Inside the patient journey: Three key touch points for consumer engagement strategies Findings from the Deloitte 2018 Health Care Consumer Survey

25 September 2018

Improving engagement at three key touchpoints in a consumer's health care journey could help health care stakeholders improve patient outcomes and reduce the cost of care.

Introduction

Consumer engagement with health care continues to grow, from searching for care and accessing new channels of care to tracking and sharing health data. Consumer engagement could be the key to improving patient outcomes and reducing health care costs; patients who are informed about their condition and involved in their treatment decisions tend to have better health outcomes and typically incur lower costs.1 Many health systems, clinicians, and health plans—as well as biopharmaceutical and medical device companies—are developing tools and strategies that can help consumers become more engaged in their health. But what do health care consumers really want?

Learn More

Explore the 2018 surveys of US health care consumers and physicians

Watch the video

Visit the Health care collection

Subscribe to receive related content from Deloitte Insights

The Deloitte Center for Health Solutions conducted a nationally representative survey of US adults from February to March 2018 to identify trends in health care consumer engagement. We identified three touchpoints during a consumer’s health care journey when active interaction with the health care system peaks: searching for care, accessing new channels of care (for example, at-home testing, diagnosis, and digital tools), and sharing personal health information.

Our findings show that:

- More consumers are using quality ratings and other tools than in previous years, though we continue to see a gap between expressed interest and actual use.

- Consumers are increasingly open to new channels of care—particularly at-home diagnostic testing.

- The number of consumers tracking their health data with wearables has more than doubled since 2013; many are also willing to share their data to improve their health or the device’s performance.

Understanding consumer attitudes and preferences across the patient journey can be central to supporting healthy behaviors, achieving better health outcomes, and improving the patient experience. As life sciences and health care organizations continue to evolve their strategies, they should consider:

- Offering tools that are flexible and meet the changing needs of consumers as they transition through life stages, disease states, and health status; and

- Creating a seamless experience, including tools that are connected and easily accessed by the patient, caregiver, and care team.

Consumer touchpoints across the patient journey

In this paper, we offer a framework to organize our 2018 survey findings about consumer attitudes and behaviors across three different stages of consumer engagement. While not inclusive of the entire patient journey, the stages that we examined for this study include:

- Searching for care;

- Accessing new channels of care (e.g., at-home testing, diagnosis, and digital tools); and

- Sharing personal health information.

Searching for care

Searching for care

Consumers want in-network and convenient health care providers. One key step in the patient journey is finding the right health care provider. Half of the surveyed consumers said making sure a physician or hospital was a part of their health plan’s network was one of the most important factors when choosing a doctor (see figure 1). For 43 percent, a convenient location was important. Reputation (39 percent) and bedside manner (34 percent) were the third and fourth, and not far behind were convenient hours and out-of-pocket costs (32 and 31 percent, respectively). Few consumers said technology for online scheduling and accessing labs and test results were important.

These findings suggest that health care consumers are less focused on “bells and whistles” and more on convenience, cost, and bedside manner, possibly because they continue to face challenges accessing and obtaining affordable and reliable care.

More consumers are looking at quality ratings and pricing tools than in previous years, but use is still low. More consumers are looking up pricing and quality information in 2018 versus 2015, and while use is still relatively low, the trend is upwards. The percentage of consumers looking up cost information has nearly doubled in the last three years from 14 to 27 percent (see table 1).

Previous research, including Deloitte’s, has shown that there is a gap between what consumers say they are likely to use and what they actually do.2 In 2018, 53 percent said they were likely to use a tool to look up quality ratings for specific physicians or hospitals, but only 23 percent did so in the past year, and though 50 percent said they were likely to use a tool to look up pricing in the future, only 27 percent did so in the past year. However, this gap is decreasing, down to 20 percent in 2018 from 30 percent in 2015. This persistent, though decreasing, gap may indicate an opportunity to improve current pricing and quality tools and make them more user-friendly.

Using new channels of care: Digital tools and at-home diagnostic tests

Using new channels of care: Digital tools and at-home diagnostic tests

About a third of consumers are interested in using apps for identifying symptoms and for health coaching. The number of digital tools and apps available for health care and health coaching is increasing significantly,3 and many developers are offering more evolved and sophisticated tools. These tools have the potential to improve health outcomes through faster diagnosis, 24/7 access to health coaching, and the ability to recognize mood and lifestyle changes that could affect adherence to a treatment plan.

