SFDR compliance: A look into current status, challenges, and possible solutions has been saved

Article

SFDR compliance: A look into current status, challenges, and possible solutions

The SFDR Level 2 applies from 1 January 2023 and requires application of the Regulatory Technical Standards on the content, methodology and presentation of ESG disclosures. The Authority for the Financial Markets has announced that they will be conducting supervisory reviews on SFDR Level 2 in 2023, thus highlighting the immediate need for structured and complete disclosures. This article aims to provide compliance insights into the SFDR Level 2 implementation challenges and possible solutions.

Explore Content

SFDR background

The EU Sustainable Finance Action Plan kickstarted the development of the most comprehensive and detailed set of regulations affecting the global field of ESG investing.1 One of the major pillars supporting the transition to a more transparent and sustainable investment landscape is the Sustainable Finance Disclosures Regulation (SFDR), which largely entered into force on 10 March 2021.2 The SFDR applies to all financial market participants and financial advisors with 500+ employees offering investment advice, insurance advice or financial products and performing portfolio management. While one of the major pillars of the EU Action Plan, the SFDR is supplemented by other regulations such as the EU Taxonomy Regulation and the IDD/MiFID II sustainability amendments. These regulations have one common objective: increasing transparency in the value chains and preventing greenwashing.

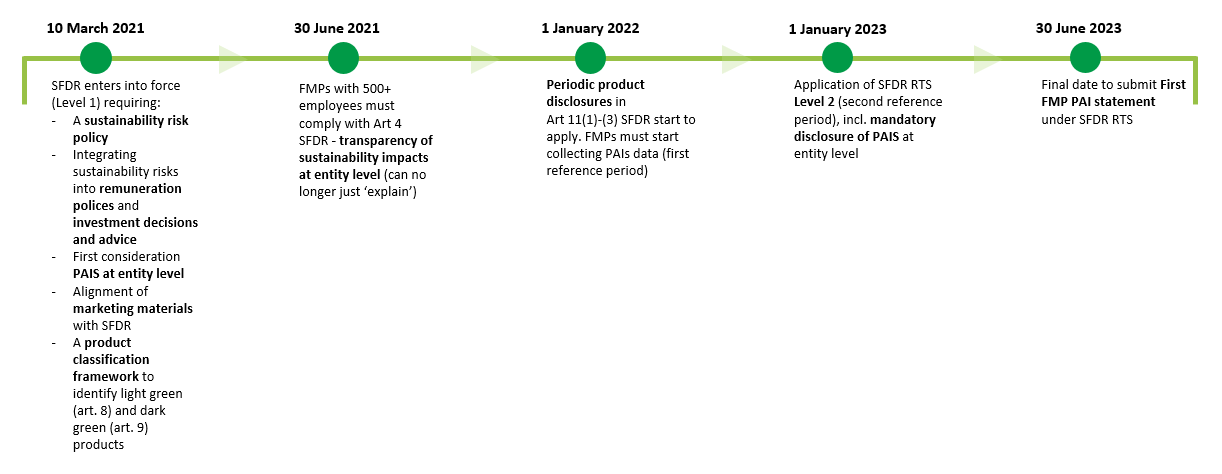

Level 1 of the SFDR product and entity level requirements came into force on 10 March 2021, which are classified as follows:

- Product level requirements a.o. mandate that products with an ESG focus should be reviewed and classified across a gray, light green, and dark green scale.3

- Entity level requirements a.o. mandate the:

o Formulation of a sustainability risk policy

o Update of the remuneration policy

o Integration of sustainability risks into investment decisions and advice

o Alignment of marketing materials with information disclosed per the SFDR

o Consideration of Principal Adverse Impact reports (PAIS) at the entity level in the investment process (effective from 30 June 2021)

Greenwashing is a misleading market practice in which firms give false impressions of their environmental impact or benefits (green claims). In other words, greenwashing is a tactic used by firms to mislead customers into thinking their products and activities have more environmental impact than they actually do. It is a big concern because it does not give due advantage to those firms that in fact make the effort to implement sustainable practices. Greenwashing also makes it more difficult for sustainable-minded consumers to make environmentally friendly choices.

30 June 2021 marked one of the key dates for the start of a multi-layered SFDR implementation. From this day, the ‘comply or explain’ obligation became mandatory for Financial Market Participants (‘FMPs’) with more than 500 employees. It requires firms to publish and keep a statement on their website relating to their PAI and due diligence policies, including how they plan to take action on their investments’ negative social impact and ecological footprint. This statement is often referred to as a ‘PAI Statement’, as its purpose is to cover the PAIS of funds’ investments on ESG factors.

