The Effects of COVID-19 on Tax Audits and Controversy Bookmark has been added

Article

The Effects of COVID-19 on Tax Audits and Controversy

Japan Tax & Legal Inbound Newsletter January 2022, No. 74

Japan’s National Tax Agency recently published its latest fiscal year (FY) 2021 statistics on tax audits (July 2020 through June 2021) and tax appeals and litigation (April 2020 through March 2021). The statistics indicate that these activities notably decreased due to the effects of COVID-19. However, the tax authorities have been actively conducting tax audits in the first half of FY 2022 and likely will continue to do so provided that the COVID-19 situation does not worsen in Japan.

Explore Content

Tax audits

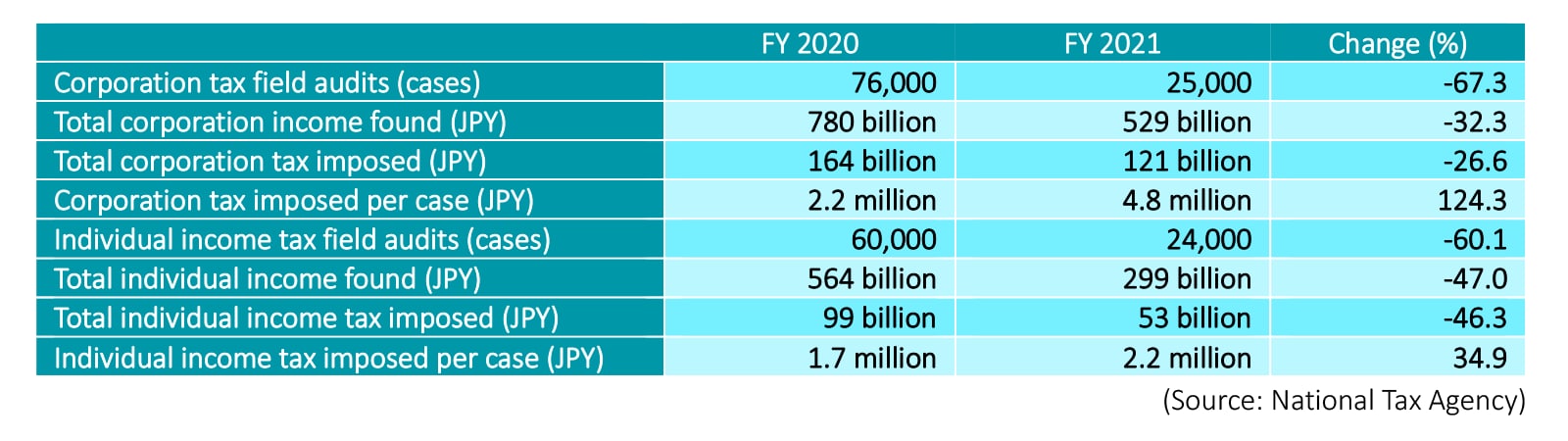

The number of field audits of corporate taxpayers in FY 2021 decreased by 67.3% from FY 2020. In addition, the total amount of income found by field audits of corporations in FY 2021 decreased by 32.3% from FY 2020. The total amount of corporation tax imposed by field audits in FY 2021 decreased by 26.6%. These decreases are considered to be due to the effects of COVID-19.

However, the amount of corporation tax imposed by field audits per case in FY 2021 increased dramatically by 124.3% from FY 2020. Major tax audit targets included corporate taxpayers that (i) were claiming a refund of consumption tax, (ii) were conducting cross-border transactions, or (iii) did not file corporation tax returns. This clearly indicates that the tax authorities were focusing on cases where a taxpayer’s misconduct was suspected and the tax amount at stake was larger.

With respect to individual taxpayers, the number of field audits in FY 2021 decreased by 60.1% from FY 2020. Also, the total amount of income found by field audits of individuals in FY 2021 decreased by 47.0% from FY 2020, and the total amount of individual income tax imposed by field audits in FY 2021 decreased by 46.3%. Again, these decreases are deemed to be caused by the effects of COVID-19.

However, the amount of individual income tax imposed by field audits per case in FY 2021 increased by 34.9% from FY 2020. Major tax audit targets included (i) wealthy individuals, in particular those having foreign investments, (ii) individuals conducting business over the internet, and (iii) individuals that did not file an income tax return. This could indicate that the tax authorities were focusing on larger cases possibly involving a taxpayer’s misconduct.

Due the decrease in tax audits in FY 2021, the tax authorities have been actively conducting tax audits in the first half of FY 2022 and likely will continue to do so provided that the COVID-19 situation does not worsen in Japan.