About a third of respondents are interested in using apps for these purposes (see figure 2):

- Thirty-five percent of respondents were interested in using a virtual assistant to identify symptoms and direct them to a physician or nurse.

- Thirty-one percent were interested in connecting with a live health coach that offers 24/7 text messaging for nutrition, exercise, sleep, and stress management.

- Twenty-nine percent were interested in using an app that uses voice-recognition software to recognize depression or anxiety from changes in the tone of voice.

Consumers who consider themselves to be in excellent/good health are more likely to use such tools than are less-healthy consumers.We found that consumers who consider themselves to be in “excellent” or “very good” health are more interested in using health apps or digital tools than are less-healthy consumers. On the other hand, respondents who consider themselves to be in “poor health” are also more interested in such tools than those who consider themselves to be in moderate (good or fair) health. Health care providers may need to find ways in which to engage consumers who consider themselves to be in “fair” or “good” health. Considering that 43 percent of consumers considers themselves in fair or good health, this is a sizable segment that has the potential for increasing engagement. Organizations may attract these consumers by offering to help them identify tools that target prevention of potential health issues, and possibly combining these tools with diagnostic or predictive (for instance, genomic profiling) solutions in the market today. In addition, health systems or health plans may consider building a role for a person who can proactively approach consumers and educate them on the use of digital tools and platforms.

At-home self-diagnostic and genetic tests are becoming more popular among consumers. Many consumers are comfortable using at-home tests for their current health concerns and identifying potential future health issues. For instance:

- Fifty-one percent are comfortable using an at-home test to diagnose infections (such as strep throat and urinary tract infection) before going to the doctor for treatment.

- Forty-five percent are comfortable using an at-home genetic test to identify existing or future health risks.

- Forty-four percent are comfortable using an at-home blood test (a quick prick with a fine needle) that connects to an app to track overall health trends (for instance, cholesterol, fasting blood glucose, inflammation, triglycerides).

- Forty-one percent are comfortable sending/mailing a stool sample to a laboratory service that identifies gut bacteria, which in turn can help guide nutritional choices.