On 1 January 2023, SFDR Level 2 will be adopted, requiring detailed sustainability-related disclosure obligations, including a mandatory reporting template and the methodology, on which the firms must report. The mandatory reporting template details a set of indicators for the PAI statement, focusing on climate and environment related adverse impacts, as well as adverse impacts on social, employee, respect for human rights, anti-corruption, and anti-bribery levels.

These indicators are divided into a set of 14 core indicators and 31 additional indicators. Investors should report on all 14 core indicators + 2 additional indicators (of which at least one relates to the climate and the environment and one relates to the social and employee level).

The disclosure requirements go beyond the PAI indicators requiring firms to set up policies on the identification of principal adverse impacts, actions taken and planned to mitigate the principal adverse impacts, compliance to international standards, and a historical comparison covering at least five previous reference periods.

As the SFDR Level 2 application deadline also marks the end of the first reference period (running from 1 January 2022 to 31 December 2022), in-scope firms must collect all relevant data according to the SFDR’s requirements for this period needed for their SFDR reporting on 30 June 2023.

What should a PAI statement include?

- Information about your companies’ policies on the

identification and prioritization of principal adverse sustainability impacts and indicators - A description of the PAIS and already taken or planned actions to manage them

- Summaries of engagement policies with reference to internationally recognized standards for due diligence and reporting and, where relevant, the degree of their alignment with the Paris Agreement goals.

Current implementation status

The European Supervisory Authorities (ESAs) published a joint report in July 2022, on the extent of voluntary disclosure of PAIS under the SFDR. The report is written off the back of 33 responses received from National Competent Authorities (NCAs). The responses covered a significant proportion of EU supervised entities under the scope of the SFDR. According to the report, the NCAs have reported an overall low level of disclosures and alignment to Paris Agreement objectives, noting that any alignment made is vague and high-level. The same report prompts NCAs to increase supervision on compliance with SFDR in their jurisdictions through information requests and offsite inspections, among other ways.4

In the Netherlands, the Authority of Financial Markets (AFM) has conducted Level 1 compliance investigations and has recently announced that it will conduct further investigations into SFDR compliance in 2023. The AFM shares a number of findings in a report published in November 2022, whose overall conclusion indicates a low level of SFDR compliance for, e.g., incorrect classification of funds and insufficient integration of sustainability risks in the remuneration policy and codes of conduct. The AFM notes in its report an understanding of the challenges involved in SFDR implementation, but also indicates that the publication of the final RTS should increase clarity on next steps.5

SFDR compliance challenges

In spite of the publication of multiple guidance documents from various regulatory bodies, companies are struggling to implement the SFDR Level 2 requirements. We list a few challenges that we have identified from a regulatory compliance perspective:

- Integrating the adverse sustainable impact in the PAIS:

Using the 14 mandatory indicators to determine the adverse impacts of investment decisions is one of the main challenges to address. Adverse impact means ‘an entity's negative impact on environmental and social issues’.6 The indicators are extensive and complex making it extremely difficult to analyze and decide, when choosing to invest regarding the preferences for consequences on climate and environment.7 Furthermore, to ensure coherence with other sustainability related disclosures, the indicators of principal adverse impacts should use standardized metrics, for which the market has no best practices available yet. This can lead to disagreements on the appropriate way to interpret the results of an adverse impact analysis and on the way to respond to any identified negative impacts.8 The business (first line) and Compliance (second line) have to jointly determine their approach on the classification of adverse impacts aligned with the 14 indicators. - Aligning SFDR implementation with related ESG regulations into the ESG Compliance Framework

Updating the ESG Compliance Framework with the Level 2 requirements, while also considering other key ESG regulations, is another challenge to tackle for the second line. These other regulations include the amendments to the IDD/MiFID II regulation, such as the ESG suitability assessment, where a match should be made between client sustainability preferences and the product portfolio. Making the match involves classifying the products according to their sustainability related ambition, as required by the SFDR.9 And, the EU Taxonomy Regulation, which has implications for the classification of products against ESG factors, will also come into force from 1 January 2023. Hence, its product level requirements must likewise be taken into account. Implementing these regulations requires identification of the areas where they have an overlap with the SFDR.10 The Compliance department will have a significant role to play in this, as it is responsible for analyzing the latest regulatory developments and including them in the Compliance framework. Increased collaboration with the business will be key to identify the impacted areas and keep oversight of the framework’s correct functioning. - Designing SFDR policies and procedures

