2022 tax reform changes to scope of earnings stripping rules and the potential impact on Japanese real property investment by foreign investors Bookmark has been added

Article

2022 tax reform changes to scope of earnings stripping rules and the potential impact on Japanese real property investment by foreign investors

Japan Tax & Legal Inbound Newsletter September 2022, No. 78

The scope of the Japanese earnings stripping rules was expanded to cover direct investment in Japanese real property by foreign investors for fiscal years commencing on or after 1 April 2022. This change could adversely affect the after-tax profitability of such an investment. This article discusses such a potential impact with an illustrative example.

Explore Content

- Overview of the Japanese earnings stripping rules

- Extension of the scope of the earnings stripping rules

- Importance of signer identification

Overview of the Japanese earnings stripping rules

The following is a brief overview of the Japanese earnings stripping rules:

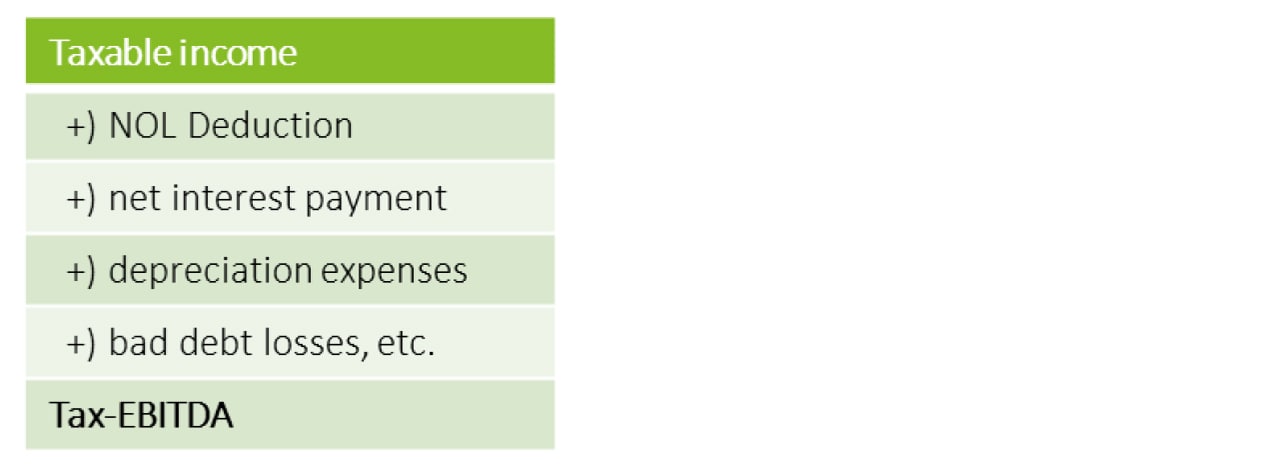

- The earnings stripping rules restrict deductions for net interest expenses that exceed 20% of adjusted taxable income (“Tax-EBITDA”).

- “Net interest expenses” are defined as the sum of the interest on loans (excluding interest that is fully subject to Japanese corporate income tax) less the sum of certain interest income.

- Tax-EBITDA is calculated using the following formula:

- Disallowed interest expenses may be carried forward and deducted from taxable income in the succeeding seven fiscal years.

- There are certain exceptions to the earnings stripping rules. A de minimis rule applies in the event that (1) net interest expenses are JPY 20 million or less or (2) the sum of interest expenses of a domestic group (i.e., no foreign corporations included) exceeds the sum of 20% of the Tax-EBITDA of such group.

Extension of the scope of the earnings stripping rules

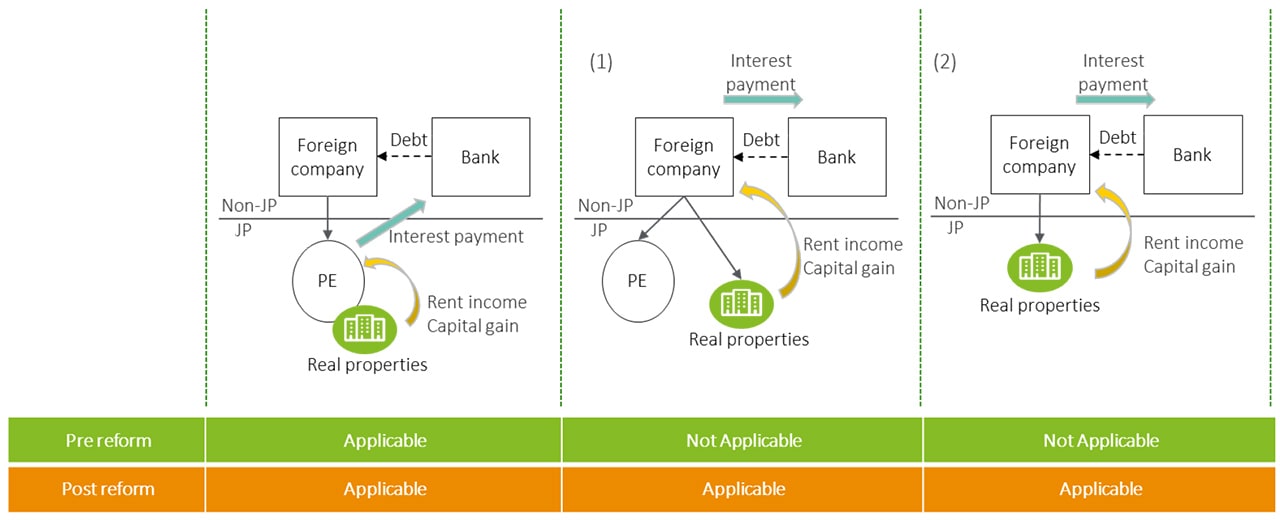

Prior to the 2022 tax reform, the earnings stripping rules were applicable only to Japan-source income attributable to a permanent establishment (PE) of a foreign corporation, and, accordingly, the rules were not applicable to the following:

- Japan-source income not attributable to a PE in Japan of a foreign corporation; or

- Japan-source income of a foreign corporation without a PE in Japan.

Under the 2022 tax reform, the scope of the earnings stripping rules was extended to cover scenarios (1) and (2) above, with effect as from fiscal years commencing on or after 1 April 2022.

Importance of signer identification

Prior to the 2022 tax reform, interest on acquisition indebtedness was fully deductible in calculating Japan-source income of a foreign corporation arising from Japanese real property investments (e.g., rental income and capital gains), as long as the interest was not attributable to a PE in Japan. However, the deduction of such interest may be partially or wholly limited after the 2022 tax reform as per the revised earnings stripping rules, which could adversely affect the after-tax profitability of direct Japanese real property investments by foreign investors. The following is an illustrative example:

- In fiscal year one, a foreign company directly invests in Japanese real property and finances 75% of the acquisition from a third party lender;

- From fiscal year one to fiscal year four, the foreign company derives rental income from the investment and pays interest on the debt from the third party lender; and

- At the end of fiscal year four, the foreign company transfers the investment to a third party buyer.

Deloitte Japan’s View

For fiscal years commencing on or after 1 April 2022, the earnings stripping rules may be applicable to direct investment in Japanese real property by foreign investors. Accordingly, due consideration should be given to the impact of the revised Japanese earnings stripping rules in assessing the after-tax profitability of an investment.

* This Article is based on the relevant Japanese or specific country’s tax law and other authorities in effect on the date of this Article. This Article would not be guaranteed updating if there are any changes in Japanese tax law, any other law, or interpretations by the courts or tax authorities thereof after the date of this Article.