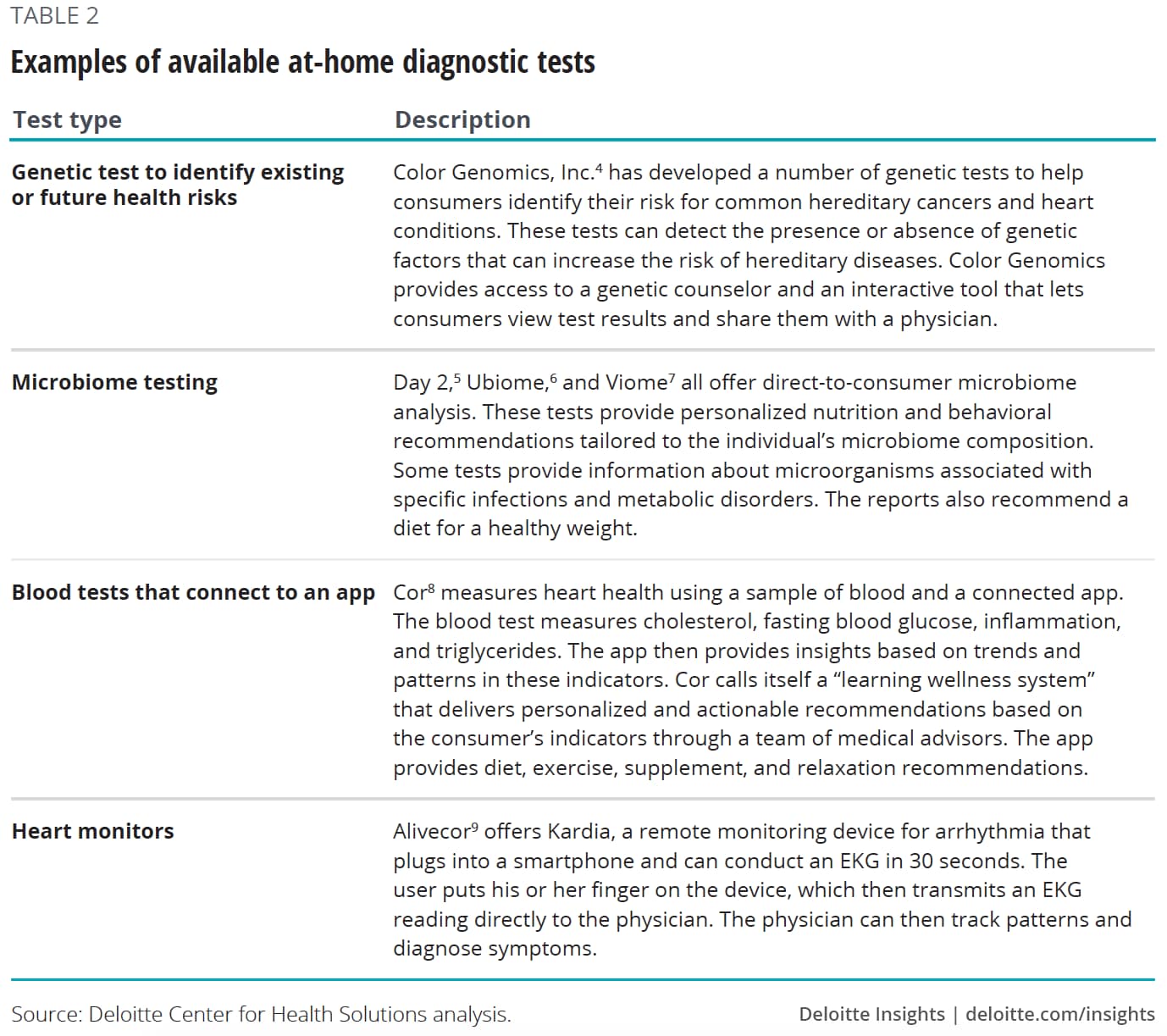

At-home diagnostic tests

At-home tests, mobile devices, and related technologies are helping to enable new ways to diagnose, monitor, and manage patients and their treatment. Many companies are developing these tests and apps along a continuum of wellness and prevention, ranging from acute diagnosis and chronic-disease management to identifying future risks of illness. Some examples of recent innovations are shown in table 2.

As these tests become more widespread, consumers will likely need actionable information, including medical advice from a physician or a genetic counselor. As consumer interest rises, we expect the development of at-home tests for many other diseases. The use of these tests also has the potential to help with provider efficiency and making sure the patient is getting the right level of care when needed.

Tracking and sharing health data

Tracking and sharing health data

The use of technology to monitor health and measure fitness levels has increased since 2013. Sixty percent of surveyed consumers say they are willing to share personal health data (generated from wearable devices) with their doctor to improve their health. The use of tools for measuring fitness and health improvement goals jumped from 17 percent in 2013 to 42 percent in 2018, according to our survey results. (Figure 3.)

Of the consumers who have used a wearable fitness device in the past year, 73 percent said they used it consistently, 25 percent used it sporadically, and only 2 percent completely abandoned the device. It appears that persistence is increasing with wearable fitness devices. Prior studies have shown that fitness devices were discarded much sooner.10 This increased persistence could be due to consumers getting more comfortable with the idea of health quantification, the devices increasing in utility, and price points going down.