Tax appeals and litigation

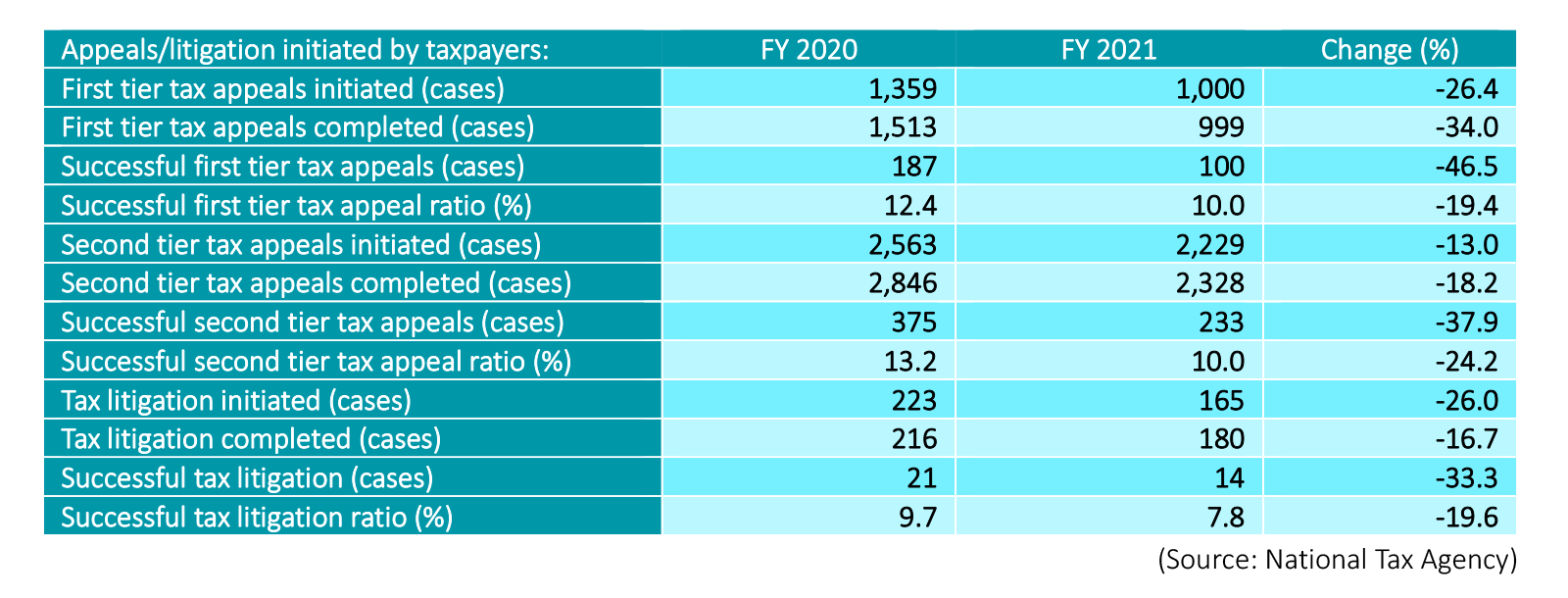

The number of first tier tax appeals filed with the tax authorities in FY 2021 decreased by 26.4% and those completed in FY 2021 decreased by 34.0% from FY 2020. The number of second tier tax appeals filed with the National Tax Tribunal in FY 2021 decreased by 13.0% and those completed in FY 2021 decreased by 18.2% from FY 2020. Also, the number of tax litigation cases initiated in FY 2021 decreased by 26.0% and those completed in FY 2021 decreased by 16.7% from FY 2020.

These decreases largely could be explained by the fact that the number of assessment notices decreased due to the COVID-19 situation.

The number of successful first tier tax appeals in FY 2021 decreased by 46.5% from FY 2020, with the success ratio in FY 2021 decreasing by 19.4%. The number of successful second tier tax appeals in FY 2021 decreased by 37.9% from FY 2020, with the success ratio in FY 2021 decreasing by 24.2%. Furthermore, the number of successful tax litigation cases in FY 2021 decreased by 33.3%, with the success ratio in FY 2021 decreasing by 19.6%.

The number of successful tax appeals and litigation cases decreased as the number of tax appeals and litigation cases filed also decreased. However, the success ratio of tax appeals and litigation cases were almost the same as the recent five-year average, which could indicate that they may not have been affected by COVID-19.

Deloitte’s View

Since tax audits decreased in FY 2021 due to COVID-19, the tax authorities have been actively conducting tax audits in FY 2022, focusing on larger cases possibly involving taxpayer misconduct. At the same time, the success ratios for tax appeals and litigation cases appear not to have been affected by COVID-19.

In regard to tax appeals and litigation, major differences of opinion between taxpayers and the tax authorities arise in the underlying tax audits during the fact finding process that determines whether tax will be imposed. The National Tax Tribunal and the courts ultimately decide which side’s argument is correct by evaluating evidence presented by both sides and generally using a framework where they examine which arguments are more consistent with relevant hard facts. Such hard facts may include those admitted by both contractual parties or found by objective evidence.

As such, when a taxpayer is deciding whether to appeal their case to the tax authorities or the National Tax Tribunal, the taxpayer should use the same framework as above and examine which arguments are more consistent with relevant hard facts. Published National Tax Tribunal cases are great reference sources for how facts are applied to various cases.

* This Article is based on the relevant Japanese or specific country’s tax law and other authorities in effect on the date of this Article. This Article would not be guaranteed updating if there are any changes in Japanese tax law, any other law, or interpretations by the courts or tax authorities thereof after the date of this Article.