The current lack of readily available and clear guidelines and standards in the market on how to implement SFDR is another challenge in the market. This lack of existing standards make it difficult for the business to understand, translate and implement requirements posed by an increasingly complex and rapidly evolving ESG regulatory landscape. The Compliance department can support the business by setting clear policies and work instructions with business’ input for e.g., a clear framework for entity and product level website discloures. This will ensure support for the business and inevitably lead to proper and complete SFDR implementation. A strong collaboration with the business will also help the second line in spreading awareness on the urgency of the ESG regulatory agenda, particularly in terms of implementing the SFDR effectively and in a timely manner. This will also ultimately shift the business’ priority to the ESG regulatory agenda.11 - ESG data quality and availability. The requirement to describe 14 indicators and a series of optional indicators creates a challenge in terms of data quality and availability. Companies have to collect data from multiple vendors to determine the adverse impacts. With the SFDR requiring mainly non-financial ESG data, which is not automatically part of the current data sets, market data vendors need to be engaged. For instance, to calculate the GHG emissions indicator, firms need to collect data on market capitalization, the entity itself and greenhouse gas emissions. The Compliance department can provide support by setting up a data quality framework to address potential issues with the vendors and the business in a timely manner.

Conclusion

While the current status of SFDR implementation is peppered with challenges for several market participants, it is an opportunity for the second line to optimize collaboration with the business and place ESG risks and regulatory compliance as a top priority. With investors, consumers and regulators increasingly becoming sustainability driven, the Compliance department unarguably has a crucial role in preventing greenwashing and ensuring an effective implementation of the SFDR. In our experience, an increased collaboration between the first and second lines on the strategy and roadmap to implement the SFDR can achieve effective compliance outcomes and help integrate sustainability further into the DNA of companies.

1. To comply with the Paris Climate Agreement, the European Commission has presented the EU Green Deal, which describes Europe becoming the world's first climate-neutral continent by 2050. The European Commission has published the European Action Plan for Financing Sustainable Growth as a framework for reaching this goal. The plan shows the strategy on sustainable finance in Europe and contains 10 action points that will result in legally binding frameworks. The legally binding frameworks are discussed in more detail below, focusing on the SFDR and the EU Taxonomy Regulation.

2. This regards the ‘Level 1’ regulations, imposing general disclosure requirements by mandating that draft RTS must be more aligned with the content of the disclosures. The ‘Level 2’ regulations include more technical requirements, such as disclosure templates.

3. For more information on Level 1, please read our SFDR research paper: ‘Sustainable Finance Disclosure Regulation - Is the financial industry ready for the Big One?’, deloitte.com.

4. ‘Joint ESAs’ Report on the extent of voluntary disclosure of principal adverse impact under the SFDR’, esma.europa.eu.

5. ‘SFDR in de praktijk: blijvende aandacht nodig’, afm.nl.

6. Table 1 from Annex I Delegated Regulation (EU) 2022/1288 of the Commission.

7. For instance, the indicators ”total carbon emissions”, ”carbon footprint”, ”carbon intensity” involve complexity regarding investee company’s Scope 1, 2 and 3 carbon emission, see: Final Report on draft Regulatory Technical Standards with regard to the content, methodologies and presentation of disclosures pursuant to Article 2a(3), Article 4(6) and (7), Article 8(3), Article 9(5), Article 10(2) and Article 11(4) of Regulation (EU) 2019/2088, esma.europa.eu.

8. For instance, to calculate the CO2 emission Indicator, you will need to collect data on market capitalization, the entity itself and greenhouse gas emissions.

9. As part of the IDD/MiFID II amendments, FMPs are required to implement sustainability preferences in suitability assessments for portfolio management and investment advice.

10. The EU Taxonomy classification system aims to classify economic activities with E, S and G factors. Currently, only the E (Environmental) factors need to be classified. From 1 January 2023, the EU Taxonomy Regulation requirements regarding the provision of universal concepts for the S and G factors will also apply.

11. ‘AFM doet nader onderzoek naar naleving SFDR en Taxonomie door beheerders’, afm.nl.

Recommendations

Sustainability Has Entered the Business Cycle

Key Takeaways from the Second Dutch FSI Sustainability Round Table