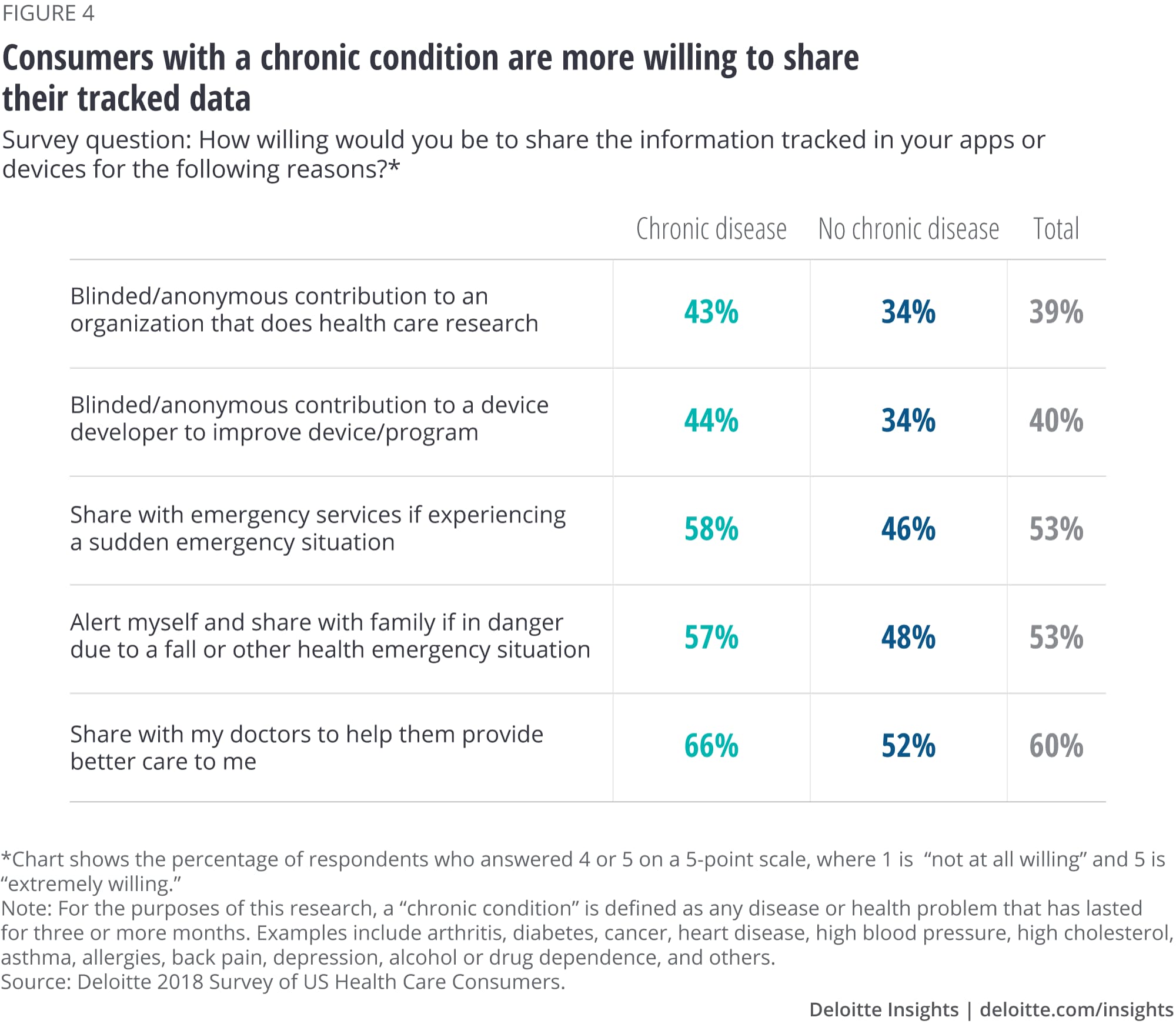

The data generated from wearables can help improve population health, advance clinical research, and enhance the performance of the device. How do consumers feel about sharing this data? Our survey results indicate that consumers are most willing to share this information with their personal doctor to improve their care (figure 4).

The survey results also show that:

- Slightly more than half of consumers are willing to share health data for emergency situations (to alert either family members or emergency responders).

- Forty percent are willing to share their data for health care research or to improve the device.

- Across the board, chronically ill consumers are more willing to share their tracked health information.

This sharing of data can help both providers and consumers be more proactive in their health management. Health systems and clinicians should think about how to organize this incoming data, if they decide to work with patients’ tracked data.

Consumers are most willing to share their medical record data with their health plan or a hospital affiliated with a university. Every time a patient interacts with a hospital/health system, another piece of health care data is created and stored in an electronic health record (EHR). We found that many consumers are willing to share EHR data (provided their personal identifiable information is protected) with their health plan or with a hospital affiliated with a university (46 percent each). Fewer are willing to share this information with medical device manufacturers (35 percent), state/public health agencies (34 percent), or pharmaceutical companies (31 percent).

Organizations will likely need to build trust to encourage consumers to share their data. One way may be to let consumers own their health data. Today data often resides in multiple medical records across different providers. This makes valuable nuggets and a complete picture of one’s health unavailable to doctors, researchers, and the consumers themselves, sometimes making it difficult for people to get the targeted care they need at the most critical times.

Some organizations are working to help consumers own their data:

- Apple released a feature on smartphones that provides an individual’s collated medical records.11 Apple worked with the health care community to take a consumer-friendly approach, creating health records based on Fast Healthcare Interoperability Resources (FHIR), a standard for transferring electronic medical records.

- Ciitizen is a startup working to give cancer patients access to their own records.12 The company is developing technology to make it easy for patients to access electronic versions of their labs, genetic test results, and images, which they can share with doctors, researchers, and their broader care team. Having access to their health records in one place helps cancer patients connect to relevant clinical trials and potential lifesaving therapies.

These organizations are working to give consumers one-stop access to their medical information, in addition to control over data-sharing. But this can require interoperability between the various organizations that currently “own” or store the data, so this movement has the potential to create pressure for centralized records and interoperability in the industry.

