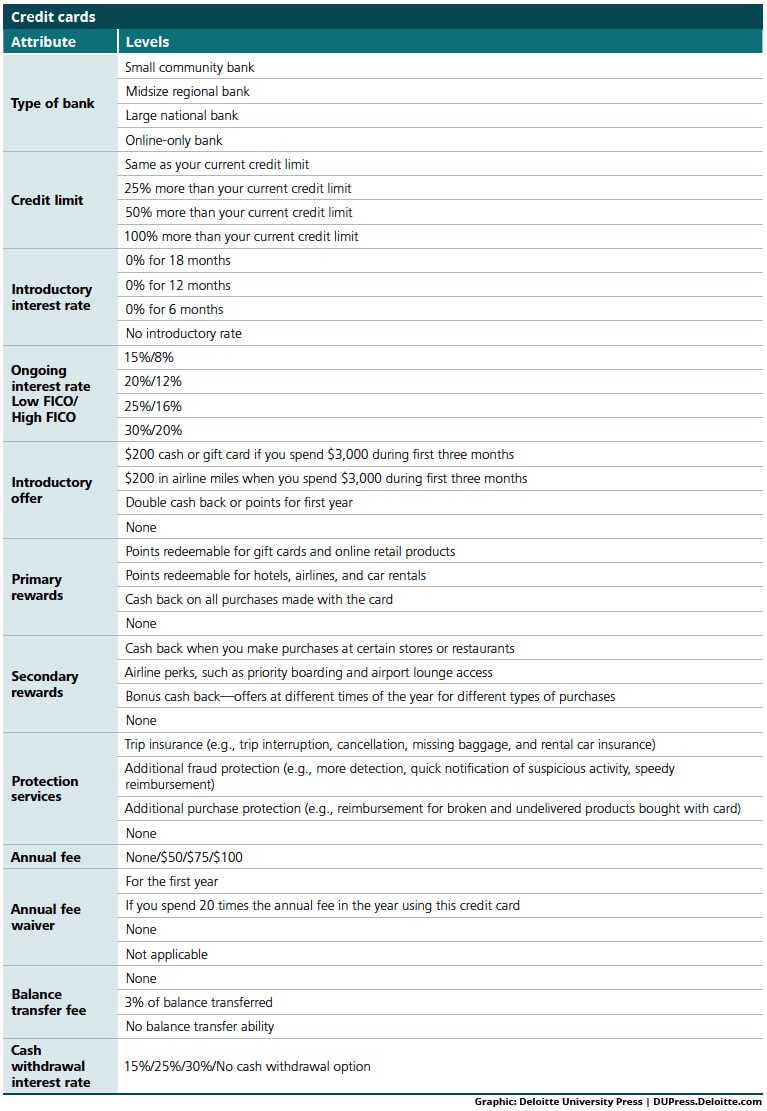

Choice task design

A discrete choice modeling approach using stated preference data was utilized in order to understand the trade-offs individuals make when selecting a financial product.

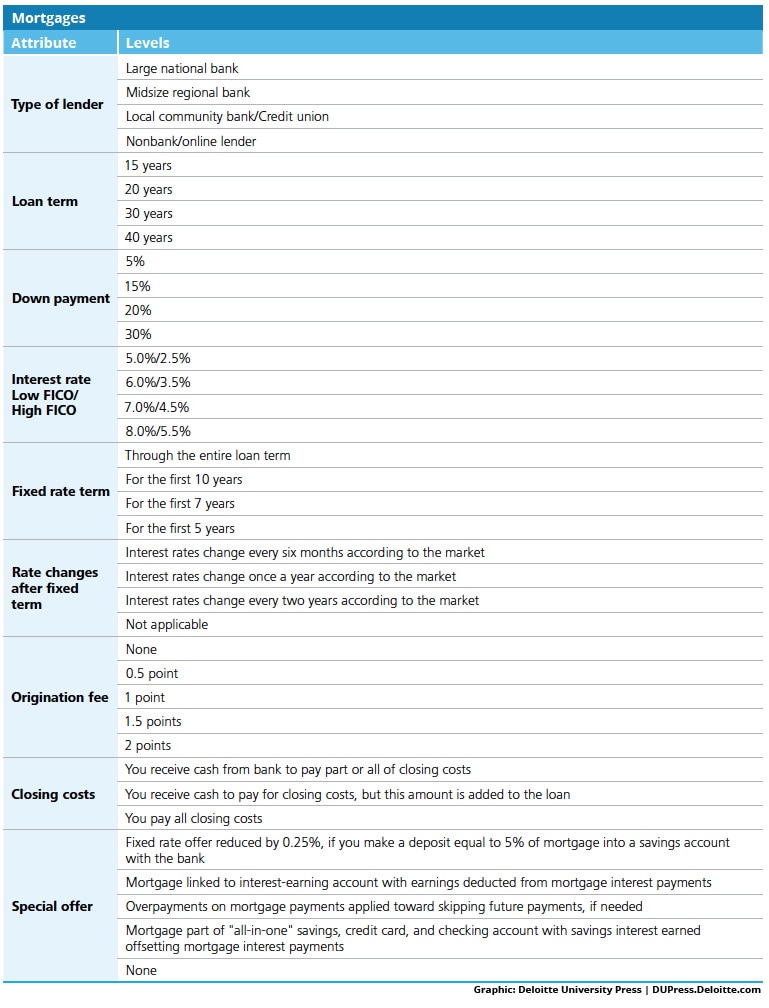

Main-effects experimental designs were first created to construct three sets of scenarios—a set for each product. A total of 128 scenarios, grouped in 32 blocks of four scenarios, were created for each product. The specific product attributes and levels used to generate these scenarios are included for reference in appendix B.

Scenario design was nearly orthogonal, enabling the estimation of the impact on customers’ preferences of every product feature independently from the others. Each participant saw one block of scenarios per product (that is, four choice cards), and two products in total, based on current product ownership.

Conjoint analysis methodology

Nested logistic regression (logit) models were initially estimated to determine the impact of each attribute on a product offer’s choice probability. Given that in each model, the value of the inclusive parameter wasn’t significantly different from 1, multinomial logit models were used instead. Each model included the main effect for each design variable, covariates interacting the design variables with individual-specific data on current usage, preferences or thresholds, and interactions of the design variables with segment membership.

The models were used to develop simulators for each product that predict customers’ choice probability, either individually, or in a market simulation of up to four products. The results from this simulator analysis have been extensively discussed in this paper.

Appendix B: Product attributes and levels

Below are the specific set of product attributes and levels that were randomized to design the choice task analysis described above.

© 2021. See Terms of Use for more information.