Millennials are most likely to engage with and use digital tools in each path. Seniors are more likely to share their health information than middle generations.

- Searching for care. Twenty-five percent of millennials have looked up quality ratings for a hospital compared to 14 percent of Gen X, 8 percent of boomers, and 7 percent of seniors.

- Accessing new channels of care. Fifty-two percent of millennials are interested in connecting with a virtual assistant to identify symptoms compared to 38 percent of Gen X, 20 percent of boomers, and 12 percent of seniors.

- Sharing health information. Fifty-four percent of millennials and 47 percent of seniors are willing to share their blinded EHR data with health plans compared to 41 percent of boomers and Gen X.

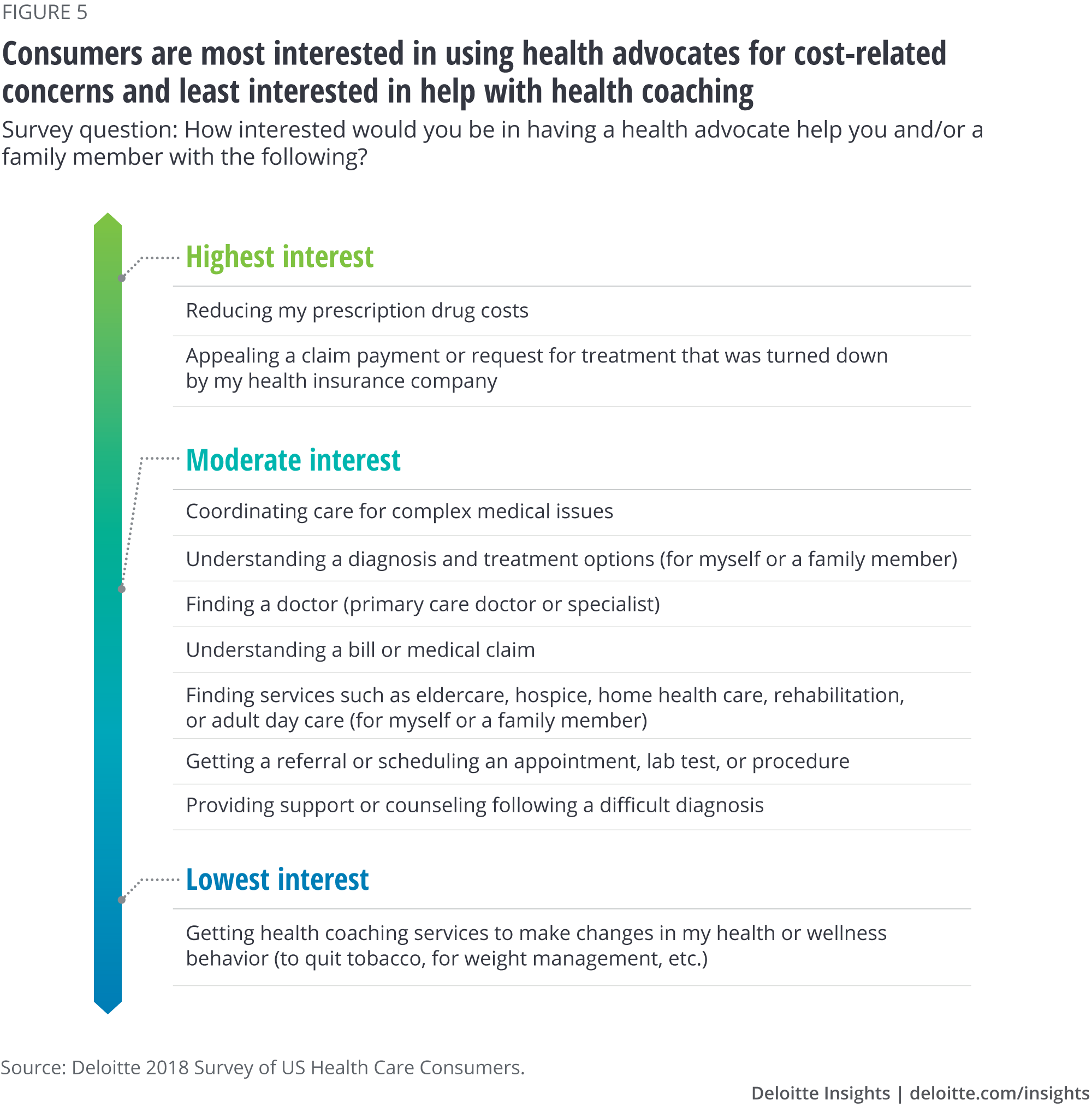

Consumers are turning to health/patient advocates and other trusted sources for information, especially about costs. Despite a growing number of tools that can help engage consumers at each stage of the patient journey, many consumers still find it difficult to navigate the health care system.13 Health or patient advocates—that some consumers can avail through employers, private agencies, health systems, and health plans—can help individuals with everything from finding specialists for hard-to-diagnose diseases to negotiating medical charges with hospitals and doctors to resolving claims-processing issues with insurance companies.

Our survey indicates that what consumers want most from an advocate is help with cost issues (see figure 5). About half of consumers say they would like to use an advocate’s aid for appealing a health insurance claim or for lowering prescription costs. Health advocates could help consumers navigate prescription assistance programs or use their benefits to help ensure they are getting the lowest cost on their prescription medications. Just 35 percent of respondents said they were interested in getting health coaching services for lifestyle behavior changes from an advocate.

While a variety of organizations provide health advocacy services, more consumers would trust an independent health advocacy/navigator service (44 percent) or a hospital to provide the service than a health plan (36 percent) or their employer (24 percent).

Employers or health plans looking to offer these services should consider ways to build consumer trust—such as ensuring privacy and confidentiality and clear communication about these services and how they are used. They could also consider partnering with reputable third-party organizations.

Hospitals and medical societies top the list of trusted sources for information on effective/safe treatments. Consistent with our previous studies, we found that consumers trust information from hospitals and medical societies more than any other source.14 While consumers’ trust in health plans and pharmaceutical companies is still fairly low, they are twice as willing to trust information from these groups than they were in 2010. (Figure 6.) To continue to foster consumer trust, organizations should focus on developing resources and tools that are centered around consumer needs, including privacy and clarity on how patient data will be used and shared. Organizations that are low on trust but are developing tools to provide information on treatments may consider a partnership with a more trusted source to attract consumer interest.

Conclusion and implications for industry stakeholders

Engaging the consumer can hold profound potential benefits for health care. New digital tools can play an important role in the future of care—monitoring a person’s health, helping individuals get access to more convenient care, giving caregivers peace of mind, and helping older adults stay in more comfortable settings. These tools also have the potential to increase consumer satisfaction, improve medication adherence, and help consumers track and monitor their health (including signs and symptoms that may alert them to the need for care).

To increase consumer engagement, organizations should provide easy-to-use platforms, high-quality care through these newer channels, and security and privacy of health and personal information.

Some observations and implications from survey results include:

- Consumers vary in their interest in and use of tools. Care providers and technology/software developers should recognize the importance of targeting different segments, not only by age, but also by health condition and perceived health status.

- Organizations should facilitate the use of consumer information (for example, from fitness devices) that goes to physicians and care teams. Technology/software developers should make it easy for care teams to use the data, and organizations may need to train consumers and professionals on how to use the tools and interpret the data. Physician adoption of new technologies could depend on the company’s ability to convince them of the tool’s efficiency or cost-effectiveness and whether it is integrated with providers’ EHR systems and workflows.

- Different users/customers seek different benefits:

- Consumers seek convenience, health improvements, and cost savings, with variation based on consumer segments.

- Physicians want ease of use/simplification of workflow and/or improvement in outcomes and efficiency of care, and accuracy and reliability of data from these devices.

- Health systems look for efficiency of care, lower cost, cybersecurity, and ease of integration with HIT systems.

- Tech/software/medtech companies should develop products that deliver all these benefits.

- The growth of at-home diagnostic tests and genetic tests, coupled with increasing use of wearables and tools to measure health and fitness goals, can provide a wealth of consumer-generated information that can be used to better understand the patient journey. This data can support discovery, development, and commercialization.

- All stakeholders have an opportunity to build trust through transparency, efficiency, and delivery of value. In addition, partnerships with physicians and health systems may help overcome consumers’ lack of trust for organizations who have low levels of trust.

- Organizations should pay attention to the areas where consumers are asking for advocates the most and how they can consider digital means or other tools to support those needs.

- All stakeholders developing tools should provide meaningful and easy-to-understand data and access to care and care support such that consumers can recognize the benefit of technology engagement.

- There will be a growing expectation for physicians and health systems to take in all these additional data streams and determine what to do with them. Partnerships with technology companies (including EHR vendors) could potentially help this effort. There also may be additional opportunities for health plans to be data brokers/data aggregators.

© 2021. See Terms of Use for more information.